Is investing in IPOs truly a sure win? 8 major projects valued at over 3 billion, with Monad leading the charge in November.

Recently, the 8 most popular new projects are launching, with Monad leading the charge at an estimated valuation of 3 billion dollars on the largest compliant encryption exchange in the United States, with an initial price of 0.025 dollars, open from November 17 to 22, with a minimum investment starting at 100 dollars. Infinex, launched by the founder of Synthetix, will launch on the Sonar platform in December, and the team voluntarily locks up positions for an additional 12 months.

Top Valuation Projects: Monad and Infinex Lead

Monad, developed by the Pyth and Solana teams over more than two years, is a high-performance L1 public chain compatible with Ethereum. On the evening of April 9, 2024, Monad Labs announced the completion of a $225 million financing round with a valuation of $3 billion, led by Paradigm with participation from Electric Capital and Greenoaks. As one of the most notable projects in the Layer 1 space, Monad, which emphasizes the concept of “Parallel EVM,” aims to introduce a “parallel processing” execution layer scaling solution that significantly improves network execution efficiency while being 100% compatible with all bytecodes of EVM.

Monad's initial offering will take place on the largest compliance encryption exchange in the United States, from 9 AM on November 17, 2025, to 9 PM on November 22, 2025 (ET). The initial offering price is $0.025, with a minimum investment amount of $100 and a maximum investment amount of $10,000. To participate, one must register for an account on the largest compliance encryption exchange in the United States and pass KYC verification. According to feedback, users from mainland China can complete KYC verification using a passport and proof of address in Hong Kong.

Infinex is a decentralized finance platform launched by Synthetix founder Kain Warwick in April 2024. The project aims to break the boundaries between CeFi and DeFi, providing a seamless user experience similar to centralized exchanges while maintaining the non-custodial nature and security of decentralized services. Infinex founder Kain stated that the TGE is expected to take place between late December and early January, with a “Sonar” presale to be launched before the TGE. All Infinex tokens will be 100% allocated to Patron NFT holders.

It is worth noting that Kain also stated that regarding the token TGE, the team decided to voluntarily lock up 20% of the total token supply's team share for 12 months, and release it linearly over 12 months after unlocking, to ensure that liquidity is not obtained prematurely before achieving product-market fit. This commitment to voluntary lock-up is extremely rare in new projects, demonstrating the team's confidence in long-term development and respect for community interests.

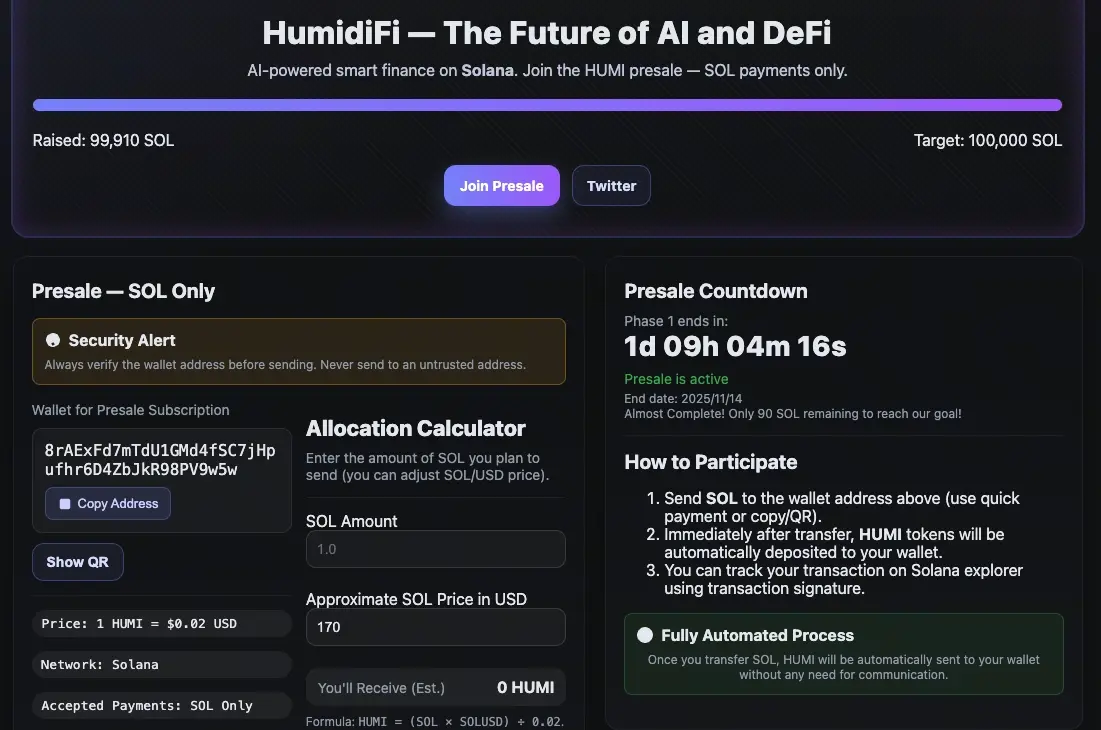

Solana Dark Horse: HumidiFi Trading Volume Surpasses Raydium

HumidiFi is a dark pool trading platform, and dark pool trading platforms (Dark Pool AMM) are a type of automated market maker that has recently emerged in the Solana ecosystem. Unlike mainstream DEXs such as Uniswap, it operates in the background, typically has no official website, and does not support users providing liquidity to earn fees. It mainly relies on the personal funds of anonymous creators and routes transactions through aggregators like Jupiter.

According to DefiLlama data, HumidiFi's total trading volume in October reached 35.9 billion USD, surpassing Meteora (34 billion USD) and Raydium (22.7 billion USD), becoming the largest decentralized exchange by trading volume on the Solana chain. This data is extremely impressive, as Raydium has long been the leading DEX in the Solana ecosystem, and HumidiFi's ability to surpass it in a short period indicates that its dark pool mechanism has gained high recognition among professional traders.

On October 30, Jupiter posted on the X platform stating that its first ICO project on the DTF platform will be HumidiFi. According to feedback, this new project is divided into three phases: whitelist phase, JUP token staker phase, and first-come-first-served public sale phase, with payment options being SOL/USDC. This tiered mechanism rewards early community supporters while also reserving participation opportunities for ordinary users.

CoinList Dual Star: BOB and Immunefi Launching Simultaneously

BOB stands for “Build on Bitcoin,” and is an L2 technology stack designed to support Bitcoin DeFi innovation and ecosystem development. It not only inherits the PoW security of Bitcoin and supports the Bitcoin ecosystem such as Ordinals, Lightning, and Nostr, but is also fully compatible with EVM. At the end of March 2024, BOB announced the completion of a $10 million seed round financing, with participation from Mechanism Ventures, Bankless Ventures, and others.

The BOB token sale is currently taking place on the CoinList platform and will end at 1 AM Beijing time on November 14. The total supply of BOB tokens is 10 billion, with 4% (400 million) allocated for this public sale, and the purchase limit for a single account is between 50,000 to 250,000 USD. The new token offering is divided into the General Public round (raising 230 million USD FDV, with 20% unlocked at TGE and linear unlocking over 12 months) and the BOB Community Member round (raising 165 million USD FDV, with linear unlocking over 12 months).

Immunefi is a Web3 vulnerability bounty platform where participants typically explore and report vulnerabilities independently in exchange for rewards. Currently, the platform has launched an AI-supported security platform, Magnus, which uses artificial intelligence to automate security operations in various aspects such as vulnerability scanning, auditing, bounty programs, on-chain monitoring, and firewalls. According to official information, Immunefi will conduct a new token offering on the CoinList platform at 1 AM Beijing time on November 13, with a new price of $0.01337 (raising $133.7 million FDV), 100% unlocked at TGE, and a minimum investment amount of $100.

Andre Cronje's comeback masterpiece endorsed by V God

FlyingTulip is an all-in-one DeFi platform launched by Andre Cronje, which includes functions such as trading, liquidity pools, and lending. It allows spot, leverage, and perpetual trading to be concentrated in a single AMM protocol, eliminating the need to store in different protocols and resolving the issue of fragmented liquidity. The official claims that this product can offer compared to other DEX protocols: a 42% reduction in impermanent loss, a 9-fold increase in LP returns, and an 85% improvement in capital efficiency.

According to official news, FlyingTulip is currently launching on the Impossible platform, and users need to stake IDIA tokens to obtain token shares. The activity deadline is 3 PM Beijing time on November 17. Andre Cronje, as one of the most influential developers in the DeFi field, attracts widespread attention with each new project, and this return work is worth focusing on.

Brevis is an off-chain computation engine built on zero-knowledge proofs, positioned as “the infinite computation layer for Web 3 and everything.” Brevis enables smart contracts to be “smarter,” shifting from passive execution to active computation, saving computation costs while improving efficiency. Brevis has recently garnered significant community discussion due to receiving Vitalik's “platform.” Brevis completed a $7.5 million seed round financing last November, led by Polychain and Yzi Labs.

According to community speculation, Brevis may launch on the Buidlpad platform, with reasons including: Brevis is a project invested by the cryptocurrency venture capital fund Nomad Capital, and the founder of Nomad Capital is also the founder of the Buidlpad platform; Brevis's official account followed the Buidlpad official account on October 20. Additionally, Brevis can still participate in the second phase interactive tasks for the token airdrop.

Makina is a programmable DeFi platform that assists professional DeFi capital allocators in deploying complex multi-chain yield strategies on a non-custodial, transparent, and fully automated infrastructure. According to DefiLlama data, Makina's TVL has exceeded $100 million. Currently, it is only confirmed that Makina is a new project under the Legion platform, with specific details awaiting notification from the official X account.

New Investment Risk Warning and Participation Strategy

Comparison of Key Data for 8 Major New Projects

Monad: Valuation of 3 billion USD, IPO price of 0.025 USD, the largest compliance encryption exchange in the United States, November 17-22.

Infinex: 100% distribution to Patron NFT holders, Sonar platform, late December to early January

HumidiFi: October trading volume of 35.9 billion USD, Jupiter DTF platform, divided into three phases.

BOB: Seed round of 10 million USD, CoinList platform, deadline on November 14.

Immunefi: FDV $133.7 million, TGE 100% unlocked, CoinList platform, November 13

Makina: TVL exceeds 100 million USD, Legion platform, time TBD

FlyingTulip: Andre Cronje project, Impossible platform, deadline November 17

Brevis: Endorsed by Vitalik, Buidlpad platform (to be confirmed), can participate in airdrop interactions.

Investing in new projects is not always guaranteed to be profitable; investors should be aware of the following risks: the project may experience a price drop after launch, especially if the FDV is too high or if the lock-up mechanism is lenient; some platforms may have KYC restrictions or regional limitations; there are significant differences in token economic models, so the unlocking plan must be studied carefully; if the overall market sentiment deteriorates, all new projects may be affected. Carefully assess the risks and only invest funds that you can afford to lose.