US SEC and CFTC Chairmen Join Forces to Pave the Way for Cryptocurrency Regulation

1h ago

Cryptocurrency exemption fails to take effect in January! US SEC urgently "puts on the brakes," Wall Street erupts

4h ago

Trending Topics

View More379.72K Popularity

8.62K Popularity

8.42K Popularity

4.81K Popularity

3.13K Popularity

Hot Gate Fun

View More- MC:$3.24KHolders:22.12%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.88KHolders:20.09%

- MC:$2.83KHolders:10.00%

Pin

Major Capital Withdrawal from the Cryptocurrency Market! Stablecoin Market Cap Plummets, Bitcoin's Rebound May Not Last?

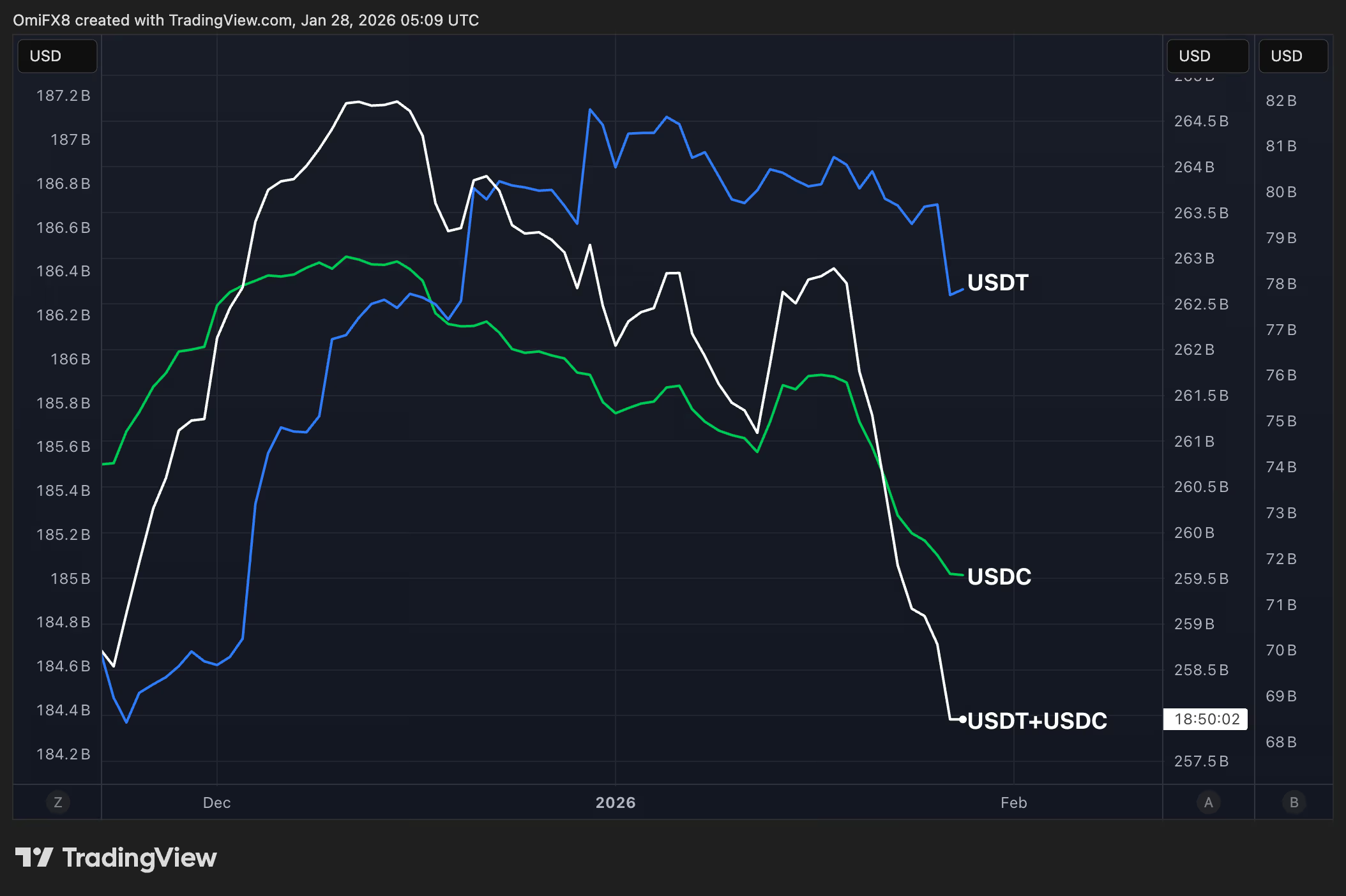

The cryptocurrency market is showing a rare and concerning warning sign: the supply of stablecoins is beginning to shrink, and this “capital outflow” phenomenon is casting a shadow over Bitcoin’s future trajectory. According to data from CoinDesk, the combined market capitalization of the two major US dollar stablecoins, USDT and USDC, has shrunk to $257.9 billion, hitting a new low since November 20, 2022. Looking back to mid-December last year, their market caps once approached a peak of $265 billion, but in the past 10 days alone, the market cap has decreased rapidly.

In this wave of capital withdrawal, USDC has borne the brunt, with its market cap evaporating over $4 billion in 10 days; compared to mid-December, it has already shrunk by $6 billion, with the current market cap at $71.65 billion; in contrast, USDT has performed relatively steadily, with only about a $1 billion decline during the same period, and its current market cap is approximately $186.25 billion. The downward trend in stablecoin market cap reflects traders withdrawing funds from the cryptocurrency market, aligning with the recent trend of institutions pulling tens of billions of dollars out of the US Bitcoin spot ETF.

Stablecoins have always played the role of “capital entry” and “liquidity hub” in the crypto market. Whether it’s buying cryptocurrencies or participating in DeFi to earn yields, stablecoins are an indispensable bridge.

To understand this phenomenon, imagine USDT and USDC as “casino chips.” Most people first exchange cash for chips before entering the game; however, the current situation is that players are cashing out their chips back into USD and “leaving the casino.”

Blockchain analytics firm Santiment pointed out: “Funds are leaving the cryptocurrency market, not just waiting on the sidelines: typically, when traders sell Bitcoin or competing coins, these funds remain in the crypto market in the form of stablecoins. Now, the decline in stablecoin market cap indicates that many investors are choosing to cash out directly into fiat currency rather than preparing to buy the dip.”

Santiment added that stablecoins are the primary liquidity source for purchasing cryptocurrencies. When the ammunition (funds) decreases, there isn’t enough capital to quickly push prices higher, which weakens the market’s rebound strength.

The downward trend in stablecoin market cap reflects traders withdrawing funds from the cryptocurrency market, aligning with the recent trend of institutions pulling tens of billions of dollars out of the US Bitcoin spot ETF.

Stablecoins have always played the role of “capital entry” and “liquidity hub” in the crypto market. Whether it’s buying cryptocurrencies or participating in DeFi to earn yields, stablecoins are an indispensable bridge.

To understand this phenomenon, imagine USDT and USDC as “casino chips.” Most people first exchange cash for chips before entering the game; however, the current situation is that players are cashing out their chips back into USD and “leaving the casino.”

Blockchain analytics firm Santiment pointed out: “Funds are leaving the cryptocurrency market, not just waiting on the sidelines: typically, when traders sell Bitcoin or competing coins, these funds remain in the crypto market in the form of stablecoins. Now, the decline in stablecoin market cap indicates that many investors are choosing to cash out directly into fiat currency rather than preparing to buy the dip.”

Santiment added that stablecoins are the primary liquidity source for purchasing cryptocurrencies. When the ammunition (funds) decreases, there isn’t enough capital to quickly push prices higher, which weakens the market’s rebound strength.