【Madman on Trends】Bitcoin heading towards "break," consider swing trading below 80,000

1h ago

Hyperliquid will support prediction markets and options! The native token HYPE is skyrocketing, surging over 20% in a frenzy.

3h ago

Trending Topics

View More7.96K Popularity

5.77K Popularity

6.44K Popularity

299 Popularity

1.63K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$2.83KHolders:10.00%

- MC:$2.83KHolders:10.00%

- MC:$2.89KHolders:20.09%

- MC:$2.84KHolders:10.00%

Pin

The more they suppress, the more it rises? Uncovering the black and white truth behind XMR's surge

Author: Frank, PANews

Monero (XMR), one of the leading privacy coin projects, hit a new all-time high on January 13, with the spot price surpassing $690, reigniting market discussions about privacy coins.

Since January 2025, nearly a year ago, XMR has surged from around $200, with a maximum increase of 262%. In an environment where mainstream altcoins are generally weak, such a rise is extremely rare. What’s more intriguing is that this rally occurred amid unprecedented global regulatory tightening.

Due to compliance pressures, major centralized exchanges like Binance have already delisted spot trading of XMR. On January 12, the Dubai Virtual Asset Regulatory Authority (VARA) officially announced a ban on the trading and custody of privacy tokens within Dubai and its free zones. However, this de facto ban not only failed to cast a shadow over XMR but also went against the trend, with the new high serving as a sarcastic rebuke to Dubai’s government.

Amid liquidity drying up on exchanges and regulatory sticks waving, who is truly driving the rise of XMR? PANews strips away the surface and seeks the real demand behind this market movement.

Exchanges are not the core price-setting venues

Despite the hot market, it is not primarily driven by funds within exchanges.

In the spot market, recent trading volume for XMR has increased with the price rally but remains within the range of a few hundred million to 200 million USD, without any extraordinary surge. Historically, the highest spot trading volume was on November 10, reaching 410 million USD. This indicates that, during this recent doubling phase, spot trading (or spot buying within centralized exchanges) was not the main driver.

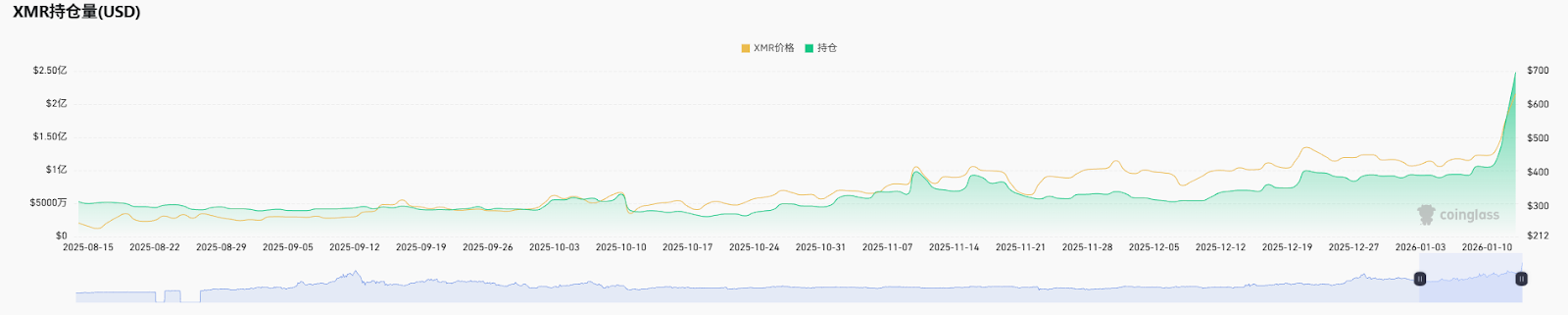

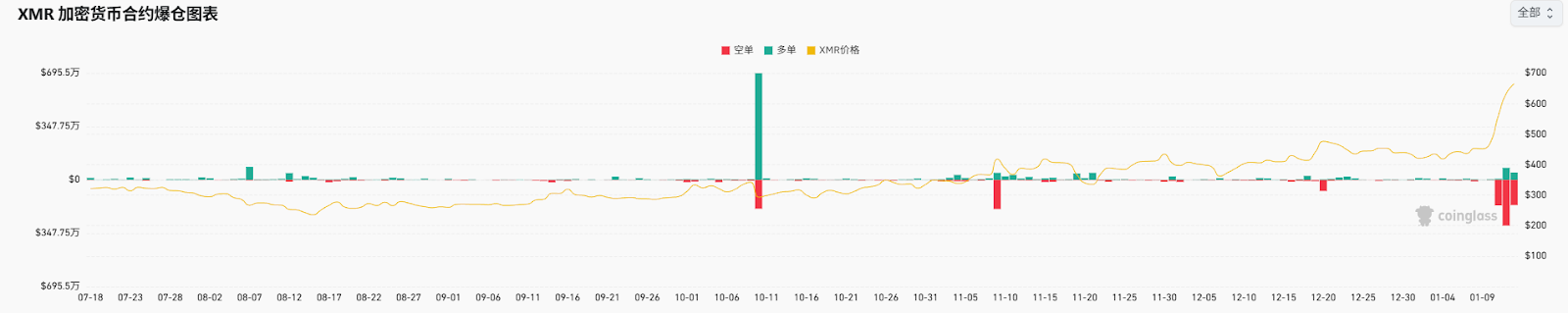

In terms of derivatives, the situation is similar. The peak trading volume also occurred on November 10. Since then, until about a week ago, derivatives trading volume has not shown significant growth and even shows some decline. Observing open interest data, the USD-denominated change curve almost perfectly overlaps with the price trend. The number of XMR holdings in the market has not experienced abnormal spikes; the increase in open interest is merely due to the rising price, not large-scale new capital entering the market.

Clearly, mainstream exchanges are not the core price-setting venues for XMR at present.

Hidden currents on the supply side, miner reshuffling and pre-positioning

Since the “visible” funds are unremarkable, we need to turn to the “hidden” on-chain world. As the most privacy-focused network, XMR has minimal exploitable information, but changes in mining difficulty and rewards can give us clues about capital deployment on the supply side.

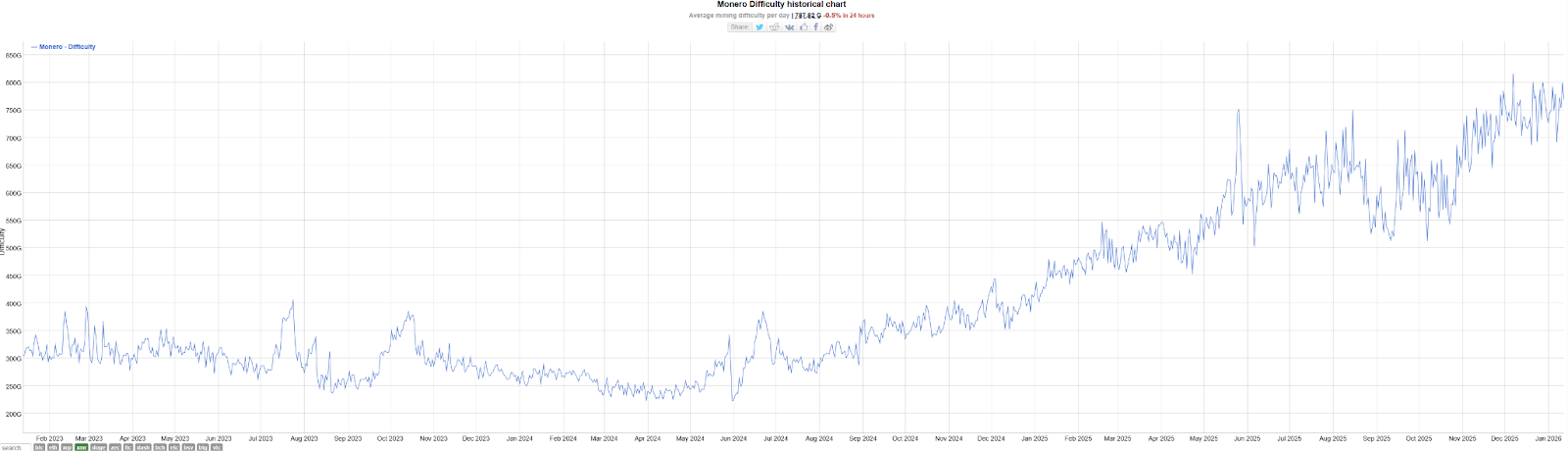

Mining difficulty historically reflects the enthusiasm of capital participation in the network ecosystem. Data shows that XMR’s mining difficulty began to rise rapidly at the end of 2024, maintaining a fast growth throughout the first half of 2025. Although there was some fluctuation from September to November, a new round of difficulty increase has recently begun.

A noteworthy episode occurred in September: the Qubic project claimed control of over 51% of XMR’s total network hash rate and conducted a “demonstration attack,” causing an 18-block chain reorganization. This event sounded an alarm in the community, prompting many miners to migrate hash power to the established pool SupportXMR. This turbulence was a major reason for the sharp fluctuations in mining difficulty at the end of 2025, but it also indirectly confirmed the activity and resilience of the hash market.

More interestingly, the link between mining rewards and difficulty deserves attention.

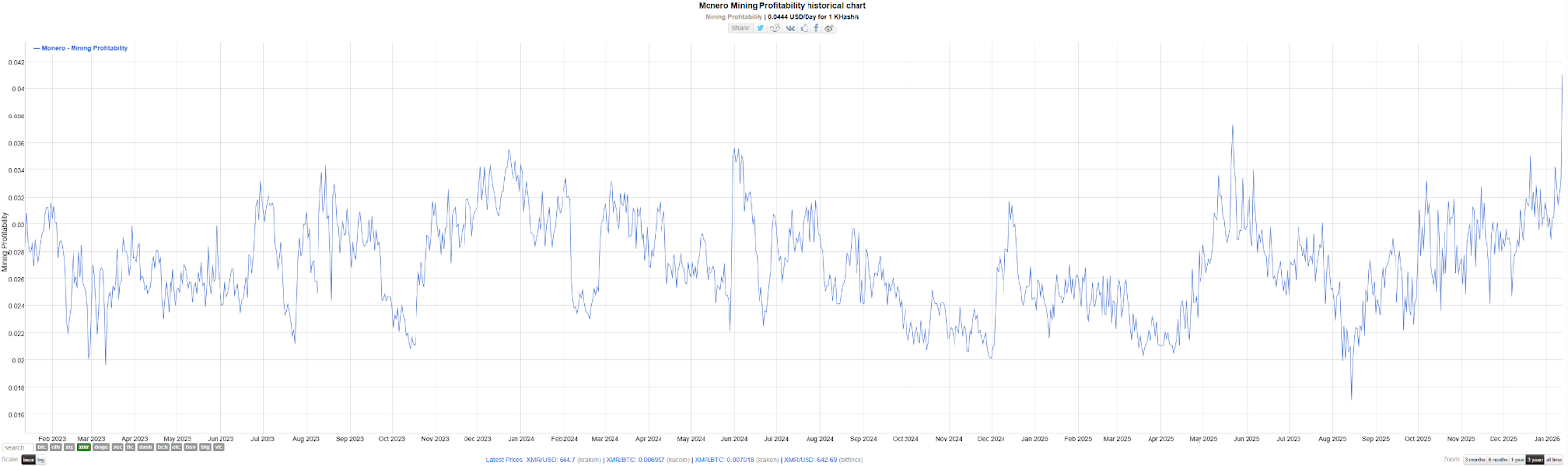

Before April 2025, Monero’s mining rewards experienced a clear decline. Coupled with the difficulty chart at that time, hash rate surged sharply while the coin price remained volatile. This divergence led to thinner rewards, possibly forcing some small miners with higher costs to exit the market. Data shows that mining difficulty briefly retreated in April, supporting this hypothesis.

This is a typical “miner capitulation” and “chip exchange” scenario. Afterward, as the price surged significantly, both mining rewards and difficulty once again moved in sync. From the data during this phase, it appears that as early as the beginning of 2025, some large, risk-resistant miners or capital had already started to pre-position themselves in Monero mining at low yields.

Demand-side verification, paying a premium for privacy

If miners represent supply-side confidence, then the average transaction fee most truly reflects user demand.

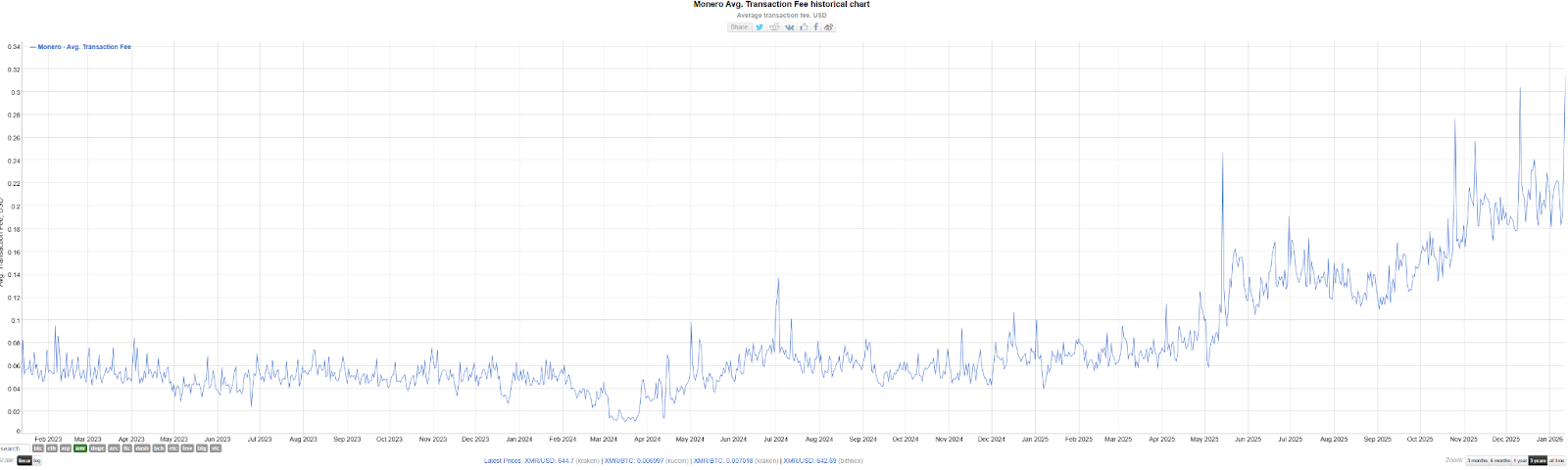

From the chart, Monero’s average transaction fee remained relatively stable before the first half of 2025, generally below $0.1. But starting in June, an upward trend emerged; by December 11, the highest average fee reached over $0.3, more than tripling compared to six months earlier.

Because Monero has a dynamic block size adjustment mechanism, the spike in fees indicates that many users are trying to send transactions quickly and are willing to pay high fees to compensate miners for expansion costs. This indirectly proves that real transaction demand on the Monero chain has increased significantly since the second half of 2025.

However, we also notice an interesting pattern: on-chain fee surges often coincide with sharp price rallies.

For example, on April 28, XMR suddenly surged 14%, and the average transaction fee spiked to over $0.125; during the subsequent slow price climb, fees fell back to lows (dropping to $0.058 on May 4). This suggests that while market volatility can temporarily boost on-chain demand, demand tends to calm down once volatility subsides. Although sometimes the two are not perfectly aligned (e.g., on May 14, fees rose but prices did not move), overall, in the past six months, short-term price increases have driven on-chain demand, and the genuine growth in on-chain demand has, in turn, fueled market optimism for XMR—both are causally linked.

The dual nature of the truth

Combining the above data, the recent surge in XMR may have a “dual” reality.

The “white” side is the resilience of privacy demand in the face of strict regulation.

Regulatory counterforces are becoming more evident. The Dubai VARA ban not only failed to crush XMR but also made market participants realize: regulators can prohibit exchange trading but cannot ban the protocol itself. When major exchanges exit XMR trading, the logic of market-making and derivative pricing is rewritten. XMR has returned to a mode controlled by real users or some heavyweight players. Once outside the exchange system, privacy coins have moved into an independent rhythm different from the mainstream market.

The “black” side is the capital game under information asymmetry.

Behind this opacity, there may be “whales” lurking beneath the iceberg. The “not-so-impressive” trading data (even on January 13, when the price hit a new high, the contract holdings were only $240 million, and liquidation volume was just over $1 million) shows that mainstream institutions almost failed to anticipate and participate in this rally, only following behind.

This information gap controlled by a few leads to extreme price volatility. Especially when the market begins to focus on such rallies, it often signals short-term emotional overheating. Referencing the privacy coin ZEC in November, after a surge, it experienced a retracement of over 50%. Ultimately, in the privacy coin market, there is a large amount of “information asymmetry,” putting ordinary retail investors at a significant disadvantage.

In the intense fluctuations of privacy coins, on-chain data may be our only credible guide. But in the deep, opaque sea, high premiums for freedom always come with unknown risks.