Search results for "CRVUSD"

Yieldbasis Boosts Curve’s Liquidity and DAO Revenue Growth

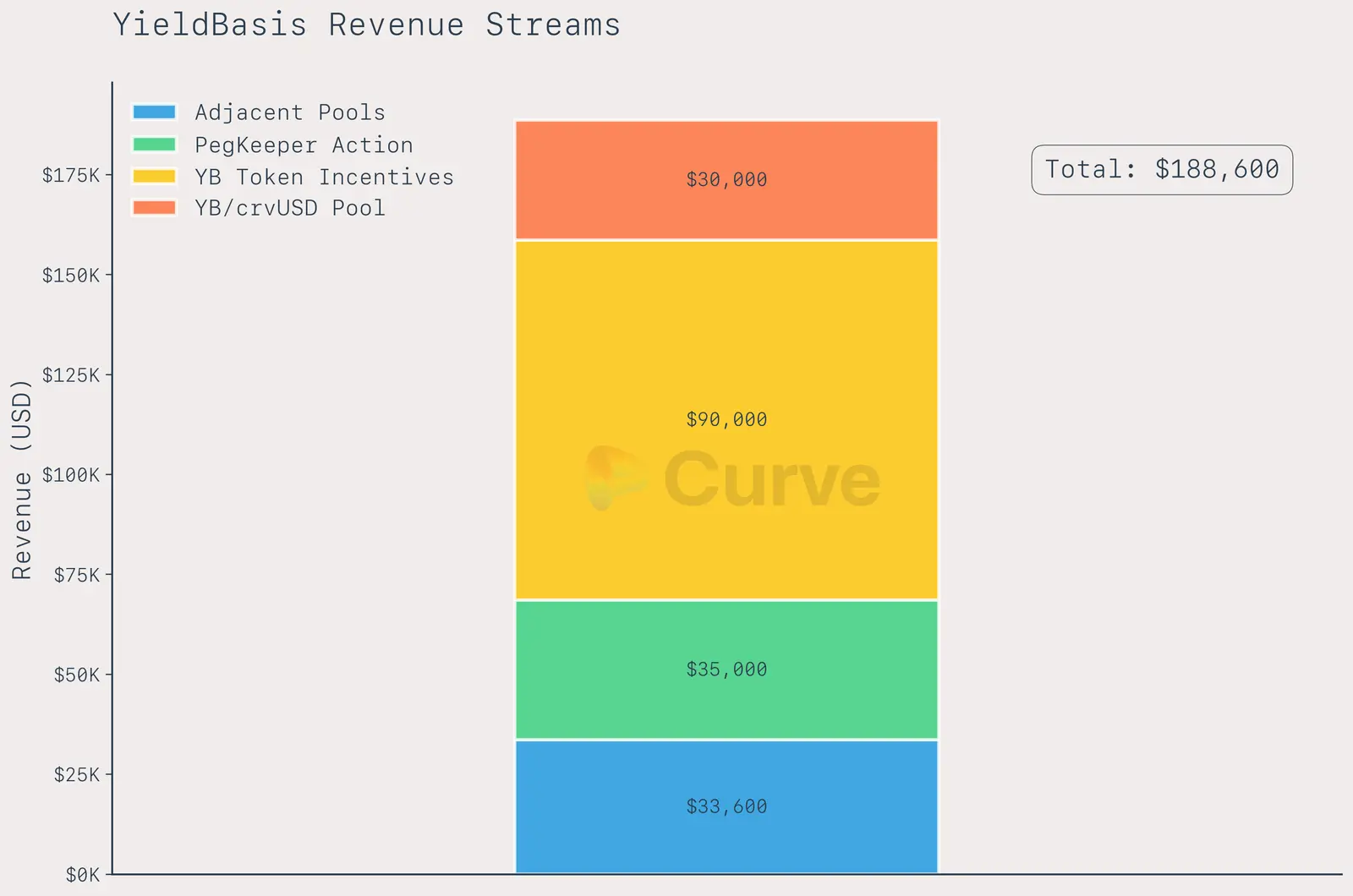

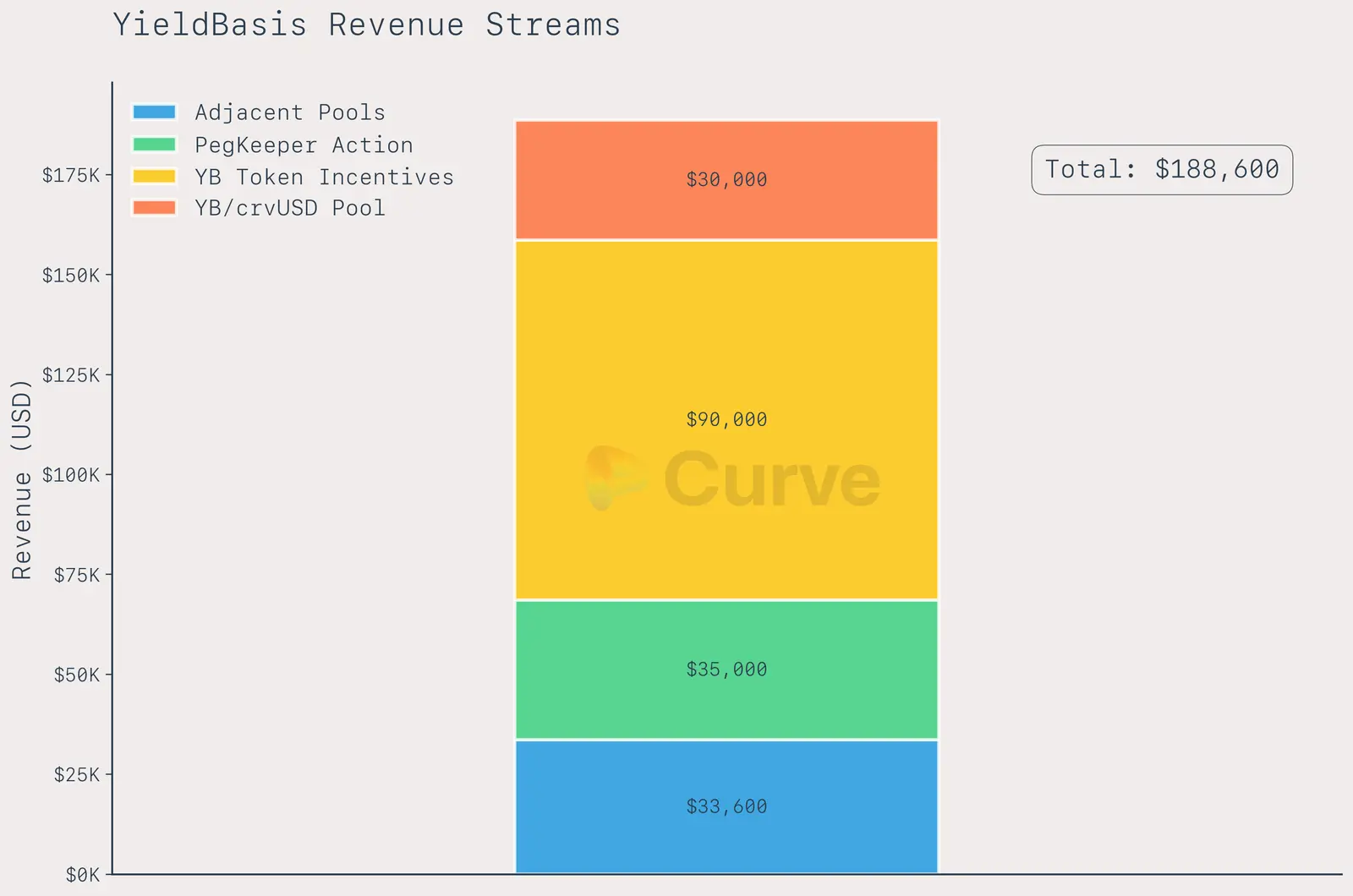

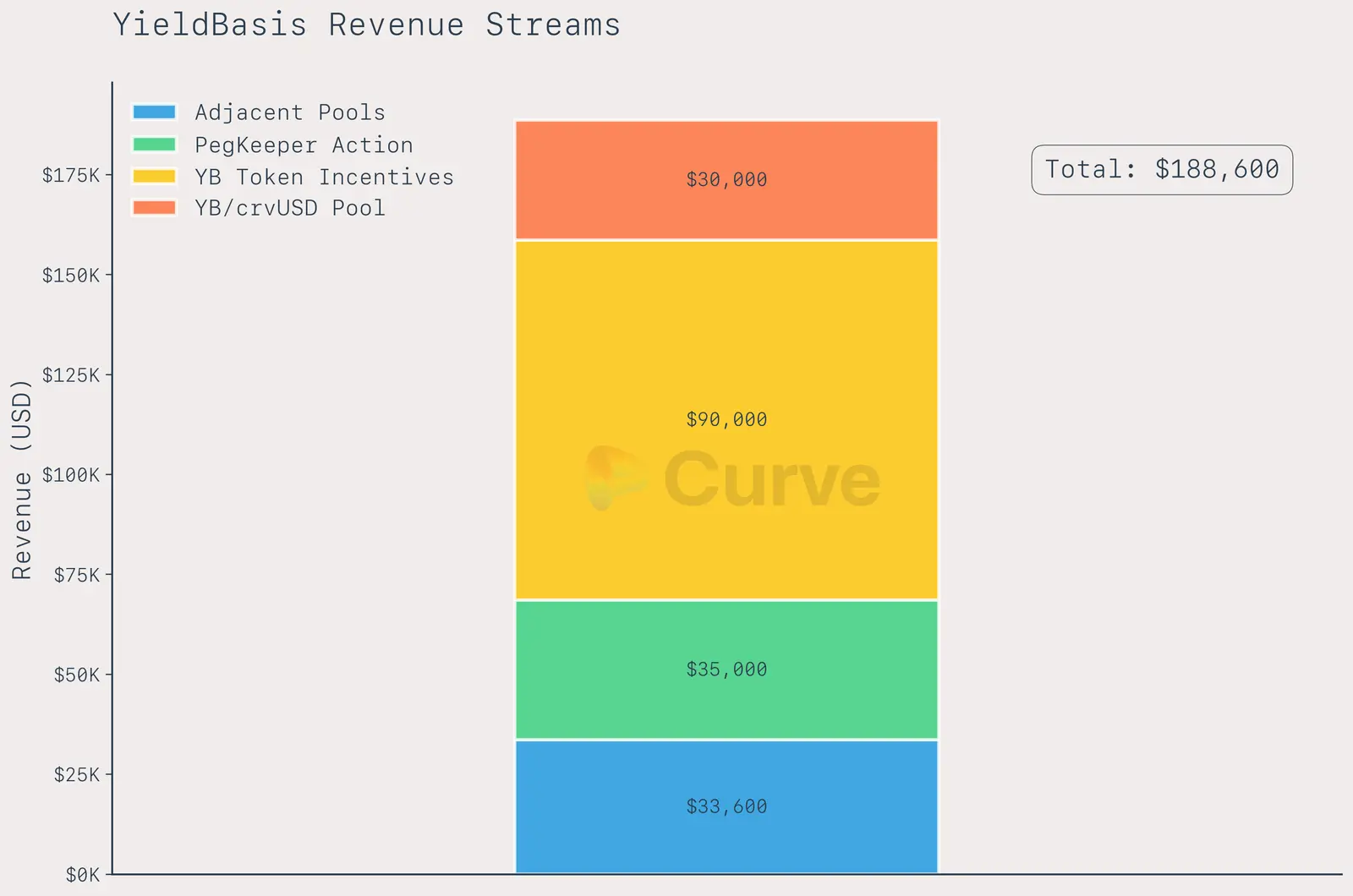

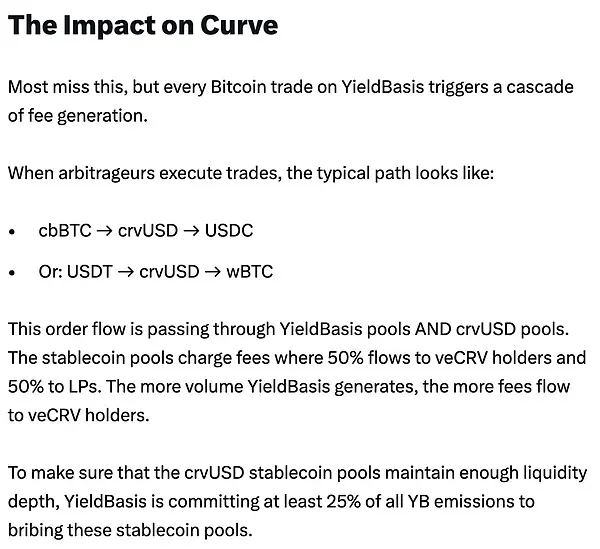

Curve’s latest collaboration with Yieldbasis has reshaped decentralized governance on the protocol, sparking a flurry of DAO proposals, liquidity expansions, and fresh revenue channels centered on crvUSD growth.

Curve and Yieldbasis Deepen Integration

The partnership between Curve and Yieldbasis

Coinpedia·20h ago

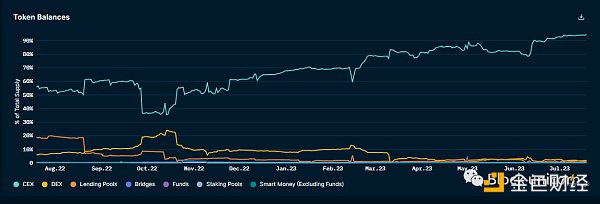

Curve Finance captures 44% of Ethereum DEX fees as activity surges

Curve Finance has moved back into the spotlight, not because of hype, but due to where users are actually paying fees on Ethereum.

Summary

Curve captured about 44% of Ethereum decentralized exchange fees over the past 30 days, up from \~1.6% a year ago

Growth is driven by crvUSD trading and de

Cryptonews·2025-12-23 03:36

Yieldbasis Boosts Curve’s Liquidity and DAO Revenue Growth

Curve’s latest collaboration with Yieldbasis has reshaped decentralized governance on the protocol, sparking a flurry of DAO proposals, liquidity expansions, and fresh revenue channels centered on crvUSD growth.

Curve and Yieldbasis Deepen Integration

The partnership between Curve and Yieldbasis

Coinpedia·2025-12-09 03:44

Curve And Resupply Proposal Seeks To Mint 5M crvUSD To Boost reUSD Growth

In Brief

Curve Finance’s DAO is considering a proposal from Resupply to mint 5 million crvUSD into the sreUSD Llamalend market to enhance liquidity, stabilize reUSD, and generate predictable yield for the DAO.

Decentralized exchange (DEX) and automated market maker (AMM) protocol Curve Finance

MpostMediaGroup·2025-10-27 07:06

Yieldbasis Boosts Curve’s Liquidity and DAO Revenue Growth

Curve’s latest collaboration with Yieldbasis has reshaped decentralized governance on the protocol, sparking a flurry of DAO proposals, liquidity expansions, and fresh revenue channels centered on crvUSD growth.

Curve and Yieldbasis Deepen Integration

The partnership between Curve and Yieldbasis

Coinpedia·2025-10-22 17:38

Yield Basis (YB): Curve Founder's Bitcoin Yield Protocol Revolutionizes DeFi in 2025

On October 15, 2025, Yield Basis (YB) emerges as a groundbreaking DeFi protocol founded by Curve's Michael Egorov, designed to enhance yields for Bitcoin (BTC) and Ethereum (ETH) holders through leveraged liquidity and Curve's crvUSD stablecoin.

CryptopulseElite·2025-10-15 08:08

A Deep Dive into Yieldbasis by the Founder of Curve: Is the $1.4 Billion FDV "Impermanent Loss Solution" a Wealth Code or a Bubble?

Yieldbasis (YB) is a DeFi protocol developed by Michael Egorov, the founder of Curve Finance, aimed at addressing the core pain point of Impermanent Loss faced by Liquidity Providers through automated leveraged AMM technology. The project launched with a Fully Diluted Valuation of $1.4 billion, with a pre-trading price that is 7 times higher than the institutional financing price, and received $60 million in crvUSD credit support from Curve DAO. Despite gaining high market attention due to the founder's reputation and strong resources, it faces risks from unproven technology and high valuation, making it a high-risk, high-reward asset with significant potential and uncertainty.

MarketWhisper·2025-10-13 02:20

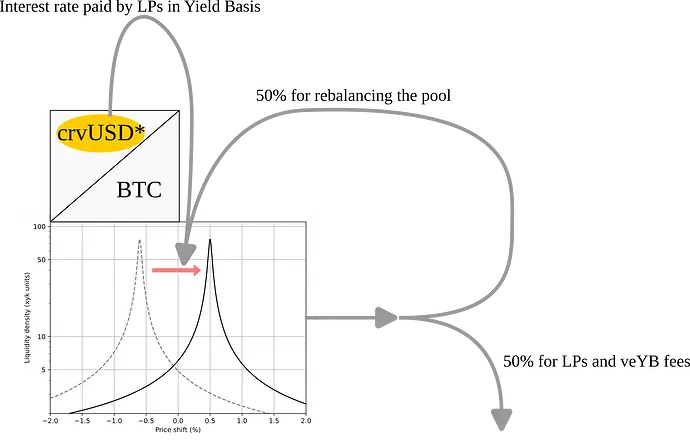

Impermanent Loss No More: How Yield Basis Reimagines Curve’s Crypto Pools

Some ideas about Curve’s latest innovation.

Yesterday Curve Finance introduced a governance proposal to extend a $60M crvUSD credit line to Yield Basis — aiming to turn crvUSD into a stronger income‑generating asset. Sentora’s research team has reviewed YIeld Basis in details over the last few

BitcoinInsider·2025-09-30 12:11

Curve DAO approves a crvUSD credit limit of 60 million USD for Yield Basis before the mainnet launch.

Curve DAO has approved a $60 million credit line for Yield Basis, aimed at deploying Bitcoin liquidity pools on Ethereum. Although there is a goal to integrate crvUSD and increase fees for veCRV holders, there is still debate regarding the risks and transparency of the project.

TapChiBitcoin·2025-09-25 11:38

"Building a road in the open while secretly crossing the river, will Yield Basis make crvUSD great again?"

In the DeFi world, few projects have garnered widespread attention like Yield Basis since its launch. This new protocol, launched by Curve Finance founder Michael Egorov in 2025, carries multiple technological innovations - eliminating Impermanent Loss, circular leverage, creating stablecoin demand, releasing BTC Liquidity, and capturing governance token value, among others.

Its complex mechanism design and multi-layer narrative structure are both exciting and thought-provoking. On one hand, the protocol attempts to address the core issue that has long existed in AMM Liquidity pools—Impermanent Loss, which is considered a "holy grail" breakthrough for liquidity providers; on the other hand, the project's strategic intentions and the historical controversies surrounding the founder have also sparked market discussions. For example, Egorov previously faced near liquidation due to huge borrowing positions, which raised community concerns about

CRVUSD0.3%

PANews·2025-08-26 13:36

Impermanent Loss Transfer Technique, is Curve's new work Yield Basis a financial innovation or a Ponzi trap?

Curve's new project Yield Basis proposes a solution to eliminate Impermanent Loss by amplifying returns through leverage, but it has also sparked a heated debate on whether it is a financial innovation or just another Ponzi scheme. This article is derived from an article by Zuo Ye on Waipo Mountain, compiled, translated, and written by PANews. (Previous summary: 7 ways to earn interest on Bitcoin, along with the new exploration by the founder of Curve) (Background information: Bancor study: 49% of Uniswap V3 Liquidity Providers are losing! Due to Impermanent Loss) After the Luna-UST collapse, stablecoins have completely bid farewell to the era of stable calculations. The CDP mechanism (DAI, GHO, crvUSD) once became the hope of the entire village, but ultimately broke through the encirclement under USDT/USDC.

CRV-1.7%

動區BlockTempo·2025-08-25 06:27

The technique of transferring uncompensated losses, is Curve's new work Yield Basis a financial innovation or a Ponzi trap?

After the Luna-UST crash, stablecoins completely bid farewell to the era of stability. The CDP mechanism (DAI, GHO, crvUSD) once became the hope of the entire village, but ultimately what broke through the encirclement of USDT/USDC was Ethena and the yield anchoring paradigm it represented, which not only avoided the inefficiency issues caused by over-staking but also leveraged native yield characteristics to unlock the DeFi market.

in contrast

CRV-1.7%

PANews·2025-08-25 03:07

Curve Conspiracy Sequel Yield Basis Stablecoin Yield New Paradigm

The path of stablecoin trading expansion beyond Ethena

After the collapse of Luna-UST, stablecoins have completely bid farewell to the era of stability. The CDP mechanism (DAI, GHO, crvUSD) once became the hope of the entire village, but ultimately the ones that broke through the siege of USDT/USDC were Ethena and the yield anchoring paradigm it represents, which not only avoids the inefficiency of excessive collateralization but also leverages the native yield characteristics to open up the DeFi market.

In contrast, the Curve ecosystem, after opening the DEX market relying on stablecoin trading, has gradually ventured into the lending market Llama Lend and the stablecoin market crvUSD. However, under the brilliance of the Aave ecosystem, the issuance of crvUSD has long hovered around 100 million USD, essentially only serving as a backdrop.

However

CRV-1.7%

金色财经_·2025-08-22 09:24

DeFi New Revolution: Why Are Top Protocols Issuing Stablecoins?

In the world of encryption, DeFi (Decentralized Finance) is undergoing a profound transformation in business models. As more and more DeFi projects begin to issue coin, project valuation has become the focal point of attention, and valuation is necessarily based on the foundation of business models.

Why are DeFi giants issuing stablecoins?

Recently, you may have noticed a phenomenon: almost all major DeFi protocols have begun to issue their own stablecoins. From Aave's GHO to Curve's crvUSD, these established projects have coincidentally chosen the same path. What is the secret behind this?

The answer lies in the evolution of the DeFi business model.

Traditional Banking vs Decentralized Finance: Fundamental Differences in Competitive Dimensions

The competition in traditional banking is relatively simple—mainly relying on regulatory licenses and user switching costs to build a moat. Banks need regulatory licenses to operate, which inherently limits the number of competitors.

DEFI-1.11%

金色财经_·2025-07-04 02:50

Resupply proposes to burn 6 million reUSD to bounce back after the 10 million USD hack.

The stablecoin protocol Resupply plans to burn 6 million reUSD from its insurance fund to address a $10 million exploit. The attack manipulated the crvUSD-wstUSR exchange rate, leading to a temporary halt and a proposal to manage the remaining bad debt.

H-14.5%

TapChiBitcoin·2025-06-29 19:36

Resupply: The hacker attack caused approximately 10 million USD reUSD bad debts, and the stolen funds are still on-chain.

Resupply has released a hacker attack analysis report, stating that the attack on its crvUSD-wstUSR trading pair resulted in approximately 10 million USD in reUSD bad debt. The debt limit for the affected trading pair has been set to 0, and withdrawals from the insurance pool have been suspended, requiring a governance vote to lift. The relevant code segments have been audited multiple times, with no issues found, and the stolen funds are currently being monitored.

CRVUSD0.3%

CoinVoice·2025-06-28 15:49

CrvUSD Two-Year Evolution: From Over-Collateralized Stablecoin to DeFi Interest Rate Setter

Original Title: crvUSD: 2 Years On

Original author: Curve News

Source:

Compiled by: Daisy, Mars Finance

crvUSD celebrates its second anniversary, with circulation reaching an all-time high.

On May 14, 2025, crvUSD will celebrate its second anniversary, and scrvUSD will have been launched for six months. During this period, both systems have undergone multiple subtle optimizations, continuously validating their robustness under different market conditions. Just this week, the circulating volume of crvUSD surpassed $181 million, reaching a historical high and demonstrating the market's increasing recognition of its protocol design and practicality.

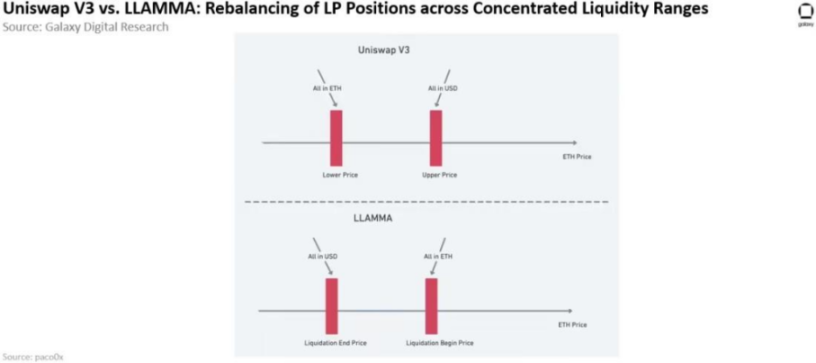

Starting Point: The Birth of crvUSD and LLAMMA

On May 14, 2023, crvUSD made its debut in the market as a truly decentralized and over-collateralized stablecoin. Its innovation lies in the unique liquidation mechanism LLAMM.

MarsBitNews·2025-05-14 15:51

Penny Cryptos Set to Skyrocket – Don’t Miss These Picks

Arbitrum’s governance expands with ARB, introducing Orbit & Stylus for enhanced scaling and smart contract flexibility.

Sonic’s Fee Monetization model & 10,000 TPS speed offer Web3 developers lucrative incentives & high-speed transactions.

Curve strengthens DeFi with crvUSD lending, low-slippage s

CryptoFrontNews·2025-02-18 06:13

DeFi opportunities revolve around $CRV Curve Finance, one of the largest DeFi projects.

The project's Curve Finance token - $CRV - has surged nearly 500% for many reasons, including the increase in DEX revenue, more usage of crvUSD, and higher fees collected per user. Projects of interest to watch include those using a token model similar to CRV and those participating in the "Curve War".

AICoinOfficial·2024-12-08 11:07

Curve Finance (CRV) Sees 20%+ Revenue Growth Amid DeFi Boom

Curve Finance's revenue increased 23% to $37 million in the last month due to new products like crvUSD and scrvUSD, and DeFi market optimism and partnerships.

CryptoNewsLand·2024-12-06 05:23

AC's long article questions Ethena (USDe): The next UST?

Original author: Andre Cronje

Translator: Odaily Planet Daily Azuma

Editor's note: Ethena Labs officially opened ENA airdrop applications yesterday. In the past few months, the issuance scale of USDe has grown rapidly with the expectation of potential airdrops and the high yield derived from "spot + contract arbitrage". As of the publication of this article, the minting volume of USDe has exceeded 1.8 billion U.S. dollars. In the decentralized stable currency track, it has surpassed the pioneers such as FRAX, crvUSD, and GHO, which are backed by head projects. It is likely to continue to grow and shake the top spot of DAI. .

However, when USDe's data is advancing rapidly, many doubts have come to mind in the market. This afternoon, Andre Cronje, the “old king” in the DeFi field

星球日报·2024-04-03 09:33

Curve Finance Continues to Grow in DeFi: Takes Its First Step on Arbitrum with New crvUSD Pool!

Curve Finance, a leading player in the DeFi space, recently announced the launch of the crvUSD pool on the Arbitrum network.

This significant development marks Curve's expansion into one of the fastest-growing Layer 2 solutions in the blockchain industry.

Opening a crvUSD pool on Arbitrum

Koinfinans·2024-01-04 01:49

In-depth: The latest asset risk assessment analysis of the stablecoin TrueUSD (TUSD)

Author: LLAMARISK Compiler: Block unicorn

Relationship to Curve

TrueUSD (TUSD) plays an important role in crvUSD as one of the Pegkeeper pools (crvUSD/TUSD), along with USDC, USDT and USDP. Pegkeepers algorithmically control crvUSD to a $1 anchor by minting or burning crvUSD tokens based on market conditions, essentially backing the outstanding crvUSD supply with a portion of their Pegkeeper pair.

Pegkeeper enforces balance in each Pegkeeper pool, so if the peg value of the Pegkeeper asset is less than $1, it will lead to excessive...

金色财经_·2023-08-21 00:29

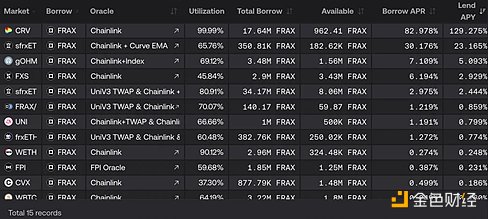

Why did the founder of Curve create the crvUSD/fFRAX pool

Author: DeFi Cheetah, encryption KOL; translation: Golden Finance xiaozou

This article will specifically look at the newly created crvUSD/fFRAX pool in Curve Finance's biggest potential crisis. Its purpose is to reduce the utilization rate (UR) of the CRV/FRAX lending pair and the interest charged by Fraxlend. But why Fraxlend?

Because there is a time-weighted variable rate (TWVIR) which adjusts the rate over time (max = 10,000%) - the higher the utilization, the shorter the half-life (12 hours at 100% UR) and the interest doubles.

The crvUSD/fFRAX pool is set up to always find a market rate that borrowers are willing to pay, while maximizing the use of the FRAX lent. So in this case, compared to other lending platforms, Fraxle...

金色财经_·2023-08-01 07:05

The hardest stablecoin? The most comprehensive arrangement of crvUSD information

Original Author: Poopman, Encryption Researcher Original Compiler: Leo, BlockBeats

crvUSD was launched one and a half months ago. There may be many discussions and articles about it. This article written by encryption researcher Poopman is a relatively comprehensive and detailed one among many articles. This article introduces: crvUSD, LLAMMA, band (band), Uniswap V3 and The hooking and stability of LLAMMA and crvUSD, compiled by BlockBeats as follows:

crvUSD is the most hardcore stablecoin ever created. There is no need to face full liquidation when borrowing CDP, and crvUSD introduces the LLAMMA mechanism, an algorithm that uses soft liquidation to reduce impermanent losses during huge liquidation. The following is a very in-depth introduction to crvUSD.

cr...

金色财经_·2023-07-04 00:28

The hardest stablecoin? The most comprehensive arrangement of crvUSD information

crvUSD may be the most hardcore stablecoin ever.

星球日报·2023-07-03 12:05

Understand the mechanism and risks of Curve's native stablecoin crvUSD in one article

Is there a mechanism that allows users to simply deposit collateral to mint stablecoins without worrying too much about liquidation risks?

ForesightNews·2023-06-02 08:32

Load More