Cognition 102 Billion Valuation Wealth Creation! 28-Year-Old CTO's Net Worth Surpasses Zuckerberg

3h ago

STABLE surges 125% against the market! Stablecoin protocol tokens become the strongest dark horse in the bear market

3h ago

Trending Topics

View More9.04K Popularity

6.4K Popularity

6.61K Popularity

325 Popularity

2.02K Popularity

Hot Gate Fun

View More- MC:$2.82KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.84KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.83KHolders:10.00%

Pin

Gate Daily (February 3): Bitcoin ETF withdraws $2.8 billion in two weeks; CBOE plans to launch "Binary Options Contracts"

Bitcoin (BTC) has experienced a strong rebound, currently trading around $78,960 on February 3. Major derivatives exchange CBOE is targeting the prediction market and plans to relaunch the “All or Nothing” options product. After investors withdrew $2.8 billion over the past two weeks, the average purchase price of Bitcoin ETFs has decreased. White House officials met with representatives from the cryptocurrency and banking industries to discuss stablecoin issues.

Macro Events & Crypto Hotspots

According to The Block, citing The Wall Street Journal, major derivatives exchange Cboe Global Markets is considering reintroducing “All or Nothing” binary options contracts for retail investors to directly compete in the rapidly growing market prediction sector. These contracts will operate as fixed-income derivatives, paying a fixed amount if the underlying asset reaches a preset condition at expiration, otherwise zero. CBOE previously launched binary options linked to major financial indices in 2008 but withdrew due to lack of traction in the then-institution-dominated market. The relaunch plan states that the products will undergo strict legal and compliance review before listing, and the contracts will be regulated by the U.S. Securities and Exchange Commission or the Commodity Futures Trading Commission.

According to Galaxy Research Director Alex Thorn, Bitcoin’s current trading price is below the average cost basis of US spot Bitcoin ETFs, which experienced the second and third largest capital outflows last month. Data from CoinGlass shows that over the past two weeks, 11 spot Bitcoin ETFs saw a total outflow of $2.8 billion, including $1.49 billion last week and $1.32 billion the week before. The total assets under management of US Bitcoin ETF products are approximately $113 billion; according to BiTBO data, these products hold about 1.28 million BTC, meaning the average cost per Bitcoin is roughly $87,830.

White House officials met with representatives from the cryptocurrency and banking sectors to discuss stablecoin issues. The digital advocacy organization “The Digital Chamber” posted on X that its CEO Cody Carbone and others had met at the White House to discuss provisions of the “Digital Asset Market Transparency Act” (CLARITY Act). The bill was previously delayed after a hearing by the Senate Banking Committee in January. Topics expected to be discussed before resuming hearings include tokenized stocks, decentralized finance, ethical issues of elected officials investing in cryptocurrencies, and stablecoin reward mechanisms.

News Highlights

A 74-year-old man in France was kidnapped and tortured for 16 hours; kidnappers mistook his son for a crypto billionaire.

The US has reduced tariffs on Indian goods from 50% to 18%, and India has agreed to stop purchasing Russian oil and switch to US oil.

Galaxy Digital: Bitcoin may test the 200-week moving average of $58,000 within a few months.

SpaceX acquires xAI, valued at $1.25 trillion.

The auction feature on Uniswap’s web application is now live.

Huang Licheng deposits another 250,000 USDC into Hyperliquid and opens long positions in ETH and HYPE.

US prosecutors accuse stablecoin legislation of enabling crypto companies to profit from fraud.

Tom Lee: All signs indicate that the crypto market has bottomed out.

WSJ: CBOE targets prediction markets and plans to relaunch the “All or Nothing” options product.

Market Trends

Latest Bitcoin news: $BTC has rebounded strongly, currently around $78,960, with $189 million in liquidation over the past 24 hours, mainly long positions.

(Source: Gate)

US stocks rebounded strongly on February 2, breaking last week’s slump, driven by the fastest manufacturing growth since 2022. The Dow Jones Industrial Average surged 515.19 points, up 1.1%, closing at 49,407.66, less than 200 points from its all-time high. The S&P 500 rose 37.41 points, up 0.5%, ending a three-day losing streak at 6,976.44, approaching last week’s record high. The Nasdaq Composite also performed steadily, rising 130.26 points, up 0.6%, to 23,592.11.

(Source: Gate)

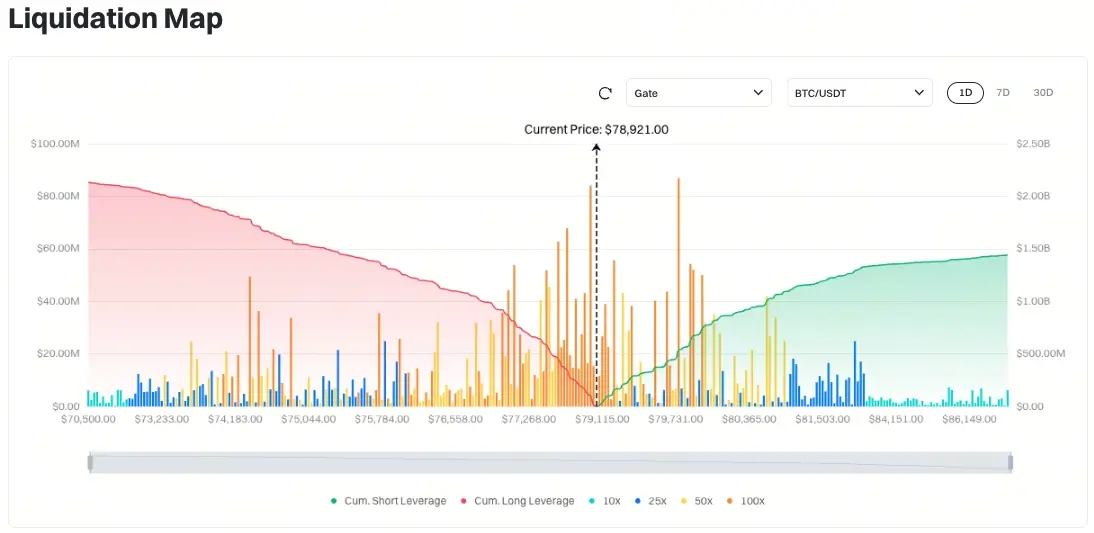

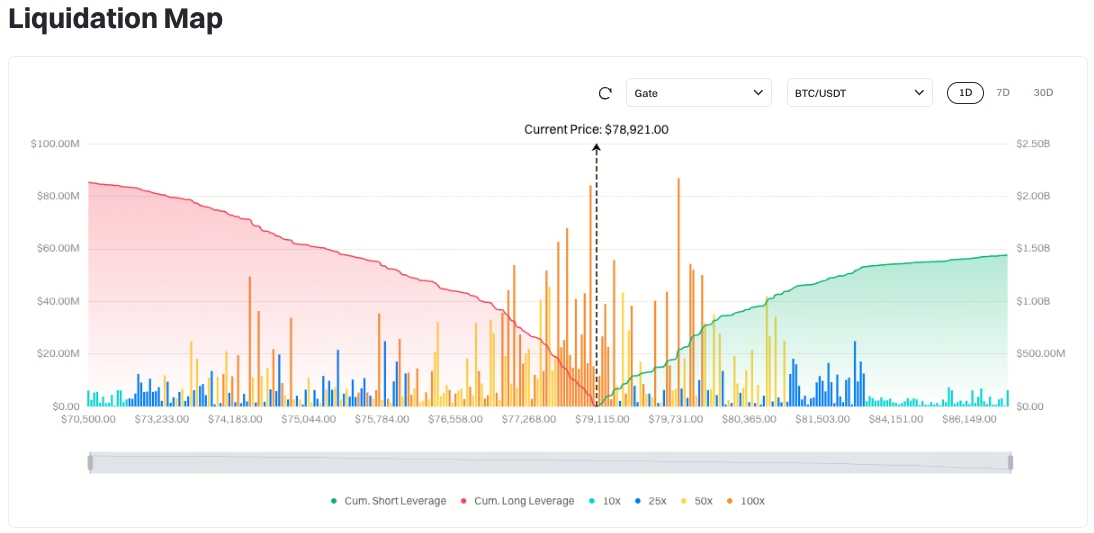

According to Gate’s BTC/USDT liquidation map, with the current price at $78,921.00, if the price drops to around $78,149, total long liquidation exceeds $99.29 million; if it rises to around $79,770, total short liquidation exceeds $538 million. Short positions are significantly more liquidated than longs, so it is advisable to control leverage ratios reasonably to avoid large-scale liquidations during market fluctuations.

(Source: Coinglass)

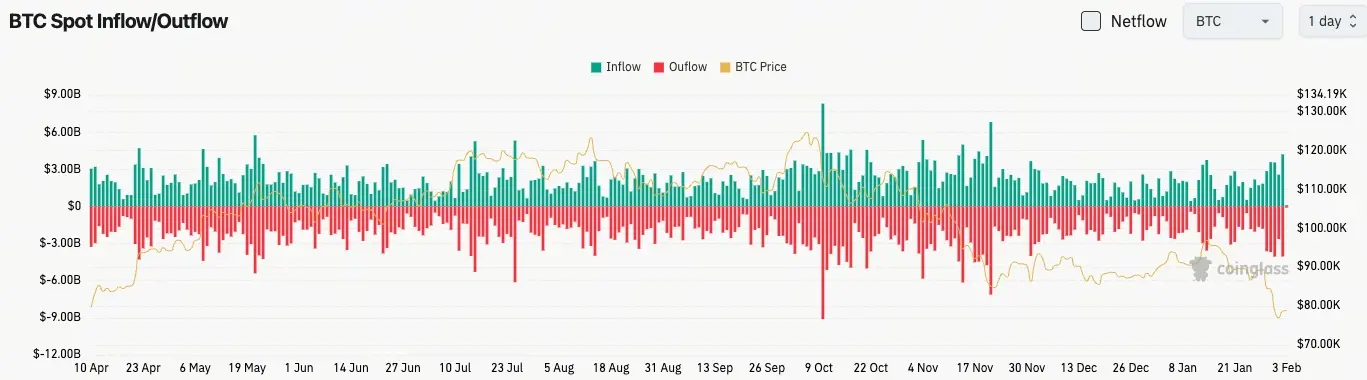

In the past 24 hours, spot inflows totaled $4.2 billion, outflows $4.04 billion, net inflow $160 million.

(Source: Coinglass)

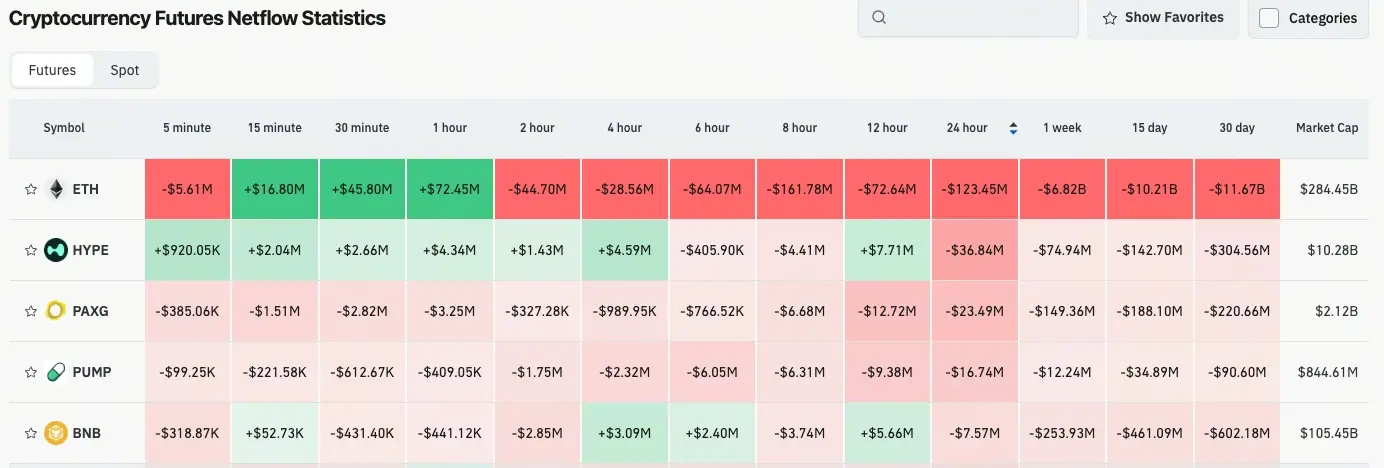

In the past 24 hours, contracts for $ETH, $HYPE, $PAXG, $PUMP, $BNB, and others have experienced net outflows, presenting trading opportunities.

X KOL Selected Opinions

Phyrex Ni (@Phyrex_Ni): “Today’s analysis is a bit easier to write. Over the weekend, I thought that if no systemic risks emerge, the downside for US stocks and cryptocurrencies should be limited. Although Asian investors panicked early Monday morning, with futures falling sharply at CME open, markets started to recover during the European trading hours. After opening, US stocks and BTC rebounded well, but gold and silver remained steady.”

“The decline started last week due to cash shortages among fund managers, compounded by passive reductions during earnings season. The probability of this continuing is increasing. This week, we’ll see if fund managers’ cash holdings have increased. Also, the halt that was expected to end Monday night seems to be extending a few more days.”

“This halt again delayed the release of labor data, but January’s data is what it is. Everyone is more interested in the trend after the transition. The halt, which was supposed to end Tuesday, might be further delayed, but since only a few departments are involved, it probably won’t be as big as the October 2022 shutdown.”

“Looking at Bitcoin data, turnover isn’t high, which is within expectations. The current price is below the cost basis of MSTR and the average ETF purchase price, making it attractive for BTC investors. Also, data from miners shows that over 20 W/T miners are on the verge of shutting down, and mining difficulty is starting to decrease.”

“Especially now, with no fundamental negative news, there is still hope. The last drop to $74,000 was mainly due to US-China tariffs. Now, it’s just a halt, with some poor earnings data, but panic shouldn’t escalate. Overall, the US is selling the most. As long as there are no surprises here, there’s still a chance.”

Today’s Outlook