Solana Dominates Network Transactions Across All Chains in 2025

Solana’s transaction surge aligns with rising users, strong DEX volume, and deep stablecoin liquidity.

Fresh on-chain data shows Solana widening its lead over rival blockchains in 2025. Transaction counts have climbed to levels no other major network currently matches. Interestingly, activity growth extends beyond raw throughput and points to deeper user and capital engagement. Recent metrics suggest dominance rests on structural demand rather than short-term spikes.

Solana Dominates Throughput Rankings as User Activity Rebounds

According to a chart posted by Solana Sensei, daily transaction data shows Solana consistently surpassing 100 million transactions. Late January peaks ranged from 150 million to 165 million per day.

Solana dominated all chains in the number of transactions recorded in 2025. pic.twitter.com/xKkWopCx6g

— Solana Sensei (@SolanaSensei) February 22, 2026

Meanwhile, fourth-quarter activity ranged from 70 million to 100 million. January marked a clear breakout phase, followed by cooling that still sits well above 2024 averages.

Notably, the network holds a significant gap versus competitors during that period. Among these chains, Ethereum, BNB Chain, Base, and Sui process only a fraction of Solana’s throughput. Solana’s lead is significant, with transaction volumes running an order of magnitude higher than competitors during peak periods.

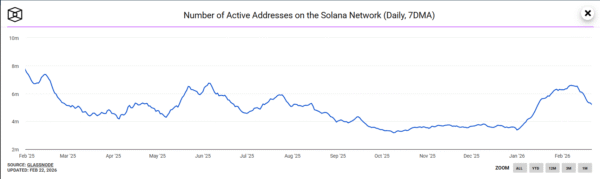

User participation moved in tandem with transaction growth. As per The Block data, daily active addresses slid towards the end of last year. In fact, data shows the figure bottomed near 3.3 to 3.5 million.

_Image Source: _The Block

However, the trend flipped sharply at the turn of the year. Active addresses surged past 6.5 million before settling around 5 to 5.5 million. Even so, current levels remain well above fourth-quarter lows.

The parallel growth in transactions and addresses reduces concerns of bot-driven spikes. More so, broader participation suggests genuine engagement during January’s expansion phase.

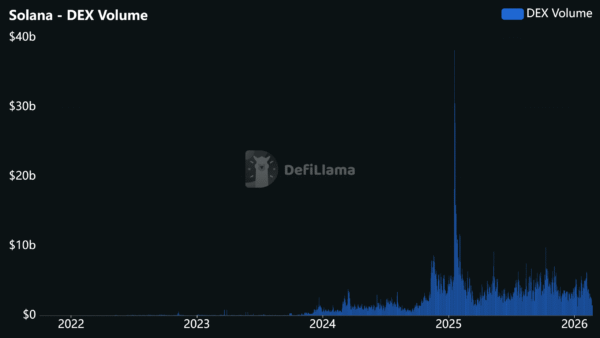

DEX Volume Holds Above $1.4B Daily as App Revenue Outpaces Base Fees

On-chain data from DefiLlama shows steady DEX growth from 2023 through 2024, followed by a sharp surge early last year. Activity has remained elevated into 2026. Current figures show $1.456 billion in 24-hour volume and $115.8 billion over 30 days. Weekly volume is down 26%, but still well above levels seen before 2024.

_Image Source: _DefiLlama

Over the past 24 hours, the blockchain collected about $637,000 in fees, with only around $58,000 counted as network revenue. In comparison, applications built on Solana generated about $5.86 million in fees and roughly $3.01 million in revenue.

Low base-layer fees keep transactions cheap for users. Meanwhile, apps make money through trading activity, token launches, and DeFi services. This setup allows heavy network usage without making transactions expensive.

Solana Liquidity Metrics Signal Sustained Trading and DeFi Demand

Strong liquidity supports Solana’s high activity levels, with stablecoins on the network total about $15.18 billion in value. Additionally, total value locked stands near $6.57 billion, showing funds committed to DeFi protocols.

Perpetual futures volume reached $404.9 million in 24 hours, while bridged total value locked is around $39.75 billion.

Basically, large stablecoin reserves help power trading, derivatives, arbitrage, and fast token rotations. Because real capital is active on-chain, high transaction numbers reflect real economic use, not empty transfers.

Related Articles

3 Altcoins That Could Explode as Total3 Eyes 40% Upside — SOL, PIPPIN, and PENGU

Tech-Led Stock Rally Fails to Lift Crypto as Ether, XRP, and Solana Slide