Search results for "DRIFT"

No Catalyst, No Breakout? DOGE Could Drift Sideways into Summer 2026 - U.Today

Dogecoin has experienced brief price increases but remains in a sideways trading pattern, with expectations of stagnation until a new catalyst, such as the upcoming "Such" app, potentially driving future price movements.

DOGE-3.42%

UToday·01-28 15:38

Strategist Warns Ethereum Risks Sliding Toward $2,000 as Macro Volatility Rises

Mike McGlone of Bloomberg Intelligence warns that Ethereum faces downside risks and may drift toward its $2,000 support level, as rising macro volatility impacts its trading range between $2,000 and $4,000.

Coinpedia·01-27 03:36

Pi Network News: Pi Coin Set For Tumble Below $0.10, As Experts Call RTX The Next XLM

Fresh Pi Network news is raising serious concerns among traders as Pi Coin continues to drift lower under mounting supply pressure. While early supporters once believed Pi Network could mirror the long-term success seen in assets like XLM, recent price action tells a different story. Meanwhile, o

LiveBTCNews·01-26 14:30

Bitcoin’s Quantum Dilemma: Michael Saylor Warns of Protocol Drift Amid Rising Hype

A fundamental debate about Bitcoin's future is intensifying, pitting the network's legendary stability against emerging technological threats. Michael Saylor, executive chairman of MicroStrategy, has issued a stark warning that the most significant danger to Bitcoin comes not from external advancements like quantum computing, but from internal pressures to alter its core protocol.

This warning coincides with major industry moves, most notably Coinbase forming an independent quantum adviso

CryptopulseElite·01-26 02:48

XRP Funding Rate Dips on Binance: How Low Could Price Go This Time?

XRP price has slipped into another uncomfortable zone where confidence feels thin and conviction appears tilted in one direction. After failing to hold above $2 again in mid January, XRP has continued to drift lower, mirroring broader market weakness. This pullback comes just weeks after a

CaptainAltcoin·01-22 14:00

BNB and Zcash Drift Sideways As 400x ROI Projections Drive Investors to Zero Knowledge Proof’s Pr...

Right now, discussions around the top crypto to buy are starting to shift as many big names struggle against newer projects. The BNB coin price is holding within a defined range in the mid-to-upper $800 area, with traders focused on support and resistance rather than clear

BlockChainReporter·01-07 16:05

XRPL Addresses Escrow Bug Impacting Institutional Tokenization Workflows

XRPL 3.0.0 introduces TokenEscrowV1 to fix MPT escrow accounting with transfer fees, preventing LockedAmount supply drift.

The amendment requires validator approval to activate, ensuring consistent escrow completion behavior across network nodes.

Ripple has released XRP Ledger

XRP-6.91%

CryptoNewsFlash·01-07 11:25

Ethereum and Solana Prices Drift Sideways While Zero Knowledge Proof Delivers $249 Proof Pods in 5 Days!

As December moves forward, the crypto market is showing a clear split in behaviour. Solana remains locked in a tight range, testing resistance but unable to break through as sellers maintain control. Meanwhile, Ethereum hovers in consolidation, facing technical barriers overhead with no strong

CaptainAltcoin·01-01 17:35

From Inauguration Week to Year-End Drift: Trump’s Meme Coin Reviewed

Donald Trump closed 2025 as the first sitting U.S. president to preside over a meme coin experiment that began in spectacle and ended in spreadsheets.

President Trump’s Meme Coin Experiment

In the days leading up to his Jan. 20, 2025, inauguration, President Trump unveiled official trump

Coinpedia·2025-12-26 15:34

Best Altcoins to Buy for 10x Gains During the Crypto Bear Market

Crypto bear markets have a way of testing patience. Prices drift lower, excitement fades, and many traders step away. Quiet periods like this often shape the strongest setups. History shows that some of the biggest long-term winners start building their case when attention is low, and sentiment

CaptainAltcoin·2025-12-24 13:05

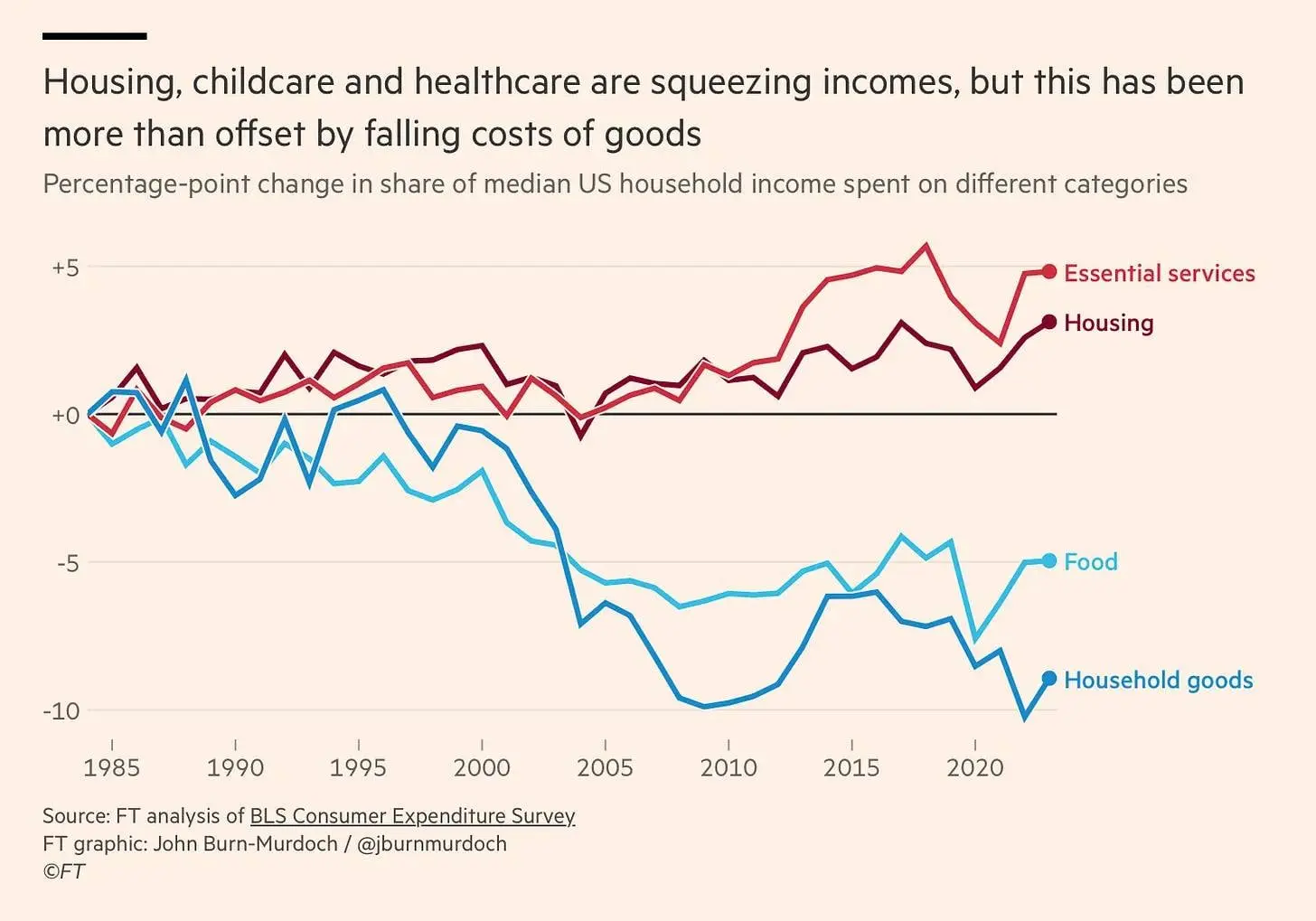

A joyless casino economy, American young people are losing confidence in the future

Author: KYLA SCANLON

Translation: Deep潮TechFlow

Good morning, greetings from Washington, D.C.! This article is a bit long, so it might be truncated in your email. Recently, I embarked on a new journey for work, with destinations including Michigan, Kentucky, and Washington, D.C. During security checks, I saw a lady ahead of me coughing with her mouth open like a baby. I looked at her, initially surprised by her "carefree" attitude, then a wave of deep fear washed over me.

Most people are friendly. But living in society means facing different internal norms of others. Some people cough openly—that's the reality. I have a theory: they might believe that collective comfort isn't their responsibility, perhaps because they lack a sense of belonging in public spaces. This is a social drift phenomenon, becoming increasingly apparent in public spaces (for example, looking down 90 degrees while...

PANews·2025-12-14 23:33

Bitcoin (BTC) at a Critical Juncture: Downward Drift or Recovery Ahead?

Bitcoin is currently trading around $90.3K, facing bearish pressure despite a recent trading volume surge of over 44%. Indicators suggest indecision in the market, with potential for upward or downward movement based on buyer activity.

TheNewsCrypto·2025-12-13 07:06

Solana Tests 0.618 Level As Chart Signals Deep Move Toward $41

Solana now trades under the 0.618 line, and the chart shows a steady pattern that points toward a slow drift into lower zones.

The key support line sits near the mid-range and a clear break forms a path that guides the price into deeper areas of the chart.

The projected drop shows lower steps that

SOL-5.85%

CryptoNewsLand·2025-12-09 04:53

Don’t Sell XLM Yet – Here’s How High Stellar Price Could Go in 2026

Crypto AiMan, who has built a strong following of more than 88.5k subscribers, is sending a very direct message to Stellar (XLM) holders: don’t sell too quickly

The market looks shaky, fear levels are high and many people are losing patience after watching Stellar drift lower for months. But

CaptainAltcoin·2025-12-08 07:34

Solana Price Outlook: Can SOL Hold $124 As Whales Start Accumulating?

Solana is moving into a key area as price approaches the $124 support Ali Martinez pointed out. After slipping out of the mid-$140s, the SOL price has been sliding steadily, and the break below $136–$138 shows sellers are controlling the action

Ali’s chart hints that the SOL price could drift

CaptainAltcoin·2025-12-06 21:34

Pi Network Monetary System Isn’t Collapsing: Here’s PI Hidden Mechanism Everyone Is Missing

Pi Network price continues to drift as the year rolls by, it currently trades at $0.22. Many holders glance at that figure and could immediately assume the ecosystem might be losing strength. A voice that stands out in this conversation is an advocate known as “π (Pi) is Money itself with GCV”,

CaptainAltcoin·2025-12-06 12:54

Bitcoin Dominance Begins to Slip as Markets Prepare for a 2026 Risk-On Rotation

Bitcoin dominance has started to drift lower even as spot ETF flows stabilize and global macro conditions quietly strengthen. With global PMI readings moving back into expansion territory and traders increasingly expecting an eventual end to quantitative tightening, early signs of a risk-on

ICOHOIDER·2025-12-04 13:13

Kevin O’Leary: December Fed rate cut won’t move Bitcoin much

Kevin O'Leary downplays a possible December Fed rate cut, saying persistent inflation may keep policy tight and Bitcoin will likely drift within about 5% of current prices.

Summary

O'Leary rejects market odds of a December cut, saying he is not positioning his portfolio for easier policy.

He e

BTC-4.6%

Cryptonews·2025-12-03 06:00

Drift v3 Townhall Set to Reveal Major Upgrade for On-Chain Trading

Drift co-founders are hosting a townhall to launch Drift v3, the biggest upgrade yet, enhancing performance for traders. The event includes a 2025 progress overview, a roadmap reveal, and a live Q&A. Join in Abu Dhabi for Liquid Hours following the event.

DRIFT-7.19%

ICOHOIDER·2025-12-01 12:43

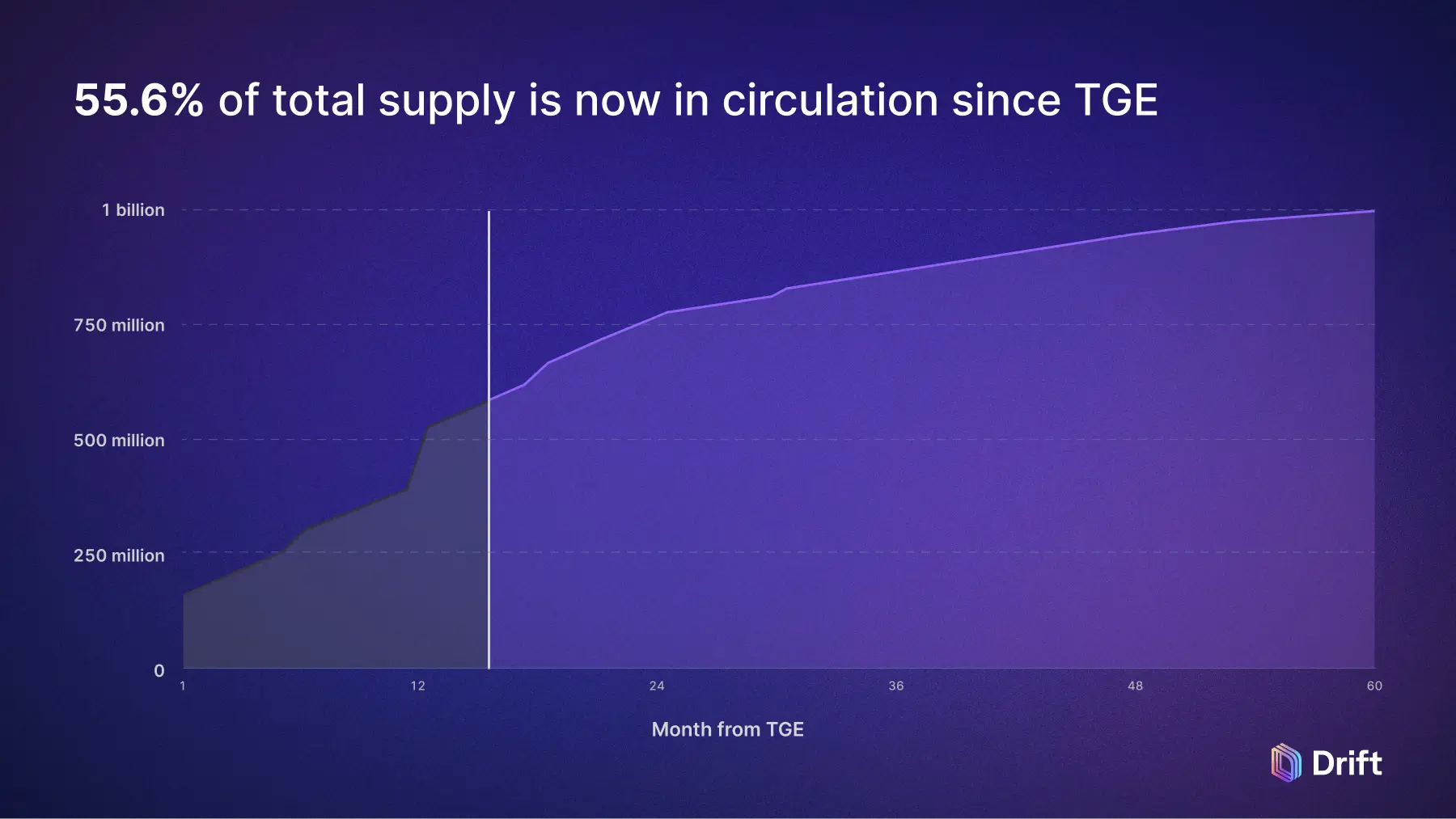

Drift Protocol announces updates to its tokenomics and issuance progress after TGE

Kể từ sự kiện phát hành TOKEN vào tháng 5 năm 2024, 55.6% tổng cung DRIFT đang lưu hành. DRIFT, TOKEN quản trị cho một DEX hàng đầu trên Solana, cho phép người dùng ảnh hưởng đến tương lai của giao thức. Các chỉ số chính bao gồm tổng cung 1 tỷ Token và khối lượng giao dịch đáng kể. Bản nâng cấp Drift v3 được lên kế hoạch sẽ cải thiện hiệu suất và quản trị người dùng trong hệ sinh thái.

DRIFT-7.19%

TapChiBitcoin·2025-11-20 04:09

In 47 days, from earning 44 million dollars to losing all capital, the fate of Brother Ma Ji was determined by the "Gambler's Ruin Theorem."

Brother Maji, a former artist and tech entrepreneur, is now a Whale in the crypto world. He put on a jaw-dropping wealth roller coaster at the Hyperliquid exchange.

With an aggressive leverage strategy, he once pushed his account to nearly $60 million (with more than $44 million in floating profits).

However, driven by the "gambler's fallacy" and the "disposition effect," he ignored the market reversal and frantically added to his position, trying to fight against mathematical laws.

Ultimately, in 47 days, it fell from its peak to only 1718 dollars, losing all capital, vividly and brutally illustrating the conclusion of the "gambler's ruin theorem."

To understand this defeat, one must grasp three concepts: random walk, absorption barrier, and negative drift.

① Random Walk

Imagine a drunkard walking in a straight line. He tosses a coin, if it's heads he moves forward (making money), if it's tails he takes a step back (losing money).

The experience of Brother Maji is essentially that of a drunken man's footsteps. In the short term, he may be...

DeepFlowTech·2025-11-20 01:49

Analysts Say Ethereum’s Multi-Year Structure Now Points Toward the “$1,800 Buy Zone,” but Derivat...

Ethereum's price trend indicates consistent returns to the $1,800–$2,000 support zone, supported by rising derivatives activity and long-heavy positioning. Analysts suggest this area is a strong buying opportunity, while market data reflects potential price drift toward this trendline.

CryptoFrontNews·2025-11-18 05:17

Coinbase seeks legal sanctuary in Texas amid Delaware drift

Coinbase is severing ties with Delaware, seeking refuge in Texas' nascent business courts after losing faith in the once-reliable Chancery's judicial predictability and corporate deference.

Summary

Coinbase will reincorporate in Texas after shareholders approved leaving Delaware.

The move

Cryptonews·2025-11-12 20:36

Why Is Stellar (XLM) Price Down Today?

The Stellar price has been under pressure over the past day, sliding from the upper $0.28 area toward the low $0.27s

The XLM chart shows a steady drift lower, with weak rebounds and consistent lower highs and naturally, traders want to know what’s driving the drop

In this case, it’s a mix of

CaptainAltcoin·2025-11-09 22:34

The next step for Crypto Assets is "there is only one way", which is to become part of the mainstream world itself.

The only path forward for Crypto Assets is to no longer drift outside the mainstream, but to become part of the mainstream world itself, allowing Crypto to serve as a carrier of technology. (Background: Standard Chartered: Bitcoin may "never" return below $100,000, with four major forces supporting BTC) For Crypto Assets, there is only one path forward—no longer drifting outside the mainstream, but becoming part of the mainstream world itself. On October 29, when Nvidia became the first publicly traded company in the world to surpass a market capitalization of $5 trillion, crypto practitioners collectively "broke defense." This is not only because Nvidia's market capitalization alone exceeds the total market capitalization of Crypto Assets ($4 trillion), but also because of Nvidia and what it represents.

動區BlockTempo·2025-10-31 10:23

Pi Coin Rally Heats Up: Every Group Buys In, But Risk Lurks Below $0.29

Pi Coin (PI) is experiencing a robust rally, up 32% weekly, as smart money, whales, and retail investors converge, signaling renewed confidence after months of drift. However, a bearish RSI signal threatens the uptrend unless key support holds.

PI-4.8%

CryptopulseElite·2025-10-29 08:50

Market Funding Rates Drift Back Toward Neutrality After Short-Term Rebound

Funding rates on major CEX and DEX platforms indicate normalization following a brief market rebound, with rates nearing neutral levels. However, market sentiment remains slightly bearish, reflecting traders' lack of confidence in sustained upward momentum.

ICOHOIDER·2025-10-24 10:07

The biggest painful trade in Bitcoin investment! Strategy stock premium 50%, retail investors suffered a loss of 17 billion.

The 10X Research report shows that retail investors lost $17 billion chasing indirect Bitcoin investments through companies like Strategy. This painful trading stems from valuation drift, where the premiums on these stocks reached absurd levels during the peak of the pump, with some cases showing company stock prices exceeding their Bitcoin net asset value per share by 40% to 50%.

MarketWhisper·2025-10-20 03:49

Why Smart Investors Are Choosing BlockchainFX Over Shiba Inu and Solana Right Now

When markets turn uncertain, smart investors don’t follow hype – they follow opportunity. While Shiba Inu (SHIB) continues to drift on meme momentum and Solana (SOL) fights to hold its gains after a strong run, one presale project has quietly captured the spotlight: BlockchainFX (BFX).

Now

CaptainAltcoin·2025-10-16 11:24

Crypto Markets Face $20B Shock as Drift Protocol Holds Strong

Crypto markets lost $20B after Trump’s tariff news but Drift Protocol stayed solid, handling $76M in liquidations safely.

Drift’s $50M insurance fund protected users as prices plunged from 223 to 173 in one of crypto’s worst trading days.

Solana and Drift ran smoothly with 3,200+ TPS, proving

DRIFT-7.19%

CryptoFrontNews·2025-10-12 11:47

Meme Coin Rally 2025, Pepeto Presale With Zero Fee Swap and 222% APY Outshines PEPE and PENGU

Retail appetite for meme coins is flaring again as Bitcoin and Ethereum drift sideways and traders hunt high risk, high reward setups. While familiar tickers like Pepe (PEPE) and Pengu (PENGU) still carry clout, a fresh challenger, Pepeto (PEPETO), is drawing serious bids with shipped tech, a demo e

CaptainAltcoin·2025-10-10 20:04

Cardano Founder Admits ADA Is Lagging: Unveils Secret Weapon to Flip Solana

Cardano token has not lived up to the massive expectations that surrounded it at the start of the year. While many holders waited for big moves, ADA price continued to drift behind top competitors. Meanwhile, the Solana token raced ahead in both performance and adoption, it even reached an all

CaptainAltcoin·2025-10-09 16:24

ChatGPT Predicts Cardano (ADA) Price in Q4 2025

Many holders may wonder where Cardano (ADA) price might go next as Q4 unfolds. Can ADA make a comeback, or will it continue to drift sideways?

Cardano price has moved in a wide but narrowing range since December 2024. During this time, ADA has mostly traded between $1.2 and $0.5 without forming a c

CaptainAltcoin·2025-10-07 10:03

Top Crypto to Buy for Uptober: Investors Ditch Shiba Inu and Polkadot for Avalon X (AVLX)

Over the last 30 days, the Shiba Inu price has hardly moved. It has stayed in a narrow range between $0.00001160 and $0.00001280, even though burn rates are rising and social media buzz is fading.

Polkadot (DOT), on the other hand, is stuck in a sideways drift between $3.85 and $4.5, and this

CaptainAltcoin·2025-10-06 08:06

Solana's Treasury Staking: From Balance Sheet to Ecosystem Flywheel

Sorting: Golden Finance

As the intersection of cryptocurrency and traditional financial markets deepens, Digital Asset Carriers (DAX) have emerged as a key tool connecting the two, gradually becoming the focal point of market attention. In this field, the Solana ecosystem has become a core choice for many institutions in laying out digital asset carriers due to its efficient computing capabilities, low-cost transaction advantages, and highly potential ecological layout. At the Token2049 event held in Singapore on October 2, professionals from institutions such as the Solana Foundation, Galaxy, Drift, Pantera Capital, and Jump Crypto engaged in dialogues on core industry topics, providing key references for understanding the integration path between the crypto ecosystem and traditional capital.

---

The following is the full content of the roundtable meeting:

Akshay

SOL-5.85%

金色财经_·2025-10-02 09:45

2025's Perp DEX Wars: New Money, New Tech, No off-Switch

Perpetual futures have become crypto’s main event, and the perp DEX wars—led by Hyperliquid, Aster, GMX, DYdX, ApeX, Drift, Jupiter, EdgeX, and Sunperp—are where the action won’t quit.

From Order Books to Onchain: Inside 2025’s Perp DEX Dogfight

Perpetuals are derivatives without an expiry;

Coinpedia·2025-09-26 03:37

Gate Research Institute: altcoin market shows significant warming | Decentralized Finance Development SOL total holdings exceed 2 million coins

Abstract

1. The cryptocurrency market as a whole maintained a slightly strong fluctuation this week, with BTC and ETH both rising slightly.

2. Tokens such as EIGEN, KMNO, and DRIFT have performed remarkably well, each recording double-digit increases.

3. DeFi Development further increases holdings by 60,000 SOL, total holdings exceed 2 million.

4. Benefiting from multiple treasury programs, Solana has seen an increase of over 10% in the past 7 days.

5. The altcoin season index has risen to 73, indicating a significant warming of the altcoin market.

6. Forward Industries completes $1.65 billion financing and establishes a treasury reserve strategy centered around SOL.

Market Interpretation

Market Commentary

BTC Market —— This week BTC has risen by 2.10%. BTC is maintaining a bullish structure in the short term, currently priced at

GateResearch·2025-09-18 06:13

Downward Drift: Are Bears Steering the Bitcoin (BTC) Market Toward a Drop?

Bitcoin's price hovers around $115K, facing increased bearish pressure as trading volume rises over 45%. Key indicators show a weakening market sentiment, with potential further declines if support levels fail.

TheNewsCrypto·2025-09-15 13:40

Market Movers: XRP Near Resistance, FLOKI in Sideways Drift, BEERCOIN Goes Wild

XRP has held its own above an important mark of 2.95 in spite of pullbacks, and it now has a new level of resistance at the key point of 3.00.

FLOKI exhibited consolidation cues, in an otherwise sideways trade following a sharp mid-day decline and recovery, indicating lower volatility in the

CryptoNewsLand·2025-09-10 21:33

Lombard launches the first institutional-grade interest-bearing Bitcoin asset LBTC to Solana.

Lombard brings $1.5 billion worth of liquid staked Bitcoin into the leading DeFi ecosystem; integrating multiple Solana protocols including Jupiter, Drift, Meteora, and Kamino.

August 28, 2025 - The protocol Lombard behind the Bitcoin leading interest-bearing token LBTC

TechubNews·2025-08-28 14:24

Analyst Says SEI May Be Entering “Point of No Return” as Charts Align with SUI

SEI trades at $0.2985 after bottoming at $0.16, with analysts eyeing similarities to SUI’s past breakout structure.

RSI at 46.70 and converging MACD suggest SEI is consolidating, with potential for potential reversal or extended drift.

SEI’s support is near $0.29, with resistance at $0.33–$0.35; b

CryptoFrontNews·2025-08-27 19:16

Maple revolutionizes onchain trading: the first use of syrupUSDC as margin on Drift arrives

Maple, leader nella gestione di asset onchain, has announced an innovation set to change the landscape of decentralized trading: the introduction of yield on syrupUSDC as margin for perpetual futures on Drift, the leading decentralized derivatives trading platform on Solana.

This integration

TheCryptonomist·2025-08-14 16:47

Sui Stalls at Key Level, ADA Extends Rally, and Cold Wallet Closes In on $6M in Presale! Which Is...

Some markets drift quietly, others buzz with tension, and right now, Sui (SUI) sits firmly in the second category. The latest update has traders split, with price hovering at $3.50 as VWAP pressure meets a surge in DeFi activity. Meanwhile, Cardano (ADA) is pushing forward after a sharp rebound,

CryptoFrontNews·2025-08-12 00:08

From Drift's dilemma, see why Solana is persistent with the order book.

After studying the Drift Protocol, I fully understand why Solana is so obsessed with CLOB, which is the order book.

Because implementing perpetual contract AMM on-chain is really too difficult, too difficult, too difficult. So much so that I gave up and turned to embrace centralized market makers.

Despite the founding of Perpetual Protocol

PANews·2025-08-07 02:04

Solana Launchpad Battle: Why Can the New Platform Take Bonk's Place?

> To see if the assets of the new platform are sufficient and what kind of "traffic" that can attract real money comes from.

Written by: Squid | drift

Compiled by: Saoirse, Foresight News

There are already dozens of homogeneous Launchpads on Solana, and new ones are being added every day.

This article aims to provide a simple framework to help organize the chaos in the industry and provoke thought. We start with the core issue:

Why would users choose the new Launchpad instead of Pump.Fun (or today's

ForesightNews·2025-08-01 04:13

Bitcoin treasuries stay king as crypto firms drift toward riskier tech bets

The essay discusses how corporate treasuries increasingly favor Bitcoin as their primary digital asset, while others explore riskier investments in newer cryptocurrencies. Experts express skepticism about the need for multiple crypto treasury firms, highlighting concerns over the long-term viability of alternatives to Bitcoin and Ethereum.

YahooFinance·2025-07-31 20:22

Stack drift and the hidden cognitive tax in decentralized work

This post is a guest contribution by George Siosi Samuels, managing director at Faiā See how Faiā is committed to staying at the forefront of technological advancements here.

Why your blockchain startup is bleeding energy—and how to fix it

Decentralized systems promise autonomy, resilience, and

DRIFT-7.19%

CoinGeek·2025-07-29 23:00

Solana’s Top 5 TVL Projects Secure $1.25B–$3.8B in Locked Value, Weekly Gains Reach 12.5%

The cumulative TVL locked in the top five DeFi protocols on Solana was between $1.25 and 3.8 billion and increased by 12.5% in the last seven days.

Raydium and Marinade dominate the Solana DeFi sector, and Drift Protocol, Orca, and Fragmetric are growing rapidly in terms of trading and staking.

Th

CryptoNewsLand·2025-07-11 03:34

Drift snapshot FUEL, distribution of 28.2 million DRIFT tokens based on volume.

Drift Protocol completed the FUEL snapshot on June 3, 2025, marking an important milestone in the DRIFT token distribution campaign based on actual user transaction activity. Eligible users may receive a total of 28.2 million DRIFT tokens soon. Allocation factors include transaction volume, staking, and user activity, with tokens from major wallets vesting over 9 months to align go long-term interests with the Drift protocol's development on the Solana ecosystem.

TapChiBitcoin·2025-06-02 18:29

Load More