Cryptocurrency exemption fails to take effect in January! US SEC urgently "puts on the brakes," Wall Street erupts

4m ago

"Short-term bear market" is not a cause for concern! Bernstein: Bitcoin will bottom out at $60,000 and is brewing a major comeback

8m ago

Trending Topics

View More9.04K Popularity

6.4K Popularity

6.61K Popularity

325 Popularity

2.02K Popularity

Hot Gate Fun

View More- MC:$2.82KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.84KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.83KHolders:10.00%

Pin

Bullish feast over? Bitcoin unexpectedly shows "bear market signal": holders "cut losses and exit" for the first time in 2 years

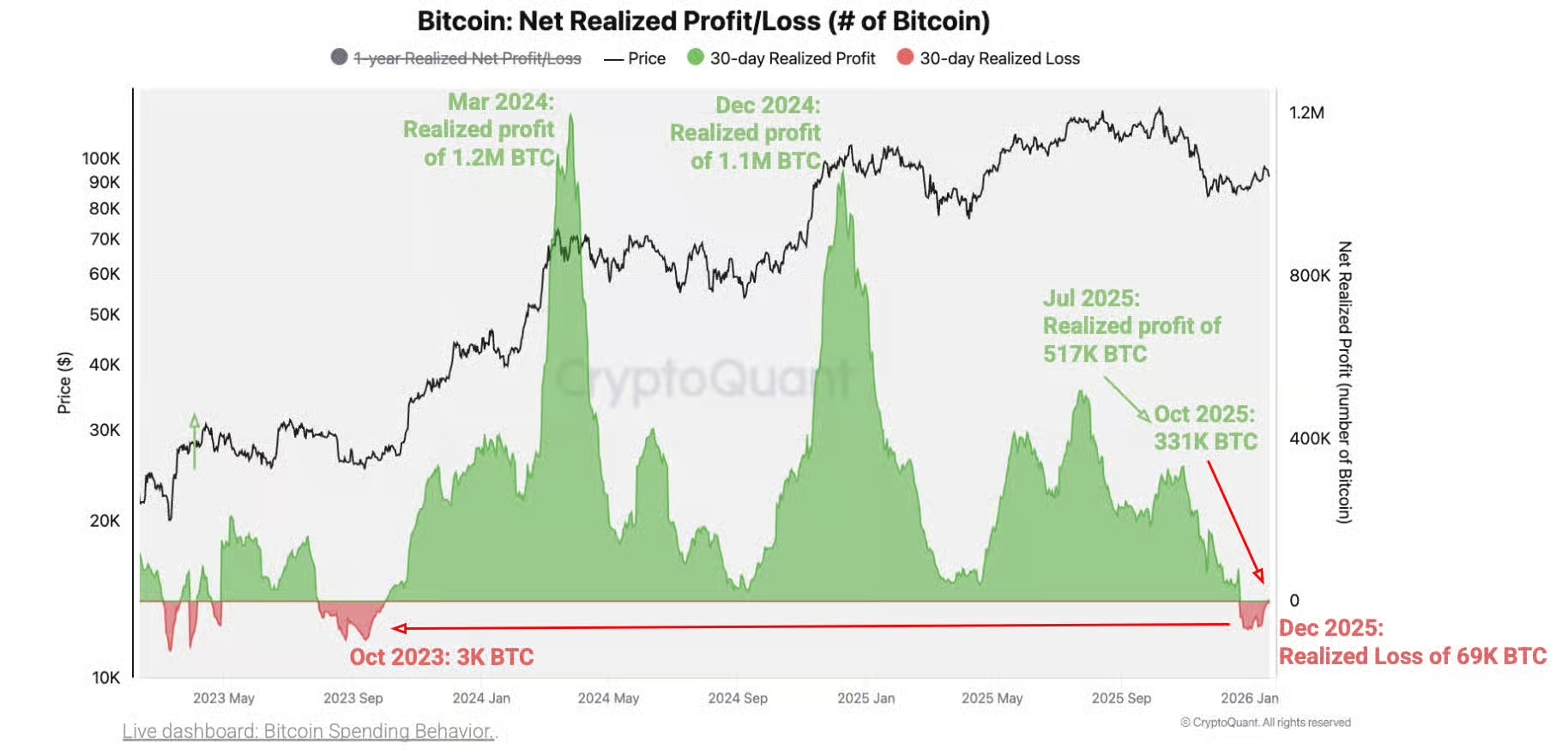

After more than a year of profit frenzy, on-chain profit dynamics for Bitcoin have undergone a significant change. On-chain data analysis firm CryptoQuant states that Bitcoin holders have recently started to show “net realized losses,” meaning they are selling Bitcoin at substantial losses, a phenomenon not seen since October 2023. This not only indicates a major shift in market sentiment but also strongly suggests that the bull market may have entered its final phase. CryptoQuant’s report notes: “In the past 30 days, investor behavior has shifted from ‘profit-taking’ to ‘loss-cutting.’” Further analysis reveals that as early as the beginning of 2024, the market’s profit momentum has been declining in a stepwise fashion. Examining data from January and December 2024, as well as July and October 2025, shows a trend where profit peaks are progressively lower. This implies that even though Bitcoin prices on paper remained high earlier, the internal strength supporting these prices has already been waning. Data shows that since December 23, 2025, the total realized losses for Bitcoin holders amount to approximately 69,000 BTC. CryptoQuant believes that this long-term weakening of profit momentum is a typical sign of a “bull market ending.”

Regarding how these figures are calculated, CryptoQuant’s research director Julio Moreno explains that the indicator is derived from cross-referencing “on-chain transfer behavior” with “market prices.”

Simply put, when Bitcoin is transferred or spent on-chain, analysts compare the “price at this transfer” with the “price at the last transfer,” then calculate profit or loss based on these prices and the amount of Bitcoin transferred.

CryptoQuant further warns that the current shift from “net profit” to “net loss” closely resembles the process of the 2021 to 2022 bull market turning into a bear market.

At that time, realized gains peaked in January 2021, then declined steadily, and ultimately, before the 2022 bear market officially began, on-chain activity shifted entirely to losses.

From a longer-term perspective, CryptoQuant points out that Bitcoin’s “annual net realized profit” has also weakened again, currently around 2.5 million BTC, which is not only lower than the 4.4 million BTC recorded in October last year but also marks a new low since March 2024. CryptoQuant believes that the decline in net realized profit indicates that Bitcoin’s price support is breaking down.

Data shows that since December 23, 2025, the total realized losses for Bitcoin holders amount to approximately 69,000 BTC. CryptoQuant believes that this long-term weakening of profit momentum is a typical sign of a “bull market ending.”

Regarding how these figures are calculated, CryptoQuant’s research director Julio Moreno explains that the indicator is derived from cross-referencing “on-chain transfer behavior” with “market prices.”

Simply put, when Bitcoin is transferred or spent on-chain, analysts compare the “price at this transfer” with the “price at the last transfer,” then calculate profit or loss based on these prices and the amount of Bitcoin transferred.

CryptoQuant further warns that the current shift from “net profit” to “net loss” closely resembles the process of the 2021 to 2022 bull market turning into a bear market.

At that time, realized gains peaked in January 2021, then declined steadily, and ultimately, before the 2022 bear market officially began, on-chain activity shifted entirely to losses.

From a longer-term perspective, CryptoQuant points out that Bitcoin’s “annual net realized profit” has also weakened again, currently around 2.5 million BTC, which is not only lower than the 4.4 million BTC recorded in October last year but also marks a new low since March 2024. CryptoQuant believes that the decline in net realized profit indicates that Bitcoin’s price support is breaking down.