Heavy betting on Ethereum hits a wall! Bitmine's accounting losses exceed $6.6 billion

1h ago

Taiwanese traders start accepting stablecoins! The Financial Supervisory Commission confirms: banks are "quietly training" to seize business opportunities

1h ago

Trending Topics

View More382.04K Popularity

12.07K Popularity

11.45K Popularity

6.98K Popularity

4.94K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.87KHolders:00.00%

- MC:$2.87KHolders:00.00%

Pin

Golden on the left, Wall Street on the right, Bitcoin stands at the crossroads of the "new and old cycles"

Author: Nancy, PANews

There are so many good assets in the world, Bitcoin is no longer as sexy.

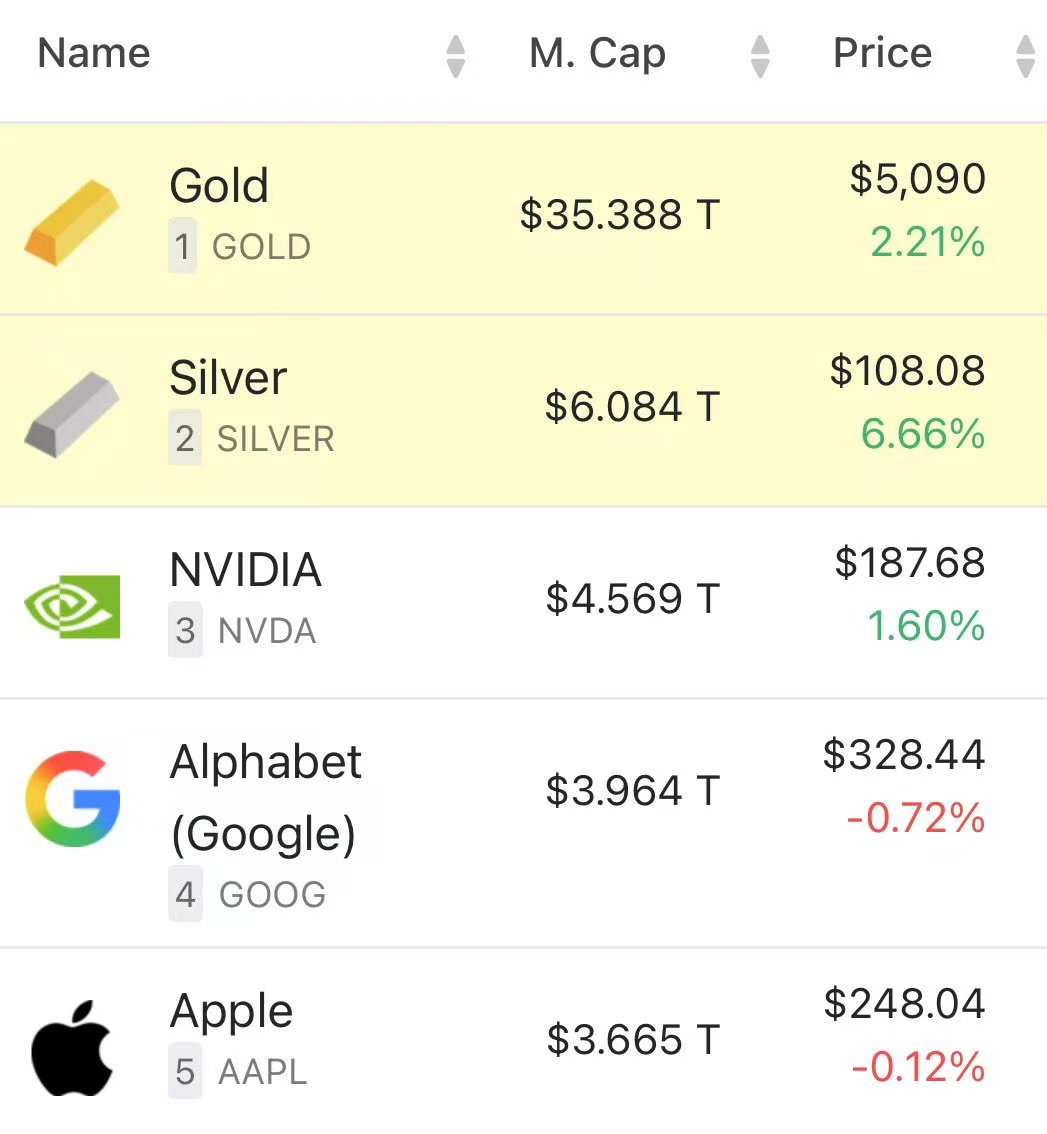

When gold broke through $5,000 to reach a historic high, Bitcoin was sleeping. A “debate” about Bitcoin’s role fermented within the cryptocurrency community. People couldn’t help but ask, “Can the story of ‘digital gold’ still be continued?”

Recently, crypto KOL @BTCdayu shared the perspective of a Bitcoin OG, who has sold over 80% of their Bitcoin holdings, and openly stated that Bitcoin is facing a fundamental shift in narrative. This viewpoint quickly sparked heated discussion within the circle.

New operators, new pricing logic

In the first half, Bitcoin was the golden age of recognition-to-realization, with the stage mainly belonging to early accumulators and infrastructure builders.

But in the second half, the game rules have fundamentally changed. With the approval of spot Bitcoin ETFs, large-scale allocations by Strategy and other DAT companies, and the U.S. government incorporating Bitcoin into national strategic considerations, Bitcoin has been forced to don the “formal attire” tailored by Wall Street.

During this cycle, Bitcoin quietly completed a large-scale transfer of chips. Early accumulators gradually exited, Wall Street institutions entered en masse, and Bitcoin shifted from a growth asset to a portfolio asset.

This means that Bitcoin’s pricing power has shifted from the offshore wild west to the onshore financial system dominated by the US dollar. From trading channels, liquidity, to regulatory frameworks, Bitcoin is moving closer to high-volatility, high-beta dollar-denominated risk assets.

Solv Protocol co-founder and CEO Meng Yan bluntly stated that the world has entered an era of empire rivalry, where the most important issue is who wins and who loses. The U.S. regulation’s goal is not only to dollarize crypto assets but also to turn crypto and RWA (real-world assets) into tools for maintaining dollar hegemony in the digital age. If Bitcoin is just another mediocre dollar asset, its prospects are indeed worrying. But if crypto becomes the core system of the dollar digital economy, then BTC, as its nuclear-powered aircraft carrier, remains promising.

For the U.S., the main issue now is that their control over Bitcoin is not yet strong enough.

Meanwhile, in the view of crypto @email, although Bitcoin has become a highly correlated “dollar asset” with US stocks, its impact on prices is more supportive than suppressive. The underlying beneficiaries are ETFs, listed companies, and even national strategies. This “institutionalization” has added a layer of safety against declines, effectively raising the price floor.

However, while mainstream players’ entry through compliant channels has expanded the capital pool, Bitcoin is currently caught in an awkward asset positioning dilemma.

Some argue that if one is optimistic about the dollar system, buying US stocks, US bonds, or tech giants offers better liquidity, real cash flow, and higher certainty. Compared to that, Bitcoin now resembles a high-risk tech stock without cash flow, with questionable value for money; if one is bearish on the dollar system, logically they should seek assets negatively correlated with the dollar. But after being “transformed” by mainstream institutions, Bitcoin’s correlation with US stocks is very high. When dollar liquidity contracts, Bitcoin often crashes before US stocks, rather than acting as a hedge.

In other words, Bitcoin is caught between safe-haven and risk assets, neither like gold as a safe haven nor like tech stocks as growth assets. Some even trace data suggesting Bitcoin’s current attributes are 70% tech stock + 30% gold.

This new identity is also beginning to influence Bitcoin’s geopolitical neutrality premium.

Against the backdrop of rising global geopolitical risks and out-of-control US debt deficits, non-US camps are accelerating de-dollarization. Gold, with thousands of years of credit and political neutrality, is returning to the spotlight, hitting new highs repeatedly. In the eyes of non-American countries, Bitcoin is no longer a borderless currency but a dollar derivative influenced by Wall Street’s pricing power.

As a result, traditional hard currencies like gold are returning to the center stage, while Bitcoin is stuck in a prolonged sideways and dull oscillation, continuously eroding investor confidence.

Nevertheless, in the opinion of crypto KOL @Pickle Cat, there are as many Hamlets as people—cryptopunks are at the core of Bitcoin’s demand, but their strength has been weakened due to “mainstreaming and traditional finance.” Where there is weakness, there must be strength. It’s like democracy: its charm lies in its self-healing mechanism, but the precondition for healing is often that the system has already touched some extreme state, prompting the public to realize it.

Hash rate migration, Bitcoin mining companies’ “rebellion”

Besides demand-side narrative shifts, supply-side changes have also intensified market pessimism. As a key player in the Bitcoin network, miners are experiencing a capital migration from “coin abandonment to AI.”

According to the latest data from Hashrate Index, the 7-day moving average of Bitcoin’s total network hash rate has fallen to 993 EH/s, down nearly 15% from the all-time high in October last year. Meanwhile, Morgan Stanley analysts indicate that by December 2025, the daily block reward income per EH/s for Bitcoin miners will drop to $38,700, a record low.

The direct cause of the hash rate decline is the ongoing deterioration of Bitcoin mining economics. The halving cycle has halved block rewards, coupled with record-high mining difficulty, pushing many mining machines close to or below shutdown costs. Miner profit margins are severely squeezed, with some forced to shut down to cut losses, while others sell Bitcoin to ease cash flow pressures.

A deeper crisis is that hash rate has become the new “oil,” changing the flow of computing power.

Many mining companies see AI data centers as having long-term, stable demand and higher returns compared to the highly cyclical, volatile, and uncertain profitability of Bitcoin mining. More importantly, their long-term accumulated large-scale power infrastructure, site resources, and operational experience are precisely the most scarce resources for AI computing clusters, making the transition more feasible.

Thus, Bitcoin miners like Core Scientific, Hut 8, Bitfarms, HIVE, TeraWulf, and Cipher Miner are collectively “defecting.” According to CoinShares, by the end of 2026, the proportion of mining revenue from mining activities may drop from 85% to below 20%, shifting reliance to AI infrastructure.

However, this transition is extremely costly. On one hand, upgrading traditional mining farms into AI data centers requires large-scale infrastructure renovation, which is expensive; on the other hand, high-performance GPU servers remain costly, and forming a scaled computing power cluster demands huge upfront capital.

For miners urgently needing to transition, Bitcoin, the most liquid asset they hold, naturally becomes the most direct and efficient financing tool. They have started continuously selling Bitcoin on the secondary market. This ongoing supply-side selling not only suppresses the price but also further compresses the profit margins of remaining miners, forcing more to shut down or switch to AI.

This “sell coins to buy chips” rebellion to some extent drains liquidity and undermines market confidence.

However, Meng Yan points out that the idea of Bitcoin miners transitioning to AI computing infrastructure is actually a false proposition, more a story fabricated by U.S. listed mining companies to stabilize stock prices amid shrinking earnings. Besides electricity, which can be reused, there are almost no overlaps between hardware, network architecture, operational skills, and software ecosystems—making the transition less practical compared to professional AI data centers.

Joshua.D further notes that the main Bitcoin mining machines are ASIC miners, which can only mine. The only things that can be transformed are the site and power infrastructure. So, the decline in hash rate is more about industry internal selection and淘汰. Historical data shows that hash rate declines are often market “bubble squeezing,” reducing future selling pressure rather than triggering a crash. As long as the Bitcoin network can still produce blocks normally, hash rate fluctuations are simply market adjustments.

The folded Bitcoin, standing at the crossroads of new and old cycles

Today, Bitcoin, having officially entered the mainstream, is not only telling the old story of “digital gold” but also writing a new script for mainstream financial assets.

Bitcoin is shedding its purely speculative coat and evolving into a global liquidity reservoir. Mainstream acceptance has opened the gates for compliant capital inflows. This financialization significantly enhances Bitcoin’s survivability and fragility.

Beyond Wall Street’s spotlight, in countries like Nigeria, Argentina, and Turkey with severe inflation, Bitcoin’s usage is exploding. There, Bitcoin is not just an asset but a lifeboat to counteract fiat currency over-issuance and protect household wealth. This bottom-up genuine demand proves that Bitcoin remains a shield in the hands of ordinary people.

Undoubtedly, a folded Bitcoin is now before us.

It has bid farewell to the myth of sudden wealth in the pioneering days of the West and has shed its cyberpunk idealism, instead presenting a more mature, even somewhat dull, asset characteristic.

But this is not the end of digital gold; it is a sign of its entering maturity. Just as gold underwent a long process of value consensus rebuilding before becoming a central bank reserve asset, today’s Bitcoin may be standing at a similar historical turning point.

Looking back at Bitcoin’s development, its narrative has been constantly changing. From Satoshi Nakamoto’s original white paper envisioning a peer-to-peer electronic cash system enabling small, instant payments; to being seen as a sovereign currency against fiat inflation; to evolving into “digital gold,” a store of value and inflation hedge; and now, with Wall Street’s involvement, its next potential narrative may point toward sovereign national reserve assets. Of course, this process will be lengthy, but it is no longer a pipe dream.

However, everything has its cycle, and assets are no exception. According to the Merrill Lynch clock’s asset rotation law, the global economy’s indicator is now turning toward a favorable environment for commodities. Bitcoin has risen millions of times over the past decade and is entering a new macro cycle. It cannot be dismissed just because of temporary price consolidation or phased underperformance relative to gold and silver.

At this crossroads of old and new cycles, whether OGs exiting or institutions entering, they are all voting with real money for the future. And time will give the final answer.