Wintermute: Bitcoin Stuck Below $70K as Leverage Drives Choppy Price Discovery

Low conviction, weak spot demand, and macro shifts keep Bitcoin capped below $70K, says Wintermute.

Bitcoin is still trading below $70,000 as investors seek clear direction following a large wave of liquidations two weeks ago. Price moves have become unstable, with futures trading driving swings more than real buying in the spot market.

Recent economic data has added to uncertainty by rapidly shifting expectations about interest rates. In a new report, Wintermute said confidence is low, and prices remain fragile, even though key support levels are holding.

Relief Rally Fades as Bitcoin Struggles to Build Momentum Above $68K

At the time of writing, the firstborn asset sits near $68,300 after several failed attempts to reclaim the $70K mark. Additionally, the BTC dominance remains below 60%. Post-liquidation positioning is lighter, yet spot volumes remain muted. Derivatives activity now drives short-term moves.

Sharp swings in both directions reflect a market lacking a strong structural bid. Without steady spot buying, rallies struggle to hold and pullbacks deepen quickly.

Strong January jobs data beat expectations and pushed unemployment down to 4.3%, shaping market sentiment during the week. Treasury yields rose after the report, lowering hopes for near-term rate cuts. Spot Bitcoin ETFs then saw heavy outflows as investors trimmed risk.

Mood shifted days later when the January CPI came in softer at 2.4% year over year, down from 2.7%. Cooling inflation sparked a relief rally that carried through Saturday. Sunday brought a modest pullback. However, ETF flows stayed under pressure, limiting confidence in the bounce.

Outside crypto, markets began to rotate as investors moved money out of technology and AI-related stocks into cyclical and value names. Consumer discretionary, industrial, and chemical sectors saw renewed interest.

The change followed U.S. FY25 earnings and product updates from Anthropic, including Opus 4.6. However, Wintermute said the rotation had been building for months.

Crypto Feels Heat as Investors Rotate From Tech to Hard Assets

Tech stocks had become expensive going into earnings season, and some results did not support the earlier rally. Investors pointed to economic uncertainty and earnings fatigue as reasons to take profits and rebalance their portfolios.

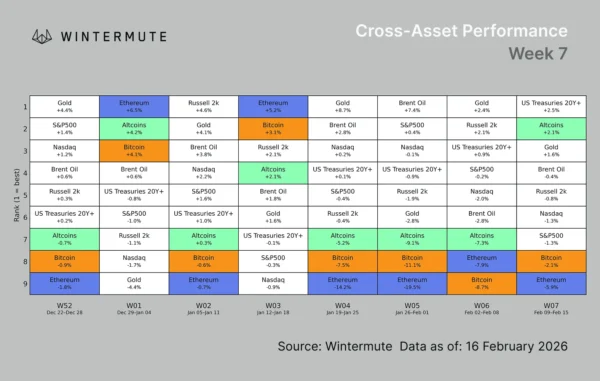

_Image Source: _Wintermute

A deeper structural question now hangs over risk assets. Costs tied to AI innovation are falling quickly. Lower barriers raise disruption risk across established software models. Risk premia on growth assets have risen as investors reassess long-term moats.

Gold and precious metals rallied earlier on U.S. dollar debasement concerns. That move overheated and later corrected. Even so, appetite for hard assets remains part of broader portfolio rebalancing. Crypto, positioned at the high-beta end of growth exposure, tends to feel pressure when capital rotates away from momentum trades.

Bitcoin Rangebound With Downward Bias, Says Wintermute

Wintermute cautions against calling a lasting regime shift. Dip-buying in technology has defined markets for two years. Narrative-driven flows can return quickly if macro data improves. A renewed bid for growth would likely support digital assets.

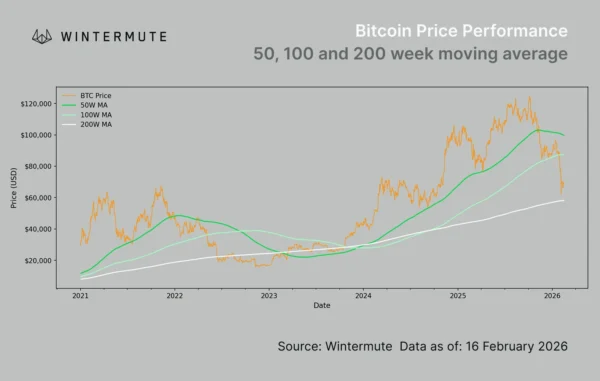

Technically, Bitcoin has found support near its 200-week moving average. Historically, that level has aligned with bear market bottoms. Holding above it reduces the risk of more serious structural damage. Still, repeated rejection near $70,000 keeps short-term bias tilted lower.

_Image Source: _Wintermute

“Positioning is light, conviction is absent, and until macro clarity returns, every rally will be perceived as an opportunity to derisk versus momentum to chase,” Wintermute wrote.

Bitcoin may continue to trade within a tight range in the coming weeks, with volatility remaining high and futures markets driving price movements. Clearer signals on interest rates and inflation could shift expectations. Wintermute urged investors to stay patient until then.

According to the firm, a second-half 2026 recovery remains possible. Achieving it may prove difficult, as many participants have already exhausted their tolerance for uncertainty.

Related Articles

Bitcoin’s 4-Year Cycle Analysis – Why Analysts Are Eyeing a $50,000 Bottom in 2026

Is Bitcoin a Democracy? Adam Back Clarifies Protocol's Nondemocratic DNA - U.Today