Will SEC Approve the First DeFi ETF? AAVE Filing Sparks Big Question

A quiet regulatory document can sometimes carry more weight than a loud market rally. That idea comes into focus after a new filing connected to AAVE appeared at the United States Securities and Exchange Commission. The paperwork points to a possible path that could move decentralized finance closer to traditional investment access.

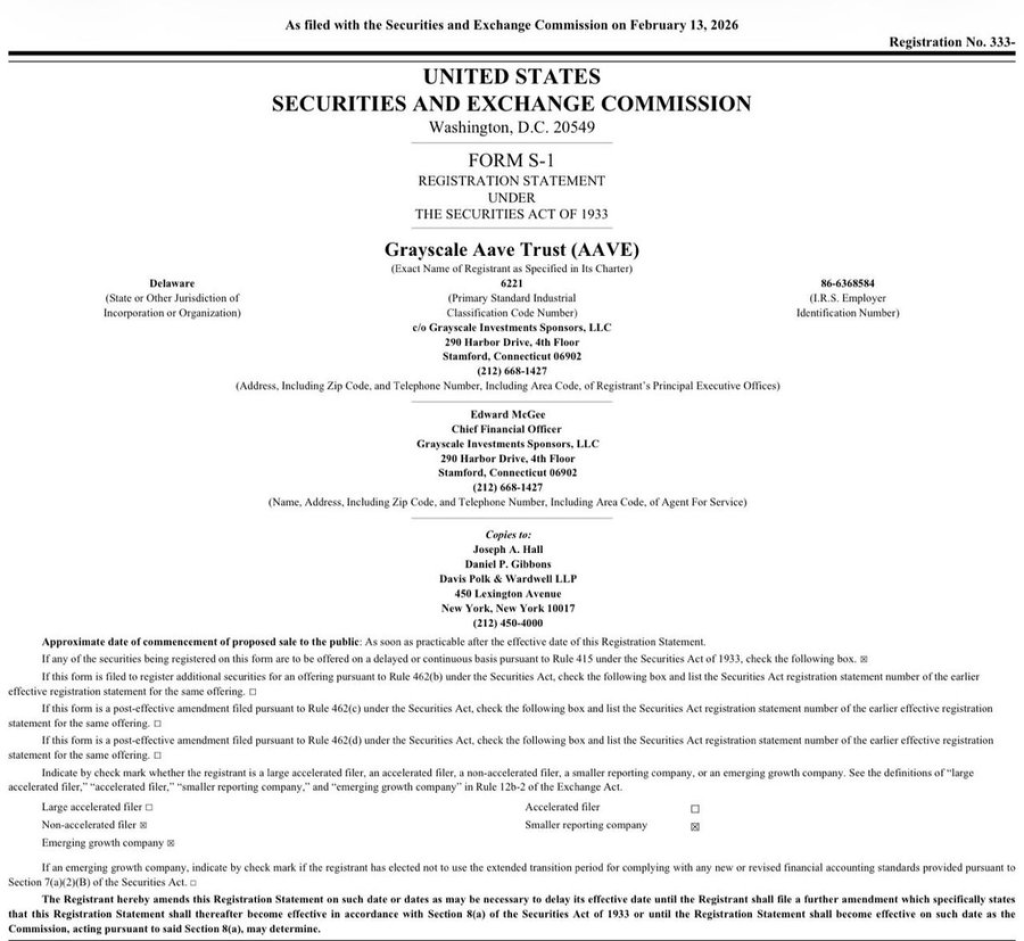

Crypto Patel noted the development in a post that framed the moment as a serious step toward a DeFi exchange-traded fund. The post notes that Grayscale submitted an S-1 registration tied to an Aave trust.

That type of filing usually marks the early stage of a product meant for public market exposure, which explains why the conversation around AAVE has started to focus on regulation instead of short term price action.

@CryptoPatel / X

SEC Filing Shows Formal Structure Behind Potential AAVE Investment Product

Details inside the document reveal that the proposed vehicle is named the Grayscale Aave Trust. The registration statement sits under the Securities Act of 1933, which governs how securities reach public investors in the United States. Grayscale Investments Sponsors appears as the listed sponsor, with corporate addresses and executive oversight clearly outlined.

Such structure matters because it shows preparation for institutional compliance rather than experimental token exposure. Traditional filings require disclosure, governance clarity, and operational transparency. Each requirement creates a bridge between decentralized assets like AAVE and regulated financial markets.

Crypto Patel connects this step to a wider pattern that includes similar ETF ambitions across the altcoin sector. Expansion beyond Bitcoin and Ethereum would mark a meaningful change in how regulators view decentralized finance infrastructure. Access through brokerage accounts could introduce AAVE to investors who never interact with on chain lending protocols.

Regulatory Approval Remains Uncertain Despite Growing DeFi Interest

Regulatory progress rarely follows a straight timeline. SEC review can stretch across months, and approval depends on market surveillance, custody standards, and investor protection rules. AAVE must satisfy those conditions before any product reaches trading desks.

Crypto Patel frames the moment as an open question rather than a guaranteed outcome. The post asks whether the SEC will allow a DeFi focused ETF during the current cycle. That question captures the tension between innovation and oversight that defines the digital asset market today.

Kaspa Crosses 600 Million Transactions: One of Crypto’s Most Underrated Growth Stories_**

Aave already holds a strong position inside decentralized lending, which gives the filing practical relevance beyond speculation. Institutional packaging could expand visibility, yet final approval still depends on regulatory comfort with DeFi mechanics. That balance will shape how quickly decentralized finance enters mainstream portfolios.

Related Articles

Pound Sterling Stablecoin Issuer Agant: UK Cryptocurrency Legislation May Come Into Effect as Early as 2027

New Dutch Tax Law to Hit Bitcoin and Ethereum Holders With 36% Levy on 'Paper Gains'

Annual increase of 90 billion USD surpasses USDT! The "Russian stablecoin" A7A5, sanctioned by the U.S., is emerging in gray finance.

China strikes again! Virtual currencies are now fully classified as illegal finance; strict regulation of RWA tokenization and RMB stablecoins

Fed Governor Notes Fading Crypto Euphoria; Chinese Exchanges Tighten Rules; Senators Query UAE Stake in WLFI