Gold prices hit a new high, Bitcoin crashes 50%! Grayscale: The digital gold theory is completely shattered

Grayscale research shows that Bitcoin prices are highly correlated with software stocks and have zero correlation with gold. The report’s author, Zach Pandl, points out that Bitcoin has fallen 50% from its October high of $126,000, while gold has surpassed $5,000. This reflects Bitcoin’s deeper integration with traditional finance, driven by institutional participation and ETF activity, but its long-term value storage potential remains optimistic.

Bitcoin’s Correlation with Software Stocks Surges: The Collapse of the Digital Gold Myth

(Source: Grayscale)

According to Grayscale’s latest research, the long-term narrative of Bitcoin as “digital gold” is being challenged, as its recent price movements increasingly resemble those of high-risk growth assets rather than traditional safe havens. On Tuesday, author Zach Pandl stated that although Grayscale remains bullish on Bitcoin due to its fixed supply and independence from central banks, recent market behavior suggests otherwise.

Pandl wrote, “Bitcoin’s short-term price movements are not closely correlated with gold or other precious metals,” noting that gold and silver prices have hit record highs. Gold broke $5,000 per ounce in January, up over 35% from the beginning of the year’s $3,700. Silver surged to $100 per ounce, a more than 230% increase from $30 earlier this year. These trends exemplify safe-haven characteristics: rising counter to market panic.

In stark contrast, Bitcoin’s performance during the same period was entirely different. When Trump announced a 100% tariff increase on China, triggering global market panic, investors sold stocks and cryptocurrencies and flocked to gold. Bitcoin not only failed to serve as a safe haven but also became one of the assets sold off. Similar patterns appeared during the March 2020 pandemic crash and the 2022 Fed rate hike cycle, indicating these are not isolated events but intrinsic to Bitcoin’s market nature.

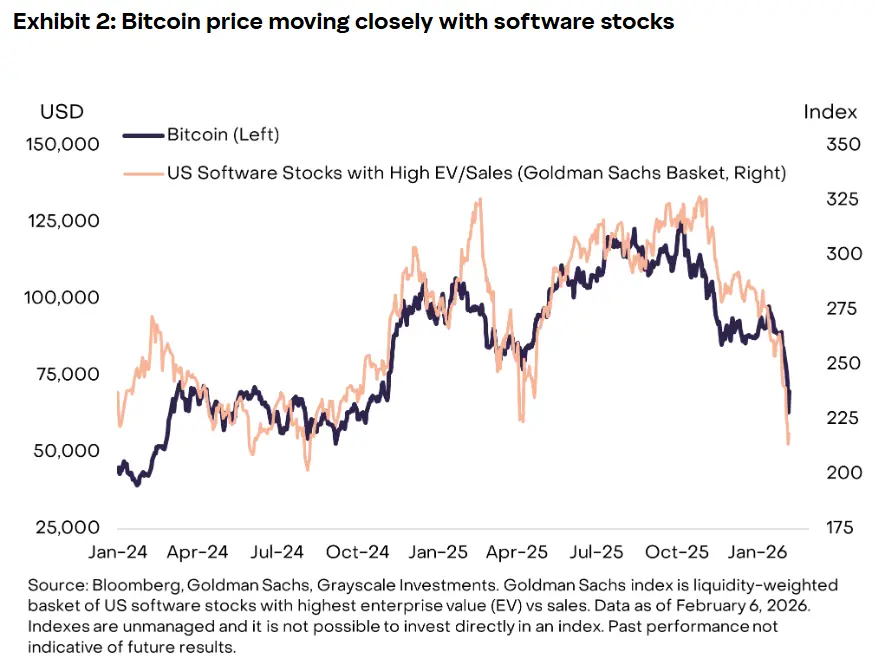

Grayscale’s charts clearly show that Bitcoin’s recent plunge mirrors the collapse of software stocks since early 2026. When the IGV (iShares Expanded Tech Software ETF) index declines, Bitcoin almost follows the same trajectory and magnitude. This mirror relationship is statistically significant, with correlation coefficients likely exceeding 0.8 (perfect correlation being 1).

Pandl’s core argument is that “Bitcoin’s short-term price movements are not tightly correlated with gold or other precious metals.” This observation challenges the core assumption of Bitcoin as digital gold. If Bitcoin truly were digital gold, it should maintain high correlation with physical gold, rising in tandem during safe-haven demand. Yet, data shows the correlation is near zero or even negative at times.

Grayscale’s Long-Term Defense: Evolution, Not Failure

Grayscale argues that Bitcoin’s recent failure to establish itself as a safe-haven asset should not be seen as a setback but as part of its ongoing development. Pandl states that expecting Bitcoin to replace gold as a monetary asset in such a short period is unrealistic. He notes, “Gold has been used as money for thousands of years, and until the early 1970s, it was the backbone of the international monetary system.”

This defense aims to position Bitcoin as a “growing store of value” rather than a “mature safe-haven asset.” Grayscale’s logic is that gold took millennia to establish its safe-haven status, while Bitcoin, with only 16 years of history, is still evolving. As time progresses and markets mature, Bitcoin may gradually acquire safe-haven properties.

Pandl emphasizes that although Bitcoin has not yet achieved a similar monetary role, the increasing digitization of the global economy through AI, autonomous agents, and tokenized financial markets could steer Bitcoin toward that future. This narrative links Bitcoin to the future of digital economy rather than its past as gold.

Grayscale’s charts show that despite recent poor performance, Bitcoin’s annualized returns over the past decade have significantly outperformed gold. From 2015 to 2025, Bitcoin’s annualized return is approximately 230%, compared to just 8% for gold. This substantial return differential supports its classification as a growth asset rather than a safe haven. Investors buy Bitcoin primarily for capital appreciation, not for preservation during crises.

In the short term, Bitcoin’s recovery may depend on new capital inflows, whether through ETF re-investment or retail investor re-entry. Market maker Wintermute notes that recent retail participation has been concentrated in AI-related stocks and growth concepts, limiting demand for crypto assets. This further confirms Bitcoin’s competitive relationship with growth assets. When retail investors with limited funds choose between AI stocks and Bitcoin, they currently favor the former due to clearer applications and profit models.

From an investment strategy perspective, Grayscale’s research redefines Bitcoin’s role. Investors should view Bitcoin as a growth allocation within their portfolios, not as a safe-haven. This implies that the appropriate allocation to Bitcoin should be comparable to technology stocks, not gold. In risk management terms, holding Bitcoin does not hedge against stock market declines and may even amplify overall portfolio volatility.

Related Articles

Tokenized goods surpass $6 billion! The gold on-chain trend exceeds stocks and funds RWA

Bitcoin ETF capital inflow slows down, with the main reason being the narrowing of the basis

Non-Farm Payrolls Preview: January Expected to Surprise with Only 70,000 Jobs Added, Wages Cool Down Sparks Rate Cut Expectations

BlackRock IBIT options surpass 7.33 million contracts, exceeding gold! Bitcoin's attracting power outperforms traditional hedging

Bitcoin drops below $67,000 as hawkish Federal Reserve expectations pressure the crypto market

Bank of Malaysia tests stablecoin in 2026! Standard Chartered and Maybank explore linking the Ringgit to the blockchain