Search results for "GBTC"

Crypto Spot ETFs Turn Risk-Off as BTC, ETH, XRP Bleed While SOL Gains

US spot Bitcoin ETFs recorded $479.61 million in single-day net outflows amid rising risk-off sentiment.

Products like GBTC, FBTC, and IBIT led withdrawals, a sign of institutional caution and profit-taking.

Solana spot ETFs posted modest inflows, suggesting a selective capital rotation

CryptoFrontNews·01-22 05:41

Bitcoin spot ETF, after four consecutive trading days of outflows, turned into a net inflow of $116.67 million.

The US Bitcoin spot ETF market shows a trend of net inflows and conversions.

According to SoSoValue data, as of January 12 (local time), the US Bitcoin spot ETF market had a single-day net inflow of $116.67 million.

Although there was a net outflow for four consecutive trading days from January 6 to 9, funds flowed back in on that day, indicating a short-term buying momentum recovery. The total net inflow has now reached $56.52 billion.

By ETF segment, Fidelity FBTC had a net inflow of $111.75 million, Grayscale GBTC had a net inflow of $64.25 million, VanEck HODL had a net inflow of $6.48 million, and Grayscale Mini BTC had a net inflow of $64.25 million, with a total of four products showing net inflows. BlackRock IBIT experienced a net outflow of $70.66 million.

The total trading volume reached $3.14 billion, slightly less than the previous trading day ($2.97 billion).

BTC-2.56%

TechubNews·01-13 07:33

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·01-01 14:36

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·2025-12-31 14:34

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·2025-12-30 14:26

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year’s double festival are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." U.S. Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the U.S. Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock’s IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity’s FBTC and Grayscale’s GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net inflow of $84.6 million the previous day.

区块客·2025-12-29 14:17

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·2025-12-28 14:13

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·2025-12-28 14:10

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·2025-12-27 14:04

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·2025-12-26 14:04

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

Christmas and New Year holidays are approaching, and the cryptocurrency market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, compared to a net outflow of $84.6 million the previous day.

区块客·2025-12-25 13:59

[Evening News Brief] Bitcoin Spot ETF experiences net outflows for 5 consecutive trading days… 254 billion KRW outflow

Bitcoin spot ETF experiences net outflows for 5 consecutive trading days… 254 billion KRW

On the 24th local time, according to Trader T, the net outflow of the US Bitcoin spot ETF was $175.3 million (approximately 254 billion KRW). This marks the fifth consecutive trading day of net outflows. BlackRock IBIT saw a net outflow of $91.4 million, Fidelity FBTC a net outflow of $17.2 million, Bitwise BITB a net outflow of $13.3 million, Ark Invest ARKB a net outflow of $9.9 million, Franklin EZBC a net outflow of $5.1 million, VanEck HODL a net outflow of $8 million, Grayscale GBTC a net outflow of $24.6 million, and Grayscale Mini BTC a net outflow of $5.8 million. No ETFs recorded net inflows on that day.

Ethereum spot ETF experiences net outflows for 2 consecutive trading days

On the 24th local time,

BTC-2.56%

TechubNews·2025-12-25 07:13

Christmas market hype fizzles out! Bitcoin and Ethereum ETFs lose momentum, analysts: next year's trend depends on post-holiday performance

The Christmas and New Year holidays are approaching, and the crypto market seems to have already entered a "hibernation mode." US Bitcoin and Ethereum spot ETFs collectively lost value on Tuesday, mainly due to year-end asset rebalancing and liquidity tightening before the long holiday, with profit-taking selling pressure clearly increasing.

According to SoSoValue data, the US Bitcoin spot ETF experienced a net outflow of $188.6 million on Tuesday, marking the fourth consecutive day of withdrawals. Among them, BlackRock's IBIT suffered the heaviest outflow, with a net outflow of $157.3 million in a single day; Fidelity's FBTC and Grayscale's GBTC also could not escape.

On the other hand, Ethereum spot ETFs also recorded a net outflow of $95.5 million on Tuesday, following a previous day with $84.6 million

区块客·2025-12-24 13:47

Bitcoin ETFs saw a $1.2 billion outflow in a single week, marking the third-largest outflow on record, while altcoin funds are rising against the trend.

In the second week of December, US spot Bitcoin ETFs experienced significant capital outflows, with a net weekly outflow reaching $1.2 billion, marking the third-largest weekly outflow since the products launched 22 months ago. BlackRock’s iShares Bitcoin Trust (IBIT) was hit hardest, losing over $1 billion in a single week, while Grayscale’s GBTC and Fidelity’s FBTC saw outflows of $172 million and $116 million, respectively. Although Fidelity’s FBTC saw a $108 million capital inflow on Friday, it was not enough to reverse the week’s downward trend. Meanwhile, emerging altcoin ETFs performed strongly, with Canary Capital’s XRP ETF (XRPC) raising $58 million on its first day, making it the best-performing ETF launched in 2025.

MarketWhisper·2025-11-24 01:43

Yesterday, the net inflow into the US Spot Bitcoin ETF was $238.4 million.

According to Mars Finance, on November 22, the net inflow of the US Spot Bitcoin ETF was $238.4 million, with specific inflow and outflow data including the performance of several ETFs, such as IBIT with a net outflow of $122 million and GBTC with a net inflow of $84.9 million.

BTC-2.56%

MarsBitNews·2025-11-22 05:19

Bitcoin ETFs Update: Net Inflows Drop By -$492.11 Million As IBIT Leads With -$463.10 Million Out...

IBIT ETF saw the largest outflow, -$463.10 million, and a 3.80% price drop, despite strong cumulative inflows of $63.79 billion.

Grayscale ETFs experienced declines, with GBTC seeing a -$25.09 million outflow and BTC a minor gain of $4.17 million in inflows.

FBTC and ARKB ETFs faced modest

BTC-2.56%

CryptoNewsLand·2025-11-16 07:44

Data: Grayscale Trust Address transfers over 173 Bitcoins to Coinbase, worth approximately 19 million USD.

According to Mars Finance, on-chain data shows that Grayscale Bitcoin Trust (GBTC) and Bitcoin Mini Trust addresses transferred a total of approximately 173.68 BTC (about 19.09 million USD) to Coinbase Prime. Among them: Grayscale Bitcoin Mini Trust transferred out 79.68 BTC (about 8.76 million USD); Grayscale Bitcoin Trust transferred out 94 BTC (about 10.33 million USD).

BTC-2.56%

MarsBitNews·2025-10-31 13:54

Bitcoin ETFs Regain Momentum but Demand Still Modest

Bitcoin ETFs are seeing a resurgence in inflows, dominated by BlackRock’s iShares Bitcoin Trust, while Grayscale’s GBTC faces ongoing declines. Overall demand remains modest, reflecting cautious investor sentiment despite increased institutional interest.

BTC-2.56%

CryptoFrontNews·2025-10-29 11:03

Data: Bitcoin Spot ETF saw a net inflow of $446 million last week, with BlackRock's BIT leading the way with a net inflow of $324 million.

Last week, net inflows for Bitcoin Spot ETFs reached $446 million, with BlackRock's IBIT being the most prominent, netting $324 million. Grayscale's ETF GBTC saw a net outflow of $117 million, with a total net asset value of $149.96 billion.

BTC-2.56%

MarsBitNews·2025-10-27 03:54

Bitcoin ETF Market Update: IBIT Dominates Inflows As Total Bitcoin Products Reach $20.33M in Dail...

IBIT Dominates with the highest daily net inflow of $107.78 million and a cumulative inflow of $65.27 billion.

Grayscale&39;s GBTC and ARKB face outflows despite price gains.

EZBC and BTCW see price increases and daily inflows, reflecting strong market interest.

As of October 23, the total daily

BTC-2.56%

CryptoNewsLand·2025-10-24 12:43

Data: Bitcoin Spot ETF had a total net inflow of $20.3254 million yesterday, with BlackRock IBIT leading the net inflow at $108 million.

According to SoSoValue data, the total net inflow of Bitcoin Spot ETF is $20.3254 million, with BlackRock's IBIT achieving a single-day net inflow of up to $108 million, and a historical total net inflow of $65.273 billion. Grayscale ETF GBTC saw a single-day net outflow of $60.485 million. The current net asset value of the Bitcoin Spot ETF is $149.431 billion.

BTC-2.56%

MarsBitNews·2025-10-24 04:15

Ether ETFs See $170 Million Inflow as Bitcoin ETFs Slip

Investor sentiment shifted midweek as bitcoin ETFs faced $104 million in outflows, primarily from Grayscale’s GBTC, while ether ETFs attracted $170 million in new investments, led by Blackrock’s ETHA.

Coinpedia·2025-10-16 13:40

TAO price prediction: Grayscale submits Form 10 sign up statement for Bittensor Trust, TAO is expected to pump 236% to challenge new highs.

Grayscale Investments has taken a bold step by submitting a Form 10 registration statement to the SEC for its Bittensor Trust (TAO). This move aims to shorten the lock-up period of the TAO private sale from 12 months to 6 months and to make it an SEC Reporting Company. Once approved, TAO will take a new step in transparency, accessibility, and regulatory status, potentially standing alongside Grayscale's flagship products GBTC (Bitcoin Trust) and ETHE (Ethereum Trust). From a Technical Analysis perspective, the TAO price is currently in a bullish pattern of a falling wedge, with a potential rise of up to 236%, possibly recovering or even breaking the historical high (ATH) of $1,248 in April 2024.

MarketWhisper·2025-10-13 01:39

BlackRock Bitcoin ETF Tops S&P 500 Funds With $3.5B Inflows

Key Notes

BlackRock Bitcoin AUM approaches $100 billion, making it one of the fastest ETFs to reach this milestone.

All 11 original spot Bitcoin ETFs, including GBTC, recorded inflows last week, highlighting robust institutional interest.

Bitwise CIO Matt Hougan expects Bitcoin ETFs to see reco

Coinspeaker·2025-10-08 15:05

Yesterday, the total net outflow of the U.S. Bitcoin Spot ETF was approximately $194 million.

According to Techub News and data from ichaingo, yesterday (August 21, Eastern Time) the total net outflow of Bitcoin Spot ETFs in the United States was approximately $194 million.

BlackRock ETF IBIT saw a net outflow of about 127 million USD in a single day; Fidelity ETF FBTC had a net outflow of about 31.77 million USD in a single day; Grayscale Micro ETF BTC had a net inflow of about 4.97 million USD in a single day; Ark & 21Shares ETF ARKB experienced a net outflow of about 43.28 million USD in a single day; Franklin ETF EZBC saw a net inflow of about 3.25 million USD in a single day; Bitwise ETF BITB, VanEck ETF HODL, Grayscale ETF GBTC, Valkyrie ETF BRRR, I

BTC-2.56%

TechubNews·2025-08-22 05:36

Yesterday, the total net outflow of Bitcoin spot ETF in the United States was approximately 312 million dollars, marking the fourth consecutive trading day of net outflow.

According to Techub News and ichaingo data, on August 20, Eastern Time, the total net outflow of Bitcoin Spot ETFs in the United States was approximately $312 million, marking a consecutive 4 trading days of net outflow.

BlackRock ETF IBIT had a daily net outflow of about 220 million USD; Fidelity ETF FBTC had a daily net outflow of about 7.46 million USD; Grayscale ETF GBTC had a daily net outflow of about 8.98 million USD; Ark 21Shares ETF ARKB had a daily net outflow of about 75.74 million USD; Bitwise ETF BITB had a daily net inflow of about 619.8 thousand USD; Grayscale Micro ETF BTC, VanEck ETF HODL, WisdomTree ETF

BTC-2.56%

TechubNews·2025-08-21 03:51

DCG countersues Genesis: $1.1 billion rescue loan significantly exceeds losses, bankrupt platform turns profit of hundreds of millions.

The crypto giant Digital Currency Group (DCG) has sued its bankrupt subsidiary Genesis, accusing it of profiting hundreds of millions of dollars from the soaring value of collateral (Bitcoin and GBTC rise), far exceeding the $1.1 billion rescue loan provided by DCG. Previously, Genesis sued DCG in May for fraudulently transferring $3.1 billion, with both parties revealing the core dispute over collateral revaluation in the crypto bankruptcy creditor game.

## DCG Accuses Genesis of Profiting After Bankruptcy

Digital Currency Group (DCG) has filed a lawsuit against its bankrupt encryption lending platform Genesis. This crypto giant claims that the $1.1 billion loan it provided to Genesis in 2022 far exceeds the latter's actual losses, and that Genesis was in a long-term profitable state after bankruptcy.

On July 25

BTC-2.56%

MarketWhisper·2025-08-18 06:27

Gate Institute: ETH breaks new high of $4,600 | Circle enters the public chain field

crypto market panorama

BTC (0.27% | Current Price 119,574 USDT): BTC continues its upward trend today, once approaching the 120,000 US dollar mark during the trading session, indicating that bulls still maintain their offensive. The overall trend remains in a high-level consolidation phase. If it can break through and stabilize above 120,000 US dollars, it will further enhance market bullish sentiment. On August 12, the net inflow of BTC ETF reached 65.9 million US dollars in a single day, with BlackRock's IBIT inflow of 111 million US dollars, Ark's ARKB outflow of 23.9 million US dollars, and Grayscale's GBTC outflow of 21.6 million US dollars. Although some institutions are taking profits and withdrawing, there is still significant buying power in the market.

ETH-8.19%

GateResearch·2025-08-13 08:15

Yesterday, the total net inflow of Bitcoin Spot ETF in the United States was approximately 65.95 million USD.

According to Techub News, on August 12, the total net inflow of Bitcoin Spot ETFs in the United States was approximately $65.95 million, with BlackRock ETF IBIT experiencing a net inflow of about $111 million, while Grayscale ETF GBTC and other ETFs saw a net outflow.

BTC-2.56%

TechubNews·2025-08-13 05:31

BlackRock’s IBIT Dominates Bitcoin ETF Outflows at $292 Million - Coinspeaker

Key Notes

BlackRock Bitcoin ETF (IBIT) saw a massive $5.2 billion in net inflows in July, reinforcing its positions as a leader in the space.

US spot Bitcoin ETFs saw their third consecutive day of outflows, led by IBIT, Fidelity’s FBTC, and Grayscale’s GBTC.

Bloomberg’s Eric Balchunas

BTC-2.56%

Coinspeaker·2025-08-05 00:40

Spot ETF records the largest outflow in history, Bitcoin loses 812 million USD in a day.

Vào ngày 1 tháng 8, các quỹ ETF Bitcoin giao ngay đã trải qua một đợt rút ròng đáng kể trị giá 812 triệu đô la, đánh dấu một trong những lần rút tiền lớn nhất trong lịch sử. FBTC của Fidelity dẫn đầu với 331 triệu đô la, trong khi GBTC của Grayscale và IBIT của BlackRock cũng chứng kiến sự rút tiền đáng kể. Các quỹ ETF Ethereum giao ngay đã phải đối mặt với 152 triệu đô la trong số tiền rút ròng, chấm dứt chuỗi 20 ngày dòng tiền tích cực.

BTC-2.56%

TapChiBitcoin·2025-08-01 20:19

Ethereum ETFs Outperform Bitcoin ETFs for Sixth Day, Led By $440M Inflow Into BlackRock’s ETHA

BlackRock’s ETHA led Ethereum ETFs with a $440.10M inflow, holding $10.69B in net assets.

Ethereum ETFs outpaced Bitcoin ETFs in daily inflows, reaching $2.4B over six consecutive days.

Grayscale’s GBTC posted a $50.50M outflow, while IBIT led Bitcoin ETFs with $92.83M in daily inflows.

Ethereum

CryptoNewsLand·2025-07-26 11:44

Bitcoin ETFs See $67.9M Outflow, GBTC Posts Rare Inflow

Bitcoin spot ETFs experienced a $67.93 million outflow, contrasting with Grayscale’s GBTC, which saw a $7.51 million inflow. This indicates investor caution amid market volatility, though the overall net asset value remains strong at $154.77 billion and cumulative inflows are at $54.55 billion, suggesting long-term confidence in Bitcoin ETFs.

BTC-2.56%

Coinfomania·2025-07-22 21:26

Bitcoin ETF (GBTC) Hits New 52-Week High

Grayscale Bitcoin Trust ETF (GBTC) has seen significant gains, rising 135.2% recently, driven by Bitcoin's all-time high prices and renewed institutional interest. It offers a secure way to invest in Bitcoin with lower fees, potentially hinting at further gains for investors.

BTC-2.56%

YahooFinance·2025-07-14 17:23

This week, the net inflow of Bitcoin Spot ETF in the United States reached 769.5 million dollars.

According to Mars Finance, data from July 5 shows that this week, net inflows into Bitcoin Spot ETFs in the United States reached $769.5 million, with BlackRock and Fidelity seeing the most inflows, while Grayscale's GBTC experienced outflows.

BTC-2.56%

MarsBitNews·2025-07-05 09:18

The net inflow of the US Bitcoin Spot ETF yesterday was 407.8 million USD.

According to Mars Finance news on July 3, monitoring by Farside Investors reports that the net inflow into the U.S. Bitcoin Spot ETF yesterday was $407.8 million, with IBIT having a net inflow/outflow of 0 for two consecutive days, FBTC with a net inflow of $184 million, BITB with a net inflow of $64.9 million, ARKB with a net inflow of $83 million, and Grayscale's GBTC with a net inflow of $34.6 million.

BTC-2.56%

MarsBitNews·2025-07-03 04:28

What is GBTC? A Complete Guide to the Grayscale Bitcoin Trust

GBTC, managed by Grayscale, was the first major product to offer Bitcoin exposure through traditional markets, and has since transitioned into a spot Bitcoin ETF.

Buying GBTC is simple via brokerage platforms like Robinhood or Fidelity, offering security, regulatory clarity, and portfolio

CoinRank·2025-07-02 11:13

BlackRock’s IBIT Dominates, GBTC Logs Weakest Month Yet

BlackRock's IBIT fund saw significant inflows in June, boosting its value to over $52 billion, while Grayscale's GBTC recorded its smallest outflow. The crypto market remains cautious, anticipating Bitcoin's next move amidst broader bearish pressures.

Coinspeaker·2025-07-01 01:28

An overview of 44 listed companies' encryption layouts: Who is using Bitcoin as a market capitalization engine?

The wave of encryption is sweeping the global capital market! This article is sourced from Ethan, Odaily Star Daily. (Background: Are there hidden worries about the encrypted reserves of listed companies: Could it repeat the GrayScale GBTC "explosion script"?) (Background Supplement: Can investing in newly listed crypto companies yield tenfold returns? A paradigm shift in alts?) From trading giants like Coinbase to "enterprise-level Bitcoin buyers" like Meitu and MicroStrategy, and then to the "mining + on-chain financial complex" represented by Galaxy and Marathon—more and more listed companies are minting a new narrative engine that drives stock prices soaring by integrating crypto assets with blockchain technology! What capital logic and evolutionary trends are hidden behind this wave? To clear the fog, Odaily Star Daily conducts an in-depth scan of 44 representative listed companies worldwide.

動區BlockTempo·2025-06-30 06:48

IBIT ETF Holdings Grow by 118,000 BTC Since April 2025

On June 28, Axel Adler Jr. shared updated data on X regarding spot BTC ETFs. From early April 2025, total BTC held by U.S. spot ETFs, excluding GBTC, increased from 932,000 to 1,056,000 BTC. This growth of 124,000 BTC happened over 87 days, averaging 1,430 BTC added daily. BlackRock IBIT holdings

BTC-2.56%

Coinfomania·2025-06-27 22:43

Yesterday, the total net inflow of BTC Spot ETF in the United States was approximately 5.89 billion US dollars

Techub News, according to ichaingo data, the total net inflow of BTCSpot ETF in the United States on June 24th (Eastern Time) was approximately 5.89 billion dollars.

BlackRock ETF IBIT net inflows of about 436 million US dollars per day; Fidelity ETF FBTC net inflows of about 85.16 million US dollars per day; Ark & 21 Shares ETF ARKB net inflows of about 43.85 million US dollars per day; Grayscale Micro ETF BTC net inflows of about 7.49 million US dollars per day; Bitwise ETF BITB net inflows of about 9.76 million US dollars per day; VanEck ETF HODL net inflows of about 5.97 million US dollars per day; Grayscale ETF GBTC, Valkyrie ETF

BTC-2.56%

TechubNews·2025-06-25 03:50

Generation Z encryption new elite Christian recounts: founded Infini, Heavy Position in GBTC and Coinbase made a fortune

Editor: Wu Discusses Blockchain

Original title: Post-00s crypto nouveau riche Christian talks about personal experiences: founded Infini, heavily invested in GBTC and Coinbase for huge profits.

This content is from an interview with Christian, a post-00s investor and entrepreneur in the cryptocurrency field, conducted by "Turtle Talk," with authorization for editing and reprinting by Wu. Christian is one of the most关注华语 entrepreneurs in this cycle, and he provides an in-depth review of his journey from university to founding the cryptocurrency payment project Infini. The interview covers three core sections: first, the transformation of his personal investment path, from decentralized allocation to "logic-driven + concentrated positions" practical experience; second, his judgment on the current market structure and sentiment, including understanding bull and bear cycles, main capital, and the essence of projects. Christian also shares his thoughts on.

GateUser-6bbdc2fc·2025-06-13 13:23

00s post-00s encryption new elite Christian discusses personal experiences: founding Infini, Heavy Position in GBTC and Coinbase made a fortune

Editor: Wu Says Blockchain

This content is derived from an interview with Christian, a post-00s investor and entrepreneur in the cryptocurrency field, conducted by "Turtle Talk". Wu has been authorized to edit and reprint it. Christian is one of the most noteworthy Chinese entrepreneurs in this cycle, providing an in-depth review of his journey from university to founding the crypto payment project Infini. The interview covers three core sections: first, the transformation of his personal investment path from decentralized allocation to "logic-driven + concentrated positions" practical experience; second, his assessment of the current market structure and sentiment, including insights on bull and bear cycles, main funds, and the essence of projects. Christian also shares reflections on the gains and losses from heavily invested cases like Cheems, GMX, and Coinbase, and points out that the current logic for selecting coins should focus on three major standards: "team structure, token structure, and consensus concentration."

TechubNews·2025-06-13 09:08

Yesterday, the total net inflow of Bitcoin Spot ETF in the United States was approximately 165 million USD, achieving net inflow for three consecutive trading days.

According to Techub News and data from ichaingo, as of June 11, Eastern Time, the total net inflow of Spot Bitcoin ETF in the United States was approximately $165 million, achieving net inflow for three consecutive trading days.

BlackRock ETF IBIT net inflow of approximately 131 million USD in one day; Fidelity ETF FBTC net inflow of approximately 11.87 million USD in one day; Franklin ETF EZBC net inflow of approximately 6.3 million USD in one day; VanEck ETF HODL net inflow of approximately 15.39 million USD in one day; Grayscale ETF GBTC, Grayscale Micro ETF BTC, Bitwise ETF BITB, Ark 21Shares ETF ARKB, WisdomTree ETF

BTC-2.56%

TechubNews·2025-06-12 03:51

Bitcoin Treasury Companies Redefine Institutional Crypto Strategy as Jeff Park Draws Apollo Athene Parallel

Bitcoin treasury companies are gaining attention once again after a bold statement from investment strategist Jeff Park went viral on X. Park, a partner at a digital asset firm, criticized comparisons between BTC treasury firms and GBTC, arguing that these operating companies, especially those

BTC-2.56%

Coinfomania·2025-06-02 05:11

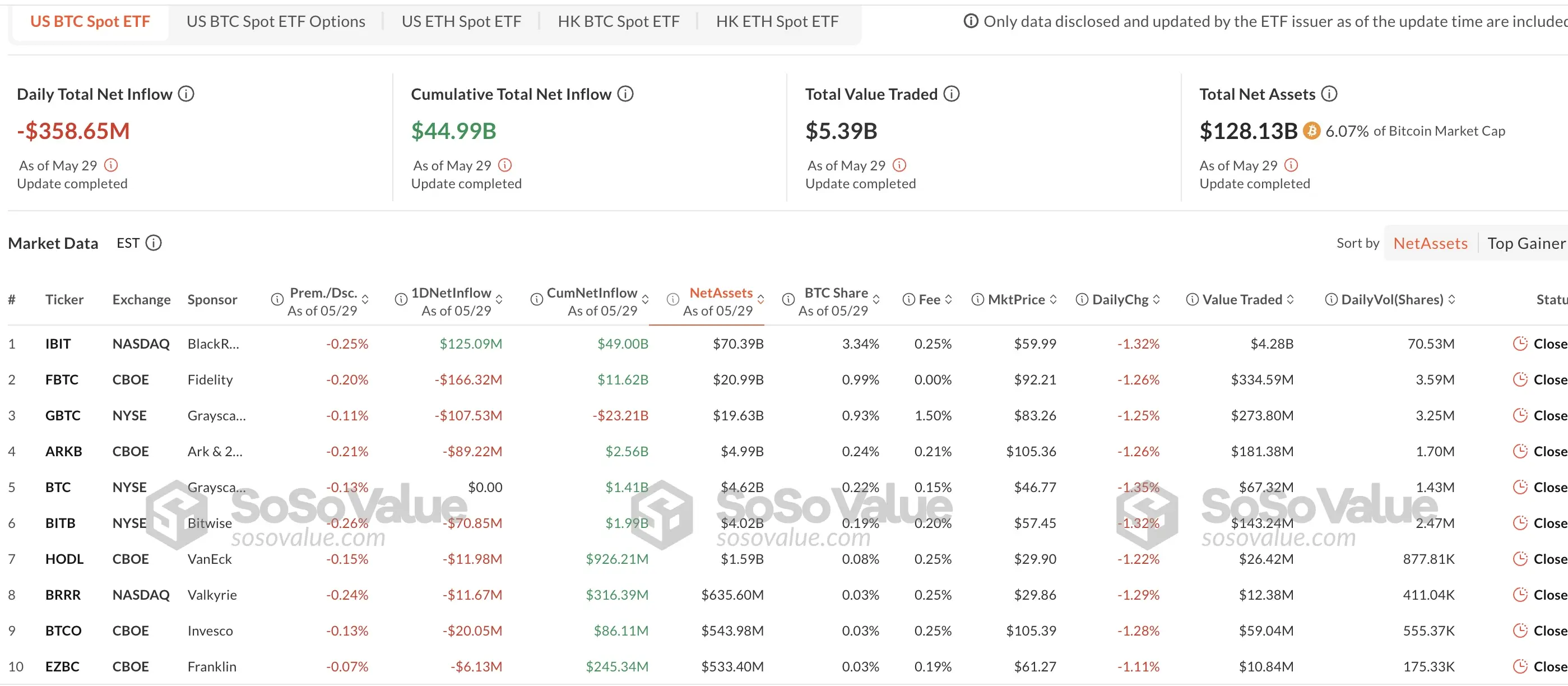

Bitcoin ETF in America recorded a net withdrawal of 358.6 million USD, ending a 10-day capital inflow.

ETF Bitcoin in the US faced significant outflows, marking $358.6 million withdrawn on Thursday. Solely IBIT by BlackRock saw inflows, while others like Fidelity's FBTC and Grayscale's GBTC experienced outflows. Overall daily trading volume spiked to $5.39 billion. Total net inflows across 12 Bitcoin ETFs dropped from $45.34 billion to $44.99 billion.

BTC-2.56%

TapChiBitcoin·2025-05-29 22:35

Gate Research Institute: Qatar plans to tokenize real estate | Sui launches zero-knowledge verifier ZKAT to enhance scalability

crypto market panorama

BTC (+1.87% | Current price 109,759 USDT)

BTC continues to fluctuate, experiencing a downward trend after breaking through the $111,000 mark. Due to profit-taking demand following the breakthrough of the previous new high, it is likely to continue oscillating around the recent high points in the short term.

Last Friday, the net inflow for BTC ETF was $211 million, with Fidelity's FBTC seeing an outflow of $73.7 million and Grayscale's GBTC experiencing an inflow of $89.2 million.

SUI-3.45%

GateResearch·2025-05-26 07:31

The net inflow for the US Bitcoin Spot ETF last week was 2.75 billion dollars, while the Ethereum ETF had a net inflow of 248 million dollars in a single week.

On May 26, according to SoSoValue data, the net inflow of the Bitcoin Spot ETF in the United States last week was 2.75 billion dollars, marking six consecutive weeks of net capital inflow.

Among them, Blackrock's Bitcoin ETF IBIT ranks first in weekly net inflows with $2.43 billion, and currently, IBIT has a total accumulated net inflow of $47.98 billion.

Secondly, there is the Fidelity Bitcoin ETF FBTC, which had a net inflow of nearly $210 million last week, bringing the total cumulative net inflow of FBTC to $11.8 billion.

However, Grayscale's Bitcoin ETF GBTC saw a net inflow of $89.17 million last week, becoming the ETF with the highest net outflow in a single week. Currently, GBTC's historical total net outflow has reached $23.08 billion.

Currently, the net asset value of the Bitcoin spot ETF is 131.39 billion USD, accounting for 6.11% of the total market value of Bitcoin, with a cumulative total net inflow of 44.53 billion USD.

In the same week, the Ethereum Spot ETF recorded a net inflow of 248 million USD last week, marking two consecutive weeks of net capital inflow.

Among them, Blackrock's Ethereum ETF ETHA topped the weekly net inflow list with 52.84 million USD last week, and the total cumulative net inflow of ETHA is 4.4 billion USD.

Secondly, Grayscale Ethereum Trust ETF ETHE had a net inflow of 43.75 million USD in a single week, and the total historical net outflow of ETHE is 4.29 billion USD.

Currently, the net asset value of the Ethereum Spot ETF is 9.12 billion USD, accounting for 2.97% of the total market value of Ethereum, with a cumulative net inflow of 2.76 billion USD.

In summary, the Bitcoin and Ether spot ETFs in the United States continue to attract capital, especially the Bitcoin ETF, which has achieved net inflows for six consecutive weeks, surpassing the threshold of $100 billion in total net assets. Although the Ethereum ETF is smaller in scale, it has also maintained a net inflow for two consecutive weeks.

Indicates that investors remain optimistic about the long-term investment value of mainstream cryptocurrencies such as Bitcoin and Ethereum. As the market matures further in the future, the scale and influence of ETFs are expected to continue to expand.

#比特币ETF # Ethereum ETF # capital flow

RunningFinance·2025-05-26 05:32

Data: Bitcoin Spot ETF saw a net inflow of $2.75 billion last week, marking the third highest in history.

According to SoSoValue data, last week the net inflow of Bitcoin Spot ETF reached 2.75 billion USD. The BlackRock Bitcoin ETF IBIT had the highest net inflow at 2.43 billion USD, while FBTC had 210 million USD. The Grayscale ETF GBTC experienced the most net outflow, totaling 89.17 million USD. The total net value of the Bitcoin Spot ETF is 131.39 billion USD, with a net asset ratio of 6.11%, and the historical net inflow reached 44.53 billion USD.

BTC-2.56%

CoinVoice·2025-05-26 05:05

Load More