Hyperliquid will support prediction markets and options! The native token HYPE is skyrocketing, surging over 20% in a frenzy.

23m ago

Bitcoin's "Ironclad Price" Emerges! Compass Point Analyst: Cryptocurrency Bear Market Nearing the End

27m ago

Trending Topics

View More4.96K Popularity

3.99K Popularity

5.85K Popularity

167 Popularity

897 Popularity

Pin

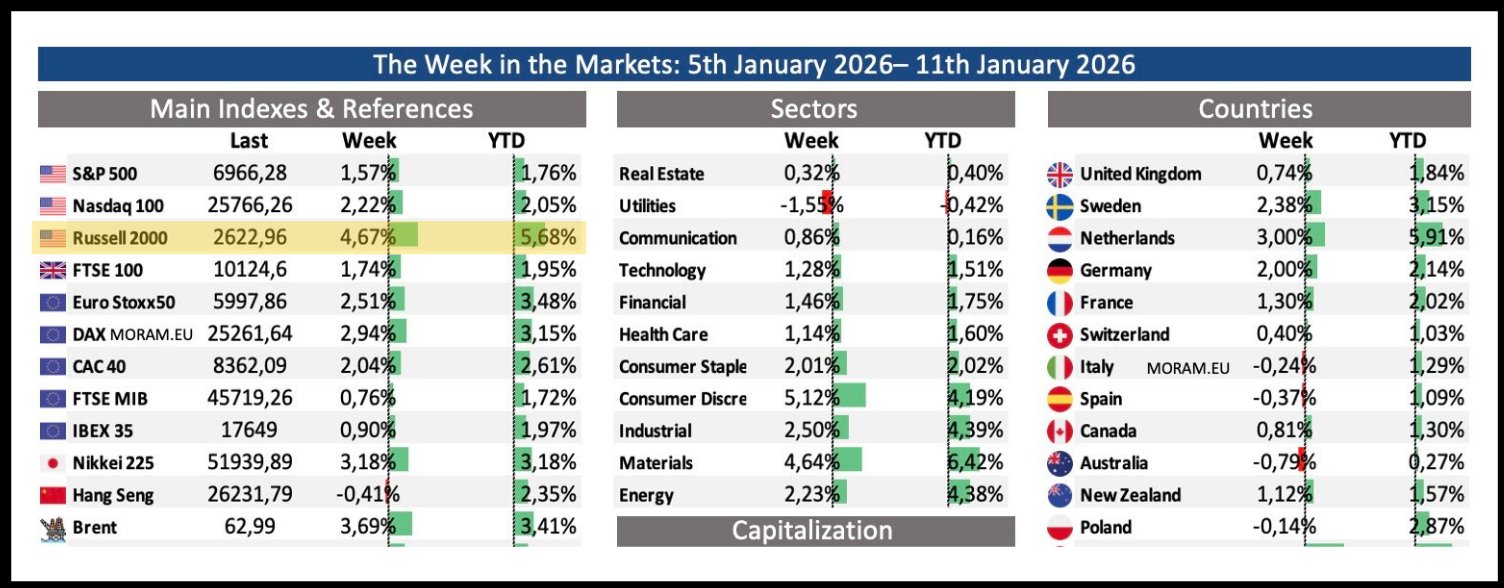

Russell 2000 Index Breaks Out Strongly, Is the Cryptocurrency Rally Ready to Take Over?

Author: Our Crypto Talk

Translation: Yuliya, PANews

This article is not about a cryptocurrency chart, nor about a Meme coin narrative, and is temporarily unrelated to Bitcoin. We are focusing on the Russell 2000 Index quietly accomplishing a feat that has only happened twice in its history: breaking through and thereby driving a return of risk appetite.

If you have been in the market long enough, you’ve seen this “movie” more than once.

A pattern that most people continue to overlook

History always repeats itself. Even if you don’t believe in cycles, you should respect this repetition.

Although each market narrative is different each time, and the popular tokens vary, the underlying driving mechanism remains the same.

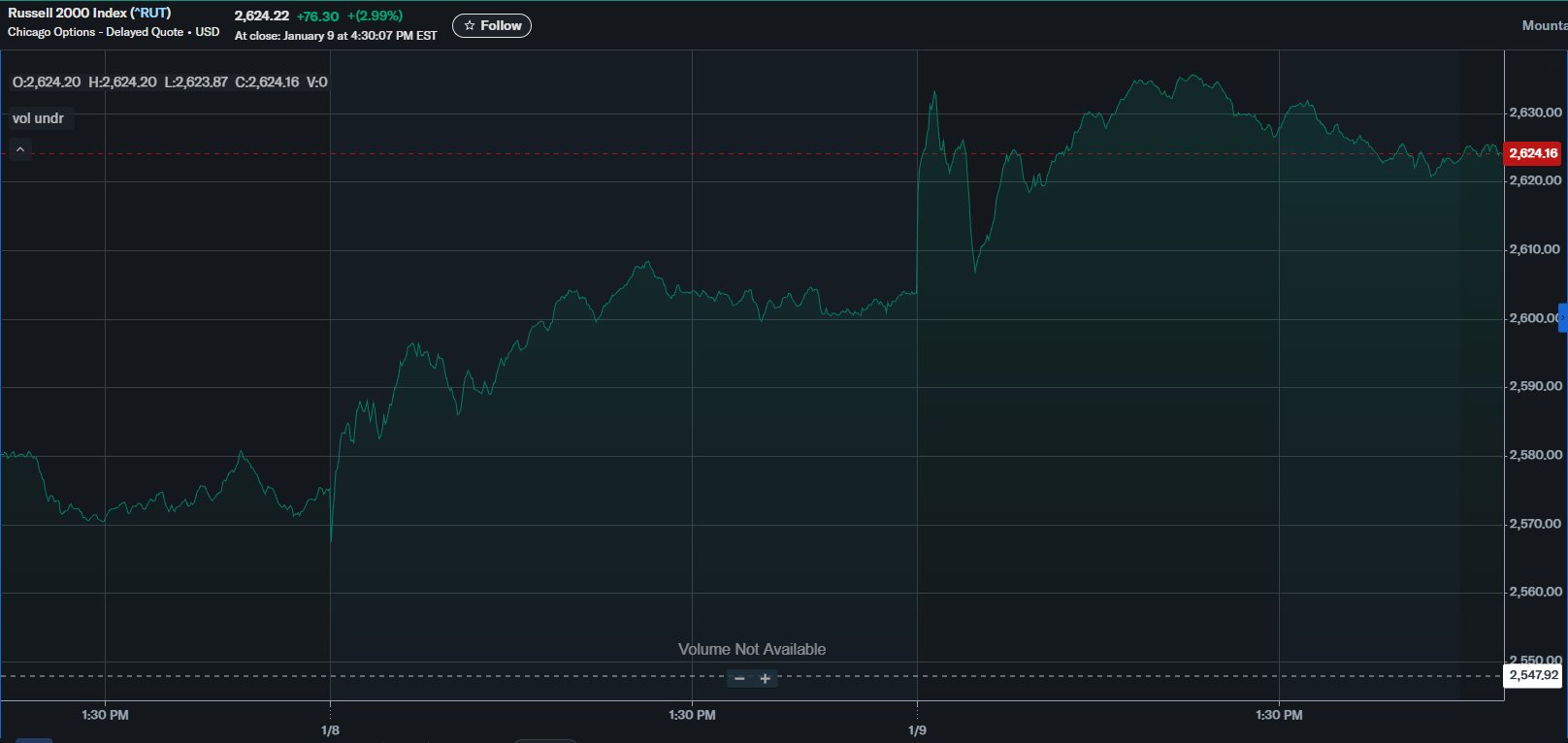

Now, in January 2026, the Russell Index has broken through 2,600 points for the first time in history.

This breakout is not an illusion, nor a false move caused by light trading during holidays, but a comprehensive breakout with huge trading volume and broad participation. The index has gained about 15% since the beginning of the year.

What does the Russell Index truly represent?

Trading in small caps is not based on market sentiment or feelings but is a liquidity-driven trade.

The Russell Index tracks about 2,000 smaller U.S. companies, including regional banks, industrial firms, biotech companies, and more. The survival and growth of these companies are closely related to borrowing conditions and growth expectations.

That’s why, in defensive markets, the Russell Index never leads the charge; but when risk appetite returns, it often becomes the leader. Therefore, the index’s breakout is not just a technical phenomenon; it’s a clear signal: capital is moving down the risk curve, seeking higher returns.

This is not an isolated case: macroeconomic context supports it.

Zooming out, you’ll find that the current macro environment fits this trend in an unsettling way.

Individually, none of these measures are strong “stimulus” signals. But collectively, they form a powerful liquidity waterfall. And liquidity is never static.

The true transmission path of liquidity

This is a common misconception. Liquidity does not simply “transfer” from cash to competing assets out of thin air; it follows a certain order and hierarchy:

Small caps are in the middle of this chain. They are riskier than mega caps but are logically clear and easy for institutional investors to understand. When small stocks start outperforming the market, it usually means capital has crossed the “safety” zone and is now chasing “growth.”

That’s why the Russell Index’s breakout has historically always foreshadowed broader risk asset expansion. It’s not coincidence but a mechanical, inevitable transmission process.

The position of cryptocurrencies in this process

The crypto market is not a leader in the liquidity cycle but an amplifier.

When the Russell Index enters a sustained upward trend, higher beta assets tend to lag behind. Historical data repeatedly shows that ETH and competing coins usually react one to three months later.

This is not because traders are closely watching the Russell Index on platforms like TradingView, but because the same liquidity that drives capital into small caps ultimately seeks assets with higher “convexity” (i.e., the potential for large returns with relatively small risks).

And cryptocurrencies, especially in markets that have experienced capitulation, order book thinning, and exhausted sellers, are precisely the endpoint of this search. This is exactly the environment facing the crypto market in early 2026.

Why does this feel different but the essence remains unchanged?

Every cycle has its “this time is different” reasons.

These superficial explanations change, but the rules of capital flow remain the same.

What’s different now is that the “pipeline” (i.e., infrastructure) of the market has greatly improved: clearer regulatory frameworks, institutional-grade custody standards, spot ETFs continuously absorbing market supply, and excessive leverage on the fringes of the market decreasing.

Even insiders are starting to openly discuss previously secretive viewpoints. When CZ talks about a potential “super cycle,” he’s not hyping; he’s pointing to the synergy of multiple factors: liquidity, regulation, and market structure finally moving in the same direction. This kind of synergy is extremely rare.

Mistakes crypto-native traders are making

Most crypto traders are still glued to crypto charts, waiting for confirmation signals from the market itself. But this is often too late.

When competing coins start soaring, the rotation of capital has already completed in other markets. The signal of risk appetite returning.

It first appears in markets that don’t need hype to rise. Small caps are one such market. They don’t rely on memes to pump; they rise because borrowing becomes easier and capital regains confidence.

So, if you ignore the Russell Index’s breakout because “it’s not related to crypto,” you’re missing the point entirely.

The true meaning of the “super cycle”

A “super cycle” does not mean all assets will rise forever. It implies:

This is precisely the environment where, in history, competing coins stop “bleeding” and start revaluing. Not all will rise, and the magnitude of gains will not be uniform, but the trend will be decisive.

Signals are on the table

The Russell Index breaking to a new high is no coincidence. When it happens, it is accompanied by easing liquidity, a return of risk tolerance, and capital decision-making resuming.

You don’t need to predict specific target prices or precisely time the rotation. You only need to recognize that when small caps lead the market, they are telling you what’s coming next.

The crypto market has previously ignored this signal and often regrets it months later.