Hyperliquid (HYPE) Rebounds From Key Support — Is More Upside Ahead?

Key Takeaways

-

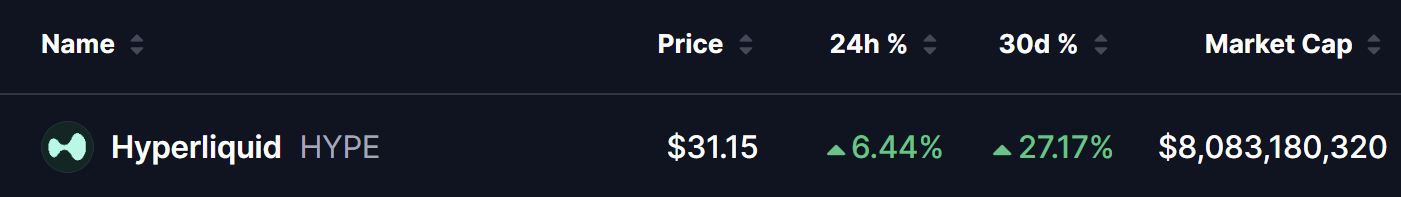

HYPE is up ~6% today and nearly 27% on the month despite broader market weakness

-

Price bounced strongly from the critical $28.20 demand zone

-

HYPE is trading inside a right-angled ascending broadening wedge on the 4H chart

-

Reclaiming the 100-MA near $31.70 could trigger a move toward $46

-

A breakdown below $28.20 would invalidate the bullish structure

HYPE, the native token of Hyperliquid — one of the fastest-growing decentralized perpetual trading platforms — is once again showing notable relative strength despite the broader crypto market softness.

While many altcoins remain under pressure, HYPE surged nearly 6% today, extending its monthly gains to 27%. More importantly, the latest price action suggests this move could have more room to run, as the token rebounds cleanly from a critical support zone.

Source: Coinmarketcap

Right-Angled Ascending Broadening Wedge Takes Shape

On the 4-hour chart, HYPE is trading inside a right-angled ascending broadening wedge — a high-volatility structure that often precedes strong directional moves.

After a sharp upside push, HYPE faced rejection near the wedge’s upper resistance around $38, triggering a swift 25% pullback. That correction drove price straight into a key demand region near $28.20.

This area proved decisive.

Hyperliquid (HYPE) 4H Chart/Coinsprobe (Source: Tradingview)

Buyers stepped in aggressively, defending the zone and forcing a rebound back toward $31.15, with price now hovering just below the 100-period moving average near $31.70. Throughout this wedge formation, the $28.20 region has repeatedly acted as a strong defense layer, reinforcing its importance as higher-timeframe support.

The quick reaction from this level signals that dip buyers remain active — a constructive sign for bulls.

What’s Next for HYPE?

From a technical standpoint, the structure remains constructive.

If HYPE can hold above the rising support trendline and successfully reclaim the 100-MA, momentum could shift back in favor of buyers. That would likely open the door for a recovery toward the wedge’s upper boundary near $46.0.

A confirmed breakout from this right-angled ascending broadening wedge would be a strong bullish signal, potentially accelerating upside continuation as volatility expands.

However, bulls still need follow-through.

Failure to reclaim the moving average or sustained weakness below current levels could invite another test of demand.

Key Risk to Watch

The bullish setup hinges on the $28.20 support zone.

If HYPE loses this level decisively, the wedge structure would be invalidated, increasing the risk of bearish continuation and opening the door to deeper downside.

For now, though, price is reacting exactly where buyers previously stepped in — keeping the short-term outlook cautiously optimistic.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.