The Endgame of "Coin Hoarding Company": Liquidation or Self-Rescue?

Author: Prathik Desai

Translated and Edited by: BitpushNews

More than a year ago, becoming a cryptocurrency reserve company (DAT) seemed like an easy decision for many firms seeking to boost their stock prices.

Some Microsoft shareholders convened to ask the board to evaluate the benefits of including some Bitcoin on their balance sheet. They even mentioned Strategy, the largest publicly listed Bitcoin DAT.

At that time, a financial flywheel was in place, attracting everyone to follow.

Buy large amounts of Bitcoin, Ethereum, Solana (SOL). Watch the stock price trade above the value of these assets. Issue more shares at a premium. Use the proceeds to buy more cryptocurrencies. Repeat. This financial flywheel supporting publicly traded stocks seemed almost perfect, enough to tempt investors. They paid over two dollars just to gain indirect exposure to Bitcoin worth only one dollar. It was a crazy era.

But time tests the best strategies and flywheels.

Today, with the total crypto market cap evaporating over 45% in the past four months, most of these packaged companies’ market-to-net asset value ratios have fallen below 1. This indicates that the market values these DAT companies below the worth of their crypto reserves. This has changed how the financial flywheel operates.

Because a DAT is not just a package of assets. In most cases, it’s a company with operating expenses, financing costs, legal, and operational fees. During the mNAV premium era, DATs raised funds by issuing more shares or taking on more debt to buy cryptocurrencies and cover operational costs. In the mNAV discount era, this flywheel collapses.

In today’s analysis, I will show what a persistent mNAV discount means for DATs and whether they can survive a crypto bear market.

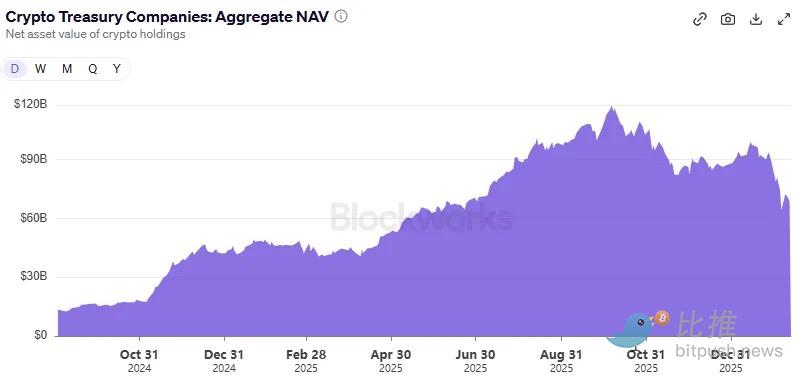

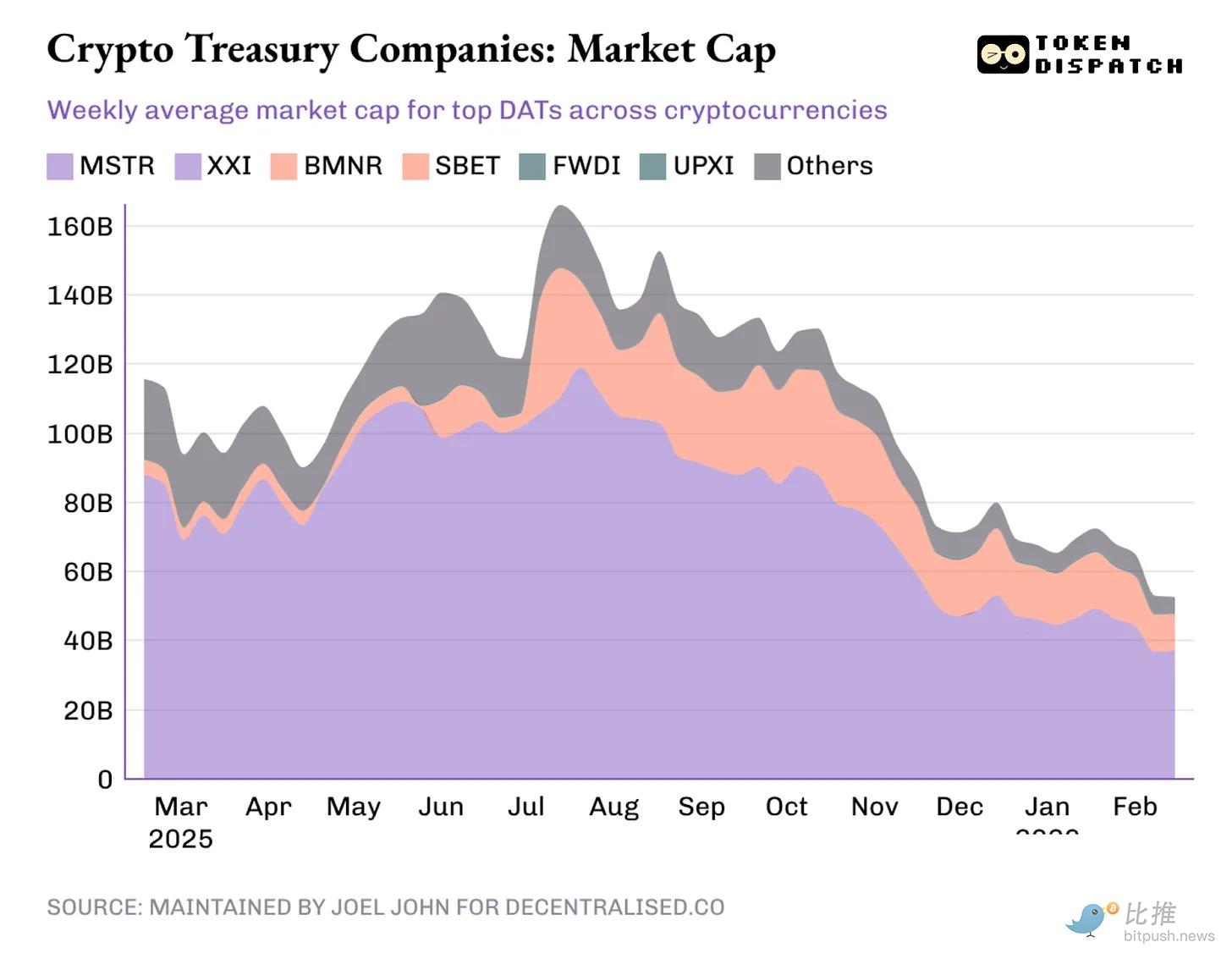

Between 2024 and 2025, over 30 companies are vying to transform into DATs. They are building reserves around Bitcoin, Ethereum, SOL, and even meme coins.

At the peak on October 7, 2025, the crypto held by DATs was valued at $118 billion, with these companies’ total market cap exceeding $160 billion. Now, the crypto holdings are worth $68 billion, and their discounted total market cap is just over $50 billion.

Their fates all hinge on one thing: their ability to package assets and weave stories that justify a valuation higher than the assets’ worth. This difference becomes the premium.

The premium itself becomes a product. If the stock trades at 1.5 times mNAV, a DAT can sell stock worth $1 and then buy crypto exposure worth $1.50, describing the transaction as “value-added.” Investors are willing to pay a premium because they believe the DAT can continue selling shares at a premium and use the proceeds to accumulate more crypto, thereby increasing the per-share crypto asset value over time.

The problem is, premiums don’t last forever. Once the market stops paying extra for this packaging, the “sell stock, buy crypto” flywheel stalls.

When stocks no longer trade at 1.5 times asset value, the amount of crypto bought with each new share issuance decreases. The premium turns into a discount.

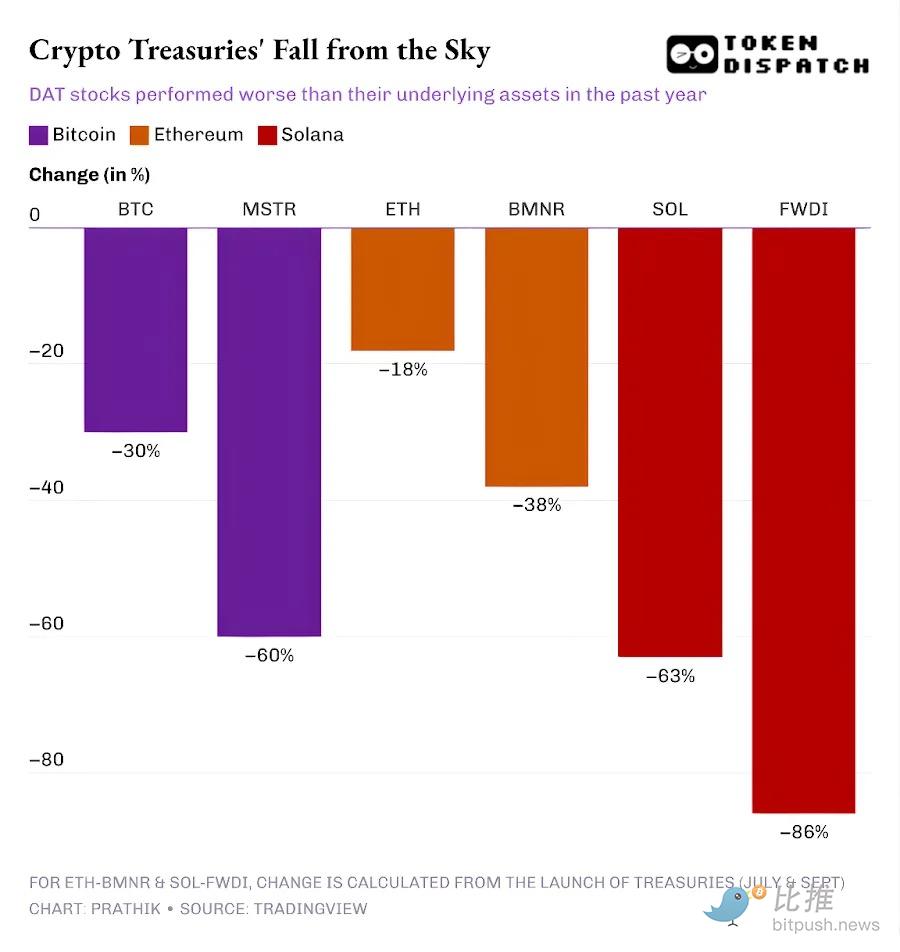

Over the past year, leading Bitcoin, Ethereum, and SOL DATs have seen their stock prices fall more than the cryptocurrencies themselves.

Once the premium relative to the underlying assets disappears, investors will naturally ask: why can’t they buy crypto directly elsewhere, such as on decentralized or centralized exchanges, or through ETFs, at a cheaper price?

Bloomberg’s Matt Levin posed an important question: if the trading price of a DAT doesn’t even reach its net asset value, let alone a premium, why don’t investors push the company to liquidate its crypto reserves or buy back stock?

Many DATs, including the industry leader Strategy, try to convince investors that they will hold crypto through the bear cycle, waiting for the premium era to return. But I see a more critical issue. If a DAT cannot raise additional funds in the foreseeable long term, where will it get the money to operate? These DATs have bills and wages to pay.

Strategy is an exception, for two reasons.

-

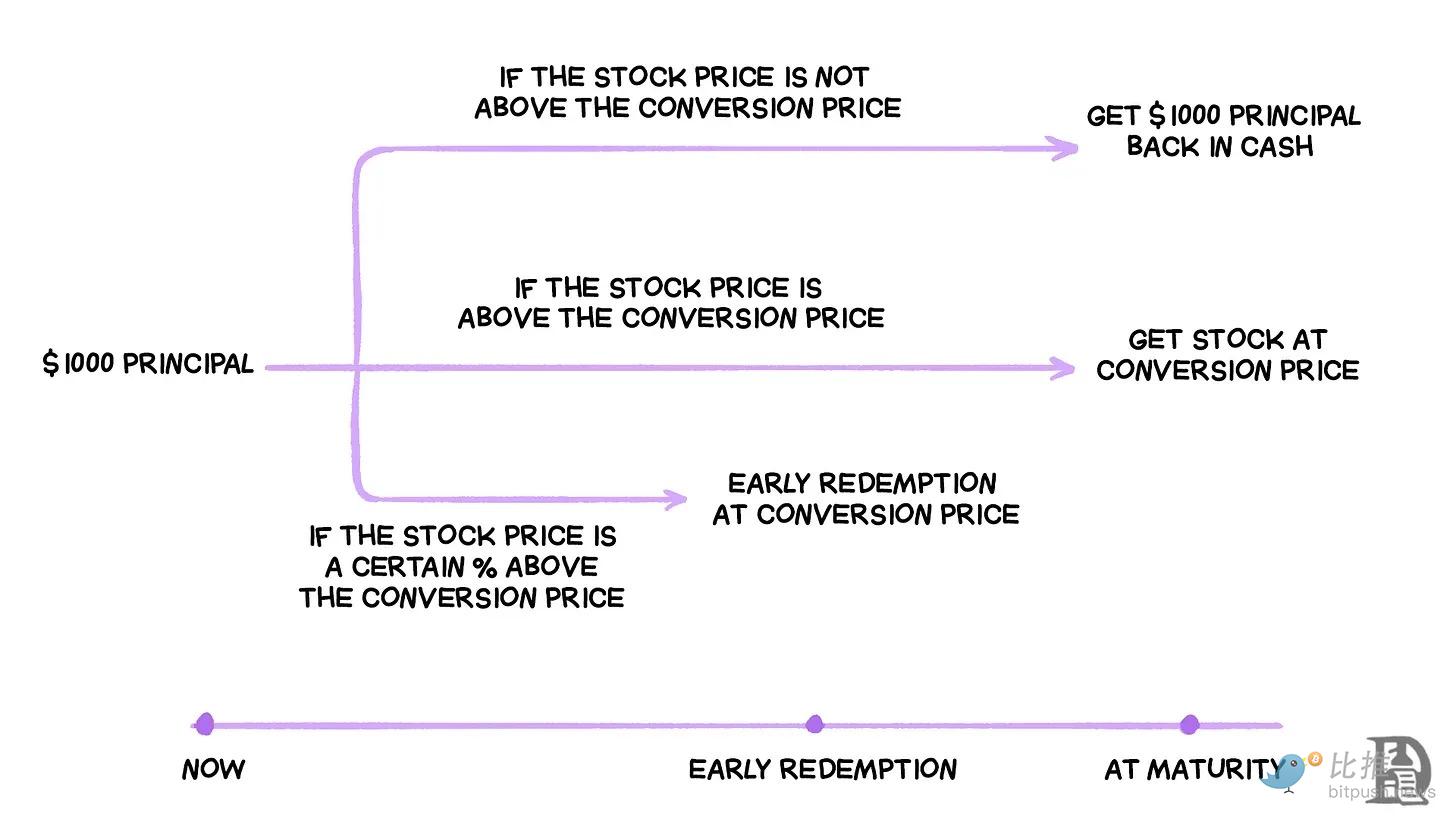

According to reports, it holds $2.25 billion in reserves, enough to cover dividends and interest obligations for about 2.5 years. This is significant because Strategy no longer relies solely on zero-coupon convertible bonds for fundraising. It has also issued preferred instruments that require paying substantial dividends.

-

It also has an operational business, no matter how small, that can generate recurring income. In Q4 2025, Strategy reported total revenue of $123 million, with a gross profit of $81 million. Although Strategy’s net profit can fluctuate significantly due to changes in the market valuation of crypto assets each quarter, its business intelligence division is the company’s only tangible cash flow source.

But this still doesn’t make Strategy’s strategy invulnerable. The market can still punish its stock—just as it has over the past year—and weaken Strategy’s ability to raise funds at low cost.

While Strategy might survive the crypto bear market, emerging DATs lacking sufficient reserves or operational businesses to cover unavoidable expenses will feel the pressure.

This difference is even more apparent in Ethereum-based DATs.

The largest ETH-based DAT—Bitmine Immersion—has a marginalized operational business supporting its ETH reserves. As of the quarter ending November 30, 2025, BMNR reported total revenue of $2.293 million, including consulting, leasing, and staking income.

Bitmine’s balance sheet shows the company holds digital assets valued at $10.56 billion and cash equivalents of $887.7 million. BMNR’s operations resulted in a net negative cash flow of $228 million. All cash needs are met through issuing new shares.

Last year, since BMNR’s stock traded at a premium to mNAV most of the time, raising funds was relatively easier. But over the past six months, the mNAV has dropped from 1.5 to about 1.

So what happens when the stock no longer trades at a premium? Issuing more shares at a discount could lower the ETH price per share, making it less attractive to investors than buying ETH directly from the market.

This explains why BitMine announced last month it would invest $200 million to acquire shares of Beast Industries, a private company owned by YouTuber MrBeast. The company said it would “explore ways to collaborate on DeFi projects.”

Ethereum and SOL DATs might also argue that staking income—something Bitcoin DATs can’t boast—can help them operate during market crashes. But this still doesn’t solve the issue of meeting cash flow obligations.

Even with staking rewards (accumulated in ETH or SOL), as long as these rewards aren’t exchanged for fiat currency, DATs can’t use them to pay wages, audit fees, listing costs, or interest. Companies must either have sufficient fiat income or sell or re-mortgage reserves to meet cash needs.

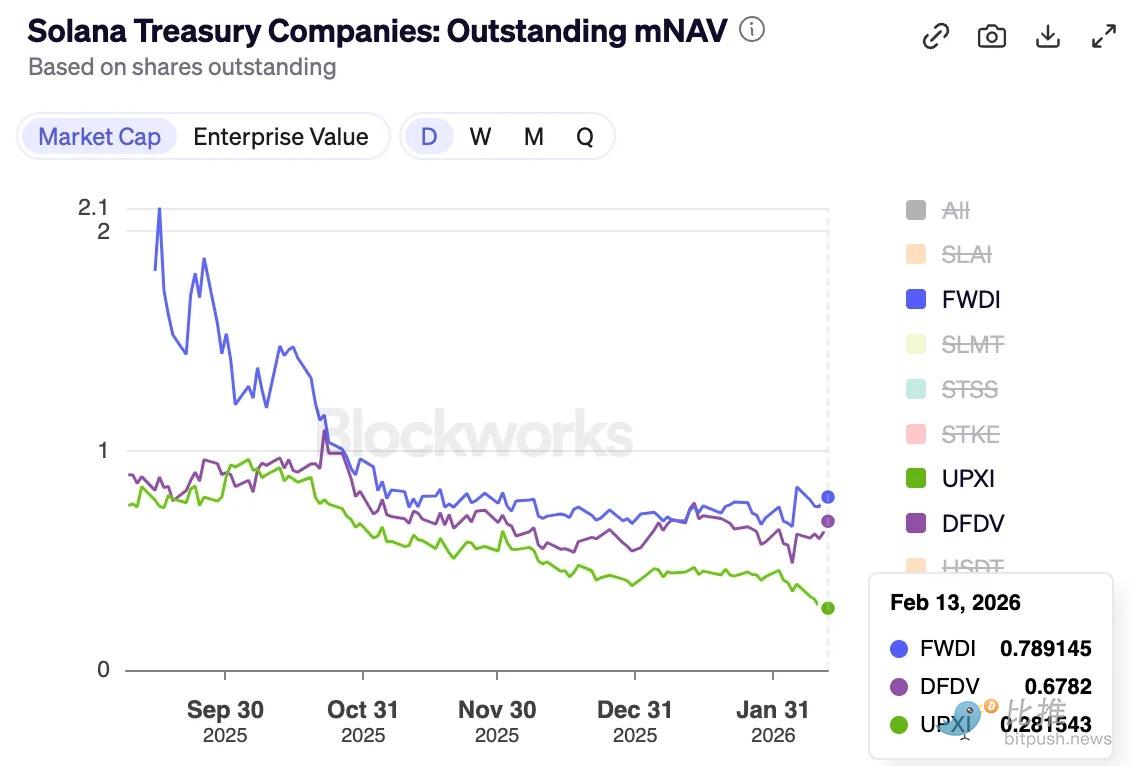

This is especially evident in the largest SOL holder—Forward Industries.

FWDI reported a net loss of $586 million in Q4 2025, despite earning $17.381 million in staking and related income.

Management explicitly stated that the company’s “cash balance and working capital are sufficient to meet our liquidity needs at least until February 2027.”

FWDI also disclosed an active capital-raising strategy, including issuing stock at market price, buybacks, and a tokenization experiment. However, if the mNAV premium doesn’t persist long-term, all these efforts may fail to manage the packaging’s valuation.

The Road Ahead

Last year’s DAT craze centered on the speed of asset accumulation and the ability to raise funds through issuing shares at a premium. As long as the packaging trades at a premium, DATs can continue converting expensive equity into more crypto per share, calling it “beta.” Investors also pretend the only risk is the asset price itself.

But premiums won’t last forever. Crypto cycles can turn them into discounts. I first discussed this issue shortly after the October 10, 2022 liquidation event, when the premium started to decline.

However, this bear market will push DATs to evaluate: once the packaging no longer trades at a premium, should they still exist?

One way to address this dilemma is for companies to improve operational efficiency, building profitable or cash-generating businesses or reserves to supplement DAT strategies. Because when the story of a DAT can no longer attract investors in a bear market, a conventional company story will determine its survival.

If you’ve read the article “Strategy & Marathon: Faith and Power,” you’ll recall why Strategy has remained resilient across multiple crypto cycles. However, a new wave of companies—including BitMine, Forward Industries, SharpLink, and Upexi—cannot rely on the same strength.

Their current attempts at staking income and weak operational businesses may collapse under market pressure unless they consider other options to cover real-world obligations.

We saw this with ETHZilla, an ETH reserve company that last month sold about $115 million worth of ETH and bought two jet engines. Subsequently, the DAT leased the engines to a major airline and hired Aero Engine Solutions for monthly management fees.

Looking ahead, people will evaluate not only digital asset accumulation strategies but also their ability to survive. In the ongoing DAT cycle, only those that can manage dilution, debt, fixed obligations, and trading liquidity will weather the market downturn.

Related Articles

If Ethereum breaks through $2100, the total liquidation strength of mainstream CEX short positions will reach 652 million.

Data: Major Ethereum whales collectively shift to a floating loss state for the first time

Data: If ETH breaks through $2,076, the total liquidation strength of long positions on mainstream CEXs will reach $683 million.

Vitalik Buterin Plans “Cypherpunk” Upgrade Path to Strengthen Ethereum Over the Next Five Years