Search results for "BID"

Uniswap Labs launches native auction feature: A milestone for bringing tokens to the market

Uniswap Labs has launched a new feature called Auctions, enabling users to explore, bid, and acquire tokens directly on its platform. This continuous cash auction model promotes fair token launches, with automatic transition to secondary markets post-auction.

TapChiBitcoin·5h ago

Gold Reaches Record High Above $5K as Bitcoin Falls Under $86K

Gold surges to multi-decade highs as geopolitical risk and tariff tensions fuel a metals bid, while Bitcoin drifts lower in a widening gap with traditional safe havens. Prices for gold topped the $5,000 level, climbing to a record around $5,080 on Monday after a robust year-to-date rally of

BTC1.92%

CryptoBreaking·01-27 04:10

Gold Reaches Record High Above $5K as Bitcoin Falls Under $86K

Gold surges to multi-decade highs as geopolitical risk and tariff tensions fuel a metals bid, while Bitcoin drifts lower in a widening gap with traditional safe havens. Prices for gold topped the $5,000 level, climbing to a record around $5,080 on Monday after a robust year-to-date rally of

BTC1.92%

CryptoBreaking·01-26 04:05

OCC Advances Trump-Backed WLF Bank Charter Application

Introduction The Office of the Comptroller of the Currency defended its review process for World Liberty Financial’s bid for a national trust bank charter, rejecting a call from Senator Elizabeth Warren to pause the review while the President divests his stake in the crypto platform. Officials

CryptoBreaking·01-25 01:40

OCC Advances Trump-Backed WLF Bank Charter Application

Introduction The Office of the Comptroller of the Currency defended its review process for World Liberty Financial’s bid for a national trust bank charter, rejecting a call from Senator Elizabeth Warren to pause the review while the President divests his stake in the crypto platform. Officials

CryptoBreaking·01-24 01:35

Bitcoin, Ethereum ETFs Shed $1 Billion Amid Trump Waffling on Greenland and Tariffs

In brief

Spot Bitcoin and Ethereum ETFs shed a combined $996 million on Wednesday.

Investors’ retreat came amid a twist in President Donald Trump’s bid for Greenland.

Bitcoin is behaving like a risk-on asset, according to an analyst.

Investors pulled nearly $1 billion from

Decrypt·01-22 17:20

Learn Negotiation from Trump|What is TACO Trading? Understand his "initial bid, then retreat" extreme pressure philosophy

Trump's "TACO trading" strategy triggered panic through extreme tariff threats, then retreated at the right time to gain bargaining chips. This "shock first, concede later" approach is effective but also carries risks. As countries gradually become accustomed to this strategy, Trump's threat effectiveness may diminish. If a real crisis occurs in the future, the consequences are unpredictable. Countries need to remain vigilant against threats while also demonstrating negotiation resilience.

動區BlockTempo·01-22 07:55

Can Grayscale’s NEAR ETF unlock a fresh spot bid for NEAR price at $2–$3?

Grayscale files to convert its NEAR Trust into a spot ETF with staking, NYSE Arca listing, and Coinbase custody, raising questions about NEAR's next price trend.

Summary

Grayscale filed a Form S‑1 to convert Grayscale Near Trust into a spot NEAR ETF on NYSE Arca, mirroring its spot Bitcoin ETF

Cryptonews·01-21 13:54

Mastercard Reportedly Eyes Zerohash Stake After Failed $2B Takeover Bid

Mastercard is pivoting from a full acquisition to a strategic investment in crypto infrastructure giant Zerohash, following the blockchain company's decision to remain independent, sources reveal.** **

The shift comes after advanced talks for a deal valued up to \$2 billion reportedly stalled last year. This move underscores a significant trend: traditional finance titans are aggressively seeking footholds in the digital asset ecosystem by backing essential, revenue-generating infrastruct

BID4.19%

CryptopulseElite·01-21 02:52

Japan's 40-year government bond yield breaks 4%, hitting a record high, while 20-year auction demand remains weak.

The Japanese bond market experienced intense volatility, with the 40-year government bond yield surpassing 4% for the first time, hitting a record high. The reasons include concerns over Prime Minister Fumio Kishida's tax cut policies. Demand for the 20-year government bond auction was weak, with bid-to-cover ratios below expectations. Insurance companies set a record by selling long-term bonds, and foreign holdings increased. The market is focused on the upcoming Bank of Japan meeting and political risks.

動區BlockTempo·01-20 07:00

Nasdaq Orders Canaan to Boost Its Share Price or Face Delisting

Introduction

Canaan Inc., a maker of crypto mining hardware, faces Nasdaq scrutiny after its shares plunged over the past year and briefly traded below the $1 threshold for an extended period. The regulator’s warning gives the China-based company 180 days to lift its closing bid price above $1 for

CryptoBreaking·01-20 04:25

Revolut Accelerates Latin American Expansion Drive with Peru Banking License Bid

Revolut, the \$75 billion European fintech titan, has formally applied for a full banking license in Peru, marking a decisive escalation in its Latin American expansion strategy.

This move, led by newly appointed Peru CEO Julien Labrot, aims to challenge the nation's highly concentrated banking sector, where the top four banks control 82% of all loans. With a focus on remittances and multi-currency services for a population where 1 million depend on funds from abroad, Revolut's entry pro

BID4.19%

CryptopulseElite·01-20 02:35

Dark Pools and the Hidden Side of Crypto Trading

Introduction

When you trade in the crypto market on centralized exchanges, you can see order books, ask and bid prices and trade data on your screens. On decentralized exchanges, this is not the case. There are no order books or ask and bid prices. Yet, you can see buying and selling on chain.

BlockChainReporter·01-19 13:13

Nasdaq Orders Canaan to Boost Its Share Price or Face Delisting

Introduction

Canaan Inc., a maker of crypto mining hardware, faces Nasdaq scrutiny after its shares plunged over the past year and briefly traded below the $1 threshold for an extended period. The regulator’s warning gives the China-based company 180 days to lift its closing bid price above $1 for

CryptoBreaking·01-19 04:20

Binance Delists 4 Coins, With AI and Legendary Auto DeLorean in Focus - U.Today

Binance's decision to delist several tokens linked to innovative concepts has sent them into decline. The market reacted sharply, with BID experiencing a significant drop, while others like DMC and TANSSI faced steep declines. Binance cited volatility and liquidity issues as reasons for the move, indicating a setback for futuristic projects.

UToday·01-18 17:03

Amazon Launches New Chatbot-Style Interface for Alexa

In brief

Amazon announced Alexa.com on Monday, bringing its Alexa+ assistant to a browser-based, chat-style interface.

The early access product lets users manage tasks, upload documents, and view Ring camera feeds from the web.

Alexa.com offers text and image generators in a bid to

Decrypt·01-06 01:26

Challenge the longest consecutive rally in 3 months! Analyst: Bitcoin enters a bull market

Bid farewell to the dull end of 2025, as the cryptocurrency market begins 2026 with a strong rebound. Bitcoin rose over 1% during Asian trading hours on Monday, expected to mark its fifth consecutive day of gains, the longest streak since early October last year.

According to CoinGecko data, Bitcoin climbed from $91,270 to $92,500 this morning (5th), briefly breaking the $93,000 level during trading; mainstream competing coins also gained, with Ethereum, Ripple (XRP), and Solana (SOL) increasing between approximately 0.7% and 1%.

Markus Thielen, founder of 10x Research and recently recognized as a top cryptocurrency analyst, stated: "Market sentiment is improving, and both Bitcoin and Ethereum are entering a bull market."

区块客·01-05 14:18

Bitwise Matt Hougan: Bitcoin will enter a decade of steady growth, with returns that are not spectacular but strong

Bitwise Asset Management Chief Investment Officer Matt Hougan predicts that Bitcoin will show a steady upward trend over the next ten years rather than explosive growth, emphasizing its stable returns.

"I believe we are in a period of sustained 10-year steady growth with strong returns. Although the returns are not astonishing, they are robust, with lower volatility and fluctuations along the way," Matt Hougan said on CNBC on Friday.

Hougan predicts a paradigm shift for Bitcoin. He expects this cryptocurrency to bid farewell to the four-year "boom and bust" cycle and transition into a "10-year grind" characterized by sustained but no longer explosive returns. In recent interviews and the company's annual outlook, Hougan forecasts that despite the digital

区块客·01-05 11:28

SEC Commissioner Caroline steps down! Her anti-crypto stance once sparked controversy; what regulatory impacts remain

The last Democratic commissioner of the SEC, Caroline Crenshaw, steps down, and the decision-making leadership fully shifts to Republican dominance. Cryptocurrency regulation is expected to move from strict enforcement to institutionalization and modernization of rules.

The rare Democratic commissioner steps down, ushering in a full Republican decision-making era at the SEC

---------------------------

The U.S. Securities and Exchange Commission (SEC) officially bid farewell to its core member Caroline Crenshaw, who served for over ten years, on January 2, 2026.

With the term of the last Democratic commissioner ending, the SEC's five-member decision-making committee now consists of only three Republican members: Chair Paul Atkins, Commissioner Hester Piers, and Commissioner

TRUMP2.58%

CryptoCity·01-05 02:15

Bitwise Matt Hougan: Bitcoin will enter a decade of steady growth, with returns that are not spectacular but strong

Bitwise Asset Management Chief Investment Officer Matt Hougan predicts that Bitcoin will show a steady upward trend over the next ten years rather than explosive growth, emphasizing its stable returns.

"I believe we are in a period of sustained 10-year steady growth with strong returns. Although the returns are not astonishing, they are robust, with lower volatility and fluctuations along the way," Matt Hougan said on CNBC on Friday.

Hougan predicts a paradigm shift for Bitcoin. He expects this cryptocurrency to bid farewell to the four-year "boom and bust" cycle and transition into a "10-year grind" characterized by sustained but no longer explosive returns. In recent interviews and the company's annual outlook, Hougan forecasts that despite the digital

区块客·01-03 09:18

Why Is Shiba Inu (SHIB) Price Pumping Today?

Shiba Inu is back in focus after a sharp move higher that surprised a lot of traders. After days of going nowhere, SHIB suddenly caught a bid, with volume picking up and attention returning to the meme coin space.

On the surface, the move looks fast, but underneath it’s being driven by a mix of se

CaptainAltcoin·01-02 22:35

Bitwise Matt Hougan: Bitcoin will enter a decade of steady growth, with returns that are not spectacular but strong

Bitwise Asset Management Chief Investment Officer Matt Hougan predicts that Bitcoin will show a steady upward trend over the next ten years rather than explosive growth, emphasizing its stable returns.

"I believe we are in a period of sustained 10-year steady growth with strong returns. Although the returns are not astonishing, they are robust, with lower volatility and fluctuations along the way," Matt Hougan said on CNBC on Friday.

Hougan predicts a paradigm shift for Bitcoin. He expects this cryptocurrency to bid farewell to the four-year "boom and bust" cycle and transition into a "10-year grind" characterized by sustained but no longer explosive returns. In recent interviews and the company's annual outlook, Hougan forecasts that despite the digital

区块客·01-01 09:06

Bitwise Matt Hougan: Bitcoin will enter a decade of steady growth, with returns that are not spectacular but strong

Bitwise Asset Management Chief Investment Officer Matt Hougan predicts that Bitcoin will show a steady upward trend over the next ten years rather than explosive growth, emphasizing its stable returns.

"I believe we are in a period of sustained 10-year steady growth with strong returns. Although the returns are not astonishing, they are robust, with lower volatility and fluctuations along the way," Matt Hougan said on CNBC on Friday.

Hougan predicts a paradigm shift for Bitcoin. He expects this cryptocurrency to bid farewell to the four-year "boom and bust" cycle and transition into a "10-year grind" characterized by sustained but no longer explosive returns. In recent interviews and the company's annual outlook, Hougan forecasts that despite the digital

区块客·2025-12-31 09:04

Bitwise Matt Hougan: Bitcoin will enter a decade of steady growth, with returns that are not spectacular but strong

Bitwise Asset Management Chief Investment Officer Matt Hougan predicts that Bitcoin will show a steady upward trend over the next ten years rather than explosive growth, emphasizing its stable returns.

"I believe we are in a period of sustained 10-year steady growth with strong returns. Although the returns are not astonishing, they are robust, with lower volatility and fluctuations along the way," Matt Hougan said on CNBC on Friday.

Hougan predicts a paradigm shift for Bitcoin. He expects this cryptocurrency to bid farewell to the four-year "boom and bust" cycle and transition into a "10-year grind" characterized by sustained but no longer explosive returns. In recent interviews and the company's annual outlook, Hougan forecasts that despite the digital

区块客·2025-12-30 09:02

Bitwise: Bitcoin will enter a 10-year period of stable growth! Returns may not be astonishing but still strong

Bitwise Chief Investment Officer believes that Bitcoin will bid farewell to the four-year cycle, entering a decade of stable growth characterized by low volatility and institutional dominance, and reaching new highs in 2026 under favorable regulatory conditions.

Bitwise Asset Management Chief Investment Officer Matt Hougan predicts that Bitcoin will show a steady upward trend over the next ten years rather than explosive growth, emphasizing its stable returns.

"I believe we are in a phase of sustained 10-year steady growth with strong returns. Although the returns are not astonishing, they are robust, with lower volatility, and there will be ups and downs during this period," Matt Hougan said on CNBC Friday.

Hougan predicts that Bitcoin will undergo a paradigm shift

CryptoCity·2025-12-30 04:40

Bitwise Matt Hougan: Bitcoin will enter a decade of steady growth, with returns that are not spectacular but strong

Bitwise Asset Management Chief Investment Officer Matt Hougan predicts that Bitcoin will show a steady upward trend over the next ten years rather than explosive growth, emphasizing its stable returns.

"I believe we are in a period of sustained 10-year steady growth with strong returns. Although the returns are not astonishing, they are robust, with lower volatility and fluctuations along the way," Matt Hougan said on CNBC on Friday.

Hougan predicts a paradigm shift for Bitcoin. He expects this cryptocurrency to bid farewell to the four-year "boom and bust" cycle and transition into a "10-year grind" characterized by sustained but no longer explosive returns. In recent interviews and the company's annual outlook, Hougan forecasts that despite the digital

区块客·2025-12-29 08:59

TPS is just a ticket to entry; rankings determine success or failure, and on-chain transactions enter a new phase of "application awareness."

Blockchain competition has shifted from TPS to transaction ordering layers. Ordering directly affects market makers' bid-ask spreads and depth. The new generation of ordering innovations is transitioning from "general ordering" to "application-aware ordering," which could be the key turning point for DEX to surpass CEX. This article is adapted, translated, and written by Dongqu from PANews.

(Previous context: What does it mean for Solana to reach 100,000 TPS under ideal conditions?)

(Additional background: Ethereum's impact of 10,000 TPS? How to use ZK technology to break the "impossible triangle")

The competition between chains has risen to the level of "transaction ordering," which directly influences market makers' bid-ask spreads and depth🧐🧐

The demand for "general chains" has been disproven. Currently, the competition between chains focuses on two levels:

1) Building "application chains" on the basis of existing mature businesses, allowing

動區BlockTempo·2025-12-29 08:15

Bitwise Chief Investment Officer: Bitcoin will not perform "exceptionally well" in the next decade

Bitcoin hit a new high of $125,000 in October 2025, but looking back over the year, it was the first time in history to see a half-year decline, and the market remains divided on whether it's a bull or bear. Bitwise Chief Investment Officer Matt Hougan admits that the next decade will show a "strong but not surprising" price performance, while Jan3 founder Samson Mow believes a decade-long bull market is coming.

The four-year cycle curse is here: what will Bitcoin's price do over the next ten years?

Recently, in an interview with CNBC, Bitwise CIO Matt Hougan pointed out that Bitcoin has bid farewell to the era of early exponential surges, and over the next ten years, it will show a "strong but not surprising" upward trend:

Market volatility will gradually decrease, and long-term growth will be steady, with 2026 still being a bullish year.

In response to Bitcoin's decline from its high point in Q4 of this year,

TRUMP2.58%

ChainNewsAbmedia·2025-12-29 03:54

When the crypto industry dresses up in suits, how well can the annual report of 11 leading projects score?

Author: Nancy, PANews

The curtain of 2025 gradually falls. Looking back on this year, the crypto world has undoubtedly reached a watershed moment. The industry has officially bid farewell to the wild gold rush era of the past, shedding T-shirts for suits, and opening the door to mainstream financial institutions.

In this annual exam of moving from crypto to the mainstream world, PANews reviews the annual responses of 11 leading projects, covering tracks such as public chains, DeFi, stablecoins, cross-chain, and AI. These projects are no longer merely engaged in an arms race based on performance metrics but are collectively shifting towards compliance, practicality, and large-scale development. However, the completion of infrastructure has not yet directly led to a booming proliferation of crypto applications. The industry still faces issues such as homogenization and internal competition, difficulty in capturing value, and insufficient product-market fit. Looking ahead to 2026, these projects are focusing on integrating liquidity, breaking through scenarios to reach wider audiences, and developing sustainable economic models.

PANews·2025-12-25 06:57

Infrared 2026 roadmap revealed! Native stake and Dutch auction reshape the BGT market.

The Berachain liquid staking protocol Infrared has announced its roadmap for 2026, launching the IR rewards vault and supporting the USDT0-IR and IR-WBERA trading pair staking. In January next year, native IR staking will be introduced, allowing users to stake IR in exchange for sIR and earn returns through protocol revenue buybacks. A Dutch auction system will be launched in Q1, enabling third-party protocols to use IR to bid for BGT emission rights.

MarketWhisper·2025-12-24 02:22

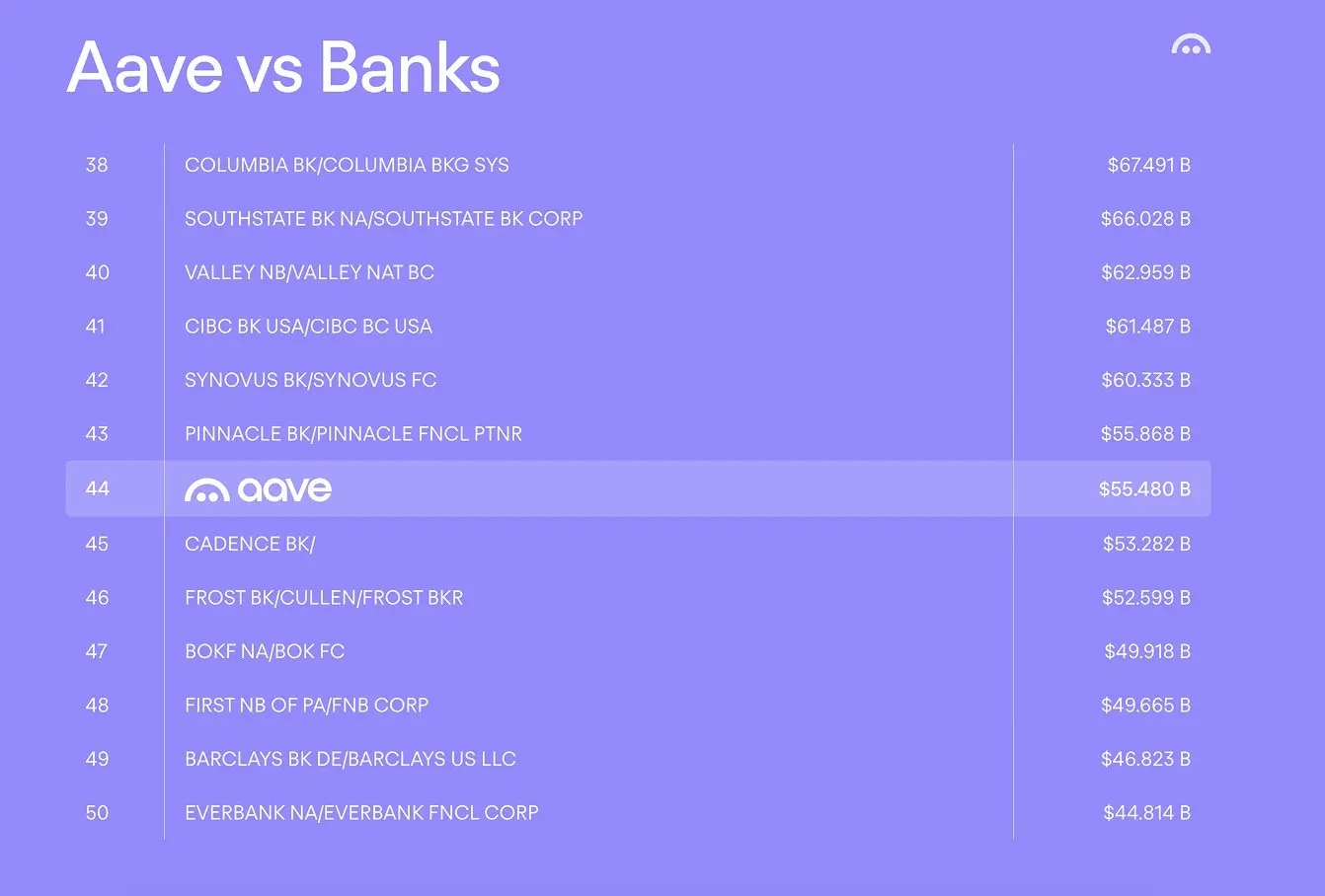

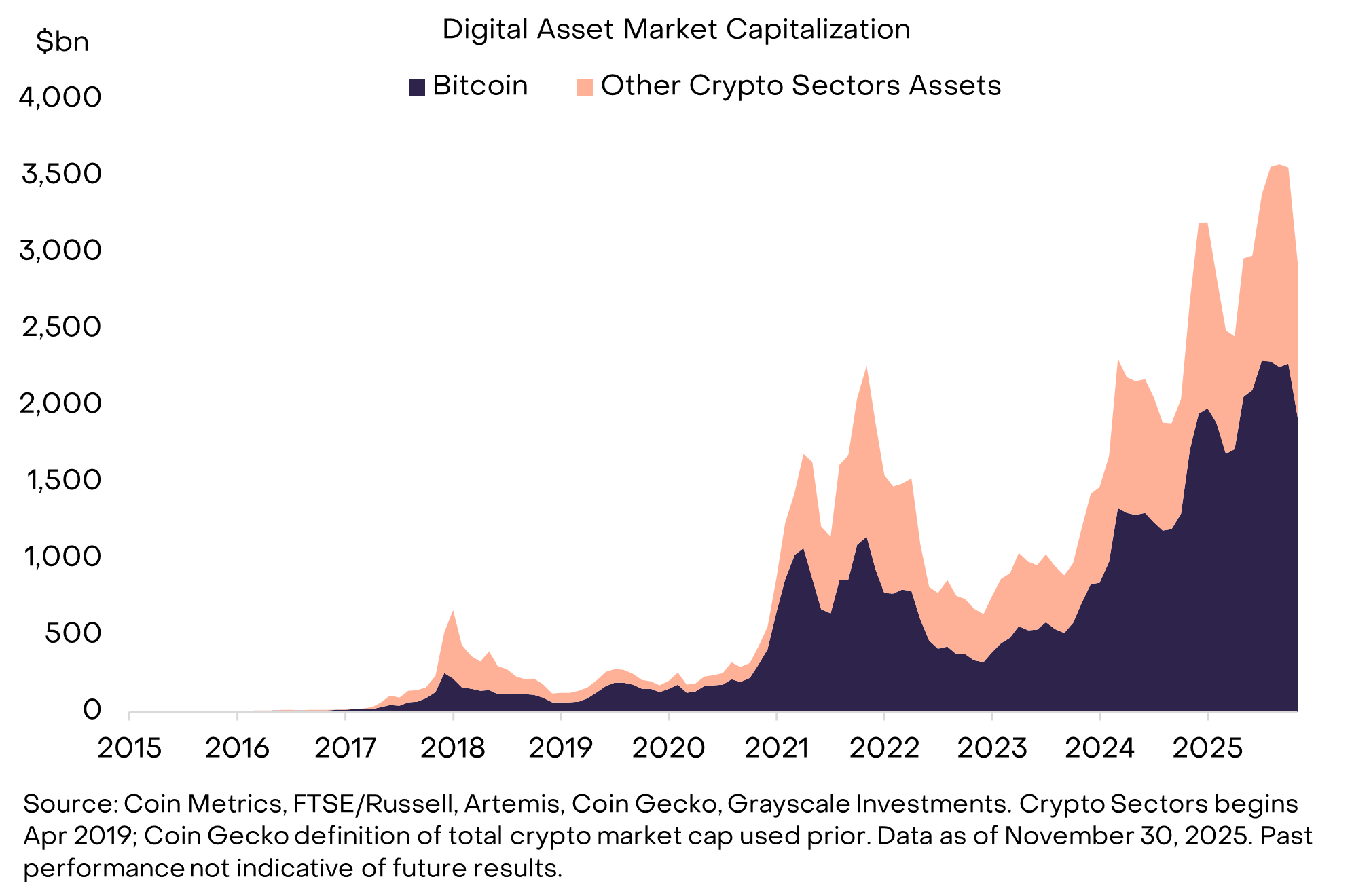

Wall Street’s bid on crypto dominated 2025, but what’s the demand outlook for 2026?

2025 was a blockbuster year for Bitcoin (BTC) and the wider crypto market as crypto-friendly legislators platformed growth-focused regulation and Wall Street finally accepted Bitcoin, Ether (ETH), and numerous altcoins as a valid asset class worthy of inclusion in an investment portfolio.

The

Cointelegraph·2025-12-23 23:15

Wall Street’s bid on crypto dominated 2025 but what’s the demand outlook for 2026?

2025 was a blockbuster year for Bitcoin (BTC) and the wider crypto market as crypto-friendly legislators platformed growth-focused regulation and Wall Street finally accepted Bitcoin, Ether (ETH), and numerous altcoins as a valid asset class worthy of inclusion in an investment portfolio.

The

Cointelegraph·2025-12-22 23:10

Coinbase Super App Bid, Saylor $1B Buy, and More — Week in Review

This week, Coinbase expanded its services, Saylor invested nearly $1 billion in Bitcoin as prices fell, Circle acquired Interop Labs raising concerns, and over 125 groups advocated for stablecoin rewards amid regulations. Additionally, Ripple's RLUSD surged in market cap.

Coinpedia·2025-12-21 21:19

Cardano Price Jumps on Midnight Launch, but Bigger Risks Still Linger

Cardano caught a short-term bid after Charles Hoskinson unveiled Midnight, a privacy-focused blockchain built for cross-chain use. The announcement sparked speculative interest and pushed ADA higher after weeks of weak price action. Still, the bounce does not erase the broader issues hanging

CaptainAltcoin·2025-12-19 19:00

Coinbase borrows Kalshi’s playbook, sues three states over prediction markets

Coinbase is taking three US states to court in a bid to lock in federal protection for its planned prediction markets, opening a new front in the battle over whether event contracts are finance or gambling.

The exchange has sued regulators in Connecticut, Illinois, and Michigan, asking federal

IN0.4%

Cointelegraph·2025-12-19 08:39

Grayscale Report: Four-Year Crypto Cycle Ends, US Dollar Depreciation Drives Currency Substitutes

Grayscale releases the 2026 Digital Asset Outlook Report, predicting that cryptocurrencies will bid farewell to the four-year cycle theory, with Bitcoin potentially reaching new highs in the first half of the year. The report highlights two main drivers: the risk of US dollar depreciation fueling demand for alternative stores of value, and increased regulatory clarity attracting institutional capital. The top ten investment themes include dollar depreciation-driven currency alternatives, regulatory clarity supporting adoption, the GENIUS Act promoting stablecoins, asset tokenization inflection points, and more.

MarketWhisper·2025-12-18 07:32

India's Competition Regulator Clears Coinbase's Minority Stake in CoinDCX

In brief

India's Competition Commission has approved Coinbase's bid to acquire a minority stake in CoinDCX, valuing the exchange at $2.45 billion.

The latest development is a "big win for the Indian crypto ecosystem," Coinbase CEO Sumit Gupta told Decrypt.

The approval comes as Coinbase

IN0.4%

Decrypt·2025-12-18 06:12

Nasdaq Warns Bitcoin Treasury Firm KindlyMD as Shares Linger Under $1

Bitcoin treasury company KindlyMD is now officially on the Nasdaq countdown clock after its shares fell below the $1 minimum bid requirement, putting the company at risk of delisting if it fails to rebound by mid-2026.

KindlyMD Stock Below $1 Triggers Nasdaq Compliance Notice

According to a

BTC1.92%

Coinpedia·2025-12-17 08:51

After Setbacks, Crypto Bank Custodia Keeps Fight Alive to Gain Fed Master Account

Custodia Bank is requesting an en banc rehearing from the 10th Circuit after losing its bid for a master account from the Federal Reserve. The bank argues this case raises significant constitutional and states'-rights issues.

Decrypt·2025-12-16 18:57

SEC review puts Nasdaq tokenized stocks to first real test at DTCC’s gate

SEC opens formal review into Nasdaq's bid to list tokenized stocks, testing how blockchain shares can coexist with DTCC‑cleared equities.

Summary

SEC launches consultation on Nasdaq's proposal to trade tokenized securities on the same order book and rights framework as traditional shares.

Cryptonews·2025-12-15 13:06

Evening Must-Read 5 Articles | The Future of the U.S. Economy Amid Inflation Fission

1. Not Just a Quick Purchase of Juventus: The $15 Billion Annual Profits of the Tether Empire

On December 12, 2025, Tether announced plans to acquire Italian football club Juventus FC entirely. Tether submitted a full cash mandatory bid to its controlling shareholder Exor to purchase 65.4% of its shares and is prepared to launch a public tender offer for the remaining shares after the transaction is completed, aiming to increase its stake to 100%. However, EXOR Group rejected Tether's proposal to acquire Juventus shares, reaffirming no intention to sell Juventus shares. Click to read

2. US SEC Hands-On Guide to Crypto Asset Custody

The US SEC Investor Education and Assistance Office issued this investor notice to help retail investors understand how to hold crypto assets. This notice outlines the types of crypto asset custody

金色财经_·2025-12-15 11:50

Tether's 1.1 billion euro bid to buy Juventus rejected? The century-long showdown between "new money" and "old wealth"

Stablecoin giant Tether has officially launched a comprehensive acquisition of Italy's century-old football powerhouse Juventus, showcasing a direct clash between the new crypto giants and traditional industrial dynasties. The company proposed to acquire 65.4% of the shares of Exor NV, controlled by the Agnelli family, at a price of €2.66 per share, paying entirely in cash, with the overall club valuation estimated at around €1.1 billion. However, this bold offer was immediately met with a “unanimous rejection” by the Exor board, and family head John Elkann explicitly stated that “Juventus is not for sale.” This acquisition attempt is not only about football but also reflects, on a deeper level, the cultural, trust, and value barriers faced by cryptocurrency capital in seeking recognition from the traditional world and diversifying assets.

MarketWhisper·2025-12-15 02:38

Tether Plans Up to €1 Billion Investment in Juventus Pending Approvals

Tether made a binding offer to Exor to acquire majority control of Juventus Football Club.

Juventus shares jumped after the bid, pushing the club’s market value close to one billion euros.

Tether plans to invest up to one billion euros into Juventus, pending regulatory approval.

Tether, the

CryptoFrontNews·2025-12-14 03:16

Tether Makes Bold Bid to Buy Juventus, Exor Rejects Offer

Tether proposed a €2.66/share bid for Exor's 65.4% stake in Juventus, valued at €1.1 billion, but Exor rejected it, stating the club is not for sale. Tether remains committed to investing €1B in Juventus and is focused on sports integration.

CryptoFrontNews·2025-12-13 19:30

Tether Submits €1.1B Cash Bid for Juventus Control

Tether offered €2.66 per share for Exor’s 65.4% stake, valuing Juventus near €1.1B and aiming for full ownership.

Juventus shares and the JUV fan token jumped after the bid, though Exor sources say the club is not for sale.

Tether plans to invest €1B post-acquisition, expanding beyond crypto

JUV1.84%

CryptoFrontNews·2025-12-13 14:33

Bitcoin bulls face deeper pain as Fed’s third rate cut fails to spark bid

Bitcoin extends weakness after the Fed's third rate cut as on-chain data show realized losses at -18%, still far from the -37% capitulation zone seen at past bottoms.

Summary

The Fed delivered a third straight 25 bps cut to 3.5%--3.75%, with one Trump-appointed official pushing for a

BTC1.92%

Cryptonews·2025-12-12 09:42

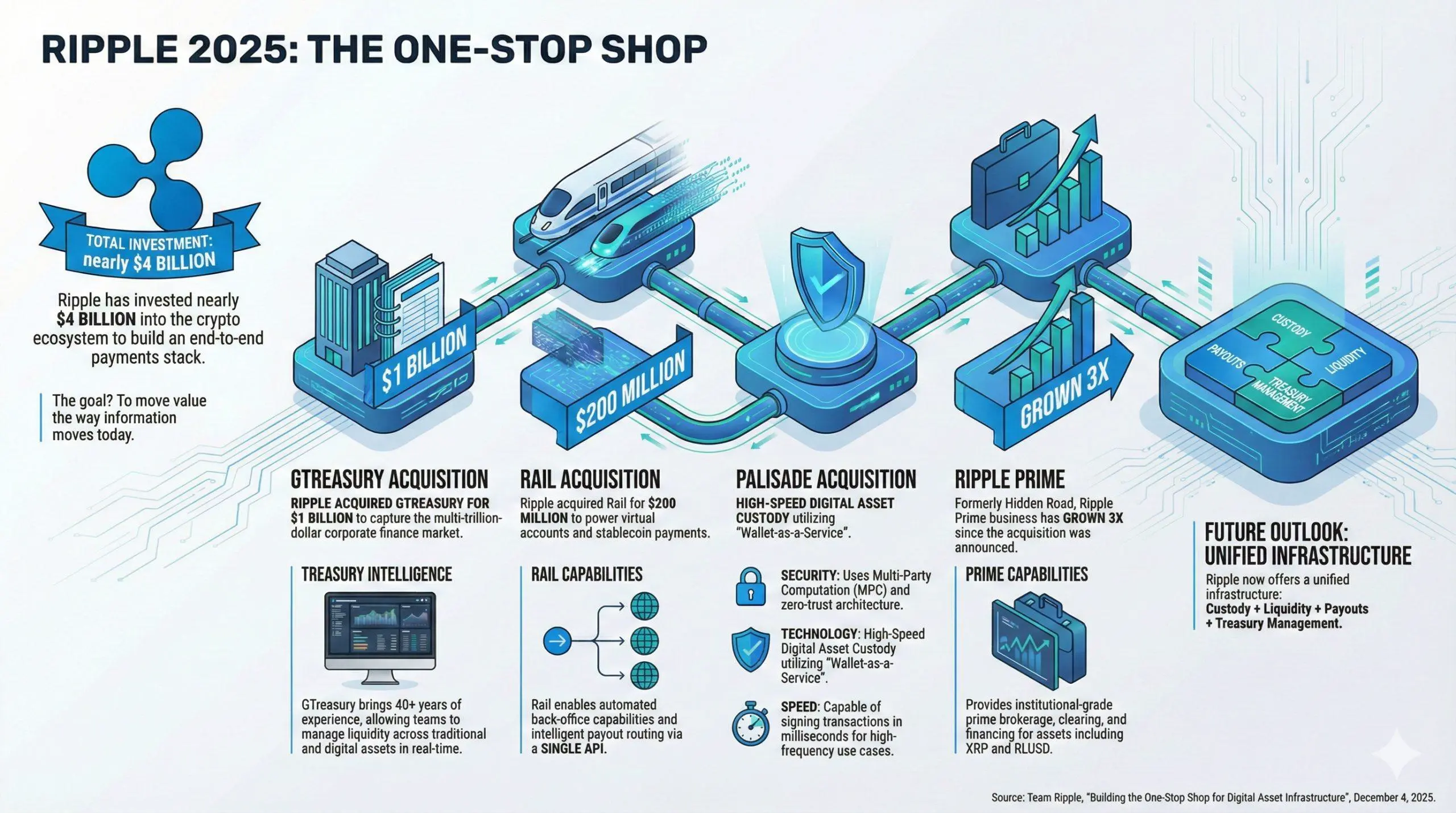

Ripple Fuses 4 Core Acquisitions to Build One-Stop Finance Grid

Ripple’s expanded push into unified digital asset infrastructure signals a bid to anchor real-time global finance by fusing treasury intelligence, custody, liquidity and settlement into a single enterprise platform.

Ripple Broadens Its Institutional Finance Ambitions

Growing institutional

XRP0.94%

Coinpedia·2025-12-05 00:34

EU plan boosts ESMA powers over crypto and capital markets

The European Commission has proposed expanding the powers of the European Securities and Markets Authority (ESMA) over crypto and broader financial markets in a bid to narrow the competitive gap with the United States.

Published Thursday, the package would transfer “direct supervisory

Cointelegraph·2025-12-04 15:00

Hayden Adams blasts Citadel’s SEC bid to classify DeFi as traditional finance

Citadel urges SEC to regulate DeFi like TradFi, prompting Hayden Adams to accuse the firm of attacking open, peer-to-peer finance.

Summary

Hayden Adams accused Citadel and founder Ken Griffin of attacking DeFi developers by asking the SEC to treat them as traditional intermediaries and

Cryptonews·2025-12-04 07:24

Load More