Search results for "CROSS"

Solana breaks below the $100 psychological level! ETF funds show the first "outflow" signal

Solana dropped below $100 on Monday, with a weekly decline of over 15%. The financing rate turned negative to -0.0080%, the long-short ratio decreased to 0.97, and the ETF experienced a weekly outflow of $2.45 million for the first time. The RSI fell to 25, indicating extreme oversold conditions, and the MACD death cross persists. The daily closing price broke below the $100 target, reaching $95.26, further testing the $79 level.

SOL-2.42%

MarketWhisper·3h ago

CrossCurve Threatens Legal Action After $3M Cross-Chain Bridge Exploit

In brief

CrossCurve said Sunday an attacker exploited a flaw in its bridge contracts and identified 10 Ethereum addresses that received the funds.

Its CEO, Boris Povar, said their team would pursue legal and enforcement action if the funds are not returned within 72 hours.

Security

Decrypt·4h ago

Gold trading fragrance, gangsters copying the perfect heist roadmap? Tokyo trading, robbing money, Hong Kong alternating

A large cash robbery occurred consecutively at Ueno and Haneda Airport in Tokyo. The police suspect a connection between the two incidents or a link to the robbery in Hong Kong. The victims are all cash transport personnel who have been robbed multiple times. Investigations indicate that the incidents may involve cross-border gangs; the criminal groups are familiar with the transportation routes and schedules. Authorities from both sides have initiated cooperative investigations.

ChainNewsAbmedia·6h ago

The CrossCurve Exploit Is a $3 Million Alarm Bell for Cross-Chain Security's Broken Promise

CrossCurve's \$3 million bridge exploit, stemming from a basic validation bypass, exposes a critical failure in the "consensus security" narrative promoted by next-generation cross-chain protocols.

This incident signals that despite four years of catastrophic bridge hacks, fundamental smart contract security and message validation remain the industry's Achilles' heel, forcing a reassessment of risk models for investors and a strategic reckoning for builders betting on multi-chain liquidi

CryptopulseElite·9h ago

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun.

Author: Ryan Watkins

Translation: Deep潮 TechFlow

Introduction: By 2026, the crypto economy is in the most critical transition period in 8 years. This article explores how the market has "soft-landing" from the overexcitement of 2021 and gradually establishing valuation frameworks based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for an industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but an underestimated, cross-cycle entry opportunity.

The full text is as follows:

Key Points

This asset class in 2021

区块客·9h ago

CrossCurve hacked, $3 million evaporated! Fake messages breach multi-chain bridge

Cross-chain liquidity protocol CrossCurve confirmed to have been attacked on Sunday, with a smart contract verification vulnerability leading to multi-chain losses of approximately $3,000,000. The attacker bypassed ReceiverAxelar contract verification by forging messages, similar to the 2022 Nomad hacker incident. The project was previously invested in by Curve Finance founder and raised $7,000,000.

MarketWhisper·9h ago

CrossCurve Exploit Strikes Crypto Bridge Protocol

CrossCurve, a cross-chain liquidity bridge, has halted interactions with its protocol as it probes a smart contract breach that security researchers describe as exploiting a vulnerability in one of its contracts. The incident appears to have driven losses around $3 million across multiple

CryptoBreaking·11h ago

5 Warning Signs Emerging Across Bitcoin, Gold, and Global Markets

At press time at 4:45 p.m. EST on Sunday, Feb. 1, bitcoin is trading at $76,601 as cross-asset markets wobble under liquidation pressure, geopolitical tension, and a sudden loss of risk appetite.

Markets Lose Their Balance as Risk Appetite Fades Across Assets

The crypto economy now stands at

Coinpedia·12h ago

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun.

Author: Ryan Watkins

Translation: Deep潮 TechFlow

Introduction: By 2026, the crypto economy is in the most critical transition period in 8 years. This article explores how the market has "soft-landing" from the overexcitement of 2021 and gradually establishing valuation frameworks based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for an industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but an underestimated, cross-cycle entry opportunity.

The full text is as follows:

Key Points

This asset class in 2021

区块客·02-01 01:16

Ripple launches Ripple Treasury worth $1 billion, managing digital assets for enterprises

Ripple has launched Ripple Treasury, a corporate platform for managing traditional cash and digital assets, following its acquisition of GTreasury for $1 billion. It enables cross-border payments using RLUSD stablecoin, reducing transaction times to 3-5 seconds. The system aims to streamline liquidity management for global corporations and integrates seamlessly with existing treasury processes, allowing businesses to view crypto infrastructure as an extension of traditional banking. The platform also connects clients to overnight repo markets and tokenized money market funds, providing opportunities to earn yields on excess capital. This is Ripple's first major product since acquiring GTreasury.

TapChiBitcoin·01-31 03:40

Why Is the Crypto Market Down Today? Key Crypto Crash Reasons Explained

Key Insights

Cross-market selloff hit crypto, equities, and metals, signaling broad liquidity tightening.

Over $1.7B in liquidations accelerated declines as leveraged long positions were closed rapidly.

Regulatory developments may influence sentiment as markets assess structural reforms.

The cry

CryptoBreaking·01-30 16:00

3 Best Cryptos to Buy Now for Long-term Gains — ETH, ADA, and LINK

Ethereum: Scalability upgrades and ETFs boost adoption, making ETH ideal for long-term growth.

Cardano: Hydra scaling and real-world use cases strengthen ADA’s steady, sustainable development.

Chainlink: Reliable oracle services and cross-chain connectivity drive LINK’s long-term

CryptoNewsLand·01-30 14:36

Where Is XRP Headed Next? Ripple Leaders and Community Go Live for Two Days - U.Today

The XRP Community Day event on February 11-12, 2026, will bring together Ripple leaders and the XRP community to discuss XRP's current use and future direction, featuring sessions on regulated products, innovation, and cross-chain liquidity.

UToday·01-30 09:20

Financial Supervisory Commission: Taiwanese import and export companies "are already using stablecoins for payments," and some banks have begun to deploy.

The Financial Supervisory Commission stated that although the Virtual Asset Service Law has not yet been implemented, Taiwanese importers and exporters have already begun using USD stablecoins for payments. As demand grows, banking institutions are actively planning custody services for stablecoin assets. The FSC also looks forward to providing seamless cross-border payment services and emphasizes the importance of a comprehensive regulatory framework to ensure investment security.

動區BlockTempo·01-30 08:00

Cathie Wood Sounds Alarm on Gold Bubble, Touts Bitcoin as Portfolio Hedge

In a striking dual thesis, ARK Invest CEO Cathie Wood has declared gold a late-cycle bubble while positioning Bitcoin as a strategic diversification tool for modern portfolios.

Her warning on gold is based on a key metric—the metal's market cap relative to the U.S. money supply—hitting historical extremes, coinciding with a violent \$9 trillion cross-asset market shakeout driven by extreme leverage. Simultaneously, Wood's 2026 outlook champions Bitcoin’s maturation, framing it not as mer

CryptopulseElite·01-30 07:46

Circle 2026 Strategic Exposure! Arc Blockchain Launches Institutional Stablecoin, Deepening USDC Full-Chain Deployment

Circle 2026 focuses on promoting institutional adoption of durable infrastructure. The Arc blockchain moves from testing to production, deepening the practicality of USDC, EURC, and USYC. Expand the payment network to allow institutions to use stablecoins without building their own infrastructure. USDC market cap is 70 billion, ranking second, with Tether leading at 186 billion. Invest in seamless cross-chain operation, simplifying complexity and optimizing development tools.

MarketWhisper·01-30 07:33

SWIFT’s 2026 Overhaul: A Ripple-Inspired Upgrade That Leaves Banks in Control

In a significant move for global finance, SWIFT has announced a new retail payments scheme set to launch in 2026, aiming to make cross-border transfers faster, transparent, and predictable.

This initiative, backed by over 40 major banks, directly addresses long-standing critiques famously championed by Ripple Labs regarding opaque fees and slow settlements. However, while SWIFT is adopting Ripple's playbook on user experience, it stops short of leveraging blockchain to solve the core ban

CryptopulseElite·01-30 02:12

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun.

Author: Ryan Watkins

Translation: Deep潮 TechFlow

Introduction: By 2026, the crypto economy is in the most critical transition period in 8 years. This article explores how the market has "soft-landing" from the overexcitement of 2021 and gradually establishing valuation frameworks based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for an industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but an underestimated, cross-cycle entry opportunity.

The full text is as follows:

Key Points

This asset class in 2021

区块客·01-30 01:10

Bitcoin Plunge Could Get Much Worse as Death Cross Gains Power

In brief

Bitcoin plunged Thursday, with the 50-day EMA crossing below the 200-day EMA—a classic death cross pattern that typically signals sustained downward pressure.

Gold and silver hit record highs while Bitcoin struggles, raising questions about which assets truly function as stores of v

Decrypt·01-29 21:36

Stellar Community Fund Kicks Off Growth Hack Cohort Focused on Real-World Adoption

Stellar launches SCF Growth Hack Cohort 1 to help Stellar mainnet teams run go-to-market and user acquisition for real-world adoption.

Cohort includes stablecoin payments, cross-chain, and Soroban ZK-ready projects as the network deploys Protocol 25 X-Ray upgrade.

Stellar has launched the St

CryptoNewsFlash·01-29 14:45

Ripple Partners With Riyad Bank’s Jeel to Advance Saudi Arabia’s Vision 2030 Blockchain Strategy

Ripple has announced a new partnership with Jeel, the tech arm of Riyad Bank, one of Saudi Arabia’s largest banks.

The two will explore how blockchain can be integrated into the country’s national financial systems, including in cross-border payments.

Ripple has signed a Memorandum of

XRP-3.3%

CryptoNewsFlash·01-29 09:10

Gold and US stocks at all-time highs, how to hedge risk? CFD Hedging Strategy Analysis

In response to high market volatility, multi-asset trading platform Vantage has enhanced its CFD (Contract for Difference) trading depth. CFDs feature characteristics such as cross-market hedging, short selling, and relatively stable costs, making them one of the tools investors use to manage risks and adjust cost structures when US stocks and gold are at high levels.

(Background recap: Bitcoin fell below $88,500, gold surged to a new high of 5600 MOP before pulling back, hawkish Federal Reserve comments and new chairperson candidates have caused market hesitation)

(Additional background: Is Bitcoin in a "coma"? Bloomberg analysts: BTC still outperforms gold and silver after 2022!)

Table of Contents

What is a CFD? What role does it play in the current market?

Common scenarios for CFD hedging operations

Cost and risk differences between CFDs and perpetual contracts

Cost volatility of perpetual contracts

C

動區BlockTempo·01-29 09:05

The UAE Central Bank approves USD stablecoin USDU, the first regulated settlement token that complies with the regulatory framework.

The Central Bank of the United Arab Emirates officially approves the first USD stablecoin USDU as a tool for cross-border settlement and virtual asset trading. USDU is issued by Universal Digital, fully backed by USD reserves, stored in a protected account at a top UAE bank, aiming to provide institutional investors with a secure capital flow channel and showcase the UAE's competitiveness in digital asset regulation.

動區BlockTempo·01-29 07:20

Addressing cross-border compliance challenges! Hong Kong and the UAE sign their first digital asset regulatory cooperation agreement

Written by: Liang Yu

Edited by: Zhao Yidan

On January 27, 2026, the Hong Kong Securities and Futures Commission and the UAE Capital Markets Authority officially signed a Memorandum of Understanding to establish a bilateral consultation and information exchange framework for "regulated digital asset entities." This is the first specialized cooperation agreement between Hong Kong and overseas regulators in this field, marking the transition of cross-border digital asset regulation from general principles to the development of specific mechanisms.

RWA-3.48%

TechubNews·01-29 05:40

Building a Cross-AI Large Model "Privacy Memory Layer", ZetaChain Collaborates with Multi-Model Aggregation Application Anuma to Create a New AI Experience

Author: Zen, PANews

In today's generative AI applications, users often face fragmented conversational experiences. When switching between different models, the context of previous conversations is often not preserved, requiring users to repeatedly provide the same information from scratch. For example, details discussed on ChatGPT cannot be directly transferred when switching to Claude or other models, severely impacting efficiency.

Moreover, the dialogue data of these large models is usually stored on various platform servers, leaving users without privacy guarantees and lacking control over their own data. "These real-world issues not only cause a fragmented user experience but also raise concerns about user data sovereignty and security."

To address this pain point, the industry has begun exploring the concept of a "migratable, user-controlled memory layer," and blockchain technology may be the key to achieving this goal.

An open interoperable blockchain-based system

PANews·01-29 04:51

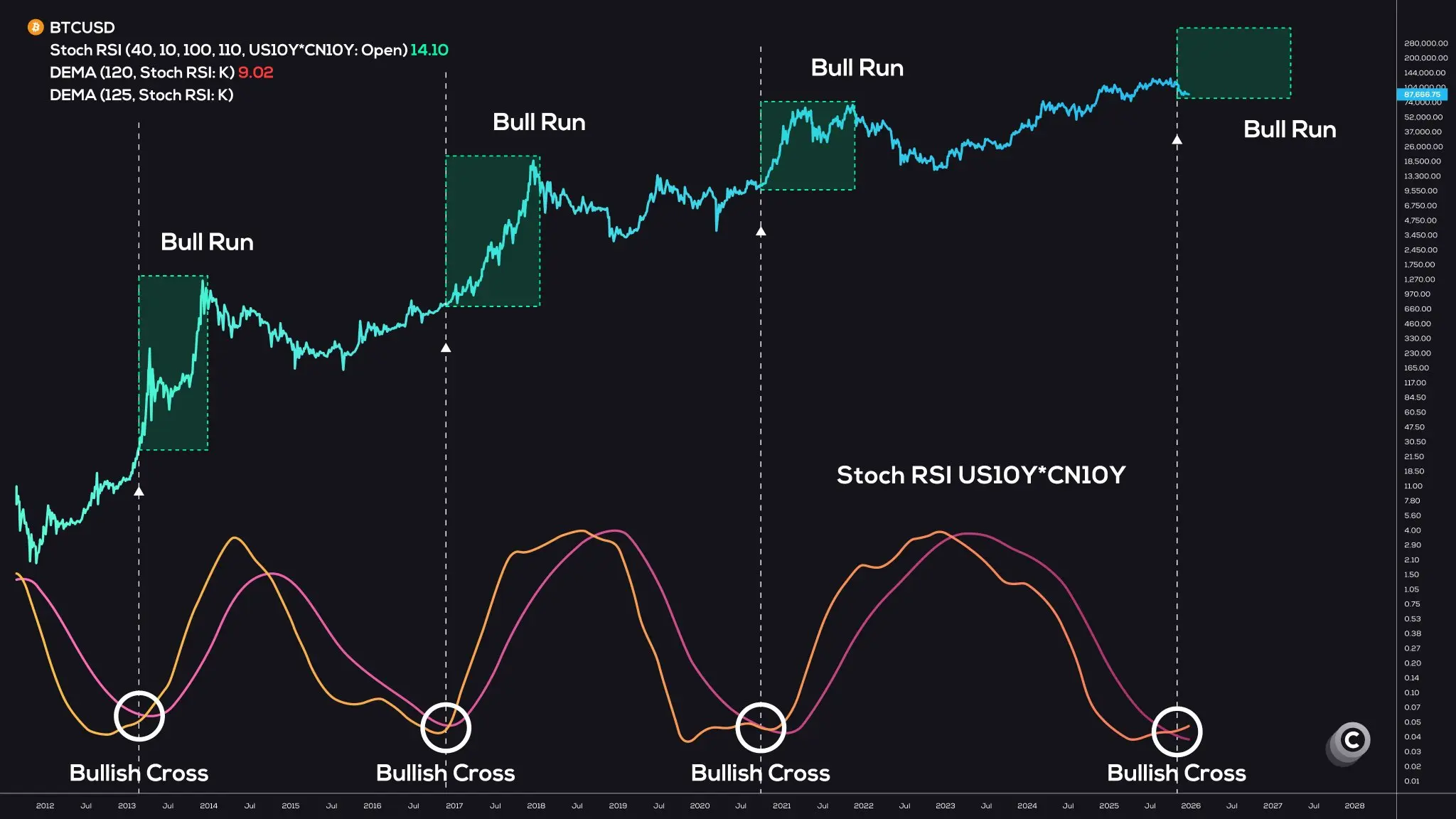

The 10-year US-China government bond yield spreads cross! Bitcoin bull market signals are coming

Multiple analysts have pointed out that the "most accurate bull market signal for Bitcoin" has appeared. The Stochastic RSI of the 10-year US and Chinese government bond yields has experienced a bullish crossover, triggering for the fifth time. The previous four times all led to significant Bitcoin rallies, indicating that improved liquidity will drive a rebound in risk assets. However, after rate cuts, gold surged dramatically while Bitcoin did not rise but instead fell.

MarketWhisper·01-29 03:38

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun.

Author: Ryan Watkins

Translation: Deep潮 TechFlow

Introduction: By 2026, the crypto economy is in the most critical transition period in 8 years. This article explores how the market has "soft-landing" from the overexcitement of 2021 and gradually establishing valuation frameworks based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for an industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but an underestimated, cross-cycle entry opportunity.

The full text is as follows:

Key Points

This asset class in 2021

区块客·01-29 01:05

Ripple Launches Regulated Treasury Platform for Global Corporate Finance Operations

Ripple has launched Ripple Treasury, a unified platform for managing cash and digital assets, enabling near-instant cross-border payments. This new corporate treasury tool merges GTreasury's software with Ripple's blockchain technology.

TheNewsCrypto·01-28 14:53

Stellar Community Fund Kicks Off Growth Hack Cohort Focused on Real-World Adoption

Stellar launches SCF Growth Hack Cohort 1 to help Stellar mainnet teams run go-to-market and user acquisition for real-world adoption.

Cohort includes stablecoin payments, cross-chain, and Soroban ZK-ready projects as the network deploys Protocol 25 X-Ray upgrade.

Stellar has launched the St

CryptoNewsFlash·01-28 14:45

3 Altcoins Poised to Gain as Global M2 Liquidity Expands

Solana: Fast, low-cost transactions and multiple spot ETFs attract both retail and institutional capital.

Ripple: Spot ETFs and locked supply position XRP to benefit from rising global liquidity.

Chainlink: Cross-chain infrastructure and tokenization demand make LINK poised for growth

CryptoNewsLand·01-28 14:36

Paving the way for "AI Agent Economy": Ethereum's new standard "ERC-8004" is about to go live

Ethereum will deploy the new technical standard ERC-8004 this week, aimed at facilitating cross-platform interaction of trustless AI agents on the blockchain. ERC-8004 introduces a retrievable identity and portable reputation mechanism to ensure AI agents can collaborate freely across different organizations, forming a decentralized AI economy. The standard adopts a tiered trust model to accommodate varying task risks, providing AI agents with a persistent identity and credit evaluation system, breaking the limitations of traditional closed systems.

ETH-5.96%

区块客·01-28 11:18

Most Reliable Bitcoin Price Signal Points to a 2026 Bull Run

Bitcoin (CRYPTO: BTC) traders were watching a confluence of momentum signals that historically foreshadow sizable moves, but on-chain data suggests a cautious path ahead as market participants lean defensive. A fresh cross between momentum indicators tied to major yield curves has rekindled

CryptoBreaking·01-28 10:30

The birth of the "App Store" in the robotics world: How far are we from "write once, run on all robots"?

OpenMind announced the launch of its robot app store on the Apple App Store on January 27, 2026, marking the industry's shift from hardware competition to software ecosystem development. The OM1 operating system aims for a unified cross-platform development experience, facing diverse hardware and security challenges. Developers need to define physical requirements for each skill, address uncertainties, and validate applications through crowdsourced testing networks. Meanwhile, OpenMind is also exploring the skill economy and dynamic pricing models to promote the trading and combination of robot skills, creating new opportunities for the industry.

TechubNews·01-28 10:09

Ripple Partners With Riyad Bank’s Jeel to Advance Saudi Arabia’s Vision 2030 Blockchain Strategy

Ripple has announced a new partnership with Jeel, the tech arm of Riyad Bank, one of Saudi Arabia’s largest banks.

The two will explore how blockchain can be integrated into the country’s national financial systems, including in cross-border payments.

Ripple has signed a Memorandum of

XRP-3.3%

CryptoNewsFlash·01-28 09:06

Risk skyrocketing! Let's talk about the current red lines in our country's crypto OTC market...

Article by: Xiao Sa Legal Team

As a key link connecting fiat currency and virtual assets, cryptocurrency OTC trading is frequently exploited by illegal activities such as telecom network fraud and online gambling due to its anonymity and cross-border features, making it an important channel for fund circulation and money laundering. Whether it is individual traders or related institutional practitioners, all face extremely high criminal legal risks. Sister Sa's team will systematically analyze the legal boundaries of cryptocurrency OTC trading from multiple dimensions, including the application of criminal charges, the subjective "knowing" standard, the threshold for amounts, and judicial practice considerations, providing risk avoidance guidance for practitioners.

Participating in cryptocurrency OTC trading and knowingly or should have known that the funds originate from telecom network fraud, online gambling, or other criminal activities, and still providing assistance such as payment settlement or fund transfer, may trigger multiple criminal charges, including aiding information

TechubNews·01-28 08:23

Ripple Enters Saudi Arabia to Build New Financial Architecture

Ripple has partnered with Jeel Movement, the innovation arm of Riyad Bank, to explore the use of blockchain technology within Saudi Arabia’s financial system.

Key Takeaways

Ripple and Jeel Movement have partnered to co-develop blockchain-based cross-border payment tools.

The partnership focuses o

BTC-1.84%

CryptoBreaking·01-28 08:15

IOTA Showcases Enterprise Blockchain Use Cases in Trade and Digital Identity

IOTA updates its enterprise work into trade/supply chains, digital identity, tokenization, lifecycle, and DeFi use cases.

Showcases include Salus trade finance tokenization and TWIN cross-border digital trade data transfer on IOTA.

The IOTA Foundation has recently updated iota.org to

IOTA-1.77%

CryptoNewsFlash·01-28 07:50

Gate Research Institute: Short-term recovery and rebound in the crypto market | Polygon leads with x402 smart agent payment transaction volume

Cryptocurrency Asset Overview

BTC (+0.85% | Current Price 89,342 USDT)

BTC has shown a volatile correction trend over the past day, with prices repeatedly oscillating within the 88,800–89,800 USD range. The rebound following the sharp decline on the 26th continues, but selling pressure above remains. The moving average system has shifted from bearish to bullish, with MA5, MA10, and MA30 forming a bullish alignment, and the current price trading above these three moving averages, indicating a short-term bullish trend but still in the recovery phase. The MACD is above the zero line and maintains a golden cross structure, with the red histogram gradually enlarging, suggesting short-term bullish momentum. Overall, if BTC can hold steady above 89,000 USD and increase volume to break through 90,000 USD, it may further challenge the previous high near 91,200 USD; conversely, if it falls back and breaks below the support zone of 88,800–88,400 USD, caution should be exercised for a potential rebound failure and

GateResearch·01-28 06:16

Gate Research Institute: Polygon Leads x402 Intelligent Agent Payment Transactions | Gate TradFi Trading Volume Surpasses $10 Billion

Cryptocurrency Market Overview

BTC (+0.85% | Current Price 89,342 USDT): BTC has shown a volatile correction trend over the past day, with prices repeatedly oscillating within the $88,800–$89,800 range. The rebound following the sharp decline on the 26th continues, but selling pressure above remains. The moving average system has shifted from bearish to bullish, with MA5, MA10, and MA30 forming a bullish alignment, and the current price trading above these three moving averages, indicating a short-term bullish trend but still in the recovery phase. The MACD is above the zero line and maintains a golden cross structure, with the red bars gradually enlarging, suggesting short-term bullish momentum is dominant. Overall, if BTC can hold steady above $89,000 and increase volume to break through $90,000, it may further challenge the previous high near $91,200; conversely, if it falls back below the support zone of $88,800–$88,400, caution should be taken as the rebound may weaken and reverse.

GateResearch·01-28 06:06

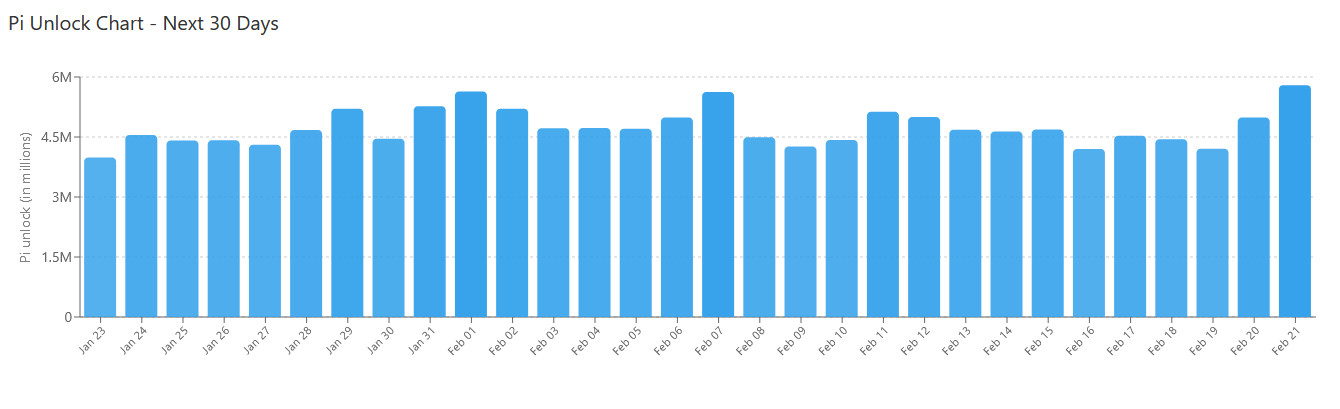

Pi coin price crashes to $0.17! RSI oversold, MACD death cross confirms downtrend

Pi coin drops to $0.17, approaching the all-time low of $0.1585. In January, 134 million tokens will be unlocked (far exceeding December's 8.7 million), which the market finds hard to digest. RSI is at 30.94 indicating oversold conditions, and MACD shows a bearish trend. The key support level is $0.13; if broken, it may test $0.12. Despite having 215 applications in the ecosystem, the short-term outlook remains bearish.

PI-1.48%

MarketWhisper·01-28 03:43

Ripple’s Saudi Bank Deal Fuels XRP Ledger Boom: Is a Parabolic Run Next?

In a strategic move signaling deepening institutional adoption, Ripple has entered a landmark partnership with Jeel, the innovation arm of Saudi Arabia's Riyad Bank. The Memorandum of Understanding (MoU) will explore blockchain applications in cross-border payments, digital asset custody, and asset tokenization, directly supporting Saudi Arabia's Vision 2030 economic diversification plan.

This news coincides with a revelation that the XRP Ledger (XRPL) now holds over \$2 billion in token

CryptopulseElite·01-28 03:24

Fake exchange scam exposed! Online dating誘 investment money laundering $37 million caught

45-year-old Chinese citizen Jingliang Su was sentenced to nearly 4 years in federal prison and ordered to pay $26,000,000 for participating in a $37,000,000 cross-border cryptocurrency money laundering scam. The organization used fake trading platforms and online dating to lure 174 American victims. After converting funds through Bahamian banks into USDT, the money flowed to a Cambodian scam center, highlighting the organized nature of transnational crypto crimes.

MarketWhisper·01-28 01:30

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun.

Author: Ryan Watkins

Translation: Deep潮 TechFlow

Introduction: By 2026, the crypto economy is in the most critical transition period in 8 years. This article explores how the market has "soft-landing" from the overexcitement of 2021 and gradually establishing valuation frameworks based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for an industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but an underestimated, cross-cycle entry opportunity.

The full text is as follows:

Key Points

This asset class in 2021

区块客·01-28 01:01

Saudi Arabia's largest bank partners with Ripple! TradFi embraces blockchain custody and payments

Ripple and the Innovation Department of Riyadh Bank in Saudi Arabia sign a Memorandum of Understanding to explore blockchain applications in cross-border payments, digital asset custody, and asset tokenization. Riyadh Bank's assets exceed $130,000,000,000, marking a deep integration of traditional finance (TradFi) with blockchain. The global banking industry’s institutional confidence in blockchain is rapidly increasing, while also supporting Saudi Arabia's 2030 vision for economic transformation.

XRP-3.3%

MarketWhisper·01-28 00:49

Ripple Treasury Officially Announced - U.Today

Ripple has launched "Ripple Treasury," a platform designed to enhance corporate finance with blockchain settlement. Integrating GTreasury's tools, it aims to improve cross-border liquidity management, eliminating pre-funding needs for foreign accounts.

UToday·01-27 17:23

Stellar Community Fund Kicks Off Growth Hack Cohort Focused on Real-World Adoption

Stellar launches SCF Growth Hack Cohort 1 to help Stellar mainnet teams run go-to-market and user acquisition for real-world adoption.

Cohort includes stablecoin payments, cross-chain, and Soroban ZK-ready projects as the network deploys Protocol 25 X-Ray upgrade.

Stellar has launched the St

CryptoNewsFlash·01-27 14:45

Most Reliable Bitcoin Price Signal Points to a 2026 Bull Run

Bitcoin (CRYPTO: BTC) traders were watching a confluence of momentum signals that historically foreshadow sizable moves, but on-chain data suggests a cautious path ahead as market participants lean defensive. A fresh cross between momentum indicators tied to major yield curves has rekindled

CryptoBreaking·01-27 10:25

3 Cryptos Gaining Momentum and Real Adoption in 2026 — SUI, SOL, and XRP

Sui Network offers fast transactions, developer-friendly tools, and growing adoption in NFT and gaming projects.

Solana provides high-speed, low-cost transactions with thriving consumer apps and Solana Pay integration.

Ripple focuses on institutional payments, fast cross-border

CryptoNewsLand·01-27 09:26

Ripple Partners With Riyad Bank’s Jeel to Advance Saudi Arabia’s Vision 2030 Blockchain Strategy

Ripple has announced a new partnership with Jeel, the tech arm of Riyad Bank, one of Saudi Arabia’s largest banks.

The two will explore how blockchain can be integrated into the country’s national financial systems, including in cross-border payments.

Ripple has signed a Memorandum of

XRP-3.3%

CryptoNewsFlash·01-27 09:05

The Four Pillars Reshape the Future of Crypto: Survival Rules in the Post-Speculation Era

Author: Go2Mars Web3 Research

This article aims to provide an analytical framework to help understand: the current "value return" is not a helpless end to the bear market, but a necessary pain before the birth of the next generation of trusted financial infrastructure.

Over the past two years, the crypto industry has experienced Bitcoin shifting from a speculative asset and cycle indicator, to a liquidity pool during monetary easing, and now to a non-sovereign macro anchor asset and strategic reserve option; stablecoins have also evolved from a medium for crypto speculation to a healthy on-chain USD that facilitates cross-border on-chain payments and settlements, providing the world with a low-threshold channel to access USD.

In stark contrast, the altcoin market has seen the vast majority of crypto projects disprove themselves so far, with some projects' former glory unlikely to reoccur. More broadly, many projects have perished during their preparation phase due to the industry's bleak outlook.

As liquidity tides recede, investment

PANews·01-27 08:35

Load More