Search results for "ALICE"

Data: CTSI falls over 29% in 24 hours, DATA falls over 35%.

According to Mars Finance news, Binance Spot data shows that the market has experienced significant fluctuations. CTSI has fallen 29.93% in the last 24 hours, and DATA has also performed poorly, with a decline of 35.32%. Meanwhile, ALICE, ATOM, and C98 have also shown a "high-to-low" state, with declines of 9.52%, 12.93%, and 11.41% respectively. DUSK, on the other hand, has shown a "bottoming out" state, with a rise of 6.66%.

CTSI0.36%

MarsBitNews·2025-11-21 04:15

Data: ATOM rise over 12%, COTI rise over 10%

According to Mars Finance news, data from Binance Spot shows that the market has experienced significant fluctuations. ATOM has risen by 12.21% in the last 24 hours, reaching a new high for today, while COTI has increased by 10.29% and is showing signs of a rebound from the bottom. At the same time, ALICE and CHR are also showing signs of a rebound from the bottom, with increases of 9.68% and 6.74% respectively. Among other tokens, AUDIO, DASH, and DGB have all shown a trend of rising and then falling back, with declines ranging from 6.74% to 6.9%.

COTI-2.04%

MarsBitNews·2025-11-20 09:53

Alice & Bob CEO: Quantum Computers may have the ability to crack Bitcoin after 2030.

According to Deep Tide TechFlow news on November 19, as reported by Fortune, Théau Peronnin, the CEO of Alice & Bob, a quantum computing partner of Nvidia, stated that Quantum Computers should possess sufficient power to break Bitcoin's security features shortly after 2030.

Peronnin told Fortune at the Lisbon Web Summit that Quantum Computers could threaten cryptocurrency security by instantly solving mining mechanisms or brute-forcing wallet passwords. Currently, quantum technology is not sufficient to pose a threat to cryptocurrencies, but it is gradually developing.

Peronnin suggests: "Bitcoin needs to undergo a fork upgrade to a stronger blockchain before 2030. Quantum Computers will be ready shortly after that to pose a threat." He adds

DeepFlowTech·2025-11-19 09:33

$ALICE Adventure Airdrop Enters Final 'Hollow Wave' With $250,000 Prize Pool Up for Grabs

This wave, which runs from November 4th to December 2nd, has a greater emphasis on in-game action than before.

Additionally, there will be two last Game Nights for you to improve your score, socialize with other players, and perhaps learn some secrets.

We’ve reached the last part of the $ALICE Ad

TheNewsCrypto·2025-11-06 04:46

Looking back at Bitcoin in 2025: Why has "digital gold" disappointed investors?

Bitcoin's return rate from 2025 to now is only 5.8%, far behind major asset classes, facing challenges such as the resistance level of $100,000, weak demand, and the flow of funds into AI stocks. This article is based on a piece by Alice Liu, organized, translated, and written by PANews. (Background: Standard Chartered: Bitcoin may "never" drop below $100,000, supported by four major forces for BTC) (Background Supplement: Why has this bull run seen Bitcoin repeatedly hitting new highs, while alts frequently hit new lows?) Although there is much hype about a potential crypto boom during the "Trump era," Bitcoin's performance has almost lagged behind all major asset classes. Looking back at Bitcoin's performance from 2025 to now, 2025 can be called the "disappointing year." Since U.S. President's inauguration in January this year, Bitcoin's return rate has been around 5.8%, while Nasda

動區BlockTempo·2025-11-01 05:37

MyNeighborAlice Coin Surges 51%: Is the ALICE Crypto Rally Real?

Alice Crypto's price surged 51% in 24 hours despite a market downturn, with trading volume increasing by 1,400%, indicating restored investor confidence, driven by the Pudgy Penguins and game airdrop.

ALICE0.33%

BitcoincomNews·2025-10-14 08:48

ALICE Breaks Falling Wedge As Price Surges 10% to $0.3744 — Resistance Ahead At $0.3926

ALICE's recent breakout from a falling wedge has led to a 10.1% price increase to $0.3744, showing improved market strength. Short-term resistance is at $0.3926, and support is at $0.3391. The token's performance against BTC and ETH indicates increasing buying activity and potential for further momentum.

CryptoNewsLand·2025-10-11 01:54

Foresight Ventures’s Alice Li On Codex And The Future Of Stablecoin Infrastructure: Scaling, Compliance, And The Path To Global Payments

In Brief

Codex, an Ethereum L2 stablecoin platform, aims to advance scalable, compliant, and interoperable digital payments, but widespread global adoption will depend on regulatory alignment and commercial execution.

The development of money and digital payment systems has historically been

MpostMediaGroup·2025-09-26 12:02

Bitcoin Near the End of 2025: A VC’s View on Its Strategic Role

In Brief

Alice Li of Foresight Ventures says today’s quiet, institution-driven bull run, marked by ETFs, low leverage, and whale accumulation, signals a unique transition that could send Bitcoin toward \$150,000.

Looking back at the past year’s trends, the use of low leverage and high whale acc

MpostMediaGroup·2025-09-10 15:41

Hong Kong Web3 FinTech Policies and RWA Opportunities: Regulatory Interpretation, Compliance Pathways, and Youth Entrepreneurship Empowerment to Explore New Industry Landscapes

On August 19, 2025, the "Hong Kong Web3 Fintech Policy and RWA Opportunities" themed event, organized by Student Power and supported by institutions such as Antalpha, China Resources Longdi, Web3Labs, Techub News, and MetaEra, was successfully held at Runnovation - Runwei Creation Workshop in Wan Chai. The Secretary for Home and Youth Affairs of Hong Kong, Ms. Alice Mak, member of the National Committee of the Chinese People's Political Consultative Conference/Chairman of the Hong Kong Legislative Council's Web3 and Virtual Assets Development Subcommittee, Dr. Wu Jiezhuang, the Securities and Futures Commission (SFC) member and Executive Director of the Intermediary Division, Mr. Ye Zhiheng, the CEO of Web3Labs, Mr. Huang Junlang, and representatives from various enterprises attended the event. They jointly interpreted the Web3 policy and the opportunities of RWA, providing key policy references and industry insights for young entrepreneurs.

RWA-3.48%

TechubNews·2025-08-31 06:29

Wall Street Talks LABUBU and Moutai: A Familiar Encounter or a Paradigm Shift?

> Bank of America believes that Labubu and Moutai both possess social currency attributes, but there are significant generational differences.

Written by: Ye Zhen

Source: Wall Street Journal

The wildly popular Labubu is jokingly referred to as the "Moutai for young people," so what exactly are the similarities and differences between the two?

According to news from the Chasing Wind Trading Platform, Bank of America recently released a report comparing this new trendy IP with traditional liquor giants, attempting to clarify whether it is a historical replay of the consumption cycle or a profound paradigm shift.

Bank of America analysts Alice Ma, Chen Luo, and Lucy Yu pointed out that although both are social coins, Labubu's social attributes are more based on the shared interests and values of the younger demographic, while Moutai's social functions rely more on power and hierarchical relationships. This difference reflects the "new consumption" and

LABUBU-12.37%

ForesightNews·2025-06-24 04:06

My Neighbor Alice launched its first chapter on Chromia, airdrop 40,000 NFT Pudgy

The blockchain game My Neighbor Alice has officially released Chapter One: A New Adventure on Chromia – marking its first full public launch after many testing seasons. The game now supports direct play in the browser, without the need for a wallet or token to get started.

ALICE, the native token of the game, c

TapChiBitcoin·2025-06-17 16:05

My Neighbor Alice Celebrates Full Public Launch on Chromia With “Chapter One: a New Adventure”

A new chapter is starting for community builder game My Neighbor Alice (MNA). In fact, it’s the very first chapter, which might come as a surprise to players who’ve been exploring its archipelago world for years. The difference is that MNA has now officially exited alpha following its full public la

CryptoDaily·2025-06-17 15:13

The Polkadot community proposed to establish a Bitcoin strategic reserve by exchanging 500,000 DOT for tBTC.

According to Mars Finance, on June 13, community members jump\_BAHA\_jump and Alice\_und\_Bob published a post on the Polkadot forum, proposing to establish an initial Bitcoin strategic reserve for the Polkadot treasury. This proposal responds to the community's vision in the previous referendum 1394 (Wish for Change), aiming to enhance the long-term stability and risk resistance of the treasury through asset diversification. Currently, this proposal has just been published on the Polkadot forum and has not yet officially started on-chain. Proposal 1394: This is a proposal that has been passed under "Wish for Change," with community member @Phunky proposing to allocate 1 million coins.

MarsBitNews·2025-06-13 11:40

Pudgy Penguins Prepare to Make a Splash in My Neighbour Alice Following Landmark Partnership

Pudgy Penguins are on the move – and they’re waddling straight for Lummelunda, the island archipelago that’s home to My Neighbor Alice. A partnership between the two web3 entertainment giants has broken new ground for interoperability while giving Pudgy

CryptoDaily·2025-06-11 14:05

The famous CEO revealed two events that could push Bitcoin above 150 Thousand Dollars!

Bitcoin reached an all-time high of $111,000 recently, but its subsequent drop has raised investor concerns. Foresight Ventures CEO Alice Li predicts BTC could hit $150,000, driven by regulatory clarity and favorable policies in the U.S.

Bitcoinsistemi·2025-06-05 07:50

What Rank is Satoshi Nakamoto in the World's Richest People List? Hasn't Done Anything for 16 Years, Here is the Result

The anonymous founder of Bitcoin, Satoshi Nakamoto, with his wealth, surpassed Nvidia CEO Jensen Huang and Walmart heirs Jim, Rob, and Alice Walton, becoming the 11th richest person in the world.

The interesting information was shared by the blockchain analysis firm Arkham Intelligence.

Arkham's

Bitcoinsistemi·2025-05-27 22:27

AI combines mechanical aesthetics, Nvidia supports the startup AeiROBOT humanoid robots Alice and AIMY debut together.

AeiROBOT, a humanoid robot startup from South Korea, made a stunning appearance at this year's Computex 2025 NVIDIA Inception pavilion, and the humanoid robot Alice became the focus of the audience. Alice's cute appearance is not only capable of bartending and playing dice, but also interacting with visitors, showcasing advanced artificial intelligence and robotic arm control technology.

NVIDIA Inception is a global accelerator program launched by NVIDIA, dedicated to supporting startups in fields such as artificial intelligence, data science, and high-performance computing. Currently, the program has over 28,000 startups participating, which can receive customized SDK technical support, NVIDIA.

ALICE0.33%

ChainNewsAbmedia·2025-05-23 01:54

The Alice Collective Elevates ‘My Neighbor Alice’ in Collaboration With Persona Journey

The strategic collaboration between the Alice Collective and Persona Journey infuses retro charm with blockchain technology to expand the immersive landscape of My Neighbor Alice, introducing themed game nights, shared events, and exclusive rewards for the community. This partnership aims to redefine retro tech into digital assets and create a new on-chain gaming experience while paving the way for more exclusive partnerships in the future.

ALICE0.33%

BlockChainReporter·2025-05-15 11:48

CoinVoice has recently learned that, according to an official announcement, Binance will adjust the minimum price fluctuation unit (TickSize) for 16 spot trading pairs, including ALICE/USDT, BCH/BNB, and the ORDI series, on May 16, 2025, at 05:00 (UTC) to enhance market liquidity and trading experience. Existing orders will not be affected, and API users can obtain the latest parameters via GET/Api/v3/exchangeInfo.

CoinVoice·2025-05-09 10:36

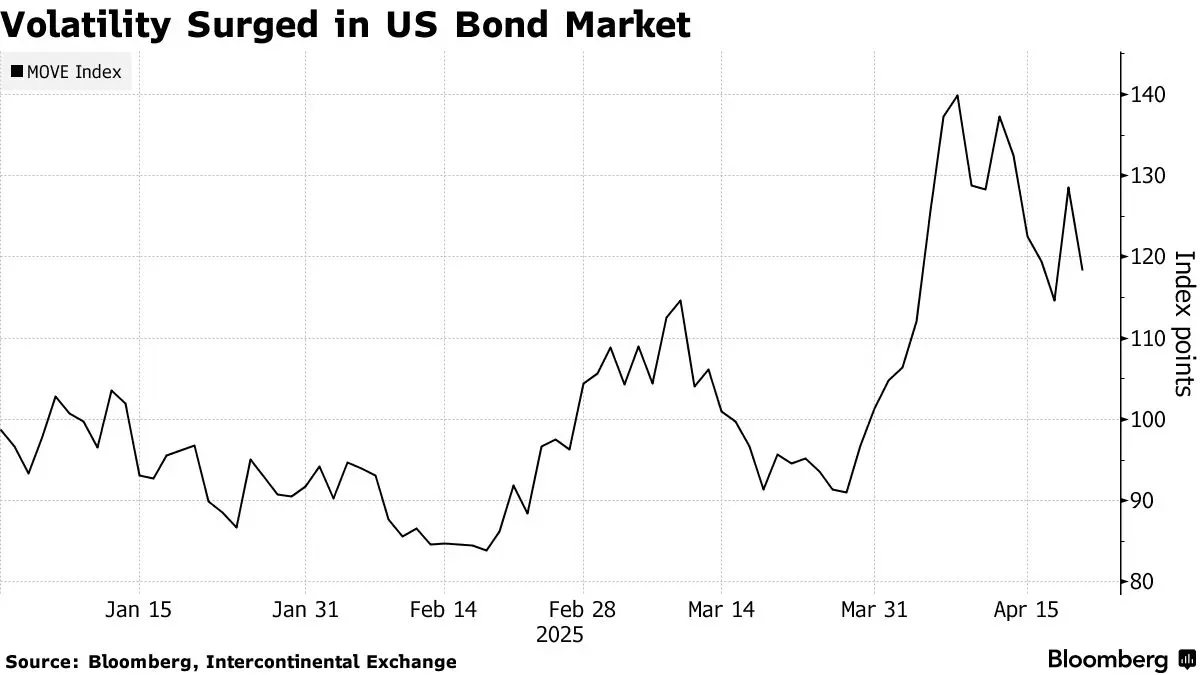

Bloomberg: Has the appeal of U.S. Treasuries as a safe haven really diminished?

> Original Title: Are US Treasuries Really Losing Their Safe-Haven Appeal?

> Original Authors: Alice Atkins & Liz Capo McCormick, Bloomberg

> Original compilation: Felix, PANews

Investors often flock to U.S. Treasury bonds to escape the turmoil of financial markets. During the global financial crisis, the 9/11 attacks, and even when the U.S. credit rating was downgraded, U.S. Treasury bonds rebounded.

However, in early April, amidst the chaos caused by President Trump's implementation of "reciprocal" tariffs, something unusual occurred. As risk assets such as stocks and cryptocurrencies plummeted, U.S. Treasury prices did not rise; instead, they fell. U.S. Treasury yields recorded the largest weekly drop in over twenty years.

世链财经_·2025-04-25 13:06

4 Coins Trading At Key Support Levels (Up to +250% Forecast)

The uprising potential of VET, ATOM, ALICE and ESF looks promising because they rest on vital support zones.

Signs from technical research, together with fundamental strengt,h point toward a 200-250% rise that will occur after resistance breaks for these coins.

Investors who want high-yield

CryptoNewsLand·2025-04-09 02:38

dRPC to Premiere AI-Enhanced Short Film 'Alice in Nodeland' at ETHDenver 2025

In a recent announcement, the blockchain infrastructure provider dRPC revealed that it will be premiering a one-of-a-kind short film at the ETHDenver event. Alice in Node-land is an animated short film that is eleven minutes long and has a colorful cast of characters. Its purpose is to enrich the

ALICE0.33%

TheNewsCrypto·2025-02-24 06:00

Germany’s Chancellor Front-Runner Friedrich Merz Signals Shift in Crypto Policy

Friedrich Merz leads Germany’s election with a pro-business agenda that could indirectly benefit crypto and fintech sectors

Alice Weidel’s AfD proposes radical crypto deregulation, challenging Germany’s traditional financial stability approach.

---

Germany’s upcoming federal election on

ALICE0.33%

CryptoNewsFlash·2025-02-21 16:04

RWA Is the Number One Use Case in Crypto Right Now, Research Lead At CoinMarketCap Says

Research Lead at CoinMarketCap Alice Liu has predicted that the number one trend in the digital asset sector in 2025 will be Real World Assets (RWA). According to the official, the RWA trend aligns with the ongoing influx of institutional investors in the crypto industry.

During an interview with

Cryptopolitan·2025-01-10 09:00

2025: The Big Year of Bitcoin and the Rise of Utility Altcoins

Despite a recent market downturn, Bitcoin and altcoins are showing strong growth potential, according to CoinMarketCap's Head of Research, Alice Liu. She predicts that strong demand and continuous buying pressure could make 2025 a breakthrough year for Bitcoin, despite potential economic events or recessions affecting its price volatility. Liu also notes the divide between utility-focused cryptocurrencies like XRP, XLM, and ADA and speculative "casino coins". She believes that strong, utility-focused projects will ultimately succeed in the next cycle.

Blotienso·2025-01-09 23:01

The Best Utility Tokens for 2025: Transforming Gaming and Virtual Ownership

The Sandbox (SAND): Empower creativity with decentralized gaming, buy land, create NFTs, and earn rewards in a thriving metaverse economy.

My Neighbor Alice (ALICE): Playful farming meets DeFi with tradable assets, staking, and governance, merging gamers and crypto enthusiasts.

Decentraland

CryptoFrontNews·2025-01-05 03:31

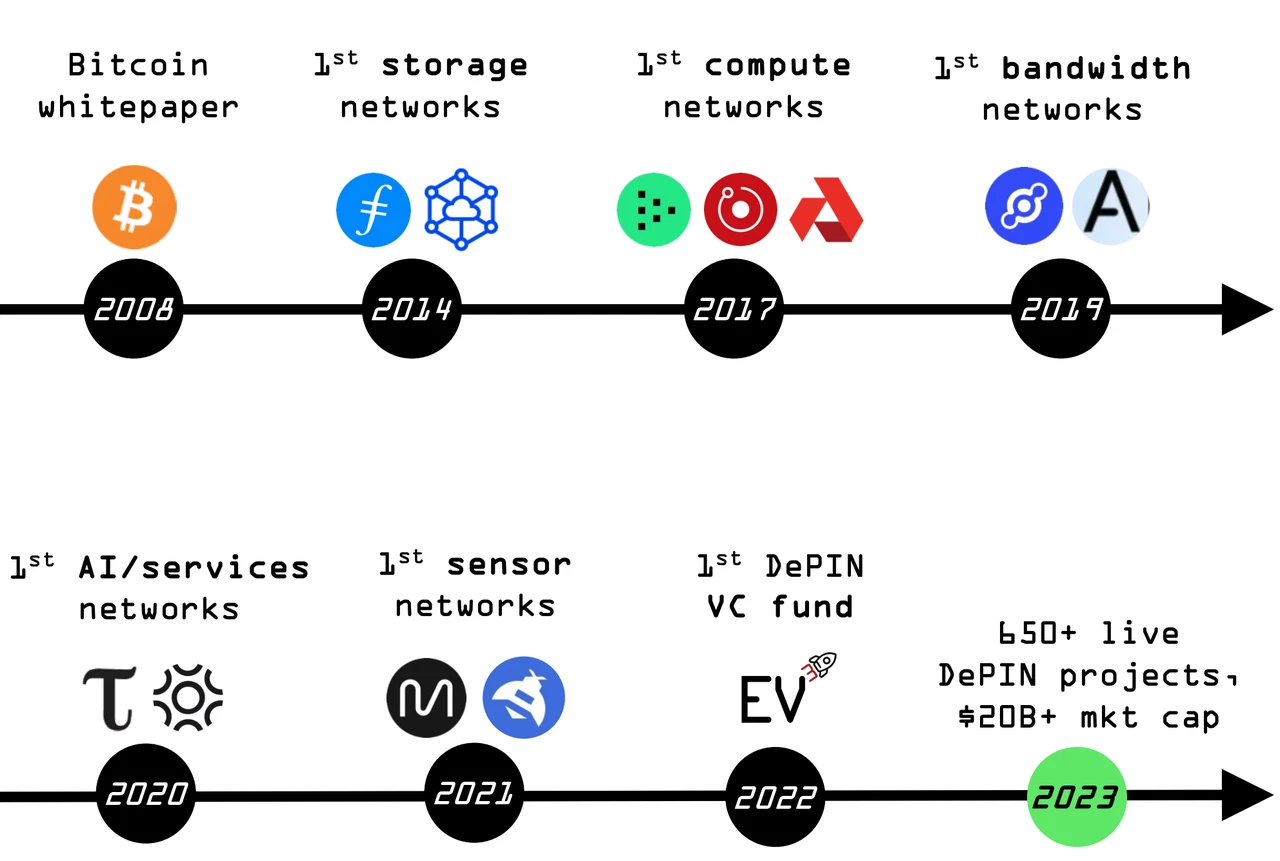

The rising narrative, peering into the present and future of DePIN

## 引言

如今作为全球化标志的互联网,其实恰是冷战巅峰期的产物。

1969 年,处于「核威慑」纪元的美国军方希望在突遭核打击时,能有一个可以避免中心化单点故障并自主恢复的网络,因此互联网的雏形「阿帕网」(ARPAnet),便秉持「去中心化」初心,以「终端直接链接终端」的全分布式架构形式应运而生。

只是 55 年来,从 Web1 到 Web2,伴随着互联网黄金年代的快速膨胀,反而在商业化和全球化浪潮中催生了「终端链接服务器」的多对一中心化架构,愈发与初心背道而驰——条块分割的平台体系中,Web2 巨头圈地为王,掌控着网络世界的的绝对裁量权,坐拥举足轻重的影响力与价值分配权力。

因此近年来高举去中心化、去平台化叙事的 Web3 浪潮才方兴未艾,单纯的应用去中心化难以解决根本性矛盾,效率瓶颈、安全隐患等问题依旧存在,如何对互联网底层技术栈进行彻底改造,颠覆目前过于中心化的 Web2 所导致的效率、安全问题,才是抽薪止沸。

在此背景下,DePIN 或许提供了一个值得关注的新解:**通过结合 Web3 的金融属性和激励机制,DePIN 可以构建起高效的 P2P 物理资源网络,打造「去中心化的物理网络基础设施」,并使得网络拥有可编程能力,帮助实现「DePIN+」的升维,以构建完全不同于传统互联网架构的新物种。**

与此同时,AI 在 Web3 的爆火,除了为其注入新的活力之外,还见证了一个事实,即区块链应用逐渐从链上活动扩展至现实世界,如 RWA、AI、DePIN。

DePIN 的叙事,也意味着物理现实与不断扩展的区块链世界之间的鸿沟正在逐渐模糊。接下来,就让我们一览 DePIN 的现在与未来。

## Part.1、DePIN 概览:What & Why

### 什么是 DePIN ?

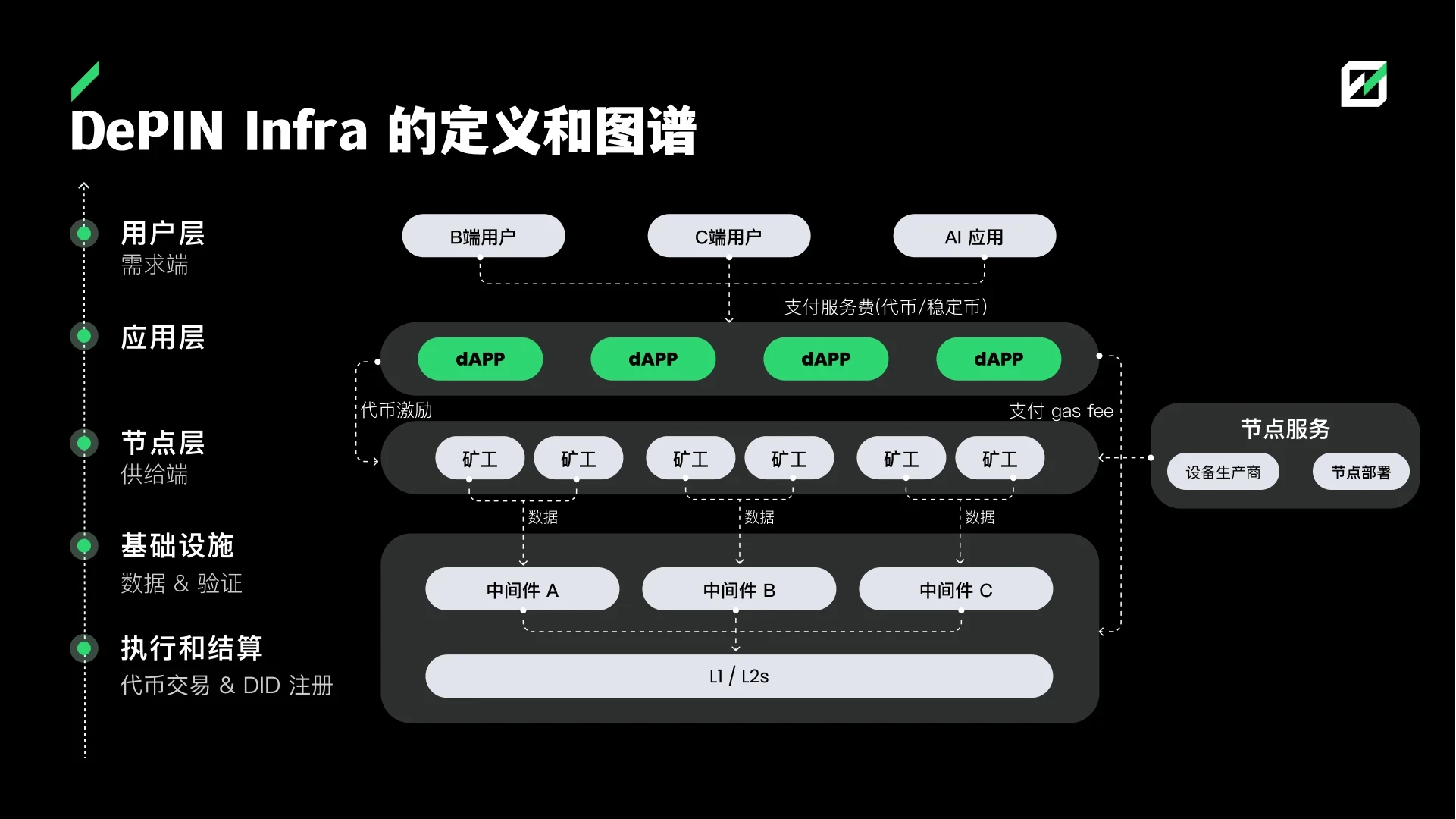

DePIN 的概念已经老生常谈,但从梳理的角度而言还是有必要重新阐述,我们在这里将重点放置在 DePIN 的基础运行模式上。从定义上讲,DePIN(Decentralized Physical Infrastructure Network,去中心化物理基础设施网络)是一种将物理基础设施资源与区块链技术结合的模式,通过分布式账本、Token 激励和智能合约协调全球范围内的资源协作。

简而言之,**DePIN 就是通过把硬件和区块链挂钩,创造了一个「资源共享+经济激励」的双边市场,**这种社区驱动的模式,比传统单点式的资源管理更加灵活,也更具规模化效应与鲁棒性。

通常来说,一个完整的 DePIN 网络由项目方、链下物理设备、供给方与需求方组成,基础运行模式分为五个步骤:

**1、链下硬件设备**:通常由项目方提供或者要求,主要分为:

* **定制化的专用硬件**:如 Helium 需要用户通过购买第三方制造商制造的 Helium 硬件热点( Hotspot ),为附近的物联网设备提供热点信号获得挖矿奖励;Hivemapper 通过其专用行车记录仪(HiveMapper Dashcam)鼓励用户为地图网络做出贡献。

* **专业级别硬件**:装备了 GPU、CPU 芯片的闲置电脑,只需下载浏览器插件就可以开始参与算力/数据的供给。如 Heurist, 对于持有闲置 GPU 设备的所有者,只需下载其矿工程序并设置矿工节点,便可开始通过共享其算力获得挖矿奖励,在 io.net 的参与方式中,明确了设备并网的起步门槛为英伟达 GeForce RTX 3050 。

* **智能移动设备**:体现为智能手机、智能手表、手环甚至指环这些轻量级别的移动设备,通过两种方式加入 DePIN 网络:运行节点程序,成为 DePIN 硬件的控制端;直接提供传感器数据或者计算资源。如 Silencio 利用人们智能手机的内置麦克风绘制世界各地噪音污染的动态地图;Acurast 利用旧手机的存储空间构建一个任何人都可以做出贡献的去中心化云。

**2、证明:**物理设备产生的数据,需要通过链下基础设施上传到链上记录在防篡改的区块链账本上,为利益相关者提供透明且可审计的基础设施运营记录,以证明其按要求付出了一定的工作来获取激励,这个验证方式称为物理工作证明( PoPW )。

**3、身份核验:**在数据得到验证后,需要对该设备所有者的链上账户地址进行核对,一般使用公私钥进行身份核验私钥用于生成和签署物理工作证明,而公钥则被外界用于验证证明或作为硬件设备的身份标签( Device ID )。

**4、奖励发放:**核对完数据后,将链下物理设备获取的代币奖励发到该链上地址中,这其中涉及到 DePIN 的代币经济学。代币经济学作为数据价值网络的经济基础,是 DePIN 项目能否良好运行下去的关键。

* BME :代币燃烧机制,需求侧的用户购买服务后会把代币销毁,那通缩程度就由需求决定;也就是说需求越旺盛,那代币的价值就越高。

* SFA :要求供给侧的用户质押代币以成为合格的矿工,供给决定了通缩的程度,即提供服务的矿工越多,代币价值就越高。

**5、需求匹配:**一个 DePIN 市场平台,供需双方在这里购买、出售、租赁,完成资源的交换与匹配;与此同时,DePIN 市场提供实时市场数据,包括资产价格、历史表现和能源生产数据,有助于确保公平定价,并通常由去中心化自治组织 (DAO) 管理,允许利益相关者参与决策过程。

图源:FMG

### 我们为什么需要 DePIN ?

举个简单的例子。噪音污染,是城市生活中尤为普遍的现象,对噪音污染数据的量化,不仅对于房地产开发商、酒店、餐馆等企业都具有商业价值,且对于城市规划与学术研究也有参考意义,但你会乐意让一家私人公司在你的城市各处安装麦克风吗?或者想象一下这样做的前期成本,它的覆盖范围能扩大到多远?扩张速度有多快?

而如果这是用户自发组成噪音检测网络,这一切就简单不少。例如 Silencio,通过其应用程序在用户手机上的下载,部署噪音污染传感器,移动用户通过提供准确的、超局部的噪音污染数据来建立一个全球测量网络,并以此获得代币奖励,与此同时,平台通过出售噪声污染数据来盈利。

这正是 DePIN 的意义之一。在传统的物理基础设施网络(如通信网络、云服务、能源网络等)中,由于巨大的资本投入和运营维护成本,市场往往由大公司或巨头公司主导,这种集中化的产业特性带来了以下几大困境与挑战:

* **中心化控制**:由中心化机构控制,存在单点故障的风险,易受攻击,且透明度低,用户对数据和操作没有控制权。

* **高进入门槛**:新进入者需要克服高额资本投入和复杂的监管门槛,限制了市场竞争和创新。

* **资源浪费**:由于中心化管理,存在资源闲置或浪费现象,资源利用率低。

* **激励机制不足**:缺乏有效的激励机制,用户参与和贡献网络资源的积极性不高。

而 DePIN 的核心价值可以归纳为以下四点:

* **资源共享与数字化**:将闲置的物理资源(如存储、通信、算力)以去中心化的方式转变为可交易的数字资产;

* **去中心化治理**:基于开放协议和加密经济模型,用户为同一个目标贡献资本、资产和劳动力,并受到透明和公平的激励;

* **链上结算**:区块链通过成为所有市场参与者共享分类帐本的单一来源来减少费用;

* **创新**:在开放、无许可的全球圣药系统中,实验速度比中心化基础设施高出一个数量级。

### DePIN 发展现状

**赛道**:作为区块链发展较早的领域,DePIN 发展时间较久,最早成立的一批项目,例如去中心化网络 Helium,去中心化存储的 Storj、Sia,基本都聚焦在存储和通信技术方面。

图源:Messari

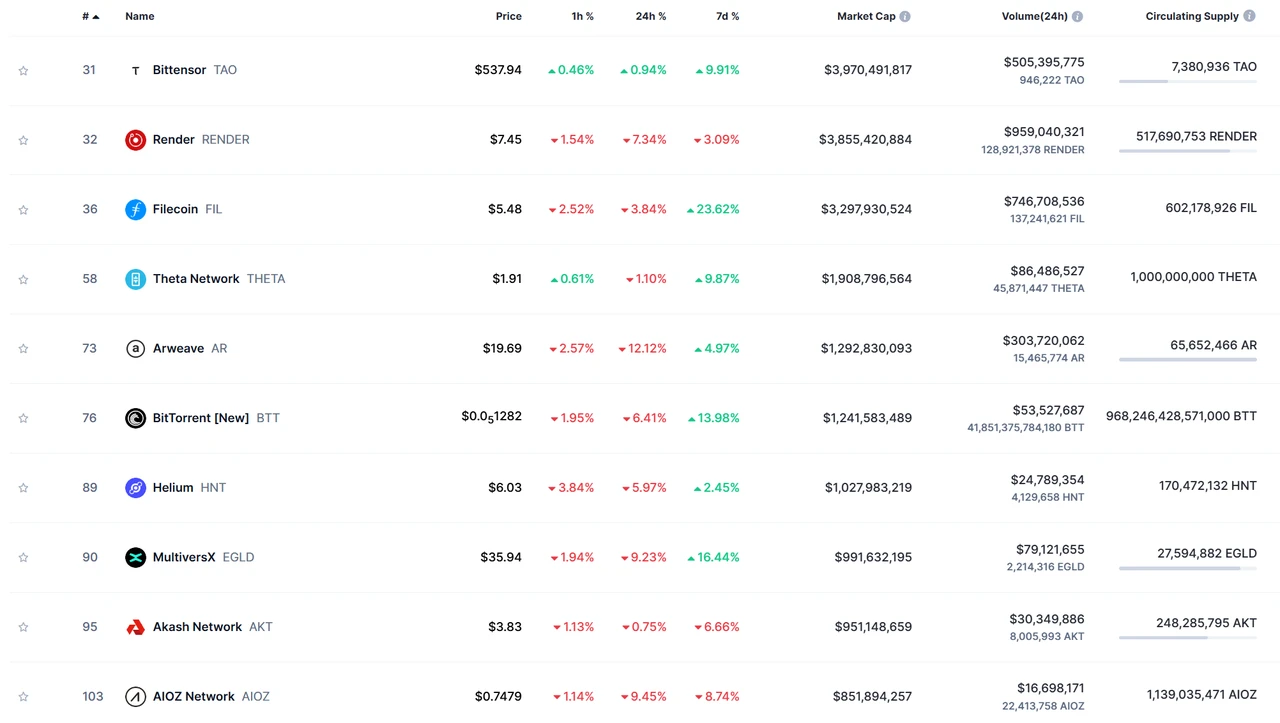

然而,随着互联网、物联网的不断发展,对基础设施的要求和创新需求越来越多,DePIN 的项目主要拓展至算力、数据收集与分享、无线、传感器、能源等等,不过,从 DePIN 领域目前市值排名前 10 的项目来看,大部分都属于存储与算力领域。

AI 是此轮周期中 DePIN 的关键词,由于 DePIN 天然适合 AI 数据、算力的去中心化共享需求,由此出现了一批 AI DePIN 的项目,致力于整合全球范围内的计算、存储、网络和能源等资源,为 AI 模型的训练、推理和部署提供底层基础设施支持。

图源:CoinMarketCap

**市场规模**:根据 DePIN Ninja 的数据,目前已经上线的 DePIN 项目数量达到 1561 个,总市值约为 220 亿美元;对于 DePIN 板块的总潜在市场规模,Messari 做了预测:到 2028 年 DePIN 市场规模可能会突破 3.5 万亿美元,同时可能在未来十年内为全球 GDP 增加 10 万亿美元(十年后为 100 万亿美元)。

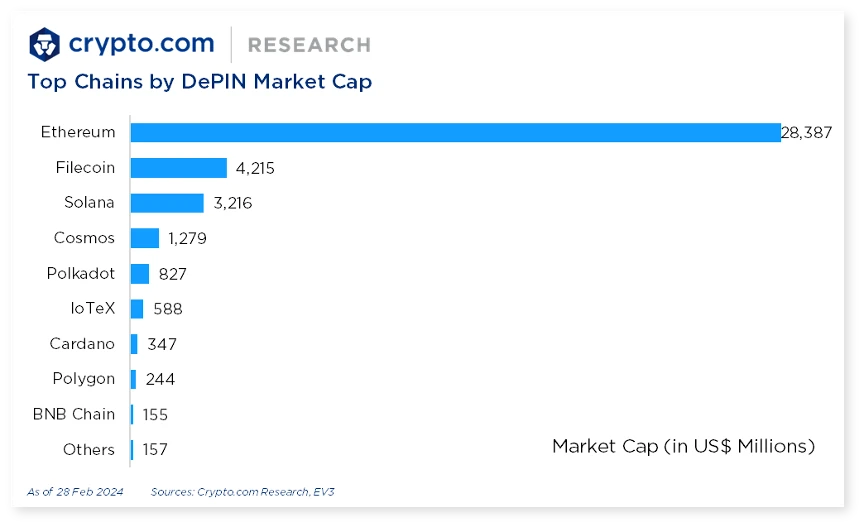

**L****1/L2**:由于高吞吐量与低 gas 费用,当下 DePIN 项目主要集中在 Solana 公链上部署,以及像 IoTex、Peaq 这样的 DePIN 专用链。与此同时,Polygon、Arbitrum 逐渐成为后起之秀。

图源:Cryptoresearch

由于硬件的供应链已经非常成熟,项目方无需投入大量研发精力,所以按照侧重方向,当前的 DePIN 项目分成了两条方向,**一条是专注于 DePIN 的中间层;一条则是专注于 DePIN 需求端的拓展。**

## Part.2、DePIN 中间层

**DePIN 相关的物联网设备要大规模接入到区块链,存在技术上的难点和流动性的压力**,如硬件设计以及生产、如何实现链下数据如何在链上实现可信的传输和数据处理、代币经济设计。由此,DePIN 赛道衍生出了连接设备和 DePIN 网络的中间件,涉及了连接与双向服务的部分,旨在帮助项目方快速启动 DePIN 应用类项目,为其提供开发框架、开发者工具、整体解决方案等等。

不仅仅包括像 DePHY,Swan 这样的开发者友好工具和一站式服务;也有专门服务于 DePIN 的再质押协议 Parasail,旨在增强 DePIN 网络的原生代币流动性和价值利用。

### DePIN infra

* **DePHY** :旨在为 DePIN 项目提供开源硬件解决方案、SDK 和工具,并通过同步区块链运行的 500 ms 级链下网络节点,降低硬件产品桥接区块链的制造和网络消息传递成本。

* **W 3 bStream** :离链计算协议 W 3 bstream 允许 IoTeX DePIN 项目轻松生成基于智能设备数据的逻辑,触发区块链操作。一些知名的基于 IoTeX 的 DePIN 项目有 Envirobloq、Drop Wireless 和 HealthBlocks。

目前,随着提供框架、解决方案的 DePIN 项目增多,基于其 infra 搭建的 DePIN 应用层项目也开始逐渐涌现,例如基于 IoTeX 的 Pebble 的 EnviroBLOQ,基于 W 3 bstream 的 Dimo、Drife,基于 DePHY 的 Starpower、Apus Network 等等。

### 流动性方案

* **PINGPONG** 是一个 DePIN 流动性和服务聚合器,通过创新工具和解决方案来优化和最大化多个网络的挖矿收益。

* **Parasail** 则是专门为 DePIN 服务的再质押协议,通过激活成熟网络中的闲置资产(如质押或再质押的代币),为 DePIN 服务提供经济保证,帮助 DePIN 项目吸引更多用户和服务提供商。

以 Parasail 作为详细例子,目前 Parasail 主要提供 Filecoin 链上的再质押服务,未来将会开放如 Iotex,Arbitrum,以太坊链上的再质押。以下以 FIL 举例 Parasail 是如何工作的:

* **质押 FIL 代币化**:存储提供商(Storage Provider)可以质押 FIL 并按 1: 1 比例铸造 pFIL 代币。

* **pFIL 的开放市场**:存储提供商可以出售 pFIL 以获得流动性,代币持有者则可以购买 pFIL 以获得 FIL 挖矿回报。

* **风险回收和奖励分配**:当质押的 FIL 被释放或矿工获得区块奖励时,Repl 协议回收 FIL 并通过拍卖回购 pFIL,多余收益则作为奖励分配。

## Part.3、DePIN 应用层

DePIN 应用层占据了 DePIN 赛道数量中的的大头,本文基于公开研报资料与 DePIN 浏览器项目汇总,主要分为云网络(存储、计算)、无线网络(5 G、WiFi、蓝牙、LoRaWAN)、传感器(环境、地理、健康)、能源四大板块。

### 云网络

DePIN 在云网络上的领域包括去中心化存储、计算。

**▼ 存储**

去中心化存储是 DePIN 生态中的关键一环,旨在解决传统中心化存储的高成本、隐私风险和抗审查性不足等问题:

* 作为最知名的 DePIN 项目之一,**Filecoin** 基于 IPFS 技术,( IPFS 本身已经是一个被广泛认可的分布式文件系统),利用存储证明机制来确保数据完整性和真实性,矿工通过贡献存储空间获取 FIL 奖励,用户按需付费存储数据。这种模式不仅降低了存储成本,还激活了全球大量闲置的硬盘资源;

* **Arweave** 则提供了一种永久存储的解决方案,用户只需支付一次费用,非常适合需要长期保存的数据,如历史档案、NFT 元数据或区块链交易记录;

总的来看,相比传统云存储,去中心化存储的抗审查能力和透明度显然更胜一筹,不过存储速度和初期准入门槛可能仍是需要优化的问题。

**▼ 算力**

算力作为本轮 AI 浪潮的核心生产力资源,去中心化算力等 DePIN 项目是对现有以中心化云巨头为主的算力服务格局(CePIN)的错位补充,而非直接替代:即手握海量算力资源的云服务巨头负责大模型训练、高性能计算等「急难险重需求」;去中心化云算力市场负责中小模型计算、大模型微调、推理部署等更多元化的「灵活低成本需求」。

其实就是提供一条更具包容性的成本效益和算力质量之间的动态平衡供需曲线,这也更符合市场优化资源配置的经济学逻辑。以 Render Network、Akash Network 等老牌去中心化计算项目为代表,以及今年最新的 DeAI 融合叙事巨头 io.net:

* **Render Network**:提供去中心化 GPU 渲染服务,能够为需要实时计算的应用(如虚拟现实、3D 渲染和工业自动化)提供灵活、低成本的算力支持,特别是在元宇宙和实时交互领域具有应用价值;

* **io.net**:更进一步,不仅是算力资源的撮合平台,还通过一整套产品架构实现分布式 GPU 的高效协同:

* **「IO Cloud」**:支持用户根据需求创建 GPU 集群,用于 AI 模型训练等复杂任务;

* **「IO Worker」**:为算力供给方提供管理工具,包括温控监测、算力利用率分析等;

* **「IO Explorer」**:提供网络统计和奖励数据的可视化,方便用户跟踪算力资源的动态流转;

* **PinGo** 是 TON 网络上的 AI 和 DePIN 项目,其目的是解决闲置算力资源碎片化、闲置的问题,为构建 AI 模型提供了计算能力基础。PinGo 最初是 Cpin Web2 公司,拥有近 10 万台设备,未来这些设备将集成到其自己的 DePIN 网络中。

不过,算力去中心化以盘活闲置算力并不容易,大模型训练最需要的是稳定性,如果中断则沉没成本太高。因为算力交付技术细节复杂,类似 Uber 和 Airbnb 的双边调度模型在此失灵,此外,英伟达的 CUDA 软件环境和 NVLINK 多卡通信使替代成本极高,NVLINK 对显卡物理距离的限制要求显卡集中于同一数据中心。

在这一背景下,去中心化算力供应的商业模式难以实现,沦为单纯的叙事,许多算力项目被迫放弃训练市场,转而服务推理市场。然而,在应用未大规模爆发的情况下,推理需求不足,大企业通过自建满足推理需求,显得更稳定且具有性价比。

### 无线网络

Dewi(去中心化无线)是 DePIN 赛道中尤为重要的一环,通过允许许多独立实体或个人协作建立基于 Token 激励的无线基础设施,为物联网和移动通信提供服务,可共享的无线网络包括:

* **蜂巢 5 G** :提供高下载速度和低延迟,如 Pollen Mobile,利用去中心化基站构建分布式 5 G 网络,目标是降低移动通信成本并提升覆盖率;

* **WiFi** :提供特定区域的网路连线,如 Wicrypt,用户可购买其专用设备贡献 WiFi 赚取代币;Metablox(现更名为 Roam)类似于「Web3 版万能钥匙」,用户可以通过它共享其自建的全球公共 WiFi 网络;Wifi Dabba,主要合作印度本地的优先电视营运商。

* **低功率广域网路(LoRaWAN)**:为物联网通讯提供便利,头部 DePIN 项目 Helium 就是典型代表,通过 LoRaWAN 路由器,为物联网设备提供低成本、高覆盖率的通信服务,从而取代传统电信网络的集中化服务模式。用户通过运行路由器获得 HNT 奖励,这一模式特别适合农业物联网、物流追踪和环境监测等需要大规模设备覆盖的场景。

* **蓝牙** :实现短距离资料传输。

这种网络模式适合智能城市、农业物联网等场景,不过去中心化通信的优势在于对传统电信基础设施的低成本替代,但部署效率和物理设备的维护仍是不可忽视的挑战。Dewi 需要借助传统运营商网络力量拓展市场,比喻如 DePIN 传统运营商的补充、或者为他们提供相应的数据。

### 传感器

传感器网络是 DePIN 的另一个利基领域,基本上由相互连接的设备组成,每个设备都旨在监控和收集其环境中的特定数据,主要是通过对环境、地理位置、健康等数据的监测和捕获:

* **环境**:一个明显的用例是天气预测,WiHi 希望成为连接所有这些实体的统一平台,简化资料共享,提高预测准确性,改善气候监测。任何操作天气感测器的实体都可以申请向 WiHi 贡献资料。

* **地理**:如 HiveMapper,通过持有者(如出租车司机、快递员)安装的车载摄像头收集最新的高分辨率数据(4 K 街道级图像),为地图影像绘制收集贡献其数据获得代币奖励,需求方通过购买现有地图或者突发事件悬赏新区域数据,目前,对于保险评估及时取得房屋外部状况的数据、自动驾驶车辆开发者获得最新的道路状况和施工区资讯以及现实世界资产(RWA)都具有真实的商业价值。

### 能源

传统能源市场面临以下问题:区域能源网络中供需不匹配、缺乏透明且可交易的能源市场、未开发的清洁能源市场庞大、能源网络扩展缓慢且成本高昂。而通过能源网络的去中心化,DePIN 使用户能够以直接的方式利用其过剩的能源生产。这种方法不仅鼓励更谨慎的能源消费,而且减少了对传统能源供应商的依赖。能源网络的 DePIN 方法可以为能源生产和消费提供一种更民主、更高效且更有利的模型。

* **Starpower**:通过创建去中心化的虚拟电厂(VPP),将小型供电网络与需求端连接起来,减少能源传输,提高能源利用效率。

* **Powerpod** :通过创建一个去中心化的社区充电站网络,改变电动车(EV)充电方式。

* **Arkreen** :通过激励提供者提供太阳能装置的容量和其他类似的数据,包括可再生能源认证(REC)发行者和绿色计算运营商提供访问数据的途径,构建应用程序和服务。

## Part.4、如何看待 DePIN 的未来?

### DePIN 趋势

**▼ 与 web2 应用场景结合**

DePIN 的潜力不仅在于其底层的去中心化技术优势,更在于广泛的web2行业应用场景,这些场景横跨物联网(IoT)、智能城市、能源共享、边缘计算等多个领域,每一个领域都代表了 DePIN 在推动物理世界和数字网络融合中的重要角色。

可以设想未来的一种生活场景,在 2030 的一天早晨,Alice 上班过程中,启动 Helium 为附近的行人和设备提供通信支持。在开车上班的路上,打开 DIMO 记录自己的车辆设备数据,并且为 Hivemapper 持续贡献最新的地图数据,然后达到办公室,这是一个太阳能企业,Alice 熟练的为各个太阳能组件安装好 Arkreen 采集设备,方便用户记录自己的碳足迹。

图源:Waterdrip Capital

**▼ 硬件门槛降低**

此前 DePIN 设备主要业务包括算力、存储和带宽,设备通常固定在某个位置,当前,DePIN 在硬件端呈现出专业级别设备向消费级产品的过渡,如手机(Solana Mobile Saga)、手表(WatchX)、AI 智能戒指(CUDIS)、电子烟(Puffpaw)等等,设备小巧灵活,可以随身携带,甚至可以穿戴。

作为最普及的硬件设备,硬件门槛的降低有望促进用户层的进一步扩大:**一方面**,加密手机的传感器、计算模块是天然的募集端,可以作为 DePIN 设备参与 DePIN 经济,降低销售门槛提高使用频率;**另一方面**,加密手机内置的加密应用市场,是 dAPP 绝佳的用户入口,这类市场种类繁多,应用范围广泛,尚待深入挖掘,是一片具有巨大潜力的蓝海。

**▼ 金融化**

物理硬件的代币化,也为 DePIN 开创了链上金融的想象空间:

* 质押流动池,增加收益来源,如 Hivemapper 推出的 HONEY-JitoSOL 流动性金库激励计划,进一步提高激励效果。

* DePIN 硬件资产证券化上链,发行传统金融类似 Reits 模式的产品;

* 在数据资产代币化基础上可以创建以数据为支撑的金融产品,如 DIMO 的汽车数据可以用于链上车贷。

**▼ DePIN 与 AI 互哺**

DePIN 的特征,同样天然适用于 AI 的发展。

首先,DePIN 能够在算力、模型、数据等多个层面为 AI 服务,以去中心化的方式释放 AI 原本不具备的能力。AI 本质上是基于海量数据训练的智能系统,DePIN 中的物联网设备收集的丰富端侧数据,正好为 AI 提供了广泛的训练和应用场景,当前,许多 AIPIN 项目通过硬件传感器捕获数据,再利用 AI 优化数据处理能力,在应用层面实现端到端流程自动化,释放行业细分场景的潜力。

同时,AI 的加入也使 DePIN 变得更智能和可持续。AI 可通过深度学习和预测来提升设备效率和优化网络资源分配,还可以帮助审计智能合约、提供个性化服务,甚至通过算法动态调整 DePIN 项目的经济激励模型。

### DePIN 走向规模化的掣肘

尽管 DePIN 理念充满吸引力,但技术实现、市场接受度、监管政策等多方面的复杂性显著增加了其走向规模化的落地难度:

* 从存储到算力、从通信到能源,每一项 DePIN 解决方案都需要整合不同类型的物理硬件和去中心化协议,**这对硬件制造商、网络开发者和参与节点提出了极高要求;**

* 此外**市场对于 DePIN 模型的接受程度尚不明朗**,在实际应用中,如何说服企业或个人切换到 DePIN 的网络基础设施并支付高昂的初期成本,仍是一个未解难题;

* **盈利模式的不确定性**也限制了 DePIN 的吸引力,当前许多项目依赖代币经济激励参与者提供资源,但这种模式能否维持长期可持续性,取决于市场对代币价值的认可程度以及实际需求的增长速度;问题在于,大部分项目的叙事略显陈旧,产品体验不足,往往难以与 Web2 相媲美。如果单纯依赖于 Token 激励来吸引用户,一旦激励模型崩溃便可能陷入“死亡螺旋”。由于其依赖硬件销售收入和代币模型的双重飞轮,经济系统的稳定性至关重要。如果代币价值波动过大,或硬件部署和维护成本过高,整个系统的经济激励将难以维系,可能导致用户流失,甚至网络瘫痪。

* 同时由于 DePIN 涉及存储、计算和通信等关键领域,**其潜在影响力可能引发国家或区域性的法律和政策干预**,例如去中心化存储网络可能被用于存储敏感或非法内容,这会导致某些国家的监管部门对整个网络施加压力,要求其采取更严格的内容审核机制(此前就有人通过去中心化存储项目存储涉政敏感信息);

总的来说,从技术的复杂性到市场的接受度,再到监管的不确定性,每一步都关乎它能否真正成为基础设施的新标杆。如何突破这一格局,让用户真正感受到 DePIN 的经济性和独特价值,是其必须面对的竞争压力。

## Part.5、一个 DePIN 潜力项目需考量的因素

**▼ 硬件**

* **自制 VS 第三方**:当前,大多数的 DePIN 项目专用硬件均为第三方硬件生产。优势是能够保证其专业度,但隐忧是其拓展有可能受其第三方供应链的影响,相较之下,掌握强大的硬件供应链能力的项目可以通过设备销售和代理商模式,在第一曲线的阶段实现业务的快速增长。

* **一次性 VS 持续成本**:一些 DePIN 网络是一次性成本的,比如 Helium ,购买其硬件设备设置热点之后,并不需要用户做太多额外工作的情况下,向网络提供被动覆盖;有一些则需要持续的用户参与。如果贡献者在最开始支付一次性成本(时间或金钱),而不是持续不断的成本,DePIN 网络的扩展会更容易;被动网络更易于设置,因此也更易于扩展。

* **高密度 VS 低密度**:硬件覆盖的密度也需要纳入 DePIN 项目的考量因素,如 XNET 正在建立一个运营商级 CBRS 无线网络。他们的网络无线电需要由当地 ISP 的专业人员安装,安装难度较大不利于密度铺陈,但由于其设备更为专业,其网络仍有扩张潜力。高密度的网络需要更多贡献者才能达到阈值规模。相反,密度较低的网络可以利用更复杂的硬件和/或专业贡献者。

* **稀缺 VS 常见**:如 XNET 正在建立一个运营商级 CBRS 无线网络。他们的网络无线电需要由当地 ISP 的专业人员安装,安装难度较大不利于密度铺陈,但由于设备更为专业资源更为稀缺,其网络仍有扩张潜力。

**▼ 代币经济的设计**

**代币经济学作为数据价值网络的经济基础,是 DePIN 项目能否良好运行下去的关键**。目前主流的两种为 BME(burn and mint equilibrium) 和 SFA(stake for access)。BME 和 SFA 构成了 DePIN 项目的基本核心框架,而对代币的赋能则完善了代币经济,如:

* 使用积分形式作为给矿工的预挖承诺,代币发行后按一定比例兑换,或采用积分+代币的经济模型。

* 赋予代币治理功能,允许持有者参与网络重大决策,如网络升级、费用结构或资金库的重新分配。

* 质押机制激励用户锁定代币,维持代币价格的稳定;

* 项目方也可以用收入的一部分购买代币,并与其他主要加密货币或稳定币配对加入流动性池,保证代币拥有充足的流动性,便于用户在不大幅影响价格的情况下进行交易。

这些机制有助于确保供需两端的用户利益与项目方的利益长期保持一致,从而实现项目的长期成功。

## 总结

把视线收束到宏观角度,我们会发现 Web3 作为一个价值网络,具有重塑生产关系,释放生产力的巨大潜能。而 DePIN 的核心逻辑,正是通过采用「Web3+代币经济」的基础架构,构建一个分布式的双边市场。从这个角度看,无论是存储、算力、数据还是通信网络等,都有可能借助 DePIN 的新模式焕发新生机。

通过整合全球闲置资源(如存储、算力、通信设备等),解决传统中心化模式下资源垄断和分配效率低下的问题。这种模式将全球硬件资源与用户需求有效连接起来,不仅降低了资源获取的成本,也提高了基础设施的弹性和抗风险能力,为去中心化网络的普及和应用奠定了基础。

不过,DePIN 虽然展现出了巨大的发展潜力,但仍面临着技术成熟度、服务稳定度、市场接受度和监管环境等方面的挑战。今天区块链性能、代币经济模型日益丰富和成熟、市场周期都为 DePIN 的爆发做好了准备,而大规模的应用仍然缺少契机。“屈身守分,以待天时,不可与命争也”,DePIN 依赖的是飞轮效应,需博观而约取,厚积而薄发,绝不会成为沉默的叙事。

## Reference

State of depin 2023

FMG 深度研报:DePIN 赛道从下至上的 5 个机会

考古 DePIN,寻找赛道“正统性”

\*Coinspire 平台上的所有内容仅供参考,不构成任何投资策略的要约或建议,基于本文内容所做的任何个人决策均由投资者自行承担责任,Coinspire 不对由此产生的任何收益或损失负责。投资有风险,决策需谨慎!

星球日报·2024-12-28 04:01

Farewell to Liquidity restrictions: iCKBprotocol brings changes to Nervos DAO

在区块链的世界里,流动性是王道。近日,Nervos DAO 质押工具 NervDAO 完成了与 iCKB 协议的集成。这一里程碑式的进展不仅使 Nervos DAO 的储户能够摆脱最短 30 天的存款周期限制,**有效解决流动性难题**,同时还为用户打开了**通过 “BTCFi 乐高” 实现更高收益**的大门。

本文将详细介绍 iCKB 协议的工作原理及其在市场中的重要意义。

**CKB 经济模型,Nervos DAO 与 NervDAO**

在深入了解 iCKB 协议之前,我们先简要回顾一下 CKB 的经济模型、Nervos DAO 及其质押工具 NervDAO 的基本情况。

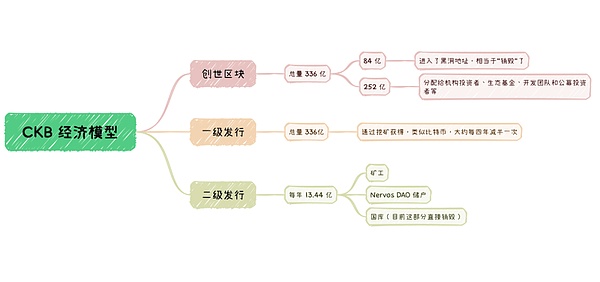

截至 2024 年 12 月 8 日,CKB 的总发行量达到了 462.02 亿,其中 81.33 亿 CKB 被锁仓于 Nervos DAO。这些 CKB 主要源自三个渠道:

* 创世区块:总量 336 亿,其中 84 亿在发行之初就进入了黑洞地址(相当于 “销毁” 了),剩下的 252 亿 CKB主要分配给机构投资者、生态基金、开发团队和公募投资者等,这些 CKB 设有时间锁,但目前已全部解锁。

* 一级发行(基础发行):总量 336 亿,全部奖励给矿工,其发行机制类似于比特币,大约每四年减半一次,直到全部发行完毕。

* 二级发行:每年固定发行 13.44 亿,这部分按照比例分配给矿工、Nervos DAO 储户、国库(目前这部分直接销毁)。

关于 CKB 经济模型的更详细介绍,请阅读《**一文看懂 CKB 的经济模型及其巧妙设计**》。

Nervos DAO 是一个写在系统底层的智能合约,可以自动将 CKB 的二级发行分配给 Nervos DAO 的储户。换句话说,如果持币者愿意牺牲代币的流动性,将 CKB 锁定在 Nervos DAO 合约中,就可以获得系统的补偿,从而避免因二级发行而造成的资产稀释。

NervDAO 是 Nervos DAO 的质押工具,旨在为用户提供便捷的质押与提取服务。与其他支持 Nervos DAO 质押的工具相比,比如 Neuron 钱包和 CKBull 钱包,NervDAO 的优势主要体现在以下两个方面:

* **更低的操作门槛**:用户可以直接在网页上操作,无需下载额外的 App 或钱包软件,也不必同步区块数据。

* **支持多链钱包登录**:目前已支持 JoyID、MetaMask、OKX Wallet、UniSat、UTXO Global Wallet,未来还将支持 SOL、DOGE 和 Nostr 在内的其他主要生态钱包。

随着 NervDAO 集成 iCKB 协议,用户除可以选择 “传统” 的 Nervos DAO 质押方式外,还能通过 iCKB 协议进行质押。

**iCKB 协议详解**

iCKB 协议由 Nervos 社区开发者 Phroi 提出并开发,**旨在解决 Nervos DAO 存款的流动性问题:它允许用户随时存入、快速提取任****何数量的 CKB。**

那么,iCKB 协议是如何运作的呢?

从用户视角来看,通过 iCKB 协议存入 CKB 至 Nervos DAO,仅需一步操作:**将 CKB 兑换为 iCKB**。提取时,同样只需**将 iCKB 兑换回 CKB**。因此,我们可以将 iCKB 视为用户在 Nervos DAO 中存入 CKB 的存款凭证。

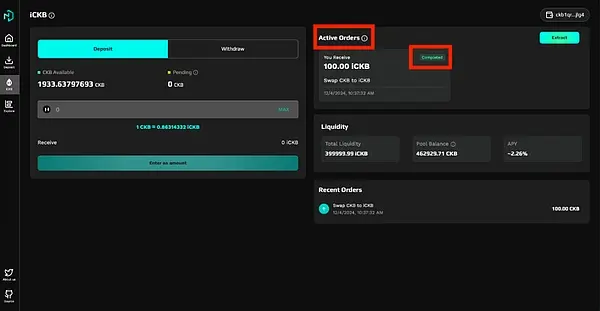

目前,1 CKB 可以兑换约 0.86287995 iCKB,1 iCKB 可以兑换约 1.15890975 CKB。存于 Nervos DAO 的 CKB 享有二级发行的补偿(当前年化收益率约为 2.26%),因此,代表存款凭证的 **iCKB 也会随时间增值**,即随着时间的推移,iCKB 兑换的 CKB 数量也将逐渐增加。

iCKB 协议会将用户的 CKB 存款分解为**大额存款**和**小额存款**两部分,**每一份大额存款等价于 10 万 iCKB**,并引入 **Market Maker** 机制来解决小额存款的流动性问题。

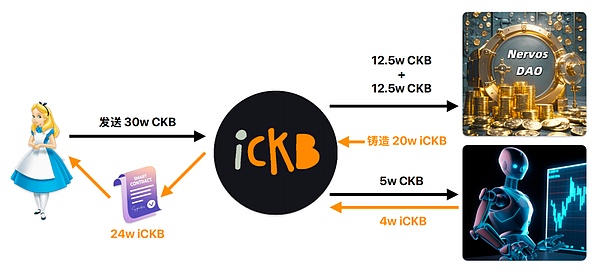

下面,我们通过一个例子来阐述 iCKB 的工作原理(为简化计算,假设兑换汇率为 1 CKB = 0.8 iCKB,1 iCKB = 1.25 CKB):

假设 Alice 手中有 30 万 CKB,她通过 iCKB 协议存入 Nervos DAO。iCKB 协议会将这 30 万 CKB 分解为:12.5 万 CKB + 12.5 万 CKB + 5 万 CKB。其中,12.5 万 CKB 正好等值 10 万 iCKB,这部分 CKB 会被存入 Nervos DAO 中(即存入 2 份,每份 12.5 万 CKB),剩下的 5 万 CKB 挂单后,由 Maket Maker 吃单。最后,Alice 会收到 24 万 iCKB。

这里需要特别说明的是,这 24 万 iCKB 会暂时处于链上合约托管的状态,如果要立刻回到 Alice 的钱包中,还需要 Alice 发起 “Extract” 操作;如果不发起 “Extract” 操作,等下一次 Alice 再存入 CKB 换取 iCKB 或者用 iCKB 兑换 CKB 时,这 24 万 iCKB 也会自动解除托管并回到 Alice 的钱包中。处于托管状态的 iCKB 不能直接兑换 CKB,也不能直接转移至其他钱包或者参与 BTCFi。

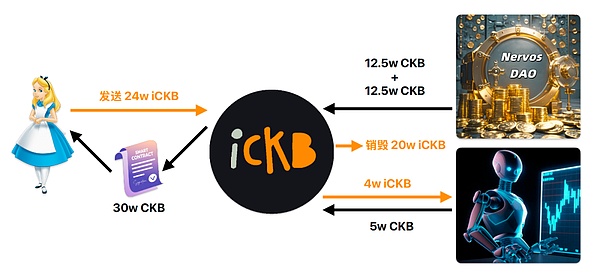

几天后,Alice 决定换回 CKB。为了方便计算,我们假设兑换汇率不变,iCKB 协议收到 Alice 的 24 万 iCKB 后,会将其分解为:10 万 iCKB + 10 万 iCKB + 4 万 iCKB。其中,这两份 10 万 iCKB 会被销毁,同时 iCKB 会从 Nervos DAO 中选择 2 份可以最快时间提现的存款,将其取出。剩下的 4 万 iCKB 挂单后,由 Maket Maker 吃单。最后,Alice 会收到 30 万 CKB(同上,这些 CKB 也处于链上合约托管状态,通过 “Extract” 操作可以立马会回到钱包中,也可以等下一次兑换时自动解除托管并回到钱包中)。

通过这个例子,我们可以清晰地看到 iCKB 如何有效解决 Nervos DAO 存款的流动性问题:**大额存款的流动性通过聚合其他用户的存款来实现,而小额存款的流动性则由 Market Maker 来保障。**这里需要说明的是,任何人都可以成为 iCKB 协议下的 Market Maker,其主要收入来自用户支付的服务费。

**iCKB 协议的深远影响**

“传统” 的 Nervos DAO 质押方式存在两大限制:

* 金额限制:最少存入 102 CKB(不包括矿工费)。

* 时间限制(流动性问题):有约 30 天的最短存款期限,且提现还受到补偿周期的影响(即发起提现交易后,并不一定能立马提现)。

iCKB 协议通过巧妙的设计,允许用户随时存入、快速提现任意数量的 CKB,成功化解了 “传统” Nervos DAO 质押方式的金额和时间限制,**极大提高了 Nervos DAO 存款的流动性。**

此外,iCKB 代币也属于 RGB++ 资产,这意味着 **iCKB 持有者不仅可以获得 Nervos DAO 的利息,还能参与各类 BTCFi 应用,博取更多的收益。**例如,iCKB 持有者可以在 UTXOSwap 上建池并成为流动性提供者(LP),从中赚取交易费用。RGB++ 协议的下一步动作是扩展到 DOGE,未来还会扩展到其他 UTXO 链。iCKB 通过 RGB++ 的 Leap 无桥跨链技术,可以安全地转移到 DOGE 等 UTXO 链上,参与这些链上的生态。

不仅如此,等 CKB 的闪电网络 Fiber Network 主网上线后,**iCKB 还可以进入到闪电网络中,享受闪电网络带来的低成本、高隐私、即时确认的交易优势。**

**操作指南**

NervDAO 网站提供了 2 种质押方式:一种是 “传统” 的质押方式,在 NervDAO 网站的 Deposit 页面进行操作;另一种是通过 iCKB 进行质押,在网站的 iCKB 页面操作。**这两种质押方式是相互独立的。**

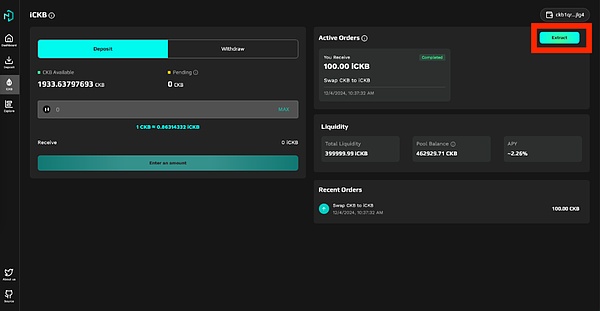

如前文所述,通过 iCKB 协议将 CKB 存入 Nervos DAO,用户只需简单的一步操作:将 CKB 兑换为 iCKB。若要提取相应的 CKB,只需将 iCKB 兑换为 CKB 即可。具体操作步骤如下:

**存入**

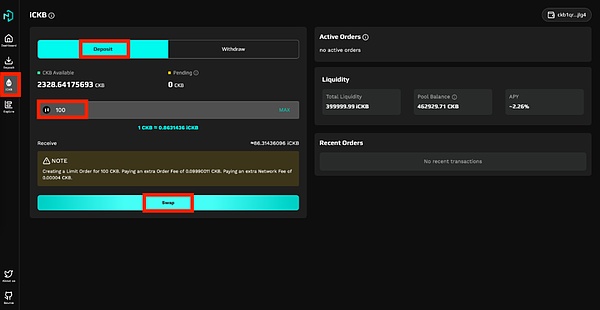

1. 打开 NervDAO 网站( JoyID、MetaMask、OKX Wallet、UniSat、UTXO Global Wallet)。

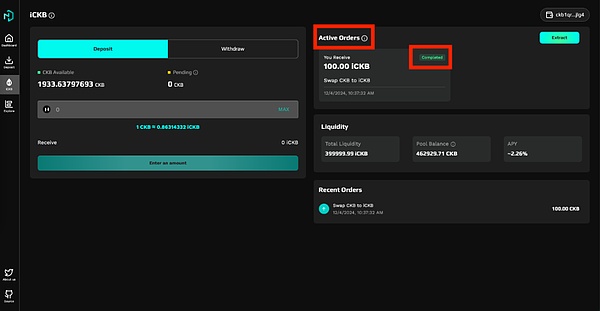

2. 点击左边导航栏的 iCKB,选择 “Deposit”,输入想要存入的 CKB 数量,然后点击 “Swap” 按钮并在钱包中签名确认。

3. 等待约 90 秒的确认时间。当 “Active Orders” 中的订单显示为 “Completed”,说明链上操作已完成。

4. 此时,你的 iCKB 将处于链上合约托管状态。如需提取,点击 “Extract” 并在钱包中进行签名确认;若不进行提取,下次再存入 CKB 换取 iCKB 或者用 iCKB 兑换 CKB 时,这部分 iCKB 也会自动解除托管并回到你的钱包中。是否进行 “Extract” 操作,都不影响 Nervos DAO 的生息。唯一的区别在于,这些处于托管状态的 iCKB 无法直接兑换回 CKB,也不能直接转移至其他钱包或者参与 BTCFi。

**取出**

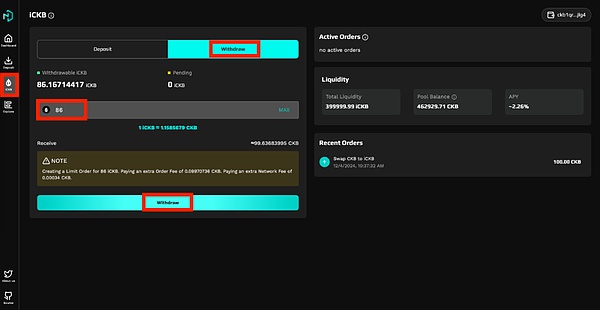

1. 打开 NervDAO 网站并连接钱包。

2. 在 iCKB 页面,选择 “Withdraw”,输入想要兑换的 iCKB 数量,然后点击 “Withdraw” 按钮并在钱包中进行签名确认(如需兑换所有的 iCKB,且 “Active Orders” 中有链上合约托管的 iCKB,需先通过 “Extract” 操作取回所有 iCKB)。

3. 等待链上的交易确认,当 “Active Orders” 中的订单显示为 “Completed”,说明链上操作已完成。同上,这些 CKB 也处于链上合约托管状态,通过 “Extract” 操作可以立马会回到钱包中,也可以等下一次兑换时自动解除托管并回到钱包中。

**结语**

iCKB 协议的推出,标志着 Nervos DAO 质押工具的重大进步,不仅为用户解决了流动性问题,还为他们提供了更灵活的投资选择与收益方式。通过 iCKB ,用户能够充分享受 Nervos DAO 和整个 BTCFi 生态带来的机遇与价值。

金色财经_·2024-12-12 09:50

Foresight Ventures sets up its New York strategic office in Tower 1 of the World Trade Center

CoinVoice has recently learned that Foresight Ventures has established a strategic office in Building 1 of the World Trade Center. The new office is located on the 77th floor of this skyscraper.

Alice Li, Head of Foresight Ventures North America and Investment Partner.

ALICE0.33%

CoinVoice·2024-11-27 11:44

Exploring the new potential of BTCFi: How the Core dual stake mechanism affects the BTC ecosystem

With the continuous new high of BTC prices and the continuous improvement of BTC ecosystem technology, BTCFi will usher in a wave of outbreak in the next six months.

Host: Joe Zhou, Foresight News Deputy Chief Editor

Guests: Core DAO Core Contributors Chanel, Crypto Wersearch Daily Coin Research Founder Alvin Hung, Cactus Product Director Alice Du, WaterDrip Capital Founder Jademont, Independent Researcher Ningning, Solv Protocol Ecological Cooperation Director Catherine

Host: Please let the six guests introduce themselves.

Chanel: I am

AICoinOfficial·2024-11-26 09:47

Exploring the New Potential of BTCFi: How Core's Dual Stake Mechanism Impacts the BTC Ecosystem

> With the continuous rise in the price of BTC and the continuous improvement of BTC's ecological technology, BTCFi will experience a wave of explosion in the next six months.

Host: Joe Zhou, Foresight News Deputy Chief Editor

Guests: Core DAO core contributors Chanel, Crypto Wersearch founder Alvin Hung, Cactus product director Alice Du, WaterDrip Capital founder Jademont, independent researcher Ningning, Solv Protocol ecosystem cooperation director Catherine

Host: Please introduce yourselves, six guests.

ForesightNews·2024-11-26 07:35

Top Play-to-Earn Games in 2024: the Best Crypto Picks for Fun and Profit

Blockchain-based games Axie Infinity, Decentraland, Illuvium, and My Neighbor Alice offer unique gameplay elements, ownership models, and governance structures that attract players and investors alike. With play-to-earn mechanics, NFTs, and gas-free transactions, these games represent the future of gaming platforms.

CryptoNewsLand·2024-11-19 21:35

What is ALICE Coin? MyNeighborAlice Price Prediction

The gaming industry and blockchain technology are two rapidly growing important sectors. However, the combination of these two powerful areas increases the proliferation of digital assets and the adoption of blockchain technology. ALICE Coin is one of the projects that best represents this combination. Here

Kriptokoin·2024-06-15 00:11

Popular Science: What is a Taproot transaction?

I haven't seriously studied the script of Bitcoin for a long time, and recently I wanted to figure out Taproot assets, and found that I couldn't bypass Taproot transactions, so I had to read several BIPs of Taproot.

P2PKH

The most common Bitcoin transaction is called Pay-to-Publick-Key-Hash (P2PKH), which locks Bitcoin to the hash of the public key, which is our Bitcoin address, that is, the kind of address that starts with 1.

If Alice wants to pay 1btc to Bob via a P2PKH transaction, the process can be explained as follows:

The technical process of P2PKH trading:

Address and public key hash: Bob gives Alice a Bitcoin address, which is actually a hash of his public key.

Unlock & Lock: Alice wants to send 1 BTC to B...

金色财经_·2023-11-19 01:43

Layer 2 History: The Rise of State Channels

Author: Logic; Source: LXDAO

MyFirstLayer2 is sponsored and supported by the Ethereum Foundation and is an educational project of LXDAO's "My First" series. We hope to popularize Layer 2 knowledge to Web3 users and start using Layer 2 safely in the most simple and easy-to-understand way through text + image + animation + interaction.

In the previous article, we explored the origins and fundamentals of Layer 2 technology, which solves a series of challenges posed by the "impossible triangle" for blockchains. However, the maturity of every technology is inseparable from continuous exploration and trial and error. Today, we're going to dive into the history of Layer 2 and see what important milestones Layer 2 has experienced along the way.

Let's start with the example of Alice. Hypothesis...

金色财经_·2023-11-04 01:48

Quickly understand Lightning Network replacement transaction loop attacks

Recently (late October 2023) the Bitcoin community revealed that the Lightning Network may have major flaws, allowing users to construct an attack method to steal money, called the "Lightning Replacement Cycling Attack".

I read the principle of it, and Chinese name can be translated as "Lightning Network Cyclic Replacement Transaction Attack".

Its attack principle is as follows.

First, explain how the Lightning Network works:

1. Alice and Bob open a payment channel, that is, jointly open a 2-2 signature address, each of them holds a private key.

Alice and Bob recharge 0.5BTC and 0.6BTC to this 2-2 signature address respectively (the amount can be arbitrarily chosen, I'm just an example), both of which occur on the main Bitcoin chain, and miners are to confirm. So this payment channel...

金色财经_·2023-10-23 00:32

Track market sentiment with liquidity pools

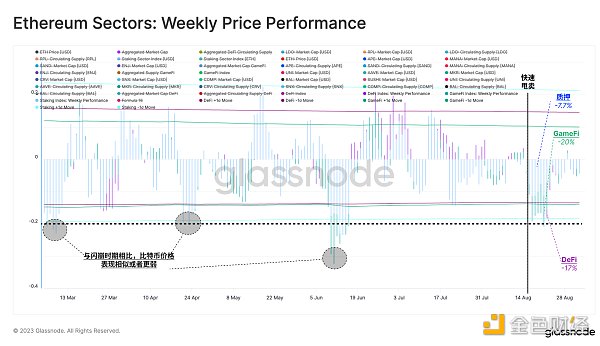

Author: Ding HAN, Alice Kohn, Glassnode; Source: glassnode

Summary

Over the past few weeks, digital asset markets have experienced increased volatility due to specific events, and at the same time, significant signs of capital outflows have emerged.

Derivatives markets are showing continued liquidity outflows, especially on ETH futures, implying that capital is moving from the highs of the risk curve to relatively safe positions.

We took a closer look at the many similarities between the Uniswap liquidity pool and the options market to decipher how liquidity providers view volatility and price.

Digital asset market awakens

In recent weeks, digital asset markets have emerged from a historically mild period of volatility. This is mainly caused by the following two key events:

August 17th Flash Crash BTC and ETH Dropped Separately -…

金色财经_·2023-09-06 00:35

Can the Livepeer (LPT) market break through the previous high when it starts again?

1. Project Introduction

Livepeer is a decentralized video streaming network built on Ethereum as a scalable platform-as-a-service that provides the real-time media layer of the decentralized development stack for developers who want to add live or on-demand video to their projects. solution. Livepeer can improve the reliability of video streaming for centralized broadcast services while reducing the costs associated with it by up to 50 times. Video streaming currently consumes 80% of all Internet bandwidth, and companies that distribute videos on the Internet need to transcode the video first (transcoding refers to the process of taking the original video file and reformatting it to ensure that whether it is using 2g or 5g bandwidth or different devices can achieve the best viewing experience), and Livepeer can greatly reduce this cost. The following is an example to introduce how Livepeer operates.

Alice is an application...

金色财经_·2023-09-04 09:09

5 Strategies to Reduce Side-Channel Attacks on Cryptocurrency Hardware Wallets

Author: ALICE IVEY, CPINTELEGRAPH; Compiler: Songxue, Jinse Finance

Cryptocurrency hardware wallets have become a trusted solution for protecting digital assets from online threats. However, even these seemingly indestructible devices are not immune to attack. Side-channel attacks exploit unintended information leakage in the physical implementation of a system and pose a significant risk to the security of cryptocurrency hardware wallets.

This article will delve into the world of side-channel attacks, explore their potential dangers, and outline five effective strategies to mitigate these attacks and protect your valuable crypto assets.

Understanding Side Channel Attacks

The goal of side-channel attacks is the physical realizability of the system, not its algorithm. They exploit information leaked during device operation, such as power consumption, electromagnetic emissions, or timing changes, to attack.

These subtle leaks can give attackers insight into sensitive data such as encryption keys, allowing...

金色财经_·2023-08-22 01:49

Load More