Heavy betting on Ethereum hits a wall! Bitmine's accounting losses exceed $6.6 billion

3h ago

Taiwanese traders start accepting stablecoins! The Financial Supervisory Commission confirms: banks are "quietly training" to seize business opportunities

3h ago

Trending Topics

View More382.32K Popularity

12.72K Popularity

11.87K Popularity

7.7K Popularity

5.82K Popularity

Hot Gate Fun

View More- MC:$2.88KHolders:10.00%

- MC:$2.88KHolders:10.00%

- MC:$2.93KHolders:20.05%

- MC:$2.92KHolders:20.11%

- MC:$0.1Holders:10.00%

Pin

K1 Research: Funds have not exited the market; they just no longer love competing coins.

This article is jointly published by K1 Research & Klein Labs

2025 Monthly Event Review Calendar. source: Klein Labs

Looking back at 2025, this year was not simply a bull or bear market, but a re-positioning of the crypto industry within the multiple coordinates of politics, finance, and technology—laying the foundation for a more mature and institutionalized cycle in 2026.

At the beginning of the year, Trump’s inauguration and the digital asset strategy executive order significantly changed regulatory expectations. Meanwhile, $TRUMP token issuance brought cryptocurrencies into mainstream awareness, market risk appetite rapidly increased, Bitcoin achieved a historic breakthrough above $100,000, completing the first transition from “speculative asset” to “political and macro asset.”

Subsequently, the market quickly faced a backlash from real-world constraints. Celebrity tokens declined, Ethereum’s “injection event,” and Bybit’s epic hacking attack exposed issues of high leverage, weak risk control, and narrative overreach. The crypto market gradually cooled from frenzy between February and April, resonating with macro tariff policies and traditional risk assets, prompting investors to reassess the importance of safety, liquidity, and fundamentals in asset pricing.

During this phase, Ethereum’s performance was particularly representative: ETH faced pressure relative to Bitcoin, but this weakening was not due to degradation of technology or infrastructure. On the contrary, in the first half of 2025, Ethereum continued to advance on key roadmaps such as gas limit, Blob capacity, node stability, zkEVM, PeerDAS, and others, steadily improving infrastructure capabilities. However, the market did not price in these long-term developments accordingly.

Mid-year, structural recovery and institutionalization processes unfolded simultaneously. Ethereum’s Pectra upgrade and the Bitcoin 2025 conference supported technological and narrative momentum, while Circle’s IPO marked deep integration of stablecoins and compliant finance. The formal implementation of the GENIUS Act in July became the most symbolic turning point of the year—crypto industry’s first clear, systemic legislative endorsement in the US. Bitcoin hit a new high in this context, and on-chain derivatives platforms like Hyperliquid grew rapidly. New forms such as stock tokenization and Equity Perps began entering market view.

In the second half of the year, capital and narratives diverged noticeably. ETF approvals accelerated, retirement fund entry expectations grew, and the rate cut cycle began, collectively boosting mainstream asset valuations. Meanwhile, celebrity tokens, Meme coins, and high-leverage structures frequently experienced liquidations. The large-scale liquidation event in October became a concentrated reflection of risk release for the year; simultaneously, privacy tracks strengthened periodically, and new narratives like AI payments and Perp DEX quietly took shape in specific sectors.

At year-end, the market closed with high-level declines and low liquidity. Bitcoin fell below $90,000, while traditional safe-haven assets like gold and silver performed strongly, indicating that the crypto market had become deeply embedded in global asset allocation systems. At this point, mainstream crypto assets entered a phase of bottoming out: in 2026, will the market rebound following the traditional four-year cycle and then enter a bear market, or will institutional capital continue to flow in and regulatory frameworks improve, breaking cyclical laws and reaching new highs? This will be the core research question for the next phase.

Macroe Environment and Policies: Structural Changes in 2025

Reviewing previous crypto cycles, policy and regulation have always been key exogenous variables influencing market expectations. However, their mode of action changed fundamentally in 2025. Unlike the laissez-faire growth of 2017, the relaxed regulation of 2021, or the comprehensive suppression from 2022 to 2024, 2025 shows a systemic shift from suppression to allowance, from ambiguity to regulation.

In past cycles, regulation often intervened negatively: either through bans, investigations, or enforcement at market peaks to curb risk appetite, or through accountability measures during bear markets to release uncertainty. Under this model, policies could neither effectively protect investors nor provide long-term industry outlooks, instead exacerbating cyclical volatility.

Entering 2025, this governance approach began to change structurally: executive orders led the way, supervisory agencies aligned their rhetoric, and legislative frameworks gradually advanced—replacing the previous case-by-case enforcement model.

Cryptocurrency Regulation Development Map. source: Messari

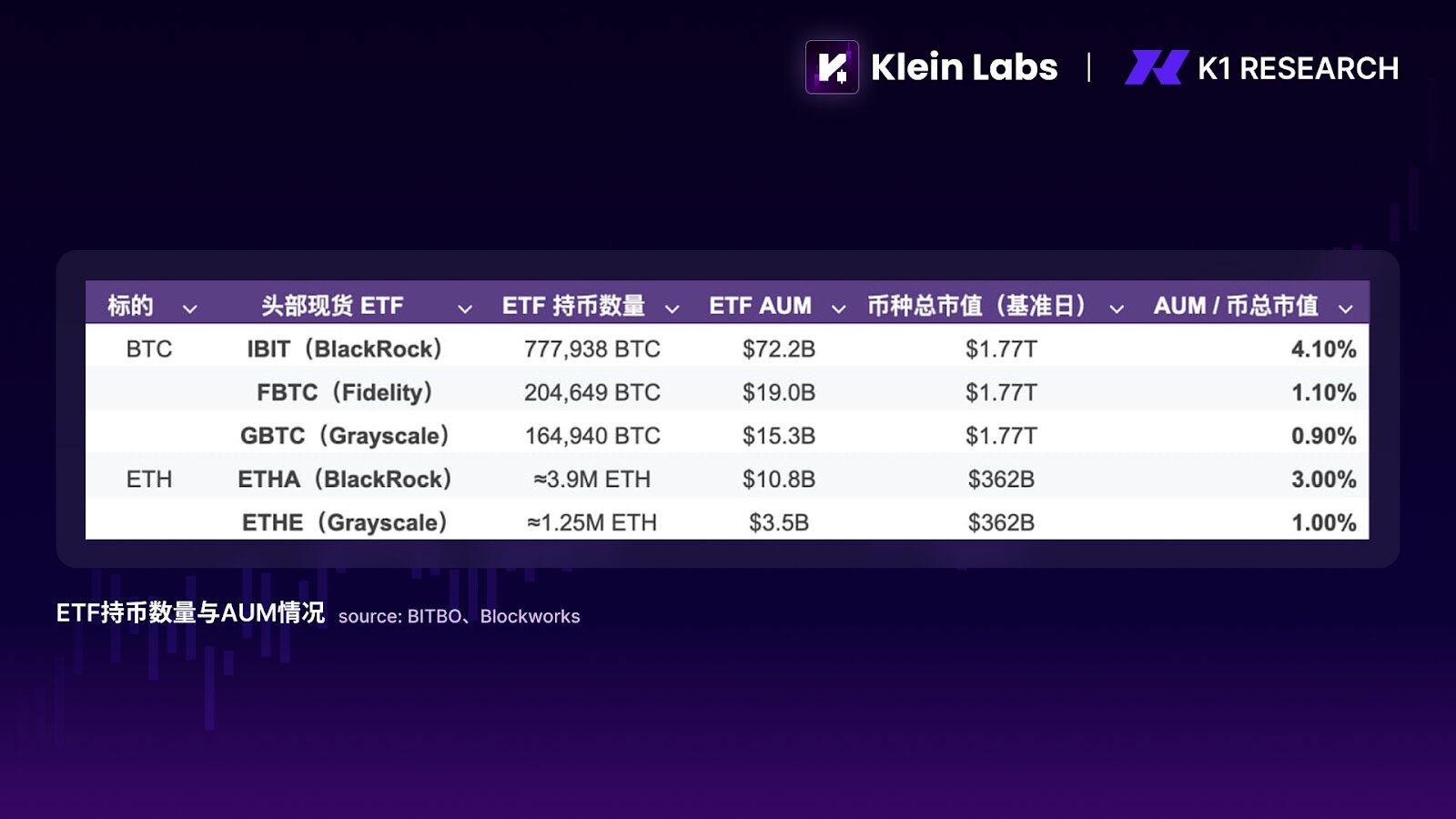

During this process, the advancement of ETFs and stablecoin legislation played a key role as “expectation anchors.” The approval of spot ETFs allowed Bitcoin, Ethereum, and other crypto assets to enter traditional financial systems for the first time, providing compliant channels for long-term capital allocation. By the end of 2025, the scale of Bitcoin- and Ethereum-related ETP/ETF products reached hundreds of billions of dollars, becoming the main institutional vehicle for regulated crypto asset investment.

Simultaneously, legislation related to stablecoins (such as the GENIUS Act) clarified the layered classification of crypto assets: which possess “financial infrastructure attributes” and which remain high-risk speculative products. This segmentation broke the blanket valuation of “cryptocurrencies” and prompted the market to differentiate valuation across assets and sectors.

It’s important to note that the policy environment in 2025 did not produce a “policy dividend explosion” like in previous cycles. Instead, its greater significance lies in providing a relatively clear lower bound: defining permissible behavior boundaries, distinguishing assets with long-term viability from those destined to be marginalized. Under this framework, policy shifted from “driving markets” to “risk constraint,” from “creating volatility” to “stabilizing expectations.” From this perspective, the policy shift in 2025 is not a direct driver of a bull market but a systemic foundation.

2. Capital Leads: Stablecoins, RWA, ETFs, and DAT Construct a “Low-Risk Channel”

In 2025, a counterintuitive yet crucial phenomenon became clearer: capital did not disappear, but prices did not respond accordingly. Stablecoin market cap and on-chain transfer volume remained high, spot ETF net inflows persisted across multiple periods, yet most competing tokens, aside from a few mainstream assets, remained under pressure. This divergence between capital activity and price performance is key to understanding the 2025 market structure.

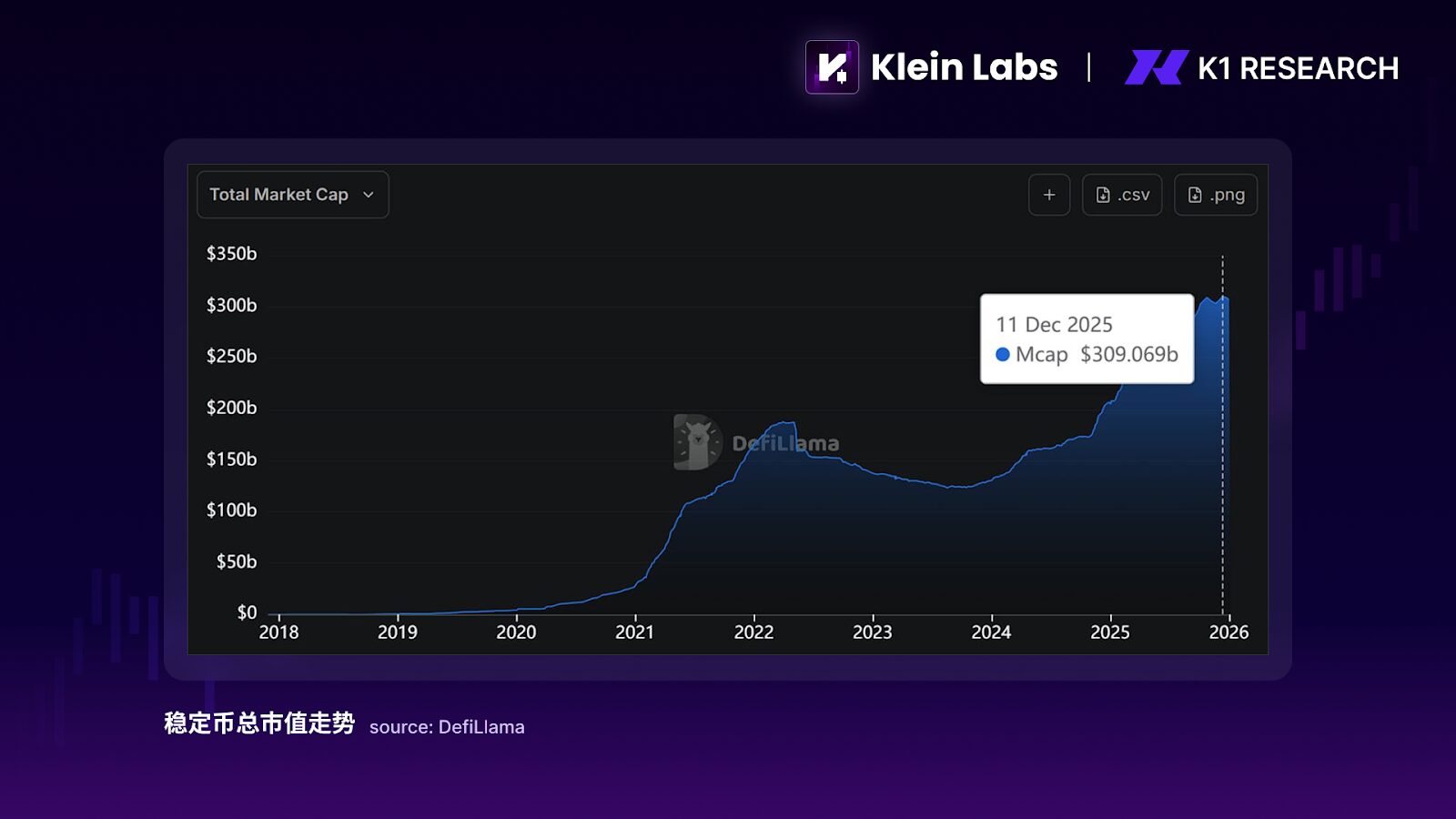

Stablecoins played a role entirely different from previous cycles. Historically, stablecoins were seen as “intermediary currencies” within exchanges or leverage fuel in bull markets, with growth closely tied to speculation. In 2025, stablecoins evolved into tools for capital retention and settlement. Their total market cap grew from about $200 billion at the start of the year to over $300 billion by year-end, with an increase of nearly $100 billion, while the overall market cap of competing tokens did not expand proportionally.

Meanwhile, stablecoin on-chain settlement volume reached trillions of dollars, even surpassing the annual transaction volume of traditional card networks in nominal terms. This indicates that in 2025, stablecoin growth was driven mainly by payment, clearing, and capital management needs, rather than speculation leverage.

The development of RWA further reinforced this trend. Real-world assets (RWA) that truly materialized in 2025 mainly included government bonds, money market fund shares, and short-term notes—low-risk assets. Their core significance was not to create new price elasticity but to verify the feasibility of compliant assets existing on-chain.

On-chain data shows that RWA protocol TVL accelerated from 2024 and continued upward in 2025—by October 2025, RWA protocol TVL approached $18 billion, several times higher than early 2024.

Although this scale is insufficient to directly influence crypto prices at the macro capital level, its structural impact is clear: RWA provides near risk-free yield options for on-chain capital, allowing some funds to “stay on-chain but not participate in crypto price volatility.” In a context of attractive interest rates and gradually clarified regulation, this choice marginally weakens the traditional positive correlation between on-chain activity and token prices, further explaining the “capital growth but price elasticity decline” characteristic of 2025.

ETF’s influence is more about capital layering than broad diffusion. Spot ETFs offer compliant, low-friction channels for mainstream assets like Bitcoin and Ethereum, but this capital entry path is highly selective. As of early 2026, top BTC/ETH spot ETFs hold over 6%/4% of the total circulating supply of these tokens, forming a clear institutional capital absorption at the mainstream asset level. However, this incremental capital has not spilled over into a broader asset spectrum.

During ETF promotion, Bitcoin dominance (the proportion of Bitcoin market cap in total crypto market cap) did not experience the rapid decline typical of previous bull markets; instead, it remained high, reflecting that institutional capital did not flow into long-tail assets (tokens ranked outside top 100). As a result, ETFs strengthened the capital absorption capacity of top assets but objectively increased internal market structural differentiation.

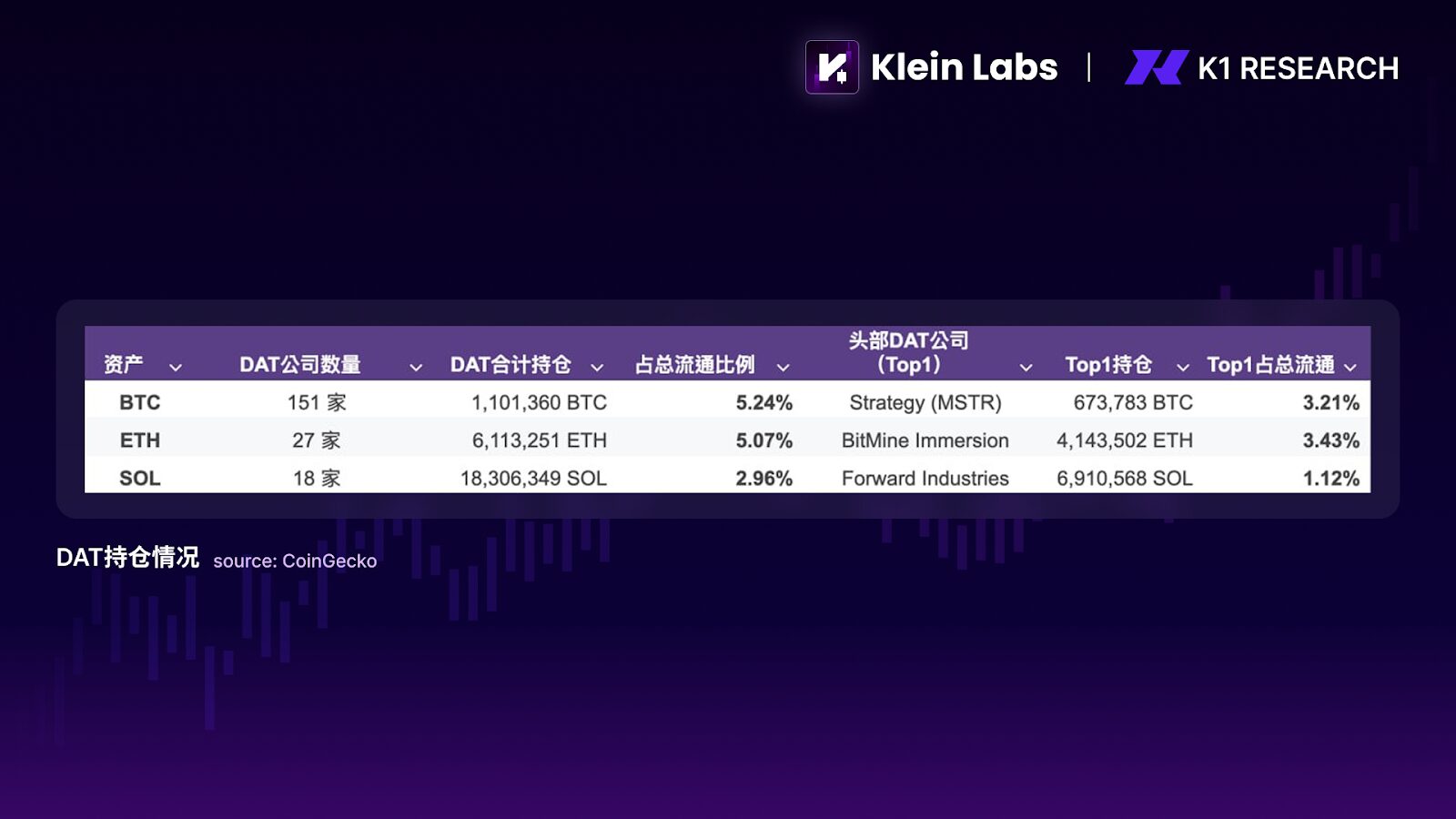

Similarly noteworthy is the rapid rise of “Coin-Stock Companies” DAT (Digital Asset Treasury Companies) in 2025: listed companies include BTC, ETH, and even SOL in their balance sheets, and through capital market tools like issuance, convertible bonds, buybacks, and collateralized income, they turn stocks into “fundable, crypto-equity-like assets with added value.” Nearly 200 companies have disclosed adopting similar DAT strategies, holding over $130 billion in digital assets. DAT has evolved from individual cases into a trackable capital market structure.

The structural significance of DAT is that, like ETFs, it enhances the capital absorption of mainstream assets, but with a more “equity-like” transmission mechanism—funds flow into stock valuation and financing cycles rather than directly into long-tail tokens’ secondary liquidity, further deepening capital stratification between mainstream assets and altcoins.

Overall, the incremental capital in 2025 did not disappear but systematically flowed into “compliant, low-volatility, long-term hold” channels.

3. Market Outcomes: Structural Segregation of Mainstream and Altcoin Markets

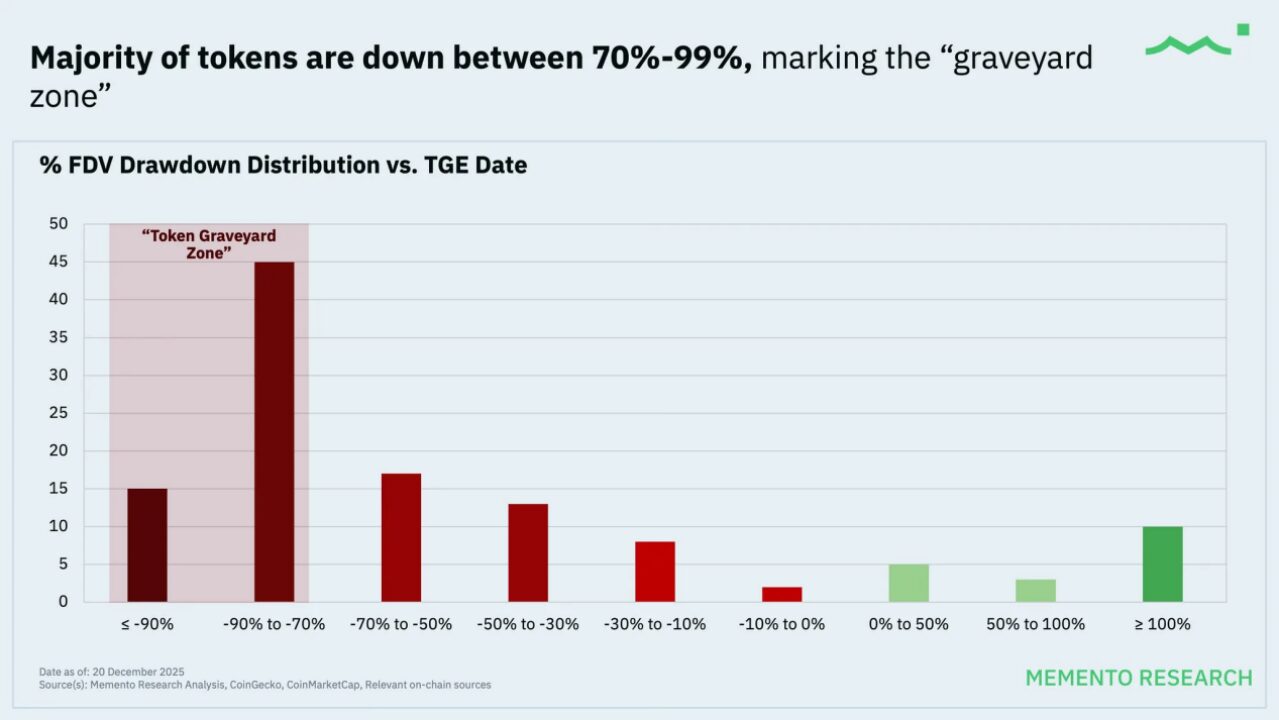

From the final price results, the 2025 crypto market exhibited a highly counterintuitive but logically consistent state: it did not collapse, but most projects continued to decline. According to Memento Research’s statistics on 118 token issuances in 2025, about 85% of tokens traded below their TGE (Token Generation Event) price, with median FDV retracement exceeding 70%. This performance did not significantly improve during subsequent market recovery phases.

2025 Token Issuance Status. source: MEMENTO RESEARCH

This phenomenon was not limited to tail projects but covered most small- and mid-cap assets, including some projects with high initial valuations and market attention that also significantly underperformed Bitcoin and Ethereum. Notably, even when weighted by FDV, overall performance remained negative, indicating that larger, higher-valuation projects exerted greater drag on the market. This clearly shows that the issues of 2025 are not demand “disappearing,” but demand shifting direction.

Against a backdrop of gradually clarified policies and regulation, the crypto capital structure is changing, but this change is not yet enough to replace the short-term dominance of narratives and sentiment in price movements. Compared to previous cycles, long-term capital and institutional funds are increasingly selective, entering assets and channels with regulatory compliance and deep liquidity—such as mainstream tokens, ETFs, stablecoins, and some low-risk RWAs. These funds mainly serve as “bottom-layer absorbers,” not short-term price drivers.

Meanwhile, the main trading activity remains driven by high-frequency capital and sentiment, and token supply still follows the issuance logic of previous cycles, expanding under the assumption of a “bullish rising market.” As a result, the highly anticipated systemic “altcoin season” has not yet materialized. New narratives, driven by sentiment, can generate short-term price feedback, but lack the capital support to sustain across volatility cycles. Prices tend to fall faster than narratives can be validated, leading to a clear phase and structural mismatch between supply and demand.

Under this dual structure, 2025 presents a new market state: at the macro cycle level, allocation logic begins to concentrate on mainstream assets and assets with institutional capacity; at the short cycle level, the crypto market remains a narrative- and sentiment-driven trading environment. Narratives are not invalid, but their scope is significantly compressed—they are more suitable for capturing sentiment swings rather than supporting long-term valuation.

Therefore, 2025 is not the end of narrative-based pricing but the beginning of a process where narratives are filtered by capital structure: prices will still react to sentiment and stories, but only assets capable of attracting long-term capital after volatility will truly realize value. In this sense, 2025 is more like a “transition period of pricing power” than an endpoint.

Industry and Narrative: Key Directions Under Structural Segregation

1.1 2025 Review: Yield-Generating Assets Become Capital’s Main Recipients

In a context where narratives still dominate short-term prices but long-term capital begins setting participation thresholds, tokens with genuine yields were the first to adapt to capital structure changes. This track showed relative resilience in 2025 not because its narrative was more attractive, but because it offered capital a participation path that did not rely on continuous emotional upward momentum—holding still provided clear returns even if prices stagnated.

This change was first evident in the acceptance of yield-bearing stablecoins. USDe, for example, did not depend on complex narratives but quickly gained recognition through a clear, explainable yield structure. In 2025, USDe’s market cap briefly surpassed $10 billion, becoming the third-largest stablecoin after USDT and USDC, with growth rates and scale significantly outpacing most risk assets of the same period.

This indicates that some capital now views stablecoins as cash management tools rather than mere trading intermediaries, especially in a high-interest-rate environment with gradually clarified regulation. They are beginning to stay long on-chain in stablecoin form. Its valuation logic shifted from “whether it has narrative elasticity” to “whether the yield is real and sustainable.” This does not mean the crypto market has fully entered a cash flow valuation stage, but it clearly shows that when narrative space is compressed, capital prefers asset forms that do not require storytelling to be viable.

1.2 2026 Outlook: Capital Will Further Concentrate on Core Value Assets

When markets enter rapid decline or liquidity contraction phases, the so-called “worthy assets” are not judged by their narratives but by their resilience—specifically, whether they can generate fees/income in low-risk environments and whether this income can support the token through buybacks, burnings, fee switches, or staking yields. Assets like BNB, SKY, HYPE, PUMP, ASTER, RAY, which have more direct value capture mechanisms, tend to be prioritized during panic periods. Conversely, assets like ENA, PENDLE, ONDO, VIRTUAL, with clearer functions but more differentiated value stability, are better suited for structural filtering during emotional recovery phases after declines: those that can convert functional use into sustainable income and verifiable token backing qualify to move from “trading narratives” to “allocatable assets.”

DePIN (Decentralized Physical Infrastructure Networks) extends the logic of genuine yield over a longer horizon. Unlike yield-bearing stablecoins and mature DeFi, DePIN’s core is not financial structure but whether tokenization incentives can transform highly capital-intensive or low-efficiency infrastructure needs in the real world into sustainable decentralized supply networks.

By 2025, the market has completed initial screening: projects unable to prove cost advantages or heavily reliant on subsidies quickly lose capital patience; those that connect to real needs (computing power, storage, communication, AI inference, etc.) are beginning to be viewed as “income-generating infrastructure.” Currently, DePIN is more like a direction closely watched by capital amid accelerating AI demand, but not yet fully priced. Its ability to enter mainstream valuation in 2026 depends on whether real needs can be converted into scalable, sustainable on-chain revenue.

Overall, tokens with genuine yields are the first to be retained not because they have entered mature value investment stages, but because they meet a very practical condition: providing capital with a reason to stay without relying on continuous price appreciation. This also determines that the key issue for this track in 2026 will no longer be “whether there is a narrative,” but “whether yields remain sustainable after scaling.”

2.1 2025 Review: AI and Robotics Narrative Cooling Down

If any track in 2025 “failed” in price terms but became more important in the long run, AI and Robotics × Crypto are the most representative. Over the past year, DeAI investment enthusiasm in primary and secondary markets cooled significantly compared to 2024, with related tokens underperforming mainstream assets and narrative premiums rapidly compressed. But this cooling was not due to the direction itself failing; rather, AI’s productivity change manifests more in systemic efficiency improvements, causing a phase mismatch with crypto market valuation mechanisms.

Between 2024 and 2025, structural changes occurred within the AI industry: inference demand rose faster than training demand, post-training and data quality gained importance, open-source model competition intensified, and agent economies began transitioning from concept to practical application. These changes point to a fact—AI is moving from “model capability race” to “system engineering stage involving compute, data, collaboration, and settlement efficiency.” These are also areas where blockchain can play a long-term role: decentralized compute and data markets, composable incentive mechanisms, and native value settlement and access control.

2.2 Outlook for 2026: Productivity Revolution as the Key to Narrative Limit

Looking ahead to 2026, the significance of AI × Crypto is shifting. It is no longer a short-term narrative of “AI project issuing tokens,” but a supplementary infrastructure and coordination tool for the AI industry. Robotics × Crypto is similar; its real value lies not in robots themselves but in how identity, permissions, incentives, and settlement are managed automatically in multi-agent systems. As AI agents and robotic systems gradually gain autonomous execution and collaboration capabilities, friction in traditional centralized systems regarding permissions and cross-entity settlement will become apparent, and on-chain mechanisms offer a potential solution.

However, this track did not receive systemic valuation in 2025, mainly because its productivity value cycle is too long. Unlike DeFi or trading protocols, the commercial closed-loop of AI and Robotics is not yet fully formed. Real demand is growing but difficult to convert into scalable, predictable on-chain revenue in the short term. Therefore, in the current market structure where narratives are compressed and capital prefers receivable assets, AI × Crypto is more like a continuously tracked but not yet mainstream allocated direction.

AI and Robotics × Crypto should be understood as layered narratives: in the long term, DeAI is a potential productivity infrastructure; in the medium and short term, protocol-level innovations like x402 may become highly elastic narratives repeatedly validated by sentiment and capital. The core value of this track is not whether it is immediately priced but the higher ceiling it can unlock once entering valuation ranges, far exceeding traditional application narratives.

3.1 2025 Review: Stable and Steady Speculative Demand

In a context where narratives are compressed and long-term capital is cautious, prediction markets and decentralized perpetual contracts (Perp DEX) became some of the few sectors with countercyclical growth in 2025. The reason is simple: they serve the most fundamental and hardest-to-eliminate demand in crypto—pricing uncertainty and leverage trading. Unlike many application narratives, these products do not create new demand but transfer existing demand.

Prediction markets aggregate information; capital “votes” on future events through betting, and prices approach collective consensus through continuous adjustment. Structurally, they are a natural, relatively compliant “gambling” form: no house controls odds, outcomes depend on real-world events, and platforms profit from transaction fees.

The first high-profile appearance of this track was during the US presidential election. Prediction markets around election results rapidly gathered liquidity and public attention on-chain, elevating from fringe DeFi products to influential narrative directions. In 2025, this narrative did not fade but continued to ferment with infrastructure maturity and multiple protocol token issuance expectations. Data shows that the total transaction volume of prediction markets exceeded $2.4 billion, with open interest around $270 million, indicating real capital is continuously bearing event risk, not just short-term speculation.

Perp DEX’s rise more directly points to the core product form of crypto—contract trading. Its significance is not whether “on-chain is faster than off-chain,” but whether it introduces a verifiable, settlement-ready, trustless environment to the opaque, high-counterparty-risk contract market. Transparent positions, liquidation rules, and fund pool structures give Perp DEX different security attributes from centralized exchanges.

However, it must be acknowledged that in 2025, most contract trading volume still concentrated on CEXs, not due to trust issues but because of efficiency and user experience.

3.2 Outlook for 2026: System and Technology as Cross-Cycle Enablers

Looking ahead to 2026, collaborations like Polymarket and Parcl launching real estate prediction markets could reach broader non-crypto audiences, becoming breakthrough applications. Major global events like the World Cup, which naturally involve betting, could become the next traffic pivot for prediction markets.

More importantly, infrastructure maturity—such as deeper liquidity, improved market-making mechanisms, cross-event capital reuse, and large order capacity—will determine whether prediction markets evolve from “event-based gambling” to a long-term probability pricing infrastructure capable of handling macro, political, financial, and social uncertainties. If these conditions mature, the ceiling of prediction markets will extend beyond short-term traffic to becoming one of the few core applications with cross-cycle longevity in crypto.

Whether Perp DEX can continue to expand depends not on “decentralization” per se but on whether it can provide incremental value on the demand side that centralized platforms cannot offer temporarily. For example, improving capital efficiency: integrating unused contract margins with DeFi protocols to participate in lending, market-making, or yield strategies without significantly increasing liquidation risk, thereby enhancing overall capital utilization.

If Perp DEX can further unlock such structural innovations on a secure, transparent basis, its competitiveness will no longer be just “safer” but “more efficient.”

From a broader perspective, prediction markets and Perp DEX share a common trait: they do not rely on long-term narrative premiums but on repeatable, scalable speculative and trading demand. In environments where narratives are filtered and altcoin seasons are absent, these tracks are more likely to sustain continuous attention. They may not be the first choice for long-term capital allocation but could become the core stage where sentiment, trading capital, and technological innovation repeatedly intersect in 2026.

Summary

Looking at the big picture, 2025 is not a “failed bull market,” but a deep restructuring of crypto market pricing power, participant structure, and value sources. Policy-wise, regulation shifted from high uncertainty suppression to clear boundary and function delineation; capital-wise, long-term funds did not directly flow back into high-volatility assets but first established compliant, auditable, low-volatility channels through ETFs, DAT, stablecoins, and low-risk RWAs; market-wise, price mechanisms fundamentally changed, narrative diffusion no longer automatically triggered linear upward feedback, and the era of rising competitive coins gradually faded, giving way to structural differentiation.

But this does not mean narratives have exited the market. On the contrary, in shorter timeframes and more localized sectors, narratives and sentiment remain the most important trading drivers. The recurring activity in prediction markets, Perp DEX, AI payments, Meme coins, etc., indicates that crypto remains a highly speculative, decentralized information and risk game. The difference is that these narratives are increasingly difficult to solidify into long-term valuation bases; they are more like phased opportunities around real use cases, trading needs, or risk expressions, constantly filtered, quickly validated, and rapidly cleared by capital structures.

Therefore, entering 2026, a more realistic and operational framework is taking shape: at the macro cycle level, the market will continue to concentrate on mainstream assets and infrastructure with genuine utility, distribution capacity, and institutional acceptance; at the micro cycle level, narratives still matter but are no longer to be blindly trusted. For investors, the key is no longer betting on “the next full bull,” but more pragmatically assessing which assets and sectors can survive market contractions, regulatory constraints, and increased competition, and which can lead in sentiment recovery and risk appetite phases.