Search results for "JEFF"

What if this is the bottom?

If this is the case, then what happens when you reach the lowest point? Does everything end here, or is there something beyond? It's worth considering what lies beneath and whether there's more to discover below this level.

Written by: Jeff Park

Translated by: Block unicorn

Introduction

A few days ago, influenced by rumors that Kevin Woor could be nominated as Federal Reserve Chair, Bitcoin's price rapidly dropped to $82,000, then briefly fell to around $74,500. This volatile price movement made me realize that even among the most seasoned traders in the global macroeconomic field, there is always a sense of unease—an alertness to the contradictory personality of an "inflation hawk Federal Reserve Chair who wants to cut interest rates." Because this contradiction itself reflects the duality inherent in currency devaluation.

The theory behind currency devaluation trading sounds simple: print money, devalue the currency, and hard assets appreciate. But this "cheap money" narrative conceals a more fundamental issue, and that issue determines the success or failure of Bitcoin: interest rates will

BTC3.02%

TechubNews·6h ago

Axie Infinity (AXS) Surges Following In-App Token Detailing Update

_Key Takeaways_

_AXS surged 16%+ in the last hour and 177% in 30 days thanks to Jeff Zirlin’s bAXS explanation._

_bAXS introduces

CoinsProbe·01-30 08:36

Axie Infinity (AXS) Surges Following In-App Token Detailing Update

_Key Takeaways_

_AXS surged 16%+ in the last hour and 177% in 30 days thanks to Jeff Zirlin’s bAXS explanation._

_bAXS introduces

CoinsProbe·01-29 08:31

Axie Infinity (AXS) Surges Following In-App Token Detailing Update

_Key Takeaways_

_AXS surged 16%+ in the last hour and 177% in 30 days thanks to Jeff Zirlin’s bAXS explanation._

_bAXS introduces

CoinsProbe·01-28 08:31

Standard Chartered: 500 billion in TradFi deposits will migrate to stablecoins before 2028

Standard Chartered Bank Digital Asset Research Director Jeff Kendrick predicted on Monday that by the end of 2028, up to $500 billion of US bank deposits could shift to stablecoins, accounting for about one-third of the total. He emphasized that "the tail is starting to wag the dog," indicating a rapid increase in the influence of stablecoins. Regional banks, heavily reliant on net interest margins, face the greatest risk, and delays in the 《CLARITY Act》 could accelerate the shift.

MarketWhisper·01-28 05:07

Procap CIO Compares Bitcoin’s Setup to Silver’s Record Trading Frenzy

Gold and silver have dominated market chatter in recent weeks, but a record-breaking silver trading session has also reignited a broader debate over bitcoin’s stalled momentum and its uneasy relationship with volatility.

Jeff Park: Bitcoin Faces a Trader’s Market

The discussion was sparked

BTC3.02%

Coinpedia·01-27 21:32

Axie Infinity (AXS) Surges Following In-App Token Detailing Update

_Key Takeaways_

_AXS surged 16%+ in the last hour and 177% in 30 days thanks to Jeff Zirlin’s bAXS explanation._

_bAXS introduces

CoinsProbe·01-27 08:26

Hyperliquid Claims Top Spot in Global Crypto Liquidity

_Hyperliquid claims global crypto liquidity leadership as BTC perpetual spreads tighten, HIP-3 growth accelerates, and TradFi perpetual markets expand rapidly._

Hyperliquid entered 2026 with a bold claim that reshaped ongoing discussions around crypto market structure. Founder Jeff stated that t

LiveBTCNews·01-27 06:30

Hyperliquid open interest skyrockets past 790 million! Jeff: Has quietly surpassed Binance

Jeff Yan first announced Hyperliquid as the most liquid place, with BTC price difference surpassing Binance. HIP-3 OI surged to 7.9 billion, a 200% increase. TradeXYZ's daily trading volume reached 1.29 billion, accounting for 90%. Driven by hedging products, HYPE rose 13% and broke through the 20-day EMA.

MarketWhisper·01-27 03:37

Hyperliquid "silently" surpasses a major milestone, Jeff announces leading global price discovery liquidity

In his first tweet of 2026, Hyperliquid founder Jeff announced that the platform has quietly become the world's highest liquidity venue for cryptocurrency price exploration. He highlighted significant growth in Bitcoin perpetual contract liquidity compared to Binance, achieved naturally without major promotional campaigns. Under the HIP-3 team's leadership, Hyperliquid also excels in liquidity for traditional asset-linked perpetual contracts, showcasing its ambition to bridge the crypto market with the global financial ecosystem.

HYPE24.96%

TapChiBitcoin·01-27 01:36

Axie Infinity (AXS) Surges Following In-App Token Detailing Update

_Key Takeaways_

_AXS surged 16%+ in the last hour and 177% in 30 days thanks to Jeff Zirlin’s bAXS explanation._

_bAXS introduces

CoinsProbe·01-26 08:21

Last night's and this morning's important news (January 21 - January 22)

AI startup Humans& completes $480 million seed round funding, valued at $4.48 billion

According to TechCrunch citing The New York Times, the human-centered AI company Humans&, co-founded by former members of Anthropic, xAI, and Google, has completed a $480 million seed round funding, with a valuation of $4.48 billion. Investors include Nvidia, Jeff Bezos, SV Angel, GV, and Emerson.

PANews·01-22 02:31

Bitmine invests in MrBeast company with 200 million USD! Tom Lee: Confident to achieve 10x returns

The publicly traded company with the largest holdings of Ethereum worldwide, Bitmine Immersion Technologies (BMNR), announced that it will invest 200 million USD in the super influencer "MrBeast"'s company, Beast Industries. The investment is expected to be completed on January 19, at which point the company will hold shares in Beast Industries.

Beast Industries CEO Jeff Housenbold revealed that the funds will be used to create a new financial services platform integrating decentralized finance (DeFi) technology, with the goal of evolving the company into "the most influential entertainment brand globally."

In fact, this strategic move has been anticipated for some time. Beast Industries previously submitted a...

区块客·01-16 08:43

Hyperliquid Founder Says His Goal Is Building New Finance

Jeff said Hyperliquid is not a rival to centralized exchanges, but a separate system designed to host open, permissionless finance.

He argued Hyperliquid focuses on solving undefined problems, unlike centralized platforms that optimize known products.

Jeff said decentralized and centraliz

HYPE24.96%

CryptoFrontNews·01-14 08:36

AI proxy purchasing books but scams money? IBM reveals the risk of indirect prompt injection in AI agents

As AI agents begin to have the ability to browse the internet independently, some people have simply outsourced hobbies like collecting second-hand books to AI labor. From searching, price comparison, filtering criteria, to finally placing orders, users don't have to manually do anything. However, a recent case has emerged where AI clearly found reasonably priced products but ultimately chose a version that was nearly twice as expensive. Further investigation revealed that the issue was not a calculation error by AI but an invisible manipulation called "indirect prompt injection."

Outsourcing book purchasing to AI, price comparison and ordering completed in one go

According to IBM security technology director Jeff Crume and IBM chief inventor Martin Keen, in an analysis video, a well-known internet user outsourced the book purchasing process to an AI agent that combines large language models with browsing capabilities. Just by entering the desired book title, the AI will

ChainNewsAbmedia·01-14 04:08

AI Bubble Theory Gets a Reality Check: Tech Giants' Wealth Doubles, Stock Prices Soar

Last year, artificial intelligence became a global focus, also causing dramatic changes in the tech industry's wealth landscape. Some skeptics, including Michael Burry, who is famous for the movie "The Big Short," have warned that the tech industry is falling into an AI bubble. He believes that these tech companies are over-investing in chips, data centers, and other infrastructure to win in the AI race, which could eventually lead to a bubble burst. However, in stark contrast to these concerns, the wealth of tech giants has not shrunk; instead, it continues to double, and AI and related tech stocks are soaring.

Tech billionaires are accumulating wealth to new heights thanks to the AI boom

According to the latest data, Amazon founder Jeff Bezos, along with Google co-founders Larry Page and Sergey Brin, are approaching the $300 billion mark in personal wealth. Over the past few years, they have each been worth around $200 billion.

ChainNewsAbmedia·01-12 03:30

Binance launches "TradFi Perpetual Contracts," initially covering gold and silver

Binance, the largest cryptocurrency exchange by global trading volume and user base, announced today (8th) the official launch of "TradFi Perpetual Contracts," allowing users to trade traditional assets through USDT-settled perpetual contracts. This expands Binance's derivatives product line, unlocking 24/7 access to diverse traditional financial markets for users and bringing new trading opportunities.

Jeff Li, Vice President of Binance Products, stated: "The launch of TradFi Perpetual Contracts is an important step in connecting traditional finance with crypto innovation. By providing round-the-clock access to traditional assets and offering a smooth and secure trading experience, we help users diversify and manage their investment portfolios more effectively. Supported by robust regulatory compliance and trust foundations, this product creates new opportunities for crypto traders on the Binance platform and traditional financial participants."

区块客·01-08 16:53

Morgan Stanley Exec Says Bitcoin ETF Offers Intangible Benefits Beyond Flows

_Morgan Stanley’s Bitcoin ETF targets reputational and strategic gains, positioning the bank for long-term growth beyond ETF inflows._

Morgan Stanley has launched a Bitcoin exchange-traded fund (ETF), with the belief that it will provide strategic advantages.

Jeff Park, Chief Investment

LiveBTCNews·01-08 12:20

Binance's first regulated, stablecoin-settled traditional financial perpetual contracts, initially covering gold and silver

The world's largest cryptocurrency exchange connects traditional finance and crypto assets, opening up new opportunities for crypto market and traditional finance participants

The largest crypto exchange by trading volume and user base, Binance, announced today the official launch of traditional finance (TradFi) perpetual contracts. This innovative product category allows users to trade traditional assets through USDT-settled perpetual contracts, further expanding Binance's derivatives product line, unlocking 24/7 access to diverse traditional financial markets, and bringing new trading opportunities.

Binance Vice President of Products Jeff Li stated: "The launch of TradFi perpetual contracts is an important step in connecting traditional finance with crypto innovation. By providing round-the-clock access to traditional assets and offering a smooth and secure trading experience, we help users more effectively diversify and manage their investment portfolios. Built on a solid foundation of regulatory compliance and trust"

ChainNewsAbmedia·01-08 09:14

Elon Musk, Ultraman, Steve Jobs, Zuckerberg, Jensen Huang, Jeff Bezos - The Success Secrets! Revealing 4 Major Anti-Human Traits

Elon Musk, Ultraman, Steve Jobs, Mark Zuckerberg, Jensen Huang, Jeff Bezos' success is not about talent, but about four anti-human traits: first principles thinking, reality distortion field, redefining failure, and extreme long-termism. While most people use "analogical thinking"—doing what others do—these top performers dare to deconstruct common sense and hit the core. Conforming to human nature only makes you comfortable; going against human nature is what makes you outstanding.

MarketWhisper·01-06 07:01

Can VPN truly protect privacy? IBM cybersecurity executive analyzes the underlying trust risks

As virtual private networks (VPN) become widely promoted "privacy tools" in the online world, related advertisements can be seen everywhere—from websites and apps to YouTube ads—highlighting anonymous browsing and personal data protection. In response, IBM security technology executive Jeff

ChainNewsAbmedia·01-05 09:15

Blue Origin embraces Ethereum? Bezos may bring space travel into the era of crypto payments

On January 5, 2026, according to community reports, Blue Origin, the space exploration company founded by Amazon founder Jeff Bezos, is planning to accept cryptocurrencies such as Ethereum as payment for its "New Shepard" suborbital space travel program. If this news is officially confirmed, it will be the first time that cryptocurrency serves as the primary payment method for commercial crewed space flights, marking a milestone breakthrough for digital assets in high-end physical consumption scenarios.

Currently, the ticket price for a single "New Shepard" flight is still estimated to be in the millions of dollars, with nearly 100 passengers having experienced it so far. If this move materializes, it will not only be a key business strategy for Blue Origin to catch up with competitor SpaceX but also potentially open a new "space-grade" application paradigm for the entire cryptocurrency payment field.

MarketWhisper·01-05 03:12

Bitcoin Hashrate Expected to Follow Moore's Law by Top Industry Analyst - U.Today

Analysts present contrasting views on Bitcoin's hash rate growth. While Dr. Jeff Ross predicts a significant increase driven by tax incentives encouraging over-investment, Bob Burnett argues that energy limitations will hinder this growth, comparing it to Moore’s Law.

BTC3.02%

UToday·01-02 07:06

IBM Outlook 2026 Security Trends: Proxy AI Drives New Attack Risks, Quantum Protection Demand Rises

IBM Security Technology Director Jeff Crume, in his latest video analysis, reviews his previous judgments on AI, cybersecurity risks, and emerging technologies, and summarizes the most noteworthy cybersecurity changes after 2026. He states that as enterprises rapidly adopt AI to improve efficiency, cybersecurity risks are also being amplified. From shadow AI, deepfake attacks, proxy AI, to encryption threats brought by quantum computing, the future of cybersecurity will enter a new phase with faster attack-defense cycles and broader impact.

AI Enhances Convenience While Simultaneously Amplifying Security Risks

Crume points out that while AI brings efficiency to enterprises, it is also rapidly expanding cybersecurity risks. The most representative issue is "Shadow AI." Shadow AI refers to AI systems that are unapproved by the organization and lack governance and security controls. They may simply be someone downloading models in the cloud and connecting to internal data, which

ChainNewsAbmedia·2025-12-31 08:53

'Harvard Thinks It's Bitcoin When It's Ethereum': Jeff Park Burns Harvard University - U.Today

Jeff Park argues that Harvard's admissions process mirrors Ethereum's governance rather than Bitcoin's rigid structure. He highlights the discretionary and changeable nature of Harvard's system and criticizes elite institutions for maintaining artificial scarcity in admissions, which obscures the true nature of their governance.

UToday·2025-12-30 09:26

AI automatically resolves IT issues... Resolve AI, with a corporate value of 1.44 trillion won.

It is reported that Resolve AI, a company providing an automated diagnostic and solution platform for enterprise technology infrastructure issues, recently achieved a corporate valuation of $10 billion (approximately 14.4 trillion Korean won) through a round of financing. According to sources, this Series A financing adopted a multi-batch structure, and some shares appear to be trading at prices below this valuation.

According to reports, this round of investment is led by global venture capital firm Lightspeed Venture Partners, with participation from several anonymous investors. Resolve AI also received $35 million (approximately 50.4 billion South Korean won) in seed funding last year from existing investors such as Graylock, global AI expert Fei-Fei Li, and Google DeepMind chief scientist Jeff Dean. Its two co-founders, Spyros Kotsantonis and Mayank Agarwal, sold their startup in 2019 to

TechubNews·2025-12-22 21:13

The reason Bitcoin can't break through 90,000 has been found! The giant whale's "cover" strategy is the culprit

Bitcoin prices are trading around $90,000 with little movement, despite continued strong inflows into spot ETFs. Market analyst Jeff Park pointed out that this unusual phenomenon mainly stems from long-term holders selling covered call options rather than weak spot demand. Bitcoin whales widely selling covered call options are quietly suppressing the spot price; these veterans are using the options market to extract short-term gains from Bitcoin held for over ten years.

MarketWhisper·2025-12-15 06:44

Bezos vs. Musk: The Space Data Center Race Begins

Jeff Bezos’ Blue Origin has officially entered the tech race with Elon Musk’s SpaceX by announcing the development of crucial technology for operating data centers in Earth’s orbit. This move makes it a direct competitor to SpaceX, which is working on satellites capable of running artificial

Moon5labs·2025-12-11 14:02

Castle Island Ventures Partner: I don't regret spending eight years in the cryptocurrency industry.

Written by: Nic Carter, Partner at Castle Island Ventures

Translated by: AididiaoJP, Foresight News

Ken Chang recently published an article titled "I Wasted Eight Years of My Life in Cryptocurrency," in which he painfully discusses the industry's inherent capital destruction and financial nihilism.

People in the crypto world often mock such "angry exit" articles and enjoy reminiscing about historical figures like Mike Hearn or Jeff Garzik who made high-profile exits back then (while also noting how much Bitcoin has increased after they left).

But Ken's article is largely correct. He says:

Cryptocurrency claims to help decentralize the financial system. I once believed it wholeheartedly, but the reality is, it is just a super system of speculation and gambling, essentially just a

BTC3.02%

DeepFlowTech·2025-12-11 04:36

Important News from Last Night and This Morning (December 9 - December 10)

Hyperliquid Co-founder: ADL does not transfer P&L to HLP; its treatment of users and HLP is completely symmetrical

Hyperliquid co-founder Jeff published a post refuting the view that "ADL (Auto-Deleveraging Mechanism) transfers P&L to HLP." Jeff stated that the ADL mechanism does not transfer profit and loss to HLP (Hyperliquidity Provider), and its treatment of users and HLP is completely symmetrical. ADL will also not destroy $653 million in profits.

He Yi's WeChat account suspected to be hacked and promoting a certain meme coin

According to crypto KOL AB

PANews·2025-12-10 02:34

Hyperliquid Co-founder: ADL does not transfer profits and losses to HLP, denies the claim that "ADL destroyed $653 million in profits"

Hyperliquid co-founder Jeff responded to an academic paper questioning its Auto-Deleveraging (ADL) mechanism, emphasizing the author's misunderstanding of this mechanism. He pointed out that ADL does not transfer profits and losses and is unrelated to HLP or backstop liquidation. He refuted the paper's claim that ADL destroys profits and criticized the author for using complex terminology to obscure the truth.

DeepFlowTech·2025-12-10 01:57

From Traditional Market Making Giant to Core Market Maker in Prediction Markets, SIG's Forward-Looking Deployment in Crypto

Author: Zen, PANews

From forming a connection with poker and horse race betting to founding a quantitative trading company, billionaire Jeff Yass established Susquehanna International Group (SIG) in 1987. Starting with proprietary capital trading, SIG has now become one of the largest market makers for listed equity options in the United States, providing liquidity for stocks and derivatives in over 50 markets worldwide.

In the domestic market, SIG is well known largely because its fund SIG Asia Investments participated in ByteDance’s angel round in 2012 and remains one of its major shareholders to this day.

Whether in investment or trading, SIG is always forward-thinking. Over the past decade, SIG has gradually entered the crypto asset sector, first by participating in the spot and derivatives markets for Bitcoin, and then through its...

PANews·2025-12-03 10:00

Analysis: The predicted bottom for Bitcoin will not be lower than $55,000.

Crypto Assets analysts believe that the bottom of this round of Bitcoin Bear Market will not fall below $55,000, and the current cycle has not yet fully expanded, with historical data supporting this prediction. CoinEx analyst Jeff Ko is optimistic about future prices, predicting a pullback range of $65,000-$68,000. The current Bitcoin price is around $87,000.

BTC3.02%

DeepFlowTech·2025-12-02 06:29

The Bitcoin four-year cycle has ended, replaced by a more predictable two-year cycle.

The core of the new cycle is the cost basis and profit and loss situation of ETF holders. Fund managers face annual performance pressure, which may trigger concentrated buying and selling actions, forming a price turning point. This article is derived from a piece by Jeff Park, organized, translated, and written by ForesightNews. (Background: Texas in the U.S. invested $5 million to buy BlackRock's IBIT: DAT has cooled down, can SBR take over to reignite the Bitcoin bull run?) (Additional Background: Nobel Prize-winning economist warns: Trump's trades are failing, and the big dump of Bitcoin is the reason.) Bitcoin has historically followed a four-year cycle, which can be described as a combination of mining economics and behavioral psychology. Let's first review the implications of this cycle: each Halving mechanically reduces new supply and tightens miner profit margins, forcing weaker participants out of the market, thus reducing sell.

動區BlockTempo·2025-11-27 15:19

The four-year cycle of Bitcoin has ended, replaced by a more predictable two-year cycle.

Written by: Jeff Park

Compiled by: AididiaoJP, Foresight News

Bitcoin has historically followed a four-year cycle, which can be described as a combination of mining economics and behavioral psychology.

Let us first review the meaning of this cycle: each halving mechanically reduces new supply and tightens miner profit margins, forcing weaker participants out of the market, thereby reducing selling pressure. This subsequently reflexively drives up the marginal cost of new BTC, resulting in a slow but structural tightening of supply. As this process unfolds, fervent investors anchor themselves in the predictable halving narrative, creating a psychological feedback loop. The loop is: early positioning, price increase, viral attention through media, retail FOMO, ultimately leading to leveraged frenzy and ending in a crash. This cycle is effective because it is programmatic supply.

BTC3.02%

DeepFlowTech·2025-11-27 12:49

SIG Founder: Why Do I Believe in Prediction Markets?

Source: Generating Alpha Podcast

Compiled by: Jiahua, Chaincatcher

Who is Jeff Yass?

This week on "Generating Alpha," we have a unique guest - Jeff Yass, the founder of one of the world's most successful trading firms, Susquehanna International Group (SIG).

Jeff is a legendary figure in the financial world who applies the principles of poker, probability, and decision theory to the markets. Over the past forty years, he has quietly built a global trading giant, operating behind the scenes on Wall Street, trading everything from options to cryptocurrencies, all based on mathematical precision and rational thinking. He is also one of the most influential yet mysterious and low-profile figures in modern finance.

金色财经_·2025-11-27 10:00

Watch out for black swans appearing suddenly! Jeff Park: Bitcoin could surge to $150,000 if adopted by sovereign nations

ProCap Chief Investment Officer Jeff Park stated that a black swan event for Bitcoin’s upside would be adoption by a sovereign nation. Park pointed out that if a major developed market, an OECD country, suddenly announced it would purchase Bitcoin on its balance sheet—and actually did so—such an announcement could push Bitcoin to around $150,000 overnight.

MarketWhisper·2025-11-24 03:52

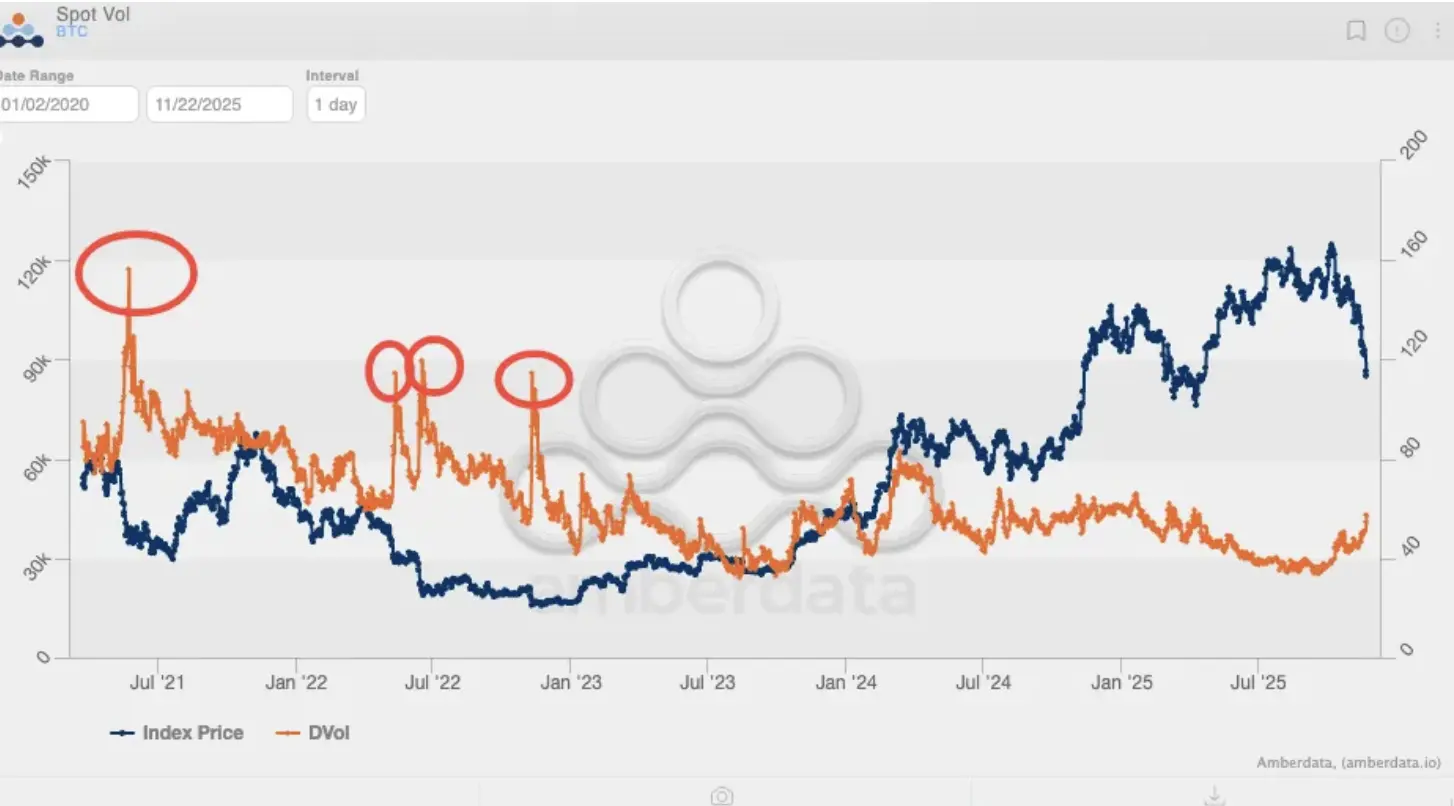

Bitcoin volatility soars to 60! Options-driven mode returns, imminent two-way turbulence

In the past two months, Bitcoin's price volatility has risen sharply, indicating that price trends may be returning to an options-driven pattern, which could lead to significant two-way market swings. According to Jeff Park, market analyst and advisor at investment firm Bitwise, since Bitcoin ETFs were approved in the US, Bitcoin's implied volatility has never exceeded 80%. However, as of the time of writing, Bitcoin's volatility is slowly climbing back to around 60.

MarketWhisper·2025-11-24 01:45

Wall Street bets on Bitcoin volatility: year-end bonuses rely on this market trend.

Original title: Wall Street is counting on Bitcoin's high volatility to pay year-end bonuses

Original Author: Jeff Park

Original source:

Reprinted: Daisy, Mars Finance

In just six weeks, Bitcoin's market value evaporated by $500 billion, with ETF funds flowing out, Coinbase trading at a discount, structural sell-offs, and poorly positioned long positions being liquidated, all without any obvious catalysts to stimulate a market rebound. Moreover, the continuous concerns of whale sell-offs, heavily loss-making market makers, lack of defensive liquidity supply, and survival threats from the quantum crisis remain obstacles to Bitcoin's potential rapid recovery. However, during this decline, one question has consistently troubled the community: what exactly has happened to Bitcoin's volatility?

In fact, the fluctuation mechanism of Bitcoin has quietly undergone a change.

Over the past two years, it has been widely believed that the ETF has been "tamed".

BTC3.02%

MarsBitNews·2025-11-23 19:04

Wall Street is counting on Bitcoin's high volatility to pay year-end bonuses.

null

This article is from: Jeff Park, Bitwise Advisor

Compiled by: Moni, Odaily Planet Daily

In just six weeks, Bitcoin's market value has evaporated by $500 billion, with ETF fund outflows, Coinbase discounts, structured sell-offs, and poorly positioned long positions being liquidated, while there are no clear catalysts to stimulate a market rebound. Moreover, concerns about whale sell-offs, struggling market makers with significant losses, lack of defensive liquidity supply, and the survival threat posed by the quantum crisis continue to hinder Bitcoin's potential for a rapid recovery. However, throughout this decline, one question has persistently troubled the community: what has happened to Bitcoin's volatility?

In fact, the volatility mechanism of Bitcoin has quietly undergone a transformation.

Over the past two years, it has been widely believed that ETFs have "tamed" Bitcoin, suppressing its volatility.

BTC3.02%

MarsBitNews·2025-11-23 14:52

Liquidity Crunch + Geopolitical Crisis: Can BTC Still Have a Bull Run?

Podcast Source: Anthony Pompliano; Translation: TechFlow

Guest: Jeff Park, Bitwise Investment Advisor & ProCap BTC Partner and Chief Investment Officer

Host: Anthony Pompliano

Original Title: The Bitcoin Bull Market Is CANCELLED?!

Broadcast Date: November 20, 2025

Key Takeaways

Jeff Park is a Partner and Chief Investment Officer at ProCap BTC. In this conversation, we dive deep into the recent decline in Bitcoin prices and whether the market is truly signaling the start of a bear market. Jeff analyzes the key factors influencing market sentiment from the perspectives of liquidity pressures and global macroeconomic changes, and points out

BTC3.02%

金色财经_·2025-11-22 13:35

AI News: Nvidia’s Earnings Strength Collides With Tough Market Expectations

Sovereign adoption and quantum computing clarity could spark Bitcoin’s next major move, says ProCap CIO Jeff Park

Sovereign adoption has become a major talking point for Bitcoin. Jeff Park from ProCap said it could trigger a massive upswing in price if a developed country chose

BTC3.02%

LiveBTCNews·2025-11-22 11:49

Dialogue with Bitwise Investment Advisor: Liquidity tightening + geopolitical crisis, is there still a bull for BTC?

Organization & Compilation: Deep Tide TechFlow

Guest: Jeff Park, Bitwise Investment Advisor & ProCap BTC Partner and Chief Investment Officer

Host: Anthony Pompliano

Podcast Source: Anthony Pompliano

Original title: The Bitcoin Bull Market Is CANCELLED?!

Release date: November 20, 2025

Key Points Summary

Jeff Park is a partner and Chief Investment Officer of ProCap BTC. In this conversation, we delved into the reasons behind the recent decline in Bitcoin prices and whether the market is truly signaling the arrival of a bear market. Jeff analyzed the factors affecting this from the perspectives of liquidity pressures and changes in the global macroeconomic landscape.

BTC3.02%

DeepFlowTech·2025-11-22 02:42

Sovereign Bitcoin adoption would be the ultimate upside catalyst: Jeff Park

While many crypto market participants are debating what it might take to trigger a significant Bitcoin daily candle, ProCap chief investment officer Jeff Park has narrowed it down to one key catalyst.

“A black swan event for Bitcoin upside would be sovereign adoption,” Park said during a podcast in

BTC3.02%

Cointelegraph·2025-11-22 02:26

If HYPE and PUMP were stocks, they would both be undervalued.

Author: Jeff Dorman, CFA

Compiled by: Deep Tide TechFlow

Revealing the disconnect between fundamentals and prices

In the cryptocurrency space, there are currently only three sectors that continue to grow: stablecoins, decentralized finance (DeFi), and real-world assets (RWAs). Moreover, these sectors are not just growing; they are experiencing explosive growth trends.

Please see the following chart:

Growth of stablecoins (click to see more growth data):

The growth of DeFi (click to see more data: here, here and here):

The growth of Real World Assets (RWA) (click to see more data):

These are the applications that should be widely recognized in the cryptocurrency industry. The charts of these growth trends should appear in CNBC, The Wall Street Journal, and Wall Street research reports, and in every cryptocurrency exchange.

DeepFlowTech·2025-11-19 10:13

Elon Musk and Barack Obama hacked! Bitcoin eyewash mastermind chased for 5 million dollars.

The British hacker Joseph James O'Connor, responsible for the most serious data breach in Twitter's history in 2020, has been ordered to forfeit over £4.1 million (5 million USD) in Crypto Assets. The 26-year-old was sentenced to five years in prison in the United States in 2023 for orchestrating the Twitter attack in July 2020, which led to the accounts of globally renowned figures such as Elon Musk, Barack Obama, Joe Biden, Jeff Bezos, and Kim Kardashian being compromised.

MarketWhisper·2025-11-18 00:37

Peter Schiff Slams Strategy’s Model as ‘Fraud’, Jeff Dorman Pushes Back

Crypto markets are experiencing instability due to Bitcoin's pullback, drawing attention to Michael Saylor and his firm Strategy. Peter Schiff, a gold advocate and Bitcoin critic, has raised concerns about the risks associated with Strategy's model.

BTC3.02%

BitcoincomNews·2025-11-17 09:58

Wall Street Clash Deepens as Jeff Dorman Rejects Fears of Forced Bitcoin Sales at Strategy

Strategy’s leveraged Bitcoin exposure faces scrutiny as critics cite structural risks while Dorman rejects claims of forced sales.

Dorman notes Saylor’s 42% control, covenant-free debt and cash flow support, claiming Strategy faces no need to unwind.

Strategy’s NAV multiple and stock weaken as Bit

CryptoFrontNews·2025-11-17 09:02

TradeXYZ, Ventuals, And Felix Protocol Launch HIP-3, Introducing Permissionless Perpetual Markets On Hyperliquid

In Brief

TradeXYZ, Ventuals, and Felix have HIP-3, enabling permissionless perpetual futures markets on Hyperliquid with enhanced capital efficiency and on-chain governance.

Co-founder of the decentralized exchange (DEX) Hyperliquid, Jeff Yan, announced that the non-custodial cryptocurrency tra

MpostMediaGroup·2025-11-17 07:11

Hyperliquid founder Jeff talks about three sources of inspiration for entrepreneurship.

Author: TPBN, Translated by: Wu Talks Blockchain

This issue features an interview with Jeff Yan, the founder of Hyperliquid, in the TPBN column. Jeff shared his experience of transitioning from a trader to an entrepreneur, as well as the opportunity to rethink the decentralized spirit of the crypto industry after the collapse of FTX. Jeff discussed the birth process of Hyperliquid, its technological philosophy, and development vision: committed to creating a fully decentralized, on-chain native financial system, becoming the "underlying network" for all future financial infrastructure.

He delved into why to reject traditional venture capital, how to draw on Satoshi Nakamoto's spirit to maintain protocol neutrality, and Hyperliquid.

HYPE24.96%

金色财经_·2025-11-17 04:23

Load More