Hyperliquid will support prediction markets and options! The native token HYPE is skyrocketing, surging over 20% in a frenzy.

1h ago

Bitcoin's "Ironclad Price" Emerges! Compass Point Analyst: Cryptocurrency Bear Market Nearing the End

2h ago

Trending Topics

View More6.36K Popularity

4.52K Popularity

3.88K Popularity

235 Popularity

1.16K Popularity

Hot Gate Fun

View More- MC:$2.89KHolders:20.09%

- MC:$2.84KHolders:10.00%

- MC:$2.83KHolders:10.00%

- MC:$2.87KHolders:20.00%

- MC:$0.1Holders:10.00%

Pin

Say goodbye to "storytelling" for funding: What kind of projects can survive past 2026?

Author: Nikka / WolfDAO( X: @10xWolfdao )

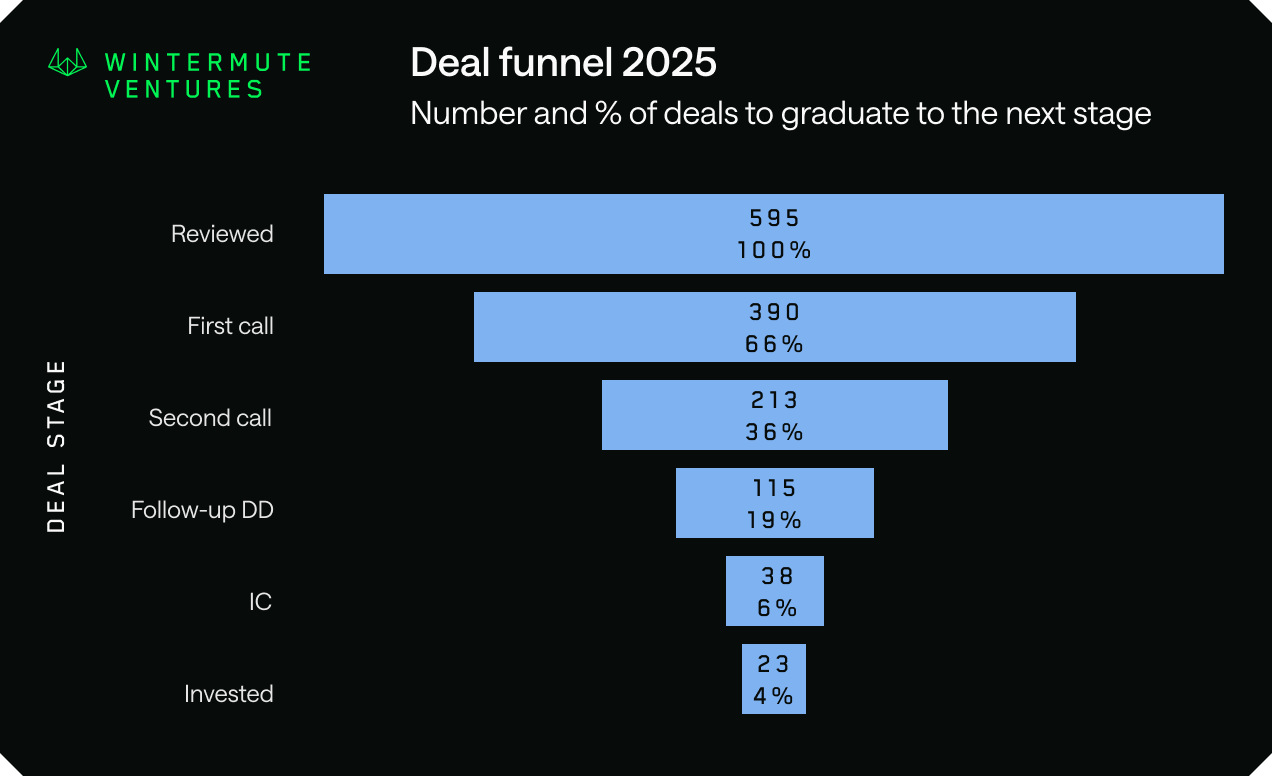

1: The Dramatic Shift in VC Investment Logic Wintermute Ventures’ data from 2025 reveals a brutal reality: this top-tier market maker and investment firm reviewed about 600 projects throughout the year, ultimately approving only 23 deals, with an approval rate of just 4%. Even more astonishing, only 20% of those projects entered the due diligence stage. Founder Evgeny Gaevoy openly states that they have completely bid farewell to the “spray and pray” approach of 2021-2022.

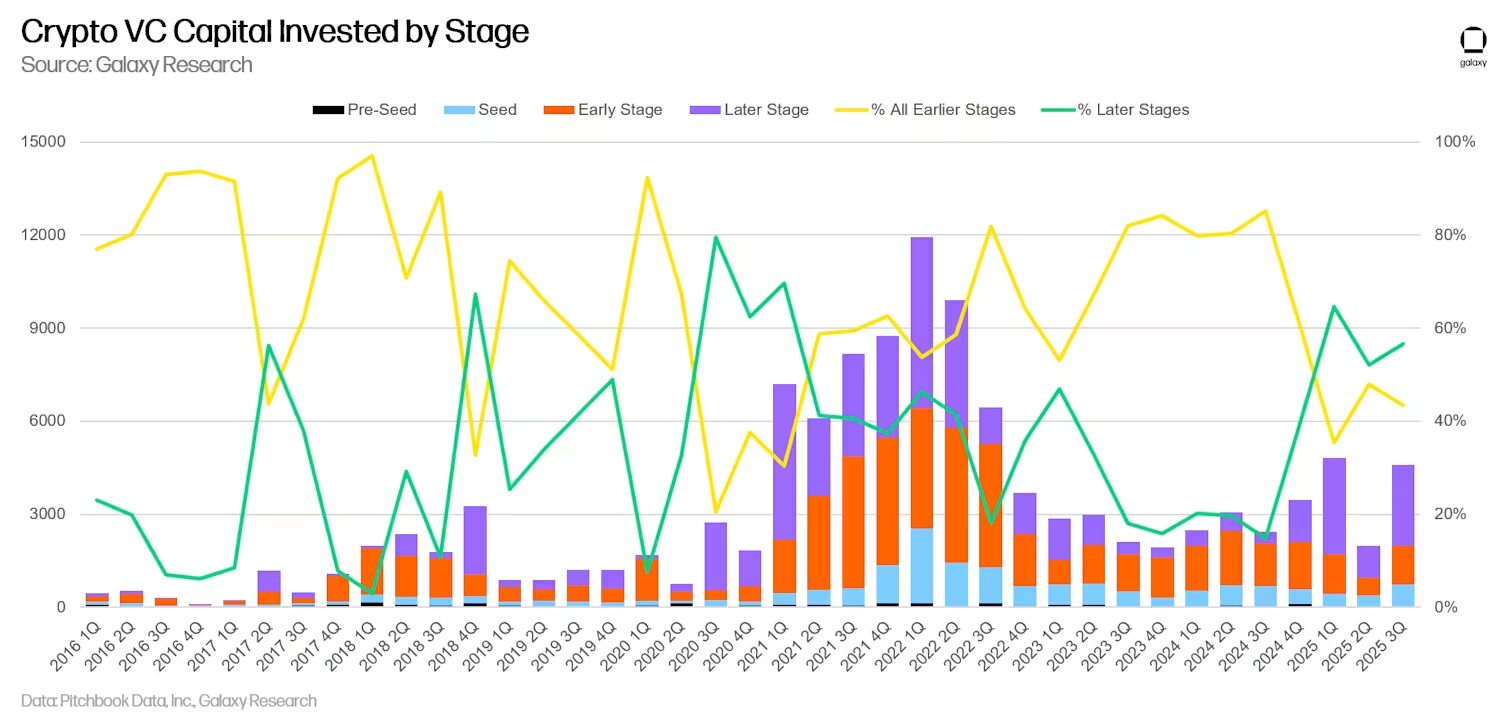

This shift is not unique to Wintermute. The entire crypto VC ecosystem saw a 60% drop in deal volume in 2025, decreasing from over 2,900 deals in 2024 to about 1,200. Although funds are still flowing, the total global crypto VC investment reached $4.975 billion, but these funds are increasingly concentrated in a few projects. Late-stage investments account for 56%, while early seed rounds have shrunk to a historic low. Data from the US market illustrates this further: deal volume decreased by 33%, but median investment size grew 1.5 times to $5 million. This indicates that VCs prefer to heavily back a few projects rather than cast wide nets.

Wintermute Ventures’ data from 2025 reveals a brutal reality: this top-tier market maker and investment firm reviewed about 600 projects throughout the year, ultimately approving only 23 deals, with an approval rate of just 4%. Even more astonishing, only 20% of those projects entered the due diligence stage. Founder Evgeny Gaevoy openly states that they have completely bid farewell to the “spray and pray” approach of 2021-2022.

This shift is not unique to Wintermute. The entire crypto VC ecosystem saw a 60% drop in deal volume in 2025, decreasing from over 2,900 deals in 2024 to about 1,200. Although funds are still flowing, the total global crypto VC investment reached $4.975 billion, but these funds are increasingly concentrated in a few projects. Late-stage investments account for 56%, while early seed rounds have shrunk to a historic low. Data from the US market illustrates this further: deal volume decreased by 33%, but median investment size grew 1.5 times to $5 million. This indicates that VCs prefer to heavily back a few projects rather than cast wide nets.

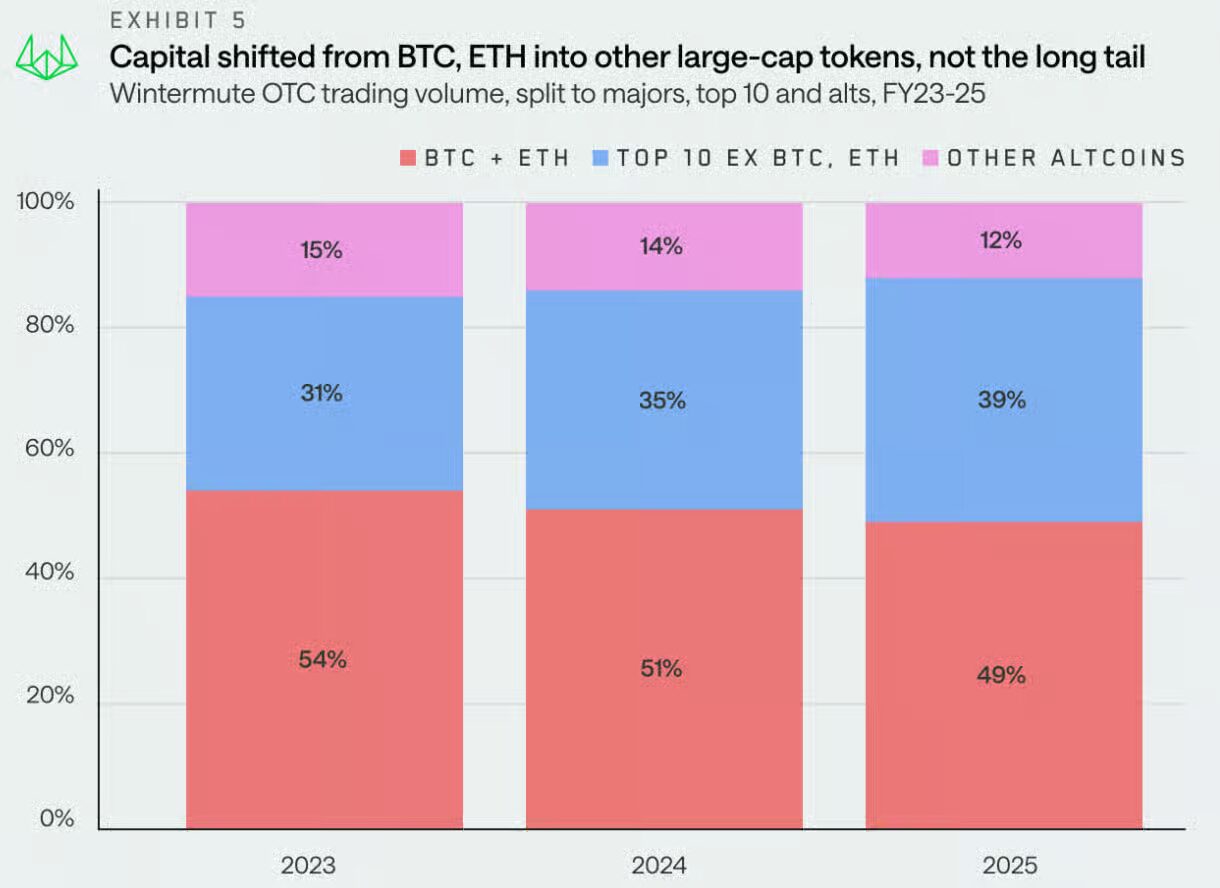

The root cause of this dramatic change lies in the high concentration of market liquidity. The crypto market in 2025 exhibits extreme “narrowness”: institutional funds account for up to 75%, but these funds are mainly locked in large-cap assets like BTC and ETH. OTC trading data shows that while BTC and ETH’s market share decreased from 54% to 49%, the overall share of blue-chip assets grew by 8%. More critically, the narrative cycle for alternative coins plummeted from 61 days in 2024 to 19-20 days in 2025, leaving no time for capital to flow into small and medium projects. Retail investors are no longer frantically chasing cryptocurrencies as before; they are shifting their attention to AI and tech stocks, resulting in a lack of incremental capital in the crypto market.

The traditional “four-year bull cycle” has been completely shattered. Wintermute’s report clearly states that the recovery in 2026 will not come naturally as before; it will require at least one strong catalyst: either ETF expansion to assets like SOL or XRP, a renewed FOMO-driven surge from BTC breaking the $100,000 psychological barrier, or a new narrative reigniting retail enthusiasm. In this environment, VC firms cannot afford to gamble on projects that only “tell stories.” They need projects that can prove their ability to survive and thrive from the seed stage, with access to institutional liquidity.

This is why investment logic has shifted from “invest in 100 projects for a hundredfold return” to “only invest in 4 projects that can survive to listing.” Risk aversion is no longer conservative but essential for survival. Top funds like a16z and Paradigm are reducing early-stage investments and shifting focus to mid and late rounds. The high-profile funding rounds in 2025—Fuel Network’s valuation dropping from $1 billion to $11 million, Berachain falling 93% from its peak, Camp Network losing 96% of its market cap—are stark reminders to the market: narratives are dead, execution is king.

2: The Deadly Requirements for Seed-Stage Self-Sustainability

Under this extreme precision aesthetic, the biggest challenge for startups is: seed rounds are no longer the starting point for burning money but the critical threshold to prove self-sustainability.

Self-sustainability first manifests in rigorous validation of product-market fit (PMF). VC firms are no longer satisfied with beautiful business plans or grand visions; they want real data: at least 1,000 active users or monthly revenue exceeding $100,000. More crucially, user retention—if your DAU/MAU ratio is below 50%, it indicates users are not buying in. Many projects fail here: they have polished whitepapers and cool tech architectures but cannot produce evidence of actual user engagement or willingness to pay. Among the 580 projects rejected by Wintermute, many failed at this stage.

Capital efficiency is the second critical threshold. VC predicts that in 2026, many “profitless zombies” will emerge—companies with ARR of only $2 million and annual growth of 50%, unable to attract Series B funding. This means seed teams must achieve a “pre-set survival” state: monthly burn rate not exceeding 30% of revenue or early profitability. It sounds harsh, but in a market with depleted liquidity, it’s the only way out. Teams need to be lean—under 10 people, prioritize open-source tools to cut costs, and even supplement cash flow through side businesses like consulting. Teams with dozens of members and rapid burn rates will likely be unable to secure the next round in 2026.

The technical requirements are also rapidly escalating. Data from 2025 shows that for every dollar invested by VC, 40 cents go into AI-powered crypto projects—double the proportion from 2024. AI is no longer a luxury but a necessity. Seed projects need to demonstrate how AI helps shorten development cycles from six months to two, how AI-driven agents facilitate capital transactions or optimize DeFi liquidity management. Simultaneously, compliance and privacy protections must be embedded at the code level. With the rise of RWA (Real World Asset) tokenization, projects need zero-knowledge proofs to ensure privacy and reduce trust costs. Those ignoring these requirements will be considered “lagging behind.”

The most critical demands are liquidity and ecosystem compatibility. Crypto projects must plan their listing pathways from the seed stage, clearly connecting to institutional liquidity channels like ETFs or DEX aggregators. Data shows that in 2025, institutional funds account for 75%, stablecoin market cap surged from $206 billion to over $300 billion, and projects driven solely by narratives face exponentially increasing difficulty in fundraising. Projects should focus on ETF-compatible assets, establish early partnerships with exchanges, and build liquidity pools. Teams thinking “raise money first, list later” will likely not survive beyond 2026.

All these requirements mean that seed rounds are no longer just testing waters but a comprehensive exam. Teams need cross-disciplinary composition—engineers, AI experts, financial specialists, compliance advisors are indispensable. They must adopt agile development for rapid iteration, speak with data rather than stories, and pursue sustainable business models rather than just fundraising for survival. 45% of VC-backed crypto projects have already failed; 77% generate less than $1,000 in monthly revenue; 85% of token projects launched in 2025 are underwater—these figures tell us that projects lacking self-sustainability will not reach the next funding round, let alone listing and exit.

3: Warnings and Strategic Shifts for Investment Institutions

For strategic investors and VC firms, 2026 is a watershed: either adapt to new rules or be eliminated by the market. Wintermute’s 4% approval rate is not bragging about their pickiness but warning the entire industry—those still using old models of “spray and pray” will suffer heavy losses.

The core issue is that the market has shifted from speculation-driven to institution-driven. When 75% of funds are trapped in pension funds and hedge funds, retail investors flock to AI stocks, and the rotation cycle of alternative coins shortens from 60 days to 20 days, VC firms still casting wide nets on storytelling projects are actively giving away money. GameFi and DePIN narratives declined over 75% in 2025, and AI-related projects fell an average of 50%. The liquidation cascade in October, with $19 billion in leveraged positions wiped out, underscores one thing: the market no longer pays for narratives, only for execution and sustainability.

The root cause of this dramatic change lies in the high concentration of market liquidity. The crypto market in 2025 exhibits extreme “narrowness”: institutional funds account for up to 75%, but these funds are mainly locked in large-cap assets like BTC and ETH. OTC trading data shows that while BTC and ETH’s market share decreased from 54% to 49%, the overall share of blue-chip assets grew by 8%. More critically, the narrative cycle for alternative coins plummeted from 61 days in 2024 to 19-20 days in 2025, leaving no time for capital to flow into small and medium projects. Retail investors are no longer frantically chasing cryptocurrencies as before; they are shifting their attention to AI and tech stocks, resulting in a lack of incremental capital in the crypto market.

The traditional “four-year bull cycle” has been completely shattered. Wintermute’s report clearly states that the recovery in 2026 will not come naturally as before; it will require at least one strong catalyst: either ETF expansion to assets like SOL or XRP, a renewed FOMO-driven surge from BTC breaking the $100,000 psychological barrier, or a new narrative reigniting retail enthusiasm. In this environment, VC firms cannot afford to gamble on projects that only “tell stories.” They need projects that can prove their ability to survive and thrive from the seed stage, with access to institutional liquidity.

This is why investment logic has shifted from “invest in 100 projects for a hundredfold return” to “only invest in 4 projects that can survive to listing.” Risk aversion is no longer conservative but essential for survival. Top funds like a16z and Paradigm are reducing early-stage investments and shifting focus to mid and late rounds. The high-profile funding rounds in 2025—Fuel Network’s valuation dropping from $1 billion to $11 million, Berachain falling 93% from its peak, Camp Network losing 96% of its market cap—are stark reminders to the market: narratives are dead, execution is king.

2: The Deadly Requirements for Seed-Stage Self-Sustainability

Under this extreme precision aesthetic, the biggest challenge for startups is: seed rounds are no longer the starting point for burning money but the critical threshold to prove self-sustainability.

Self-sustainability first manifests in rigorous validation of product-market fit (PMF). VC firms are no longer satisfied with beautiful business plans or grand visions; they want real data: at least 1,000 active users or monthly revenue exceeding $100,000. More crucially, user retention—if your DAU/MAU ratio is below 50%, it indicates users are not buying in. Many projects fail here: they have polished whitepapers and cool tech architectures but cannot produce evidence of actual user engagement or willingness to pay. Among the 580 projects rejected by Wintermute, many failed at this stage.

Capital efficiency is the second critical threshold. VC predicts that in 2026, many “profitless zombies” will emerge—companies with ARR of only $2 million and annual growth of 50%, unable to attract Series B funding. This means seed teams must achieve a “pre-set survival” state: monthly burn rate not exceeding 30% of revenue or early profitability. It sounds harsh, but in a market with depleted liquidity, it’s the only way out. Teams need to be lean—under 10 people, prioritize open-source tools to cut costs, and even supplement cash flow through side businesses like consulting. Teams with dozens of members and rapid burn rates will likely be unable to secure the next round in 2026.

The technical requirements are also rapidly escalating. Data from 2025 shows that for every dollar invested by VC, 40 cents go into AI-powered crypto projects—double the proportion from 2024. AI is no longer a luxury but a necessity. Seed projects need to demonstrate how AI helps shorten development cycles from six months to two, how AI-driven agents facilitate capital transactions or optimize DeFi liquidity management. Simultaneously, compliance and privacy protections must be embedded at the code level. With the rise of RWA (Real World Asset) tokenization, projects need zero-knowledge proofs to ensure privacy and reduce trust costs. Those ignoring these requirements will be considered “lagging behind.”

The most critical demands are liquidity and ecosystem compatibility. Crypto projects must plan their listing pathways from the seed stage, clearly connecting to institutional liquidity channels like ETFs or DEX aggregators. Data shows that in 2025, institutional funds account for 75%, stablecoin market cap surged from $206 billion to over $300 billion, and projects driven solely by narratives face exponentially increasing difficulty in fundraising. Projects should focus on ETF-compatible assets, establish early partnerships with exchanges, and build liquidity pools. Teams thinking “raise money first, list later” will likely not survive beyond 2026.

All these requirements mean that seed rounds are no longer just testing waters but a comprehensive exam. Teams need cross-disciplinary composition—engineers, AI experts, financial specialists, compliance advisors are indispensable. They must adopt agile development for rapid iteration, speak with data rather than stories, and pursue sustainable business models rather than just fundraising for survival. 45% of VC-backed crypto projects have already failed; 77% generate less than $1,000 in monthly revenue; 85% of token projects launched in 2025 are underwater—these figures tell us that projects lacking self-sustainability will not reach the next funding round, let alone listing and exit.

3: Warnings and Strategic Shifts for Investment Institutions

For strategic investors and VC firms, 2026 is a watershed: either adapt to new rules or be eliminated by the market. Wintermute’s 4% approval rate is not bragging about their pickiness but warning the entire industry—those still using old models of “spray and pray” will suffer heavy losses.

The core issue is that the market has shifted from speculation-driven to institution-driven. When 75% of funds are trapped in pension funds and hedge funds, retail investors flock to AI stocks, and the rotation cycle of alternative coins shortens from 60 days to 20 days, VC firms still casting wide nets on storytelling projects are actively giving away money. GameFi and DePIN narratives declined over 75% in 2025, and AI-related projects fell an average of 50%. The liquidation cascade in October, with $19 billion in leveraged positions wiped out, underscores one thing: the market no longer pays for narratives, only for execution and sustainability.

Institutions must change direction. First, fundamentally revise investment standards: shift from “how big can this story be” to “can this project prove self-sustainability at seed stage.” No longer scatter large amounts of capital early; instead, concentrate on a few high-quality seed projects or shift to later rounds to reduce risk. Data shows that in late-stage investments in 2025, the proportion reached 56%, not by chance but as a result of market voting with their feet.

More importantly, redefine the investment track. The integration of AI and crypto is not just a trend but a reality—2026 will see over 50% of investments in the AI-crypto crossover space. Institutions still investing in purely narrative-driven coins, ignoring compliance, privacy, and AI integration, will find their projects unable to access liquidity, list on major exchanges, or exit successfully.

Finally, evolve investment methodologies. Outbound sourcing should replace passive waiting for pitch decks; accelerated due diligence should replace lengthy evaluation processes; quick response should replace bureaucracy. Additionally, explore structural opportunities in emerging markets—AI Rollups, RWA 2.0, cross-border payment stablecoin applications, fintech innovations in emerging markets. VC needs to shift from a “gambling for hundredfold returns” mentality to a “carefully selected survivor” mindset, using a 5-10 year long-term perspective rather than short-term speculation.

Wintermute’s report is essentially a wake-up call for the entire industry: 2026 is not a natural continuation of a bull market but a battlefield of winners-take-all. Those who adapt early to the new precise aesthetic—whether entrepreneurs or investors—will dominate when liquidity returns. Those still clinging to old models, old thinking, and outdated standards will find their projects failing one after another, tokens going to zero, and exit channels closing one after another. The market has changed, the game rules have changed, and the only constant is that projects with genuine self-sustainability and real ability to list are the ones worthy of capital in this era.

Institutions must change direction. First, fundamentally revise investment standards: shift from “how big can this story be” to “can this project prove self-sustainability at seed stage.” No longer scatter large amounts of capital early; instead, concentrate on a few high-quality seed projects or shift to later rounds to reduce risk. Data shows that in late-stage investments in 2025, the proportion reached 56%, not by chance but as a result of market voting with their feet.

More importantly, redefine the investment track. The integration of AI and crypto is not just a trend but a reality—2026 will see over 50% of investments in the AI-crypto crossover space. Institutions still investing in purely narrative-driven coins, ignoring compliance, privacy, and AI integration, will find their projects unable to access liquidity, list on major exchanges, or exit successfully.

Finally, evolve investment methodologies. Outbound sourcing should replace passive waiting for pitch decks; accelerated due diligence should replace lengthy evaluation processes; quick response should replace bureaucracy. Additionally, explore structural opportunities in emerging markets—AI Rollups, RWA 2.0, cross-border payment stablecoin applications, fintech innovations in emerging markets. VC needs to shift from a “gambling for hundredfold returns” mentality to a “carefully selected survivor” mindset, using a 5-10 year long-term perspective rather than short-term speculation.

Wintermute’s report is essentially a wake-up call for the entire industry: 2026 is not a natural continuation of a bull market but a battlefield of winners-take-all. Those who adapt early to the new precise aesthetic—whether entrepreneurs or investors—will dominate when liquidity returns. Those still clinging to old models, old thinking, and outdated standards will find their projects failing one after another, tokens going to zero, and exit channels closing one after another. The market has changed, the game rules have changed, and the only constant is that projects with genuine self-sustainability and real ability to list are the ones worthy of capital in this era.