Bitcoin Sees Largest Realized Loss Spike in History, Analyst Says Bottom Is Near

Realized losses surge as leverage resets, but institutional flows remain cautious.

Bitcoin’s latest correction has triggered one of the largest realized loss events ever recorded on-chain. Heavy selling pressure forced many holders to exit at a loss. At the same time, derivatives markets saw a sharp contraction in positioning. According to analyst Michaël van de Poppe, such conditions often appear near major market turning points.

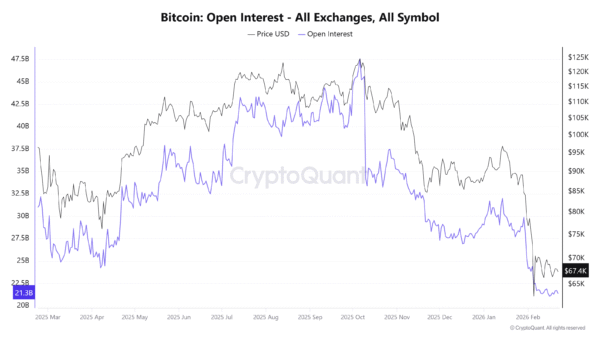

Bitcoin Open Interest Collapses 50% as Capitulation Signals Mount

On-chain data shows a historic spike in Bitcoin’s Entity-Adjusted Realized Loss. That metric tracks losses when coins move at prices below their acquisition cost. Current readings now rival capitulation phases seen during the 2018 bear market, the March 2020 COVID crash, and the 2022 Luna and FTX collapses.

This chart represents the total USD value of losses being realized by #Bitcoin holders when they sell their coins at a lower price than they bought them.

The recent correction has resulted in a massive spike in realized losses happening currently. The highest it has ever been.… pic.twitter.com/2D82w1rjbr

— Michaël van de Poppe (@CryptoMichNL) February 21, 2026

Spikes of that scale typically occur when weak hands exit under pressure. Forced liquidations and panic selling often cluster around those moments. Van de Poppe argues that the scale and speed of losses suggest broad capitulation rather than routine profit-taking.

Bitcoin open interest across all exchanges has fallen from roughly $45 billion to near $21 billion. More than 50% of positions have been wiped out in a short period. Generally, such contractions reflect long liquidations and rapid deleveraging.

_Image Source: _CryptoQuant

Historical patterns show major open interest resets often align with local bottoms. Excess speculation gets flushed from the system, leaving a cleaner structure. Combined with realized loss spike, a drop in open interest points to a liquidation-driven event.

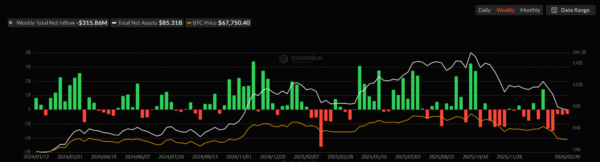

Spot Bitcoin ETF flows recorded roughly $315 million in weekly net outflows. Several recent weeks showed consistent redemptions. While scale remains modest compared to prior inflow waves, direction signals ongoing risk reduction.

_Image Source: _SoSoValue

Retail traders and overexposed longs appear to be exiting. At the same time, institutional buyers have yet to step in aggressively. Without steady ETF inflows, confirmation of a durable bottom remains incomplete.

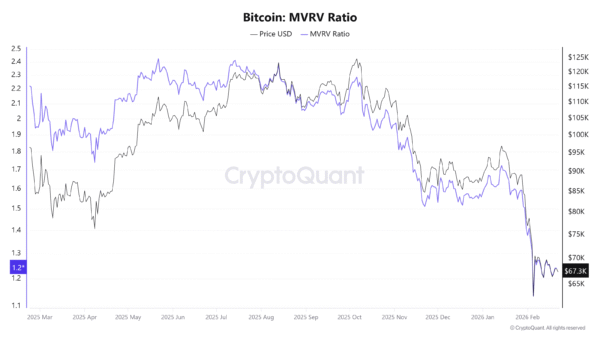

MVRV Compresses While Realized Losses Surge in BTC Correction

Valuation metrics reflect a reset but not deep-cycle undervaluation. For instance, the MVRV ratio has compressed sharply during the correction. Profit margins across the network have narrowed, and speculative excess has faded. Previous macro bottoms in 2018 and 2022 saw MVRV fall to deeply discounted levels. Current readings sit above those extremes.

_Image Source: _CryptoQuant

Van de Poppe explained that risk-adjusted returns have fallen to levels last seen near prior market bottoms. Such readings often accompany periods of severe stress and forced selling.

Data now presents a mixed but structurally important picture:

- Massive realized losses signal widespread capitulation.

- Open interest collapse confirms heavy deleveraging.

- ETF outflows show institutions remain cautious.

- MVRV compression points to a valuation reset, not deep undervaluation.

Bitcoin currently trades about 50% below its all-time high. Prior bear markets saw drawdowns between 70% and 85%. The scale of the current decline suggests a major mid-cycle deleveraging rather than a full structural collapse.

According to Michaël van de Poppe, extreme realized losses often coincide with bottoming phases as weak participants exit. A confirmation of a macro bottom will depend on stabilization in ETF flows and broader liquidity conditions in the coming weeks.

Related Articles

Bitcoin Sell Pressure Is Easing, But Whales Keep Dumping on Exchanges: CryptoQuant

Data: In the past 24 hours, the total liquidation across the entire network was $82,223,300,000, with long positions liquidated at $66,038,600,000 and short positions at $16,184,700,000.