Overhead Resistance Stacks up — Bitcoin’s Next Expansion Move Could Be Violent

As of Sunday morning, at 8 a.m. EST, bitcoin is trading between $67,926 and $68,022, compressing just below a critical resistance band while momentum metrics quietly shift under the surface. The broader structure remains corrective, but short-term price action suggests volatility is not done making headlines.

Bitcoin Chart Outlook

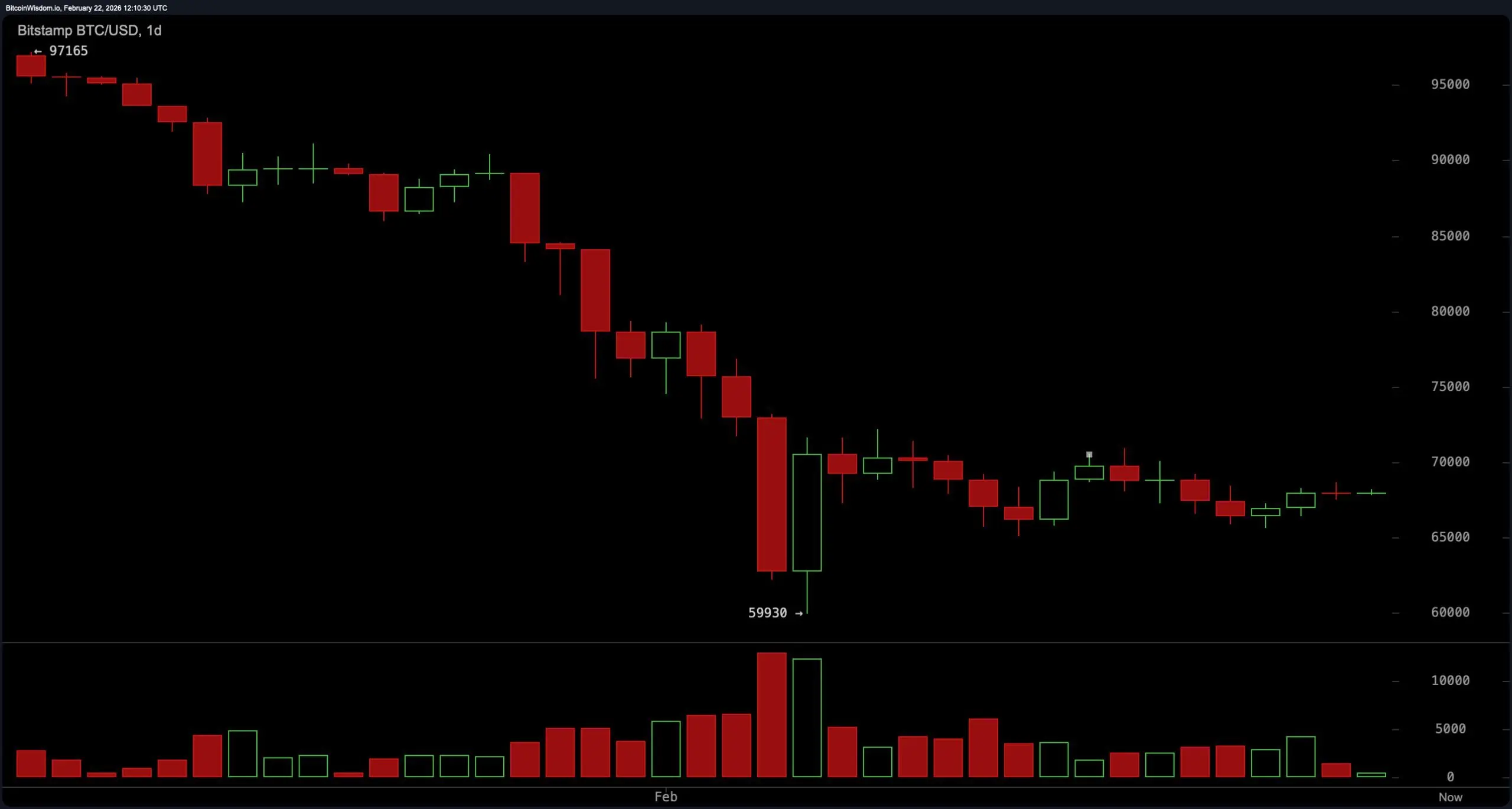

At the macro level, bitcoin‘s daily chart reflects a strong corrective phase from roughly $97,000 down to a capitulation low near $59,930, followed by stabilization in the $66,000 to $70,000 range. Price continues to form lower highs, while volume has declined during consolidation, signaling compression rather than expansion.

Major support stands at $65,000, with a breakdown level at $59,900. Overhead, resistance remains firm between $70,000 and $72,000, and only a decisive daily close above $72,000 would confirm a structural higher high. Until then, the daily bias remains neutral to bearish — not dramatic, just disciplined.

BTC/USD 1-day chart via Bitstamp on Feb. 22, 2026.

On the four-hour chart, bitcoin has staged a measured recovery off $65,620, carving a higher low before stair-stepping into the $68,500 to $69,000 region. Momentum, however, is slowing near resistance. The structure shows compression beneath $70,000, with heavy overhead supply. A sustained move above $69,500 to $70,000 would expose $72,000 and potentially $74,000, while rejection in this zone increases the probability of a rotation back toward $66,000 and possibly $65,000. In short, the four-hour timeframe reflects a range-bound recovery within a broader corrective environment — optimistic, but on a leash.

BTC/USD 1-day chart via Bitstamp on Feb. 22, 2026.

On the four-hour chart, bitcoin has staged a measured recovery off $65,620, carving a higher low before stair-stepping into the $68,500 to $69,000 region. Momentum, however, is slowing near resistance. The structure shows compression beneath $70,000, with heavy overhead supply. A sustained move above $69,500 to $70,000 would expose $72,000 and potentially $74,000, while rejection in this zone increases the probability of a rotation back toward $66,000 and possibly $65,000. In short, the four-hour timeframe reflects a range-bound recovery within a broader corrective environment — optimistic, but on a leash.

BTC/USD 4-hour chart via Bitstamp on Feb. 22, 2026.

The one-hour chart captures the market’s current personality: tight consolidation between $67,800 and $68,800. Multiple failed pushes above $68,800 confirm active resistance, while consistent defenses of $67,800 establish near-term support. Volatility has contracted, suggesting expansion is brewing. A break above $69,000 would likely accelerate momentum toward a swift test of $70,000. Conversely, a loss of $67,800 opens the door for a retracement into deeper intraday support. Compression markets reward patience; impulsive trades here tend to reward regret.

BTC/USD 4-hour chart via Bitstamp on Feb. 22, 2026.

The one-hour chart captures the market’s current personality: tight consolidation between $67,800 and $68,800. Multiple failed pushes above $68,800 confirm active resistance, while consistent defenses of $67,800 establish near-term support. Volatility has contracted, suggesting expansion is brewing. A break above $69,000 would likely accelerate momentum toward a swift test of $70,000. Conversely, a loss of $67,800 opens the door for a retracement into deeper intraday support. Compression markets reward patience; impulsive trades here tend to reward regret.

BTC/USD 1-hour chart via Bitstamp on Feb. 22, 2026.

Oscillators are largely neutral, largely pointing to the market’s indecision. The relative strength index ( RSI) reads 37, the Stochastic oscillator stands at 43, and the commodity channel index (CCI) prints negative 32 — all neutral. The average directional index (ADX) at 57 signals strong trend strength, though the direction itself remains contested. The Awesome oscillator registers negative 8,510, while momentum prints 1,787. The moving average convergence divergence ( MACD) level sits at negative 3,772. Despite select positive momentum readings, the broader oscillator suite reflects balance rather than dominance.

BTC/USD 1-hour chart via Bitstamp on Feb. 22, 2026.

Oscillators are largely neutral, largely pointing to the market’s indecision. The relative strength index ( RSI) reads 37, the Stochastic oscillator stands at 43, and the commodity channel index (CCI) prints negative 32 — all neutral. The average directional index (ADX) at 57 signals strong trend strength, though the direction itself remains contested. The Awesome oscillator registers negative 8,510, while momentum prints 1,787. The moving average convergence divergence ( MACD) level sits at negative 3,772. Despite select positive momentum readings, the broader oscillator suite reflects balance rather than dominance.

Moving averages (MAs), however, lean decisively downward. The exponential moving average (EMA) at $68,233 and the simple moving average (SMA) at $68,105 both sit above the current price, reinforcing immediate resistance. The EMA (20) at $70,664 and the SMA (20) at $68,733 further cap upside attempts. Higher time-frame averages remain stacked overhead: EMA (30) $73,436; SMA (30) $73,991; EMA (50) $77,840; SMA (50) $81,309; EMA (100) $85,180; SMA (100) $85,300; EMA (200) $92,321; and SMA (200) $98,930. That is not light resistance — that is a ceiling with reinforced concrete.

Overall, bitcoin sits in a compression regime bounded by $65,000 support and $70,000 to $72,000 resistance. The daily structure remains corrective, the four-hour chart shows recovery within constraint, and the one-hour chart coils tightly. A clean break above $72,000 with strong volume would materially shift the outlook. Until then, this remains a range-trading environment where discipline outperforms bravado — and where the next volatility expansion is likely closer than it appears.

Bull Verdict:

A confirmed daily close above $72,000, supported by expanding volume, would invalidate the current sequence of lower highs and establish a new structural higher high. Such a move would shift momentum decisively in favor of upside continuation, opening the path toward $74,000 and signaling that the compression phase has resolved into trend expansion.

Bear Verdict:

A sustained loss of $65,000 support, particularly with accelerating downside volume, would reinforce the broader corrective structure and increase the probability of a liquidity sweep toward $63,000 and potentially the prior panic low near $59,900. Failure to reclaim $70,000–$72,000 resistance keeps the macro bias vulnerable to renewed downside pressure.

FAQ 🔎

- What is bitcoin’s price on Feb. 4, 2026? Bitcoin is trading at $68,022, consolidating below the $70,000 resistance level.

- What are the key support and resistance levels for bitcoin right now? Major support sits at $65,000, while resistance stands between $70,000 and $72,000.

- What does the daily chart signal for bitcoin’s trend? The daily structure remains corrective unless bitcoin closes decisively above $72,000.

- Are technical indicators bullish or bearish for bitcoin? Oscillators are mostly neutral, while moving averages remain positioned above price, signaling overhead pressure.

Related Articles

Mysterious Offshore Entity Takes $436M Position in Blackrock’s Bitcoin ETF

The value of Strategy assets is approximately six times the liabilities, with cash reserves sufficient to pay dividends for over 30 months.