Search results for "FRAX"

KRWQ Becomes the First Korean Won Stablecoin to Surpass ₩1 Billion in Trading Volume

KRWQ, launched by IQ in partnership with Frax, hits a key milestone

SEOUL, South Korea, Nov. 19, 2025 /PRNewswire/ — KRWQ, the first fiat-backed and multichain stablecoin pegged 1:1 to the South Korean won (KRW), has officially surpassed 1 billion won in total trading volume less than two weeks

CaptainAltcoin·2025-11-19 17:36

2025 FXS coin Investment Strategy: Price Analysis and Risk Management Guide

[FXS]() [DeFi]() [Investment Strategy]() The investment strategy for FXS coin has become a hot topic in the cryptocurrency world in 2025, especially regarding FXS coin price analysis, FXS coin trading platform comparisons, and FXS coin Risk Management. The unique value of FXS coin and its deep integration with the DeFi ecosystem have shown investors tremendous potential. This article will take you in-depth into the future development prospects of FXS coin and provide a complete guide to help you make informed decisions in this rapidly rising market.

As the governance token of the Frax protocol, FXS coin is expected to perform impressively in the market in 2025. Data analysis indicates that FXS coin plays an indispensable role in the stablecoin ecosystem, which directly drives its value rise. The development of investment strategies for FXS coin needs to be based on comprehensive price trend analysis. Current market data shows that the price of FXS coin is...

幣圈動態·2025-11-14 21:08

Interpreting Crypto Banks: Wealth Remains on-chain, No Need to Go Off-chain for Spending

Author: Chilla

Compiled by: Block unicorn

Link:

Declaration: This article is a reprinted content, and readers can obtain more information through the original link. If the author has any objections to the form of reprinting, please contact us, and we will make modifications according to the author's request. Reprinting is for information sharing only and does not constitute any investment advice, nor does it represent Wu's views and positions.

Introduction

There is a principle of mental accounting in behavioral economics. People's attitudes towards money can vary depending on where it is stored. One hundred dollars in a checking account feels freely disposable, while one hundred dollars in a retirement account feels untouchable. Although money itself is interchangeable, its storage location can affect your perception of it.

Frax founder Sam Kazemian refers to this as the "Net Worth Theory." People tend to put their spare change where most of their wealth already exists.

WuSaidBlockchainW·2025-11-08 14:07

Crypto New Bank: Wealth Remains on the Chain, Spending Without Going Off-Chain

Introduction

There is a principle in behavioral economics regarding mental accounting. People's attitudes toward money vary depending on where it is stored. One hundred dollars in a flexible term account feels freely spendable, while one hundred dollars in a retirement account feels inaccessible. Although money itself is interchangeable, the location where it is stored influences how you perceive it.

FRAX founder Sam Kazemian calls this the "Net Asset Value theory." People tend to keep their pocket money where most of their wealth already exists. If your net worth is primarily in Charles Schwab's stock and bond accounts, you will keep your dollars in related bank accounts because transferring funds between them is very easy. If your net worth is mainly in Ether wallets and Decentralized Finance positions, you will want your dollars to be just as easy to move into the DeFi world.

金色财经_·2025-11-05 09:30

IQ collaborates with Frax to launch the KRWQ stablecoin.

According to Mars Finance news on October 30, The Block reported that IQ has partnered with Frax to launch the Korean won stablecoin KRWQ. This is the first Korean won stablecoin issued on Base, an Ethereum Layer 2 network under Coinbase, and the KRWQ-USDC trading pair has been launched on Aerodrome.

MarsBitNews·2025-10-30 04:34

IQ and Frax launch KRWQ – the first stablecoin pegged to the Korean won on Base

IQ, in collaboration with Frax, has launched KRWQ, the first stablecoin pegged to the South Korean won on Base network, facilitating multi-chain transfers. Initially, KRWQ is only available to qualified partners, as domestic regulations on stablecoins are still developing.

TapChiBitcoin·2025-10-30 04:05

Stable opened pre-deposits with a hard cap of $825 million "sold out in seconds": Large Investors monopolize over 60% share, retail investors are complaining.

The Layer 1 blockchain Stable, focused on stablecoin trading, announced on Thursday that its first phase pre-deposit activity's hard cap of $825 million was reached instantly after opening. Although the activity attracted participation from institutions such as Frax Finance and Morpho Labs, members of the crypto community cited on-chain data, accusing that the vast majority of the shares were occupied by a few whale addresses. Some social media users claimed that $600 million USDT had already been deposited by ten large wallets before the official announcement went live, with one address related to a mainstream CEX even transferring about $500 million USDT, accounting for over 60% of the total, raising strong doubts about retail investors' fair participation.

MarketWhisper·2025-10-24 07:00

Hyperliquid launches USDH as Australia releases draft encryption regulation legislation

Headline

The USDH stablecoin has been launched on the Hyperliquid platform.

The USDH stablecoin issued by Native Markets has been launched on the Hyperliquid platform, and the USDH/USDC trading pair is now open for trading. USDH is the first dollar-pegged token issued based on the selection process of Hyperliquid validator nodes. It is a stablecoin natively issued on HyperEVM and can circulate across chains within the entire Hyperliquid ecosystem. Native Markets won the bid earlier this month, defeating proposals from several companies including Paxos, Frax, and Agora. The plan calls for a phased rollout, with the first USDH/USDC spot market going live "within days" after the voting is approved.

▌Macau

HYPE7.82%

金色财经_·2025-09-25 00:08

USDH Competition Heats Up: Everyone Eyes the Stablecoin + Hyperliquid Opportunity

The USDH competition has ignited fierce bidding on Hyperliquid, the leading decentralized derivatives platform, as of September 23, 2025, with proposals from Paxos, Frax, Agora, Native Markets, and Ethena vying for the native stablecoin's issuance rights. Hyperliquid's $400 billion monthly volume and $106 million August fees make USDH a prized asset, potentially generating $200 million+ in annual interest from reserves.

CryptopulseElite·2025-09-23 10:14

Hyperliquid tokenomics is undergoing a major transformation! The DBA proposes a 45% reduction in HYPE supply and the cancellation of the 1 billion cap.

The cryptocurrency asset management company DBA recently proposed a significant plan to reduce the total supply of the native token HYPE of the decentralized derivatives trading platform Hyperliquid by 45%, aiming to reshape its tokenomics and enhance investor confidence. This initiative comes at a time when the Hyperliquid ecosystem is gaining traction, as its governance vote recently selected Native Markets as the issuer of the new stablecoin USDH, defeating strong competitors like Paxos and Frax. This article details the proposal, community debates, and potential impacts for crypto users, along with an analysis of HYPE price predictions for 2025, helping you evaluate the long-term investment opportunities of this DeFi platform.

MarketWhisper·2025-09-23 06:37

USDH Competition Begins: Everyone Covets All Stablecoin + Hyperliquid Concept

On September 8, 2025, the USDH competition begins on Hyperliquid, a decentralized derivatives platform, with the auction for its native stablecoin ticker drawing proposals from top players like Paxos, Frax, Agora, Native Markets, and Ethena. This USDH competition begins amid Hyperliquid's $400 billion monthly volume and $106 million August fees, holding 70% of the decentralized perpetual market.

CryptopulseElite·2025-09-22 08:24

Analyzing the purpose of Hyperliquid USDH issuance: corporate cooperation is not important, seizing the pricing power of coin listing is the real battlefield.

The bidding for Hyperliquid's native stablecoin USDH is about to enter the voting stage, with Native Markets leading by an overwhelming margin. On the surface, it appears to be a competition over who can issue USDH, but the real focus is not on corporate integration or compliance strength, but rather on how Hyperliquid can create myths by mastering the rights to list and price, competing directly with traditional CEX.

( Summary: Hyperliquid to issue stablecoin USDH? Paxos, Frax, Agora, Ethena compete for )

Bidding Situation: Native Markets Stand Out

According to usdhtracker data, the newly added proposal for Native Markets currently has 70.45% staking share support, receiving a total of 19.

HYPE7.82%

ChainNewsAbmedia·2025-09-12 07:05

The competition for Hyperliquid stablecoin USDH is heating up: the hidden doubts of "insider deals" behind the fierce competition.

The decentralized derivatives exchange Hyperliquid is vigorously advancing the issuance of its own stablecoin USDH to reduce reliance on Circle's USDC. This move has sparked fierce competition among major players in the encryption field, including Ethena Labs, Paxos, and Frax Finance. However, as the voting day on September 14 approaches, industry figures like Dragonfly partner Haseeb Qureshi have openly questioned the fairness of the process, suggesting that this bidding could be a farce "tailored" for specific entities, casting a shadow over this high-stakes competition.

USDC-0.03%

MarketWhisper·2025-09-11 02:35

Where is the pivot of DeFi stablecoins?

Recently, the bidding war for USDH issuance rights initiated by HyperLiquid has attracted players like Circle, Paxos, and Frax Finance to openly compete, with even some giants willing to put forward 20 million USD in ecological incentives as a bargaining chip. This storm not only showcased

DEFI-1.33%

金色财经_·2025-09-10 15:03

Paxos announces PayPal collaboration update Hyperliquid USDH proposal, Ethena and Sky also join the battle.

As the competition for the selection of the issuance party of the on-chain Perptual Futures exchange Hyperliquid USDH stablecoin intensifies, Paxos has submitted a new proposal through strategic cooperation with PayPal and Venmo, while Ethena Labs and Sky have also officially joined the fray, making this governance vote one of the most closely watched contests in the encryption field.

Summary: The Ambition of Hyperliquid's Stablecoin USDH

Hyperliquid announced a few days ago that it will launch its own stablecoin USDH, and the issuer will be selected through on-chain governance voting, which will not only reduce dependence on USDC but also capture reserve interest income. Entities such as Paxos, Frax Finance, Agora, and Ethena Labs have expressed their intention to assist in the issuance.

(Hype

ChainNewsAbmedia·2025-09-10 09:54

Hyperliquid’s USDH Stablecoin Bidding War

USDH is a dollar-pegged stablecoin native to Hyperliquid, designed to recycle reserve yield into community rewards and HYPE token buybacks for sustainable growth.

Bidders including Paxos, Frax, Sky, and Ethena propose different reserve models and revenue-sharing mechanisms, reflecting diverse

CoinRank·2025-09-10 08:52

Battle for Dominance Among Stablecoin Giants: Hyperliquid USDH Code Control Vote Enters Heated Stage

The decentralized exchange (DEX) Hyperliquid platform has announced the launch of its native stablecoin USDH, and the issuer will be determined through a validator voting mechanism. This initiative has attracted industry giants such as Ethena Labs, Paxos, Frax Finance, and Sky Ecosystem, with the expected winner set to control the issuance rights of digital money worth billions of dollars and earn approximately $220 million in reserve income annually. The proposal submission window will close today (September 10, 2025, UTC 10:00), and voting will officially start on September 14. The decision of the Hyperliquid community will reshape the stablecoin ecosystem of the platform.

Hyperliquid's strategic motivation: breaking free from external dependencies to achieve ecological independence.

Hyperl

HYPE7.82%

TechubNews·2025-09-10 05:18

Sky Joins Bidding War to Launch Hyperliquid’s USDH - Unchained

Major DeFi protocol Sky has put itself in the running to issue and manage Hyperliquid’s planned stablecoin USDH.

Sky, formerly known as MakerDAO, is the fifth major entity to submit a bid alongside Paxos, Frax Finance, Agora, and Native Markets.

Sky said it would offer 4.85% rewards on all USDH on

UnchainedCrypto·2025-09-09 13:46

Hyperliquid’s Native Stablecoin Battle: The Rise of USDH

Hyperliquid is releasing the long-reserved USDH ticker via validator vote, sparking fierce competition among stablecoin issuers like Paxos, Frax, and Agora.

The outcome will decide who controls distribution on Hyperliquid’s $400B monthly trading engine, with proposals ranging from full yield

HYPE7.82%

CoinRank·2025-09-09 10:38

Will Hyperliquid issue the stablecoin USDH? Paxos, Frax, Agora, and Ethena are competing.

The decentralized exchange Hyperliquid will launch the stablecoin USDH to reduce reliance on USDC and select the issuer through on-chain governance. Several institutions, such as Paxos and Frax Finance, have expressed their intention to assist with the issuance, and proposals are open for submission, with voting set to take place in September. This will promote revenue distribution and compliance within the Hyperliquid ecosystem, but will also raise competition and market challenges.

ChainNewsAbmedia·2025-09-08 04:44

From Circle to Frax, the gameplay of the stablecoin ecosystem

Original Title: "From CRCL to FRAX: The Next GENIUS Act Play"

Written by: @100y\_eth, Four Pillars

Compiled by: J1N, Techub News

Circle successfully went public, what is the secret?

The victory of the stablecoin industry

On June 5, 2025, Circle officially listed on the New York Stock Exchange (NYSE) under the stock code

FRAX-10.77%

TechubNews·2025-09-05 04:07

From CRCL to FRAX: The Next GENIUS Act Beneficiary

Author: 100y Source: Four Pillars Translator: Shan Ouba, Golden Finance

Key Points

On June 5, 2025, USDC issuer Circle successfully landed on the New York Stock Exchange, injecting new vitality into the entire stablecoin industry. Thanks to the cryptocurrency-friendly political environment in the United States, Circle has attracted the attention of many investors with its vertically integrated product strategy.

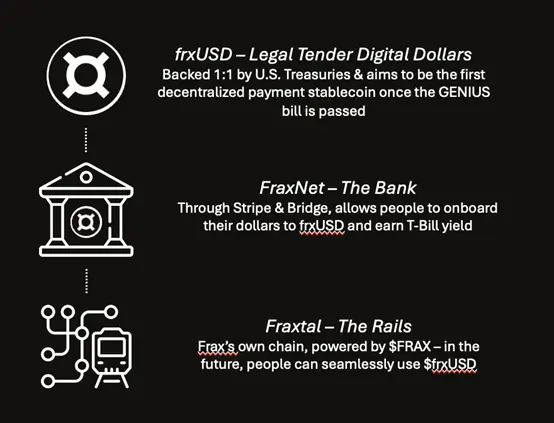

With the explosive attention on Circle, people naturally begin to look for the next winner under the GENIUS Act. There is a stablecoin protocol that feels familiar to Circle and is leading the industry with a similar strategy: Frax Finance.

Frax Finance is a stablecoin protocol that issues stablecoins compliant with the GENIUS Act.

FRAX-10.77%

金色财经_·2025-09-04 09:54

Movers of the Day 18-Jul-2025

Tokens and coins that moved the most in the last 24 hours:

🌙 00:00 CET – Daily Wrap-Up: Bulls Stage Late-Day Surge to Close at Highs – Top Movers of the Day

Frax (prev. FXS) and Sologenic: These cryptocurrencies have delivered explosive performances over the past day.

2100NEWSICO·2025-07-18 00:55

Over $40 million stolen, the story of GMX's precise ambush.

Original | Odaily Daily Report (@OdailyChina)

Author | Asher (@Asher\_ 0210 )

Last night, the leading on-chain DeFi protocol GMX platform encountered a major security incident, with over $40 million in cryptocurrency assets stolen by hackers, involving various mainstream tokens such as WBTC, WETH, UNI, FRAX, LINK, USDC, and USDT. After the incident, Bithumb issued an announcement stating that GMX's deposit and withdrawal services would be suspended until the network stabilizes.

Due to this theft incident

GMX4.34%

星球日报·2025-07-10 00:46

JPMorgan Chase applies for the "JPMD" trademark for digital asset payment services, hinting at a potential stablecoin.

Written by: Blockchain Knight

JPMorgan submitted a trademark application for "JPMD," which covers transactions, exchanges, transfers, and payment services related to Crypto assets, digital tokens, and Blockchain-enabled currencies.

According to reports on June 16, this application lists electronic fund transfers, real-time token trading, custody services, and secure online financial transactions. The document notes that the trademark owner is JPMorgan Chase Bank, located in Columbus, Ohio.

This move comes after reports on May 23 that JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo are discussing a joint stablecoin initiative.

Frax Finance founder Sam Kazemian confirmed the relevant discussions and stated that the discussions have moved beyond the initial conceptual stage.

TechubNews·2025-06-17 09:13

Conversation with the founders of Frax Finance and Aave: Despite competition, it's a positive-sum game; stablecoins will become the largest asset class on-chain.

Original: The Rollup; Compiler: Yuliya, PANews

In an era where cryptocurrency and blockchain technology are rapidly advancing, Sam Kazemian, the founder of Frax Finance, and Stani Kulechov, the founder of Aave, are undoubtedly two leading figures in the stablecoin space. In a recent special conversation with The Rollup, they shared insights on the rapid growth of the stablecoin industry, the innovative journey of their own projects, and their views on the upcoming regulatory changes, particularly how stablecoins have become the focus of the industry following the volatility in the crypto market in 2022.

Now, their attention is focused on the GENIUS Act, a landmark piece of legislation that could elevate stablecoins to legal tender, potentially transforming the global landscape of the dollar. This article will delve into Sam and Stani's insights on the stablecoin market and their thoughts on the bill.

TechubNews·2025-06-01 17:55

The Battle for the Right to Print Money: The Trillion-Dollar Game Between Banking Giants and Encryption Newcomers

Original author: Yuliya

Reprint: Daisy, Mars Finance

In an era where cryptocurrency and blockchain technology are rapidly advancing, Sam Kazemian, the founder of Frax Finance, and Stani Kulechov, the founder of Aave, are undoubtedly two leading figures in the stablecoin space. In a recent special conversation with The Rollup, they shared insights on the rapid growth of the stablecoin industry, the innovative journey of their own projects, and their views on the upcoming regulatory changes, particularly how stablecoins have become a focal point in the industry following the volatility of the crypto market in 2022.

Today, their focus is on the GENIUS Act, a landmark piece of legislation that could elevate stablecoins to legal tender, fundamentally altering the global landscape of the dollar. This article will delve into Sam and Stani's insights on the stablecoin market and their expectations for the bill,

MarsBitNews·2025-06-01 08:24

Dialogue with Aave Founder: The GENIUS Act has been passed, and stablecoins will ultimately become the cornerstone of the financial system.

Organized & Compiled: Deep Tide TechFlow

Guests: Sam Kazemian, Founder of Frax Finance; Stani Kulechov, Founder of Aave

Host: Robbie

Podcast Source: The Rollup

Original Title: How The Genius Act Could Change The Dollar Forever - Sam Kazemian & Stani Kulechov

Release date: May 29, 2025

Key Points Summary

Sam Kazemian (, the founder of Frax Finance ), and Stani Kulechov (, the founder of Aave ), recently participated in a discussion about the GENIUS Act.

AAVE2.11%

DeepFlowTech·2025-05-30 10:42

The stablecoin bill has been passed, why does FRAX become the biggest winner?

Written by: Alex Liu, Foresight News

Stablecoin legislation and FXS

On May 20, the U.S. stablecoin legislation "GENIUS Act" passed in a Senate vote, with two major steps remaining for formal approval: a vote in the House of Representatives and submission for the President's signature. The market previously viewed the Senate vote as the biggest hurdle for the bill's passage; barring any unforeseen circumstances, the complete approval of the bill is merely a matter of time.

Which crypto project is the biggest winner of this legislative victory? Based on the token price performance, it might be Frax Finance.

With the passage of the bill in the Senate, the Frax Finance token FXS (now renamed to FRAX, not yet updated on centralized exchanges) once rose above 4.4.

FRAX-10.77%

TechubNews·2025-05-21 03:01

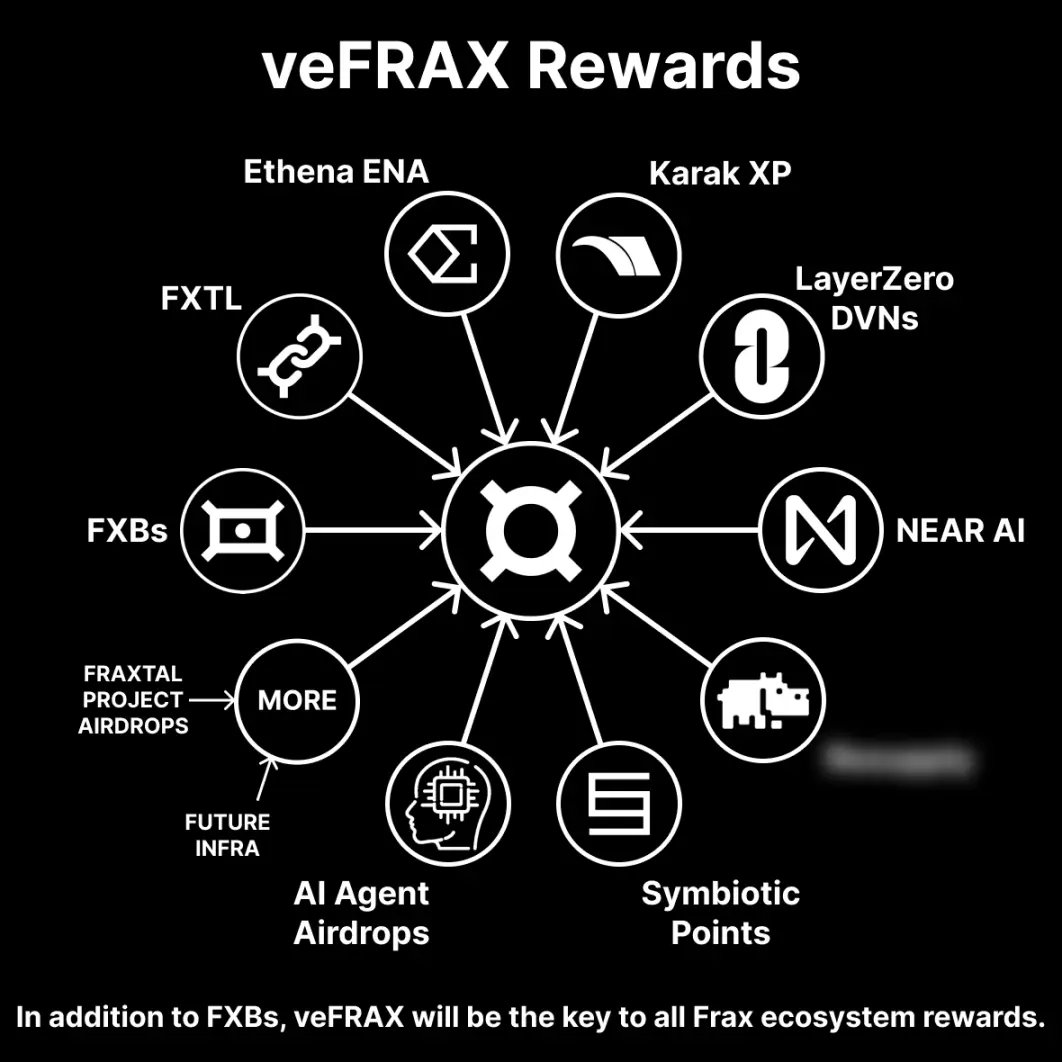

The stablecoin bill has passed. How did FRAX become the biggest winner?

After the passage of the U.S. stablecoin bill "GENIUS Act", Frax Finance's Token FXS (now renamed FRAX) performed outstandingly, with a rise of over 100%. The founder of Frax Finance has close ties with crypto legislative figures, potentially gaining a regulatory edge. In the future, FRAX is moving towards building an integrated stablecoin ecosystem, including stablecoin FRXUSD, banking interface FraxNet, and execution layer Fraxtal. The overall adjustment aims to enhance market competitiveness and obtain potential rewards through staking FRAX and other means.

FRAX-10.77%

DeepFlowTech·2025-05-20 17:40

The stablecoin bill has passed, how does FRAX become the biggest winner?

After the passage of the "GENIUS Act", the token FXS of Frax Finance has performed remarkably, with its price doubling within the month. The project develops within the stablecoin ecosystem, and the founders' involvement in the legislation may provide regulatory advantages. In the future, Frax plans to build a complete ecosystem and enhance market competitiveness by adjusting the token structure, which is worth looking forward to.

FRAX-10.77%

ForesightNews·2025-05-20 08:00

Opinion: Why is FRAX the best investment target in the stablecoin narrative?

Author: Kyle, encryption KOL

Compiled by: Felix, PANews

Note: KOL Kyle currently holds FRAX; this article represents Kyle's personal views and does not represent the views of PANews.

Key points:

Market cap $276 million / Circulating market cap $304 million; Frax provides an excellent asymmetric opportunity for betting on stablecoins, and with the upcoming "GENIUS Act," Frax aims to become one of the first payment stablecoins compliant with U.S. law.

Founder Sam Kazemian is actively involved in drafting stablecoin legislation in the United States, and FRAX has a certain degree of alignment with regulatory aspects.

Asymmetric layout: favorable regulatory environment + product-market-regulatory fit + undervalued tokens (widely criticized)

FRAX-10.77%

TechubNews·2025-05-15 11:04

Opinion: Why is FRAX the best investment target in the stablecoin narrative?

Author: Kyle, encryption KOL

Compiled by: Felix, PANews

Note: Encryption KOL Kyle currently holds FRAX; this article only represents Kyle's personal opinion and does not represent the views of PANews.

Key points:

Market cap: $276 million / Circulating market cap: $304 million; Frax provides an excellent asymmetric opportunity for betting on stablecoins, and with the upcoming "GENIUS Act", Frax aims to become one of the first payment-type stablecoins compliant with U.S. laws.

Founder Sam Kazemian is actively involved in drafting U.S. stablecoin legislation, and FRAX has a certain alignment in terms of regulation.

Asymmetrical layout: favorable regulatory environment + product-market-regulatory fit + undervalued tokens (widely criticized)

FRAX is now

FRAX-10.77%

PANews·2025-05-15 07:00

Frax Share ($FXS) Jumps 25% to $2.69, Eyes $3.53 Target After Major Breakout

The long-term downward price trendline of $FXS recently showed an important sign that could indicate an upcoming trend shift.

The price movement of $FXS depends heavily on resistance at $2.73 combined with support at $2.33 for its short-term trajectory.

If the breakout succeeds then a 73.62%

MAJOR-1.02%

CryptoNewsLand·2025-04-27 19:38

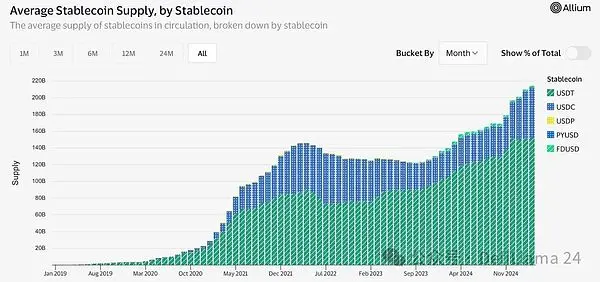

Stablecoin Wallet Activity Surges as Daily Addresses Exceed 300K

Stablecoin networks are experiencing a surge in daily active addresses, surpassing 300,000 and reaching $72 billion in on-chain volume. USDT leads in wallet activity, while emerging stablecoins like FDUSD and FRAX show limited engagement, reflecting fragmented adoption rates.

CryptoFrontNews·2025-04-08 17:30

Positioning of stablecoin rise in 2025

The stablecoin market has experienced rapid growth over the past year and is expected to see exponential growth in the future. Traditional finance and governments are increasingly getting involved, making stablecoins a hot investment area. Various centralized and Decentralization stablecoin issuers such as Tether, Circle, Ethena, MakerDAO, Ondo, and Frax are attracting attention. DeFi protocols like Aave, Curve, Pendle, Morpho, and Fluid will also benefit from the rise of stablecoins, allowing investors to seize opportunities for profit.

金色财经_·2025-04-05 03:50

The Battle Between GENIUS and STABLE: Will Congress Stifle or Promote the Development of Stablecoins?

Original author: Leviathan News Translated by: LlamaC

Text

We are in a bull market — a bull market for stablecoins.

Since the collapse of FTX, the supply of stablecoins has doubled to $215 billion within 18 months, and this figure does not yet include contributions from emerging crypto participants such as Ondo, Usual, Frax, and Maker.

The current interest rate is maintained at

金色财经_·2025-04-03 10:30

Stablecoin Market Surges to $229.98 Billion Reflecting Growing Demand

The stablecoin market, with a $229.98 billion market cap, meets increasing user demand in trading and DeFi due to its stability. Tether is the dominant player, with USDT holding 63.57% market share. Other emerging stablecoins like USDC, USDe, DAI, FDUSD, USD0, PYUSD, FRAX, and TUSD contribute to market diversification. Stablecoins play a vital role in cryptocurrency transactions amidst evolving regulations.

DEFI-1.33%

BlockchainReporter·2025-03-06 12:16

What can we expect from the crypto market in the short term? Here are the trending topics...

Bitcoin and Ethereum prices are showing signs of decline, with analysts forecasting further drops. Altcoins like Solana and XRP also face downward trends. Expectations around Bitcoin's price are discussed, focusing on the $87k resistance level. Altcoins in focus include Raydium, Bitcoin, Frax Share, and Ethereum. The article serves as informative content and not financial advice.

Kriptoparahaber·2025-02-28 13:14

Social Engagement Soars for Bitcoin and These Altcoins Amid Market Crash

Bitcoin (BTC), Raydium (RAY), and Frax (FRAX) are prominent in social media discussions. BTC acquired by Michael Saylor is a hot topic, while RAY faces a decline from a competing platform. FRAX debates focus on tokenomics and governance changes. Other trending tokens include Ethereum (ETH), Frax Shares (FXS), and Kendu Inu (KENDU), with discussions on AI technology, dilution concerns, and community-driven investments.

CryptoPotato·2025-02-25 12:26

Large Investors catch the bottom list, besides AAVE and UNI, what else?

This article points out the significant fluctuations in the BTC market recently may be related to global trade tensions and mentions an increase in market participation. Based on transaction data on the ETH blockchain, which shows single swaps exceeding $200,000, a large number of whale buy-ins have been compiled for multiple tokens, including LINK, AAVE, UNI, FRAX, ONDO, PEPE, MKR, BOLD, SPX, TEST, ENA, LDO, OHM, USUAL, SKY, GHO, and other tokens.

TechubNews·2025-02-12 10:44

Wintermute DeFi Governance Digest January 2025 | Week 5

Wintermute DeFi Governance Digest: January 2025 | Week 5

28 JANUARY 2025 | RESEARCH | AUTHORED BY IGOR

This week’s proposals include Compound moving to the CAPO model for LST/LRTs, Frax investing $5M to WLF, and ENS swapping 6k ETH to USD to replenish reserves; along with votes from

Wintermute·2025-01-28 20:12

Best Arbitrum Network Tokens to Invest in for Speed and Efficiency

Leading DeFi projects like The Graph, Lido DAO, Uniswap, and Frax Protocol have migrated to Arbitrum, effectively reducing gas fees, improving data exchange efficiency, and enhancing transaction rates through liquid staking and deep liquidity solutions.

CryptoFrontNews·2025-01-27 20:30

Million Dollar Investment from Trump's Former Advisor to WLFI!

Frax Finance, Donald Trump ve ailesi tarafından desteklenen bir kripto projesi olan World Liberty Financial'a kadar 10 milyon dolar yatırım yapma teklifi sunuyor. Teklif, ilk 5 milyon doların başarısına dayalı olarak ek 5 milyon dolarlık bir yatırımı da içeriyor. Bir topluluk üyesi, ispatlanmamış bir projeye 5 milyar dolar yatırım yapmanın riskli ve mantıksız olduğunu belirtti. Frax Finance kurucusu Stephen Moore daha önce Donald Trump'ın ekonomi danışmanlığını yapmıştı.

TRUMP2.23%

Bitcoinsistemi·2025-01-23 12:35

Frax Finance Eyes $5M Investment in Trump-Linked DeFi Platform WLFI

Key Notes

Frax Finance proposes a $5 million investment in Trump-aligned DeFi platform WLFI.

The partnership aims to integrate frxUSD into WLFI’s ecosystem, boosting adoption.

The proposal has sparked both support and criticism within the crypto community.

Renowned DeFi protocol Frax Finance

Coinspeaker·2025-01-23 09:55

Top Crypto News This Week: Frax BUIDL Stablecoin, Sui Token Unlock, Bitcoin Mutual Funds

Several events are in the pipeline for the crypto industry this week, like Frax Finance revamping its FRAX stablecoin into a new BUIDL-backed asset, Sui unlocking 64 million governance tokens, and six Israeli investment firms launching Bitcoin mutual funds.

BeInCrypto·2024-12-30 18:50

Load More