Search results for "CFX"

Conflux (CFX) Integrates CNH₮0: Supporting the First RMB Stablecoin

Conflux Network (CFX) has officially integrated CNH₮0, marking a major milestone as the platform now supports the first RMB-denominated stablecoin.

CFX-5.59%

CryptopulseElite·2025-11-12 09:48

China's public blockchain welcomes a capital tidal wave! Conflux plans to co-build an ecosystem with a listed company, and the Alibaba Group strategically invests in the Pharos public blockchain.

The Chinese public blockchain market is witnessing significant capital and strategic cooperation movements. The Conflux Foundation announced plans to authorize the Ecosystem Fund to collaborate with global listed companies, covering areas such as Digital Asset Treasury (DAT), POS Node operations, on-chain Liquidity, and RWA asset management, with plans to lock the CFX Token injected into the listed companies' treasury for no less than 4 years. At the same time, Yunfeng Financial signed a strategic cooperation agreement with Ant Digital Technology (Ant Digital) and invested in Layer1 public blockchain Pharos, which focuses on institutional-level RWA applications, promoting the deep integration of Web3 and TradFi.

CFX-5.59%

MarketWhisper·2025-09-03 05:08

Conflux proposes a 4-year treasury collaboration with a listed company, and the CFX community governance vote is imminent! Will the hard fork upgrade break through $0.5? | CFX Price Prediction

The Conflux Foundation proposed on September 2 to authorize its ecosystem fund to engage in strategic cooperation with global listed companies, involving digital asset treasury allocation, RWA asset management, and node operation, among other areas, with a lock-up period for CFX tokens set at no less than 4 years. This move marks a new stage in the integration of public chain projects with the treasury of listed companies, aiming to enhance ecological stability and liquidity through long-term institutional cooperation. At the same time, the Conflux network has just completed the v3.0.1 hard fork upgrade, with transaction speeds increased to 15000 TPS and enhanced EVM compatibility. Although the CFX price has been under pressure recently (down 18% this month), traders are paying attention to whether it can break through the critical resistance of 0.5 USD in September.

CFX-5.59%

MarketWhisper·2025-09-03 00:41

China Stock ETF Inflows Surge Before Parade

Altcoins in September 2025 are bringing some pretty critical token unlocks, along with hard fork schedule implementations, and also some major announcements across these three key digital assets right now. These September crypto events could actually reshape the altcoin price outlook as CFX

TheBitTimesCom·2025-09-01 15:39

Top cryptocurrency price predictions: PYTH soars, CFX rallies ahead of Hard Fork, JUP makes a strong breakthrough.

After the speech by The Federal Reserve (FED) Chairman Powell at the Jackson Hole seminar, the crypto market remains highly tense this week. However, amid the fluctuations, Pyth Network (PYTH), Conflux (CFX), and Jupiter (JUP) have shown strong momentum. This article will analyze the latest pump momentum and technical forecasts of these three major coins.

MarketWhisper·2025-08-29 07:35

Exclusive Crypto Indonesia 2025: OJK Rules, CFX Launch, and Stablecoin Debate

Indonesia’s OJK is enhancing bank governance and compliance. Digital Rupiah and stablecoins can coexist, but heavy reliance on dollar-backed tokens is risky. Tax reforms are intended to increase investor confidence, yet may influence traders' choice between onshore and offshore markets.

CFX-5.59%

BitcoincomNews·2025-08-25 07:29

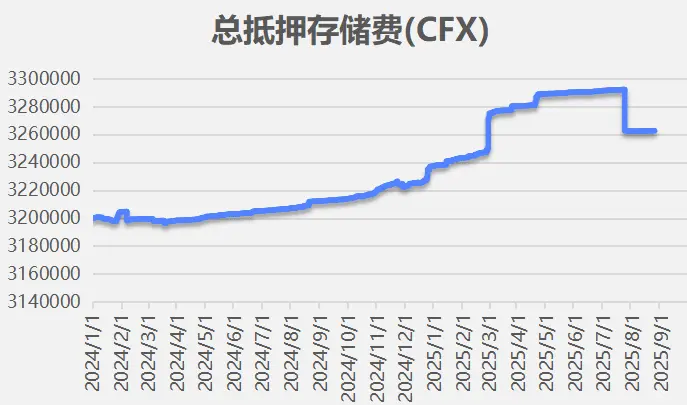

Conflux (CFX) Data Weekly Report: Staking Volume Surges by 1.42 Million CFX, New York Meetup to Focus on the Future of Web3

The on-chain data of Conflux Network (CFX) over the past week has shown several key changes, from a significant increase in stake to a rebound in the DeFi ecosystem, all reflecting the steady progress of its network activity. Meanwhile, the official announcement stated that a meet-up will be held in New York on August 26 to discuss the transition from Web2 to Web3 and the conversion of professional skills, providing opportunities for in-depth communication between the community and developers.

CFX-5.59%

MarketWhisper·2025-08-25 02:08

The altcoin with the largest pump on August 21: OKB hits 200 USD, with CFX and GT strongly following the pump.

The cryptocurrency market quickly rebounded after a brief shock caused by the Federal Reserve meeting minutes, with several mainstream and platform tokens experiencing strong rebounds. Among them, OKB (OKB) led the way, with a cumulative increase of over 50% in just two days, reaching a new historical high; Conflux (CFX) and GateToken (GT) also recorded double-digit gains, becoming the focus of the market.

MarketWhisper·2025-08-21 03:58

Conflux (CFX) August 21 AMA Preview: Comprehensive Analysis of 3.0 Upgrade, AxCNH stablecoin, and Price Predictions

Conflux (CFX) will hold an AMA event on August 21 at 18:00 (UTC) on Discord, providing open Q&A support for participants of SummerHackfest 2025. With the 3.0 upgrade, AxCNH stablecoin pilot, and the intertwining of Chinese regulatory dynamics, CFX price movement has become the market focus. This article will delve into Conflux's technical upgrades, policy challenges, and potential price movement, and explore possible market reactions before and after the AMA.

CFX-5.59%

MarketWhisper·2025-08-21 01:48

Conflux Price Prediction 2025-2031: Can CFX Become the Leader of the China crypto market?

As the only public chain project in China that meets regulatory standards, Conflux Network (CFX) has been steadily enhancing its position in the Chinese crypto market in recent years. With Bitcoin breaking through $120,000 and investor interest in the Asian market heating up, the price movement of CFX has attracted significant attention. Recent analysis indicates that CFX is expected to challenge $0.47 in 2025, potentially reaching a peak of $4.15 by 2031. So, can CFX lead the Chinese crypto market and even challenge the $1 mark?

CFX-5.59%

MarketWhisper·2025-08-20 03:08

Accumulation Alert: 5 Assets Gaining Momentum With 20%+ Growth Prospects

Five mid-cap assets—ALGO, CRV, CFX, XTZ, and CKB—are showing accumulation patterns with 20%+ growth potential.

Increased network activity and developer engagement underpin their current momentum.

Liquidity stability and adoption trends suggest sustained market interest in these tokens.

The

CryptoNewsLand·2025-08-11 02:34

Conflux has soared over 180% in a single month! The bull run flag pattern is poised to take off, with a key resistance breakthrough for China's Blockchain CFX imminent.

Conflux (CFX) has soared over 180% in a single month, forming a classic bull flag pattern in its technical chart, becoming the spotlight of the Chinese blockchain market. As the price approaches a key resistance level, traders and investors are closely following whether CFX can break through the consolidation zone and initiate a new round of pump. This article will provide an in-depth analysis of CFX's technical aspects, fundamentals, and upcoming major catalysts, helping you seize this potential opportunity.

CFX-5.59%

MarketWhisper·2025-08-08 10:00

LTC, POL, CFX bullish patterns emerge! Rebound signals heat up in the crypto market.

As the cryptocurrency market enters a narrow consolidation phase, some altcoins such as Litecoin (LTC), POL (formerly MATIC), and Conflux (CFX) are showing clear bullish technical patterns ahead of others. These assets are brewing a breakout near key resistance levels, attracting the attention of traders. Will this strong momentum lead to a new round of Rebound, or will it gradually fade away amid market hesitation? This article will delve into the latest trends and potential opportunities of three popular Tokens.

MarketWhisper·2025-08-08 02:43

Conflux (CFX) Price Prediction: The crucial level for the battle between bulls and bears is $0.23, with the head and shoulders pattern suggesting a rise to $0.27?

Conflux (CFX) has maintained a clear rise trend since it stood above $0.10 on July 19, with a single-day big pump of 10% yesterday (CFX price surged). This round of volatility was driven by the rotation of alts and the offshore RMB stablecoin plan (CFX stablecoin) narrative. The technical aspect is forming a bullish inverse head and shoulders pattern, with the neckline coinciding with the short positions' maximum pain point at $0.23. If the long positions can strongly break through this key resistance level (CFX key resistance), the price may hit $0.27; conversely, if it falls below the $0.20 support (long positions' maximum pain point), it could retreat to $0.18 or even $0.16. The number of on-chain active addresses has reached a new high for the year (CFX on-chain activity), and the Bull vs Bear Battle is heating up.

CFX-5.59%

MarketWhisper·2025-08-08 02:26

New breakthrough in the internationalization of the Renminbi! Conflux Tree Graph public chain disrupts the stablecoin landscape, who will dominate the trillion-dollar market?

With the acceleration of the internationalization process of the Renminbi, Conflux (CFX) Tree Graph Public Chain 3.0 is becoming a key strategic cornerstone for the development of stablecoins in the country. Whether it is Kyrgyzstan expatriates remitting living expenses in seconds or Central Asian cotton reaching Chinese factories directly, the Tree Graph Public Chain is using innovative technology to open up digital tracks for global capital flow. This article will deeply analyze how the Tree Graph Public Chain, with its high performance, Compliance safety, and policy endorsement, is reshaping the landscape of cross-border payments and the RWA market, bringing unprecedented opportunities for entrepreneurs.

CFX-5.59%

MarketWhisper·2025-08-07 10:29

China is cautiously laying out stablecoin strategies with Hong Kong as a testing ground, with Conflux and ChainMaker as potential infrastructure options.

China's financial regulatory authorities are closely monitoring the global stablecoin dynamics. Recently, they convened cryptocurrency experts to discuss strategies for adapting to national conditions, emphasizing the need to comply with capital flow management requirements. Hong Kong, as a policy testing ground, has legislated to allow licensed institutions to issue fiat-collateralized stablecoins, initially opening licenses only to a few major state-owned banks. Regulators are concerned that USD stablecoins enhance the dominance of the US dollar, but state-owned enterprises are increasingly interested in stablecoin payment settlements, with several central enterprises in Hong Kong applying for licenses. The offshore RMB stablecoin is also under consideration. Industry analysis points out that the public blockchain Conflux (CFX), due to its compliant status and adaptability to international standards, may become the preferred underlying for stablecoins; while the Chang'an Chain (ChainMaker), despite receiving policy support, may restrict cross-border applications due to its consortium blockchain architecture.

CFX-5.59%

MarketWhisper·2025-08-07 06:23

Conflux 3.0.0 upgrade countdown! Can CFX become the most worth following encryption investment of 2025?

With the announcement of the major upgrade v.3.0.0 of the Conflux network (CFX), node operators must complete the upgrade by September 1. This move not only brings 8 new improvement proposals (CIP) but also significantly enhances compatibility with the Ethereum Virtual Machine (EVM) and network performance. The price of CFX has recently experienced significant fluctuations, with a maximum increase of 285% within 30 days, sparking heated discussions in the market about its investment value. This article will comprehensively analyze whether CFX is worth including in your investment portfolio by combining technical upgrades, price forecasts, expert opinions, and risk opportunities.

CFX-5.59%

MarketWhisper·2025-08-07 02:56

Bullish Patterns Emerge in LTC, POL & CFX Prices as Crypto Market Consolidates—Is a Rally Brewing?

Altcoins such as LTC, POL, and CFX are gaining momentum as BTC and ETH prices stabilize. A breakout from the current range could lead to short-term rallies of 10% to 20%, making these altcoins top performers.

BitcoincomNews·2025-08-06 23:11

Conflux fluctuation intensifies! Can CFX break through the key resistance of 0.23 dollars?

Since the end of July, the price of Conflux (CFX) has fluctuated dramatically, and after a false breakout of the triangular pattern, the market's focus has shifted to the key resistance level of 0.23 USD. Can CFX continue the astonishing pump of nearly 300% in July and welcome a new round of breakthroughs? This article will analyze the latest market trends and future prospects of CFX.

CFX-5.59%

MarketWhisper·2025-08-05 09:42

Ethereum Conflux in China Goes Viral: 3.0 Upgrade Helps CFX Pump, but Are There Risks Hidden in On-Chain Data?

With the recent big pump of Conflux (CFX) prices and the upcoming 3.0 upgrade, the narrative of "China's Ethereum" is sweeping the crypto market once again. Does this highly anticipated public chain truly deliver on its promises of decentralization and high activity? This article takes you deep into the analysis of Conflux's technology, policy dividends, market enthusiasm, and the real situation behind on-chain data.

MarketWhisper·2025-08-05 08:51

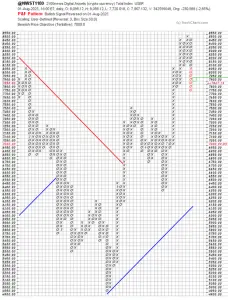

2100NEWS WEEKLY CRYPTO REPORT Aug-1

The NWST1100 index fell by 4.28% last week; CFX, a Large-Cap Coin, has made the most significant leap in rank within the NWSL100 crypto index biweekly.

\Below, we present a standardized weekly report and next week’s outlook, prepared based on the Theory Swingtum of intelligent finance. We gauge the

2100NEWSICO·2025-08-05 05:48

Top 4 Crypto Assets to Buy in August: Which can Double, XRP, TRX, CFX?

August has arrived, and the cryptocurrency market has once again become the focus of funding attention. Although the overall atmosphere for alts is bearish, certain promising crypto coins are brewing a new round of explosion against the trend. With investors' risk appetite recovering, which coins have the best chance of achieving excess returns this month? This article selects four major crypto assets worth following, from fundamentals to technicals, to help you grasp the latest investment hotspots.

MarketWhisper·2025-08-05 04:09

HYPE, PUMP, and CFX lead the pump of August alts, has a new cycle of capital rotation started?

Although the altcoin season index has not yet broken the classic threshold of 75 points, the market has once again focused on some active and liquid alts at the beginning of August. Hyperliquid (HYPE), PumpFun (PUMP), and Conflux (CFX) have become the three major topics of discussion among traders. With Bitcoin's dominance maintaining above 60%, does the selective rise of these Tokens indicate that a capital rotation wave has arrived?

MarketWhisper·2025-08-05 02:35

Conflux Price Prediction: With China's narrative and policy dividends supporting it, can CFX strongly break through the 0.23 USD resistance?

Conflux (CFX) experienced an astonishing pump in July, soaring from a low of $0.07 to as high as $0.28 within a month, with a cumulative increase of up to 297%. However, as the price fluctuated sharply and false breakouts appeared in a triangular pattern, the market has become highly concerned about whether CFX can effectively break through the key resistance level of $0.23. This article will analyze the future trend of CFX in depth, combining technical charts, on-chain data, and narratives from China.

CFX-5.59%

MarketWhisper·2025-08-05 02:24

Conflux's CFX Rallies on China Buzz, But Analysts Believe Fundamentals Still Lag

Conflux's CFX token surged 14% recently, outperforming the CoinDesk 20 index. Despite its positioning as "China's Ethereum," on-chain activity remains stagnant, raising concerns about centralization and the validity of Conflux as a narrative proxy for the growing Chinese crypto market.

YahooFinance·2025-08-04 08:27

Today's largest price prediction for crypto assets: ENA, CFX, and XLM aim to expand the rebound, flashing the golden cross indicator.

Today (4) during the Asian session, Ethena (ENA), Conflux (CFX), and Stellar (XLM) all saw slight increases, continuing the upward trend from the weekend, outperforming the Crypto Assets market in the past 24 hours. From a technical perspective, the remaining bullish momentum may catalyze a bullish reversal for the leading altcoins.

MarketWhisper·2025-08-04 03:47

Conflux Price Prediction: Massive CFX Transfer to Private Wallet Stimulates Rebound, Will There Be "Big Events" in September?

Conflux (CFX) has welcomed a strong Rebound, robustly recovering from the recent Fluctuation triggered by the upcoming v3.0 upgrade. Today (4th) during the Asian session, CFX is reported at 0.2124 USD, with a daily pump of nearly 10%. The market capitalization of Conflux is currently 1.1 billion USD, and the volume for just one day has reached 453.7 million USD, growing 151% compared to the previous trading day.

CFX-5.59%

MarketWhisper·2025-08-04 02:50

Conflux (CFX) price prediction: After a strong rise of 297%, it enters a consolidation phase, and the triangular pattern suggests a potential breakout.

Conflux (CFX) performed strongly in July, soaring from a low of $0.07 to a high of $0.28, a rise of 297%. The current price has pulled back to around $0.18 and is showing a symmetrical triangle consolidation pattern. Technical Analysis suggests that a new breakout may be imminent. Encryption traders should focus on the breakout situation at the resistance levels of $0.218 and $0.23.

CFX-5.59%

MarketWhisper·2025-08-04 02:39

Discover the Best Blockchain Projects to Invest in for 2025: CFX, TIME, and PUMP Lead the Surge

Conflux (CFX) surged with a 132.79% volume increase, indicating genuine demand and positioning it as a top blockchain project for 2025.

Chrono.tech (TIME) posted a massive price rally, supported by a fully unlocked supply and a 3,144.99% volume spike.

Pump.fun (PUMP) continued its upward trend on

CryptoNewsLand·2025-08-03 22:53

3 altcoins signal a strong reversal, recording double-digit gains

Ethena (ENA), Conflux (CFX) and Stellar (XLM) maintained a strong rise on Monday morning, continuing the positive trend from Sunday and outperforming most of the crypto market in the past 24 hours. Technical signals indicate that the upward momentum may still hold potential to act as a catalyst, paving the way for m

HAI-3.3%

TapChiBitcoin·2025-08-03 20:00

Top crypto coins increase and decrease this week: M, CFX, BONK, FARTCOIN

This week in the crypto market has witnessed a strong correction. Bitcoin fell below the $113,700 mark, while Ethereum (ETH) also slid over 5%, mainly due to weak employment data in America and increasing recession concerns.

Meanwhile, ETF funds recorded a strong outflow of capital, ending the series

TapChiBitcoin·2025-08-03 18:00

Conflux (CFX) cools down after the Hardfork v3.0.0 information – A pause before the next increase?

Conflux (CFX) has just marked an important milestone in the journey of upgrading the network infrastructure, with the hardfork v3.0.0 – a major improvement expected to be completed before September 1.

This upgrade integrates eight Conflux Improvement Proposals (CIP), categorized into three main groups: enhancing capabilities.

CFX-5.59%

TapChiBitcoin·2025-08-03 02:00

Top 5 Altcoin Gainers Today: OMNI, CFX, SQD, ZBCN, and WILD Surge Up to 90+

Low-cap altcoins outperformed major tokens today, with OMNI and CFX recording the largest percentage increases across major exchanges.

Volume surges played a crucial role, with several of these assets seeing a two- to threefold increase in 24-hour turnover.

Market conditions remain speculative, wi

CryptoNewsLand·2025-08-01 03:35

Conflux Price Prediction: CFX "Offshore Renminbi Stablecoin" Bullish Momentum Cooling, Can the National Team Help Reach 0.60 USD?

Conflux (CFX) experienced a big pump of over 40% in a single day, and today (30) during the Asian session, it fell back to 0.1984 USD, as the positive news regarding offshore RMB stablecoin quickly cooled down. However, analysts state that CFX remains above the weekly level, and if long positions can withstand the short-term pullback, it may challenge 0.60 USD in the future.

CFX-5.59%

MarketWhisper·2025-07-30 07:01

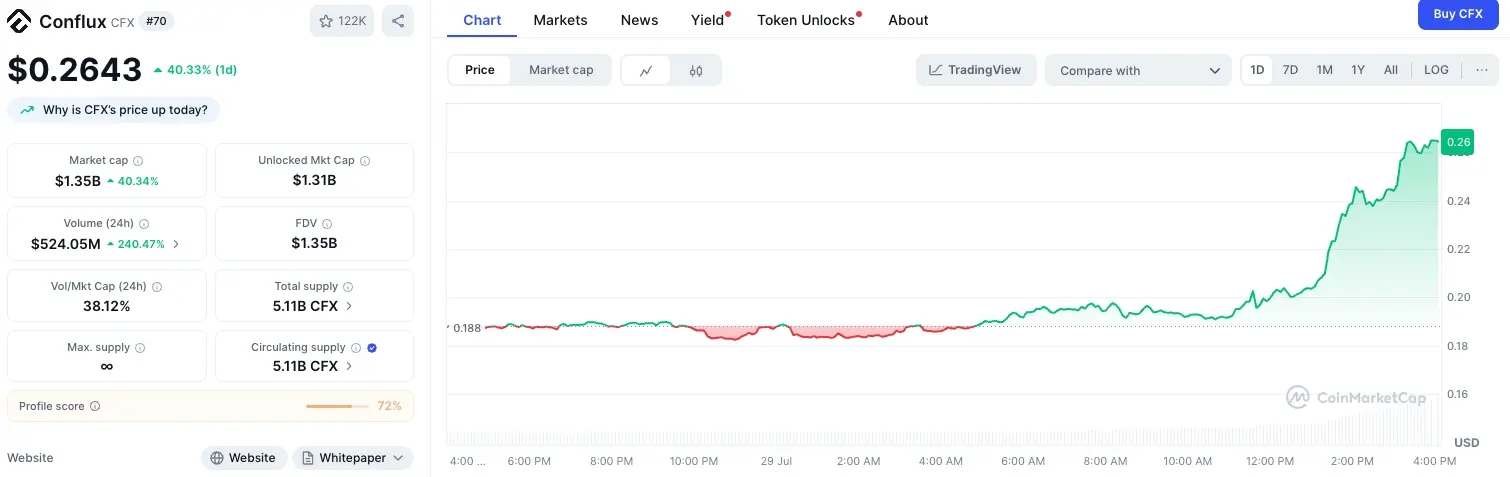

CFX Soars 38% on Tech Upgrades and China Media Push

Conflux (CFX) has seen significant price movement, surging 38% in 24 hours to $0.2648, with a market cap increase to $1.36 billion. Technological upgrades and national media coverage enhance its appeal and underscore its role in compliant blockchain solutions in China.

CFX-5.59%

TodayqNews·2025-07-29 14:33

7.29 AI Daily Crypto Assets regulatory landscape is evolving rapidly, global competition is becoming increasingly fierce.

AI today discovered 1. The Trump administration is promoting a new regulatory framework for Crypto Assets, with intensified competition between the SEC and CFTC 2. Hong Kong's "stablecoin regulation" will officially take effect on August 1, triggering a global regulatory race 3. Ethereum L1 scaling is accelerating, with heavy proposals like EIP-7987 sparking heated discussions in the community 4. Multiple favourable informations for the Conflux ecosystem, with CFX being seen as the "next 100x coin" 5. The active supply ratio of Bitcoin has soared to 37%, and institutional-level capital inflows may drive a new bull run.

GateUser-26c36996·2025-07-29 10:05

CFX big pump frenzy: With stablecoins from Hong Kong and support from the national team, will Conflux become the next phenomenon-level public chain?

Recently, Conflux (CFX) has been performing impressively in the crypto assets market, with its price chart showing a significant upward trend, a surge in 24-hour trading volume, and triggering a large number of short positions getting liquidated. The market's attention on CFX is at an unprecedented high, with some voices predicting it could become the "next 100x coin." This wave of pump is not coincidental, but rather the result of multiple favourable information stacking up on the technical, policy, and funding levels. This article will delve into the deeper reasons behind the rise of CFX and explore its potential and challenges.

CFX-5.59%

MarketWhisper·2025-07-29 08:40

Conflux Price Prediction: China Shifts to "Offshore Renminbi Stablecoin" to Counter the Dollar, CFX Soars 40% Showcasing Astonishing Confidence in Asia

Conflux (CFX) has surged over 40% in a single day, reporting at 0.2644 USD in the early European trading session today (29). China is turning to "offshore RMB stablecoin" to counter the US dollar. As a China Layer 1 Blockchain supported by the Shanghai Municipal Government, Conflux Network has partnered with fintech company AnchorX and Shenzhen-listed Dongxin Peace Technology to create a stablecoin linked to the offshore RMB.

CFX-5.59%

MarketWhisper·2025-07-29 08:11

Conflux (CFX) price rises over 40% to break through $0.26! Offshore RMB stablecoin AxCNH becomes a key catalyst, accelerating blockchain layout in Asia.

The public chain project Conflux's native token CFX is leading the rise in the Crypto Assets market today, surging 40% in a single day to break through $0.26, with volume skyrocketing by 128%. The core driving factors include: China's policy shift to support Compliance private stablecoins, Conflux's joint launch of the offshore RMB stablecoin AxCNH with Anchoring Technology, and its active layout in the fields of RWA tokenization and Blockchain cross-border payments (especially for Belt and Road Initiative Settlement). Pilot projects between Singapore and Malaysia are imminent, with long positions dominating the derivation market, and technical analysis confirming a breakout trend, but the RSI being Overbought requires caution for a pullback.

CFX-5.59%

MarketWhisper·2025-07-29 07:56

Why Is Conflux (CFX) Price Up Today?

Conflux price is having a big day, leading the crypto market with a 28% price jump to around $0.2439. Trading volume has also exploded, up over 128% in the past 24 hours, according to CoinMarketCap. The surge comes as momentum builds around stablecoin developments and Conflux’s expanding role in

CaptainAltcoin·2025-07-29 07:06

Gate today market analysis: BTC is in a narrow range of fluctuations with support, CFX is experiencing a big pump of 20% leading the alts.

Bitcoin (BTC) is fluctuating narrowly in the range of $118,000 - $120,000, touching the middle band of the Bollinger Bands on the daily chart and receiving support. BTC market share has slightly rebounded to 60.8%.

MarketWhisper·2025-07-29 06:21

CFX Surges 12% as Conflux 3.0 Upgrade Sparks Demand

CFX, the native coin of Conflux Network, has increased by 12%, emerging as the leading performer in the crypto market, highlighting its status as China's only regulatory-compliant public blockchain.

CFX-5.59%

BeInCrypto·2025-07-29 01:30

Altcoins to follow this week: CFX, PENGU, ENA, PUMP, XTZ have experienced significant fluctuations, and the battle between long and short positions may encounter larger close all positions.

The volatility of the Crypto Assets world is testing investors' confidence, as last week a Whale from the Satoshi Nakamoto era suddenly moved 80,000 Bitcoins (BTC), causing traders to closely watch the fluctuations of altcoins. Looking back at last week's trends, Conflux (CFX), Pudgy Penguins (Pengu), Ethena (ENA), PumpFun (PUMP), and Tezos (XTZ) experienced intense fluctuations, and there may be even greater shocks this week.

MarketWhisper·2025-07-28 02:53

Altcoins to Watch This Weekend: CFX, PENGU, & PUMP Price Predictions!

As the weekend of July 26-27 unfolds, the cryptocurrency market remains a hotbed of activity, with several altcoins presenting intriguing opportunities and challenges. Known for its inherent volatility, the crypto market demands vigilant observation, especially for specific assets showing unique

Coinstagess·2025-07-27 06:00

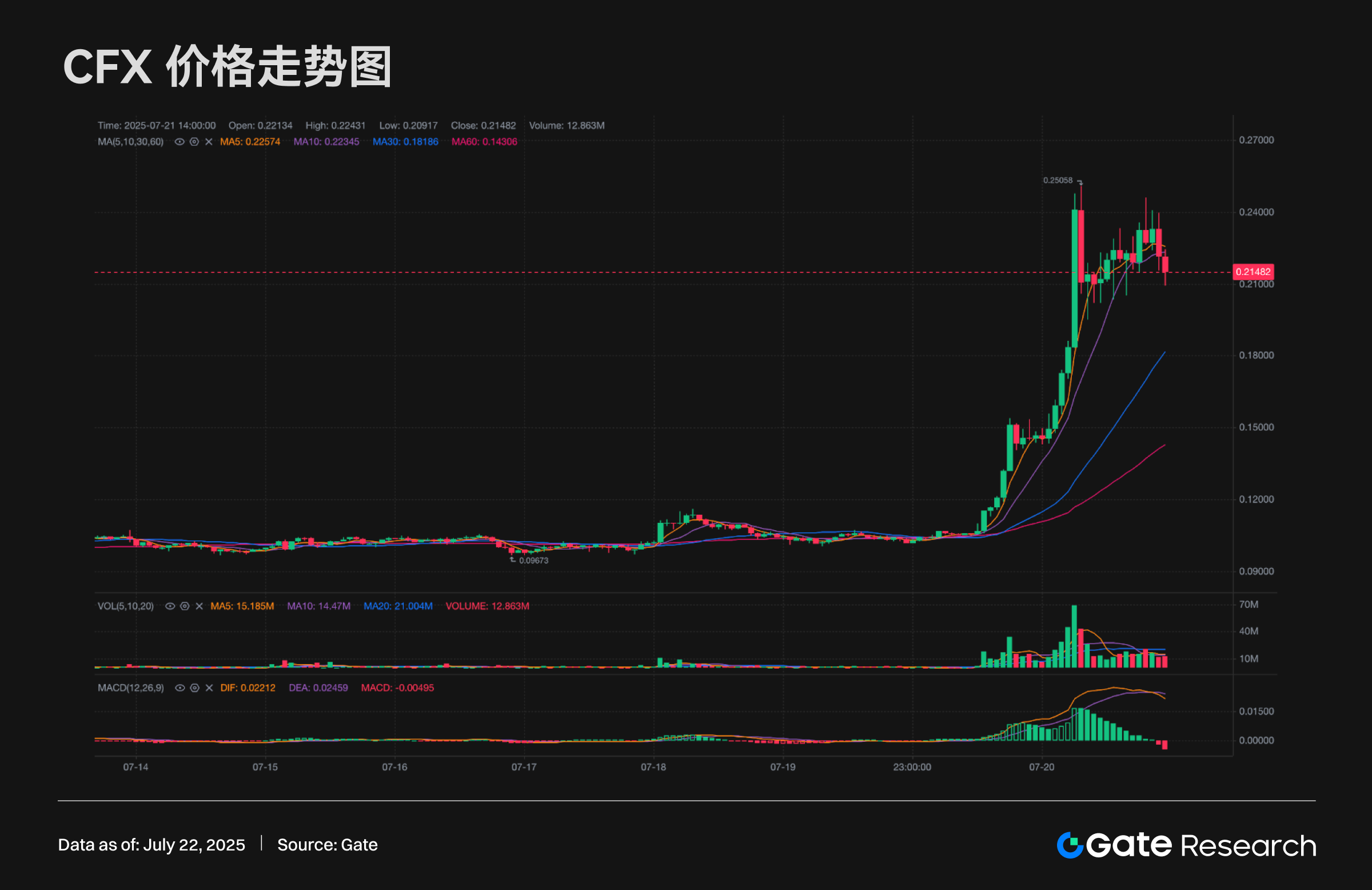

Gate Research Institute: Institutionalization of Ethereum accelerates, CFX rises over 111%, Aave TVL hits all-time high | Gate VIP Weekly Report

Recently, BTC has been oscillating and consolidating at a high level, while ETH has performed better, with prices close to 3,760 USDT. Conflux and Tezos have seen significant increases under ecological development. Ethereum has strong capital inflow, and Aave's TVL has reached a historic high. The US is accelerating the legislative process for encryption regulation.

GateResearch·2025-07-22 11:13

Gate market analysis today: BTC, ETH, CFX, Chainbase, Memecore are still expected to rise in the short term.

Bitcoin (BTC) is currently in a high-level pullback and consolidation phase after experiencing a strong surge over the past week. In the short term, both bulls and bears are locked in a tug-of-war, and market sentiment is cautious. Investors need to closely monitor the effectiveness of the support level at 116,500 USDT, as well as the breakthrough situation of the resistance level at 118,500-119,000 USDT, while also observing whether the Trading Volume can align with the price to show a clear direction.

MarketWhisper·2025-07-22 05:01

CFX defends 0.20 USD! What are the key implications behind China's public chain Conflux participating in the issuance of "offshore RMB"?

Conflux (CFX) recently welcomed a big pump in the market, all due to this Chinese blue-chip public chain announcing its participation in the "offshore RMB" issuance, which stimulated long positions sentiment in the encryption community. Today (22nd) in the Asian early session, CFX slightly retraced from the short-term high point, currently reporting at 0.2089 USD, and the bulls seem to be working hard to hold the 0.2000 USD integer level.

CFX-5.59%

MarketWhisper·2025-07-22 03:53

Conflux Token price doubled in a single day, want to participate in the offshore RMB stablecoin pilot?

Author: 1912212.eth, Foresight News

On July 20, the price of Conflux public chain token CFX started to rise sharply, rising from around $0.11 to $0.25, with a single-day increase of more than 100%. In July this year, it recorded a monthly increase of 202%. If calculated based on the bottom of $0.0

CFX-5.59%

PANews·2025-07-21 23:08

Top 3 Cryptocurrencies of July 21, 2025: Conflux, Dogwifhat, and JasmyCoin Show Varied Market Beh...

CFX experienced intraday spikes and corrections, indicating strong market indecision and potential consolidation ahead.

WIF saw early gains erased by a sharp decline, suggesting profit-taking and resistance around its recent high.

JASMY climbed during the session but faced a quick reversal,

CryptoNewsLand·2025-07-21 21:34

Conflux's CFX Price Doubles on Stablecoin Reveal, Upgrade Plans

Conflux (CFX) surged 115% after announcing an offshore-yuan-pegged stablecoin and the upcoming Conflux 3.0 upgrade. The 24-hour trading volume soared to $1.7 billion, attracting renewed interest from Asian traders and enhancing its market position.

CFX-5.59%

YahooFinance·2025-07-21 10:29

Load More