Sellers Return: Bitcoin Sinks $1,500 in 20-Minute Move

Elevated open interest and ETF outflows left Bitcoin exposed to a rapid long liquidation cascade.

Bitcoin came under heavy selling at the U.S. market open, dropping $1,500 in about 20 minutes. Selling picked up quickly as buyers pulled back and long traders were forced to exit. However, market data suggest it was mainly a forced liquidation move, not widespread panic selling.

Bitcoin Drops 2.2% in Minutes as Long Liquidations Accelerate

On the 1-minute BTCUSDT chart shared by Ted Pillows, Bitcoin was trading around $68,300 to $68,400 before strong selling entered the market. Large red candles followed, sending the price down quickly to the $66,800–$66,900 area.

$BTC dropped $1,500 in just 20 minutes after the US market open.

The sellers are back. pic.twitter.com/Z9yUOLxgcP

— Ted (@TedPillows) February 17, 2026

Notably, this marked a 2.2% drop within a compressed window. At the same time, buyers provided little support as the market declined. More so, momentum reflected sustained market selling rather than a single volatility spike.

Liquidity data reveals a fragile structure before the breakdown. Liquidation heatmaps showed dense clusters above $68,500 and into $69,000–$70,000. Price failed to reach those upper pockets. Instead, it rotated lower into thinner bid zones.

Once $68,000 gave way, acceleration followed. Price moved through a liquidity vacuum, triggering forced long liquidations. Bitcoin’s fall to $66,800 happened where many long positions were likely to be liquidated below intraday support. In simple terms, too many traders were overexposed on the long side.

These trades were forced to close as prices declined. As those positions were liquidated, additional stop-loss orders were triggered. And this trend pushed the price down even faster.

Open interest data confirms the unwind. OI had remained elevated ahead of the session, reflecting heavy speculative positioning. During the sell-off, OI declined alongside the price. Price down with OI down signals long liquidation.

_Image Source: _CoinGlass

Fresh short positioning did not dominate the move. Overleveraged longs were forced to close. That dynamic explains the speed and vertical nature of the decline.

Funding rates add another layer of context. OI-weighted funding stayed persistently positive before the drop. In addition, traders were paying to maintain long exposure.

ETF Outflows and Elevated OI Leave BTC Vulnerable to Liquidations

Positive funding combined with high OI often creates structural fragility. When momentum stalls under those conditions, even modest volatility can trigger sharp squeezes. U.S. market open provided that volatility sparks.

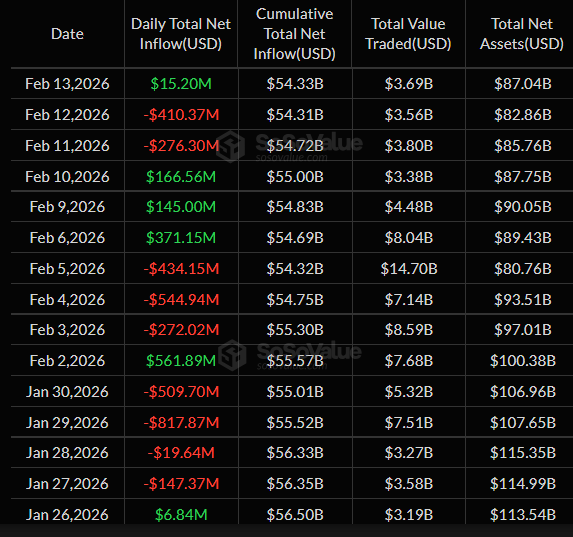

Meanwhile, spot Bitcoin ETFs recorded notable net outflows on Feb. 12 and 11, totaling $410 million and $276 million. Feb. 13 saw only a modest $15 million inflow. Looking at the data, institutional demand appears to have slowed.

_Image Source: _SoSovalue

And with fewer strong spot buyers in the market, price drops are harder to absorb. As such, leveraged traders were left exposed when key support levels broke. Additionally, selling pressure increased rapidly.

Futures trading continues to dominate over options in the current market. As per data, most positions are concentrated in perpetual and futures contracts. Oftentimes, this setup increases the risk of sudden liquidation waves.

Related Articles

Bitcoin Miner Soluna Expands Behind-the-Meter Capacity in Texas via Blockware Pact

Laurore Ltd is the largest new holder of the BlackRock Bitcoin ETF, with Jane Street following closely behind.

Yesterday, the US Bitcoin spot ETF experienced a net outflow of $104.9 million.