Search results for "ADX"

DAMUSDT Price Action Signals Upside Potential After Wedge Breakout

DAMUSDT price analysis shows a clean breakout from a long descending channel with early signs of acceptance above resistance.

Liquidity clusters around recent swing highs and lows are guiding short-term directional decisions near equilibrium.

Weak volatility and low ADX suggest

CryptoFrontNews·01-09 07:16

DAMUSDT Price Action Signals Upside Potential After Wedge Breakout

DAMUSDT price analysis shows a clean breakout from a long descending channel with early signs of acceptance above resistance.

Liquidity clusters around recent swing highs and lows are guiding short-term directional decisions near equilibrium.

Weak volatility and low ADX suggest

CryptoFrontNews·01-08 07:16

Bitcoin reclaims the 200-day moving average. If it stabilizes above 95K, a golden cross may be on the horizon.

Entering a new year, the Bitcoin market has seen a long-awaited turning point. Bitcoin prices have recently rebounded strongly, breaking above the 200-day moving average for the first time since October last year, bringing a glimmer of hope to long-term cautious bulls. As the price structure improves, the market is beginning to focus on whether Bitcoin has the chance to break free from the bearish "death cross" pattern formed in November last year and re-establish a medium- to long-term upward trend. The accumulated compression momentum over the past few weeks has already been released upward. The 200-day moving average has stabilized again. If Bitcoin's price can close above $95,000 for several consecutive trading days, and the average daily volatility (ADX) continues to rise, then Bitcoin may be able to escape the death cross dilemma and form a "golden cross." A golden cross refers to the 50-day moving average (50-day EMA) crossing upward through the 200-day (200-day) moving average.

BTC-0.57%

ChainNewsAbmedia·01-06 01:04

Gate Institute: Application and Backtesting of Momentum Indicators in the Cryptocurrency Market

Summary

Momentum investing is based on the assumption of trend persistence and is widely used in traditional finance and cryptocurrency markets. This report takes BTC as the research object, systematically reviews the theoretical basis of momentum strategies, behavioral drivers, and potential risks, providing a framework for empirical analysis.

Momentum can be understood as the "inertia" of prices, commonly quantified as the difference between the current price and historical prices. In the BTC market, short-term momentum indicators (such as the 10-day momentum) can effectively characterize cyclical trend directions.

The momentum effect is closely related to behavioral finance; herd behavior, conformity, and underreaction can reinforce trend continuation. However, unexpected events and emotional reversals may quickly invalidate momentum signals, leading to significant drawdown risks.

This report selects MACD, Bollinger Bands, ADX/DMI, and RSI as core momentum tools, analyzing from the perspectives of trend direction, volatility structure, trend strength, and market

ADX-1.71%

GateResearch·2025-12-12 08:41

Data: Multiple tokens have experienced a sharp rise and fall, SOL has hit a new low today.

According to Mars Finance news, the market is polarized, with significant falls in coins such as ARDR, LPT, ADX, and DIA, while LUMIA, EPIC, and DASH are rising against the trend, and SOL has reached a new low.

SOL-1.3%

MarsBitNews·2025-11-12 03:49

BNB vs XRP: The market capitalization is only 500 million dollars apart, and the ADX indicator reveals that BNB may narrowly win with a "weakness."

BNB and XRP have recently experienced a pullback, with the market capitalization gap narrowing to just $500 million, making the competition for the fourth largest position in Crypto Assets market capitalization more intense than ever. Traders on the prediction market Myriad are slightly optimistic about BNB, with a support rate of 55%, believing it can maintain its ranking until November 2. Technical chart analysis shows that XRP is under strong bearish momentum (ADX reading of 36.83), while BNB's trend is weaker (ADX reading of 17.86). Analysts believe that under the current market pressure, BNB, with this "drifting" state, may be more advantageous than XRP, which has a stronger trend.

MarketWhisper·2025-10-31 03:56

Data: LRC falls over 10% in 24 hours, KDA hits a new low for today.

According to Mars Finance news, Binance Spot data shows that the market has experienced significant fluctuations. LRC has fallen by 10.57% in the last 24 hours, while KDA has reached a new low today with a decline of 36.69%. Additionally, both DEGO and OG are in a "bottom-fishing rebound" state, with increases of 5% and 5.42%, respectively. Other tokens such as ADX, PARTI, and NXPC have shown a "high-pullback" state, with declines ranging from 5.46% to 6.01%. HBAR has also reached a new low today, with a decline of 7.57%.

MarsBitNews·2025-10-29 08:22

Worldcoin Loses Key Support as Bearish Momentum Points Toward the $0.40 Level

Worldcoin’s price slipped below $0.80, confirming a channel breakdown that positions $0.40 as the next key demand and support zone.

Technical readings show bearish momentum fading, though MACD and ADX indicators continue to reflect a strong downward trend still in play.

Analysts monitor the $0.75

WLD-0.27%

CryptoFrontNews·2025-10-23 15:38

Ethereum Monthly Chart Breakout Signals Return of Long-Term Bullish Momentum

Ethereum’s ADX broke a seven-year trendline while the green DI crossed above red, confirming a shift in long-term bullish strength.

The RSI breakout from a multi-year downtrend mirrors pre-2020 rally patterns, signaling renewed market confidence and building momentum.

Holding above the 21-month

ETH-3.56%

CryptoFrontNews·2025-10-05 07:04

Ethereum big dump of 10% but long positions remain strong! The RSI indicator at 58 shows sufficient rise momentum, can it break through 5000 USD under the historical pullback pressure in September?

Ethereum dropped 10% after hitting an all-time high of $4900, but the prediction market and on-chain data show that long positions sentiment remains unshaken. Myriad prediction platform traders are still betting with over a 73% probability that ETH will break through $5000 within four months. The technical indicators, with an ADX value of 39 and an RSI value of 58, both point to a healthy rising trend, but the historical seasonal pullback risk in September may pose a short-term resistance.

ETH-3.56%

MarketWhisper·2025-08-27 05:51

The crypto market is experiencing a general decline: both DOGE and XRP are technically bearish, with key support levels under pressure.

The cryptocurrency market continues to pull back, with the total market capitalization dropping below $3.9 trillion, and the fear and greed index plummeting to a neutral range. This article focuses on the leading decliners DOGE and XRP, conducting a depth analysis on their RSI, ADX, and moving average systems, pointing out that both have further downside risks in the short term, and outlining key support and resistance levels for investors, diagnosing the future trends of crypto assets.

MarketWhisper·2025-08-20 03:30

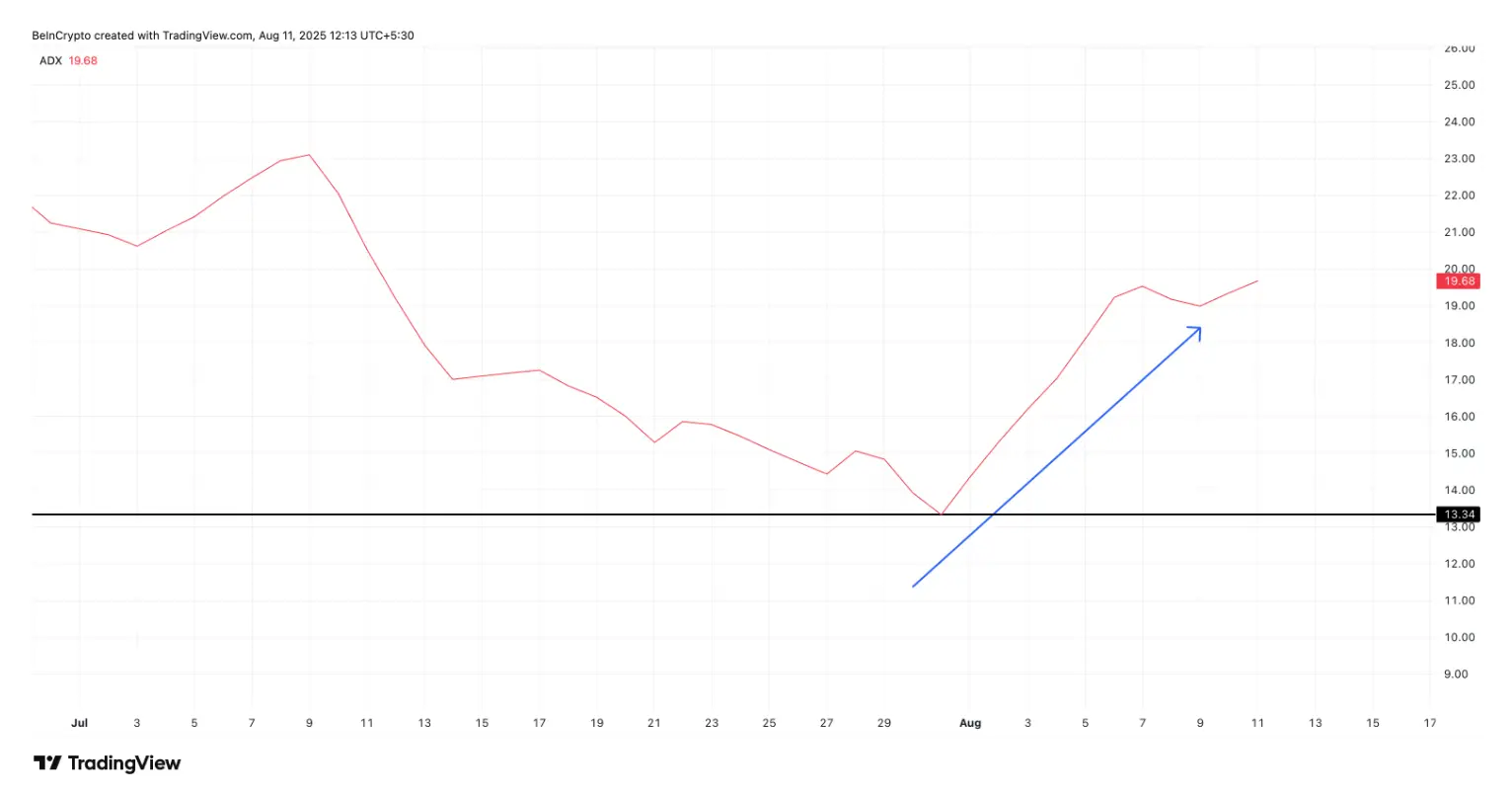

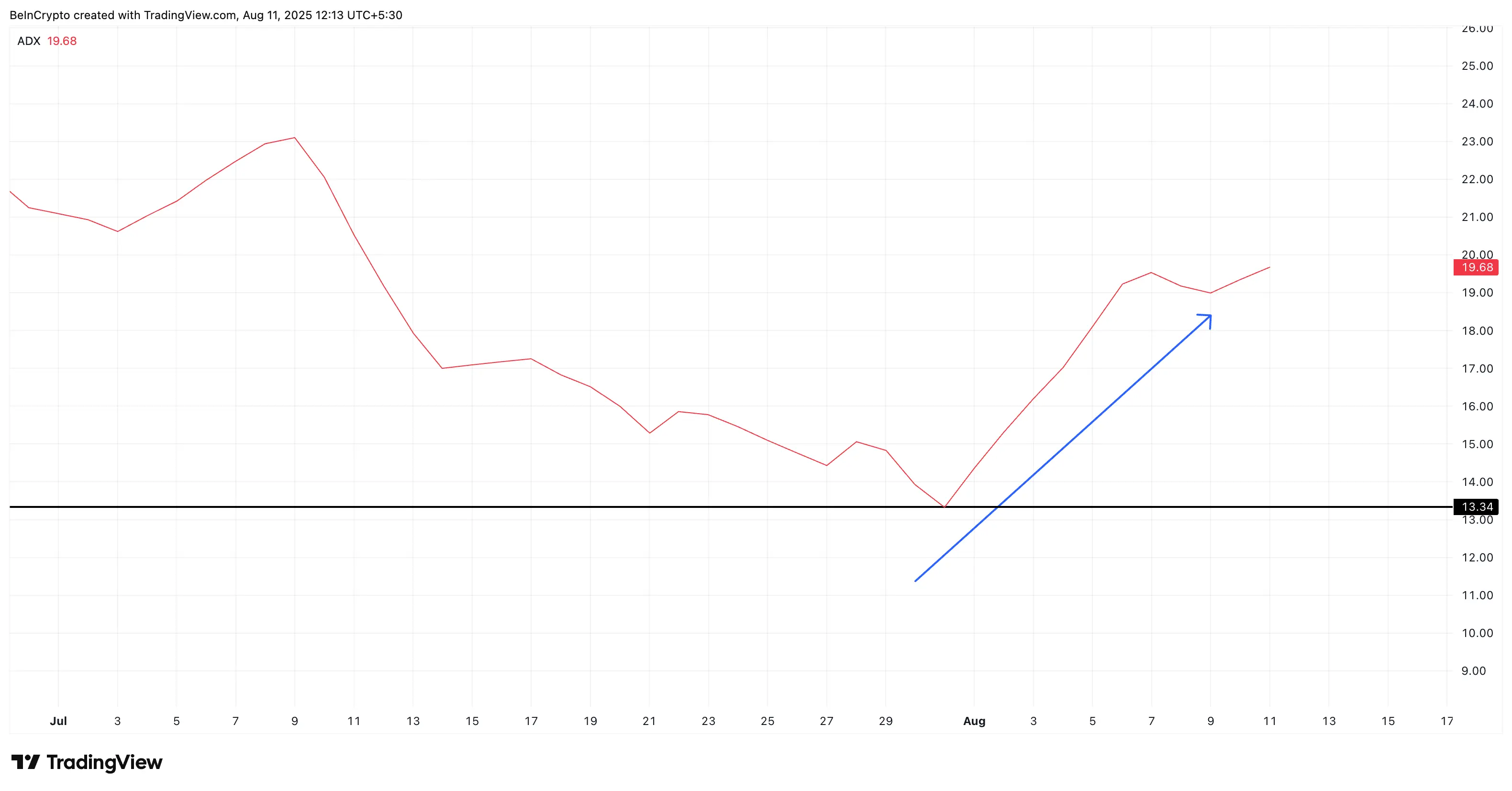

Pi coin price prediction: Triple technical indicator resonance releases bullish signal! ADX strengthens + RSI bottom divergence + EMA golden cross imminent

The price of Pi coin has recently taken advantage of the market rebound, with an increase of nearly 15% over the past 7 days, marking its best performance in over a month. The technical indicators are showing three positive signals: the ADX indicator, which measures trend strength, has significantly risen (from 13.3 to 19.6); the daily chart RSI has formed a bullish divergence (price is falling while the indicator is rising); the 4-hour chart is presenting an ascending triangle structure and is about to form a golden cross pattern with the 20/100 period EMA. If the price holds above the support at $0.39 and breaks through the resistance at $0.43, it may trigger an accelerated upward movement. However, caution is advised as a fall below $0.38 (50EMA) would damage the short-term bullish structure.

MarketWhisper·2025-08-12 05:31

Three major technical signals are firing! Will Pi Network's price see its biggest pump of the year? $0.43 becomes the key.

Pi Network (PI) has accumulated nearly a 15% increase in the past week, marking its strongest single-week performance in over a month. Recently, three technical bullish signals have emerged simultaneously: the Average Directional Index (ADX) continues to rise, the daily chart RSI shows a bullish divergence, and the golden cross on the 4-hour chart is approaching. Technical analysis indicates that if the price breaks through $0.43, Pi coin may welcome a new round of significant fluctuations; however, if it falls below $0.38, the short-term structure may turn bearish.

PI1.6%

MarketWhisper·2025-08-12 02:42

Litecoin (LTC) Price Prediction: Technical Indicators Surprise Soaring Signals, "Digital Silver" May Welcome the Highlight Moment?

Litecoin (LTC) has become one of the biggest highlights in the altcoin market in July, with a monthly rise of over 30%, but has recently entered consolidation due to market drag. The technical aspect is releasing significant bullish signals: well-known Chartered Market Technician (CMT) Tony Severino pointed out that the LTC monthly Average Directional Index (ADX) has broken the critical level of 20, with the positive indicator (DI+) gaining support and rebounding above the ADX line—this pattern is strikingly similar to the situation before the 2017 bull run. Historical data shows that when the ADX broke 20 at that time, the LTC price soared from $3 to $360, with a rise of up to 11,900%. If the current ADX can continue to rise and break the 25 threshold, it may confirm the start of a new epic bullish trend.

LTC1.06%

MarketWhisper·2025-07-28 03:12

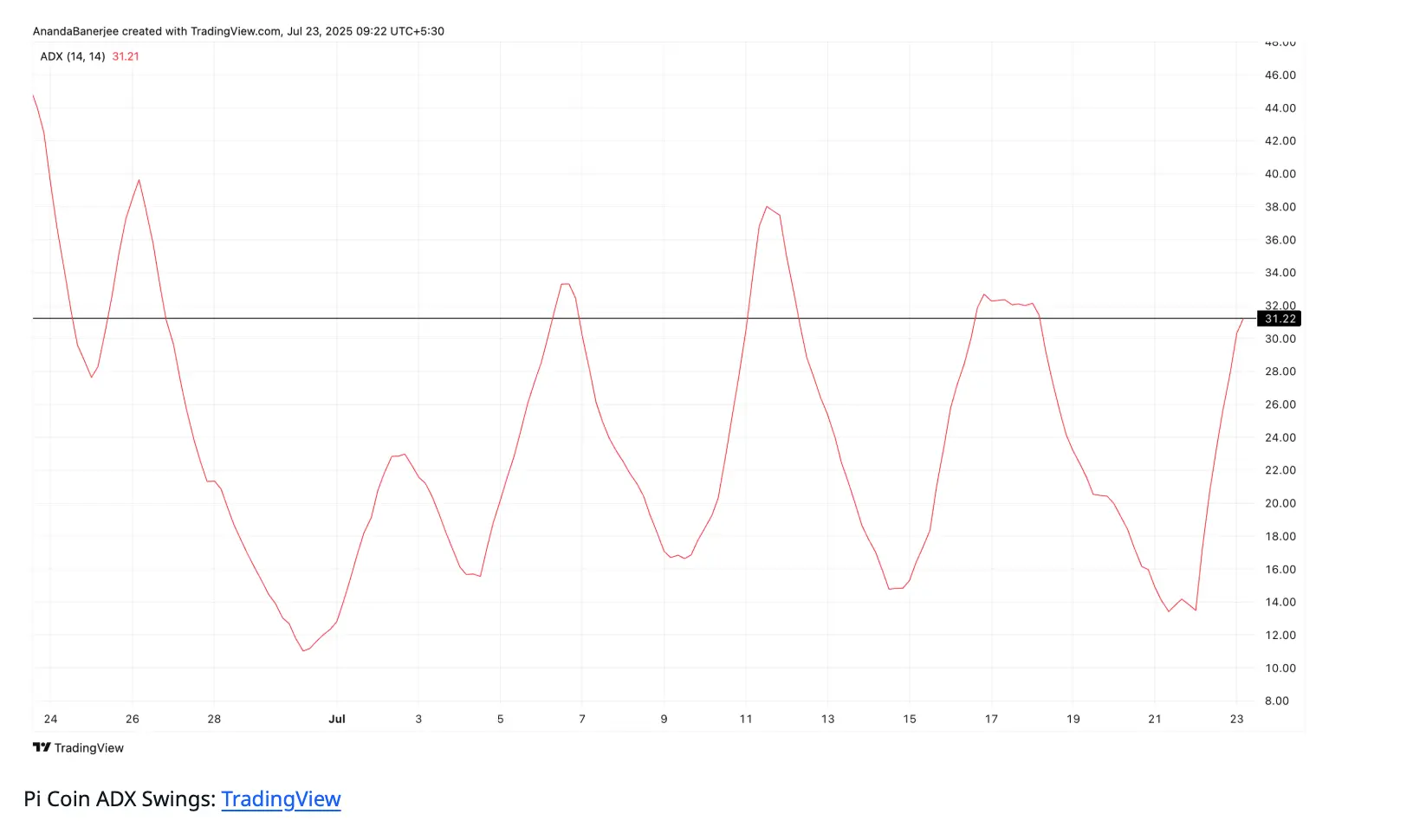

Pi coin price prediction: technical indicators currently show a double signal, indicating a 40% upside potential.

Pi Network (PI) surged to $0.52 under the announcement of the "Buy Pi" fiat entry function, marking the first significant rise in recent days. The current coin price has stabilized around $0.47. Two lower time frame technical signals indicate that this rebound may have sustainability: the Average Directional Index (ADX) has returned to a strong zone, and the fast and slow EMA are about to form a golden cross pattern. If the 20-period EMA successfully crosses above the 100-period EMA and the ADX remains strong, the PI price is expected to initiate a larger rise. Key resistance levels are set at $0.54 and the previous high of $0.66, while $0.46 serves as the dividing line between bulls and bears.

PI1.6%

MarketWhisper·2025-07-23 07:41

Abu Dhabi Ventures Into Bond Tokenization with HSBC and FAB as RWA Momentum Accelerates

The Abu Dhabi Securities Exchange (ADX) said on Thursday it is preparing to list the first blockchain-based bond in the Middle East and North Africa (MENA) region, a move that signals growing momentum behind tokenized finance in the region.

Set to be issued by First Abu Dhabi Bank (FAB) using

YahooFinance·2025-07-03 16:33

First Abu Dhabi Bank To Launch Middle East’s First Digital Bond

HomeNews First Abu Dhabi Bank plans to issue the Middle East’s first digital bond using the HSBC Orion digital assets platform.

The digital bond is at the pre-issuance pricing stage and will be listed on the Abu Dhabi Securities Exchange (ADX).

The project aims to expand access to digital

BOND3.09%

BITNEWSBOT·2025-07-03 16:32

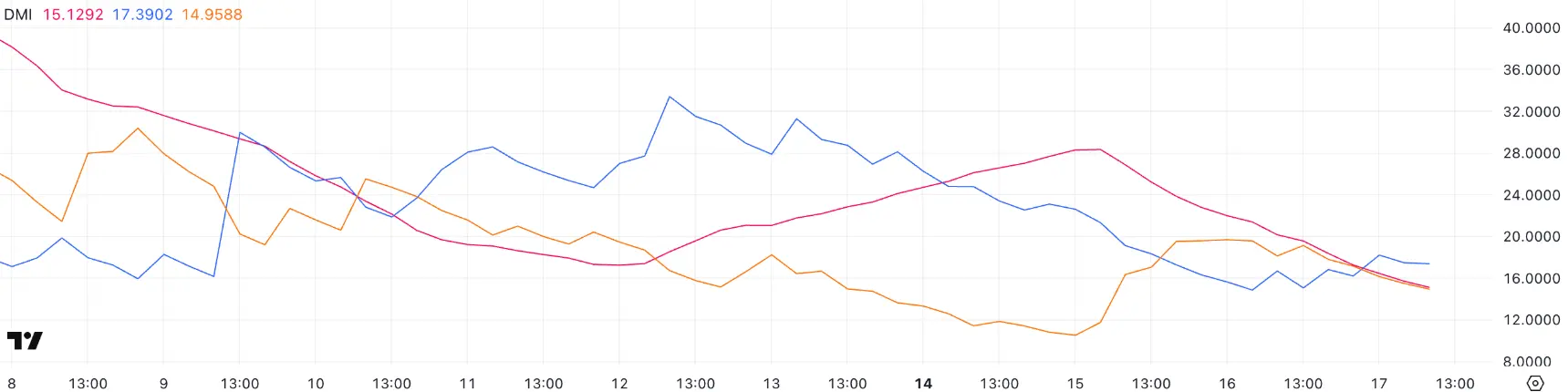

HYPE falls sharply after reaching ATH: Has the frenzy ended?

Hyperliquid (HYPE) is showing early signs of a trend reversal after a sharp fall of 12.63% in just two days, despite recently setting a new all-time high of (ATH). Key indicators such as DMI and RSI indicate weakening momentum and increasing bearish pressure.

ADX is increasing while

TapChiBitcoin·2025-06-18 18:00

ONDO Price Consolidates Below $1.00: Here’s Why $1.03 Is the Key for Breakout

ONDO price consolidates near $1.00 resistance with the 200-day SMA, holding a triangle structure above $0.91 support. Breakout potential seen as price tests critical levels, with analysts eyeing volume and ADX for momentum confirmation.

CryptoNewsLand·2025-05-04 22:57

Cardano price (ADA) struggling below $0.70 – Selling risks still lurking?

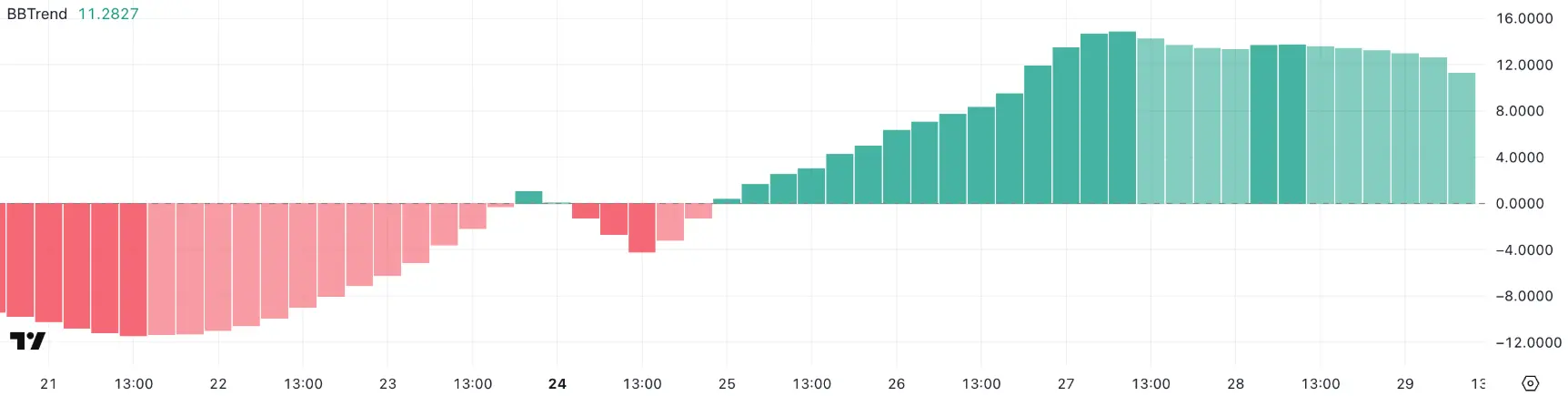

As of March 29, Cardano (ADA) has yet to break above the $0.70 mark, indicating that the uptrend is losing momentum. Although there have been flashes of recovery in the short term, the current technical indicators reflect a clear weakening of the upward momentum.

Specifically, both BBTrend and ADX show force

TapChiBitcoin·2025-04-18 02:36

Berachain price recovery cut short as bears overpower bulls

Berachain surged 12% to $4.71 but fell to $3.85 as bears dominated.

The Relative Strength Index (RSI), the ADX, and the MACD signal bearish momentum.

Berachain Network revenue is up 180% over the past month despite the price dropping by 33% over the same period.

Berachain price jumped by over 12

BitcoinInsider·2025-04-10 15:52

GRASS surged 30% in one week – Do the indicators reveal the next upward trend?

GRASS has surged nearly 30% in the past week, bringing market capitalization back to the level of 415 million USD and for the first time pushing the price above $1.70 since March 10.

This strong growth momentum is supported by positive technical signals, including a consistently positive BBTrend and a rising ADX. However, with the

TapChiBitcoin·2025-03-30 05:24

FET Struggles at $0.50 Support; Bearish Signals Indicate Move to $0.42

FET hovers around $0.50 after breaking below key moving averages, signaling a potential downside toward the next major support at $0.42-$0.43.

The -DI surpasses the +DI, confirming bearish momentum, while the ADX reading indicates sustained selling pressure in the current market.

FET is trading at

CryptoFrontNews·2025-03-29 13:42

Phoenix Group CEO Increases Stake, Signals Growth Confidence

In a significant vote of confidence in Phoenix Group PLC’s (ADX: PHX) long-term vision, CEO and Co-Founder Munaf Ali has increased his stake in the company, acquiring over 20 million ordinary shares. This strategic investment highlights Ali’s unwavering belief in Phoenix Group’s future

ADX-1.71%

CryptosHeadlines·2025-03-10 15:28

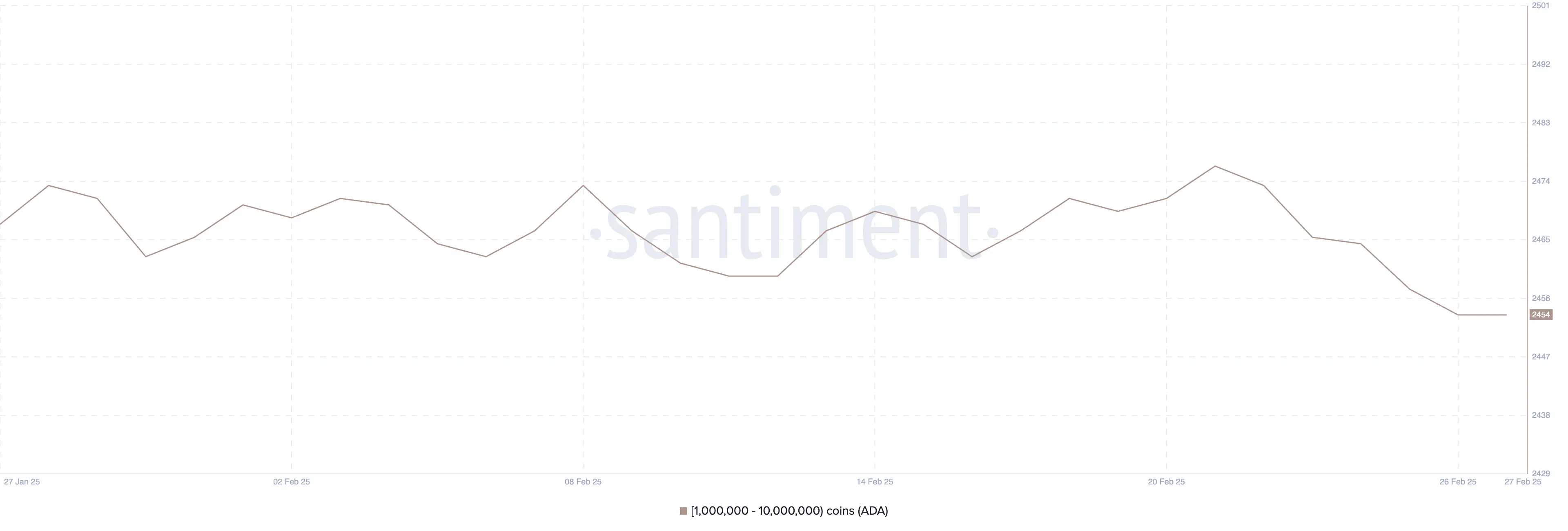

Cardano(ADA) Loses 10% Amid Declining Whale Presence

Cardano (ADA) has been down almost 34% in the last 30 days and more than 15% in the past week. Its market cap is now at $22 billion. It has been trading below $1 for over a month, reflecting persistent bearish sentiment.

Technical indicators show a strong downtrend, with ADX rising to 46.8, s

CryptosHeadlines·2025-03-01 02:14

Onyxcoin (XCN) Technical Indicators Hint at Major Breakout

Onyxcoin (XCN) has fallen 16% over the past seven days, although it’s up by 52% in the last 30 days. The XCN Relative Strength Index (RSI) is currently at 40.1, indicating mild bearish momentum but not strong enough to signal overselling.

Meanwhile, the Average Directional Index (ADX) has

CryptosHeadlines·2025-02-22 03:39

Pi Network Distributes A Record-Breaking Airdrop But Metrics Show Weak Momentum

The Pi Network (PI) has finally been launched and become the largest airdrop in cryptocurrency history, surpassing Uniswap, but its price action has been volatile since its launch. Despite the strong momentum, Pi's ADX has dropped from 60.2 to 15, indicating a lack of clear direction and market momentum.

Blotienso·2025-02-21 06:08

Pi Network (PI) Hits Record Airdrop But Momentum Falters

Pi Network (PI) was finally launched and became the biggest airdrop in crypto history, surpassing Uniswap, but its price action has been volatile since its launch. Despite the massive hype, Pi’s ADX has dropped from 60.2 to 15, indicating a lack of clear trends and diminishing market

CryptosHeadlines·2025-02-21 04:13

SOL Price Struggles Below $200 Amid Increased Scams on Solana

Solana (SOL) price has been struggling below $200, currently down nearly 13% over the past 30 days. Despite strong momentum in previous months, recent indicators suggest a weakening trend, with bearish signals dominating the charts.

The Ichimoku Cloud, ADX, and price action all point to

CryptosHeadlines·2025-02-16 20:26

HBAR Price Continues to Decline Amid Strong Bearish Pressure

Hedera (HBAR) price has dropped 5% in the last 24 hours, with an overall 22% correction in the past 30 days. Its market cap is now at $8.5 billion. Technical indicators suggest that bearish momentum is still dominant, though signs of a potential shift are emerging.

The ADX shows that the

CryptosHeadlines·2025-02-14 02:21

PinLink (PIN) Price Jumps 15%, Nears $90 Million Market Cap

PinLink (PIN) price has been gaining momentum, surging 15% in the last 24 hours as it nears a $90 million market cap. Technical indicators show mixed signals, with the RSI cooling down from near-overbought levels while the ADX suggests the uptrend is still strong but possibly stabilizing.

A

CryptosHeadlines·2025-02-12 03:21

Dogwifhat (WIF) Gains 8%: Testing Critical Resistance Levels

The price of Dogwifhat (WIF) has surged by more than 8% in the last 24 hours, despite a 36% decline over the past month. As the sixth-largest meme coin, WIF remains a key player in the market. Key technical indicators, including the Ichimoku Cloud and ADX, suggest growing bullish momentum with the

Moon5labs·2025-01-18 00:30

PEPE Flashes Signs of a Trend Reversal

PEPE faces a critical juncture as it struggles to hold support at $0.000001785 and technical indicators point to potential trend reversal possibilities. Traders should prepare for significant shifts in price as resistance at $0.000002000 and weak ADX suggest imminent volatility.

CryptoNewsLand·2025-01-14 05:29

Symmetrical Triangle Shapes XRP’s Next Big Move: $28B to $502B in Play

XRP's symmetrical triangle hints at a breakout, with $165.7B resistance as a pivot for potential bullish or bearish moves.

Key levels to watch: $28.1B support, $165.7B resistance, $502.2B target—XRP's consolidation signals imminent market action.

Technicals align: ATR of $12B, ADX at 39.95, and

CryptoNewsLand·2025-01-09 00:32

Hedera (HBAR) Drops 16% in a Week, But Bearish Momentum Could Be Fading

Hedera (HBAR) price has dropped more than 16% over the past seven days, reflecting a prolonged downtrend. However, technical indicators show weakening bearish momentum, with the ADX falling to 11.46, signaling reduced trend strength.

BeInCrypto·2025-01-01 14:41

Bitcoin (BTC) Downtrend Weakens Amid Increasing Whale Accumulation

Bitcoin (BTC) hit a record high on December 17 but has since dropped below $100,000. Key indicators, such as the ADX, alongside cautious whale activity, suggest a weakening

BeInCrypto·2024-12-30 15:56

Fantom’s Cup and Handle Setup: Is a Price Surge Imminent for FTM?

Fantom’s cup-and-handle pattern suggests a potential price surge above $1.40.

Strong technical indicators, including the MACD and ADX, support FTM’s bullish outlook.

On-chain metrics and rising Open Interest highlight growing confidence in FTM’s price movement.

Fantom (FTM) is gaining attention

ADX-1.71%

CryptoNewsLand·2024-12-16 05:53

Whales Accumulate Bitcoin (BTC), but $110,000 Might Have to Wait

Bitcoin (BTC) price reached the $100,000 milestone for the first time on December 4 and is up 128% in 2024. Despite this strong performance, BTC’s ADX of 15.8 suggests the current uptrend lacks significant strength, hinting at limited momentum behind recent price movements.

BTC-0.57%

BeInCrypto·2024-12-12 05:30

Is Chainlink Ready to Break Its All-Time High of $52?

Chainlink is preparing to break its all-time high. Despite the low trading volume, market sentiment is currently positive with RSI indicator, moving average convergence divergence (MACD) histogram, and average directional index (ADX) all showing ongoing growth. Chainlink has collaborated with numerous financial institutions and announced a list of companies they are partnering with to develop blockchain applications and digital assets. With the increasing adoption of blockchain and real-world assets (RWA) globally, no force in the world can stop LINK from developing. The strength is increasing and it is reflected in the chart.

Blotienso·2024-12-07 04:45

Cardano (ADA) Price Holds Strong as Bulls and Bears Collide

ADA price surges 195% in 30 days, but ADX and EMA indicate weakening of the bullish trend.

BeInCrypto·2024-11-27 07:30

Did you win this time? Solana hits a new all-time high, investors break through: Second Brother is still asleep

Solana ($SOL) has risen by 16.96% in the past 7 days and over 50% in the past 30 days, breaking through historical highs. In comparison, Ethereum ($ETH) has experienced less fluctuation in price. Analysts point out that the current BB trend indicator for $SOL is 9.56, indicating a strong rising trend, but its ADX value is 20.71, barely maintaining the level of 'trend exists,' and the trend intensity is clearly not as high as before. Technical Analysis shows that the key support levels for $SOL are $204 and $194 respectively. Ethereum's rapid rise in Decentralized Finance and Non-fungible Token ecosystems has yet to be realized, and its on-chain development seems to be slightly slower.

CryptoCity·2024-11-22 07:27

Here’s What’s Holding Back the Cardano (ADA) Price Recovery

The Cardano (ADA) price is experiencing a strong and sustained bearish trend, with multiple technical indicators indicating that sellers control the market. The ADX confirms that this trend has intensified recently.

BeInCrypto·2024-11-05 07:00

This Is What Bitcoin (BTC) Price Needs to Hit a New All-Time High

BTC price up 6% in last 30 days but ADX suggests weakening trend. Recent netflows into exchanges indicate caution among holders.

BeInCrypto·2024-10-24 16:30

A quick look at the details of the five major virtual asset regulations in the UAE

Author: Bowen, Source: Bailu Lounge

Compliance is a well-deserved focus for the crypto industry in 2023, and this is true for global markets.

On November 15, the news of the initial public offering (IPO) of Phoenix Group's AED 1.36 billion ($370 million) shares on the Abu Dhabi Stock Exchange (ADX) once again drew attention to the Middle East.

In recent years, the UAE has actively promoted the development of the virtual asset industry in the Middle East, including the UAE official, the Emirate of Dubai, as well as financial free zones such as Abu Dhabi Global Market and Dubai International Financial Centre, and have introduced different regulatory frameworks to meet global needs.

If Phoenix Group successfully completes the listing this time, it means that the first cryptocurrency and blockchain entity will be listed on the Middle East stock market, and it also reminds investors that they still need to focus on the Middle East market represented by the United Arab Emirates and look for more high-quality ...

金色财经_·2023-11-18 10:15

Load More