Search results for "KRW"

Investing 507.8 billion KRW… Kazakhstan begins to establish a "cryptocurrency national reserve"

The Kazakhstani government has invested 507.8 billion KRW to establish a national cryptocurrency reserve fund, with the main institution being a subsidiary of the central bank. Initially, it will invest indirectly through hedge funds. This move demonstrates an intention to view cryptocurrencies as a tool for economic stability, reflecting the country's recognition of digital assets and a shift in investment strategy.

BTC-3.59%

TechubNews·01-30 23:05

Chainlink Expands Asia Footprint With Korea-Focused KRW Stablecoin Partnership

Chainlink Labs has joined the Global Alliance for KRW Stablecoin to expand the adoption of stablecoins backed by the Korean won.

Chainlink will enable the Alliance to establish global standards and deploy digital assets for institutional use cases.

Chainlink Labs has joined a South Korean in

CryptoNewsFlash·01-28 14:05

Chainlink Labs Joins South Korea KRW Stablecoin Alliance to Strengthen Data and Oracle Infrastructure

Chainlink Labs joins South Korea KRW stablecoin alliance to strengthen oracle data infrastructure amid regulatory debate.

GAKS builds compliance focused KRW stablecoin rails while avoiding issuance risk during policy uncertainty in South Korea.

Oracle integration supports data

LINK-2.64%

CryptoNewsLand·01-28 11:36

Chainlink Joins KRW Stablecoin Alliance, Boosting Global Standards

Chainlink has partnered with GAKS and WEMADE to enhance KRW stablecoins' reliability and global trust. The alliance combines fintech and compliance expertise to promote the real-world usage of KRW stablecoins, strengthening standards and technical support.

LINK-2.64%

CryptoFrontNews·01-27 14:36

Chainlink Expands Asia Footprint With Korea-Focused KRW Stablecoin Partnership

Chainlink Labs has joined the Global Alliance for KRW Stablecoin to expand the adoption of stablecoins backed by the Korean won.

Chainlink will enable the Alliance to establish global standards and deploy digital assets for institutional use cases.

Chainlink Labs has joined a South Korean in

CryptoNewsFlash·01-27 14:00

Chainlink Backs KRW Stablecoin Standards Through New Korea Alliance

_Chainlink’s role shows how data reliability and regulation are shaping KRW stablecoin development in South Korea._

South Korea is moving closer to allowing privately issued KRW stablecoins, prompting early industry coordination. In response, infrastructure providers and compliance firms are

LINK-2.64%

LiveBTCNews·01-27 12:35

Korean prosecutors make a mistake! Gwangju District Prosecutors Office loses 70 billion KRW worth of Bitcoin, suspected of being phished

Gwangju District Prosecutors Office in South Korea lost approximately 70 billion Korean won worth of Bitcoin due to accidentally clicking on a phishing website, sparking public concerns over the government's management of encrypted assets and cybersecurity procedures. The investigation is still ongoing. The prosecution has previous experience handling large-scale crypto assets, but this incident reveals obvious vulnerabilities in their internal management and cybersecurity awareness.

CryptoCity·01-26 01:25

Oops! The Korean Prosecution Office suspects clicking on phishing websites, leading to the seizure of 70 billion Korean Won worth of stolen Bitcoin.

Gwangju Prosecutor's Office in South Korea, while inventorying Bitcoin assets seized in a criminal case, experienced a leak of private keys for approximately 70 billion KRW worth of Bitcoin due to a public official connecting to a phishing website, highlighting security vulnerabilities in asset custody. Experts call for strengthening multi-signature protocols and personnel training to enhance asset protection and prevent similar incidents.

動區BlockTempo·01-25 06:35

Hardware wallet company Ledger advances IPO in the US. Company valuation exceeds 5 trillion KRW

French cryptocurrency security company Ledger is preparing to go public in the United States, with an estimated enterprise value of over $4 billion. Ledger is working with multiple investment banks, and the transaction is expected to be completed as soon as this year. The pro-cryptocurrency environment in the U.S. and the policies of the Trump administration are part of the background for its IPO. This IPO is seen as an important opportunity for European startups to make a breakthrough.

TRUMP-0.82%

TechubNews·01-23 16:29

Upbit lists HeyElsa (ELSA) on KRW, BTC, and USDT pairs, supporting only the Base network

Upbit, the largest cryptocurrency exchange in South Korea, announced the listing of HeyElsa (ELSA) tokens on KRW, BTC, and USDT markets. The ELSA token, native to the DeFAI HeyElsa platform, facilitates staking rewards and transaction fee discounts, enhancing liquidity and access in the Korean market.

BTC-3.59%

TapChiBitcoin·01-22 07:45

Bitcoin falls below 130 million KRW... Influenced by Trump's tariff remarks, BTC, ETH, XRP, SOL plummet

Bitcoin plummeted sharply due to Trump's threat of tariffs on Europe and a wave of leverage liquidations, dropping 3.3% within 24 hours and accumulating a decline of about 9%. Market fear intensified, with liquidation amounts reaching 7.13 trillion KRW. Analysts expect Bitcoin to potentially further decline to the range of 58 million to 62 million KRW. The overall crypto market contracted, and insufficient liquidity led to larger declines in altcoins. The demand for safe-haven assets increased, causing gold prices to rise.

TechubNews·01-21 04:13

Bitcoin briefly pauses after reaching a high of $97,000... Beware of large-scale Solana unlocks

Bitcoin recently retreated to approximately 136.46 million KRW, with about 1.15 trillion KRW in derivatives market liquidations. Experts predict a short-term adjustment to 129 million KRW, but ETF capital inflows and Trump’s support may bring positive signals. Whale wallet transfers should be monitored, the altcoin market is showing a volatile trend, Ethereum and Ripple are experiencing slight fluctuations, and Solana’s unlock schedule has raised concerns.

TechubNews·01-20 04:23

Bitcoin trades sideways at 137 million KRW, XRP drops to the 2900 KRW range... SOL differentiation

The overall cryptocurrency market is weak, with Bitcoin, Ethereum, and Ripple all experiencing declines, while Solana remains relatively resilient. The market is influenced by macroeconomic factors, and experts recommend adopting a medium- to long-term investment strategy and strengthening risk management. Meanwhile, exchanges and regulators are focusing on market transparency and investor protection.

TechubNews·01-19 16:41

[Today's Focus Coins] Polkadot(BORA) is strengthening… Fear and Greed Index at 94 "Extreme Greed"

BORA has recently experienced a surge in the Korean Won market, with the trading price reaching 83 KRW, an increase of over 26% compared to the previous day. Its Fear & Greed Index is at 94, indicating "Extreme Greed." Trading volume has also increased significantly, with short-term volatility expanding. Besides BORA, projects like BeraChain are also among the top in this index. Overall, major virtual assets are experiencing mixed gains and losses.

TechubNews·01-19 07:36

Bitcoin and Ethereum plummet, market volatility influenced by regulatory uncertainty and macroeconomic variables

Bitcoin price plummeted, currently around 136,550,000 KRW, down 2.65% in 24 hours. Market volatility has increased, with institutional investors continuing to buy BTC, increasing holdings by 110,000 coins in January. Ethereum and XRP also followed the decline, with regulatory uncertainties intensifying. However, Dash rose by 8.54%, indicating capital flow into altcoins. Regulatory and macroeconomic factors will influence market trends, and investors should stay attentive.

TechubNews·01-19 04:15

Bitcoin continues to rise... Major market analysis and future outlook for ETH, XRP, SOL

The cryptocurrency market has seen a slight increase in the past 24 hours, with Bitcoin rising 1.02% to 140 million KRW; Ethereum and Ripple have increased by 1.99% and 2.33%, respectively. Despite market activity, geopolitical and policy uncertainties still limit its status as a safe-haven asset. Experts warn to exercise caution regarding the risks of altcoins.

TechubNews·01-17 16:08

XRP Tops South Korea Trading Charts as Upbit Reports Record Volume in 2025

_XRP became South Korea’s most traded cryptocurrency in 2025, with Upbit processing over $1 trillion in trades._

XRP dominated South Korea’s crypto market in 2025, according to Upbit. Consequently, XRP/KRW led daily trading volume for most of the year. The exchange processed more than $1 trillio

LiveBTCNews·01-16 17:30

Bitcoin drops to the 130 million KRW range... Ethereum, Ripple, and Solana adjust simultaneously

Bitcoin recently dropped 2.27%, with a trading price of 139.43 million KRW. Analysts believe that despite the inflow of spot ETF funds, the market is still adjusting. Movements by major financial institutions and an increase in ETF applications have boosted institutional interest. Ethereum and Ripple also experienced declines. Progress on the US cryptocurrency regulation bill has been slow.

TechubNews·01-16 16:19

[Korean Stock Market Opening] KOSPI opens higher... Driven by Kia and Doosan Energy's strong performance, the early session recovers the 2800-point mark

According to news from Korean exchanges on the 16th, as of 9:29 AM, the Korea Composite Stock Price Index (KOSPI) was at 4,816.26 points, up 18.71 points (0.39%) from the previous trading day.

In the main board market, individual investors net bought 175 billion KRW, while foreign investors and institutional investors net sold 175.1 billion KRW and 2.2 billion KRW respectively.

Among the top market capitalization stocks in the Korea Composite Stock Price Index, Samsung Electronics (+1.53%), SK Hynix (+0.13%), LG Energy Solution (+0.13%), Samsung Biologics (-2.39%), Samsung Electronics preferred stock (+0.84%), Hyundai Motor (+0.12%), Hanwha Aerospace (+0.70%), HD Hyundai Heavy Industries (-1.27%), Kia (+4.07%), Doosan Energy (+3.24%).

Meanwhile, the Korea KOSDAQ Index (K

TechubNews·01-16 00:55

Ethena News: Arthur Hayes Calls for ENA to Reach $1, USDe Listed in Korea but Cold in Dubai

At the beginning of 2026, the synthetic USD protocol Ethena became a market focus, but its core asset USDe faced completely different fates in various jurisdictions. In Asia, South Korea's domestic CEX Upbit announced the listing of USDe, offering trading pairs with KRW, Bitcoin, and USDT. This move directly drove the governance token ENA to surge over 8% in a single day, reaching $0.238. Arthur Hayes, a founding advisor of Ethena, was even more excited, shouting the slogan “ENA to hit $1.”

However, almost simultaneously, the regulatory authorities in Dubai, a major financial hub in the Middle East, clarified in the updated crypto framework that USDe and similar algorithmic stablecoins are excluded from the list of recognized “fiat-backed crypto tokens,” categorizing them only as ordinary crypto assets. This stark contrast between the cold and hot developments not only reveals USDe’s rapidly growing market influence but also highlights the severe regulatory challenges faced by its unique “delta-neutral” mechanism worldwide.

MarketWhisper·01-15 03:03

Arthur Hayes calls ENA to surge to $1! Korea buys aggressively, Dubai gets kicked out

Arthur Hayes listed Ethena's USDe on Korea's largest crypto exchange and predicts ENA will reach 1 USD. Boosted by the listing news, ENA's price rose over 8%. USDe trading pairs with KRW, BTC, and USDT are now available. However, in Dubai, USDe was excluded from the approved stablecoin framework and classified as a regular cryptocurrency token, indicating a divergent regulatory attitude towards synthetic stablecoins worldwide.

MarketWhisper·01-15 02:08

Bitcoin hits a new high after two months, BTC, ETH, XRP, and SOL rise simultaneously

Bitcoin hits a two-month high in the US amid improving inflation data and regulatory bill progress, with a trading price of 141.67 million KRW, up 3.59%. Ethereum, Ripple, and Solana also show an upward trend, and investors are paying increased attention to the overall crypto market.

TechubNews·01-14 16:42

A powerful AI without clouds... WebAI kicks off the "Sovereign AI" era with an enterprise value of 2.9 trillion KRW

In the recent funding round of AI development startup WebAI, the company's valuation reached approximately 2.9 trillion KRW ($25 billion), attracting industry attention. It is reported that this Series A extension financing round involved a "two-digit" level of significant investment, with participants including Mark Benioff's Time Ventures, Atreides Management, and existing investors such as Forerunner Ventures.

WebAI is developing a "sovereign AI" model that does not rely on the cloud and can run in users' local environments, helping enterprises utilize artificial intelligence without transmitting sensitive data. This approach excels in data security and response speed, while also significantly reducing AI computing costs by utilizing local resources to replace expensive cloud GPUs, earning industry praise.

Last year, this startup was also known for releasing a solution optimized for business environments

TechubNews·01-14 08:08

[Korean Stock Market Closing行情] The Korea Composite Stock Price Index has closed higher for 8 consecutive trading days... Power, Gas, and Military industries are strengthening, while the Kosdaq Index has shifted from gains to decline.

South Korea Exchange Briefing on the 13th shows that the KOSPI rose for the eighth consecutive day, closing at 4692.64 points. Influenced by the strong overseas stock markets the day before, the stock market opened higher, and during the session, while institutional buying flowed in, sectors centered around secondary batteries and military-related industries performed strongly, rising by 1.47%.

By industry, electrical·gas (+7.9%), metals (+7.5%), transportation equipment·parts (+6.8%), and IT services (+3.4%) performed strongly. Large-cap stocks (+1.6%), mid-cap stocks (+0.8%), and small-cap stocks (+0.2%) all generally gained across the industry. By investor category, institutional net buy was 7.88 trillion KRW, while foreign investors and individual investors net sold 2.79 trillion KRW and 7.125 trillion KRW respectively.

KOSDAQ turned to decline after 3 days, closing at 948.98 points. Although influenced by the strong overseas stock markets the day before, the opening was...

TechubNews·01-14 07:37

Startup investment growth in Central and South America increases by 14%... Mexico and Brazil's fintech lead the growth

Investment in Latin American startups in 2025 increased by 14.3% compared to the previous year, showing a clear recovery trend. According to a survey released by Crunchbase, the total funding from seed to growth stages reached $4.1 billion (approximately 59 trillion KRW), a significant increase from $3.6 billion in 2024. Especially centered around Mexico and Brazil, large transactions in the fintech sector have continued to emerge, and venture capital firms remain optimistic about the region's innovation potential.

Although this performance is far from the record $8.4 billion investment level in 2021, it is seen as an encouraging result that revitalizes the Latin American risk ecosystem. In the fourth quarter of 2025 alone, the investment amount reached $1.085 billion (approximately 15.6 trillion KRW), a 16% decrease compared to the same period last year but a slight increase from the previous quarter.

By country, Brazil still maintains the top position in funding, and Mexico is quickly

TechubNews·01-13 12:56

Bitcoin crashes, cryptocurrency market anxiety spreads ahead of US CPI release

Ahead of the US Consumer Price Index(CPI) release, Bitcoin(BTC) and the major cryptocurrency markets experienced a significant decline. Bitcoin trading price is 134.55 million KRW, down 0.43% compared to 24 hours ago, with market participants showing a clear wait-and-see sentiment. Under this trend, funds are increasingly concentrated in Bitcoin rather than altcoins.

Technical analysis indicates that Bitcoin is currently under selling pressure at key support levels and continues to test them. If the support holds, a rebound may occur. However, if the support is broken, further declines could be triggered.

Market indicator Bitcoin Seasonal Index recently dropped sharply from 57 to 39, indicating an increasing market preference for Bitcoin.

Ethereum(ETH) has fallen more than Bitcoin, with a current trading price of 4.588 million KRW. It declined 1.13% within 24 hours, reflecting the overall weakness of altcoins. Experts warn that Ethereum is also at a support level testing

TechubNews·01-13 04:17

Bitcoin breaks through 134 million KRW, BTC ETH SOL XRP rise simultaneously

Bitcoin closing price is 134,330,000 KRW, up 0.9%. Ethereum trading price is 4,580,000 KRW, up 0.43%. Solana performed outstandingly, reaching a price of 208,886 KRW. Experts predict that Bitcoin and Ethereum are expected to hit new all-time highs. Investors should closely monitor market trends.

TechubNews·01-12 16:27

Cast AI, GPU market platform goes public... corporate value surpasses 1.58 trillion KRW

Cloud cost optimization company Cast AI launches a new GPU integrated marketplace platform, valued at over $1.1 billion, and secures strategic investment. The new feature "Omni Compute" allows flexible connection of GPUs and cloud infrastructure to improve resource scheduling efficiency. Oracle opens its GPU resources to customers to promote the deployment and expansion of AI platforms. This investment brings Cast AI's total funding to over $180 million, aiming to optimize cloud usage efficiency in AI inference and high-load computing tasks.

TechubNews·01-12 14:15

Bitcoin breaks through 130 million KRW... ETH, XRP, SOL fluctuate; institutional ETFs attract attention

The cryptocurrency market experienced weekend volatility, with institutional investment and regulatory developments dominating the atmosphere. Bitcoin continued to rise, but ETF fund outflows affected its trend; Ethereum showed weak performance, with capital flows stabilizing; Ripple attracted attention due to regulatory news and still maintained gains. Solana was included in Morgan Stanley's ETF application, drawing attention. Overall sentiment remains cautious, and the market faces safety risks.

TechubNews·01-10 04:25

AI Cloud Giant Lambda Plans to Raise an Additional 480 Billion KRW Before Going Public... Will It Become a "Game Changer in the NVIDIA Ecosystem"?

AI-powered cloud infrastructure startup Lambda is reportedly advancing a new funding round worth up to 4.8 trillion Korean Won. Mubadala Capital is considered the main potential lead investor in this round, which is noteworthy because it could be Lambda's final private placement before going public. Following the successful completion of a $12 billion Series E funding just two months ago, Lambda's successive large-scale financings are part of its aggressive expansion strategy aimed at dominating the AI cloud market.

Lambda currently operates 12 data centers in the United States. Through its "Super Cluster" GPU leasing service, it can provide enterprise clients with up to 165,000 NVIDIA GPUs. The service allows each customer to configure firewall policies independently, manage encryption keys, and monitor tools, aiming to achieve high security and scalability simultaneously.

In terms of hardware configuration, L

TechubNews·01-10 00:00

Cryptocurrency market, $161.19 million in leveraged positions liquidated within 24 hours... Longs account for over 80%

In the past 24 hours, approximately $161.19 million (about 2.357 trillion KRW) of leveraged positions have been liquidated in the cryptocurrency market.

According to current aggregated data, long positions account for the majority of liquidated positions. Based on a 4-hour period, long position liquidations amount to $36.93 million (80.4%), while short position liquidations amount to $9 million (19.6%).

4-hour liquidation data across exchanges / CoinGlass

In the past 4 hours, the exchange with the most liquidations was Binance, with a total of $13.24 million (28.83% of the total) liquidated. Among these, long positions totaled $10.44 million, accounting for 78.85%.

Hyperliquid experienced $10.72 million (23.34%) in liquidations, especially with long positions reaching $10.43 million, accounting for 97.3% of the exchange's total liquidation volume, showing a

TechubNews·01-09 20:15

Elon Musk's xAI company receives 28 trillion KRW investment... The generative AI boom reignites

The 2026 venture capital market is kicking off at a breathtaking pace. Notably, Elon Musk's generative artificial intelligence startup xAI has raised as much as $20 billion (approximately 28.8 trillion KRW) in a single round of funding, becoming the absolute focus. Analysts point out that within just one week, large investments exceeding $100 million have been continuously pouring in, and after 2025, a new wave of investment has officially begun.

xAI, known for its AI chatbot "Grok," has successfully completed this Series E funding round since its establishment in 2023, amid rapid attention from strategic and financial investors. This round has brought xAI's total funding to $42.7 billion (approximately 61.4 trillion KRW), and it is itself shaking up the global tech investment landscape.

Subsequent large-scale funding cases are also not to be underestimated. Parabilis Medicin, which develops cancer treatment peptide platforms,

TechubNews·01-09 19:45

Stablecoin payment infrastructure 'Rain' raises $250 million in funding... company valuation increases 17-fold↑

American startup Rain, which is developing infrastructure for stablecoin payments, raised $250 million in Series C funding, increasing its valuation to $1.95 billion (approximately 2.81 trillion KRW). This valuation has surged 17 times compared to just 10 months ago when it announced Series A funding. The round was led by global investment firm Iconiq, with major participation from Sapphire Ventures, Dragonfly, Bessemer Venture Partners, Galaxy Ventures, FirstMark, Lightspeed, Northwest, and Endeavor Catalyst.

Rain is a fintech company founded in 2021, dedicated to developing payment solutions that can connect with cards and digital wallets.

TechubNews·01-09 18:15

South Korean court rules: Bitcoin within exchanges "has economic value" and can be lawfully seized and confiscated

The South Korean Supreme Court recently made an important ruling regarding the legal classification of cryptocurrencies, clearly stating that Bitcoin stored in cryptocurrency exchange accounts is an asset that can be lawfully seized and confiscated in criminal proceedings. This ruling not only responds to long-standing debates but also provides an important reference standard for subsequent investigations, trials, and legislation.

Money Laundering Case Sparks Debate: Can Police Seize Bitcoin Worth 600 Million KRW?

According to Chosun Ilbo, this recent ruling in South Korea originated from a money laundering investigation. In January 2020, police seized 55.6 Bitcoins from the account of suspect A at an exchange, with a market value of approximately 600 million KRW ( about $411,000) at the time, which has since appreciated to 7.37 billion KRW ( about $5.05 million).

Mr. A subsequently filed an objection, arguing that Article 106 of the Criminal Procedure Act only permits the seizure of "physical objects,"

ChainNewsAbmedia·01-09 05:33

Snowflake acquires Observe for 1.4 trillion KRW… Accelerating data problem solving with AI

Snowflake(SNOW) further strengthens its data troubleshooting capabilities through the acquisition of Observe, a startup specializing in AI-based observation platforms. This acquisition is part of a strategy to enhance operational stability for enterprise clients, with plans to integrate Observe's technology into Snowflake's cloud data platform.

Snowflake is particularly focused on Observe's core observation technology, AI.

TechubNews·01-08 22:11

Sierra, $400 million in funding... consolidating its leading position in the AI safety market

AI data security company Cyera successfully attracted large-scale investment, sparking significant industry attention. Recently, Cyera raised $400 million in Series F funding (approximately 57.6 trillion KRW), pushing the company's valuation to $9 billion (about 12.96 trillion KRW). This round was led by Blackstone Group, with participation from existing investors Sequoia Capital, Lightspeed Venture Partners, Spark Capital, Accel, and other well-known venture capital firms.

In June last year, Cyera also raised $540 million (approximately 778 billion KRW), achieving a valuation of around $6 billion (about 8.64 trillion KRW), establishing a leading position in the "AI data security" market. This funding brings its total capital raised to $1.7 billion (about 2.448 trillion KRW). Cyera co-founder and CEO Jotham Segev stated: "As the foundation of enterprise operations shifts towards AI..."

TechubNews·01-08 17:44

Luxurious presence attracts 3.17 trillion KRW investment... Using AI to change the high-end real estate landscape

Luxury Presence, a luxury real estate marketing platform, raised $22 million in Series C funding, led primarily by Bessemer Venture Partners. The funds will be used for high-end website development and AI marketing tools. The company expects a 40% annual revenue growth by 2025 and to approach profitability. The new product 'Presence CRM' will drive its strategic development to identify potential transaction opportunities and improve productivity and conversion rates.

TechubNews·01-08 13:06

Ethereum on-chain transaction volume surges by 45%... Network real-world application expansion officially launched

Ethereum on-chain transaction volume surges by 45%… Signal of improving fundamentals

Ethereum network activity has recently increased rapidly. As the market experiences unstable adjustments and attempts to recover, network usage has grown by approximately 45%. Currently, with prices consolidating around $3,200 (approximately 4.656 million KRW), these on-chain data are interpreted as signals that Ethereum's fundamentals are strengthening.

On the 8th (local time), on-chain data analysis firm CryptoQuant reported in its latest report that Ethereum's 7-day average number of transactions has reached 870,000. Compared to around 600,000 transactions at the end of December last year, this is an increase of nearly 45%. This is not a short-term spike but a structural increase in transaction activity, indicating that actual usage within the network is rising.

Especially since December 29 last year, the number of transactions once surged to a daily high of 1.06 million. Although there was a slight adjustment afterward, it has remained stable in recent weeks.

ETH-3.96%

TechubNews·01-08 12:03

Cybersecurity M&A hits a new record... AI and cloud computing are changing the landscape

The cybersecurity market reached its largest boom in history in 2025 and is expected to become an even more competitive year in 2026. According to the annual report by Momentum Cyber, the scale of mergers and acquisitions in the cybersecurity sector last year reached $102 billion (approximately 146.8 trillion KRW), setting a new record. A total of 398 M&A transactions were completed, representing a 21% increase in the number of deals year-over-year, with transaction amounts soaring by 294%.

Especially on a quarterly basis, the second quarter saw the highest number of completed deals, while the third quarter featured a massive transaction totaling $44.2 billion (approximately 63.6 trillion KRW), setting a quarterly record for the largest deal size. The dominant areas of these transactions were cloud security and identity authentication platforms, reflecting the market’s strong focus on channel-integrated security solutions.

The report analysis indicates that software-centric M&A trends are particularly prominent. Based on Sa

TechubNews·01-07 14:58

AI funding boom drives a 30% surge in startup investments... OpenAI and SpaceX become the dominant forces

In 2025, global startup investment amounts surged by 30% compared to the previous year, once again setting a new record high. Centered around AI-leading companies such as OpenAI, SpaceX, and Anthropic, large-scale investments flooded in, reversing the overall atmosphere of the venture capital ecosystem. The total investment last year reached $425 billion (approximately 612 trillion KRW), a significant increase from $328 billion (approximately 472 trillion KRW) in 2024.

According to Crunchbase statistics, this year's defining feature is undoubtedly "super investments." OpenAI set a record for the largest private funding round in history with $40 billion (approximately 576 trillion KRW), while SpaceX established a new milestone with a private market valuation of $800 billion (approximately 1,152 trillion KRW). Google (GOOGL) with $32 billion (approximately 460

TechubNews·01-07 13:31

I am, 15 billion KRW paid-in capital increase... The largest shareholder Cereon strengthens control rights

IEM has decided to conduct a third-party paid capital increase of approximately 15 billion KRW, with all shares subscribed by the largest shareholder Cereon. Market attention is focused on its control rights reinforcement and the use of funds. The purpose of this capital increase is to ensure operational funds, with specific fund usage not yet disclosed, raising concerns about the company's future strategy.

TechubNews·01-07 11:45

[Korean Stock Market Closing] Korea Composite Stock Price Index closes higher for the 4th consecutive day… Foreign investors net buy 1.2 trillion KRW, semiconductor and transportation equipment stocks perform strongly

The Korean stock market, driven by optimistic expectations for the AI industry and foreign capital inflows, has risen for four consecutive days to 4,551.06 points on the KOSPI. Despite some Asian stock markets declining due to the impact of China-Japan trade frictions, the transportation and semiconductor sectors performed strongly. The KOSDAQ index declined for two consecutive days, mainly due to selling pressure on machinery and electrical electronics stocks. The Korean won against the US dollar remains strong, and international oil prices have fallen. The US stock market rose, while the Japanese and Hong Kong markets declined.

TechubNews·01-07 07:35

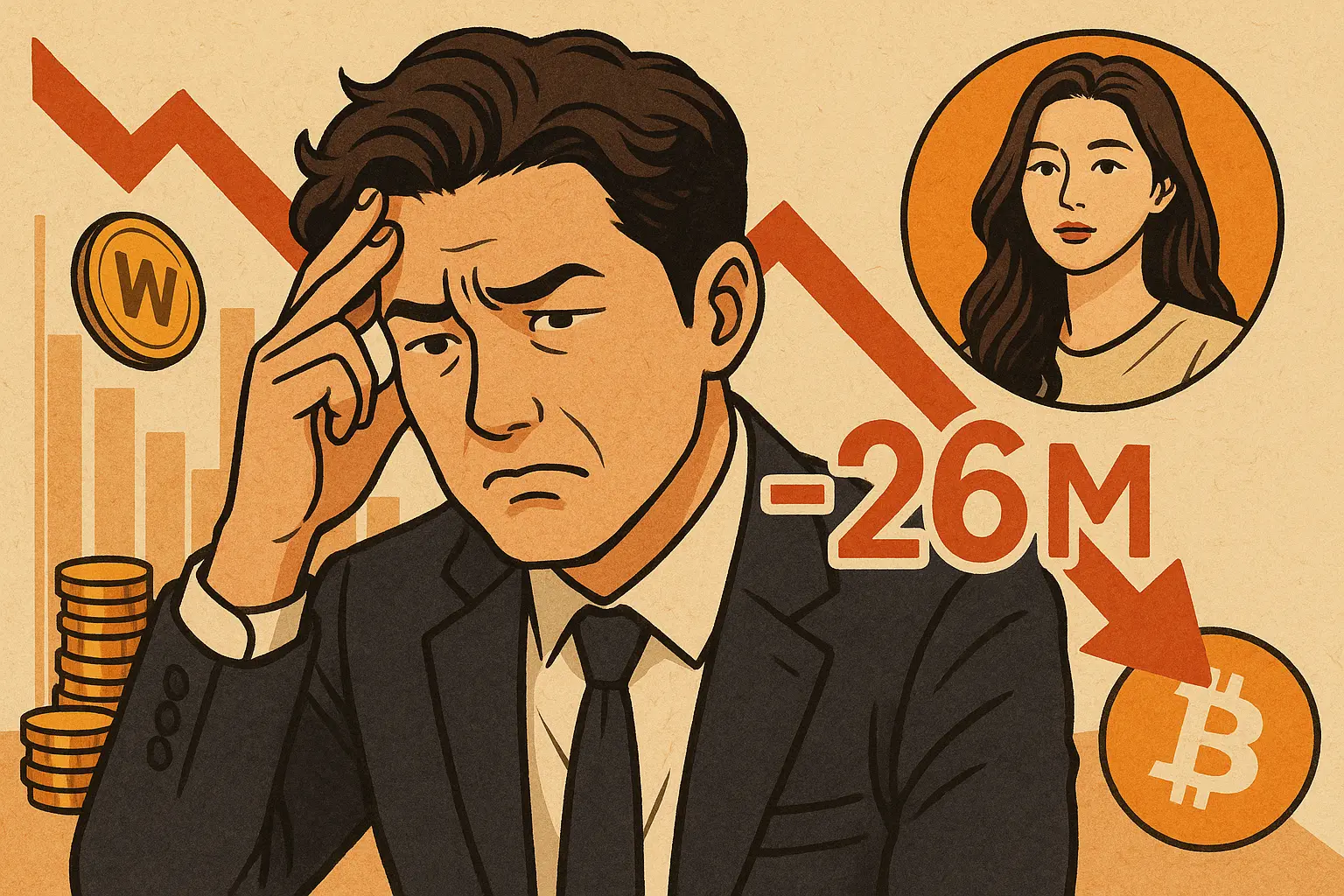

Choi Joon-Hyuk Loses $26M on Wemade: Jun Ji Hyun's Husband Crypto Crash

Choi Joon-Hyuk, CEO of Alpha Asset Management and husband of Korean star Jun Ji Hyun, faces massive losses on 35 billion KRW ($26M) Wemade investments. After purchasing shares in October 2023 and January 2024 betting on blockchain gaming, Wemade's WEMIX was delisted from Upbit and Bithumb, triggering a 25%+ stock collapse.

ON-1.23%

MarketWhisper·01-07 07:33

Taian County offers up to 84 billion KRW in guarantee support for individual businesses... interest rate reduced by 1.5%

Chungcheongnam-do Taean-gun promotes financial support projects to help small business owners affected by the economic downturn, providing guarantees and interest rate discounts, with a maximum loan of 50 million KRW. The project funds amount to 8.4 billion KRW, aiming to ensure that the support reaches businesses truly in need. This initiative will fill the support gaps of the central government and contribute to regional economic recovery.

TechubNews·01-07 06:39

[Crypto Capital Inflows and Outflows] BTC inflow of $100 million · outflow of $400 million

In the cryptocurrency market, the conversion between USDT and USDC on both the inflow and outflow sides is expanding synchronously, with a clear trend of reallocation centered around BTC.

According to CryptoMeter data from the 7th, the total euro (EUR) funds inflow on that day was $22.5 million. Among them, $9.9 million flowed directly into BTC, $6.5 million into USDC, with some funds also moving through stablecoin pathways.

Turkish Lira (TRY) funds amounted to $14.9 million, with $11 million flowing into USDT. South Korean Won (KRW) funds totaled $13.5 million, confirming the existence of stablecoin-mediated flows.

Brazilian Real (BRL) funds reached $6.9 million, and Japanese Yen (JPY) funds were $1.2 million, with relatively limited inflow.

USDT funds totaled $462.8 million, of which $415.6 million

TechubNews·01-07 04:34

The company continues to issue bonds... In the first half of this year, 52 trillion yuan worth of maturing bombs are waiting to explode.

The corporate bond issuance market, which had been quiet for a period, has become active again at the beginning of the new year. As the largest-scale corporate bond maturity wave in history arrives this year, major companies are rapidly taking action to refinance their funds.

According to the Korea Exchange, on January 5th, Korea Aerospace and Pohang Future Technology announced plans to issue corporate bonds worth 250 billion KRW each, while Lotte Wellfood and Hanwha Investment & Securities also announced they would raise 200 billion KRW and 150 billion KRW respectively. Based on demand forecast results, these companies have reserved the option to double their issuance scale. Among them, Hanwha Aerospace has already initiated its first demand forecast for this year, and the remaining companies will also conduct demand forecasts successively.

The process of companies issuing corporate bonds to raise funds is closely related to market interest rates. Until the end of last year, rapidly rising interest rates caused financing pressures for companies, leading to a continued atmosphere of delaying issuance. As the Bank of Korea maintains the benchmark

TechubNews·01-06 22:45

Risk asset appetite: USD-KRW exchange rate closes at 1,447 KRW... influenced by the warm US stock market

The USD-KRW exchange rate temporarily rose and then partially retraced in the New York foreign exchange market, ultimately closing at 1,447 KRW. Analysts believe that the strong performance of the New York stock market stimulated risk asset appetite, leading to a relatively strong Korean won.

As of 2:00 a.m. on the 7th (Korea time), the USD-KRW exchange rate closed at 1,447.10 KRW, up 3.30 KRW from the previous day's Seoul foreign exchange market close of 1,443.80 KRW. On the same day, in early trading in New York, the euro weakened due to soft European economic indicators, and the dollar remained strong, with the USD-KRW rate rising to a high of 1,449.30 KRW during the session.

However, as the US stock market showed an upward trend afterward, investors shifted their investment focus from safe assets to risk assets such as stocks, and demand for the dollar began to decrease. Notably, the Philadelphia Semiconductor Index, composed of representative US semiconductor stocks, surged 2.84% intraday, indicating a clear lead by tech stocks.

TechubNews·01-06 18:27

Milyang individual entrepreneurs can receive up to 50 million KRW in financial support... Gyeongnam Bank, the city government, and the Credit Guarantee Fund collaborate together

BNK Gyeongnam Bank collaborates with Milyang City and Gyeongnam Credit Guarantee Fund to launch a financial support program targeting small business owners, with a total investment of 800 million KRW. The program offers low-interest loans and preferential guarantees to aid economic recovery and improve financial accessibility for small enterprises. The scheme is flexible to meet the needs of different operators and is expected to have a positive impact on the regional financial ecosystem.

TechubNews·01-06 16:57

The continued upward trend of Bitcoin in 2026 is expected, with ETH, XRP, and SOL all showing an upward trend.

In early 2026, the cryptocurrency market is on the rise, with Bitcoin maintaining at 13,556,000 KRW. Despite a slight decline, analysts predict it will hit a new all-time high. Ethereum and Ripple also performed well, driven by institutional investors. Cryptocurrencies are seen as safe-haven assets, and improved market demand and regulatory environment further support their upward potential.

TechubNews·01-06 16:25

ETF net assets surpass 300 trillion KRW… Retail investor assets surge towards KOSPI high rebound trend

KOSPI, South Korea's Composite Stock Price Index, first surpassed the 4,500-point mark, while the net asset scale of domestic listed index funds(ETF) market first exceeded 300 trillion Korean won. This is interpreted as a result of investor influx driven by a strong stock market and the diversification of ETF products.

According to the Financial Investment Association, as of January 5, 2026, the total net assets of domestic ETFs amounted to 303.5794 trillion Korean won. Considering that the net assets on the previous day, January 4, were 298.2461 trillion Korean won, this means an increase of over 5 trillion Korean won in just one day. The direct background is that the KOSPI index closed 67.96 points higher than the previous trading day, reaching 4,525.48 points, setting a new record high.

ETFs are "passively" managed products that fully track specific stock price indices and do not have dedicated fund managers actively adjusting the investment portfolio. Because they are similar to stocks

TechubNews·01-06 14:25

Load More