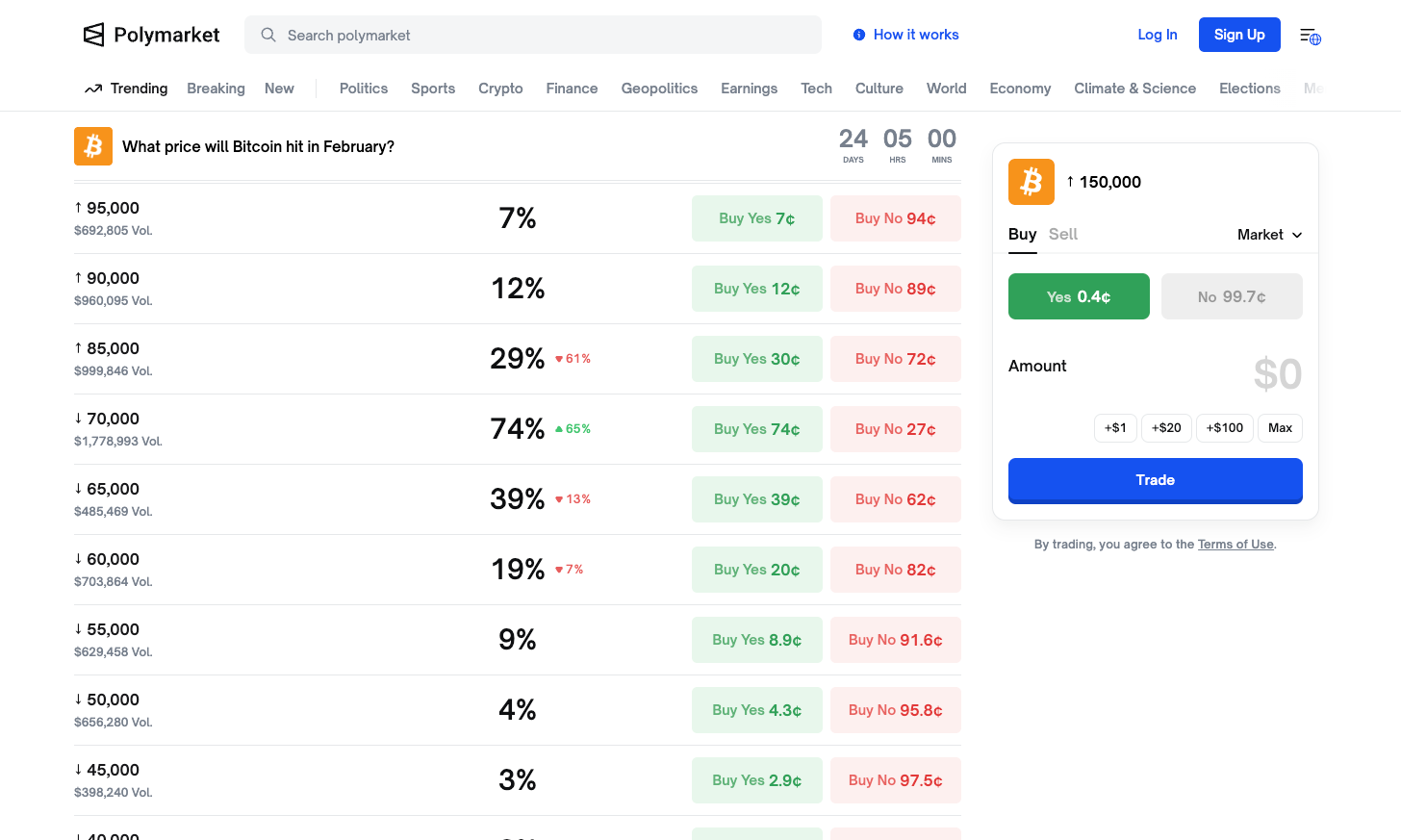

Polymarket Betting Shakeup! Bitcoin dips below 70,000 in February, probability soars to 74%

Polymarket shows a 74% probability that Bitcoin will reach $70,000 in February, with a trading volume of $1.78 million making it the most active contract. The $85,000 contract has fallen to a 32% chance, while the 100,000 target for the year still holds a 55% probability. Bitcoin broke below $72,000, hitting a 16-month low, down 16% year-to-date. ETF outflows have totaled $31 billion over three weeks, the Fear & Greed Index is at 12, and gold prices have surged above $5,000.

Bitcoin’s 74% Chance of Dropping to $70,000 in February

(Source: Polymarket)

Polymarket’s February Bitcoin price contract has 24 days until expiration, with nearly $1.78 million traded at the $70,000 target alone, clearly illustrating market sentiment. The probability of the $70,000 contract has surged to 71%, an increase of 62%, making it the most traded target price this month. This sharp shift in odds indicates a fundamental change in market sentiment, rapidly shifting from optimism to pessimism.

The bullish outlook has significantly declined: the $85,000 contract’s probability has plummeted 59% to 29%, the $90,000 contract stands at 12%, and the $95,000 contract is only at 7%. The collapse of high-price contracts suggests the market has abandoned hopes for a substantial Bitcoin rebound in February. On the downside, the $65,000 contract has decreased 13% to 39%, while the $60,000 contract remains steady at 19%. The probability of falling below $55,000 is very low. The implied price range for February is between $65,000 and $85,000, with $70,000 being the most likely target.

Polymarket February Contract Odds Changes

$70,000: 71% (up 62%), most active with $1.78 million traded

$85,000: 29% (down 59%), bullish expectations collapsing

$65,000: 39% (down 13%), moderate downside risk

Implied Range: $65,000 to $85,000, centered at $70,000

Polymarket is a blockchain-based prediction market platform where users bet real money on the outcomes of various events. Unlike traditional polls or analyst forecasts, Polymarket’s odds reflect a “money votes” market consensus, often providing a more accurate reflection of actual probabilities. While the $1.78 million trading volume isn’t huge, it’s significant for a single price point contract, indicating strong market focus.

What does a 71% probability mean? In prediction market terms, it doesn’t mean Bitcoin will definitely fall to $70,000, but rather that the market believes there’s a 71% chance it will “at least once” hit that level. This phrasing makes the odds more conservative, as a brief touch at that price during February counts as a success for the contract.

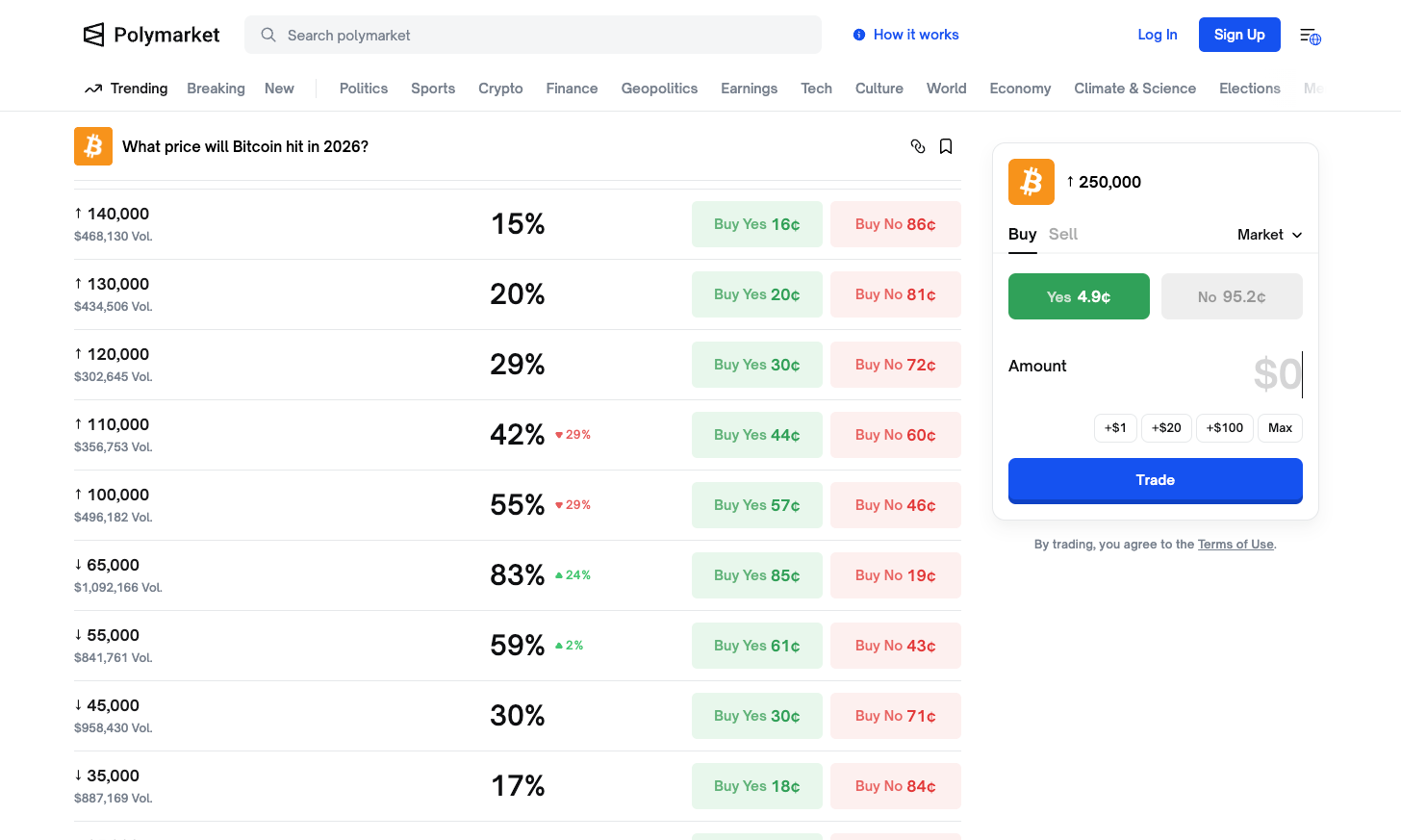

Confidence Crisis in the Yearly $100,000 Target

(Source: Polymarket)

Long-term Polymarket contracts present a more complex picture. The $100,000 level has a 55% chance, down 29%; the $110,000 level has a 42% chance, also down 29%. Compared to a few weeks ago, these declines are significant, when traders still expected a rally into 2025. This weakening of long-term optimism indicates that the market is not only pessimistic about short-term trends but also beginning to doubt whether Bitcoin can break $100,000 this year.

The $65,000 contract expiring in 2026 has surged 24% to 83%, with over $1 million traded, making it the highest-volume contract of the day. This suggests traders are more focused on downside protection than upside speculation. This “buy the dip, not the rally” capital flow is typical of a bear market. When the market fears declines more than it expects gains, demand for downside hedges pushes prices higher.

The yield curve’s upper end has dropped sharply: the $130,000 contract fell 20%, the $140,000 contract down 15%, and the $250,000 contract nearly 5%. This widespread decline in extreme price target probabilities indicates the market’s expectations for Bitcoin reaching new all-time highs in 2026 have cooled significantly. Just a few months ago, when Bitcoin was near $120,000, many analysts projected $200,000 or even $250,000 by year-end. Now, those forecasts seem highly unrealistic.

Polymarket’s real-money contracts reveal a dilemma: on one hand, defending the $70,000 floor; on the other, maintaining the expectation of a $100,000 annual return. The 55% chance of hitting $100,000 in 2026, while still a slight majority, has fallen from an overwhelming lead to a narrow margin. This slight majority indicates serious disagreement in the market, with bulls and bears evenly matched.

ETF Outflows of $31 Billion and Fear Index at 12 Signal Double Blow

As of the latest data, Bitcoin is trading around $73,199, after briefly falling below $72,000 earlier this week. Year-to-date, Bitcoin has declined 16%, roughly 40% below its October 2025 all-time high of $126,000. Such a sharp drop from a high is not uncommon in Bitcoin’s history, but the speed is startling.

Multiple factors are converging: escalating geopolitical tensions, ongoing data gaps from the 43-day government shutdown last fall, and hawkish Federal Reserve nominations—all pushing the dollar higher. Technical losses are severe: since late January, over $5.4 billion in liquidations have occurred, bringing open interest to a nine-month low.

In the past three weeks, U.S. spot Bitcoin ETFs have experienced continuous outflows: on Jan 29, $817 million; on Jan 30, $509 million; on Feb 3, $272 million; only once on Feb 2 did inflows reach $561 million. As funds continue to exit, the assets under management in U.S. spot Bitcoin ETFs have fallen from $128 billion to $97 billion, evaporating $31 billion. Such a scale of withdrawal is rare in ETF history, indicating waning institutional confidence in Bitcoin.

The crypto Fear & Greed Index has plunged to 12, deep in “extreme fear,” the lowest since November 2025. Meanwhile, gold prices have surged above $5,000 per ounce, highlighting broad capital flows into safe-haven assets. This combination of “crypto crash + gold rally” typifies risk aversion, showing investors are fleeing all high-risk assets.

Polymarket Reveals the True Market Expectations

Polymarket’s data provides a real-time window into the positions of well-funded traders. The February outlook centers around $65,000 to $85,000, with almost no chance of reaching $95,000. The annual contract terms remain relatively loose, with a slight majority still expecting to see $100,000 sometime in 2026. But even this expectation is weakening. Currently, $70,000 is the key figure everyone is watching.

Compared to traditional analysis, Polymarket’s advantage lies in its immediacy and authenticity. Analysts may issue biased opinions for reputation, attention, or client service, but Polymarket traders bet with real money, directly tying their wallets to prediction accuracy. This mechanism often makes Polymarket odds more aligned with actual outcomes than analyst forecasts.

From a trading perspective, when Polymarket shows a target probability over 70%, the market has formed a strong consensus. This consensus can become a self-fulfilling prophecy: when most believe the price will fall to $70,000, preemptive selling and stop-loss orders tend to cluster around that level, increasing the chance of the price actually touching it.

For traders, Polymarket’s data serve as a market sentiment thermometer. When short-term contracts’ high-price probability crashes and low-price probability surges, it’s a clear bearish signal. When long-term extreme high-price probabilities decline sharply, it indicates a fundamental shift in bullish expectations. Coupled with ETF outflows and extreme fear readings, Polymarket’s odds shifts are not isolated signals but the resonance of multiple negative factors.

Related Articles

Data: In the past 24 hours, the total liquidation across the network was $266 million, with long positions liquidated at $143 million and short positions at $123 million.

Data: 215 BTC transferred from an anonymous address, worth approximately 10.08 million USD

Analyst: Macro Expansion and Fed Rate Cuts Could Drive Bitcoin to New Highs in 2026