MICA Daily|Tom Lee predicts January's new high for BTC, ETH breaks 7,000, what about now?

57m ago

Bullish "hope" shattered? Bitcoin drops below $78,000, analysts warn: weekend sell-off is just the beginning

1h ago

Trending Topics

View More373.98K Popularity

1.65K Popularity

1.85K Popularity

1.04K Popularity

599 Popularity

Hot Gate Fun

View More- MC:$2.72KHolders:10.00%

- MC:$2.85KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.85KHolders:10.00%

Pin

On-chain data hits new highs. In a sluggish market, how does the Avalanche ecosystem "build nests to attract phoenixes"?

Original: Zen, PANews

Since Q4 2025, Avalanche has been experiencing a rapid resurgence in on-chain activity, almost simultaneously with institutional adoption. On one side, mainnet activity indicators have repeatedly hit new highs at the end of the year and in January. On the other side, there has been a surge of events focused on institutional workflows and compliance distribution. Even in a bearish market, the story of assets being brought on-chain continues to accelerate. Institutionalization Drives Asset On-Chain In January 2026, the well-known crypto investment bank Galaxy Digital announced the successful issuance of its first tokenized loan debt (CLO) on Avalanche, with a total scale of $75 million, of which $50 million was subscribed by the institutional credit agreement Grove. CLO is a structured credit product that packages corporate loans and sells them to investors of different risk levels. Its tranches are tokenized and issued via the regulated digital asset platform INX on the Avalanche network, offering trading to qualified investors. This investment is actually Grove’s second large-scale deployment on the Avalanche platform. In July last year, Grove announced the launch on Avalanche, with an initial deployment strategy aiming to issue up to approximately $250 million in real-world assets (RWA) on the network. Grove allocated funds to JAAA issued via the multi-chain protocol Centrifuge’s native chain, and the share tokens were issued and circulated on Avalanche C-Chain.

As a high-performance public chain designed specifically for institutional finance, Avalanche not only offers EVM compatibility, rapid deployment, and access to compliant distribution channels but also emphasizes quick deployment of customizable Avalanche L1 (subnets), which better meets requirements for access, compliance, performance, and risk control. This has made it one of the top-tier financial institutions on-chain.

For example, New Jersey-based real estate infrastructure company Balcony announced in May last year that it deployed a scalable, dedicated Avalanche L1 service via the AvaCloud platform, aiming to digitize and tokenize property records worth approximately $240 billion across more than 370,000 land parcels. AvaCloud is a hosted blockchain service provider for Avalanche L1, assisting enterprises in building, deploying, and scaling Layer-1 networks.

Data Showing “Two Extremes”

Avalanche’s institutional route has contributed to steady growth in its on-chain assets. According to Token Terminal data, the total market cap of stablecoins and tokenized funds on Avalanche’s mainnet has increased by about 70% over the past two years since January 2024.

Data from RWA.xyz shows that as of January 21, Avalanche’s stablecoin assets exceeded $2.2 billion, and RWA assets totaled over $1.351 billion — with Distributed Assets (tokens that can be transferred peer-to-peer) around $636 million, and Represented Assets (assets that cannot be transferred outside the issuing platform) around $715 million.

Distributed Assets refer to tokenized assets that can be transferred directly between wallets, focusing on market coverage, inclusive finance, and platform interoperability; while Represented Assets are more like shared ledgers for accounting, clearing, and settlement, with assets not transferable outside the platform.

By December 2025, the total transaction volume of all Avalanche Layer-1 networks surpassed 10 billion transactions. With this milestone, the ecosystem officially entered a period of recovery at the end of the year. In that month, Avalanche’s C-Chain set new records for the highest single-day and weekly transaction counts in 2025, with active addresses reaching 651.2 million, weekly capital inflows of $43 million, ranking second among all blockchains at one point.

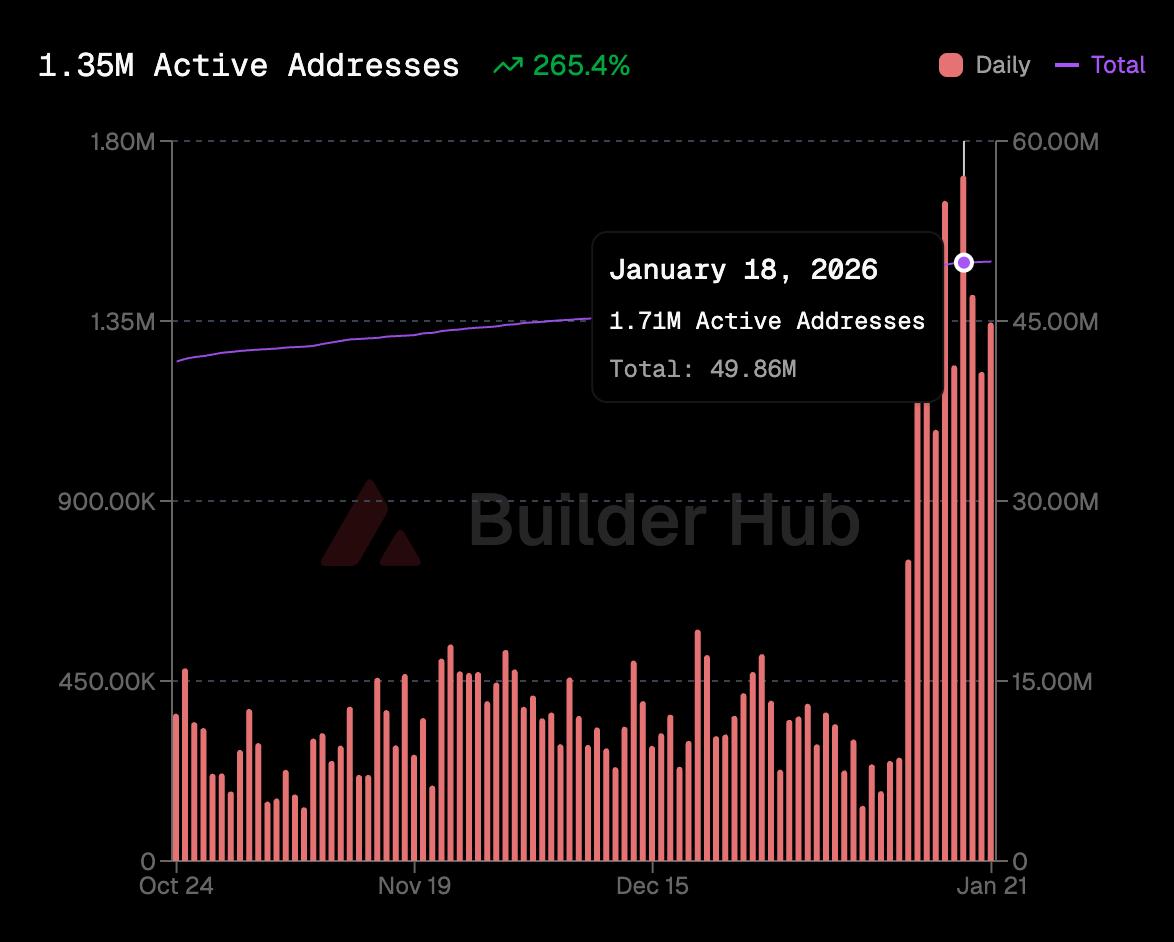

Entering the new year, Avalanche continued its growth momentum from late 2025, with its main network (primarily C-Chain, along with P-Chain and X-Chain) seeing consecutive new highs in daily active addresses, peaking at 1.71 million on January 18.

This investment is actually Grove’s second large-scale deployment on the Avalanche platform. In July last year, Grove announced the launch on Avalanche, with an initial deployment strategy aiming to issue up to approximately $250 million in real-world assets (RWA) on the network. Grove allocated funds to JAAA issued via the multi-chain protocol Centrifuge’s native chain, and the share tokens were issued and circulated on Avalanche C-Chain.

As a high-performance public chain designed specifically for institutional finance, Avalanche not only offers EVM compatibility, rapid deployment, and access to compliant distribution channels but also emphasizes quick deployment of customizable Avalanche L1 (subnets), which better meets requirements for access, compliance, performance, and risk control. This has made it one of the top-tier financial institutions on-chain.

For example, New Jersey-based real estate infrastructure company Balcony announced in May last year that it deployed a scalable, dedicated Avalanche L1 service via the AvaCloud platform, aiming to digitize and tokenize property records worth approximately $240 billion across more than 370,000 land parcels. AvaCloud is a hosted blockchain service provider for Avalanche L1, assisting enterprises in building, deploying, and scaling Layer-1 networks.

Data Showing “Two Extremes”

Avalanche’s institutional route has contributed to steady growth in its on-chain assets. According to Token Terminal data, the total market cap of stablecoins and tokenized funds on Avalanche’s mainnet has increased by about 70% over the past two years since January 2024.

Data from RWA.xyz shows that as of January 21, Avalanche’s stablecoin assets exceeded $2.2 billion, and RWA assets totaled over $1.351 billion — with Distributed Assets (tokens that can be transferred peer-to-peer) around $636 million, and Represented Assets (assets that cannot be transferred outside the issuing platform) around $715 million.

Distributed Assets refer to tokenized assets that can be transferred directly between wallets, focusing on market coverage, inclusive finance, and platform interoperability; while Represented Assets are more like shared ledgers for accounting, clearing, and settlement, with assets not transferable outside the platform.

By December 2025, the total transaction volume of all Avalanche Layer-1 networks surpassed 10 billion transactions. With this milestone, the ecosystem officially entered a period of recovery at the end of the year. In that month, Avalanche’s C-Chain set new records for the highest single-day and weekly transaction counts in 2025, with active addresses reaching 651.2 million, weekly capital inflows of $43 million, ranking second among all blockchains at one point.

Entering the new year, Avalanche continued its growth momentum from late 2025, with its main network (primarily C-Chain, along with P-Chain and X-Chain) seeing consecutive new highs in daily active addresses, peaking at 1.71 million on January 18.

However, if we shift focus from on-chain activity to asset pricing and DeFi activity, the “recovery curve” is not as evident. According to CoinGecko data, from mid-January to now, AVAX’s closing price has fluctuated roughly between $12 and $15, closing at about $12.09 on January 20, the lowest since November 2023.

Looking at DeFiLlama’s on-chain metrics, Avalanche’s native TVL is approximately $1.66 billion, with bridged TVL around $3.62 billion. Meanwhile, on-chain fees/revenue remain relatively low on a daily basis, indicating that even with increasing transaction and address counts, protocol-level value capture may not be proportionate.

Considering macro factors, cryptocurrencies, especially Layer-1 tokens, have generally been under pressure over the past year. Even with institutional collaborations or technological progress within the ecosystem, stronger market beta and the longstanding issue of lack of large-scale applications overshadow Avalanche’s valuation issues, which are not unique to it.

Building a Nest for the Phoenix: Launching a $1 Million Builder Competition

For infrastructure projects, a bear market is also a good time to accumulate strength and focus on ecosystem development.

Taking advantage of the recent rebound in on-chain activity, Avalanche has intensified its developer support initiatives. On January 21, the Avalanche Foundation announced the launch of the “BuildGames” builder competition, offering a total prize pool of $1 million. The competition is set for six weeks, with a rolling review process, and registration is open immediately. The competition has no specific theme or track restrictions. Outstanding teams may also receive follow-up guidance and funding from Avalanche’s incubation program.

However, if we shift focus from on-chain activity to asset pricing and DeFi activity, the “recovery curve” is not as evident. According to CoinGecko data, from mid-January to now, AVAX’s closing price has fluctuated roughly between $12 and $15, closing at about $12.09 on January 20, the lowest since November 2023.

Looking at DeFiLlama’s on-chain metrics, Avalanche’s native TVL is approximately $1.66 billion, with bridged TVL around $3.62 billion. Meanwhile, on-chain fees/revenue remain relatively low on a daily basis, indicating that even with increasing transaction and address counts, protocol-level value capture may not be proportionate.

Considering macro factors, cryptocurrencies, especially Layer-1 tokens, have generally been under pressure over the past year. Even with institutional collaborations or technological progress within the ecosystem, stronger market beta and the longstanding issue of lack of large-scale applications overshadow Avalanche’s valuation issues, which are not unique to it.

Building a Nest for the Phoenix: Launching a $1 Million Builder Competition

For infrastructure projects, a bear market is also a good time to accumulate strength and focus on ecosystem development.

Taking advantage of the recent rebound in on-chain activity, Avalanche has intensified its developer support initiatives. On January 21, the Avalanche Foundation announced the launch of the “BuildGames” builder competition, offering a total prize pool of $1 million. The competition is set for six weeks, with a rolling review process, and registration is open immediately. The competition has no specific theme or track restrictions. Outstanding teams may also receive follow-up guidance and funding from Avalanche’s incubation program.

From the foundation’s existing support system, Avalanche’s developer support is not just a one-time event but consists of multiple parallel channels.

One is the official accelerator Codebase, which focuses on rapid mentorship for early-stage teams and non-dilutive funding. Selected teams can receive $50,000 in funding and support across practical areas such as product development, token design, validator/infrastructure strategies, growth, and compliance.

Second is the foundation’s Grants program, mainly targeting infrastructure and AI-related projects. Lastly, Retro9000, with a maximum fund pool of $40 million, aims to reward teams that have already delivered tangible results and impact on Avalanche L1 or key toolchains, lowering the barrier of “funding before delivery” and favoring builders with proven value.

On the infrastructure side, Avalanche completed a network upgrade codenamed “Granite” at the end of last year, consisting of three ACPs (ACP-181/204/226). The Granite upgrade introduced dynamic block times, biometric authentication, and a more stable validator view, improving cross-chain message reliability and performance.

Overall, in the past month, Avalanche’s ecosystem has gained institutional capacity for scaling, and with infrastructure development and developer incentives, it has laid a solid foundation for growth in 2026.

From the foundation’s existing support system, Avalanche’s developer support is not just a one-time event but consists of multiple parallel channels.

One is the official accelerator Codebase, which focuses on rapid mentorship for early-stage teams and non-dilutive funding. Selected teams can receive $50,000 in funding and support across practical areas such as product development, token design, validator/infrastructure strategies, growth, and compliance.

Second is the foundation’s Grants program, mainly targeting infrastructure and AI-related projects. Lastly, Retro9000, with a maximum fund pool of $40 million, aims to reward teams that have already delivered tangible results and impact on Avalanche L1 or key toolchains, lowering the barrier of “funding before delivery” and favoring builders with proven value.

On the infrastructure side, Avalanche completed a network upgrade codenamed “Granite” at the end of last year, consisting of three ACPs (ACP-181/204/226). The Granite upgrade introduced dynamic block times, biometric authentication, and a more stable validator view, improving cross-chain message reliability and performance.

Overall, in the past month, Avalanche’s ecosystem has gained institutional capacity for scaling, and with infrastructure development and developer incentives, it has laid a solid foundation for growth in 2026.