Search results for "BUBBLE"

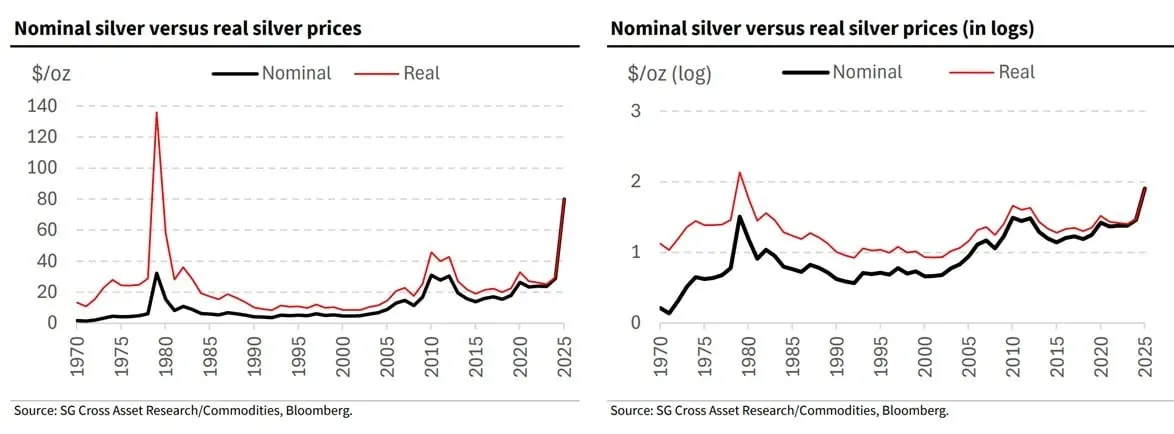

Silver Price Crisis: 40% Spread Between COMEX and Shanghai Exposes the Truth

The silver market is facing one of its most significant fractures ever. On January 30, 2026, silver futures on COMEX crashed by 31.4% in a single day, which means the largest one-day drop since the infamous Hunt Brothers collapse in 1980. Analysts quickly declared that the bubble had burst.

CaptainAltcoin·3h ago

Beyond the Gold Rush: Decoding Cathie Wood’s Bubble Call and Its Signal for Crypto

In a pivotal market commentary, ARK Invest CEO Cathie Wood has declared gold, not artificial intelligence, to be the real asset bubble, following the precious metal's parabolic surge to a record \$5,594 and subsequent 9% crash.

This assertion is grounded in a staggering metric: gold's market capitalization now equates to 170% of the U.S. M2 money supply, a level last witnessed during the Great Depression in 1934. Concurrently, Bitcoin has retreated over 35% from its 2025 highs, yet its l

CryptopulseElite·7h ago

AI competitions consume a lot of energy! Microsoft CEO: AI needs to quickly benefit more people, otherwise it will be a bubble.

Microsoft CEO Nadella warned at the 2026 World Economic Forum that if AI cannot quickly benefit humanity, it will face bubbles and loss of social license. Currently, the AI race is causing global resource shortages, yet only about 10% of companies profit from AI implementation, with most projects failing, indicating low effectiveness of technological applications.

CryptoCity·02-01 07:15

Canadian Billionaire Predicts Bitcoin Treasuries Will Start Dumping BTC - U.Today

Frank Giustra, a Canadian mining billionaire, forecasts a major sell-off of Bitcoin held by corporate treasuries, deeming it a ticking time bomb. He criticizes bullish predictions from investors like the Winklevoss brothers, suggesting Bitcoin's bubble will burst, forcing companies to liquidate their assets.

BTC-0.17%

UToday·01-30 15:37

Cathie Wood Sounds Alarm on Gold Bubble, Touts Bitcoin as Portfolio Hedge

In a striking dual thesis, ARK Invest CEO Cathie Wood has declared gold a late-cycle bubble while positioning Bitcoin as a strategic diversification tool for modern portfolios.

Her warning on gold is based on a key metric—the metal's market cap relative to the U.S. money supply—hitting historical extremes, coinciding with a violent \$9 trillion cross-asset market shakeout driven by extreme leverage. Simultaneously, Wood's 2026 outlook champions Bitcoin’s maturation, framing it not as mer

CryptopulseElite·01-30 07:46

Cathie Wood is bearish on gold against the trend, warning of a $9 trillion market capitalization bubble

Cathie Wood warns that gold has peaked, with the gold/M2 ratio surpassing the 1980 peak and forecasted to fall by 60%. Single-day crash: gold evaporated 3 trillion, silver 750 billion, US stocks 1 trillion, with a total volatility of 9 trillion over 6.5 hours. The catalyst was an 11% drop in Microsoft, CME margin requirements increasing by 47%, and 50-100x leverage liquidations. The rebound at close indicates a leverage-driven event rather than a fundamental collapse.

MarketWhisper·01-30 07:24

The "carbon assets" sold out in ten minutes: Is the country's first carbon credit digital asset a breakthrough or a bubble?

According to a report by Sina Finance on January 20, Greenland Jinchuang Technology Co., Ltd. officially launched the country's first digital asset linked to carbon credits on that day. The portion available to the public sold out within just ten minutes of opening. This rapid sell-out has caused a ripple in the intersection of green finance and digital assets.

This issuance is regarded by industry insiders as a key experiment of “RWA (Real World Assets) + Consumption Scenario”: it disassembles the originally high-threshold carbon credits into digital rights worth 88 yuan each, and links them with hotel consumption discounts to the public market. The market’s enthusiasm over the “ten minutes” has voted to recognize the potential of this model to reach ordinary consumers.

However, cheers and doubts often come hand in hand. Can the limited 500 units of scarcity support large-scale expansion? In the hybrid design of “carbon assets + consumption coupons,” which end truly motivates users to make a purchase?

TechubNews·01-28 06:53

The prophecy comes true after 24 years! Hideo Kojima: Metal Gear Solid 2 is the future I don't want to see

Hideo Kojima clarifies that Metal Gear Solid 2 was not an AI prophecy but a discussion of digital society, exploring information overload and digital control, which became a reality 24 years later. "It's less about prediction and more about a future I don't want to see." During the internet bubble in 2001, "Blue Fear" and "Reon" also explored similar themes. He predicts that future remakes will incorporate AI, with humans focusing on innovation and planning to develop "training AI" games.

MarketWhisper·01-27 05:27

The "carbon assets" sold out in ten minutes: Is the country's first carbon credit digital asset a breakthrough or a bubble?

According to a report by Sina Finance on January 20, Greenland Financial Technology Co., Ltd. officially launched the country's first digital asset linked to carbon credits on that day. The public offering portion was sold out in just ten minutes after opening. This rapid sale has caused a ripple in the intersection of green finance and digital assets.

This issuance is regarded by industry insiders as a key experiment of “RWA (Real World Assets) + Consumption Scenario”: it disassembles the originally high-threshold carbon credits into digital rights worth 88 yuan each, and links them with hotel consumption discounts to the public market. The market’s enthusiasm for “ten minutes” votes has recognized the potential of this model to reach ordinary consumers.

However, cheers and doubts often come hand in hand. Can the scarcity of 500 limited units support large-scale expansion? In the hybrid design of “carbon assets + consumption coupons,” which end truly motivates users to buy? Against the backdrop of an immature compliant circulation mechanism

RWA-1.28%

PANews·01-26 13:14

AI rewrites Japanese manga creation! Good night Bubu author laments: Will I still be drawing next year?

"Good Night Bubu" author Ichiji Asano O is concerned about the rapid development of generative AI, believing that it struggles to provide innovation and is limited to imitating known styles. He points out that if the industry cannot explore the potential of AI, it will be difficult to achieve true breakthroughs. Furthermore, the manga industry faces the risk of a bubble, and creators need to learn how to utilize AI to improve creative efficiency in order to stay competitive in the market.

CryptoCity·01-25 03:41

Google DeepMind Chief Flags 'Bubble-Like' Pattern in AI Sector, Crypto Market Reacts

Demis Hassabis, CEO of Google DeepMind, warns of a bubble in the AI sector, echoing concerns from Microsoft’s Satya Nadella. The AI crypto market has also seen significant declines, influenced by broader economic factors and market sentiment.

TheNewsCrypto·01-24 10:50

Tom Lee: Over 90% of AI companies may perform poorly in the future

In AI investment, Tom Lee pointed out that in the next ten years, no more than 10% of AI companies may succeed, similar to the internet bubble era. Although over 90% of companies may fail, a few top winners can generate significant excess returns. Therefore, it is recommended to build an "index-like portfolio" covering the entire AI ecosystem rather than investing in a single company.

PANews·01-22 08:04

What Bubble? Nvidia CEO Says AI Needs Trillions More in Investments

In brief

Jensen Huang says AI infrastructure requires trillions of dollars' worth of further investment, despite bubble fears.

The Nvidia CEO calls AI development "largest infrastructure buildout in human history."

Huang defended AI spending at Davos, claiming that energy, chips, and

BTC-0.17%

Decrypt·01-21 23:01

Qiao Wang's Rules for Surviving the AI Era: Hold 40% Cash, Concentrate on Google, Beware of the Crypto Bubble

Podcast Source: Empire

整理 & 编译:Deep潮TechFlow

嘉宾:Wang Qiao

主持人:Jason Yano

Original Title: Claude Opus 4.5’s Breakout Moment & Investing in 2026 with Qiao Wang

播出日期:January 12, 2026

Key Takeaways

This week, Qiao Wang joined the show to discuss how artificial intelligence will redefine what it means to be an investor in 2026. We delved into the breakthrough moment of Claude Opus 4.5, and why Qiao chose to invest

PANews·01-21 01:38

《The OpenAI Podcast》談 2026 AI 泡沫:別看股價,API 才是真實指標

In the latest "OpenAI Podcast," CFO Sarah Friar and Vinod Khosla, founder of Khosla Ventures, discuss whether AI is a bubble, emphasizing that API call volume rather than stock price should be the basis for evaluation. Khosla pointed out that genuine demand and usage are key indicators of a bubble and reviewed the internet bubble period, believing that market fluctuations should not affect the true value of technology. Friar also stated that current development is limited by computing power supply rather than insufficient demand.

ChainNewsAbmedia·01-20 07:54

Stop saying "AI bubble": it is actually multiple bubbles stacked on top of each other, with each layer bursting at different times.

AI Bubble Bursts in Three Layers: Shell Applications Hit First, Model Layer Faces Consolidation, Only Infrastructure Has Long-Term Value. Companies Must Deepen Workflows and Channels to Survive. This article is sourced from WEKA AI Chief Val Bercovici, compiled and organized by Dongqu as follows.

(Previous context: I spent a week at CES Consumer Electronics Show: It’s all just nonsense dressed in AI new clothes)

(Additional background: The 25 craziest ideas at CES 2026, all here)

Table of Contents

Third Layer: Shell Companies (First to Fail)

Second Layer: Core Models (Mid-tier Zone)

First Layer: Infrastructure (Withstanding the Test)

Network Effect: Why This Matters

What This Means for Developers

Conclusion

This is the question in everyone’s mind and mouth: Are we currently in a A

動區BlockTempo·01-20 02:55

I spent a week at CES: all just bullshit dressed up in AI new clothes.

Tech journalist Edward Zitron, a well-known figure in the industry, wrote an article this week revealing his observations at the Consumer Electronics Show (CES), where he witnessed the tech industry's obsession with meaningless AI product displays, from robots pretending to fold clothes to various chatbots. He exposes that the current AI investment bubble is even more severe than the dot-com bubble of the past… The following is a curated and translated summary of the article.

(Background: CES 2026 features a new "Bitcoin mining water heater," claiming to earn $1,000 annually)

(Additional context: The 25 craziest ideas at CES 2026 are all here)

I just spent a week at the Consumer Electronics Show, and one word kept echoing in my mind: bullshit.

LG, a company known for manufacturing home appliances and TVs, showcased a robot( inexplicably named "CLOiD"), claiming it could "fold clothes"( quickly

動區BlockTempo·01-18 05:15

[Market Analysis] "The chart is too perfect, it's frightening"… The unstoppable KOSPI, is it a "bubble" or a "major upward trend"?

Recently, the South Korean stock market KOSPI has been steadily rising, with a year-to-date increase of nearly 15%, driven by the AI boom and the enhancement of corporate values. Although the market performance is strong, technical indicators show signs of overheating, with the P/E ratio remaining at historical average levels. Investors should be cautious of the risks that may arise from the sharp surge in Samsung Electronics stock prices, which has a clear effect, and the instability of the Korean won exchange rate.

TechubNews·01-16 13:10

Why AI is not a bubble: a16z founder's deep thoughts on demand, investment, and judgment

Podcast: a16z

Translation: Deep Thought Circle

If someone told you that the current AI boom is just another bubble, would you believe it? Skyrocketing valuations, influx of capital, everyone talking about AI—this indeed seems like history repeating itself. But after listening to Ben Horowitz's recent talk, my perspective completely changed. This co-founder of Andreessen Horowitz, with his 16 years of experience managing top venture capital firms and a deep understanding of the tech industry, provided a thought-provoking answer: this time is different. Not because the technology is so cool, but because the demand is unprecedentedly real.

I've been pondering a question: why can some investors consistently find great companies, while most can only rely on luck? In this talk, Ben revealed some perspectives I had never considered before. He discussed how to manage a team that is smarter than you.

VC1.37%

PANews·01-16 12:41

Is AI fueling a new business model? A glimpse into former OpenAI research director Bob McGrew's AI investment framework

Bob McGrew discusses the current AI boom and investment perspectives, describing the market sentiment as a bubble, with investments leaning towards innovative applications rather than infrastructure. He emphasizes that AI's potential lies in solving problems that were previously unmanageable, and advises caution in technology and market choices, seeking new business models that can be transformed by AI.

ChainNewsAbmedia·01-15 05:24

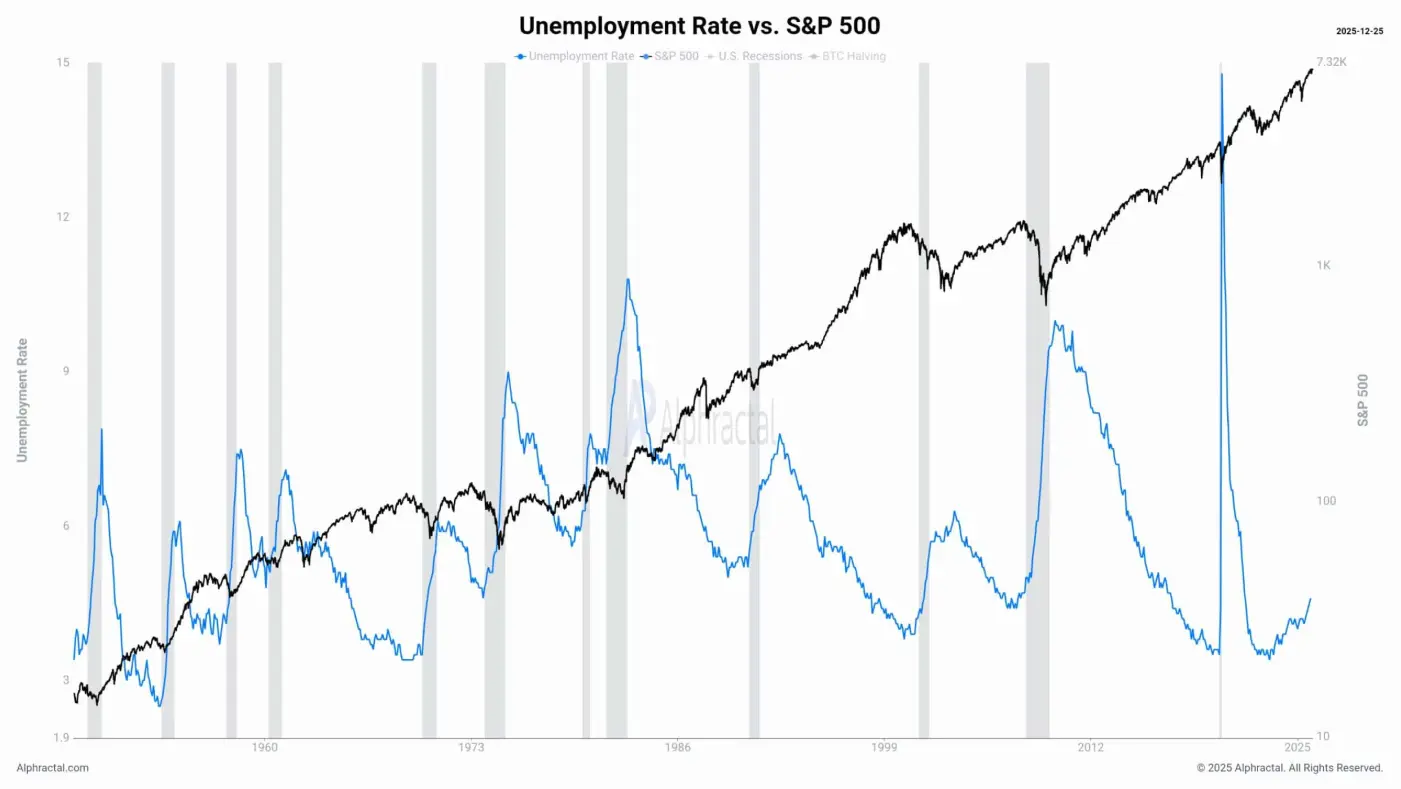

Buffett recession indicator soars 224%, reaching a new high! Stock market bubble surpasses the 2000 dot-com bubble

Buffett Indicator soars to 224%, reaching a new high, with the stock market capitalization exceeding GDP by twice. The ratio peaked before the 2000 dot-com bubble and the 2008 crisis, followed by sharp declines. The real economy is currently experiencing slowing growth and a weakening labor market. History shows that adjustments are often absorbed through declines in asset prices rather than economic expansion to digest high valuations.

MarketWhisper·01-14 02:53

The AI Bubble Has a Deadline: April 1, 2027

Venture capitalists and governments have poured nearly a trillion dollars into AI. That investment accounts for 92% of stock market growth in 2025. Nvidia (NASDAQ: NVDA) alone , the chipmaker powering the boom is now worth $4.5 trillion and represents 45% of NASDAQ growth.

The bet is simple:

BTC-0.17%

CryptoBreaking·01-13 08:05

The AI Bubble Has a Deadline: April 1, 2027

Venture capitalists and governments have poured nearly a trillion dollars into AI. That investment accounts for 92% of stock market growth in 2025. Nvidia (NASDAQ: NVDA) alone , the chipmaker powering the boom is now worth $4.5 trillion and represents 45% of NASDAQ growth.

The bet is simple:

BTC-0.17%

CryptoBreaking·01-12 08:00

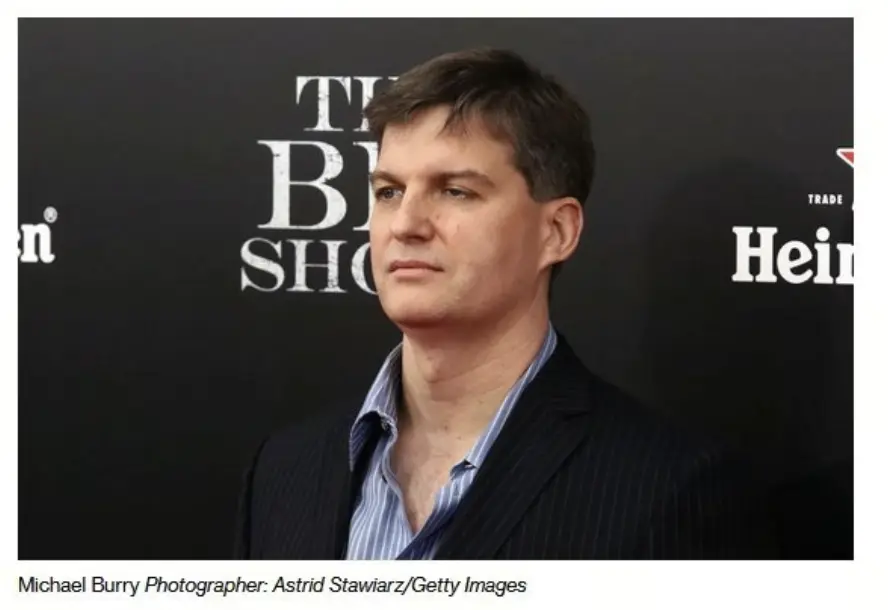

AI Bubble Theory Gets a Reality Check: Tech Giants' Wealth Doubles, Stock Prices Soar

Last year, artificial intelligence became a global focus, also causing dramatic changes in the tech industry's wealth landscape. Some skeptics, including Michael Burry, who is famous for the movie "The Big Short," have warned that the tech industry is falling into an AI bubble. He believes that these tech companies are over-investing in chips, data centers, and other infrastructure to win in the AI race, which could eventually lead to a bubble burst. However, in stark contrast to these concerns, the wealth of tech giants has not shrunk; instead, it continues to double, and AI and related tech stocks are soaring.

Tech billionaires are accumulating wealth to new heights thanks to the AI boom

According to the latest data, Amazon founder Jeff Bezos, along with Google co-founders Larry Page and Sergey Brin, are approaching the $300 billion mark in personal wealth. Over the past few years, they have each been worth around $200 billion.

ChainNewsAbmedia·01-12 03:30

When AI meets deflation, a 10% increase in global economic growth is no longer just a dream?

Last year, many economists predicted that AI was about to bubble, and that tariffs causing inflation would make people's lives miserable. However, data shows that the US economy is soaring, and AI is not only avoiding a bubble but will also drive the global supply chain to take off together! Veteran investor Vise discussed and analyzed how artificial intelligence will reshape the global economic structure this year on Pompliano's podcast. He believes that mainstream economics has long overestimated the impact of tariffs on inflation. Theoretically, raising tariffs should directly increase consumer prices, but historical experience shows that the actual costs are often shared among manufacturers, exporters, logistics providers, and importers, with the final pass-through to consumers being much lower than expected, and prices do not rise proportionally. Vise thinks that the reason most economists' predictions missed the mark is because they overlooked the deflationary power and productivity leaps brought by artificial intelligence. Relying solely on tariffs to interpret inflation is no longer sufficient to reflect reality. He further pointed out that if

ChainNewsAbmedia·01-12 03:27

Is the gold price about to explode? HSBC predicts: In the first half of 2026, gold will surge to $5,000

The driving factors behind gold prices have shifted from expectations of rate cuts to deep concerns over worsening fiscal deficits and geopolitical risks. HSBC believes that gold prices are expected to break the psychological barrier of $5,000 per ounce in the first half of 2026. This article is sourced from a Wall Street Journal article, organized, translated, and written by Foresight News.

(Previous summary: Bridgewater's Dalio annual report: AI is in the early stage of a bubble, reasons why US stocks underperform non-US stocks and gold?)

(Additional background: Bloomberg strategist Mike McGlone: Gold, silver, and US stocks are "overheated" in 2025, facing correction risks this year)

Table of Contents

Fiscal "addiction" and geopolitical chaos: the super fuel for gold prices

Deutsche Bank consensus: Rigid buying is reshaping market structure

Institutional investors' "FOMO" and potential volatility

HSBC believes that

動區BlockTempo·01-09 15:15

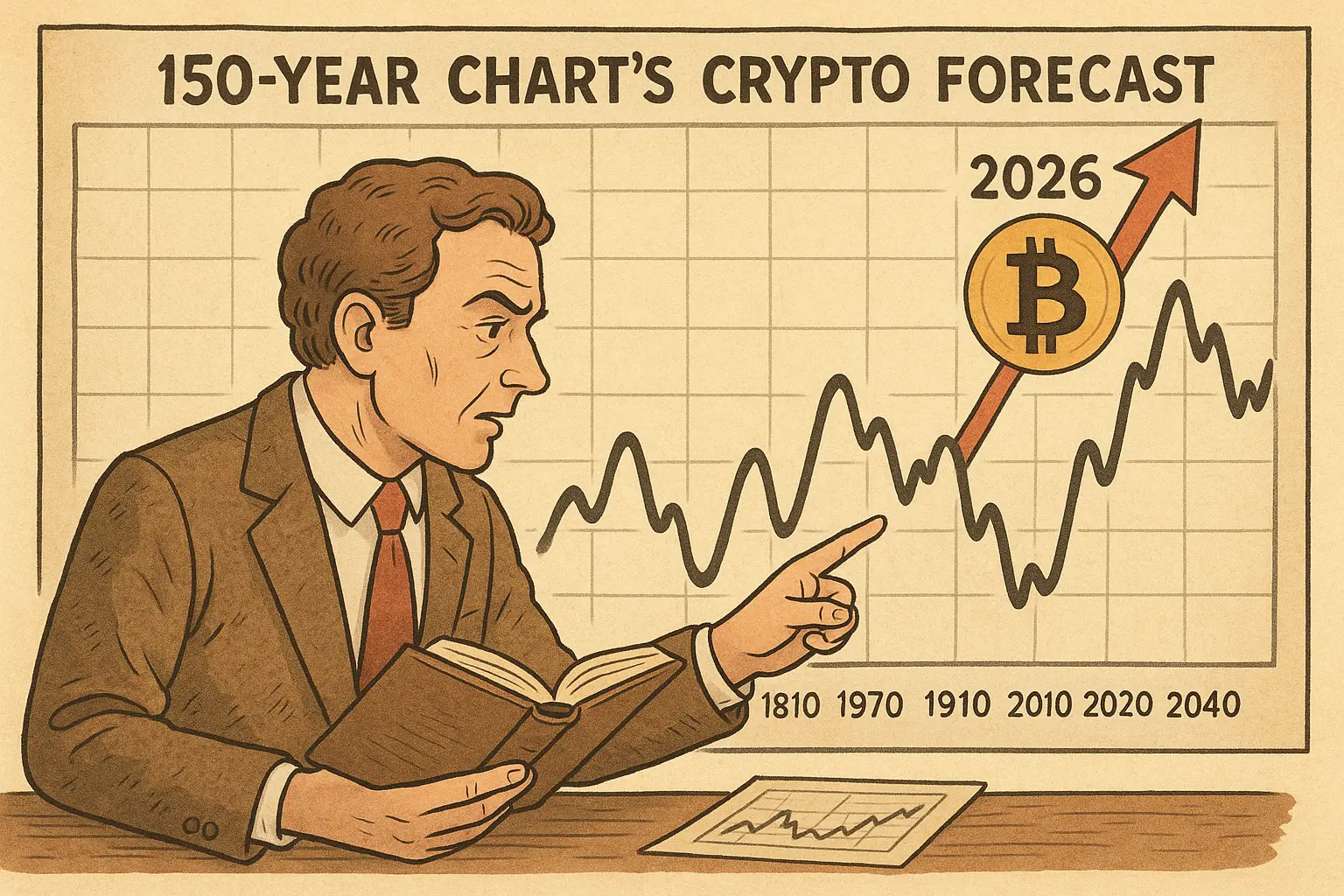

Benner Cycle Predicts 2026 Market Peak: 150-Year Chart's Crypto Forecast

The Benner Cycle, a 150-year-old tool, predicts 2026 market peak after calling the Great Depression, Internet bubble, and COVID crash. However, trader Peter Brandt dismisses it as "fantasy" while JPMorgan raises 2025 recession probability to 60%.

MarketWhisper·01-08 07:08

Hyperliquid: Breakthrough Infrastructure or Overhyped Bubble?

Hyperliquid is emerging as a leading decentralized perpetual exchange, accounting for 70% of DEX perps volume. With $116 million in monthly revenue, it offers a smooth trading experience but faces legal pressures and potential overvaluation risks.

HYPE11.23%

TapChiBitcoin·01-07 14:24

Behind the AI frenzy, an overlooked debt gamble

Written by: thiigth

Wall Street veteran and Oak Tree Capital's Howard Marks recently made a wake-up call. The gist is: if this AI frenzy doesn't end up becoming a classic bubble burst, it will be the only exception in human financial history.

But the problem is, most people are looking in the wrong place.

We are still debating whether Nvidia's stock price is too high, or who will be the next Cisco. Everyone is obsessively watching every flicker on the K-line chart, trying to find clues of a collapse. However, the real storm is not at the bustling stock exchanges, but in the silent, hidden corner that determines life and death — the credit market.

This is not a math problem about Price-to-Earnings (P/E) ratios, but a high-stakes gamble built on massive debt.

01 The Disappearing "Cash Cow"

In this story, our biggest mistake

TechubNews·01-07 05:12

From the myth of 70 million USD to a $9 figurine, is NFT really "cool" all gone?

NFT market plummeted from a peak of 17 billion USD in 2022 to 2.4 billion USD in 2025, a decline of 86%. But after the speculative bubble burst, NFTs are transforming into underlying tools that connect to physical assets, returning from financial speculation to their fundamental functions.

(Background: The veteran blockchain summit "NFT Paris" announced its suspension, and the community complained that sponsors could not get refunds)

(Additional context: Bear market NFT comeback! Fat penguins pull up to Las Vegas Sphere: What phenomena are we seeing?)

Table of Contents

NFT Market Supply and Demand Imbalance

Collective "Escape" and Evolution of Platforms

From "Tokens" to "Brands"

Physical Endorsements and Functionality Return

What has NFT lost, and what remains?

NFT did not suddenly collapse; it was just a prolonged decline that the market gradually...

動區BlockTempo·01-06 11:05

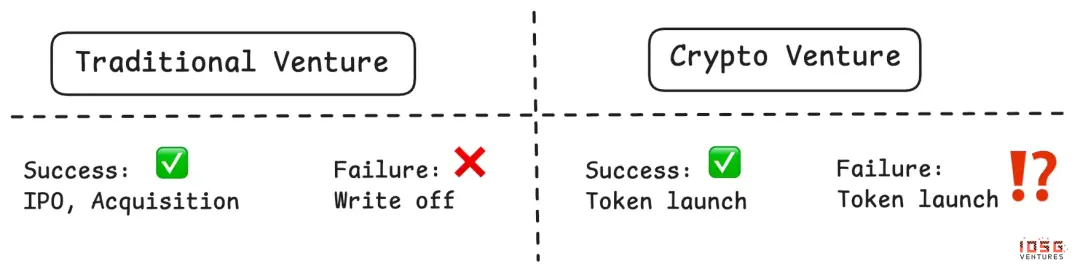

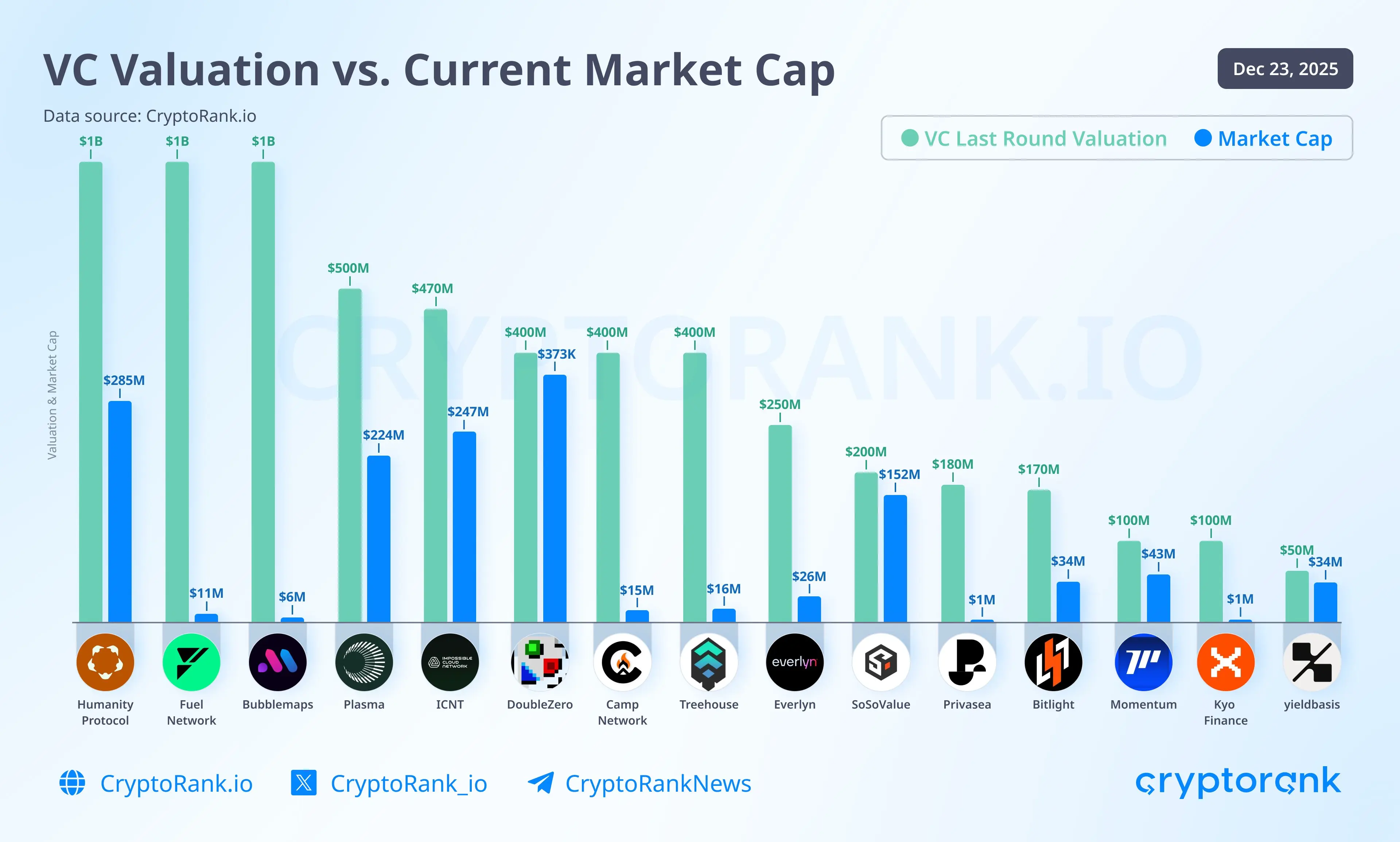

IOSG: A game with no winners—how can the altcoin market break through?

Author | Momir @IOSG

The altcoin market has experienced its most difficult period this year. To understand why, we need to go back to decisions made a few years ago. The funding bubble of 2021-2022 fueled a wave of projects that raised large amounts of money. Now, these projects are issuing tokens, leading to a fundamental problem: a massive supply flooding the market, while demand remains scarce.

The issue is not just oversupply; even more concerning is that the mechanism causing this problem has remained largely unchanged to this day. Projects continue to issue tokens regardless of whether there is a market for their products, treating token issuance as an inevitable step rather than a strategic choice. As venture capital dries up and primary market investments shrink, many teams see token issuance as the only fundraising channel or a way to create exit opportunities for insiders.

This article will analyze the "Four Losses Dilemma" that is dismantling the altcoin market, examine why past repair mechanisms have failed, and propose possible pathways for rebalancing.

1

PANews·01-06 10:52

Bridgewater's Dalio Annual Report: AI is in the early stage of a bubble. Why are US stocks underperforming non-US stocks and gold?

The world's largest hedge fund, Bridgewater Associates founder Ray Dalio, has released his annual reflection, pointing out that in 2025 the biggest winner will be gold rather than US stocks, as all fiat currencies are depreciating. He also warns that AI is in the early stages of a bubble and predicts that the five major forces—debt, currency, politics, geopolitics, and technology—will reshape the global landscape. This article is compiled, translated, and written by BitpushNews.

(Previous summary: Bridgewater's Dalio: My Bitcoin holdings have remained unchanged! Stablecoins are "not cost-effective" for preserving wealth)

(Additional background: Bridgewater's Dalio calls for dollar decline—"Gold is indeed safer": I feel the market is in a bubble)

Table of Contents

1. Changes in Currency Value

2. US Stocks Significantly Underperform Non-US Markets and Gold

3. Valuations and Future Expectations

4. Changes in Political Order

5. Global Order

動區BlockTempo·01-06 02:35

The veteran blockchain summit "NFT Paris" announces its cancellation, and the community complains that sponsors are unable to get refunds.

On January 5th, Paris time, the NFT Paris event, originally scheduled to be held at the Villette Hall and having built a four-time reputation, announced its cancellation. The 20,000 tickets along with hundreds of sponsor booths suddenly became worthless. The organizers attributed the decision to a "market crash," undoubtedly putting the NFT sector on pause and writing a calm New Year’s memo for the Web3 ecosystem in 2026.

(Background: Bear market NFT comeback! Fat penguin on the Las Vegas sphere: What phenomena are we seeing?)

(Additional background: Flow has shifted to DeFi, the former top-tier NFT momentum and dilemma)

Table of Contents

The refund dilemma highlights liquidity limits

Bitcoin rises, NFTs fall: decoupling intensifies

After the bubble bursts, where does Web3 go from here?

FLOW0.15%

動區BlockTempo·01-06 02:20

Michael Burry's $1 Billion AI Short: Betting Against the 2026 Bubble?

Michael Burry, the investor immortalized in "The Big Short" for predicting the 2008 housing crash, has placed nearly $1 billion in put options against leading AI stocks—including Nvidia and Palantir—signaling deep skepticism about the sector's valuations heading into 2026.

CryptopulseElite·01-05 10:56

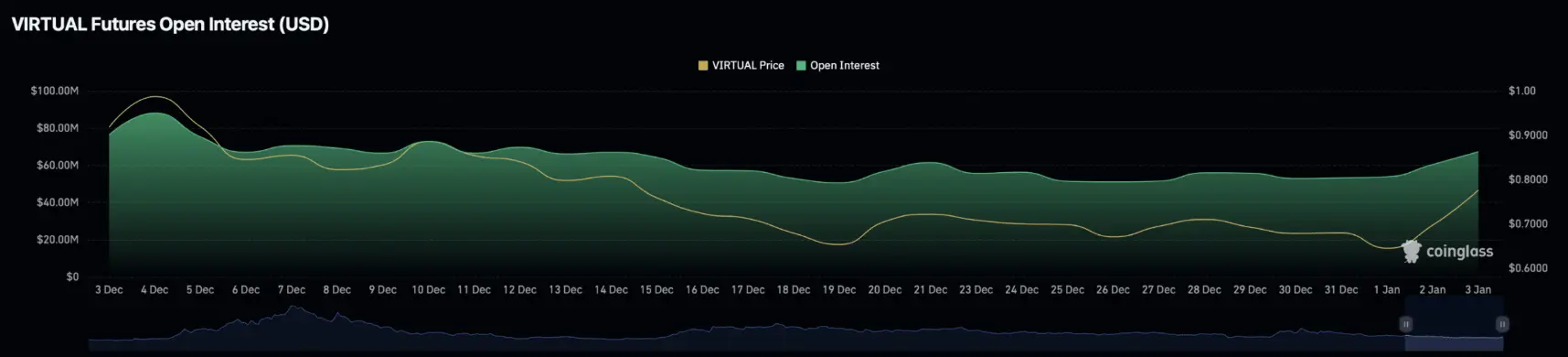

VIRTUAL Before the test: Is the growth sustainable as user activity becomes lively again?

Virtuals Protocol (VIRTUAL) – a token associated with the artificial intelligence sector – has surprised many by ignoring pessimistic forecasts about the risk of entering a "bubble" phase, continuing its impressive upward trend.

Previously, VIRTUAL experienced a correction pressure with a 12% decrease and entered a downward trend. However, n

VIRTUAL3.73%

TapChiBitcoin·01-04 01:32

Analysts Warn Silver Bubble Signals Can Appear Without Major Trend Reversal

Silver’s explosive rally is flashing bubble warnings in quantitative models, but Societe Generale says those signals may reflect volatility and structure rather than an imminent reversal, as fundamentals continue to support higher prices.

Analysts Separate Silver Bubble Signals From Calls for

Coinpedia·01-03 22:36

Tesla Q4 vehicle deliveries drop 16%, replaced by BYD as the leading brand. Michael Burry explains why he is not shorting.

Investor Michael Burry, famous for betting against the 2008 financial crisis, has recently issued multiple warnings that signs of a bubble are emerging in AI-related topics. He has also long maintained a highly cautious stance on Tesla's valuation. However, Burry recently explained that although he still believes Tesla is severely overvalued, he has not chosen to short the stock. The main reason is that the risks and costs associated with shorting have become too high to be attractive.

Tesla Q4 Deliveries Fall Short of Expectations, BYD Becomes the World's Largest Electric Vehicle Manufacturer

Burry pointed out that from a fundamental perspective, Tesla is facing multiple pressures. Its global electric vehicle sales are showing a downward trend, market competition is intensifying, price wars are eroding margins, and growth is slowing, leading to a significant gap between the current stock price and the company's actual operational status. In his view, Tesla's overall

ChainNewsAbmedia·01-03 11:34

NFT Market Matures in 2025: Utility, Gaming, and RWA Drive Growth

In 2025, the NFT market matured beyond its speculative bubble, shifting toward functional utility and sustainable growth. Market leaders included Cryptopunks, Courtyard, Dmarket and Pudgy Penguins.

The 2025 NFT Landscape: From Hype to Utility

In 2025, the non-fungible token ( NFT) market

Coinpedia·01-03 03:35

2026 Tech Stocks Continue to Rally! Dan Ives: Jensen Huang's CES Presentation Sets the Tone

American well-known tech bull and Wedbush Securities analyst Dan Ives stated in an interview on 12/31 that he shared personal views on AI tech stocks, energy, and US-China tech competition during the upcoming consumer electronics show (CES). He frankly said that the market has underestimated the "depth and breadth" of this wave of AI revolution, and believes that the current volatility is more like a pause in the middle of a party rather than a bubble burst.

CES Becomes a Key Stage, AI Officially Moves into the Physical World

Dan Ives pointed out that the upcoming CES exhibition will be an important turning point in this round of the tech cycle. He specifically mentioned NVIDIA CEO Jensen Huang's speech during the event, which is expected to set the tone for "autonomous robots" and "physical AI" (Physical AI).

In his view, CES is no longer just a showcase.

ChainNewsAbmedia·2025-12-31 04:43

The credit bubble surpasses 1929! Stock market capitalization accounts for 225% of GDP, doomsday alarm sounds

Economist Henrik Zeberg warns that the global markets are approaching a dangerous blow-off top phase. The S&P 500 has surged 900% since 2009, with US market capitalization reaching 225% of GDP, surpassing the peaks of 1929 and 2000. This prosperity is built on the credit bubble created by zero interest rates and QE after 2008, with productivity and real growth lagging behind, signaling a severe correction marking the end of the post-2008 monetary era.

MarketWhisper·2025-12-30 06:13

Hype VC bubble bursts as crypto projects in 2025 plummet disastrously

Crypto venture capital funds have poured billions of USD into early-stage tokens during the 2025 "risk-on" recovery. However, many of these bets are now trading significantly below the notable valuation levels seen in private funding rounds.

The widening gap between the figures

TapChiBitcoin·2025-12-30 00:24

2025, How will TradFi hunt bubbles? From Trump-themed coins to AI stocks

The global market in 2025 swings dramatically between extreme narratives and cold liquidation, offering investors a profound lesson in risk management. The cryptocurrency market witnessed a complete bubble cycle where "Trump concept" assets soared in popularity before crashing over 80%, exposing the fragility of relying solely on political narratives. Meanwhile, traditional financial markets (TradFi) staged several classic duels: "Big Short" Michael Burry targeted AI giants, Jim Chanos hunted Bitcoin-listed companies, demonstrating that macro trading based on in-depth research remains effective. From the soaring European defense stocks to the collapsing Turkish arbitrage trades, capital rapidly shifts driven by politics, liquidity, and human greed, ultimately revealing an eternal truth that runs through both crypto and TradFi: when the tide goes out, only solid fundamentals and prudent risk management can survive.

MarketWhisper·2025-12-29 04:14

Collapse and Rebuild: The Explosion of DeFi 2.0 Under Disordered Restructuring in 2026

December 28, 2025, written in Singapore

In Q4 2025, under the combined influence of market and policy forces, global traditional finance and emerging open finance are colliding violently in an increasingly disordered environment. The intense changes have cleared most of the residual heat from the first curve ( Note 1), leaving emotional wreckage that is difficult to digest in a short period. Meanwhile, traditional finance is also isolated and besieged amid the bubble narrative of AI and the chaos of the golden age, reaching the end of its strength. Central banks around the world are forced to rudely satisfy the market's rigid aesthetic with textbook-like monetary and fiscal policies, compelled to make everyone believe that these outdated economic inertia can still sustain for a little longer.

In several previous articles, I have already detailed the failure of the conventional economic model at the junction of the Kondratiev wave cycle, but the real experience of being in it still feels more tangible. Amidst the numerous noises, only a market outlook published by Coinbase at the end of the year stands out.

RWA-1.28%

PANews·2025-12-29 03:00

Token AI plummets sharply after 'significant divergence': Is a tech bubble forming?

The altcoin market is experiencing a clear weakening phase as liquidity flows continue to shrink. Selling pressure is spreading but not evenly distributed across asset groups, with the Artificial Intelligence (AI) sector becoming the focal point.

TapChiBitcoin·2025-12-27 15:07

2026 AI Bubble Risks & How They Could Impact Bitcoin’s Future

Strategic Outlook: Potential 2026 Market Corrections Driven by AI Bubble Burst

Growing concerns indicate that global equity markets may be approaching another speculative peak, primarily driven by exuberance surrounding artificial intelligence (AI) advancements. Analysts warn that if this AI

BTC-0.17%

CryptoBreaking·2025-12-27 11:30

AI Bubble Fears Could Hit Bitcoin and Crypto Markets First in 2026

Analysts warn that an AI-driven market correction in 2026 could negatively affect Bitcoin and the crypto sector due to strong correlations with U.S. equities, with fund managers flagging AI bubbles as a major risk. Heavy debt financing raises concerns about systemic impacts.

BTC-0.17%

ICOHOIDER·2025-12-26 13:59

2026 AI Bubble Risks & How They Could Impact Bitcoin’s Future

Strategic Outlook: Potential 2026 Market Corrections Driven by AI Bubble Burst

Growing concerns indicate that global equity markets may be approaching another speculative peak, primarily driven by exuberance surrounding artificial intelligence (AI) advancements. Analysts warn that if this AI

BTC-0.17%

CryptoBreaking·2025-12-26 11:25

How to Choose AI Technology Stocks? Understanding Dan Ives's Market Perspective on the Tech Bull Run

American well-known tech bull and Wedbush Securities analyst Dan Ives recently shared his core reasons for long-term optimism about AI topics during an interview on the "Master Investor Podcast." He recounted his personal investment experience during the 1990s tech bubble, extended to key areas such as AI chips, cloud computing, data centers, and enterprise applications, and further explained his thinking behind selecting tech stocks, as well as how he maintains investment discipline and conviction amid market volatility.

From the 1990s to today, why choose to embrace tech and AI stocks

Dan Ives stated that he has been researching tech stocks since the late 1990s, having experienced the dot-com bubble and financial crises. However, he believes that the current transformation brought by AI is different from past speculative bubbles. He described that the current AI development

ChainNewsAbmedia·2025-12-26 08:54

In the hype of the incentive bubble, who will pay for the false prosperity of the Lighter community?

Author: Zhou, ChainCatcher

Recently, the name Lighter has been trending nonstop in the community. Whether it's valuation discussions, points farm yield calculations, TGE timing guesses, or pre-market price fluctuations, the sentiment is exceptionally intense.

Binance, OKX, and other exchanges have announced the launch of pre-market trading for the LIT token. Polymarket's prediction market shows a greater than 50% chance that its valuation will exceed $3 billion after TGE. On-chain transfer signals of 250 million LIT tokens have further ignited FOMO sentiment, making everything seem logical. Lighter is undoubtedly one of the most anticipated projects in the crypto market at the end of the year.

However, while everyone is calculating how many LIT they can exchange points for or how much it will rise after TGE, the more fundamental question is being overlooked: this airdrop frenzy

PANews·2025-12-26 05:02

Bloomberg's 2026 outlook does not mention crypto, but these four macro "powder kegs" determine the fate of the bull market.

Bloomberg recently released an authoritative economic outlook for 2026. Although it did not directly mention cryptocurrencies throughout, its in-depth analysis of four core themes—threats to Federal Reserve independence, AI stock market bubble risks, the transmission of tariffs to the real economy, and the stability of the US dollar—are all closely linked to the fate of the crypto market. The analysis points out that a change in Federal Reserve Chair in May 2026 could shake the foundations of the dollar, indirectly strengthening Bitcoin's narrative as "digital gold"; meanwhile, a potential correction in the AI sector could trigger widespread risk-off sentiment, short-term dragging down crypto assets. Institutional forecasts for Bitcoin's price in 2026 vary greatly, with bullish targets reaching as high as 250,000, while bearish scenarios could see prices drop below 75,000. The market direction may be clarified in the first quarter.

BTC-0.17%

MarketWhisper·2025-12-25 05:14

Load More