Crypto enters the "16-day risk zone" as senior personnel shift focus to AI

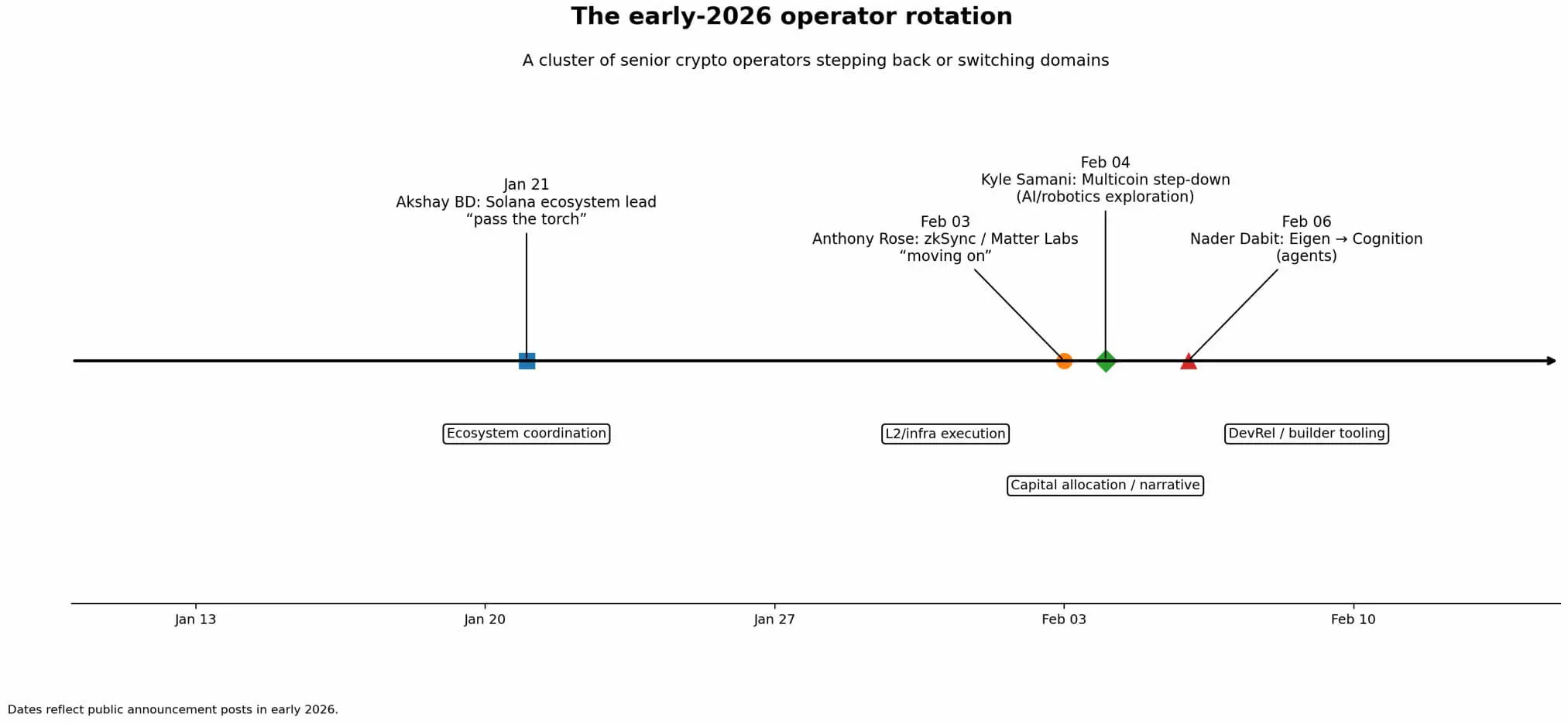

In the first few weeks of 2026, a series of senior leaders in the crypto industry announced their departure or transition to other fields, creating the impression of a large-scale personnel shift within the sector.

Akshay BD, who spent five years building the Solana ecosystem, posted a “life update,” expressing his gratitude for being handed the torch.

Anthony Rose, a leader at zkSync, also announced his departure after four years at Matter Labs.

Nader Dabit left Eigen Labs to join Cognition, where he focuses on developing end-to-end software agents capable of deploying production code.

Kyle Samani stepped down from his role as managing partner at Multicoin Capital to pursue opportunities in AI and robotics, while maintaining a long-term positive outlook on crypto.

Although there is no evidence of coordinated action, the timing of these announcements is quite close, giving the impression of a collective shift.

Using image_prompt20:46 Four senior executives in the cryptocurrency field announced their departure within 16 days at the start of 2026, taking on roles in ecosystem coordination, infrastructure enforcement, developer relations, and capital allocation.## Why These Positions Matter

Using image_prompt20:46 Four senior executives in the cryptocurrency field announced their departure within 16 days at the start of 2026, taking on roles in ecosystem coordination, infrastructure enforcement, developer relations, and capital allocation.## Why These Positions Matter

The roles recently vacated are not only about product development but also about ecosystem coordination. They connect capital with projects, programmers with infrastructure, and businesses with users.

When these key coordinators withdraw, the “linkage model” of the ecosystem can weaken, even if the core builders remain.

The Talent and Capital Pull from AI

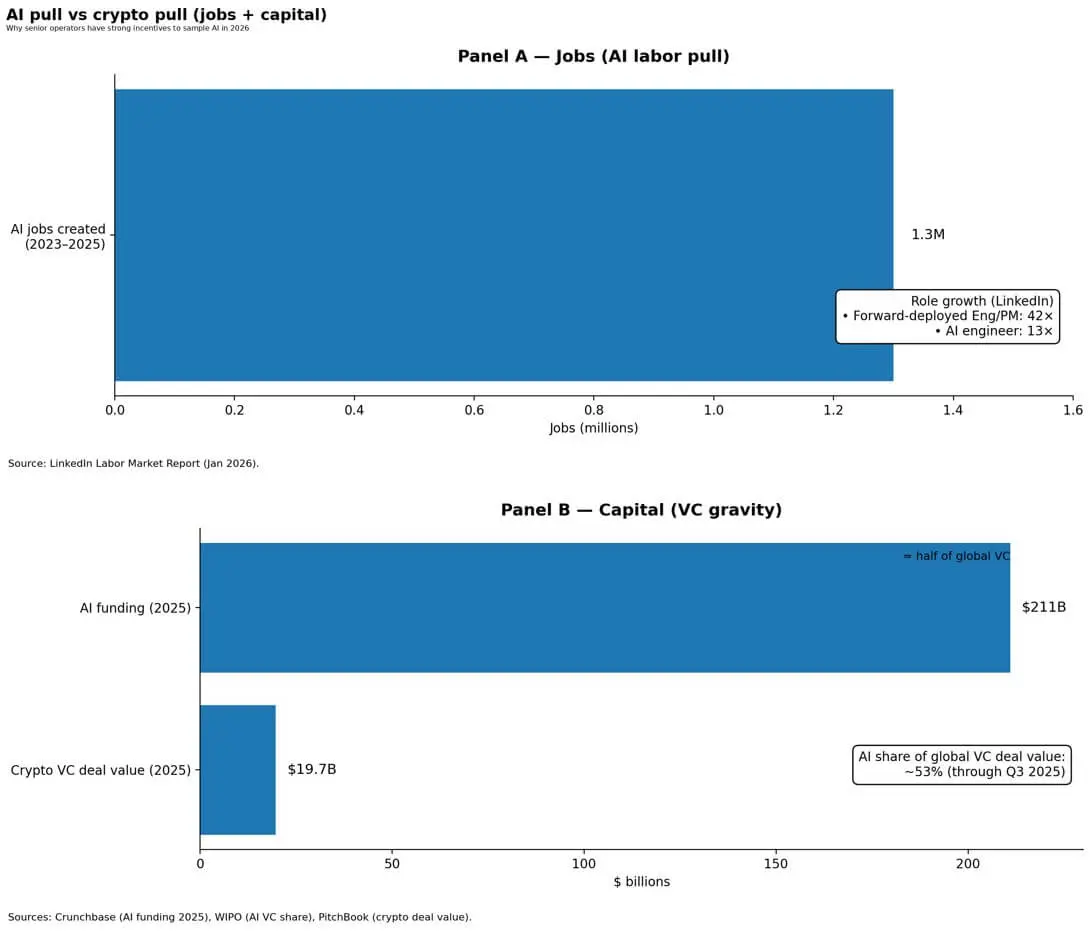

AI is attracting talent at an unprecedented rate. LinkedIn’s January 2026 labor market report notes about 1.3 million new AI jobs created worldwide between 2023 and 2025.

Some roles are growing exponentially: forward-deployed engineers and product managers increased 42-fold; AI engineers increased 13-fold.

In terms of investment, Crunchbase reports approximately $211 billion poured into AI in 2025, accounting for nearly half of global venture capital funding. Meanwhile, VC deals in crypto totaled about $19.7 billion — still significant but markedly smaller.

For top operators optimized for rapid learning and upside, AI offers faster product cycles, easier distribution, and more abundant capital. Crypto remains attractive for its mission to rebuild financial infrastructure, but deployment and compliance cycles tend to be slower.

In 2025, artificial intelligence (AI) created 1.3 million jobs and attracted $211 billion in investment, while venture capital deals in cryptocurrency reached $19.7 billion.## Industry Perspectives

In 2025, artificial intelligence (AI) created 1.3 million jobs and attracted $211 billion in investment, while venture capital deals in cryptocurrency reached $19.7 billion.## Industry Perspectives

Rodrigo Coehlo, CEO of Edge & Node, acknowledges a prominent wave of departures but considers it a cyclical phenomenon. He believes that during tough market times, some talent will seek “greener pastures” — currently, AI.

However, he also thinks many will return to crypto after experiencing AI, because AI agents need “crypto rails” to ensure transparency, observability, and reliable automated trading — features that traditional infrastructure struggles to provide.

What Developer Data Reveals

The clearest signal about whether builders are leaving crypto lies in developer activity data, not personal stories.

Electric Capital’s latest report, updated in January 2026, shows a roughly 7% decrease in active monthly developers compared to the same period in 2024. However, when broken down by experience level, the picture differs:

This pattern mirrors previous downcycles. Even in 2022, when Bitcoin prices plummeted, the number of developers increased slightly year-over-year.

Conclusion: core builders remain committed, while newcomer groups fluctuate cyclically.

Not a Complete Exodus Wave

Ethan Buchman, CEO of Cycles, views this as “cyclical noise.” He believes the talent rotation out of crypto has happened multiple times, similar to how Bitcoin has repeatedly been declared “dead.”

He asserts that crypto remains the foundation for future financial infrastructure, built on core values like neutral payments, programmable money, and composability.

Why Leadership Departures Still Matter

While core developer numbers are stable, the departure of senior operators creates bottlenecks.

Crypto’s toughest challenges are often not cryptography but productization, compliance, and distribution. Bringing financial infrastructure into real-world use requires legal expertise, enterprise sales processes, and integration with businesses.

Leadership volatility can slow the transformation of technical capacity into market momentum.

Crypto’s Unique Advantages Over AI

Crypto’s enduring strengths lie in neutral payments and programmable money. Stablecoins, tokenized real assets, and on-chain treasury infrastructure are difficult to replicate solely with pure AI stacks.

Meanwhile, AI has advantages in speed and user traction. AI applications can scale rapidly within months and face fewer financial compliance hurdles.

New legal frameworks are also making crypto more accessible to institutions, including the US GENIUS Act for stablecoins and expanded oversight roles for the CFTC in certain digital asset segments.

Three Scenarios for the Coming Period

Baseline scenario: personnel fluctuations follow cyclical patterns, but core developers remain stable. Many operators experiment with AI but maintain ties to crypto through advisory or investment roles.

Negative scenario: coordination declines. Leadership exits combined with weak capital slow long-term infrastructure projects, increasing fragmentation between Layer 2 solutions and app chains.

Positive scenario: convergence of AI and crypto. Stablecoin frameworks and banking integrations promote real-world adoption, attracting talent back. Hybrid companies no longer call themselves crypto startups but become financial infrastructure enterprises.

Conclusion

The notable departures early in 2026 do not signal crypto’s decline. They reflect AI’s strong pull and high coordination costs within crypto.

Core developers are still present. Infrastructure is maturing. The bottleneck lies in turning the “future of finance” narrative into widely used products — before AI draws away the most talented operators.