Search results for "DAI"

Hacker Wakes After 2 Years, Deposits $5.4M Into Tornado Cash

_A hacker returned after two years of inactivity and deposited $5.4M in stolen funds into Tornado Cash after swapping DAI for ETH._

An attacker linked to a previous theft has resumed onchain activity after nearly two years of dormancy.

Blockchain data shows stolen funds are now being deposited

LiveBTCNews·01-27 07:40

Altcoins at a Crossroads: Top 5 Cryptos to Trade Now With Real 80% Gains & Momentum

Capital rotation is favoring structurally strong altcoins over speculative micro-cap assets.

Momentum signals remain selective, with liquidity concentration playing a decisive role.

Defensive assets like DAI are gaining relevance alongside higher-yield opportunities.

The altcoin market h

CryptoNewsLand·01-10 00:46

Bank × Police Department × VASP First Integration: Yuanta Bank's Bankee Launches Cross-Domain Anti-Fraud Network

Far Eastern International Bank teams up with the Criminal Investigation Bureau of the National Police Agency and VASP to launch the "Cross-Domain Anti-Fraud Network," demonstrating the three parties' commitment to safeguarding the security of both virtual and real-world finance.

(Background: Far Eastern Bankee x Virtual Asset Investigation 2025: Over 80% of Taiwanese crypto investors profit, strong confidence in 2025)

(Additional background: Confession from Taiwan's crypto-friendly banks: An exclusive interview with Far Eastern Bank's Dai Songzhi—what can a somewhat sharp financial backbone do for Crypto?)

Today (8), Far Eastern International Bank announced its collaboration with the Criminal Investigation Bureau of the Ministry of the Interior Police Agency, and jointly with major virtual asset exchanges across Taiwan, to create the "Cross-Domain Anti-Fraud Network" spanning banks, police, and VASP.

Blocking over NT$450 million, demonstrating high efficiency and readiness

According to statistics from the Police Agency, from January to October 2025, the total amount of scam-related account refunds nationwide was approximately NT$198 million.

動區BlockTempo·01-08 10:00

Ethereum Foundation Launches dAI Team Focused on Standards

Ethereum Foundation launched a dAI team to coordinate AI-related standards, focusing on infrastructure rather than applications.

ERC-80004 drew attention from firms like Google, Cloudflare, and Coinbase, leading to early ecosystem development.

The dAI team stays small and neutral,

CryptoFrontNews·01-04 18:06

Early Altcoin Rotation Underway? 5 Altcoins Positioned for 2x Gains as Market Absorbs 30% Drawdowns

Litecoin, Sui, Avalanche, Dai, and Hedera stand to make 2x gains in market drawdowns.

The early rotation is biased to those tokens that have strong fundamentals, liquidity and are widely adopted.

Stablecoins and projects of interest to enterprises have strategic functions in balancing

CryptoNewsLand·01-02 02:26

Latest Aave community controversy: free asset swap becomes charged, DAO demands the recovery of revenue control.

The Decentralized Finance (DeFi) lending platform Aave is facing strong Rebound from the community. The controversy arises from Aave's recent introduction of a 0.15% to 0.25% fee on the originally free asset swap function in the official front-end interface, and this revenue does not flow into the DAO treasury but is retained by the development company Aave Labs.

This move has sparked widespread discussion in the community about whether "decentralized governance is being undermined," and has focused the entire Decentralized Finance community on a core question: who truly controls the value and revenue of the protocol?

From Free to Paid: Major Changes to Aave's Frontend Swap Functionality

In the past, Aave users could perform free asset swaps through its official front end (such as app.aave.com), such as swapping between USDC and DAI or ETH, only bearing the basic DEX slippage and

ChainNewsAbmedia·2025-12-22 09:04

Crypto Trader Loses $50M USDT to Address Poisoning Despite Test Transaction

The victim first sent a $50 test to the correct address before the attacker’s look-alike address captured the full transfer.

Key Points

Scammer converted stolen USDT to DAI within minutes, blocking any potential Tether freeze action.

Funds are being laundered via Tornado Cash, a mixing service th

CryptoNews·2025-12-20 09:56

Tangem Wallet integrates Aave for stablecoin yield

Tangem Wallet now lets users earn Aave yield on USDT, USDC and DAI inside the app, with hardware security, simple setup and no need for external dApps.

Summary

Tangem Wallet now offers Aave-backed yield through Yield Mode.

Users can earn on USDT, USDC and DAI without leaving the app.

Cryptonews·2025-12-12 04:30

Collapse of stablecoin yields

Preface

Has the era of easily earning cryptocurrency returns really come to an end? A year ago, putting money into stablecoins was like having a cheat code, providing both generous interest and (supposedly) no risk. Now, that fantasy has been shattered. The entire stablecoin yield opportunities in the cryptocurrency space have collapsed, leaving DeFi lenders and yield farmers in a near-zero return predicament. Where has the once "risk-free" annual percentage yield (APY) golden goose gone? And who is to blame for the decline of yield farming? Let’s delve into the current state of stablecoin yields, and the results are shocking.

The dream of "risk-free" returns is dead.

Do you remember the good times around 2021? Back then, various protocols tempted users to invest in USDC and DAI with double-digit annual percentage yields (APY) as if they were selling candy. Centralized platforms promised returns of 8% to 18%.

金色财经_·2025-11-28 11:47

A young police officer in Taiwan who lost money in cryptocurrency trading borrowed money to invest in Bitcoin and is unable to repay it, facing fraud charges and being searched and questioned.

A young police officer in Hsinchu, Taiwan, is suspected of losing money during a previous Bitcoin fall and unable to repay the borrowed principal, leading to charges of fraud. He was recently summoned and searched, and has been released on bail of 250,000 yuan. (Previous context: A Thai homeowner sold a river-view luxury house for 3.88 Bitcoins, is it now 31% off if bought directly?) (Background: SpaceX transferred 100 million dollars in Bitcoin, is Musk cashing out?) On the 26th of this month, the lights were on in the standby room of the Hukou Police Station in Hsinchu County as investigators searched for documents and mobile phones belonging to a 24-year-old officer with the surname Dai. Just a few months ago, he was on duty on the streets, but now he has been released on bail and is awaiting further questioning. This outcome is familiar in the crypto world: contracts, Bitcoin, loans. The leverage in cryptocurrency trading has severed the funding chain. According to reports from the Central News Agency and police sources, Officer Dai was optimistic about Bitcoin in early 2025, initially using his savings and later borrowing hundreds of thousands from friends to enter the market.

動區BlockTempo·2025-11-28 09:42

The Harsh Reality of DeFi: The Collapse of Stablecoin Yields, Welcome to the Era of Risk

Author: Justin Alick

Compiled by: ShenChao TechFlow

Has the era of easily obtaining cryptocurrency earnings officially ended? A year ago, putting cash into stablecoins felt like finding a cheat code. Generous interest, ( supposedly ) zero risk. Today, this dream has turned to ashes.

The yield opportunities of stablecoins in the entire cryptocurrency sector have collapsed, leaving DeFi lenders and yield farmers trapped in a near-zero return wasteland. What happened to that "risk-free" annual percentage yield (APY) golden goose (cash cow)? Who is to blame for the yield farming turning into a ghost town? Let’s dive deep into the "autopsy report" of stablecoin yields; it’s not a pretty sight.

The dream of "risk-free" returns is dead.

Do you remember those wonderful old days? ( Around 2021 ), various protocols were throwing out USDC and DAI like candy.

DeepFlowTech·2025-11-27 06:44

Vitalik Talks AI Agent: Building Trust with ERC-8004, Suggested Applications for Real-time Translation and More

Ethereum co-founder Vitalik Buterin and Davide Crapis, head of the Ethereum Foundation's dAI team, deeply discussed the infrastructure, trust models, and privacy protection of AI intelligent body economy at Devconnect Trustless Agent Day, detailing the x402, ERC-8004 standards, and future computing vision. This article is sourced from a ChainFeeds piece, compiled and written by Foresight News. (Background: Vitalik questions X platform's privacy policy: mandatory disclosure of user country/region has harmed the cryptocurrency community's anonymity.) (Background Supplement: Vitalik's Shanghai speech: the history of cryptography and the significance of ZK.) During the Ethereum Devconnect, a

ETH-1.15%

動區BlockTempo·2025-11-24 15:42

Interpreting Q3 Crypto Market Leverage: On-Chain Lending Drives Crypto Borrowing to New Highs

Author: Galaxy

Compiled by: Felix, PANews (This article has been edited)

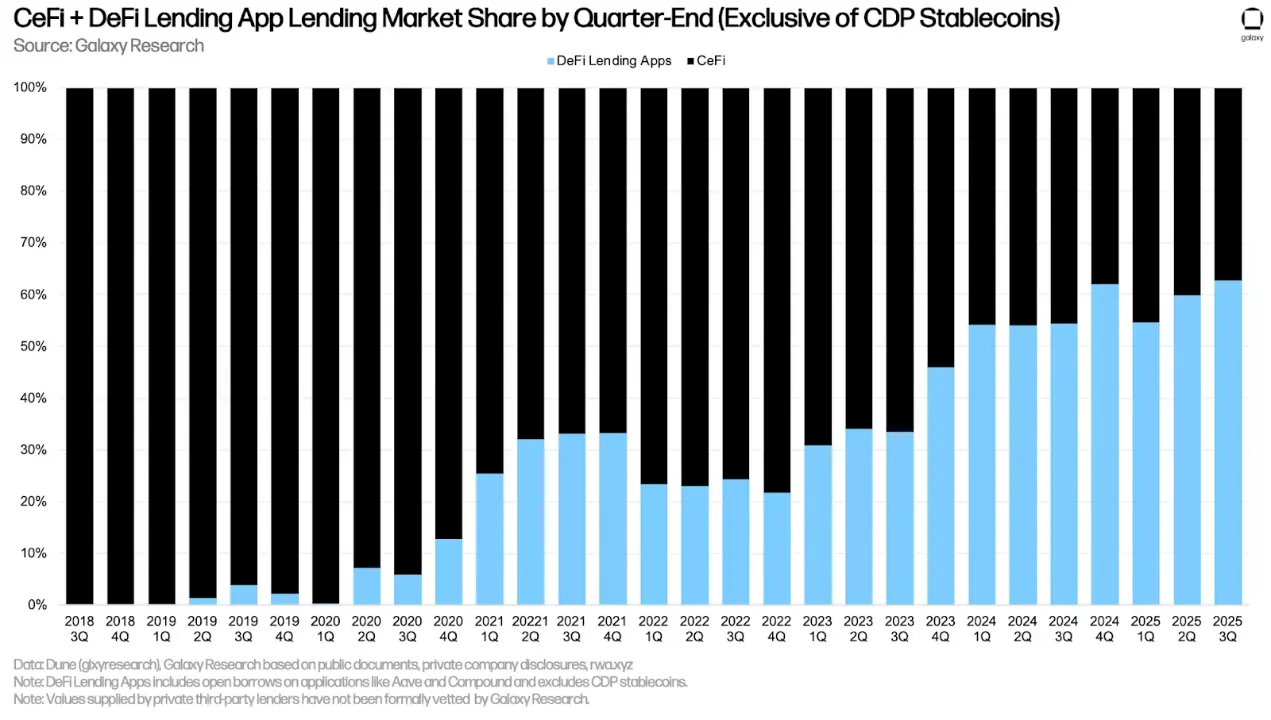

Crypto asset collateralized lending reached a historic high at the end of Q3, largely driven by the growth of on-chain lending. Although the long-standing peak set in Q4 2021 was finally surpassed nearly four years later, today’s market is very different. First, on-chain lending now accounts for a much larger share of the total lending market; at the end of Q4 2021, on-chain lending through applications like Aave and collateralized debt position (CDP) stablecoins like DAI accounted for 48.6% of the market. Today, this proportion has risen to 66.9%. In the on-chain lending sector, the balance between lending applications and CDP stablecoins has also shifted significantly. As of the end of Q3 2025, lending applications account for more than 80% of the on-chain market, while CD

PANews·2025-11-23 03:04

"Building the YC of Stablecoins": Obex Secures $37 Million in Funding to Build Yield-Generating Stablecoin Infrastructure

Author: Krisztian Sandor

Compiled by: Tim, PANews

Web3 incubator Obex recently announced the completion of a $37 million financing round, led by Framework Ventures, LayerZero, and the Sky Ecosystem Fund. The funds will be used to develop a new generation of yield-bearing stablecoins.

Obex incubator aims to invest in projects that bring RWA onto the chain and provide institutional-level risk control and underwriting standards for this rapidly developing market.

Obex will become Sky's latest capital allocator (formerly MakerDAO, which launched the DAI and USDS stablecoins with a total market value of 9 billion USD), using its large reserves to provide funding for Sky to scale up and generate returns from projects through its strategies.

Co-founder of Framework Ventures, Vance

PANews·2025-11-19 09:16

Curve: A DeFi fortress built on liquidity, incentive mechanisms, and community construction.

Author: Karl Marx OnChain, encryption KOL; Translated by: Felix, PANews

Curve does not rely on luck to survive each bear market.

It has survived because it is designed for one thing: sustainability.

From a mathematical experiment in 2019 to becoming a global liquidity pillar by 2025, Curve's development journey is the evolution of real yields, incentive alignment, and community resilience.

Let's review year by year:

2019: The birth of StableSwap (a new AMM concept)

At that time, DeFi was still in its infancy. Stablecoins like DAI, USDC, and USDT were very popular, but traders faced high slippage, and the yields for liquidity providers (LPs) were also very low.

Michael

金色财经_·2025-11-16 09:19

Traversing the three rounds of bulls and bears, thrilling revival, and continuous profit: the real reason why Curve has become the "Liquidity Hub" of DeFi.

Original Title: The Journey of Curve: A DeFi Fortress Based on Liquidity, Incentive Mechanisms, and Community Building

Original Author: Karl Marx OnChain, Crypto KOL

Source:

Reprinted: Daisy, Mars Finance

Curve does not rely on luck to survive every bear market.

It survives because it is built for one thing: sustainability.

From a mathematical experiment in 2019 to becoming a global pillar of liquidity in 2025, Curve's development journey is an evolution of real yield, incentive alignment, and community resilience.

Let's review year by year:

2019: The birth of StableSwap (a new AMM concept)

At that time, Decentralized Finance was still in its infancy. Tokens like DAI, USDC and

MarsBitNews·2025-11-15 08:52

The Journey of Curve: A DeFi Fortress Built on Liquidity, Incentive Mechanisms, and Community Building

Author: Karl Marx OnChain, encryption KOL

Compiled by: Felix, PANews

Curve did not survive each bear market by luck.

It survives because it is built for one thing: sustainability.

From a mathematical experiment in 2019 to becoming a global liquidity pillar in 2025, Curve's development journey is an evolution of real yield, incentive alignment, and community resilience.

Let's review year by year:

2019: The birth of StableSwap (a new AMM concept)

At that time, DeFi was still in its infancy. Stablecoins like DAI, USDC, and USDT were very popular, but traders faced high slippage and the earnings for liquidity providers (LPs) were also very low.

Michael

PANews·2025-11-15 07:41

Behind the x402 craze, how ERC-8004 enables AI agents to have "credit scores"

This article delves into the ERC-8004 standard, which aims to establish a decentralized trust layer for AI entities, providing verifiable identity and reputation records, addressing trust issues that the x402 protocol cannot handle independently. (Background: The Ethereum Foundation's dAI team announced the 2026 roadmap: decentralized AI agents focus on ERC-8004 and x402) (Background information: What is the Ethereum ERC-8004 protocol? Creating "on-chain identity cards" for AI agents: Google, MetaMask, Coinbase joint endorsement) Recently, with the x402 protocol designed for automated micropayments among AI entities (Agent) becoming a market hotspot, discussions about its early potential are incessant. However, under the glow of x402, a more...

ETH-1.15%

動區BlockTempo·2025-11-15 03:10

Ethereum Foundation Progresses dAI Team’s 2026 Roadmap, Highlighting ERC-8004 And x402 As Key Priorities

In Brief

Ethereum Foundation’s dAI team is working on a 2026 roadmap to establish Ethereum as the decentralized backbone for AI, focusing on standards like ERC-8004 and x402.

Co-founder of PIN AI and a research scientist at the Ethereum Foundation (EF), a non-profit organization dedicated to

ETH-1.15%

MpostMediaGroup·2025-11-11 11:25

Ethereum Foundation's dAI team announces 2026 roadmap: focus on decentralized AI agents with emphasis on ERC-8004 and x402

Ethereum Foundation's dAI team announced the 2026 roadmap, focusing on promoting trust and payment infrastructure for decentralized AI agents. The core protocols are ERC-8004 and x402, aimed at solving trust issues in the AI economy and facilitating transparent payment processes. These new protocols indicate that the integration of blockchain and AI will transform business models and market standards.

動區BlockTempo·2025-11-11 04:44

Ethereum Foundation's dAI team releases the 2026 roadmap, stating that ERC-8004 and x402 are gradually emerging.

Decentralized Artificial Intelligence (dAI) team releases the 2026 roadmap, aiming to establish Ethereum as a decentralized infrastructure for artificial intelligence. The team emphasizes the importance of trust and verifiability, launching the ERC-8004 standard and x402 protocol to promote the development of intelligent agent commerce, with over 150 projects built on ERC-8004.

ETH-1.15%

DeepFlowTech·2025-11-11 03:16

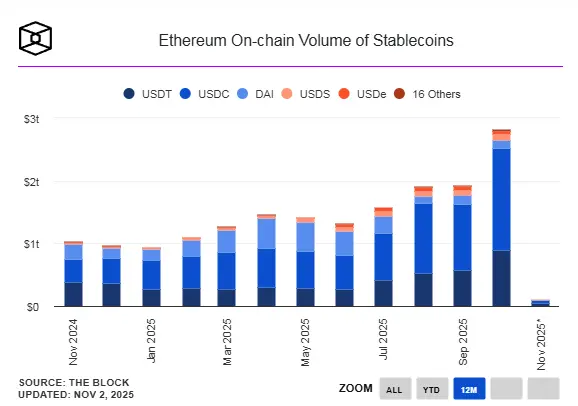

Data: In October, the stablecoin volume on Ethereum reached $2.82 trillion, setting a new historical high.

In October 2025, the trading volume of Ethereum stablecoins reached $2.82 trillion, a month-on-month rise of 45%. USDC dominated, followed by USDT and DAI. Analysis points out that during the pullback in the crypto market, traders seek profits, and stablecoin issuers become a major source of income.

MarsBitNews·2025-11-03 05:25

The monthly trading volume of Ethereum stablecoins reached a record level of 2.8 trillion dollars.

In October, Ethereum's stablecoin trading volume reached a record $2.82 trillion, a 45% increase from September. Leading the volume were USDC, USDT, and a slight decline in DAI, attributed to a search for yield amid market corrections. Analysts view this growth as a sign of a maturing cryptocurrency market.

TapChiBitcoin·2025-11-03 05:19

5 Solid Reasons Ethena (ENA) Could Be the Next Major DeFi Powerhouse

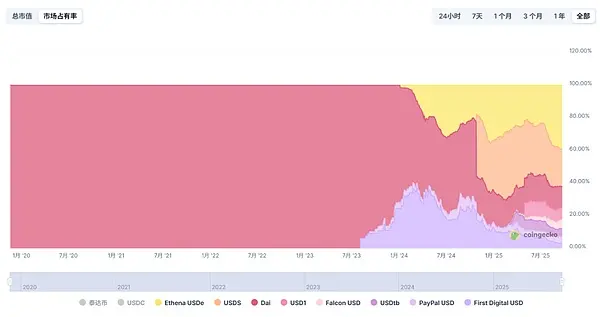

Ethena has been on a roll lately, and it’s starting to show across the charts and headlines. The project’s flagship stablecoin USDe just became the third-largest stablecoin in the world, overtaking DAI with a market cap of $12.26 billion, according to Santiment

That’s a massive milestone for a pro

CaptainAltcoin·2025-10-27 11:05

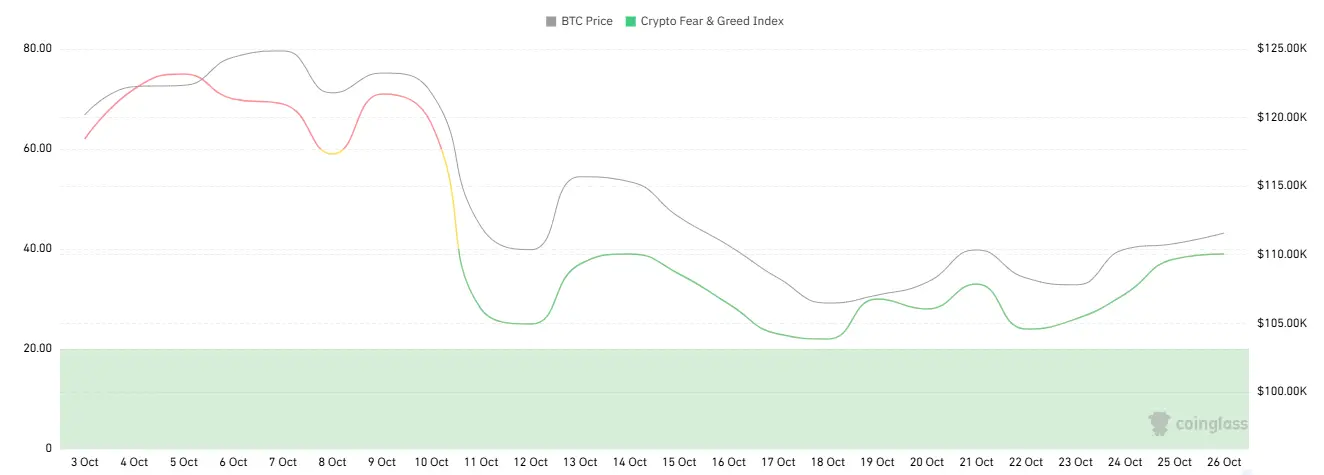

CoinW Research Institute Weekly Report (October 20, 2025 - October 26, 2025)

Key Points

The total global cryptocurrency market capitalization is $3.97 trillion, up from $3.89 trillion last week, representing a weekly increase of 2.06%. As of press time, the United States Bitcoin spot ETF has a total net inflow of approximately $61.98 billion, with a net inflow of $446 million this week; the United States Ethereum spot ETF has a total net inflow of approximately $14.35 billion, with a net outflow of $24.4 million this week.

The total market capitalization of stablecoins is $312 billion, with USDT market capitalization at $182.9 billion, accounting for 58.6% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $76.3 billion, accounting for 24.5%; DAI has a market capitalization of $5.36 billion, accounting for 1.7%.

According to DeFiLlama, the total value locked (TVL) in Decentralized Finance (DeFi) this week is $157.5 billion, up from $152.2 billion last week.

PANews·2025-10-27 08:28

A trader lost 21 million USD on Hyperliquid after his private key was exposed.

The decentralized platform Hyperliquid was severely attacked, resulting in a trader losing about $21 million. The attacker accessed private keys related to Hyperdrive and stole nearly $18 million DAI and over $3 million SyrupUSDC. The cause of the private key leak is still unknown, but evidence suggests it was a targeted attack. This incident highlights the need for users to remain vigilant about security, especially as DeFi platforms continue to be major hacker targets.

HYPE6.83%

TapChiBitcoin·2025-10-11 05:43

Ethereum Foundation launches AI protocol PayPal and Google develop AI payment

Headlines

▌The Ethereum Foundation's dAI team and Consensys have launched the ERC-8004 protocol to guide the AI agent economy.

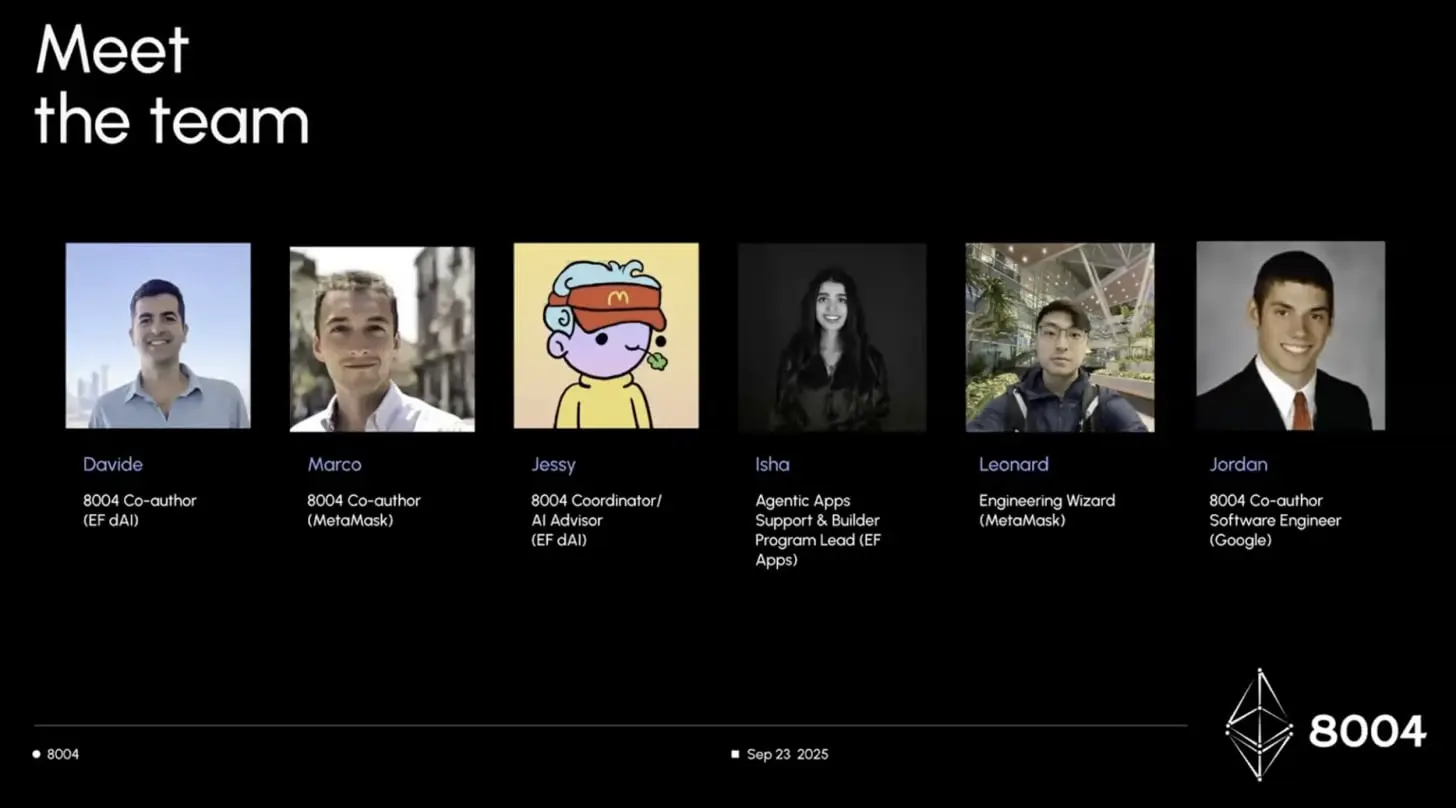

The Ethereum Foundation's dAI team and Consensys have announced the final version of ERC-8004, a protocol that allows artificial intelligence agents to discover, verify, and collaborate with one another without centralized intermediaries, bridging the gap between blockchain and artificial intelligence. ERC-8004 was drafted in August this year and addresses this issue through three lightweight on-chain registries (identity, reputation, and verification). Since its launch, ERC-8004 has facilitated numerous prototypes and generated widespread interest, with over a hundred companies planning to build upon the protocol. The final specification was authored by Marco De Rossi (MetaMask), Davide

ETH-1.15%

金色财经_·2025-10-09 23:56

Best Stablecoin Wallets for Everyday Use in 2025

The rise of stablecoins has transformed how we handle digital payments, cross-border transactions, and everyday financial activities in the cryptocurrency ecosystem. With stablecoins like USDT, USDC, and DAI gaining mainstream adoption, choosing the right stablecoin wallet has become crucial for

IN0.76%

BitcoinInsider·2025-10-06 08:08

Data: Ethereum Foundation Decentralized Finance Multi-signature Wallet sells 1000 ETH at an average price of 4508 USD.

The Ethereum Foundation's DeFi Multi-signature Wallet sold 1,000 ETH for $4,508 in the past 7 hours, exchanging it for 4.508 million DAI. In the last three months, the wallet has sold 21,000 ETH, totaling a value of $72.94 million.

MarsBitNews·2025-10-04 04:56

A certain Whale/institution bought 8,637 ETH in the past hour.

According to Mars Finance news on October 2, on-chain data analyst Yu Jin monitored that in the past hour, a Whale/institution purchased 8,637 ETH through three Wallets on-chain with 38.017 million DAI, at an average price of $4,402.

MarsBitNews·2025-10-02 08:01

Ethereum prepares the platform for the autonomous machine economy

Ethereum is positioning its foundational layer to coordinate autonomous agents (, paving the way for machine-to-machine ) trading with the ability for direct on-chain ( payments in the coming year.

This month, the Ethereum Foundation has established a dedicated team for dAI.

TapChiBitcoin·2025-10-01 06:08

Trustless Agents: How EF Changes the Rules of the Game Between AI and Blockchain through ERC-8004

Original author: Pan Zhixiong, founder of ChainFeeds

Reprint: Luke, Mars Finance

ERC-8004 is a key standard led by the Ethereum Foundation, aimed at establishing a trustless collaboration mechanism between AI Agents in the Web3 environment. This standard is derived from the Agent-to-Agent (A2A) protocol open-sourced by Google in June 2025, and was officially proposed in August of the same year by the Ethereum Foundation's dAI team (led by Davide Crapis) in collaboration with institutions like MetaMask and Google, with the goal of making Ethereum the default coordination and settlement platform for the AI agent economy. The final standard is expected to be officially released at Devconnect in November 2025.

The core design of ERC-8004 includes three lightweight on-chain components.

ETH-1.15%

MarsBitNews·2025-09-29 05:57

How EF Changes the Game Rules for AI and Blockchain through ERC-8004

Author: Zhixiong Pan Source: chainfeeds

ERC-8004 is a key standard led by the Ethereum Foundation, aimed at establishing a trustless collaboration mechanism between AI Agents in the Web3 environment. This standard is derived from the Agent-to-Agent (A2A) protocol open-sourced by Google in June 2025 and was officially proposed in August of the same year by the Ethereum Foundation's dAI team (led by Davide Crapis) in collaboration with organizations such as MetaMask and Google, with the aim of making Ethereum the default coordination and settlement platform for the AI economy. The final standard is expected to be released in November 2025 at Devconnect.

ETH-1.15%

金色财经_·2025-09-28 11:22

The attacker of Radiant Capital exchanged approximately 14 million DAI for 3490.2 ETH, most of which has been deposited into TornadoCash.

According to Mars Finance, market news indicates that the attacker of Radiant Capital has exchanged approximately 14 million DAI for 3490.2 ETH and deposited 2243.2 ETH into TornadoCash.

MarsBitNews·2025-09-28 03:42

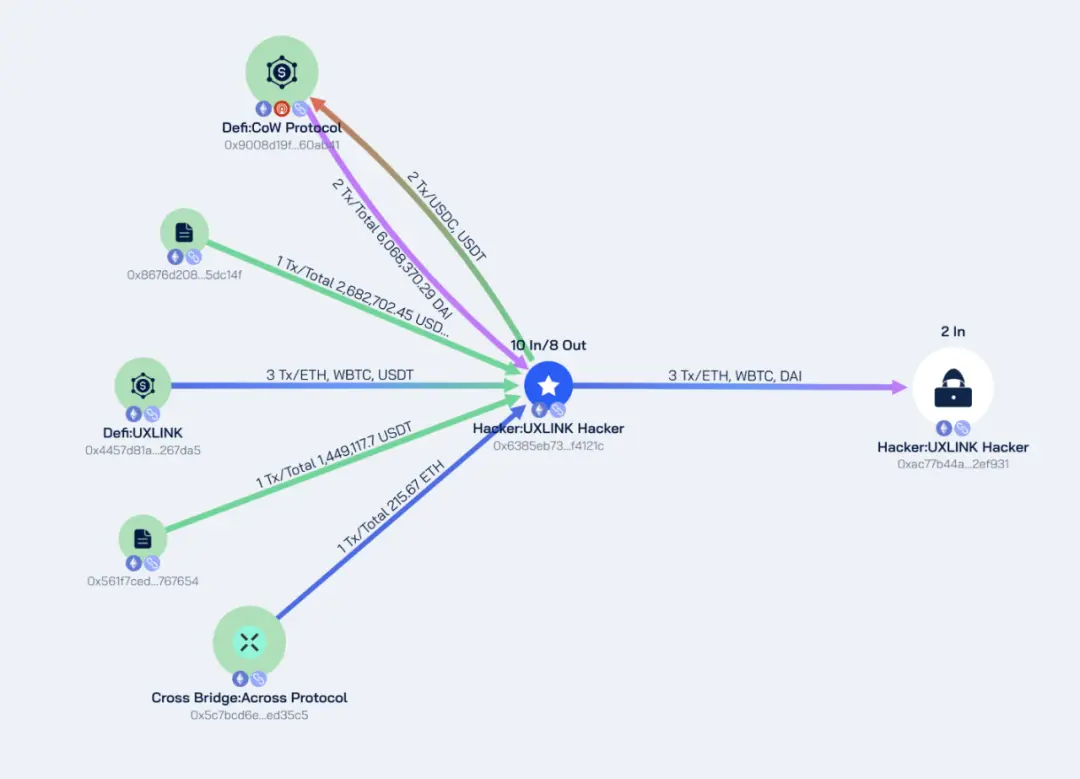

UXLINK Hack Update: $6.8M ETH Converted to Stablecoins by Attacker

UXLINK hack update: the attacker swaps $6.8M ETH to DAI, exposing multi-sig wallet flaws and renewing calls for DeFi security standards.

UXLINK Hack Raises New Concerns About Multi-Sig Wallet Security

The exploit began on September 22 and lasted until the next day. The

LiveBTCNews·2025-09-25 03:09

Here’s Why 13% of XRP Supply Could Get Locked and Trigger a Major Supply Shock

A new discussion inside the XRP community is getting louder, and it’s all about supply. Digital Asset Investor (DAI), a well-known XRP supporter, thinks as much as 13% of the circulating XRP could soon be locked away, creating a serious supply crunch that might push prices higher in the

CaptainAltcoin·2025-09-24 18:05

9.24 AI Daily Report: The integration of AI and fintech accelerates, promoting innovation and development in the Crypto Assets industry.

AI today discovered 1. Nvidia and OpenAI reached a $100 billion partnership to co-build AI data centers 2. Google released the AP2 universal payment protocol to provide payment functionality for AI agents 3. The Ethereum Foundation established the "dAI" department to develop Ethereum as an AI settlement layer 4. The Solana ecosystem financing boom continues, Helius Medical raises over $500 million 5. South Korean financial regulators are investigating the order sharing situation between humb and overseas exchanges.

GateUser-26c36996·2025-09-24 10:06

Loss exceeds 10 million USD, analysis of the UXLINK security incident vulnerability and tracking of stolen funds.

On September 23, UXLINK was attacked due to the leakage of the Multi-signature Wallet Private Key, with the attacker minting and selling UXLINK tokens to profit over 11.3 million dollars. The Beosin security team analyzed the incident, revealing that the Hacker manipulated the contract control and fund flow, converting the stolen funds into ETH and DAI, which currently remain in multiple Addresses.

PANews·2025-09-24 05:01

USDe surging? Deconstructing the Satoshi Nakamoto dollar practice behind the 14 billion scale

Who is the third stablecoin that comes to your mind?

USDT and USDC occupy the top two positions with little doubt, but the current third is not DAI, FDUSD, or TUSD, but a new face that has been launched for less than two years—USDe.

According to CoinGecko data, as of September 23, the circulating supply of USDe has surpassed $14 billion, ranking third in the stablecoin market, only behind USDT and USDC. More notably, if we exclude the volumes of USDT and USDC, USDe has nearly captured 40% of the market share of all other stablecoins, creating strong pressure on the survival space of established stablecoins.

What exactly does this rising star rely on to emerge rapidly in a short period? What are the underlying profit logic and risk vulnerabilities behind it? And as USDe rises rapidly,

USDE-0.07%

金色财经_·2025-09-24 00:31

The XRP Math: How High Could XRP Rise if Crypto Market Cap Grows by $10T

Digital Asset Investor (DAI) highlights XRP's strong market position with bullish developments, including a successful ETF launch and its price response to market liquidity. He stresses the importance of cautious investment strategies in the evolving market.

XRP0.3%

TheCryptoBasic·2025-09-19 05:39

What is the STBL protocol? Minting stablecoins by collaterizing real-world assets (RWA), tokenomics analysis.

The first stablecoin with a separation mechanism for yield, allowing users to hold NFTs to gain returns from underlying assets. This article is sourced from a piece by Alea Research, organized, compiled, and written by TechFlow. (Background: The Federal Reserve cut interest rates by 25 basis points in September's FOMC, Powell stated "tariff impact is limited," Bitcoin broke above 117,300.) (Supplementary background: The Federal Reserve's mouthpiece: Powell's final battle, how to bear the thorny economic and political pressure.) Stablecoins have become an indispensable part of Decentralized Finance (DeFi), but they also bring many trade-offs and challenges. For example, over-collateralized crypto assets supporting stablecoins (such as DAI) face volatility risks; centralized stablecoins (such as USDC and USDT) offer almost no guarantees regarding reserve transparency; algorithmic stablecoins (such as UST or...

動區BlockTempo·2025-09-19 02:43

What are the highlights of the dAI team established by the Ethereum Foundation?

Finally! The Ethereum Foundation has established the dAI team, I especially want to ask: what were you doing earlier?

I have repeatedly emphasized in several articles that AI Agents will become the "redemption" of many Crypto narratives. Ethereum needs to consolidate its position as a decentralized and secure settlement layer for global public chains, and the technical debt has already become too heavy. A new application scenario that can refresh old technology is needed, and it is highly likely to be AI Agents.

So, what are the highlights of what the dAI team plans to do?

1) Build "AI Economy on Ethereum", allowing AI Agents to autonomously pay and coordinate on-chain, eliminating intermediaries. This will require the maturity of many other AI infrastructure components:

For example, AI Memory context memory solution, AI Oracle real-time dynamic price feeding solution, AI

ETH-1.15%

金色财经_·2025-09-16 07:31

Ethereum Stakes a Claim as AI’s Settlement Layer With dAI Team

The Ethereum Foundation launched the "dAI Team" to position Ethereum as a leading settlement layer for AI, focusing on AI collaboration, decentralized systems, and ERC-8004 for trust verification. The initiative aims to merge AI and Ethereum communities while enhancing transparency and autonomy.

ETH-1.15%

Coinpedia·2025-09-15 18:10

The Ethereum Foundation has established a new AI team to recruit talent to create a new future for the decentralized artificial intelligence economy.

The Ethereum Foundation has announced the establishment of a new AI team called "dAI Team," with the goal of making Ethereum the preferred settlement and collaboration platform for the AI and machine economy.

Combining AI with Ethereum: dAI Team officially launched

The Ethereum Foundation recently announced the establishment of the "dAI Team" (Decentralized AI Team), aimed at promoting the deep integration of artificial intelligence and blockchain technology. The team's mission is clear: to make Ethereum the preferred settlement and coordination layer for AI and machine economy.

This new plan focuses on two core areas:

1. AI Economic System (AI Economy on Ethereum): Empowering AI intelligent agents and robots to conduct payments, collaborate, and adhere to rules, eliminating intermediaries.

ETH-1.15%

ChainNewsAbmedia·2025-09-15 14:34

BounceBit: Infrastructure for Native Restaking Bitcoin

BounceBitPrime $BB

@bounce\_bit BounceBit is a Layer 1 network providing native restaking solutions for BTC tokens, while aiming to expand the application of several coins such as USDT, DAI…

In addition, BounceBit is also compatible with EVM, allowing developers to execute dApps on the network of a single whale.

Blotienso·2025-09-09 15:11

"Blockchain x Far Eastern Bank Bankee 2025 Virtual Asset Survey" Fill out the questionnaire to enter the USDT prize pool! Let your encryption experience become a new industry benchmark.

In the world of Crypto Assets, every investor's story is unique. You may have witnessed the frenzy of a bull run and held onto your beliefs during a Bear Market. Whether you are a Crypto Veteran or a Newbie player, you are invited to share your experiences and leave a piece of history with this questionnaire. (Background: Coingecko survey: Who is investing in crypto AI?) (Supplementary background: Confession of Taiwan's crypto-friendly bank: An interview with Dai Songzhi from Far Eastern International Bank, what can a somewhat sharp financial backing do for Crypto?) Are you an old OG in Crypto Assets? Or an investment player who has deeply researched the crypto market? Have you experienced the excitement and entanglement of FOMO and HODL in the fluctuating markets? Now, it’s time to let your investment experiences be heard! Launched by "BLOCKTEMPO" in collaboration with "Far Eastern International Commercial Bank Bankee" for the 2025 virtual...

OG32.45%

動區BlockTempo·2025-09-09 10:31

Ethena USDe stablecoin supply surged by 42% to enter the top three! The fee switch is about to be activated, and ENA may challenge 1 USD | Ethena price prediction

The circulating supply of the synthetic stablecoin USDe under Ethena Labs has surged by 42% in one month, with a market capitalization exceeding 12.4 billion USD, surpassing DAI and USDS to become the third largest stablecoin in the world, only behind USDT and USDC. At the same time, the activation conditions for the protocol's "fee switch" are nearly all met, and it is expected to soon allow ENA holders to share in the protocol's revenue. USDe employs a unique delta-neutral hedging strategy to maintain its peg, differentiating itself from traditional fiat-collateralized stablecoins. The price of ENA rose 8% to 0.6775 USD within the day, with trading volume surging by 133%. Analysts are optimistic about its potential for further rises after breaking through key resistance.

MarketWhisper·2025-09-03 01:14

Grab the COME Mining cloud mining contract and start your mining journey easily with a stable dai...

SPONSORED POST\

While researching Bitcoin mining, we discovered that the traditional mining model isn’t suitable for most people. It requires expensive mining machines and cooling equipment, specialized skills, ongoing maintenance, and the burden of rising electricity costs. These barriers to

TheCryptonomist·2025-08-29 12:37

3 Altcoins That Will Multiply Your Investment By November

Polygon drives growth with staking rewards, governance power, and expanding ecosystem utility.

Cardano offers energy-efficient smart contracts, scalability, and strong developer adoption.

Maker powers DAI stability, DeFi governance, and long-term value growth potential.

The crypto market offers c

CryptoNewsLand·2025-08-26 14:13

Load More