Search results for "CLO"

Avalanche Expands RWA Footprint as Galaxy Launches $75M Tokenized CLO

Galaxy Digital has announced a $75 million tokenized collateralized loan obligation (CLO) on the Avalanche network.

Tokenizing private credit is a $6 trillion opportunity, and giants like Apollo, KKR and Janus Henderson have deployed products on Avalanche.

Galaxy Digital, the publicly

AVAX3.76%

CryptoNewsFlash·01-18 12:35

Avalanche Expands RWA Footprint as Galaxy Launches $75M Tokenized CLO

Galaxy Digital has announced a $75 million tokenized collateralized loan obligation (CLO) on the Avalanche network.

Tokenizing private credit is a $6 trillion opportunity, and giants like Apollo, KKR and Janus Henderson have deployed products on Avalanche.

Galaxy Digital, the publicly

AVAX3.76%

CryptoNewsFlash·01-17 12:35

Avalanche Expands RWA Footprint as Galaxy Launches $75M Tokenized CLO

Galaxy Digital has announced a $75 million tokenized collateralized loan obligation (CLO) on the Avalanche network.

Tokenizing private credit is a $6 trillion opportunity, and giants like Apollo, KKR and Janus Henderson have deployed products on Avalanche.

Galaxy Digital, the publicly

AVAX3.76%

CryptoNewsFlash·01-16 12:30

Galaxy Digital Closes $75M Tokenized CLO on Avalanche as Onchain Credit Push Grows

_Galaxy completed a $75M tokenized CLO on Avalanche, with the capacity to scale issuance up to $200M._

_Grove anchored the deal with $50M, supporting crypto-backed consumer lending via Arch Lending._

_INX tokenized the tranches, enabling secondary trading for qualified investors on a re

LiveBTCNews·01-15 18:55

CLO Price Eyes Short-Term Recovery While Ichimoku Cloud Caps Upside

CLO price analysis reveals a mixed outlook, with short-term recovery attempts facing bearish pressure. Ichimoku Cloud signals potential rebounds, while extreme oversold RSI and high volatility indicate cautious trading ahead.

CryptoFrontNews·01-08 04:11

ICP Targets 2026 AI App Layer as Dominic Williams Outlines Privacy-First Roadmap

In its 2026 roadmap, Internet Computer Protocol (ICP) will focus on Web3-native no-code tools and mass-market cloud engines.

ICP supporters said that, in addition to infrastructure, usability, cost, and trust, will play a key role in network adoption.

Dominic Williams, the founder of the clo

ICP5.02%

CryptoNewsFlash·01-05 15:30

ICP Targets 2026 AI App Layer as Dominic Williams Outlines Privacy-First Roadmap

In its 2026 roadmap, Internet Computer Protocol (ICP) will focus on Web3-native no-code tools and mass-market cloud engines.

ICP supporters said that, in addition to infrastructure, usability, cost, and trust, will play a key role in network adoption.

Dominic Williams, the founder of the clo

ICP5.02%

CryptoNewsFlash·01-04 15:30

Altcoin Season Debate Reignites: Are These 4 Crypto Assets Worth Holding as Liquidity Improves?

Improving liquidity often reshapes capital rotation before sustained price trends appear.

Larger networks like ADA are viewed as stability anchors during uncertain recovery phases.

Smaller tokens such as RTX, LYNK, and CLO carry a higher risk tied to execution progress.

As global liquidi

ADA3.73%

CryptoNewsLand·01-04 03:26

ICP Targets 2026 AI App Layer as Dominic Williams Outlines Privacy-First Roadmap

In its 2026 roadmap, Internet Computer Protocol (ICP) will focus on Web3-native no-code tools and mass-market cloud engines.

ICP supporters said that, in addition to infrastructure, usability, cost, and trust, will play a key role in network adoption.

Dominic Williams, the founder of the clo

ICP5.02%

CryptoNewsFlash·01-03 15:25

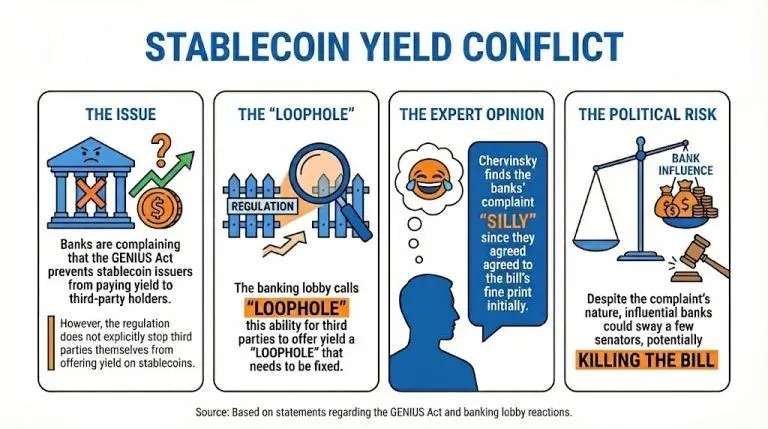

State of Senate's Crypto Market Bill: Stablecoins, Trump's Involvement and DeFi Pain Points Examined

The discussion happening in the Senate about the so-called crypto market structure bill has slowed down as the debate has reached key issues. According to Variant CLO Jake Chervinsky, it is unlikely for this bill to be approved before February.

Crypto Market Structure Bill Slows Down in Senate,

Coinpedia·2025-12-06 14:37

Grove plans to invest $100 million in anchor funds into the newly launched Securitize tokenization AAA CLO fund.

According to Mars Finance, the decentralized finance protocol Grove disclosed on its official blog that Securitize announced today the launch of the Securitize tokenization AAA rated CLO fund (STAC), which focuses on tokenized investments in AAA rated CLO tranches. The fund is custodied by BNY Mellon and its investment company Insight acts as the sub-advisor. Upon governance approval, Grove will provide $100 million in anchor investment for STAC. Fund shares will be issued in the form of Ethereum digital tokens, and qualified investors can subscribe through the Securitize platform.

ETH2.02%

MarsBitNews·2025-10-30 01:34

Is the absence of a CEO for XRP eyewash? Ripple CLO reveals the truth about the open Blockchain.

XRP has no CEO, and Ripple's Chief Legal Officer Stuart Alderoty explained the reason behind it. XRP should not be confused with Ripple, which has CEO Brad Garlinghouse, as they are two different entities.

MarketWhisper·2025-10-17 07:37

Ripple CLO Clarifies the Misconception Around Bitcoin Decentralization

The essay discusses the concept of decentralization as moving away from centralized control, highlighting that XRP and other tokens like Ethereum, Solana, and Cardano embody this principle through their open-source technologies.

BitcoincomNews·2025-10-16 13:06

Yei Finance (CLO): Pioneering Cross-Chain DeFi Liquidity on Sei Blockchain in 2025

On October 15, 2025, Yei Finance's CLO token continues its explosive post-launch rally, surging over 200% to $0.51 after debuting on major exchanges like Binance, KuCoin, and MEXC. As the largest DeFi protocol on the Sei network—with $620 million in total value locked (TVL) and $227 million in lending alone—Yei Finance addresses liquidity fragmentation across blockchains, positioning itself as a cornerstone for seamless cross-chain operations in decentralized finance (DeFi).

CryptopulseElite·2025-10-15 08:06

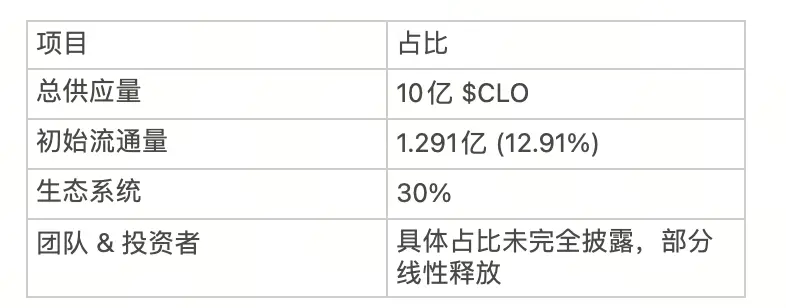

Alpha New Coin Yei Finance Depth Analysis: Is the CLO project Airdrop worth it?

Yei Finance raised $2 million in funding, with the third round of pre-sale sold out in 20 minutes, a total of 1 billion CLO tokens, with an initial circulation of only 12.91%. It is creating a dual-token ecosystem with the Sei blockchain, and the cross-chain liquidity DeFi dark horse project airdrop is about to be opened for claiming.

MarketWhisper·2025-10-15 05:16

Yei Finance (CLO) Investment Analysis Report: The New Star of cross-chain Liquidity, Airdrop Value Analysis

Yei Finance, launched in early 2025 as a DeFi cross-chain liquidity protocol, has quickly emerged in the competitive decentralized finance space with its innovative "one deposit, earn across chains" model. The project addresses the critical pain point of liquidity fragmentation in the multi-chain ecosystem through its core product, Clovis, creating an unprecedented convenient experience for liquidity providers. In just a few months, Yei Finance has successfully completed multiple rounds of pre-deposit activities, with the third round selling out in just 20 minutes, demonstrating strong market demand for its solutions.

The collaboration with the Sei blockchain further solidifies Yei Finance's ecological position, building a dual-token economic model of SEI governance tokens + CLO liquidity tokens. As of October 2025, the project has secured $2 million in funding and attracted a large community participation through airdrop activities. Against the backdrop of the DeFi total locked value surpassing a historic high of $237 billion, Yei Finance has accurately positioned itself in the rapidly growing segment of cross-chain liquidity, providing a solid foundation for the accumulation of its token value.

MarketWhisper·2025-10-15 03:14

California Becomes First State to Protect Unclaimed Crypto, Coinbase CLO Reacts

California has enacted a law to safeguard unclaimed cryptocurrencies from forced liquidation, ensuring that dormant assets like Bitcoin and Ethereum are transferred to the state without being automatically sold off.

BitcoincomNews·2025-10-14 12:57

Yei Finance ($CLO): The Cross-Chain DeFi Dark Horse—Is This Airdrop Worth Claiming in October 2025?

In the surging DeFi landscape of October 2025—fueled by the tariff thaw rebound and BNB's $1,380 ATH—Yei Finance ($CLO) emerges as a compelling cross-chain liquidity protocol, blending innovation with community incentives via its Clovis product.

CryptopulseElite·2025-10-13 08:14

Yei Finance has landed on the Alpha platform! The Clovis Q1 Snapshot has been completed, how to distribute 160,000 Tokens?

Yei Finance (CLO) officially launched on the BNB Alpha platform on October 14. The first season of Clovis points rewards snapshot has been completed, and a 160,000 CLO rewards pool will be distributed to the top 8 teams.

BNB3.39%

MarketWhisper·2025-10-13 02:20

Understanding Yei Finance in One Article (CLO): Can the Emerging Cross-Chain Liquidity Protocol Become a Dark Horse in Decentralized Finance?

Yei Finance, as a DeFi protocol launched in early 2025, quickly attracted market attention with its cross-chain liquidity solution and deep integration with the high-performance public chain Sei. Its innovative Clovis product provides an "one deposit, multi-chain yield" experience, aimed at addressing the liquidity gap of presale assets and preventing dumping. Against the backdrop of explosive growth in the Sei ecosystem (with market share doubling to 5.2% in 2025), whether Yei Finance can stand out with its dual-token ecosystem (SEI governance + CLO liquidity) and become a dark horse in this round of DeFi development is the focus of this analysis.

DEFI-3.27%

MarketWhisper·2025-10-13 01:49

Binance Alpha's new Airdrop will launch CLO, ENSO

According to Mars Finance news, on October 12, the new Airdrop of Binance Alpha will go live on October 14 for CLO and ENSO. Eligible users can visit the Alpha event page to claim the Airdrop using Binance Alpha points after the Alpha trading opens. Further details will be announced separately.

ENSO-4.9%

MarsBitNews·2025-10-12 08:14

Ripple CLO Stuart Alderoty calls on the American Congress to finalize the crypto legal framework

Stuart Alderoty calls for the U.S. Congress to quickly establish a clear regulatory framework for cryptocurrency, emphasizing its importance to both voters and the economy, and highlighting growing public support for stronger regulations.

TapChiBitcoin·2025-09-30 04:44

CLO Coinbase declares Base "not an exchange" amid SEC's close scrutiny.

Coinbase defends its Ethereum Layer-2 Base from SEC scrutiny, emphasizing it as blockchain infrastructure, not a securities exchange. It boasts significant liquidity and plans for a token launch, aligning with views from industry leaders.

TapChiBitcoin·2025-09-27 00:44

The Debate on Centralized FUD of Base Chain: Is the Sequencer a Technical Compromise or a Power Monopoly?

There has been a lot of controversy surrounding the chain, and recently there has been fear, uncertainty and doubt (FUD) targeted at the Base chain, which even prompted V God to come out and help clear things up for Base.

Currently, it seems that there are no KOLs in the CT Chinese community discussing this matter. This tweet aims to briefly outline the "Base being FUDed" incident.

The focus of FUD is: due to Base operating a centralized sequencer, it is essentially an unlicensed centralized securities exchange.

The CLO of Coinbase and the overall head of Base have both given strong rebuttals:

The core function of the sorter is to sort transactions rather than match transactions, which is achieved by smart contracts in a decentralized manner. Therefore, the Base running a centralized sorter is not a centralized exchange in the traditional sense.

"Base is not a casino, but that doesn't mean Base is decentralized." Let me share my thoughts.

PANews·2025-09-24 00:14

Coinbase CLO Argues Former SEC Crypto Stance Shares Similarities With US Tariffs Case

Paul Grewal of Coinbase draws parallels between a recent court ruling against Trump-era tariffs and the SEC's overreach in regulating cryptocurrencies. He highlights the need for clearer legislation to avoid similar issues in the crypto market.

Coinpedia·2025-09-01 11:49

Janus Henderson Launches First Native Onchain AAA CLO Strategy

Janus Henderson has launched the JAAA CLO strategy on the blockchain, backed by $1 billion from the Grove protocol in the Sky Ecosystem. This initiative aims to merge traditional and decentralized finance, facilitating institutional-grade credit exposure.

Coinpedia·2025-08-19 18:00

Ripple CLO Warns: This Crypto Bill Could Trap XRP In Endless Regulatory Watch

Ripple’s Chief Legal Officer (CLO), Stuart Alderoty, has issued a sharp warning to lawmakers, cautioning that a proposed Senate bill on digital assets could deepen regulatory confusion and place long-standing cryptocurrencies like XRP under indefinite supervision by the U.S. Securities and

TimesTabloid·2025-08-09 03:30

Ripple CLO Commends SEC Chief Ahead of August 15th Status Report Deadline- Is XRP Lawsuit Finally Ending?

Ripple CLO has praised the SEC Chief amid new policy shifts. This suggests that the end of the XRP lawsuit may finally be in sight. Experts are also speculating on whether the regulatory tides are turning for the broader crypto industry, not just for Ripple.

Advertisement

Advertisement

Ripple CLO

XRP2.82%

CryptoNewsCoinGape·2025-08-05 02:04

RWA Support Fund: Resolving the Urgent Needs of RWA Project Launch?

Author: Zhang Feng

The global wave of RWA (Real World Asset) tokenization is sweeping across traditional finance and the crypto market at an unprecedented speed. Recently, there have been frequent institutional-level actions: the credit protocol Grove deployed a $250 million tokenized credit product on the Avalanche blockchain, anchored to the U.S. Treasury and CLO market; Singapore's Giants Protocol successfully converted the properties of the largest co-living space operator into on-chain assets with the support of Singapore's sovereign wealth fund; a subsidiary of Fosun Group completed a financing round in the tens of millions of dollars to enhance RWA infrastructure.

However, behind the prosperity, the lack of startup capital has become a fatal bottleneck for project implementation—project parties are worried that the initial investment will be a total loss, and legal, technical, and other professional service institutions cannot bear the risk of advance payment. This contradiction has precisely given rise to a significant business opportunity: the establishment of RWA support funds, which fill the ecological gap through innovative capital supply models.

RWA4.02%

金色财经_·2025-08-04 07:07

Janus Henderson Launches First Native Onchain AAA CLO Strategy

Janus Henderson has launched the JAAA CLO strategy on the blockchain, backed by $1 billion from the Grove protocol in the Sky Ecosystem. This initiative aims to merge traditional and decentralized finance, facilitating institutional-grade credit exposure.

Coinpedia·2025-07-29 12:54

Sky's Grove Expands to Avalanche With $250M RWA Plan, Partnering With Centrifuge, Janus

Grove is expanding to the Avalanche network, planning to invest $250 million in tokenized credit products, including the Janus Henderson Anemoy AAA CLO Fund. This move aims to enhance traditional finance's presence in blockchain's real-world asset ecosystem.

YahooFinance·2025-07-28 16:02

Ripple CLO Says Americans Need Better Crypto Platform

A Ripple executive highlights that 55% of non-crypto holders find cryptocurrency research overwhelming, emphasizing the need for improved understanding of crypto types as demand is expected to rise in 2025.

BitcoincomNews·2025-07-23 03:02

Coinbase CLO Exposes 5 U.S. States for Defying CLARITY’s Crypto Staking Rules

Story Highlights Coinbase CLO Paul Grewal calls out five U.S. states for ignoring the CLARITY Act’s staking guidance.

The CLARITY Act confirms staking-as-a-service is not a security, yet enforcement actions continue.

Grewal urges federal and state alignment as Coinbase ramps up lobbying for

BitcoincomNews·2025-07-19 03:03

Bitcoin Tests Long-Term Channel Top Again, Here’s Why Traders Are Watching the $122,500 Level Clo...

Bitcoin is testing its long-term channel top, trading between $110,880 and $122,500 within a tightening wedge. A breakout above $122,500 could lead to a target of $260,000, with strong trading volume and structure supporting the potential rise.

CryptoFrontNews·2025-07-18 07:56

Bitcoin Could Ignite Price Discovery Rally As Weekly Structure Tightens | Bitcoinist.com

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

A crypto analyst stated that Bitcoin is pressing against key resistance near its all-time high, signaling that a breakout into price discovery territory could be just around the corner. A weekly clo

BTC1.45%

Bitcoinistcom·2025-07-05 23:37

Janus Henderson Launches First Native Onchain AAA CLO Strategy

Janus Henderson has launched the JAAA CLO strategy on the blockchain, backed by $1 billion from the Grove protocol in the Sky Ecosystem. This initiative aims to merge traditional and decentralized finance, facilitating institutional-grade credit exposure.

Coinpedia·2025-07-05 20:11

Token vs Equity Battle: on-chain Sovereignty vs Regulatory Constraints, how does the encryption economy reconstruct?

Original authors: Jesse Walden, Variant Partner; Jake Chervinsky, Variant CLO

Original compilation: Saoirse, Foresight News

Introduction

Over the past decade, entrepreneurs in the crypto industry have generally adopted a value distribution model: attributing value to two independent vehicles, tokens and equity. Tokens provide a new way for networks to expand at an unprecedented scale and speed, but the prerequisite for unleashing this potential is that tokens must represent the real needs of users. However, the regulatory pressure from the U.S. Securities and Exchange Commission (SEC) has continued to intensify, greatly hindering entrepreneurs from injecting value into tokens and forcing them to shift their focus to equity. Today, this situation urgently needs to change.

The core innovation of tokens lies in achieving "self-ownership" of digital assets. With tokens, holders can independently own and control.

星球日报·2025-06-28 06:03

Token vs Equity Battle: on-chain Sovereignty vs Regulatory Constraints, how does encryption economy reconstruct?

> Can the Token that is "bound hand and foot" by the SEC break free from the haze of regulation and redefine the autonomous ownership of digital property?

Written by: Jesse Walden, Partner at Variant; Jake Chervinsky, CLO at Variant

Compiled by: Saoirse, Foresight News

Introduction

Over the past decade, entrepreneurs in the cryptocurrency industry have generally adopted a value distribution model: attributing value to two independent carriers, tokens and equity. Tokens provide a new way for networks to expand at an unprecedented scale and speed, but the prerequisite for this potential release is that tokens must represent the real needs of users. However, the regulatory pressure from the U.S. Securities and Exchange Commission (SEC) has continuously intensified, greatly hindering entrepreneurs from injecting value into tokens and forcing them to shift their focus to equity. Nowadays,

ForesightNews·2025-06-27 08:25

Ripple CLO Backs Bitcoin Mortgage Policy: Huge Win for Crypto Adoption!

Ripple's CLO Stuart Alderoty backs the FHFA's decision to accept Bitcoin for mortgage eligibility, potentially aiding 55 million Americans with crypto-backed home loans and marking a significant advancement in Bitcoin's mainstream financial adoption.

BTC1.45%

BitcoincomNews·2025-06-26 02:03

Ripple CLO Issues Urgent Warning for XRP Holders

Ripple's legal director, Stuart Alderoty, has issued a strong warning to the cryptocurrency community, emphasizing that securing your digital assets is just as important as protecting your online bank account and email account.

His message, posted on the post of the Association

Blotienso·2025-06-14 16:01

Exodus: interview about stablecoin regulation and why Wall Street is pushing into crypto

Veronica McGregor, CLO at Exodus and former CLO at ShapeShift, has spent two decades on the legal frontlines of crypto so with Cryptonomist we decided to interview her to talk about how stablecoin regulation could limit how users hold and move their own crypto, the behind-the-scenes changes public c

WHY0.53%

TheCryptonomist·2025-06-14 06:10

Coinbase CLO Paul Grewal Hails SEC’s Reversal on DeFi and Custody Rules

The US Securities and Exchange Commission (SEC) scrapped several high-profile crypto-related proposals introduced under former Chair Gary Gensler.

DEFI-3.27%

BeInCrypto·2025-06-13 01:42

Ripple CLO Applauds U.S. Crypto CLARITY Act: 'Big Step Forward'

The new bipartisan Clarity Act is praised by Ripple CLO Stuart Alderoty as a significant move towards clear U.S. crypto regulation, emphasizing SEC-CFTC oversight and national licensing framework. The bill, combined with other Acts, reflects a rising trend toward holistic U.S. crypto legislation.

ACT3.12%

BitcoincomNews·2025-05-31 02:01

SEC Begins Review of First U.S. Spot XRP ETF Filed by WisdomTree

The SEC has commenced the official review of WisdomTree XRP Trust, potentially paving the way for the first spot XRP ETF in the US. If approved, this could lead to similar products for other crypto assets. Ripple's CLO emphasized XRP should not be considered a security.

XRP2.82%

TheNewsCrypto·2025-05-28 13:11

Ripple Urges SEC to Clarify Crypto Token Rules with ‘Network Maturity’ Proposal

Ripple’s CLO calls for clear SEC guidance on crypto token status.

Proposes a ‘network maturity’ test to identify non-security assets.

Ripple urges SEC collaboration to ensure innovation isn’t stifled.

Stuart Alderoty, Ripple’s Chief Legal Officer, formally requested the SEC for a clear-cut

TOKEN39.14%

TheNewsCrypto·2025-05-28 12:50

XRP Spot ETF in the U.S. Moves Closer to Reality

SEC is reviewing WisdomTree XRP Trust's application for a spot XRP ETF, the first of its kind in the US. The ETF could set a precedent for similar crypto products. Ripple's CLO argues against treating XRP as a security to avoid regulatory confusion.

XRP2.82%

YahooFinance·2025-05-28 11:30

Ripple’s Legal Chief Demands SEC Clear Rules to Fast-Track XRP ETFs

Ripple's CLO calls for SEC clarification on token rules amid XRP ETF prospects, pushing for fair treatment in markets. Ripple suggests 'network maturity' test to define token security, suggesting Congressional involvement in shaping crypto regulations.

BitcoincomNews·2025-05-27 22:43

Load More