Search results for "BANK"

How Stablecoins Reveal Structural Limits in Traditional Banking

_Stablecoins reveal how instant settlement outperforms bank systems built on limits, delays, and account freezes._

_Real-world assets onchain now mirror cash and treasuries while moving freely without daily transfer caps._

_User experiences show legacy banking restricts access as

LiveBTCNews·1h ago

Xapo Bank Data Reveals Bitcoin-Backed Loans Tilt Toward Long-Term

Bitcoin (CRYPTO: BTC)-backed borrowing at the Gibraltar-based Xapo Bank is increasingly being used for long-term financial planning rather than short-term liquidity, according to the bank’s 2025 Digital Wealth Report. Shared with Cointelegraph, the study reveals that 52% of Bitcoin-backed loans

CryptoBreaking·6h ago

ING Launches Bitcoin, Ethereum, Solana ETPs for Retail Clients in Germany

ING Deutschland has expanded its retail lineup with regulated crypto-linked investment products, giving everyday investors exposure to digital assets without holding crypto directly.

According to details published on ING’s website, the German retail bank now enables trading in crypto

TheCryptoBasic·7h ago

"Short-term bear market" is not a cause for concern! Bernstein: Bitcoin will bottom out at $60,000 and is brewing a major comeback

Wall Street investment bank Bernstein analyst predicts that the downturn in the cryptocurrency market will end in 2026. Bitcoin may bottom out around $60,000 in the first half of the year and will gradually build a base for a rebound. Despite the current market weakness, institutional investment remains active, and governments may support Bitcoin as a sovereign asset.

区块客·8h ago

ING Opens Cryptocurrency! German Retail Customers Can Buy Bitcoin, ETH, and SOL ETPs

Germany's major retail bank ING opens up cryptocurrency ETNs, offering investments in Bitcoin, Ethereum, and Solana. Issued by 21Shares, Bitwise, and VanEck, customers do not need to manage wallets. Holding for over a year qualifies for tax exemption. ING still warns of extreme volatility, bankruptcy risks, and states that cryptocurrencies have no intrinsic value.

MarketWhisper·12h ago

The Link Between Trump's Fed Pick and Tether's 'Made in America' Stablecoin

In brief

Trump’s Fed chair pick Kevin Warsh advised a Tether-linked bank.

Anchorage Digital was tapped to issue Tether’s new USAT stablecoin.

Anchorage’s CEO said Warsh served as an advisor for years.

Kevin Warsh, President Donald Trump’s nominee to chair the Federal Reserve, helped

BTC-4.57%

Decrypt·21h ago

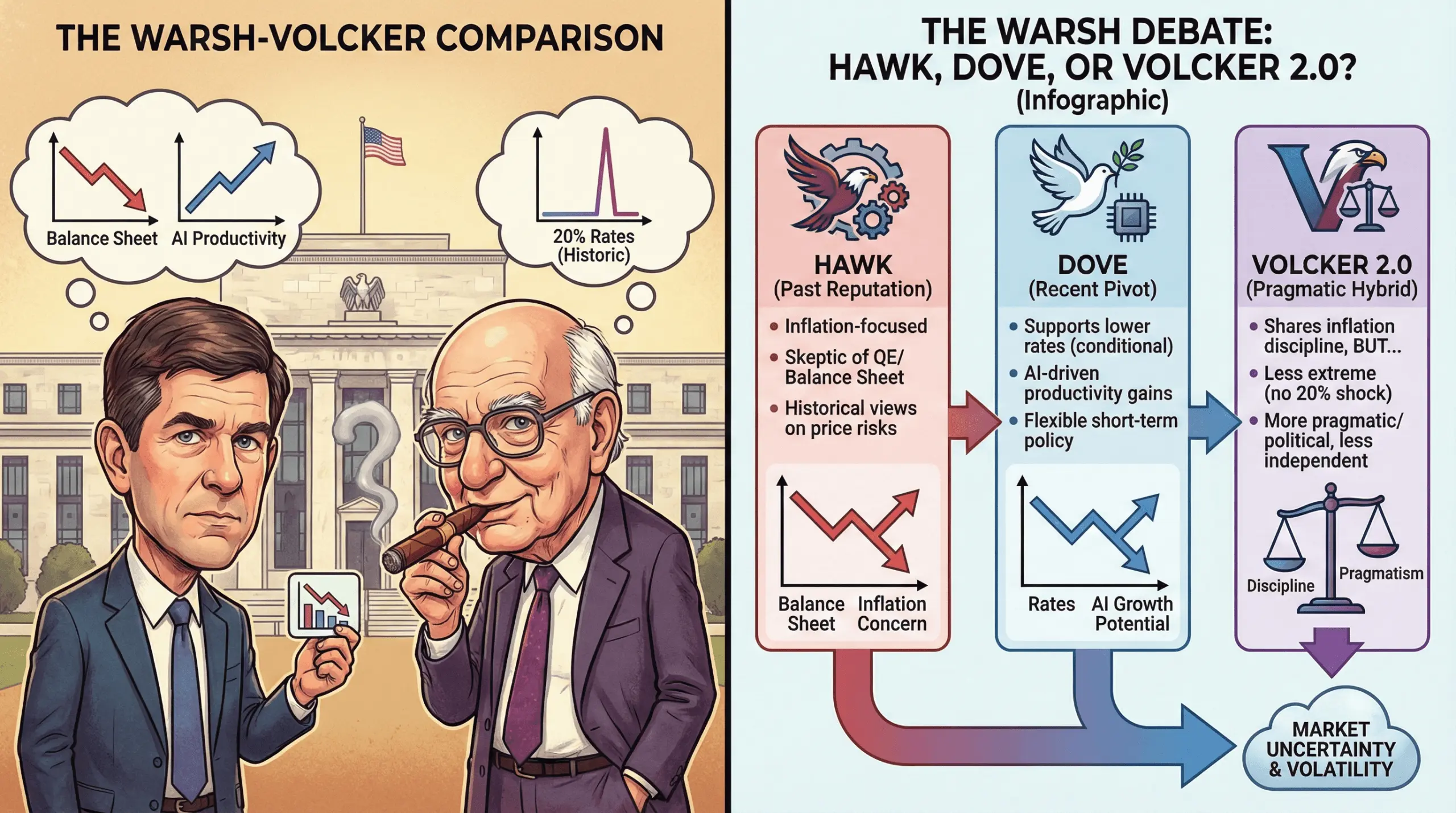

Is Kevin Warsh a Hawk, a Dove, or the Next Volcker? Markets Are About to Find Out

President Donald Trump has nominated former Federal Reserve governor Kevin Warsh to lead the U.S. central bank, instantly reviving an old debate with real market consequences: Is Warsh a hard-money hawk, a quiet dove, or something closer to a modern-day Paul Volcker?

Why Kevin Warsh’s Fed

Coinpedia·02-02 18:07

Why India’s e-Rupee Could Go Global

India is transitioning its domestic e-rupee initiative from a controlled digital payments experiment into a strategic instrument aimed at reshaping cross-border trade, remittances, and tourism flows. The central bank-backed digital rupee, issued by the Reserve Bank of India (RBI) and tested in

CryptoBreaking·02-02 16:00

Trump’s Fed Nomination: Mixed Signals on Bitcoin, US Liquidity

President Donald Trump has tapped former Federal Reserve governor Kevin Warsh to lead the central bank, a move that has rippled through crypto markets and liquidity expectations in the U.S. ahead of a potential Senate confirmation. The nomination was announced on Friday, with Warsh positioned to

CryptoBreaking·02-02 14:55

The Two-Track Tango: How Nomura’s Crypto Retreat Exposes the Mature Playbook of TradFi

Japanese financial giant Nomura has simultaneously announced a reduction in its cryptocurrency trading exposure due to quarterly losses at its Laser Digital subsidiary while aggressively filing for a U.S. national trust bank charter for that same unit.

This seemingly contradictory move reveals a sophisticated, two-track institutional strategy that rigorously separates volatile, short-term proprietary trading from long-term infrastructure investment. The event is a critical signal that th

CryptopulseElite·02-02 06:46

Libya to Iran miracle: National blackout, but Bitcoin miners keep running

In Iran and Libya, countries ravaged by sanctions and civil war, electricity is no longer just a public service but has become a hard currency that can be "financially exported." When hospitals go dark due to power outages, Bitcoin mining rigs never stop running. This energy arbitrage game reveals the absurdity and imbalance of resource allocation. This article is adapted from a piece in On-Chain Revelation, compiled, translated, and written by Foresight News.

(Previous context: The Central Bank of Iran secretly hoarded 500 million USD worth of USDT last year! It was revealed that this was used to stabilize the Rial exchange rate and respond to international sanctions.)

(Additional background: Night of the risk asset scare, under what conditions would the US go to war with Iran?)

Table of Contents

1. Power Run: When Energy Becomes a Financial Tool

2. Two Countries, Two Mining Histories

Iran: From "Export Energy" to "Export Hashpower"

Libya: Cheap

動區BlockTempo·02-02 04:00

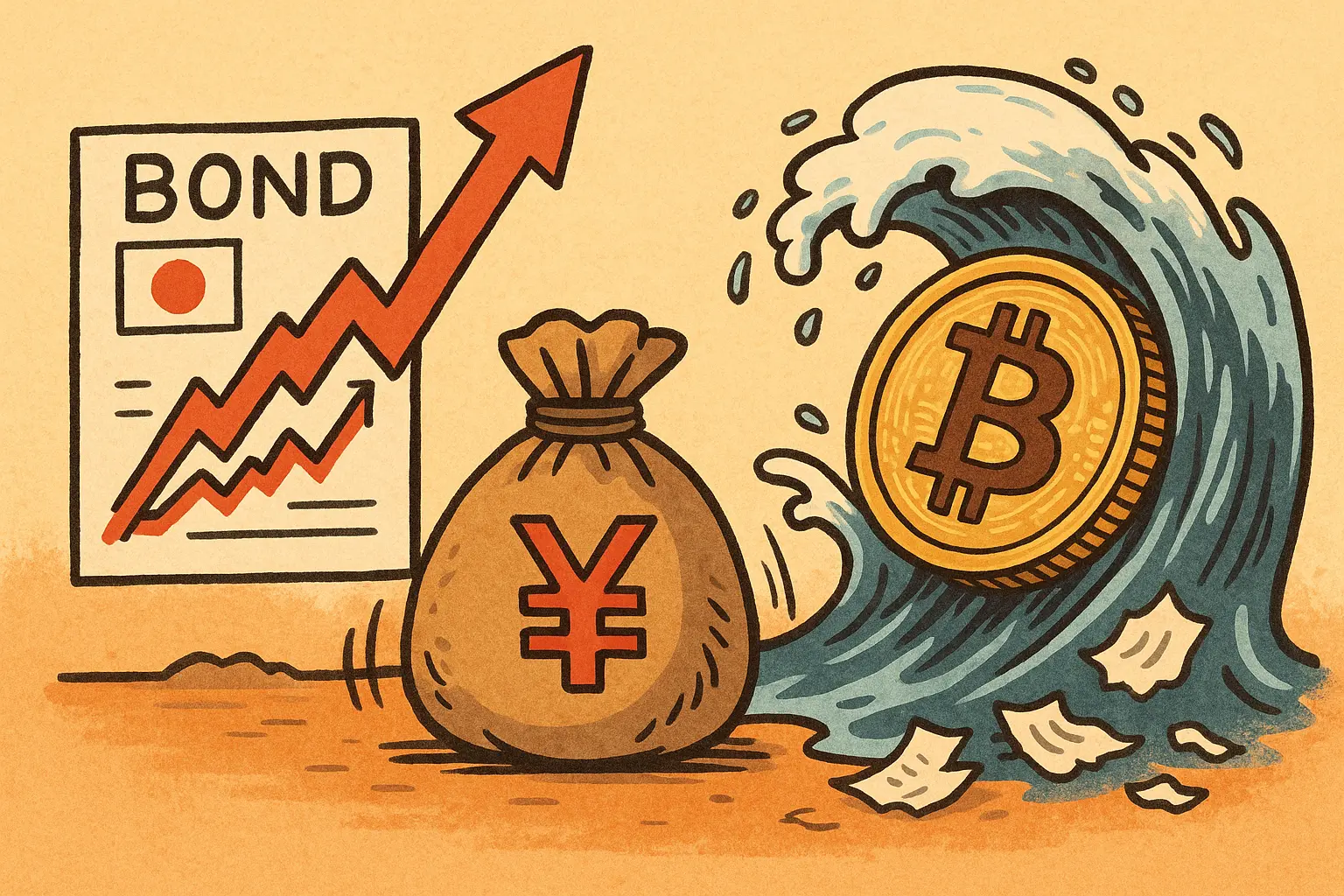

Japanese bond chaos threatens record Bitcoin liquidation as cheap money ends

Japan used to be a paradise for cheap borrowing transactions to invest for high returns. Investors could borrow yen at extremely low interest rates, buy almost any asset with higher yields, hedge just enough to "be responsible," and assume that the Bank of Japan (BOJ) would keep fluctuations at a low level.

BTC-4.57%

TapChiBitcoin·02-02 03:37

2026 First Bank Collapse! Chicago Bank Bankruptcy Sparks 2023 Chain of Crises Panic

Chicago Metropolitan Capital Bank has officially failed, becoming the first case in 2026. The regulator closed it due to insufficient capital, FDIC took over and transferred deposits to First Independent Bank. The first case after zero bankruptcies in 2025, reigniting memories of Silicon Valley Bank in 2023, with the crypto community leveraging this to promote a decentralized narrative.

MarketWhisper·02-02 03:02

JPMorgan Sees Gold Topping $8,000 as Private Investors Boost Allocations

Gold’s rally could push into uncharted territory as investors rethink portfolio defenses, with JPMorgan signaling that shifting household and central bank behavior may drive prices far beyond recent records amid persistent global uncertainty.

Gold Momentum Builds as JPMorgan Cites Technicals

BTC-4.57%

Coinpedia·02-02 02:37

Ripple Signals Institutional Shift as Banks Embrace Tokenization and Payments Strategy

Major banks are rapidly warming to digital asset payments and tokenization as strategic priorities, with senior directors signaling a clear shift from theoretical debate to real-world execution inside regulated financial systems.

Ripple Says Bank Directors Have Moved From Why to How on Digital

XRP-4.09%

Coinpedia·02-02 01:32

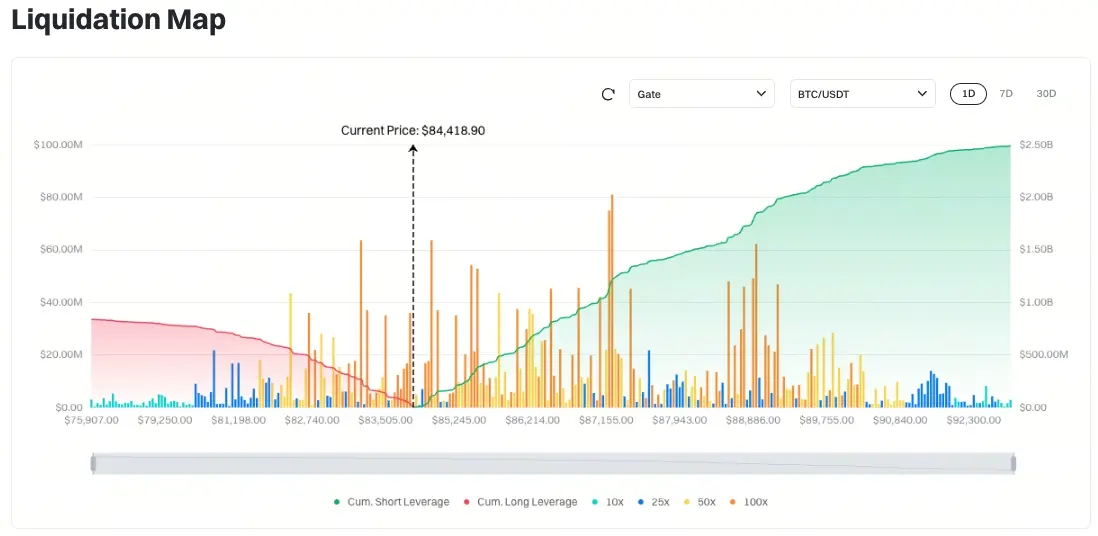

Japan's 40-year government bond yield breaks 4%! Yen arbitrage trading triggers $2.5 billion in Bitcoin liquidations

The era of "free funds" that Japan has maintained for decades has officially come to an end. On January 23, the Bank of Japan kept the policy rate at 0.75% but hinted that it will raise interest rates in the future. The 40-year government bond yield broke through 4%, and liquidity indicators rose to a record high. Forced liquidations of yen arbitrage trades triggered a chain reaction, with Bitcoin plummeting from $89,398 to $75,500, and daily liquidation amounts exceeding $2.5 billion.

MarketWhisper·02-02 01:31

Arab Bank Group Reports Record Net Profit of USD 1.13 Billion for 2025, 40% Cash Dividends

Arab Bank Group achieved strong financial performance for the year ending December 31, 2025, with a net profit after tax USD 1130 million compared to USD 1007 million in 2024, reflecting a growth of 12%. The Group’s equity position also reflects financial stability and resilience, standing at USD 13

BTC-4.57%

CryptoBreaking·02-01 16:20

Visa, Mastercard Doubt Stablecoins for Daily Payments

Visa says stablecoins lack product market fit in developed markets where fast bank payments already meet consumer needs.

Mastercard supports stablecoins as a currency on its rails, partnering widely while rejecting disruption of existing networks.

Despite on chain growth and SoFi

CryptoFrontNews·02-01 13:16

Latam Insights: Venezuelan Oil Flows to the US Again, El Salvador Buys the Gold Dip

Welcome to Latam Insights, a compilation of the most relevant crypto news from Latin America over the past week. In this edition, Citgo buys Venezuelan heavy crude once again, El Salvador buys the gold dip, and Nubank receives approval to launch as a digital bank in the U.S.

Citgo’s Venezuelan

Coinpedia·02-01 12:35

UAE Sets Global Precedent With Regulated Crypto Payments in Insurance

Zodia Custody, a subsidiary of Standard Chartered bank, has partnered with Dubai Insurance to allow users to pay premiums in crypto.

The insurer says that the initiative will establish the company as a market leader, while also integrating digital assets as adoption has spiked in the

TOKEN-7.37%

CryptoNewsFlash·02-01 10:16

Silver Wiped Out 28% in a Day as Bank Short Covering Raises New Manipulation Fears

The Silver price saw a brutal selloff on Friday, dropping 28% in a single session and erasing massive value across the market. The move shocked traders, not just because of the size of the decline, but because of what appeared to happen at the lows.

As silver price hit its bottom, data

KAS-0.03%

CaptainAltcoin·02-01 10:05

Bank of Ghana Rolls Out Digital Asset Literacy Initiative After VASP Act Passage

_Ghana shifts focus to crypto investor education as new laws bring digital assets under formal regulation._

Ghana’s digital asset market is entering a period of formal regulation following recent legal reforms. With cryptocurrency services now regulated, authorities have shifted focus toward

LiveBTCNews·01-31 22:05

U.S. bank license approval experiences a 'turnaround'... XRP, why are skeptical investors turning away?

Renowned crypto analyst Mena Wells has reversed her stance on Ripple (XRP), calling it a "world currency," and acknowledging that her previous criticisms were misguided. This shift stems from Ripple obtaining a US banking license, proving its status as a regulated bank. Although Wells remains cautious about XRP's prospects, believing the price will stay low, she emphasizes the importance of accurately assessing projects.

TechubNews·01-31 21:18

Arab Bank Group Reports Record Net Profit of USD 1.13 Billion for 2025, 40% Cash Dividends

Arab Bank Group achieved strong financial performance for the year ending December 31, 2025, with a net profit after tax USD 1130 million compared to USD 1007 million in 2024, reflecting a growth of 12%. The Group’s equity position also reflects financial stability and resilience, standing at USD 13

CryptoBreaking·01-31 16:15

Visa, Mastercard Doubt Stablecoins for Daily Payments

Visa says stablecoins lack product market fit in developed markets where fast bank payments already meet consumer needs.

Mastercard supports stablecoins as a currency on its rails, partnering widely while rejecting disruption of existing networks.

Despite on chain growth and SoFi

CryptoFrontNews·01-31 13:11

Ghana Further Formalizes Digital Asset Sector with Education Campaign

Following the passage of the virtual asset service providers (VASP) Act (Act 1154), the Bank of Ghana has launched the National Virtual Assets Literacy Initiative.

Strengthening Oversight and Consumer Protection

The Bank of Ghana (BOG) recently launched a cryptocurrency awareness initiative

Coinpedia·01-31 11:37

UAE Sets Global Precedent With Regulated Crypto Payments in Insurance

Zodia Custody, a subsidiary of Standard Chartered bank, has partnered with Dubai Insurance to allow users to pay premiums in crypto.

The insurer says that the initiative will establish the company as a market leader, while also integrating digital assets as adoption has spiked in the

TOKEN-7.37%

CryptoNewsFlash·01-31 10:15

First U.S. Bank Failure of 2026 Sparks Market Attention

Chicago's Metropolitan Capital Bank has collapsed due to weak capital and unsafe conditions, marking the first U.S. bank failure of 2026. However, the FDIC has ensured depositors' protection while fears of broader contagion remain contained.

BTC-4.57%

Coinfomania·01-31 09:56

U.S. Bank Could Turn $10,000 to $73,000 in 40 Years, But XRP in 9 Months

Market data shows that XRP recently achieved in nine months the same returns that a U.S. online bank would require 40 years to generate.

Despite witnessing multiple periods of bearish price action and price uncertainties, XRP has always proven its penchant for outsized growth during market

XRP-4.09%

TheCryptoBasic·01-31 05:56

Bitwise Investment Chief predicts: Bitcoin will surge to $6.5 million within 20 years, with central banks and institutions driving the next bull market.

Bitwise Chief Investment Officer Matt Hougan is optimistic about the long-term prospects of Bitcoin, predicting that it could surpass $6.5 million per coin within the next 20 years. Institutional investment and central bank attention will become key drivers of the next bull market. Currently, the market is in the bottom-building phase, and in the short term, it may continue to consolidate between $75,000 and $100,000. Hougan believes that Bitcoin is an upgraded version of gold with enormous future potential.

動區BlockTempo·01-31 05:15

Caleb & Brown Activates Ripple Payments, Strengthening XRP Utility

Caleb & Brown has launched Ripple payments, enhancing USD bank transfers for faster fiat withdrawals and showcasing XRP as a practical asset in real-world transactions, signaling increased utility beyond speculation.

XRP-4.09%

Coinpedia·01-31 02:36

Investing 507.8 billion KRW… Kazakhstan begins to establish a "cryptocurrency national reserve"

The Kazakhstani government has invested 507.8 billion KRW to establish a national cryptocurrency reserve fund, with the main institution being a subsidiary of the central bank. Initially, it will invest indirectly through hedge funds. This move demonstrates an intention to view cryptocurrencies as a tool for economic stability, reflecting the country's recognition of digital assets and a shift in investment strategy.

BTC-4.57%

TechubNews·01-30 23:05

Nubank Secures Conditional Approval for US National Bank Charter

Nubank has cleared a significant regulatory hurdle in the United States, securing conditional approval from the Office of the Comptroller of the Currency (OCC) to form a national bank. The decision paves the way for the fintech to build a U.S.-based bank platform capable of handling deposits,

CryptoBreaking·01-30 17:35

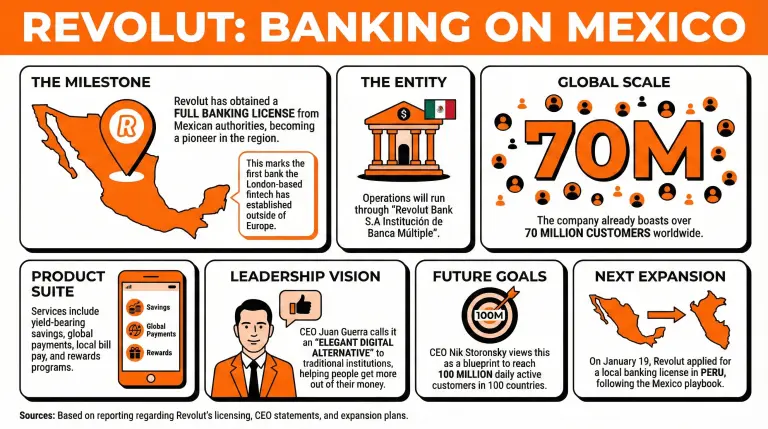

Revolut Becomes a Digital Bank in Mexico as Part of Strategic Expansion

Revolut has begun offering full banking services in Mexico after receiving a banking license through a direct application. The neobank aims to cater to a digital-first market seeking a trusted alternative to traditional banking institutions.

Revolut Reaches Milestone in Mexico, Becomes a Full

Coinpedia·01-30 11:40

Kazakhstan Plans State Crypto Reserve Using Seized Digital Assets and Central Bank Investment Oversight

Kazakhstan plans a state crypto reserve using seized digital assets under central bank oversight framework and custody.

The reserve combines seized crypto with foreign currency and gold to limit risk and improve transparency controls.

Authorities route crypto exposure through hedge

CryptoNewsLand·01-30 11:36

UAE Sets Global Precedent With Regulated Crypto Payments in Insurance

Zodia Custody, a subsidiary of Standard Chartered bank, has partnered with Dubai Insurance to allow users to pay premiums in crypto.

The insurer says that the initiative will establish the company as a market leader, while also integrating digital assets as adoption has spiked in the

TOKEN-7.37%

CryptoNewsFlash·01-30 10:11

Kevin Warsh Fed Chair Nomination Sparks Market Turbulence: What It Means for Crypto

President Donald Trump is poised to nominate former Federal Reserve Governor Kevin Warsh as the next Chair of the U.S. central bank, a move that sent immediate ripples through global financial markets.

As reports solidified on January 30, prediction market Polymarket saw Warsh's odds surge above 94%, triggering a classic "risk-off" reaction: the dollar strengthened, gold tumbled over 2.7%, and Bitcoin dipped 1.6%. This analysis delves into the implications of a Warsh-led Fed, examining h

CryptopulseElite·01-30 07:19

El Salvador invests an additional $50 million in gold. Does this shake the dollar-cost averaging strategy for Bitcoin?

El Salvador's central bank announced a $50 million investment in gold, bringing gold reserves to $360 million, while holding $618 million in Bitcoin. The total assets approach $1 billion. The country has adopted a dual-reserve strategy with gold and Bitcoin, aiming to diversify risk and reduce dependence on a single currency, but also faces challenges from market price fluctuations.

BTC-4.57%

動區BlockTempo·01-30 03:44

Copper Eyes Public Debut: IPO Talks Signal Crypto’s Shift to Wall Street’s Plumbing

London-based crypto custody leader Copper is reportedly in preliminary discussions regarding an Initial Public Offering (IPO), engaging with heavyweight investment banks including Goldman Sachs, Citigroup, and Deutsche Bank.

This exploration follows closely on the heels of rival BitGo's successful \$2 billion NYSE listing, highlighting a pivotal market evolution where investor focus is shifting from speculative tokens to the essential, institutional-grade infrastructure underpinning the

CryptopulseElite·01-30 02:56

El Salvador’s Dual Pivot: Stockpiling Gold and Bitcoin in Defiance of IMF Pressure

El Salvador continues to make bold moves on the global financial stage, with its central bank purchasing \$50 million in gold and its government persistently adding to its Bitcoin treasury.

This dual strategy has pushed the nation's gold reserves above \$360 million and its Bitcoin holdings to 7,547 BTC, valued at approximately \$635 million. These actions unfold against a tense backdrop of negotiations with the International Monetary Fund (IMF), which has pressured the country to cease

CryptopulseElite·01-30 02:42

Crypto company Copper prepares for an IPO! Goldman Sachs, Citigroup and Deutsche Bank rushed into the custody track

Copper negotiated an IPO, with Goldman Sachs and Citibank participating in the underwriting, depending on revenue performance. BitGo plummeted after rising 36% on the first day of its IPO last week. In 2025, 11 crypto companies will go public and raise $146 billion. Copper, which provides MPC custody, settlement services, has appointed a compliance officer and a new CEO.

MarketWhisper·01-30 02:01

Gate Daily (January 30): Trump declares a national emergency and Cuban tariffs; The United States will announce a new chairman of the Federal Reserve next week

Bitcoin (BTC) collapsed violently in the short term, temporarily trading at around $84,140 on January 30. Trump declared a national emergency and imposed tariffs on countries that send oil to Cuba, causing risk assets to fall. Trump said that a new Fed chairman will be nominated next week, and interest rates should be 2 to 3 percentage points lower. El Salvador's central bank has put $5,000 in gold in reserves and continues to increase its holdings in Bitcoin.

MarketWhisper·01-30 01:21

Ripple forced the palace to work! SWIFT 2026 promotes transparent payment to protect bank territory

SWIFT announced the launch of a new retail payment solution on January 29, which will be launched in the first half of 2026, with 40 banks participating. Promising transparent fees, full payment, and status tracking, responding to Ripple's criticism. However, the funds still go to the agent bank and do not touch the settlement layer. Ripple pilots blockchain settlement in Saudi Arabia, Switzerland, and Japan to reduce capital costs. SWIFT changed the interface, Ripple changed the underlying layer, and the two systems coexisted.

XRP-4.09%

MarketWhisper·01-30 00:45

Crypto, Banks, and the White House Clash Over Stablecoin Rewards

_White House mediates bank and crypto clash over stablecoin rewards as Senate delays the Clarity Act and broader US crypto rules up._

The White House is moving to address rising tensions between crypto firms and banks over stablecoin rewards.

The dispute has slowed progress on federal crypto l

LiveBTCNews·01-29 17:35

The US dollar is weakening, but Bitcoin remains "stagnant." What is the reason behind this?

The US dollar has weakened but has not ignited Bitcoin's rally as it usually does. This "unusual trend" has attracted market attention. JPMorgan Private Bank believes that the key is not Bitcoin itself, but that this wave of dollar decline is fundamentally different from previous ones.

The US Dollar Index (DXY), which measures the dollar against major currencies, has fallen about 10% over the past year; however, Bitcoin, often seen as a "beneficiary of a weak dollar," has actually fallen 13% during the same period.

Yuxuan Tang, Head of Asia Macro Strategy at JPMorgan Private Bank, pointed out that the recent dollar depreciation is driven by short-term capital flows and market sentiment, rather than changes in market expectations for the US economy or monetary policy.

He mentioned: "In fact, since the beginning of the year, the interest rate differential has been moving in a direction favorable to the dollar. Currently, what we see is..."

区块客·01-29 12:32

Ripple Partners With Riyad Bank’s Jeel to Advance Saudi Arabia’s Vision 2030 Blockchain Strategy

Ripple has announced a new partnership with Jeel, the tech arm of Riyad Bank, one of Saudi Arabia’s largest banks.

The two will explore how blockchain can be integrated into the country’s national financial systems, including in cross-border payments.

Ripple has signed a Memorandum of

XRP-4.09%

CryptoNewsFlash·01-29 09:10

White House Meets Crypto and Banking Leaders to Resolve Stablecoin Rules in Crypto Bill

The White House plans a meeting with crypto and bank executives to resolve disputes delaying a crucial crypto market structure bill, primarily concerning stablecoin regulation. Banks oppose rewards for stablecoin users, fearing deposit losses, while crypto firms argue such rewards benefit consumers.

TheNewsCrypto·01-29 07:52

UAE’s First Central Bank-Registered USD Stablecoin Goes Live

Abu Dhabi-based Universal Digital has launched USDU, the UAE’s first USD-backed stablecoin to be registered as a Foreign Payment Token under the Central Bank of the UAE’s Payment Token Services Regulation (PTSR). The registration marks a milestone for the Gulf state’s digital-asset framework,

CryptoBreaking·01-29 07:50

The UAE Central Bank approves USD stablecoin USDU, the first regulated settlement token that complies with the regulatory framework.

The Central Bank of the United Arab Emirates officially approves the first USD stablecoin USDU as a tool for cross-border settlement and virtual asset trading. USDU is issued by Universal Digital, fully backed by USD reserves, stored in a protected account at a top UAE bank, aiming to provide institutional investors with a secure capital flow channel and showcase the UAE's competitiveness in digital asset regulation.

動區BlockTempo·01-29 07:20

Load More