Search results for "BOMB"

Canadian Billionaire Predicts Bitcoin Treasuries Will Start Dumping BTC - U.Today

Frank Giustra, a Canadian mining billionaire, forecasts a major sell-off of Bitcoin held by corporate treasuries, deeming it a ticking time bomb. He criticizes bullish predictions from investors like the Winklevoss brothers, suggesting Bitcoin's bubble will burst, forcing companies to liquidate their assets.

BTC3.02%

UToday·01-30 15:37

The U.S. Senate reached a bipartisan appropriations agreement, but there is a high probability of a "technical shutdown" over the weekend, and the Department of Homeland Security bomb has not been defused

The U.S. Senate Democrats and Republicans reached a bipartisan appropriations agreement to ensure most federal agency funding until the end of September, but the Department of Homeland Security was only granted a two-week extension. The grant agreement is closely tied to the immigration enforcement controversy, signaling a resurgence of political showdowns in the future, with market uncertainty still existing.

動區BlockTempo·01-30 01:45

Senior Trader: Countdown to Collapse Has Started, All 3 Major Indicators of Recession Triggered

Senior Trader NoLimit warns on Sunday that "a full-scale crash countdown has begun," citing White House sources indicating that the market pattern in early 2026 is eerily similar to the 2008 Great Recession. Key indicators include a surge in Federal Reserve repurchase tools, gold and S&P 500 falling out of balance and breaking support levels, and the Sam rule hovering in the danger zone between 0.35% and 0.50%. The real estate debt bomb, waves of corporate bankruptcies, and de-dollarization trends form a potential perfect storm for a collapse.

MarketWhisper·01-28 02:33

The Uranium Time Bomb: Shrinking Supply Meets Exploding Demand

The uranium market is setting up one of the most asymmetric commodity trades of the decade. While most investors remain focused on gold, copper, or oil, uranium is developing a structural imbalance that looks far more severe, and far more persistent.

Two recent posts captured the scale of

CaptainAltcoin·01-20 10:05

When the NYSE begins 7×24 hour trading

Written by: Cathy

On January 19, 2026, Wall Street dropped a deep water bomb.

The New York Stock Exchange—this financial fortress with a 234-year history—officially announced the development of a blockchain-based tokenized securities trading platform. 24/7 trading, T+0 instant settlement, stablecoin payments—these features, once exclusive to the crypto world, are now being adopted by the world's largest exchange.

News of this caused a stir in the crypto community. Some cheered, "We won," while others felt a chill down their spine.

When the mainstream financial institutions step in, is there still a future for those platforms in the crypto space that rely on "tokenization packaging" to distribute US stock assets?

01 What kind of "new species" has the NYSE created?

To understand the impact of this move, we first need to see clearly what the NYSE is building.

This is not a simple "private chain implementation."

TechubNews·01-20 06:20

Trump Tariff Bomb Triggers Bitcoin Bloodbath Below $93K

_Bitcoin falls to less than $93K as Trump threatens EU tariffs, triggering a liquidation spurt of 870M in crypto. More than 240,000 traders were wiped out in a huge market selloff._

On Monday morning, Bitcoin fell to $92,000. The selloff was triggered by the tariff threats perpetrated by

LiveBTCNews·01-20 04:20

When legislation opens the door: Wang Yongli warns that stablecoins may be "bitten back" by the wave of traditional financial RWA

On January 15, 2026, at the 18th Golden Kirin Forum held in Beijing, a speech by Wang Yongli, former Vice President of the Bank of China, cast a "deep water bomb" on the global crypto finance and real-world asset (RWA) sectors. He candidly pointed out that the current legislative process for stablecoins, which many countries are racing to promote, may cause "serious backlash" to the development of stablecoins themselves.

This seemingly contradictory assertion is based on a simple logical deduction: if legislation fails to clarify the legal status of stablecoins, licensed financial institutions like banks will hold back due to compliance risks, leaving market opportunities to non-licensed tech giants like Tesla; however, once the law clarifies their legality, traditional financial giants will leverage their comprehensive advantages—regulation, capital, and customer trust—to "seize this market" with full force. Wang Yongli keenly observed that this "backlash" is already quietly happening, marked by the emergence of in the United States.

TechubNews·01-19 02:44

Trump to bomb Iran within 24 hours? US military withdraws from Middle East bases, Tehran warns of retaliation

The US military withdraws from Middle Eastern bases, with European officials stating action within 24 hours. Trump calls for a swift victory to severely weaken the regime, not a prolonged war. Iran warns Saudi Arabia, the UAE, and Turkey not to use the passage, or they will become targets of retaliation. The protests have resulted in 2,600 deaths, and officials say it is the most violent unrest since 1979.

MarketWhisper·01-15 07:49

Web3 Project Teams Must Read: Outsourced KYC, Can You Shift Blame to a Third Party if Something Goes Wrong?

Writing by: Deng Xiaoyu, Li Haojun

Introduction

In the Web3 community, there is a highly dangerous compliance illusion: as long as the project team spends money to outsource KYC (Know Your Customer) and AML (Anti-Money Laundering) services to internationally renowned third-party agencies, it is equivalent to buying a "criminal liability exemption insurance." Once the platform is involved in money laundering or black market funds, this "pot" should be borne by the outsourcing company, and the project team can sit back and relax.

This idea, in the eyes of lawyers, is "naive"; in the eyes of investigative agencies, it is "a cover-up," and in reality, it is a time bomb that could explode at any moment.

In the past two years, as judicial authorities have continuously upgraded their crackdown on crimes related to virtual currencies—especially with penetrating investigations into "assisting crime," "concealment," and even "illegal business operations"—this "ostrich-style" compliance logic has been gradually shattered by an airtight chain of evidence.

TechubNews·01-09 06:25

KOSPI targets 5,000 points... Launching a "tax incentive bomb" into the capital market

The government is expected to officially introduce a large-scale tax support plan in the near future aimed at activating the domestic capital market. Accordingly, investors in national participation policy funds will be offered tax credits or income tax deduction benefits. For dividend income generated by the funds, a low tax rate separation taxation is also expected to apply.

The Ministry of Finance and Economic Affairs plans to release the "2026 Economic Growth Strategy" centered around this plan. This strategy is the first official economic vision after the government’s department was renamed to the Ministry of Finance and Economic Affairs, and it clearly aims to inject funds directly into the stock market, attracting the attention of the investment industry and investors. Its core content involves providing tax incentives to citizens investing in national growth funds or corporate growth collective investment institutions (BDCs) and other policy funds.

The plan is to apply tax credits or income tax deductions to the investment portion for policy fund investors, and to offer 5~9% separation taxation on dividend income. This is expected to be designed to reach or exceed

TechubNews·01-03 22:03

[Editorial] The 2027 Digital Asset Taxation "Time Bomb" - Don't Miss the Last Window of Opportunity in 2026

In 2026, the digital asset market faces a dual backdrop of economic instability and Federal Reserve liquidity injections. Investors need to adjust their strategies to cope with the upcoming substantial taxation. Additionally, the selling pressure from long-term investors has weakened, and the market's potential for explosive growth has increased. Coupled with political cycles, this is favorable for the development of digital assets. Investors should seize this "golden time."

BTC3.02%

TechubNews·2025-12-31 18:55

XRP Today's News: Yen Arbitrage Trading Bomb Resurfaces, Breaking the Defense Line and Fear of Crashing to $1.75

The Bank of Japan hinted at multiple rate hikes on December 29, causing the 10-year Japanese government bond yield to rise to 2.6%, triggering the negative correlation mechanism for XRP. XRP fell to $1.8494, breaking below the double moving averages. In August 2024, the unwinding of yen arbitrage trades caused XRP to plummet by 34.5%, triggering alarms again. $2.0 is a critical support level; losing it could test $1.75, but institutional demand is supporting a medium-term target of $2.5.

XRP2.28%

MarketWhisper·2025-12-30 03:16

Hyundai Motor threatened with a bomb! The perpetrators demand 13 Bitcoins or they will blow up the Seoul headquarters.

Hyundai Motor Group received a Bitcoin ransom threat letter last Friday (December 19), threatening to detonate bombs in two major office buildings in Seoul if 13 Bitcoins (approximately 16.4 billion Korean Won) were not paid. After receiving the report, Hyundai Motor urgently evacuated employees from the office buildings located in Jongno District's Yeonhui-dong and Seocho District's Yangjae-dong, while special police, explosive ordnance disposal teams, and search dogs quickly conducted a floor-by-floor search. After several hours of searching, it was confirmed to be a false alarm.

BTC3.02%

MarketWhisper·2025-12-23 05:09

Hyundai Motor Group has been extorted! The criminals are demanding 13 Bitcoins, or they will blow up the headquarters in Seoul.

The Modern Group was threatened by a Bitcoin bomb ransom, leading to the emergency evacuation of multiple buildings in Seoul. Police confirmed it was a false alarm, revealing that the recent encryption ransom and intimidation attacks in South Korea have significantly increased, putting pressure on businesses and national security.

CryptoCity·2025-12-22 09:00

Amazing Prediction! Tom Lee Predicts Ethereum Will Soar to $62,000—Is It Realistic?

Renowned analyst and Fundstrat co-founder Tom Lee dropped a “deepwater bomb” at a recent industry conference, predicting that the price of Ethereum could reach an astonishing $62,000, with its market cap reaching 25% of Bitcoin's. The core logic behind this prediction is that Tom Lee believes Ethereum is experiencing a moment similar to the "1971 decoupling of the US dollar from gold," fundamentally transforming global finance through asset tokenization.

However, market traders and technical analysts have raised sharp doubts: although Ethereum dominates the real-world asset sector with $10.7 billion in value locked, current technical charts do not show a structure that supports such an explosive rally. This intense clash between long-term narratives and short-term technicals is sparking deep reflection within the community about Ethereum's future value.

MarketWhisper·2025-12-08 05:17

Dogecoin Price Prediction: DeepSnitch AI Rally for $1M in Funding As SEC Approves 2x Leveraged SU...

The SEC just lit the fuse on a bomb nobody saw coming, and it’s about to blow up every safe Dogecoin price prediction you’ve been clinging to. On December 5, SEC regulators approved the first-ever 2x leveraged altcoin ETF for SUI.

If the SEC is approving leveraged ETFs for smaller ecosystems like S

CaptainAltcoin·2025-12-06 15:04

Charles Schwab’s $12 Trillion Crypto Bomb: The Biggest Threat Yet to U.S. Exchanges in 2026

Charles Schwab is preparing to launch direct cryptocurrency trading on its flagship brokerage platform in the first half of 2026, giving its 35+ million accounts and $12.1 trillion in client assets seamless access to spot Bitcoin, Ethereum, and potentially a curated basket of additional digital assets.

CryptopulseElite·2025-12-04 06:13

Copy trading Paradigm: Why they abandoned launching a new chain and shifted focus to this new track.

Written by: Luke, Mars Finance

Recently, the crypto market has fallen into a strange calm during a bear market, with mainstream narratives extremely lacking. At this moment, the news that Paradigm led a $25 million Series A financing for Doma (formerly D3 Global) exploded like a deep-water bomb, opening up a new fissure in the RWA track.

At first, most people thought this was just another boring story about a "domain trading platform." But when we peel away the layers of the tech onion of Doma, especially when we delve into the pricing model of its initial asset software.ai, you will find Paradigm.

MarsBitNews·2025-12-02 07:30

Russian Man Detonates Airsoft Grenades in Botched Crypto Heist

In brief

A 21-year-old man allegedly detonated two Airsoft grenades and ignited a smoke bomb at a St. Petersburg cryptocurrency exchange on Saturday.

Police reportedly arrested the suspect after he demanded that employees transfer all available crypto to his digital wallet.

The incident comes a

BTC3.02%

Decrypt·2025-11-25 14:03

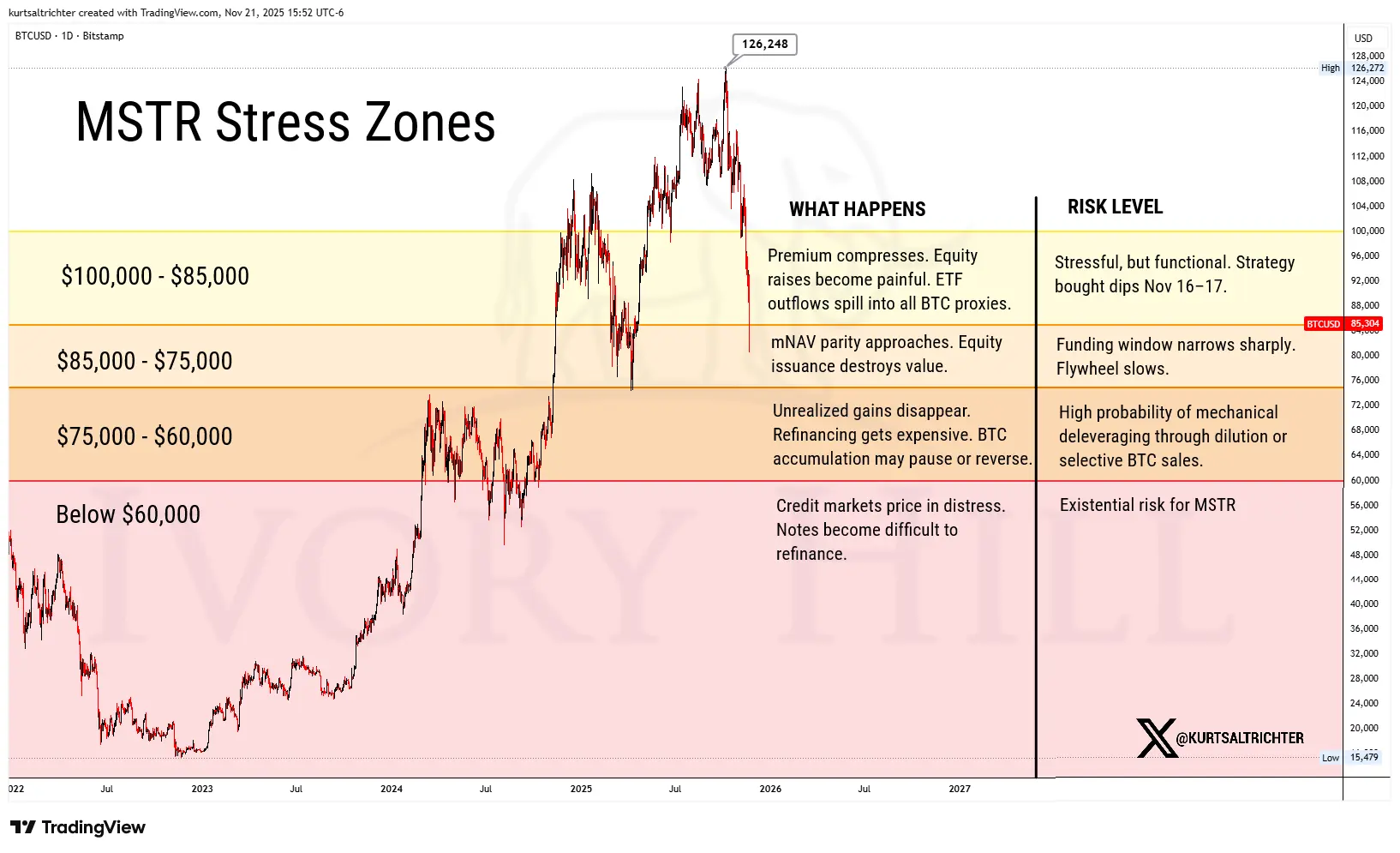

MicroStrategy will be liquidated if it falls below 70,000! 640,000 BTC becomes the largest Bitcoin ticking time bomb

This month, Bitcoin once plummeted to $81,000, with a single-day decline of up to 8%, reaching a three-month low. Bitcoin reserve company MicroStrategy (MSTR) is facing the risk of being removed from the MSCI index. The company, which holds 640,000 bitcoins and has leveraged $27.6 billion, is standing on the edge of survival. If Bitcoin falls below the critical support level of $70,000, MicroStrategy may be forced to liquidate 50,000 bitcoins, potentially triggering a market crash.

BTC3.02%

MarketWhisper·2025-11-25 09:31

Russian Bitcoin Robbery! 21-year-old unemployed man arrested for robbing exchange with a "grenade"

The St. Petersburg police in Russia reported that they recently arrested a man who attempted to steal Bitcoin by detonating air gun grenades in a cryptocurrency exchange office. The 21-year-old unemployed man detonated two air gun grenades and a smoke bomb inside the exchange located in downtown St. Petersburg, demanding that staff transfer funds to his wallet. He was ultimately arrested at the scene.

MarketWhisper·2025-11-25 07:48

Binance Drops elizaOS Airdrop Bomb: Claim 4,375 Tokens with Just 240 Alpha Points

On November 15, 2025 Binance Wallet enabled a high-profile airdrop of elizaOS (ELIZAOS). The campaign will reward early adopters. Specially those who are part of its Alpha Program. This helps to attract users to new token activities, Web3 testing, and high-volume trading. The airdrop will start at 0

Coinfomania·2025-11-15 10:42

Tom Lee’s BMNR Is a Brilliant Treasury Model or Hidden Time Bomb | US Crypto News

BMNR builds $13.7 billion Ethereum treasury with zero debt risk.

Equity-funded model avoids bankruptcy---but faces dilution and sentiment risks.

Tom Lee's ETH empire could unravel if prices or investors falter.

Welcome to the US Crypto News Morning Briefing---your essential rundown of the most i

BeInCrypto·2025-11-12 16:45

A potential $8 billion bomb in Decentralized Finance has now only been liquidated by 100 million.

Do you really understand where the profits from Decentralized Finance come from? If you don't understand, then you are the profit.

Fund managers, a role that was once trusted and then demystified in the stock market, carried the wealth dreams of countless retail investors during the booming period of A-shares. At the beginning, everyone was in pursuit of fund managers who graduated from prestigious schools and had impressive resumes, believing that funds were a less risky and more professional alternative to directly trading stocks.

However, when the market declines, investors realize that so-called "professionals" cannot combat systemic risks. Worse still, they take management fees and performance commissions, profiting from their own abilities while investors bear the losses.

Now, when the role of "fund manager" comes to the chain under the new name of "Curator" (external manager), the situation becomes even more perilous.

They do not need to pass any qualification exams, do not need to undergo any regulatory agency review, and do not even need to

MarsBitNews·2025-11-09 03:47

From "Infinite Bullets" to "Stealth Bombs": DAT Treasury Company has slowed down its purchases, but 85% of the market capitalization is still greater than the coin holding market capitalization.

Author: Frank, PANews

Reprint: White55, Mars Finance

In the frenzy of the cryptocurrency market, "Digital Asset Treasury Company" (DAT Company) has played the role of an "infinite ammo supply", absorbing huge amounts of capital from traditional markets through innovative financial instruments, constantly "transfusing blood" into the crypto ecosystem. However, as the market enthusiasm fades and recent trends remain sluggish, these once "buyers" are facing severe challenges. Can they continue to support the market? Or will they, due to their inherent structural risks, transform from a "blood transfusion pump" into an "invisible bomb", becoming an "accelerator" that amplifies market declines?

The stock price of DAT Company plummeted, with asset purchases dropping by 95%.

According to data from BBX, the number of publicly listed companies with crypto assets has reached 248, of which the number of companies holding Bitcoin has reached 187. The number of publicly listed companies holding Ethereum is

BTC3.02%

MarsBitNews·2025-11-07 07:42

Ripple CTO Drops A Truth Bomb About Where XRP Derives Its Price

Ripple CTO David Schwartz highlighted that the value of cryptocurrencies, including XRP, largely stems from speculation rather than inherent utility. Despite the advanced design of the XRP Ledger, current narratives focus on future price expectations rather than current functionality.

Blockzeit·2025-11-03 00:08

Hyperliquid (HYPE) Price Outlook: Why the Next Big Move Could Be Downward

Hyperliquid (HYPE) price is trading around $47, and the question that could be on he mind of every investor is about where it is going from here. According to Gerhard from Bitcoin Strategy, Hyperliquid’s growing popularity is both a major opportunity and a potential ticking time bomb. His latest

CaptainAltcoin·2025-10-28 16:04

From AWS downtime to the $19.3 billion liquidation storm, the "invisible bomb" of encryption infrastructure.

Amazon Web Services (AWS) recently experienced an outage, affecting multiple encryption platforms, revealing systemic vulnerabilities due to reliance on centralized cloud services. The $19.3 billion liquidation plummet triggered by the event reflects the weaknesses in encryption infrastructure, highlighting the fragility of Centralized Exchange structures and the issues of being unable to cope when demand surges rapidly, as well as the Crisis of Confidence in Oracle Machines.

AWS-2.39%

動區BlockTempo·2025-10-21 12:31

Trump's tariffs 100% nuclear bomb dropped! The killer move in November may be advanced, and the ceasefire is completely over.

Trump's tariff policy has taken a sharp turn, announcing an additional 100% levy on Chinese goods starting November 1, which may be implemented earlier. Trump's tariff retaliation against China includes the most severe rare earth ban in history, with the Dow falling 1.9% and the Nasdaq plummeting 3.5%, raising concerns about the potential collapse of the Xi-Trump meeting. Analysts warn that Trump's tariffs mark the end of the "tariff truce," and both sides have loaded their economic weapons.

MarketWhisper·2025-10-11 07:15

Trump's tariff nuclear bomb! US stocks fell 900 points, the Dow and Nasdaq crashed, and the Taiwan stock market is likely to collapse by 1600 points.

Trump's tariff announcement imposed a 100% retaliation on China's rare earth controls, causing a big dump in the US stock market and triggering Black Friday, with the Dow crashing 878 points down 1.9%, Nasdaq collapsing 3.56%, and the semiconductor index plunging 6.32%. The VIX fear index soared, with the Taiwan Futures night market dropping 5.5%, and institutions warning that Taiwan stocks could crash 1600 points on Monday, with the Trump-Xi meeting at the APEC summit being the only turning point.

MarketWhisper·2025-10-11 06:57

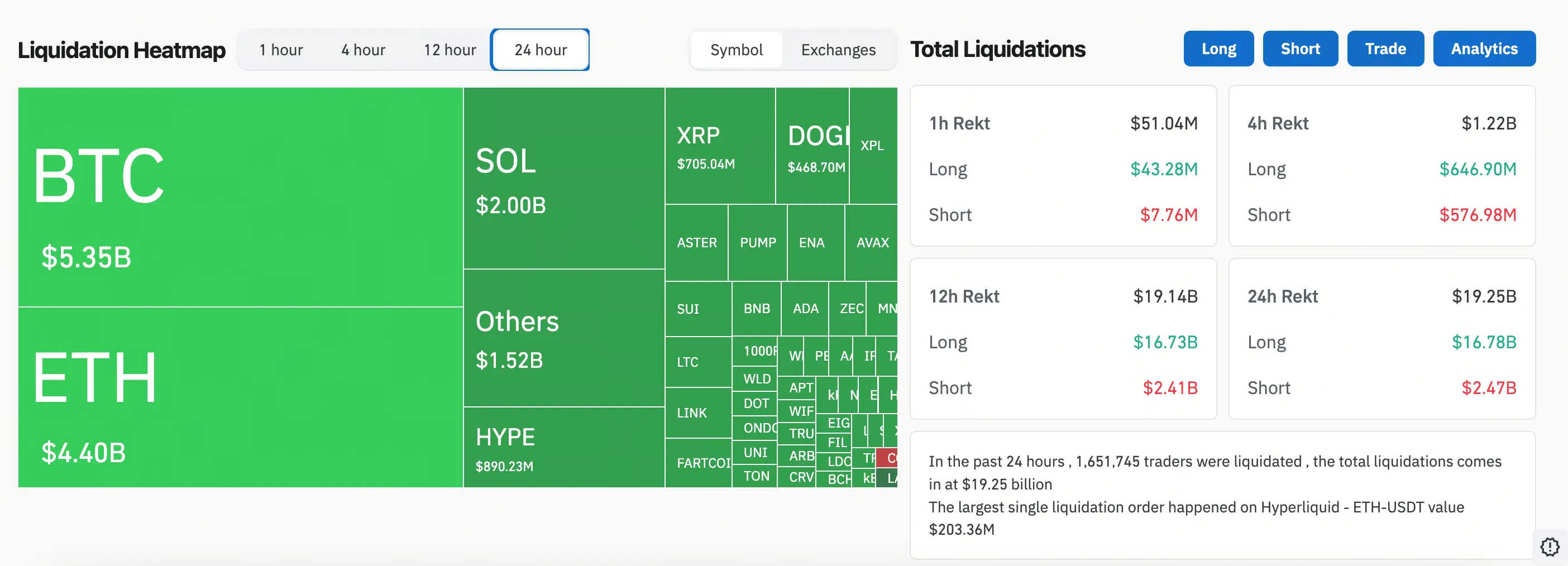

Trump's tariff nuclear bomb! Bitcoin price flash crash to 102,000, 1.65 million people get liquidated evaporating 19.2 billion dollars.

Trump's tariff announcement to impose a 100% tariff on China has caused Bitcoin prices to flash crash from $122,000 to $102,000. In the crypto assets market, 1.65 million people were liquidated within 24 hours, totaling $19.2 billion, setting a new record for the highest amount in a single day. Ethereum saw a single liquidation of $203 million, and DOGE experienced a 50% slump. Trump's tariffs have triggered the darkest day in crypto asset history.

MarketWhisper·2025-10-11 05:57

"COVID-level nuclear bomb": Trump's 100% tariff threat against China triggers a flash crash in the crypto market, with over $19 billion in Get Liquidated in 24 hours.

Affected by the announcement made by U.S. President Trump on Friday evening to impose an additional 100% tariff on Chinese goods, the cryptocurrency market experienced a "flash crash", with prices plummeting sharply. Bitcoin (BTC) fell by more than 12% in just 24 hours, dropping below the $110,000 mark, while Ethereum (ETH) plummeted by 16%, falling below $3,700. The altcoin market suffered heavy losses, with major tokens like Solana and XRP experiencing declines of 20%-30%, and ADA and AAVE seeing drops of up to 40%. According to CoinGlass data, this market crash led to over $19 billion in long positions being forcibly liquidated, and analysts likened its severity to the market crash triggered by the COVID-19 pandemic in March 2020.

MarketWhisper·2025-10-11 01:54

Alarm sounded: Ethereum validators withdrawal queue exceeds 2.44 million ETH! Liquid staking market faces 42 days latency risk.

The Ethereum staking network is facing a balance test between liquidity and network security. As of October 8, the validator withdrawal queue has accumulated over 2.44 million Ether, worth over $10.5 billion, reaching the third-highest point in nearly a month. This backlog is mainly concentrated on liquid staking (LST) platforms such as Lido, EtherFi, mainstream CEX, and Kiln. The result is that Ethereum stakers now face an average withdrawal latency of 42 days and 9 hours. Although Ethereum co-founder Vitalik Buterin defends this latency as an intentional security design, community analysts warn that long queues could become a systemic vulnerability for DeFi, triggering a "time bomb" of LST depeg and deleveraging.

MarketWhisper·2025-10-09 05:14

Bitcoin Ransom Threat Shocks Indonesia: Schools Targeted in Fake Bomb Scare

Three prestigious international schools in Indonesia experienced a day of chaos and fear after an unknown sender distributed chilling messages claiming that bombs had been planted in their buildings — and demanding a $30,000 ransom in Bitcoin (BTC) to stop the explosions.

“We have bombs in your scho

BTC3.02%

Moon5labs·2025-10-09 03:00

Ethereum $11 billion withdrawal stuck for 42 days! Timed bomb may trigger DeFi crisis

The Ethereum staking withdrawal queue has soared to the third highest in history, with 2.44 million ETH (worth $10.5 billion) stuck for 42 days before being unlocked. Analysts warn that this is a systemic flaw, and the risk of stETH depeg may trigger a bank run in DeFi, threatening the $13 billion liquid staking market. Vitalik insists this is a secure design, but who is right and who is wrong? This article provides an in-depth analysis of the Ethereum staking crisis and the chain risks in DeFi.

MarketWhisper·2025-10-09 01:22

The Wall Street Grim Reaper says AI is definitely not a bubble, and the community panics: Run, the situation is worse than we thought.

Wall Street famous analyst Jim Cramer claimed again that AI is not a bubble, but unexpectedly ignited market panic, with investors worried about the resurgence of contrary indicators. Will the AI boom repeat the internet bubble or open a new chapter? (Background: China has opened a completely robot-operated grocery store, is science fiction becoming reality or just a gimmick?) (Supplementary background: Bill Gates: AI will replace humans within 10 years, working two days a week is not a dream, three occupations may survive) Earlier this week, Wall Street financial commentator Jim Cramer stated on CNBC that "the artificial intelligence industry is definitely not a bubble," but this brief positive remark sparked chills. This host, known as a Reverse Indicator, intended to dispel doubts but made many investors feel a chill down their spine, questioning whether AI will follow in the footsteps of the 2000 internet stock crash. Contrary indicators light up, the memory of the internet bomb is still fresh in Cra.

動區BlockTempo·2025-10-01 03:16

Can blockchain transactions be revoked? Circle's stablecoin "regret medicine" plan sparks a major debate in the crypto market.

The world of Crypto Assets is facing an intense debate about its fundamental principles. Circle President Heath Tarbert recently revealed that the company is researching a reversible transaction mechanism for stablecoins, a piece of news that has detonated like a bomb, causing unprecedented controversy within the crypto community. This plan directly challenges the core feature of "transaction irreversibility" inherent in Blockchain technology, which could fundamentally change our understanding and usage of Crypto Assets.

MarketWhisper·2025-09-29 06:52

Bitcoin financial company stock price is likely to big dump by 55%, PIPE financing model has become a "time bomb".

Bitcoin financial companies are facing severe challenges, as the stock prices of companies that have raised funds through PIPE (Private Investment in Public Equity) transactions are rapidly approaching discount issuance levels, presenting investors with a potential loss risk of up to 55%. With the lock-up period ending, a large number of discounted stocks are about to flood the market, which could trigger a chain reaction, threatening not only the valuations of these companies but also potentially creating downward pressure on the entire Bitcoin market.

BTC3.02%

MarketWhisper·2025-09-26 05:48

Time Bomb: Analysis of the 2025 American Economic Bubble

Introduction: Threats to the Golden Age

Over the past decade, the U.S. stock market has performed like an unstoppable beast, delivering astonishing returns with almost no interruptions. Since August 2010, the S&P 500 index has surged 487%, turning the wealth of ordinary investors into staggering fortunes. The only significant pullback occurred in 2022, when the market fell 25% due to the Federal Reserve's aggressive rate hikes and a 10% inflation rate, but this was merely a temporary setback. By 2024, the market had returned to its all-time high, easily shaking off the global pandemic, runaway inflation, and the fastest rate hike cycle in history. However, beneath this glamorous facade, a storm is brewing. Experts are sounding the alarm, pointing out that macro fundamentals and hidden leading indicators suggest that the U.S. economy is teetering on the edge of a bubble—a recession that could trigger a bubble burst is imminent.

This article analyzes

TRUMP3.34%

金色财经_·2025-09-09 02:04

Banks are facing pressure from Crypto Assets, worried about being replaced by stablecoins?

A silent war over the future of finance is unfolding. On one side is the traditional banking industry, which has a history of hundreds of years and deep roots; on the other side is the cryptocurrency world, which is aggressive and led by stablecoins. As the regulatory framework is being initially established and technology is advancing rapidly, banks are feeling unprecedented pressure. They are not only worried about losing market share, but a deeper fear lies in whether they will be replaced by this more efficient and flexible form of digital money.

"Era of Earning Interest"

In July 2025, the United States passed the landmark "GENIUS Act," which provided a federal-level regulatory framework for stablecoins for the first time. However, this bill, aimed at regulating the market, has planted a "time bomb" in the eyes of the banking industry. The bill explicitly prohibits issuers of stablecoins from paying interest directly to users, but does not restrict third-party platforms (such as Crypto Assets exchanges) from offering rewards to holders of stablecoins.

LinkFocus·2025-09-08 09:49

Sun Yuchen is suspected of "dumping" the Trump family project WLFI and has been blacklisted with a lock-up position? He claims to be innocent and is launching a "rights protection"!

Today, the world of Crypto Assets once again staged a dramatic "Game of Thrones." The main characters in this event are the controversial yet influential founder of TRON, Justin Sun, and the crypto project World Liberty Financial (WLFI), which is backed by the Trump family and carries its own aura and traffic.

The trigger point of this turmoil was a thunderous action taken by the WLFI project team on September 4th: they directly blacklisted the wallet address of one of the project's largest early investors, Sun Yuchen. This operation instantly froze over 100 million USD worth of unlocked WLFI tokens in Sun Yuchen's wallet, as well as a much larger amount of locked tokens.

This move is like a deep-sea bomb, not only causing the price of WLFI tokens to plummet sharply, but also triggering a discussion in the entire industry about "centralized power", "asset ownership" and "market fairness."

LinkFocus·2025-09-05 10:00

Trump bans TSMC's Nanjing factory "revokes supply exemption to China", US stocks ADR once plummeted 3%

Trump's power is immense; the U.S. suddenly revoked TSMC's VEU authorization for its Nanjing factory, impacting the semiconductor Supply Chain and investor layouts. (Background: Wei Zhe-Jia: The U.S. government will not take a stake in TSMC! Not worried about "U.S. TSMC" happening) (Supplementary background: Trump imposed a 100% semiconductor tariff, and TSMC invested $20 billion to "dodge a bullet," opening with a 5% pump.) The U.S. government has thrown out a new shock bomb: It notified TSMC's Nanjing factory that the "Verified End User" (VEU) authorization will expire on December 31, 2025, reiterating Washington's long-term and normalized control stance on China's high-tech development. Even investment partner TSMC is no exception. VEU termination: A package permit has been revoked. VEU originally provided foreign-funded wafer factories with a one-stop export permit, allowing equipment, parts, and chemicals to smoothly enter Chinese factories; after the authorization is terminated, suppliers must start to ...

TRUMP3.34%

動區BlockTempo·2025-09-03 04:12

SUI Called a “Ticking Time Bomb” as 308-Day Compression Nears Breakout, Here’s What Analysts See

SUI has been trading in a 308-day symmetrical triangle pattern, with key resistance between $3.56 and $4.18. Analysts predict a significant breakout could occur, especially after its partnership with Alibaba Cloud to enhance Web3 development.

SUI3.72%

CryptoFrontNews·2025-08-28 06:16

XRP holders beware! Levi Rietveld warns: prepare for a major shift in the financial landscape.

Global financial strategist Levi Rietveld has recently issued a stern warning to XRP investors, stating that "everything is over," and urging coin holders to prepare for an impending seismic shift in the financial landscape. He pointed out that the skyrocketing U.S. debt, uncontrolled government spending, and currency devaluation are forming a "financial time bomb," and assets like XRP may become key tools for hedging against this crisis.

XRP2.28%

MarketWhisper·2025-08-27 02:44

Over $4.8 billion in cryptocurrency Options expire tomorrow: market Fluctuation intensifies, Bitcoin and Ethereum show divergent trends.

On August 22 at 16:00 (Singapore time), over $4.8 billion worth of Crypto Assets options contracts will expire, with the notional value of Bitcoin options reaching $3.83 billion and Ethereum at $948 million. This large-scale options expiration event may trigger significant short-term market fluctuations, and investors should be wary of price volatility risks.

Options expiration is often seen as a "ticking time bomb" in the crypto market. Before the contract expires, traders may amplify price fluctuations through hedging or closing positions, causing asset prices to converge towards the "Max Pain Point." This point refers to the price level at which most contract holders incur the greatest losses upon options expiration. According to data, Bitcoin's Max Pain Point is at $118,000, while Ethereum's is at $4,250. This means that if the price fails to effectively break through these levels, some options contracts will become worthless, further exacerbating

AICoinOfficial·2025-08-22 06:20

"The First in the U.S." Digital Bank SoFi Integrates Bitcoin Lightning Network: Achieving Instant Cross-Border Remittances with Low Fees Era

SoFi Bank has partnered with Lightspark to introduce the Bitcoin Lightning Network and UMA, announcing the official entry into a new era of cross-border remittances with second-level speeds and low fees. (Background: CryptoQuant analyst: Bitcoin returns to the 115,000 level, futures cool down! Waiting for The Federal Reserve (FED) to speak on Friday) (Background information: U.S. policy nuclear bomb proposal: Suggests Trump to "increase the position in Bitcoin" with tariffs from other countries to guarantee the greatness of the USA) U.S. digital bank SoFi announced on the 19th that it has teamed up with cryptocurrency payment infrastructure provider Lightspark to be the first to deeply integrate the Bitcoin Lightning Network and the universal currency address (UMA) into mainstream banking services, bringing a new vision to the global remittance market. According to the press release, this service will first launch on the SoFi App, targeting the cross-border remittance demand of up to $740.5 billion, and achieving second-level speeds with more.

動區BlockTempo·2025-08-20 02:53

Stop pretending that self-custody of Bitcoin is easy; it is not.

Self-custody of Bitcoin is filled with complexities and risks that ordinary people find hard to cope with. The author calls for the development of more intuitive and secure solutions to achieve true decentralization. This article is sourced from a piece written by Bitcoin Magazine, organized and translated by Dongqu. (Summary: CryptoQuant analyst: Bitcoin returns to the 115,000 level, futures cool down! Waiting for The Federal Reserve's speech on Friday) (Background: US policy nuclear bomb proposal: Suggesting Trump to "increase the position in Bitcoin" with tariffs from other countries, ensuring USA greatness) Anyone can do it by writing down 12 words. When discussing Bitcoin (Bitcoin) self-custody practices, this might be the most commonly heard phrase in this ecosystem. Just storing a few words is very simple; anyone can do it, right? All the criticisms and reasons people give for why one shouldn't self-custody are just fear, uncertainty, and

動區BlockTempo·2025-08-20 02:52

BlackRock's giant acquisition of the crypto landscape triggers panic! Controlling the market trend of Bitcoin and Ethereum ETF, investing in Strategy may trigger a market bomb-level dumping.

BlackRock ( is increasingly dominating the Bitcoin and Ethereum Spot ETF market, and has invested in MicroStrategy ), raising deep concerns in the market about institutional manipulation of crypto assets. Analysis indicates that BlackRock may pressure MicroStrategy's stock price, forcing Michael Saylor ( to liquidate his massive Bitcoin reserves, thereby creating market panic and low-price accumulation. If this strategy is executed, Bitcoin could plunge to $60,000-$65,000, Ethereum may dip to $1,700, and alts could evaporate 80-90% of their market capitalization. This potential "liquidity crisis" not only threatens market stability but could also undermine the foundation of decentralization in crypto assets, turning "people's money" into a new plaything for Wall Street.

## BlackRock's Crypto Empire Expansion, Monopoly Shadow Looms Over the Market

BlackRock's growing influence in the crypto space has sparked intense speculation, with reports suggesting that...

MarketWhisper·2025-08-18 06:51

Fed Kills Crypto Crackdown Program With Quiet Bomb Drop on Banking Oversight

The Federal Reserve just dismantled its targeted crypto oversight, clearing the runway for banks to re-enter digital assets under streamlined rules and unleashing fintech innovation nationwide.

Federal Reserve Just Pulled the Plug on Crypto Crackdown Machine

The U.S. Federal Reserve Board

Coinpedia·2025-08-17 02:36

Load More