ASTER Sets March 2026 Date for Privacy-Focused Aster Chain Mainnet Launch

Key Takeaways

-

Aster Chain mainnet is officially targeted for March 2026, narrowing the previous Q1 2026 window announced in late 2025/early 2026 roadmaps.

-

The custom Layer-1 blockchain emphasizes privacy via zero-knowledge proofs, “Shield Mode” for hidden trades, sub-second finality, near-gasless fees, and on-chain order books tailored for high-frequency perpetual futures.

-

Alongside mainnet, Q1 2026 deliverables include fiat on-ramps, open-source code release, initial $ASTER staking mechanisms, and deeper ecosystem growth.

Aster has officially locked in March 2026 as the launch window for the mainnet of Aster Chain, its custom-built Layer-1 blockchain designed specifically for decentralized perpetual futures trading.

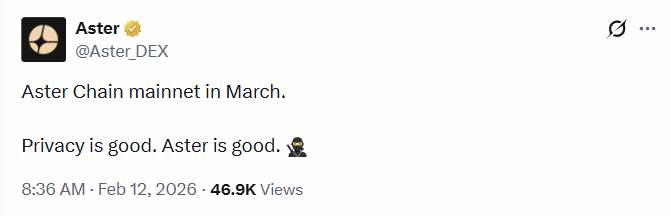

The update came directly from the project’s official X account (@Aster_DEX), offering the clearest timeline yet for what many in the community see as Aster’s most important upgrade to date.

In a short but confident post, the team wrote:

_“Aster Chain mainnet in March.

Privacy is good. Aster is good.”

_

Source: @Aster_DEX (X)

The tweet also underscores the platform’s emphasis on stealth and privacy features, a core differentiator as Aster transitions from a multi-chain DEX to a sovereign, high-performance Layer-1 optimized for derivatives trading.

From Testnet Momentum to Mainnet Readiness

The March target builds on strong recent progress. Aster Chain testnet opened to the public in early February 2026 following an initial whitelist phase in late December 2025. Key milestones during testing included:

-

Successful Human vs. AI trading seasons that stress-tested the network

-

Broad community participation for feedback and bug hunting

-

Public access to perpetual futures trading on the testnet (e.g., BTCUSDT pairs)

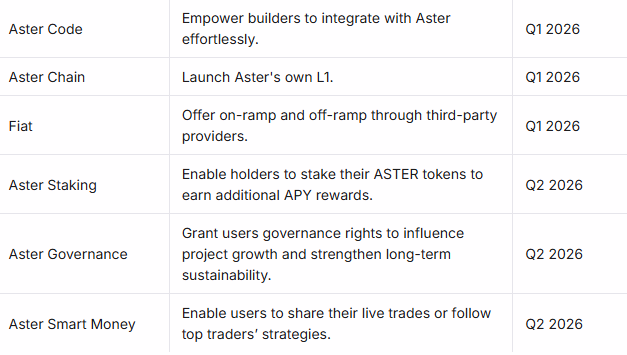

Earlier roadmap updates from December 2025 had pegged mainnet to Q1 2026 broadly, with staking and governance slated for Q2. Today’s update narrows the window to March, signaling confidence in the final stages of development and auditing.

ASTER 2026 H1 Roadmap/Source: docs.asterdex.com

Why Aster Chain Matters for Perp Traders

Aster Chain is engineered specifically for the demands of on-chain perpetuals:

-

Privacy-first design using zero-knowledge proofs to enable hidden order flow and “Shield Mode” for large/institutional trades

-

Sub-second finality and near-gasless execution

-

On-chain order books with centralized-exchange-level speed

-

Low-latency infrastructure to minimize slippage and MEV risks

These features address persistent limitations in existing DEXs and position Aster to capture more of the booming perpetual futures sector, where aggregated volumes have reached trillions annually.

The shift to a dedicated L1 also grants Aster greater control over economics—including fee structures, validator rewards, and protocol upgrades—while aligning $ASTER token utility more deeply with network growth.

Q1 2026 Deliverables: Mainnet and Beyond

Alongside the mainnet rollout, Aster plans several ecosystem enhancements in the coming weeks and months:

-

Fiat on-ramps to simplify onboarding for new users

-

Open-sourcing of the Aster Chain codebase to attract developers and builders

-

Expanded token utility features, including initial staking mechanisms

-

Continued focus on community growth and infrastructure hardening

These steps follow the platform’s successful rebranding to a perp-focused DEX and its competitive positioning against peers like Hyperliquid.

Market Sentiment

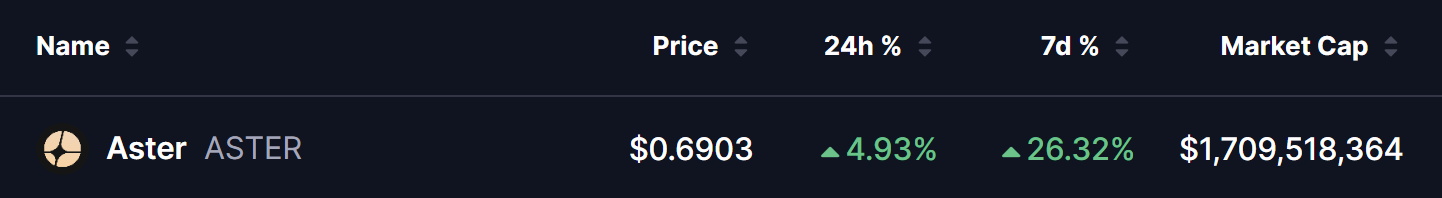

Market reaction appears constructive following the mainnet confirmation. At the time of writing, $ASTER is trading at $0.6903, posting a 4.93% gain over the past 24 hours and an impressive 26.32% surge over the past seven days. The token’s market capitalization currently stands at approximately $1.7 billion.

Source: Coinmarketcap

The strong weekly performance suggests growing investor confidence as the March 2026 mainnet launch approaches. Momentum in both price and community engagement indicates that traders are increasingly positioning ahead of the anticipated upgrade.

If development milestones continue to be met on schedule, sentiment around $ASTER could remain supported in the lead-up to launch.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.