Chiliz Targets the 2026 FIFA World Cup! Fan Token Three-Stage Roadmap Revealed

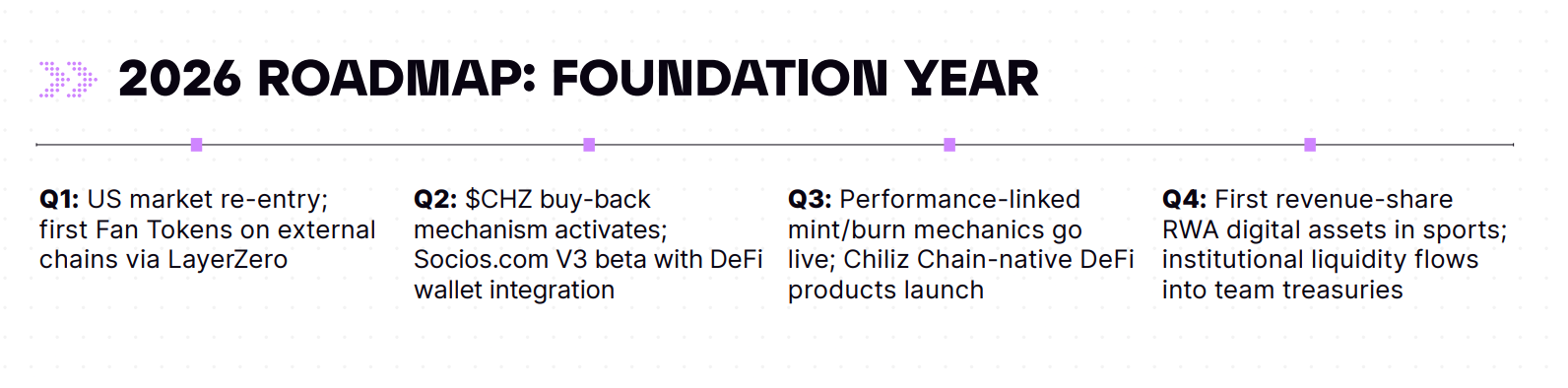

Sports Blockchain Platform Chiliz Announces Three-Phase Roadmap Preparing for the 2026 FIFA World Cup. The plan includes re-entering the U.S. market, launching national team tokens, activating Omnichain cross-chain functionality, and implementing a 10% profit buyback mechanism for CHZ tokens. Future developments will introduce performance-based supply regulation, with wins triggering token burns and losses leading to issuance increases. Starting in 2027, sports revenue streams and intellectual property will be tokenized.

Chiliz Re-enters the U.S. Market: Regulatory Breakthrough Opens New Chapter

(Source: Chiliz)

Chiliz is expected to announce its first U.S. fan token partnerships in Q1 2026, marking its official return to the world’s largest sports market after years of suspension due to regulatory uncertainties. The U.S. hosts top-tier leagues like the NBA, NFL, MLB, and hundreds of millions of sports fans, making it an essential part of Chiliz’s global expansion strategy.

In recent years, the uncertain U.S. cryptocurrency regulatory environment forced many blockchain projects to pause or scale back their U.S. operations. Chiliz was also affected, withdrawing from the U.S. market temporarily. However, with the approval of Bitcoin spot ETFs in 2024 and the Trump administration’s pro-crypto policies, the regulatory landscape has fundamentally shifted. The SEC has dismissed or settled multiple lawsuits against crypto companies, paving the way for Chiliz’s return.

Chiliz’s choice to re-enter the U.S. before the 2026 FIFA World Cup is no coincidence. The tournament will be jointly hosted by the U.S., Canada, and Mexico, with the U.S. hosting most matches. This is the first time three countries co-host the World Cup, and the U.S. will host again after 32 years. Over 5 million fans are expected to attend in person, with global TV audiences exceeding 5 billion. Such a massive sporting event offers Chiliz excellent opportunities for market education and user acquisition.

The identities of the initial U.S. partners have not been disclosed, but based on Chiliz’s past collaborations, they are likely to include MLS (Major League Soccer) teams, NBA or NFL clubs. These partnerships will offer U.S. fans exclusive digital rights, such as voting on team decisions, obtaining limited edition NFTs, and meeting players. Compared to traditional fan membership programs, blockchain-based fan tokens are tradable and can be used across platforms.

National Team Tokens: Targeting the Global Audience of the World Cup

(Source: Chiliz)

Chiliz plans to launch fan tokens related to national teams in summer 2026, representing a major expansion of the fan token ecosystem. Unlike club tokens, national team tokens are designed around major tournaments and international matches. As the 2026 FIFA World Cup approaches, Chiliz aims to reach a broader, event-driven fan base beyond traditional club supporters.

Club tokens are typically held by dedicated fans of a specific team, with high engagement but limited in number. In contrast, national teams can inspire nationwide patriotism and collective identity during the World Cup. Countries like Brazil, Argentina, Germany, and France have tens of millions to over a billion potential fans. The market size for national team tokens far exceeds that of individual clubs.

The application scenarios for national team tokens are also more imaginative. Holders may vote on friendly match opponents, influence jersey designs, or participate in exclusive World Cup activities. During the tournament, token holders might get priority ticketing, discounts on official merchandise, or opportunities to interact with stars. This model transforms fan enthusiasm into digital assets, opening new revenue streams for national football associations.

Launching national team tokens in summer 2026 means just months or weeks before the tournament (usually in June). This timing aims to maximize the conversion of World Cup hype into token sales. As global media focus on the event and football topics flood social media, national team tokens will enjoy unprecedented exposure and demand.

Omnichain Architecture: Unlocking Cross-Chain Liquidity and DeFi Integration

Another major development in 2026 is Chiliz’s shift toward a full-chain model. Starting in Q1, fan tokens will connect to external blockchains via cross-chain infrastructure. This allows Fan Tokens to move beyond the Chiliz ecosystem and interact with mainstream chains like Ethereum, BNB Chain, Polygon, and others.

The Omnichain Fan Tokens are based on cross-chain bridging protocols, enabling tokens to transfer freely between different blockchains. This aims to increase liquidity, facilitate cross-chain trading and arbitrage, and allow Fan Tokens to be used in decentralized finance (DeFi) applications outside their native networks. Specifically, fans can bridge tokens to DEXs like Uniswap or PancakeSwap for trading, or use them as collateral in lending protocols like Aave or Compound.

Three Key Advantages of Omnichain Architecture

Liquidity Multiplication: Access to external DEX liquidity pools reduces slippage and spreads

DeFi Composability: Supports lending, liquidity mining, derivatives trading, and advanced DeFi features

Enhanced User Experience: Fans can manage tokens within familiar wallets and platforms without learning new tools

This open architecture marks Chiliz’s strategic shift from a closed ecosystem to open finance. Previously, fan tokens mainly circulated on Socios.com, limited to voting and redemption rights. The Omnichain model transforms fan tokens into freely tradable financial assets in the global DeFi market, greatly enhancing their utility and appeal.

Product-wise, Socios.com will launch a new version integrating DeFi wallets. Users can manage fan tokens, participate in DeFi protocols, and view cross-chain assets within a single interface—significantly lowering the barrier to entry for Web3 sports fans and attracting more traditional sports enthusiasts into crypto.

CHZ Token Economics Upgrade: 10% Revenue-Backed Perpetual Buyback

Chiliz plans to initiate a new value accumulation mechanism for its native CHZ token in Q2 2026. Under this new model, 10% of all fan token revenue generated within the ecosystem will be used for continuous buybacks of CHZ tokens. The company states this will directly link CHZ demand to fan activity.

This buyback mechanism is akin to traditional stock buybacks but more transparent and automated. Whenever fans purchase tokens, participate in voting, or redeem benefits, the platform generates revenue (often via transaction fees or service charges). 10% of this revenue will be automatically allocated to a buyback smart contract, which will purchase CHZ on the secondary market and burn it, reducing circulating supply and increasing scarcity.

From an investment perspective, this mechanism shifts CHZ from a purely ecosystem fuel token to a value asset supported by cash flow. As Chiliz’s partner clubs and national teams grow, and user base expands, platform revenue will increase, boosting buyback activity. This provides CHZ with a form of “dividend-like” long-term value support.

Importantly, the buyback program will commence in Q2 2026, just before the FIFA World Cup. During the tournament, trading volume and usage of national team tokens will peak, leading to explosive growth in platform revenue. This means that after the buyback starts, CHZ could face unprecedented buying pressure in the first quarter, potentially driving prices significantly higher.

Performance-Based Token Economics: Wins and Losses Determine Supply

Later this year, Chiliz plans to introduce a performance-based token mechanism. Match results will directly influence the supply of fan tokens: wins will trigger token burns, while losses will lead to new token issuance. This is an unprecedented innovation in the fan token space, deeply integrating sports competitiveness with crypto economics.

The operation logic is as follows: when a team wins, a certain percentage of its fan tokens (e.g., 1%) will be burned, decreasing supply and increasing scarcity. Conversely, losses will cause the system to mint additional tokens, diluting existing holders. This design links token prices to team performance, strengthening emotional engagement.

From a behavioral economics standpoint, this mechanism will greatly boost fan participation and loyalty. Victory will bring joy and potential token appreciation, while losses will lead to token issuance, offering fans “buy-the-dip” opportunities and encouraging continued support during downturns. This dynamic balance combines the emotional value of sports with financial investment logic.

Starting in 2027: The Grand Vision of Sports Asset Tokenization

After 2026, Chiliz’s roadmap shifts toward the tokenization of physical sports assets. From 2027 onward, the company plans to tokenize revenue streams, intellectual property, and other traditionally illiquid sports assets. This marks an upgrade from a fan engagement tool to a sports financial infrastructure.

The sports industry holds numerous high-value, illiquid assets—broadcast rights, athlete image rights, stadium naming rights, sponsorship deals—that generate billions annually but are typically accessible only to institutional investors or ultra-high-net-worth individuals. Tokenization will fragment these assets into smaller shares, allowing ordinary fans to invest and share in the profits.

Related Articles

Backpack's valuation surpasses $1 billion, becoming a unicorn! Former FTX employee turns their fortunes around through tokenization

IP Creation and Distribution Platform Xross Road Completes $1.5 Million Pre-Seed Funding

Stripe's valuation soars to $140 billion! Acquisition offers continue to surge, yet they still refuse to go public

466 million subscribers, MrBeast ventures into finance! Acquiring Step Bank hints at a crypto setup

After investing $200 million in BitMine, MrBeast acquired the banking app Step targeting young people.

Privacy stablecoin project Zoth completes strategic funding, with participation from Pudgy Penguins CEO and others