Lending Tokens NEXO and Aave Shine as Bitcoin Volatility Shifts Attention to Yield-Bearing Tokens

The recent Bitcoin turbulence has persisted, forcing liquidity to shift away from catching the next breakout to other sectors of the market.

Specifically, market users are quietly pivoting from Bitcoin toward assets that can generate steady returns. As a result, market liquidity is beginning to drift away from purely speculative trades and into sectors that offer practical utility, putting lending tokens in the spotlight.

Key Points

- The recent Bitcoin turbulence has persisted, forcing liquidity to shift away from catching the next breakout to other sectors of the market.

- Liquidity is beginning to drift from purely speculative trades and into sectors that offer practical utility, putting lending tokens in the spotlight.

- Bitcoin has seen massive volatility in recent times, dropping sharply to $60,005 on February 6, only to rebound the same day to $72,000.

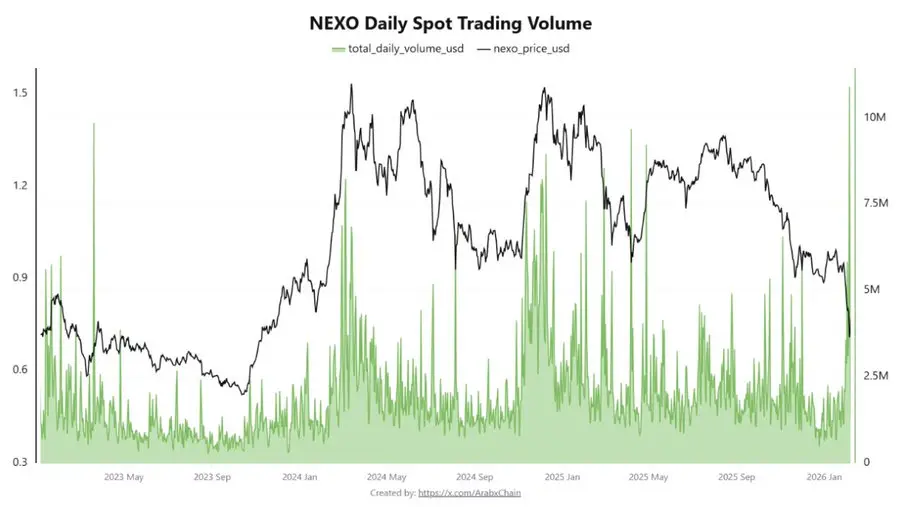

- NEXO, which calls itself a premier digital asset wealth platform, recently recorded roughly $10.9 million in daily trading volume, the highest level in its history.

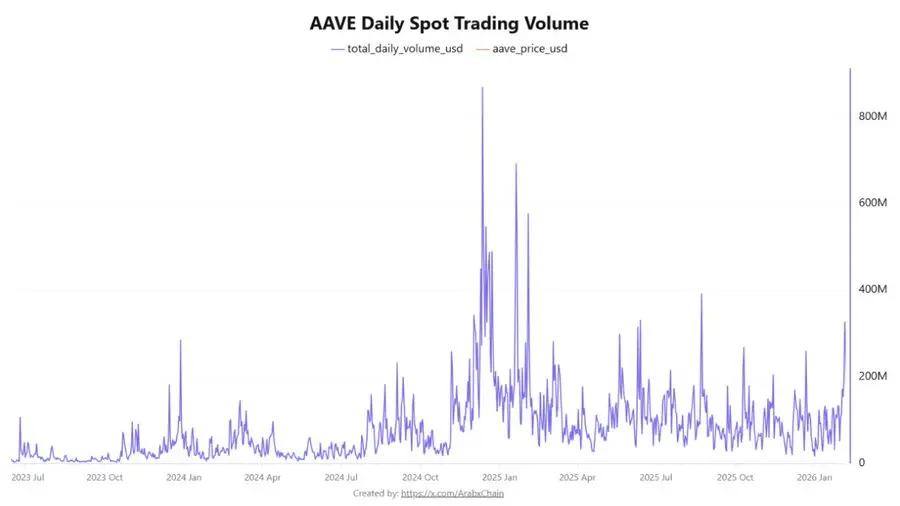

- Decentralized lending protocol Aave has also seen an uptick in trading activity, with daily volume climbing to about $327.8 million.

- The coinciding Bitcoin volatility with a surge in lending services growth indicates a partial shift in liquidity towards assets with a stronger “operational or yield-oriented focus.”

Bitcoin Volatility Redirects Liquidity

Since then, Bitcoin has traded within this $60,000 to $72,000 range, a clear sign of consolidation. This lack of conviction has rubbed off on the broader crypto market, which has experienced price swings lately. As the leading cryptocurrency, BTC’s struggle to establish a clear price direction is prompting a reassessment among traders.

With prices looking choppy, traders typically become cautious and reduce their risk. Additionally, they start searching for alternatives that can keep them profitable without relying solely on price appreciation. The CryptoQuant analysis shows that market enthusiasts are shifting attention to lending and borrowing-focused protocols.

Lending Tokens, NEXO and Aave Gain Traction

The report stated that data already highlights a clear shift toward major lending platforms. NEXO, which calls itself a premier digital asset wealth platform, recently recorded roughly $10.9 million in daily trading volume, the highest level in its history. According to Arab Chain, the spike suggests increased use of the token within its ecosystem, whether as collateral or as a liquidity management tool.

Nexo Daily Trading Volume/CryptoQuantMeanwhile, CoinMarketCap data show that its daily volume is $11.66 million at press time, up 32% in the past 24 hours. This has impacted its price, which has increased by 4.5% in the past 24 hours to $0.842.

Nexo Daily Trading Volume/CryptoQuantMeanwhile, CoinMarketCap data show that its daily volume is $11.66 million at press time, up 32% in the past 24 hours. This has impacted its price, which has increased by 4.5% in the past 24 hours to $0.842.

At the same time, decentralized lending protocol Aave has also seen an uptick in trading activity, with daily volume climbing to about $327.8 million. Per CoinMarketCap, it has risen further to $456 million but is down 3% in the past 24 hours.

This is well above its recent averages, suggesting that both retail and institutional players may be tilting toward decentralized lending platforms while broader market sentiment remains uncertain.

Aave Daily Trading Volume/CryptoQuantThe analysis concluded that the coinciding Bitcoin volatility with a surge in lending services growth indicates a “partial shift in liquidity from major assets towards sub-sectors” with a stronger “operational or yield-oriented focus.”

Aave Daily Trading Volume/CryptoQuantThe analysis concluded that the coinciding Bitcoin volatility with a surge in lending services growth indicates a “partial shift in liquidity from major assets towards sub-sectors” with a stronger “operational or yield-oriented focus.”

Related Articles

Weekly Highlights | BTC Continues to Fluctuate, AI Sparks Panic, Market Urgently Needs a New Narrative

Data: 476.03 BTC transferred from an anonymous address, routed through an intermediary, and flowed into BitGo

Bitcoin Jumps to $69K as US CPI Cools, but Rate Cut Bets Stay Muted

Technical Analysis for February 14: BTC, ETH, BNB, XRP, SOL, DOGE, BCH, HYPE, ADA, XMR