US SEC and CFTC Chairmen Join Forces to Pave the Way for Cryptocurrency Regulation

38m ago

Cryptocurrency exemption fails to take effect in January! US SEC urgently "puts on the brakes," Wall Street erupts

3h ago

Trending Topics

View More379.14K Popularity

8.09K Popularity

7.76K Popularity

4.56K Popularity

3.06K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.88KHolders:20.09%

- MC:$2.83KHolders:10.00%

- MC:$2.83KHolders:00.00%

Pin

Storm in the US hits mining farms! Bitcoin hash rate drops by 12%, the worst decline since China's ban on mining.

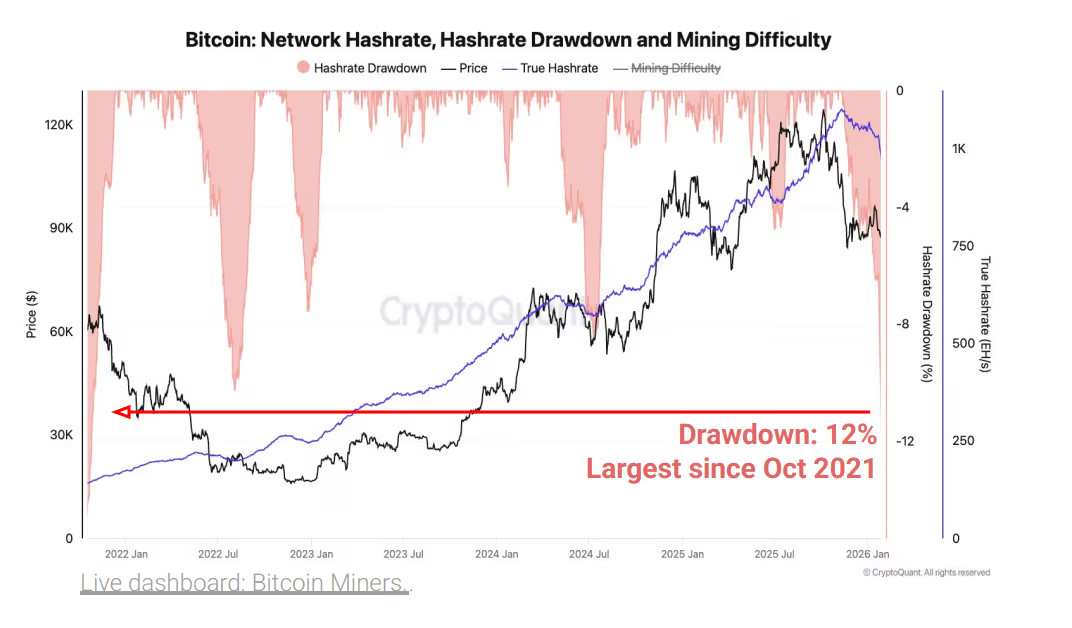

Bitcoin mining activities are facing the most severe impact since the end of 2021. Due to a strong winter storm in the United States, several major mining companies were forced to shut down emergency operations to respond to grid dispatching, leading to a全面 drop in Bitcoin network hash rate, mining output, and revenue. According to on-chain data from CryptoQuant, the total network hash rate of Bitcoin has plummeted by approximately 12% since November 11 of last year. This is the largest single-day decrease since China’s全面 ban on mining in October 2021. Currently, the total hash rate remains at only 970 EH/s per second, the lowest level since September 2025. This hash rate retreat has worsened rapidly since last week, with extreme cold impacting several major mining hubs in the US, causing tight electricity supplies. To protect equipment and comply with “power restriction requirements,” many publicly listed miners have chosen to temporarily shut down their mining rigs, and the hash rate has frozen sharply, which has immediately reflected in miners’ earnings.

Data shows that Bitcoin’s daily mining revenue dropped from about $45 million on January 22 to $28 million within just two days, hitting a new low in a year. Although it has slightly rebounded to around $34 million, it remains far below recent average levels, reflecting the dual pressures of declining hash rate and weakening coin prices.

Mining output has also shrunk sharply. The daily total production of listed miners decreased from 77 BTC to only 28 BTC; small and medium-sized miners’ output also fell from 403 BTC to 209 BTC.

Looking at the 30-day moving average, the production of listed miners decreased by 48 BTC, the largest decline since the halving in May 2024; non-listed miners’ output further decreased by 215 BTC, the largest drop since July 2024.

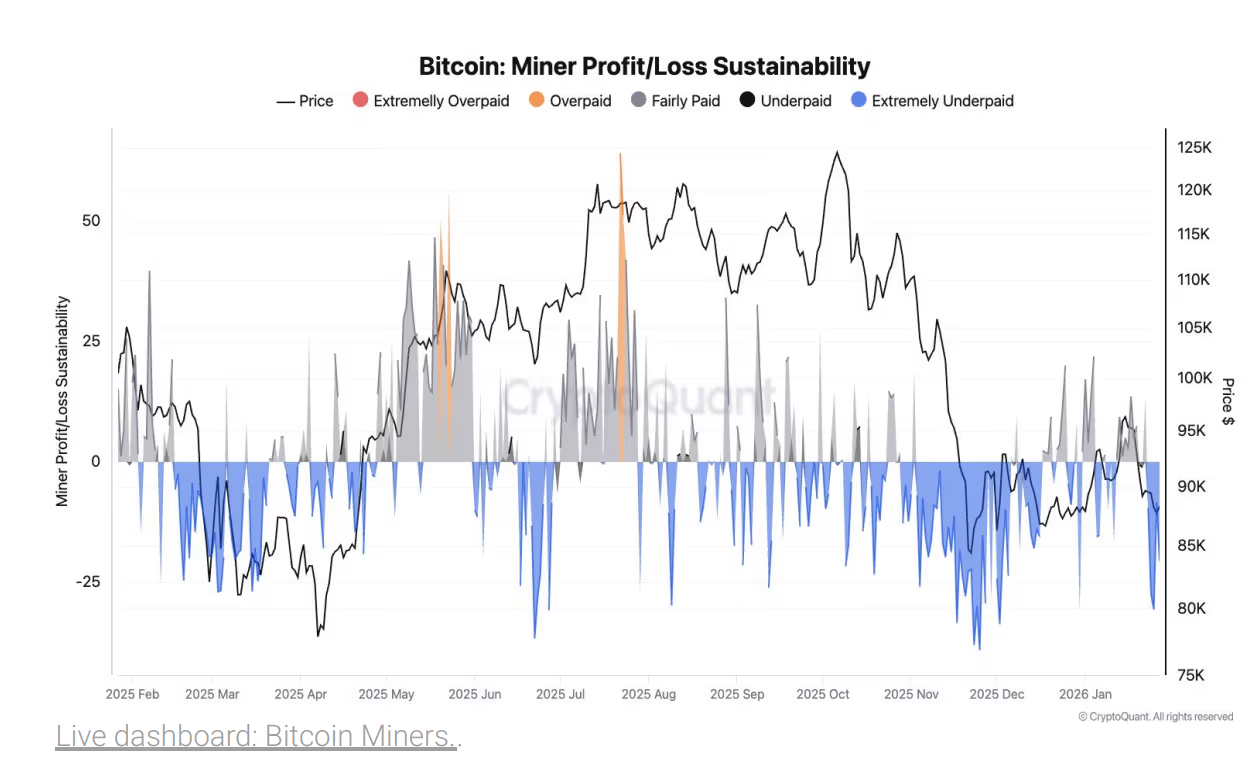

What is more concerning is that miners’ survival space is being squeezed to the limit. CryptoQuant’s “Miner Profit and Loss Sustainability Index” has fallen to 21, the lowest level since November 2024, indicating that more and more miners are “losing money.” Despite multiple adjustments to mining difficulty, mining revenue still struggles to cover the high costs of electricity and maintenance.

This hash rate retreat has worsened rapidly since last week, with extreme cold impacting several major mining hubs in the US, causing tight electricity supplies. To protect equipment and comply with “power restriction requirements,” many publicly listed miners have chosen to temporarily shut down their mining rigs, and the hash rate has frozen sharply, which has immediately reflected in miners’ earnings.

Data shows that Bitcoin’s daily mining revenue dropped from about $45 million on January 22 to $28 million within just two days, hitting a new low in a year. Although it has slightly rebounded to around $34 million, it remains far below recent average levels, reflecting the dual pressures of declining hash rate and weakening coin prices.

Mining output has also shrunk sharply. The daily total production of listed miners decreased from 77 BTC to only 28 BTC; small and medium-sized miners’ output also fell from 403 BTC to 209 BTC.

Looking at the 30-day moving average, the production of listed miners decreased by 48 BTC, the largest decline since the halving in May 2024; non-listed miners’ output further decreased by 215 BTC, the largest drop since July 2024.

What is more concerning is that miners’ survival space is being squeezed to the limit. CryptoQuant’s “Miner Profit and Loss Sustainability Index” has fallen to 21, the lowest level since November 2024, indicating that more and more miners are “losing money.” Despite multiple adjustments to mining difficulty, mining revenue still struggles to cover the high costs of electricity and maintenance.