Aave proposes a revenue model with 100% from DAO but the price still faces pressure

Aave Labs has recently introduced a new governance initiative, expected to open a new chapter in the development of the leading lending protocol in the cryptocurrency space. However, despite the positive potential of this initiative, the AAVE price has yet to show any signs of upward movement, reflecting investors’ cautious sentiment.

AAVE Launches “Aave Will Win” Governance Model

The new initiative called “Aave Will Win” calls on Aave DAO through a comprehensive strategic roadmap focused on deploying the V4 upgrade. If approved, V4 will become the foundational platform for the protocol’s next development phase, while establishing a mechanism to allocate 100% of revenue from products developed by Aave Labs directly to the DAO.

Although this is a significant governance step, the AAVE token price continues to face downward pressure. Currently, the token is in the oversold zone according to the Money Flow Index (MFI). Recent data indicates that selling pressure from macroeconomic factors may have peaked after several consecutive trading sessions showing outflows.

Historically, AAVE’s price tends to recover after entering oversold conditions, as this signals market saturation of selling pressure and a return of buyers. However, the broad weakness in the cryptocurrency market along with investors’ cautious sentiment makes this recovery more unpredictable and complex than previous cycles.

AAVE MFI | Source: TradingView ## Grayscale Converts AAVE Trust Fund into ETF for NYSE Arca Listing

AAVE MFI | Source: TradingView ## Grayscale Converts AAVE Trust Fund into ETF for NYSE Arca Listing

Grayscale has officially filed with the U.S. Securities and Exchange Commission (SEC) on Friday to convert its AAVE trust fund into an exchange-traded fund (ETF).

However, Bitwise—one of the notable crypto asset managers—seems to have taken the lead, having submitted an AAVE ETF application as early as December last year, with filings for 11 separate funds.

AAVE is the native token of the Aave protocol—one of the leading decentralized finance (DeFi) lending platforms today. With a market capitalization of approximately $1.8 billion and a current trading price of $119, AAVE has recorded an impressive 9% increase in a single day, according to data from The Block.

Selling Pressure Still Dominates

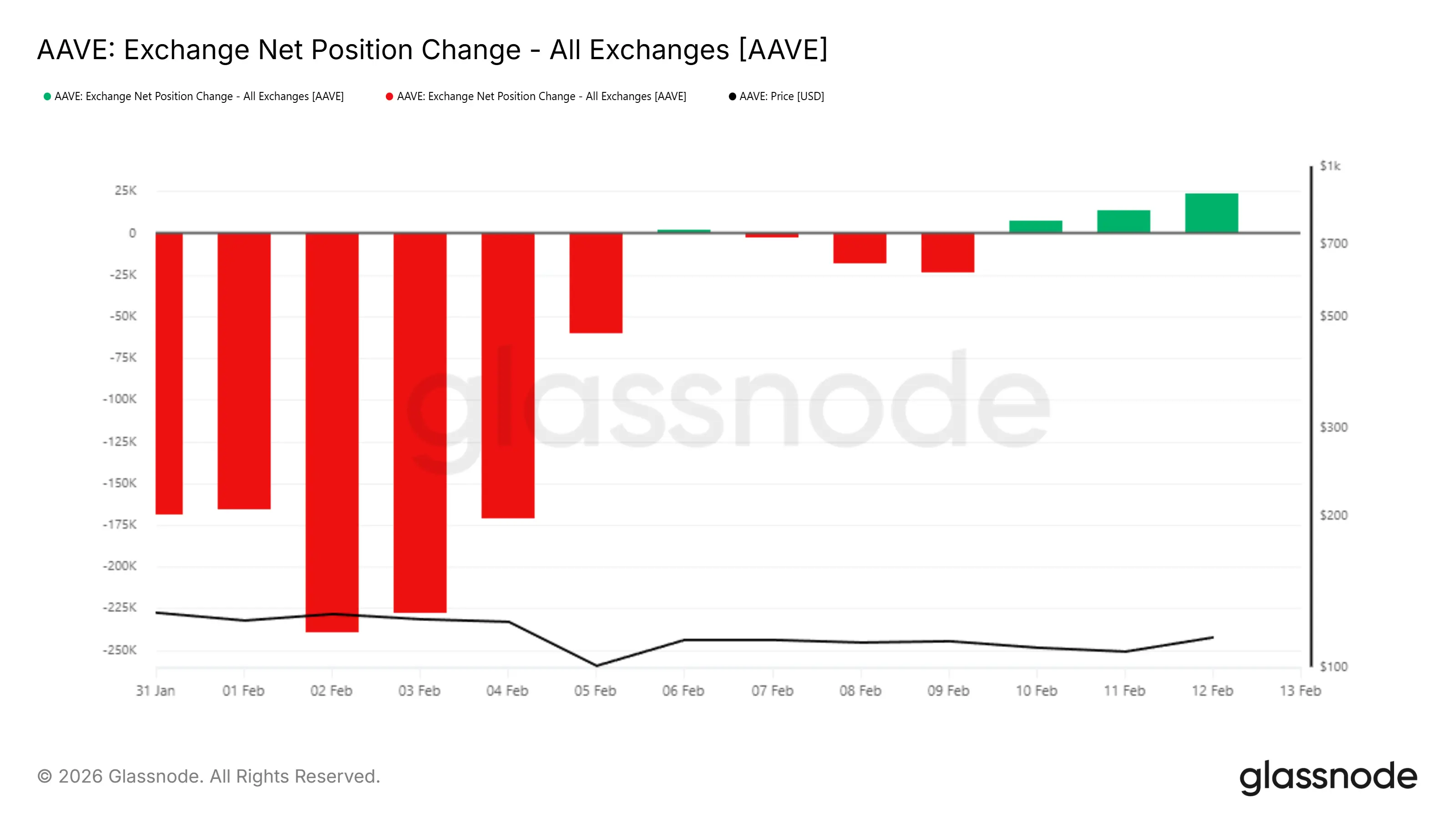

Data on net position changes across exchanges show that selling pressure remains dominant. Net inflows of funds into exchanges are continuously increasing, indicating that investors are moving AAVE onto exchanges with the intention to sell rather than accumulate.

Net Position Change on AAVE Exchanges | Source: Glassnode Strong net inflows and prolonged selling pressure could continue to delay any potential recovery of AAVE’s price. Even with positive developments in protocol development, this alone is not enough to trigger immediate upward momentum. Investors seem to prioritize liquidity factors and risk appetite over governance innovations.

Net Position Change on AAVE Exchanges | Source: Glassnode Strong net inflows and prolonged selling pressure could continue to delay any potential recovery of AAVE’s price. Even with positive developments in protocol development, this alone is not enough to trigger immediate upward momentum. Investors seem to prioritize liquidity factors and risk appetite over governance innovations.

AAVE Price Holds Above Key Support Level

Currently, AAVE is trading at $111, maintaining above the Fibonacci 23.6% level at $109—a critical support in the bearish market context. Preserving this support level is essential to avoid deeper structural declines.

Technical signals show divergence. In the short term, AAVE may hover above the $109 support and below the resistance at $119 as market momentum stabilizes. However, a breakdown below $109 could lead to further declines, potentially down to $100 or lower.

AAVE Price Analysis | Source: TradingView Conversely, if selling pressure eases and investor confidence is restored, AAVE could bounce back from the $109 support zone. A bullish breakout above $119 would be a positive sign, indicating improving market sentiment. If the price continues to rise past $128, AAVE could target the $136 level, which would significantly weaken the current downtrend.

AAVE Price Analysis | Source: TradingView Conversely, if selling pressure eases and investor confidence is restored, AAVE could bounce back from the $109 support zone. A bullish breakout above $119 would be a positive sign, indicating improving market sentiment. If the price continues to rise past $128, AAVE could target the $136 level, which would significantly weaken the current downtrend.

Conclusion

While Aave’s new governance initiative offers promising prospects for a brighter future for the protocol, its impact on the AAVE price has yet to be clearly reflected. In the volatile cryptocurrency market environment, building trust and restoring growth momentum may be a long and challenging journey.