Search results for "BENQI"

A New Era of Capital Efficiency with BENQI: Achieve Up to 95% LTV Leverage with sAVAX?

If you are still just staking AVAX on Avalanche, now is the time to take the next step.

Did you know? By further using staked assets for leveraged operations, you can not only earn profits but also release more liquidity!

Step 1: Stake AVAX on BENQI to earn sAVAX!

Through BENQI's Liquid Staking feature, you can stake AVAX to receive sAVAX.

sAVAX is a liquidity token that reflects staking interest and can be flexibly used in DeFi.

Step 2: Use sAVAX as collateral → In

BENQI2.31%

TechubNews·2025-07-30 05:31

BENQI continues to lead Avalanche Decentralized Finance innovation, showcasing at the EthCC Rooftop Sunset event.

BENQI, as an important DeFi project in the Avalanche ecosystem, continuously expands its protocol functions, enhances capital efficiency, and launches core products such as liquid staking, lending markets, Node deployment, and governance voting. It has become the application with the highest TVL ranking and will participate in offline activities during EthCC to strengthen its ecological influence.

TechubNews·2025-06-09 08:43

Balancer V3 officially launches on Avalanche: sAVAX leads a new wave of composable Decentralized Finance.

According to official news from Benqi, the decentralized trading and asset management protocol Balancer has announced that its V3 version has officially been deployed on the Avalanche Mainnet, initiating a new chapter of composable DeFi within the Avalanche ecosystem. This integration not only unlocks more efficient yield channels for Liquidity Providers (LPs) but also builds a multi-protocol linked yield engine centered around sAVAX.

Multi-protocol Integration: Creating Native Yield Machines

The deployment of Balancer V3 on Avalanche marks the official launch of a highly composable DeFi infrastructure. One of its featured pools - sAVAX / ggAVAX /

TechubNews·2025-05-06 07:22

BENQI: Empowering asset liquidity and reshaping the financial landscape of the Avalanche ecosystem.

With the development of the Decentralized Finance (DeFi) sector, users are concerned about asset appreciation and liquidity balance. BENQI in the Avalanche ecosystem offers innovative liquid staking and lending markets, reshaping the staking experience and improving asset utilization efficiency. The IGNITE program drops the participation threshold for Nodes, and a comprehensive governance system ensures network transparency and democracy. Security audits guarantee the safety of user funds. BENQI plays an important role in the Avalanche ecosystem, driving the development of Web3 finance.

TechubNews·2025-04-29 08:37

Not chasing AI, not buying Memes, smart money is steadily making profits on the Avalanche C chain.

You may not have noticed, but Avalanche's C-Chain has recently become popular again.

While the majority of ecosystems see a slow decline in TVL and market discussions are dominated by AI, Restaking, and Memes, Chain C has quietly rebounded against the trend: active addresses have increased for three consecutive weeks, mainstream protocol TVL has risen again, and even the "forgotten" old project BENQI has made a strong comeback.

At the same time, Avalanche launched the Visa virtual card, and the Core wallet supports免

世链财经_·2025-04-28 02:57

No chasing AI, no buying Memes, smart money is steadily making profits on the Avalanche C chain.

Author: 0xResearcher

You may not have noticed, but Avalanche's C-Chain has recently become popular again.

While the majority of ecosystems are experiencing a slow decline in TVL and market discussions are dominated by AI, Restaking, and Memes, the C chain has quietly rebounded against the trend: active addresses have increased for three consecutive weeks, mainstream protocol TVL has risen again, and even the "forgotten" old project BENQI has made a strong comeback.

At the same time, Avalanche launched the Visa virtual card, and the Core wallet supports免

DeepFlowTech·2025-04-27 07:44

When smart money no longer talks about "stories": where are they looking?

You may not have noticed, but Avalanche's C chain has been hot again recently.

While the majority of ecosystems are experiencing a slow decline in TVL and the market is filled with discussions around AI, Restaking, and Memes, Chain C has quietly rebounded against the trend: active addresses have increased for three consecutive weeks, the TVL of mainstream protocols has risen again, and even the "forgotten" old project BENQI has made a strong comeback.

At the same time, Avalanche launched the Visa virtual card, and the Core wallet supports免

COINVOICE(链声)·2025-04-25 02:19

sAVAX staking volume突破 997 万枚,Benqi 成为市场动荡期的优质收益选择

Benqi Finance, the leading DeFi protocol in the Avalanche ecosystem, has once again ushered in a peak of growth. The cumulative pledge volume of its liquid staking product, sAVAX, recently exceeded 9.97 million AVAX, equivalent to about $190 million, the highest level since the all-time high in November 2024, and the value continues to grow.

According to Flipside Crypto's on-chain data, this rapid growth trend shows that in the current market uncertainty, more and more funds are flowing into Benqi in pursuit of the dual goals of stable income and asset efficiency.

Stable annualized 5.23%, sAVAX stands out in a volatile market.

Benqi's sAVAX product offers approximately 5.23%

TechubNews·2025-04-21 16:17

BENQI has launched a new UI to create a faster and more concise DeFi experience, ushering in a new era of protocol revolution

In the current uncertain crypto market, projects that continue to innovate and adhere to long-termism are becoming increasingly scarce. BENQI, a leading decentralized liquid staking and lending platform in the Avalanche ecosystem, has once again demonstrated the power of the "builder spirit" through its actions. Today, BENQI officially launched its brand new user interface (UI), and through this upgrade, it has initiated a comprehensive transformation of its product experience and functional system.

This UI upgrade is not just a visual optimization, but a systematic reconstruction focused on enhancing user experience and performance. The new interface is faster and more concise, providing users with a clearer operational process and a smoother interactive experience, while laying a solid foundation for future feature expansion. As one of the most representative infrastructures in the Avalanche ecosystem, this upgrade of BENQI marks its platform's entry into the next phase: a user-centric.

TechubNews·2025-04-09 09:22

A major addition to the Avalanche ecosystem! Balancer V3 has been shockingly deployed: will it bring a liquidity revolution?

The deployment of Balancer V3 on Avalanche is like the opening of an innovative bubble tea shop to improve DeFi liquidity. The integration of BENQI and Aave makes it easier to migrate funds and increase revenue. Low governance engagement reveals potential problems that require more user involvement. The Avalanche ecosystem is growing rapidly, and the trend of RWA tokenization is steadily advancing. The Balancer V3 expansion heralds more innovative applications. Overall, the deployment of Balancer V3 promotes the development of the Avalanche ecosystem, and governance participation still needs attention.

ForesightNews·2025-04-03 09:23

QI & LUCE Surge 20%+, but BitLemons' Million-Dollar Raise Points to Even Bigger Gains Ahead!

QI (Benqi) surged 21.98% with explosive 600% volume growth despite mixed signals from its lending protocol, while LUCE jumped 31.32% on the back of its NFT philanthropy initiative though questions linger about long-term viability. Meanwhile, innovative GambleFi heavyweight BitLemons ($BLEM)

CryptoDaily·2025-02-07 14:12

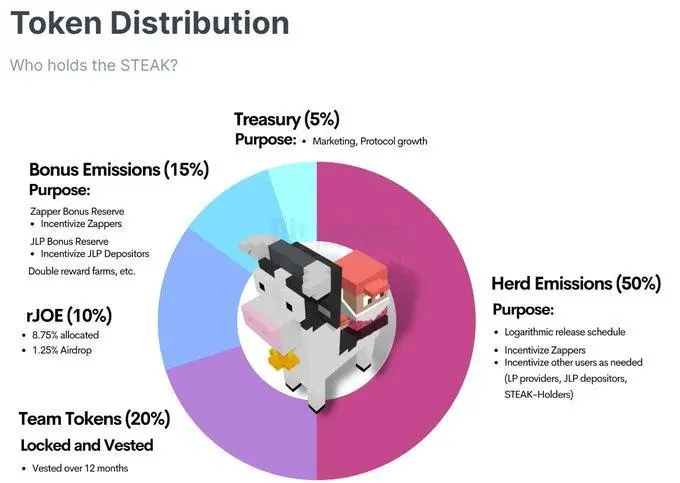

Rising over 70% in a week, how does SteakHut V2 build DeFi’s “liquidity layer”?

> V2 will become the “liquidity layer” for DeFi across multiple chains and DEXs, which means capital efficiency, automated strategies, real returns, and friendly user experience across the ecosystem.

Written by: Luccy

On November 14, SteakHut completed a seed round of financing led by ys Capital, with participation from Blizzard, Avalaunch, angel investors, BenQi founder Hansen, Camelot founder Ironboots and GMX founder Coinflipcanada.

SteakHut is a LP dynamic management + liquidity mining platform based on Trader Joe. Its native token STEAK has increased in price in the past 7 days.

ForesightNews·2024-01-05 11:55

Load More