Search results for "LONG"

Cryptocurrency asset fund profits turn to zero! DAT profit and loss ratio compressed by 93%, fear of selling off Bitcoin

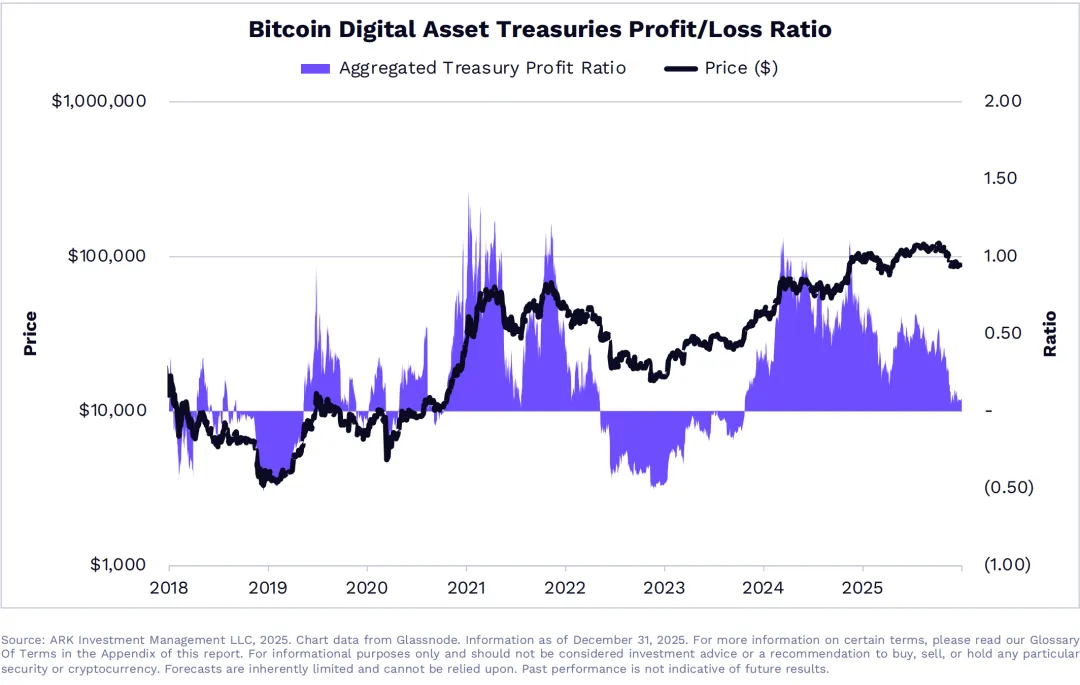

ARK Invest data shows that the Crypto Asset Fund (DAT) profit and loss ratio has compressed by 93% over the past year to break-even point. Bitcoin has fallen back to support at the ETF cost basis, but if the debt-based DAT's share price falls below net asset value (NAV), it may be forced to sell Bitcoin to buy back shares. At the same time, Bitcoin futures long positions account for 58% of total closed positions, indicating an oversold condition compared to the normal state over the past three years.

MarketWhisper·53m ago

VC funding is bleak, new coin narratives are exhausted—what can the crypto market trade in a year?

Author: Mandy, Azuma, Odaily Planet Daily

This weekend, under internal and external pressures, the crypto market was once again bloodied. BTC is currently hesitating around the Strategy holding cost basis of $76,000, while altcoins are so volatile that just a glance at their prices makes traders want to gouge their eyes out.

Behind this current downturn, after chatting with projects, funds, and exchanges recently, a question kept recurring in my mind: What exactly is the crypto market trading a year from now?

And the more fundamental question behind this is: if the primary market no longer produces the "future of the secondary," then what is the secondary market trading a year from now? What changes will occur in exchanges?

Although the idea that altcoins are dead has long been a cliché, the past year has not been short of projects. Every day, projects are still lining up for TGE. As media, it’s quite straightforward—we continue to frequently coordinate with project teams for market promotion.

(Note: In this context

PANews·1h ago

Once in "paper loss"! Strategy increases holdings by 855 Bitcoins again. How long can buying more on dips sustain?

The recent volatility in the cryptocurrency market has led crypto company Strategy to invest $75.3 million to purchase 855 Bitcoin from January 26 to February 1, bringing its total holdings to 713,502 coins, valued at approximately $56 billion. Although Bitcoin prices have recently declined and Strategy is facing unrealized losses, it continues to raise funds by selling stocks. There is ongoing discussion in the market about the viability of its long-term strategy.

BTC2.79%

区块客·1h ago

PEPE crashes 66% bottom signal! RSI drops below 30, is it time to buy the dip in meme coins?

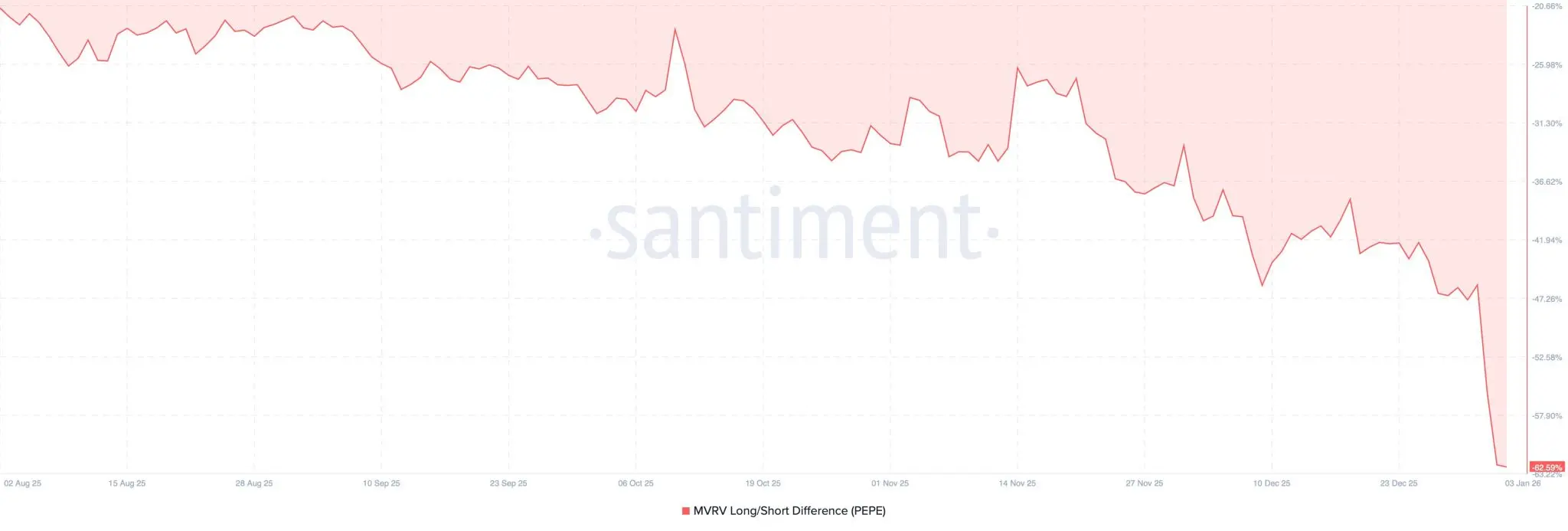

PEPE drops to $0.000004118, down 14% for the week. Santiment's MVRV long-short difference indicator is about to turn positive after months of negative values, indicating long-term holders are regaining dominance. RSI falls below 30 indicating oversold conditions, testing the $0.0000040 support level. Short-term target is $0.00000450, end of Q1 at $0.0000070, and by the end of the year at $0.000020.

PEPE3.6%

MarketWhisper·1h ago

Perplexity AI Predicts XRP at $8, Bitcoin $250K, ETH $7,500 by 2027

In a fascinating experiment, structured prompts were used to guide Perplexity AI, a leading artificial intelligence research tool, to generate long-term price forecasts for the crypto market's titans: XRP, Bitcoin, and Ethereum.

The AI's outputs are strikingly bullish, projecting a sustained bull market fueled by regulatory clarity and institutional adoption. Perplexity's analysis suggests XRP could surge nearly 400% to reach \$8 by the end of 2026, Bitcoin might chart a course toward \$

CryptopulseElite·2h ago

Decoding the Epstein Files: How Crypto’s Early Power Struggles Cast a Long Shadow Over Today’s Market

The release of emails from the Jeffrey Epstein files has unveiled a hidden layer of early cryptocurrency history, exposing how industry flashpoints like Coinbase’s 2019 Neutrino crisis and the ideological war against Ripple were monitored within elite financial and technology networks.

This is not a story of criminal involvement, but a revealing signal of how crypto's formative battles over privacy, governance, and ideological purity were of acute interest to power brokers at the interse

CryptopulseElite·3h ago

XRP Price Prediction 2026: Can the $1.50 Support Hold Against Rising Sell-Off Risks?

XRP is attempting to stabilize around the \$1.60 mark following a sharp market correction that saw its price briefly approach the critical \$1.50 support level.

While this bounce offers temporary relief, underlying on-chain data reveals a fragile recovery predominantly fueled by short-term, speculative traders rather than long-term conviction buyers. Key metrics, including a nearly 70% drop in exchange outflows and a surge in supply held by short-term holders to 5.27%, indicate weak broa

CryptopulseElite·3h ago

Bitmine stock price drops over 9%, female investor Ark Invest adds over 270,000 shares on dips and remains optimistic about ETH reserves

Ark Invest increased its holdings of BMNR by over 270,000 shares on the 2nd, optimistic about the company's long-term value of holding 4.285 million ETH.

(Background recap: Bitmine repurchased nearly 42,000 ETH! Total holdings expanded to 4.285 million ETH, but unrealized losses on paper soared to $6.5 billion)

(Additional background: BitMine pledged another 170,000 ETH! Cumulative locked-up ETH approaches 2 million, with a total value of $5.73 billion)

The world's largest Ethereum reserve company, Bitmine (BMNR), currently holds 428.5 ETH, accounting for 3.52% of the total circulating supply of Ethereum. However, amid Ethereum's price falling below $2,400, Bitmine closed the 2nd down 9.16% at $22.8, setting a record from last year

ETH4.34%

動區BlockTempo·4h ago

ASML Holding Surpasses €32B in 2025 Revenue as AI Demand Drives Growth

ASML Holding reported record 2025 revenue, supported by sustained AI infrastructure investment.

Q4 2025 bookings reached historic levels, signaling multi-year visibility for advanced lithography demand.

Long-term revenue guidance remains unchanged, despite stronger AI tailwinds than

CryptoFrontNews·4h ago

Vitalik's 16,384 ETH Bet: A Public Declaration on "Digital Sovereignty"

Vitalik Buterin withdraws 16,384 ETH, shifting the focus of cryptocurrency discussions from short-term profits to protecting user safety and freedom. He emphasizes that the Ethereum Foundation will focus on public goods, supporting the ideals of decentralization, privacy, and user sovereignty, and promoting "verifiability" technology. Additionally, his proposed investments in open-source hardware and other long-term social value projects aim to address the funding issues of public goods in the crypto space. This move prompts participants to consider the mission and value of digital technology.

ETH4.34%

TechubNews·4h ago

XRP Today's News: Five consecutive declines halt bloodshed, US ISM data triggers rebound

XRP ends five consecutive declines, rising 1.90% on February 2 to close at $1.6192. The US ISM Manufacturing Index exceeded expectations, boosting risk appetite and offsetting uncertainties from the White House crypto meeting. The meeting highlighted the deadlock between banks and the crypto industry over legislation on stablecoin yields. On the technical side, XRP found support at $1.50, with a breakout above $2.00 confirming a reversal. The medium-term target is $2.50, and the long-term target is $3.00.

XRP2.15%

MarketWhisper·4h ago

Bitcoin rebounds to $79,200, "Shorts Liquidated for $230 million," Galaxy warns: Will continue to decline and test $70,000

Bitcoin rebounded to $79,200 today, but Galaxy Research Director warns that it may fall back to $70,000 in the coming months. Analysis shows that on-chain data and market conditions are unfavorable, and the existing demand gap could lead to further weakness. Long-term holders have not increased their holdings, so future market trends need to be observed.

動區BlockTempo·4h ago

Are others afraid while I am greedy? Ripple reveals three major catalysts, XRP flashes a buying opportunity on dips

Ripple Legal Chief Stuart Alderoty Reveals Three Major Forces by 2026: Quiet Adoption, Real-World Asset Digitization, and Integration with Traditional Finance. Ripple USD (RLUSD) Stablecoin Achieves Milestone on XRP Ledger. Although XRP has dropped 15%, the $1.60 historical support level has attracted buyers, rebounding from this point to $3.60 in April this year, indicating a long-term bullish trend.

MarketWhisper·5h ago

Robert Kiyosaki Confirms He’s Buying More Bitcoin After Crash

Robert Kiyosaki says market crashes favor buyers, signaling plans to accumulate bitcoin while also adding gold and silver as long-term hedges against fiat money and financial instability.

Robert Kiyosaki Says Market Crash Signals Opportunity, Not Fear

Rich Dad Poor Dad author Robert Kiyosaki

BTC2.79%

Coinpedia·5h ago

(no title)

Alex Thorn from Galaxy Digital suggests that Bitcoin's recent weakness indicates possible further declines, potentially reaching a 200-week moving average around $58,000. He notes that 46% of BTC supply is currently "underwater," reflecting market pressure. The lack of institutional demand hampers sustainable gains, and Bitcoin's role as an inflation hedge has diminished. However, long-term technical levels remain attractive for investors.

BTC2.79%

TapChiBitcoin·5h ago

Brother Maqi doesn't admit defeat! Invested 250,000 USDC to open long positions in ETH and HYPE.

Brother Maqi Huang Licheng deposited 250,000 USDC into Hyperliquid again on February 2, opening long positions in ETH (25x leverage) and HYPE (10x leverage). This is his first large replenishment after being liquidated 241 times at the end of January, with an account balance remaining of only $20,000. His total losses have exceeded $26 million, and his unwillingness to admit defeat has sparked polarized discussions within the community.

MarketWhisper·6h ago

JPMorgan: Bitcoin futures are oversold, and gold is expected to reach $8,500.

JPMorgan analysts point out that Bitcoin futures are oversold, while gold and silver futures are overbought, reflecting retail investors shifting towards precious metals. Gold prices are expected to reach $8,000 to $8,500 per ounce in the future due to sustained demand for gold. Although precious metals face short-term risks, market sentiment remains optimistic about their long-term prospects. Bitcoin's position is being challenged, indicating its dilemma as digital gold.

区块客·6h ago

Crypto Market Massacre! Bitcoin drops below $80,000, long liquidation exceeds $1 billion

On February 1st, Bitcoin fell below $80,000, reaching $79,000, resulting in over $270 million in liquidations. Global macroeconomic pressures and geopolitical tensions have intensified the market decline, with analysts warning of further drops to $74,000 to $78,000. Recent ETF outflows and whale sell-offs have also heightened bearish sentiment.

区块客·6h ago

XRP Defends Key 33 EMA Support as Monthly Structure Signals Market Reset

XRP closed monthly candles above the 33 EMA, preserving long-term structural validity despite short-term volatility.

Liquidity grabs near the Central Line continue to align with historical XRP cycle behavior.

Expansion scenarios remain data-driven, based on prior EMA and Central Line

XRP2.15%

CryptoFrontNews·9h ago

Legend turns into tragedy? "Prophet Whale" clears Ethereum long positions, suffers a loss of $250 million, with only $53 remaining in the account

Known as the "Prophet Whale," the investor made a $200 million profit last year by accurately shorting Bitcoin and Ethereum. Recently, due to a market plunge, they suffered a $250 million loss, liquidating all their Ethereum long positions, leaving only $53 remaining. This loss occurred after a warning about risky positions, and ultimately, market panic selling forced them to cut their losses and exit.

区块客·11h ago

Ethereum Foundation Cuts Back Funding Amid Market Pressure and Long-Term Vision Shift

The Ethereum Foundation is entering a period of austerity and will cut back funding for most projects to sustain long-term operations.

Vitalik intends to become more involved in projects building on the network and to perform tasks that would have previously been designated to the Foundation’

CryptoNewsFlash·12h ago

ONDO Price Crashes 88% From All-Time Highs, But Analyst Says ‘Last Hope’ Zone Is Here

The ONDO price has drifted into a part of the chart that usually gets traders paying attention. After months of downside, the price is now sitting inside a zone that has mattered in the past. This isn’t a quick dip on a short timeframe. It’s a long-term area where the market tends to make

CaptainAltcoin·12h ago

MANTA Maintains $0.075 Support as Price Structure Tightens on the Daily Chart

MANTA price held above the $0.07547 support zone while consolidating near horizontal resistance.

Price compression developed as MANTA traded below a long-standing descending trendline.

Price was trading between the support of $0.07547 and resistance of 0.08908 as indicated by

CryptoNewsLand·12h ago

DOGE Price Stays Range-Bound Near $0.1125 as Monthly Pattern Repeats

Dogecoin trades near monthly support at $0.1125, maintaining its position within a long-term rising channel.

The current monthly structure closely matches Dogecoin’s previous market cycle, based on chart data.

DOGE/BTC holds at 0.051350 BTC, reinforcing structural alignment across both

CryptoNewsLand·13h ago

3 Altcoins to Buy For 50x Gains — KAS, RNDR, and AR

Kaspa: High-speed Layer-1 focused on scalability, adoption growth, and long-term infrastructure demand.

Render: Decentralized GPU network benefiting from rising AI and compute-intensive workloads.

Arweave: Permanent data storage blockchain suited for long-term records and patient

CryptoNewsLand·15h ago

Bitmine has repurchased nearly 42,000 ETH! The total holdings have increased to 4.285 million ETH, but the paper unrealized loss has soared to $6.5 billion.

Bitmine increased its holdings by nearly 42,000 ETH last week, bringing the total to 4.285 million ETH. However, due to a market correction in the crypto space, the paper loss reached $6.5 billion. Despite this, Executive Chairman Tom Lee remains confident in Ethereum's long-term prospects and emphasizes its strong fundamentals. Bitmine's staked ETH volume is among the world's largest, and it is expected to continue increasing its assets in the future.

動區BlockTempo·16h ago

Bernstein: Bitcoin may bottom out at $60,000, with a potential reversal of the downtrend in 2026 and the start of a new cycle

The Bernstein report indicates that the short-term bear market in the crypto sector will reverse by 2026, with Bitcoin expected to bottom out around $60,000, laying the foundation for future market trends. Although the market is currently weak, analysts believe this is a short-term correction rather than a long-term decline. Compared to gold, Bitcoin has underperformed, and future changes in U.S. policy could serve as a catalyst. Market liquidity remains stable, with companies and miners demonstrating resilience; overall, there are no signs of a systemic collapse.

BTC2.79%

動區BlockTempo·16h ago

ENA Crashes 93% From ATH: Why Retail Now Beats the $0.40 VC Entry

_ENA trades near $0.13 after a 93% drop from ATH, offering retail entry below the $0.40 VC price amid support tests unlock risks._

ENA has fallen sharply from its all-time high, and retail traders are now entering at levels well below earlier private investors.

The token is trading near long-t

LiveBTCNews·18h ago

Podcast Ep.380——Bitcoin ETF: Transforming Speculative Assets into Institutional Investment Instruments

The rise of cryptocurrency ETFs is transforming digital assets into mainstream financial products, removing traditional investment barriers and enhancing accessibility. Their design can meet compliance requirements and attract institutional investors, but they still face risks such as price deviations and regulatory changes. In the long term, ETFs are expected to become a new infrastructure in the financial system, promoting the institutionalization of digital assets.

TechubNews·19h ago

XRP Price Prediction 2026: Can It Hold $1.55 Support Amid Market Turbulence?

XRP faces a critical test as its price hovers near the \$1.60 mark, a level not seen in nearly nine months following a significant market-wide correction.

Despite a 24-hour trading volume exceeding \$4 billion indicating sustained interest, the token has succumbed to selling pressure linked to Bitcoin's downturn and broader macroeconomic concerns. However, a nuanced picture emerges from institutional activity, where select XRP-spot ETFs recorded notable inflows last week, suggesting some

CryptopulseElite·23h ago

TradingBaseAI Column | The most scarce ability in the market is not to seize opportunities, but to avoid being "eliminated" in the competition. In today's rapidly changing market environment, the true skill lies in maintaining resilience and adaptability, ensuring you are not the one who gets phased out as conditions evolve. Developing this ability is crucial for long-term success and staying ahead of the curve.

The article emphasizes that in the market, what truly matters is how to maintain ongoing participation, not just seizing opportunities. Many people are eliminated not because of a lack of ability, but because their participation methods are unstable, leading to a loss of engagement over the long term. TradingBaseAI is dedicated to enhancing participants' long-term retention ability by reducing the risk of elimination through systematic structures, thereby ensuring continuous participation in the market.

TechubNews·23h ago

Crypto Vs Gold Breaks Pattern After October 2025 Market Crash

Tom Lee discusses the October 2025 market crash that separated crypto from gold. He highlights structural issues in crypto markets and suggests Bitcoin remains a long-term digital gold, despite heightened volatility and risks. Lee believes 2026 could be pivotal for crypto adoption.

Coinfomania·23h ago

Solana breaks below the $100 psychological level! ETF funds show the first "outflow" signal

Solana dropped below $100 on Monday, with a weekly decline of over 15%. The financing rate turned negative to -0.0080%, the long-short ratio decreased to 0.97, and the ETF experienced a weekly outflow of $2.45 million for the first time. The RSI fell to 25, indicating extreme oversold conditions, and the MACD death cross persists. The daily closing price broke below the $100 target, reaching $95.26, further testing the $79 level.

SOL3.39%

MarketWhisper·23h ago

The Two-Track Tango: How Nomura’s Crypto Retreat Exposes the Mature Playbook of TradFi

Japanese financial giant Nomura has simultaneously announced a reduction in its cryptocurrency trading exposure due to quarterly losses at its Laser Digital subsidiary while aggressively filing for a U.S. national trust bank charter for that same unit.

This seemingly contradictory move reveals a sophisticated, two-track institutional strategy that rigorously separates volatile, short-term proprietary trading from long-term infrastructure investment. The event is a critical signal that th

CryptopulseElite·02-02 06:46

Japan's largest brokerage increases investment against the trend! Nomura Securities still applies for three licenses despite losses

Nomura Securities announced on January 30th that Laser Digital has reported losses for two consecutive quarters. However, just 48 hours ago, they applied for a banking license with the US OCC. Nomura is adopting a dual-track strategy: trading losses are considered short-term risk management, while infrastructure investments are part of a long-term strategy, with license applications being simultaneously pursued in the US, Japan, and Dubai.

MarketWhisper·02-02 05:44

The Unrealized Loss Litmus Test: How Corporate Bitcoin Treasuries Reveal Strategy, Not Failure

At a Bitcoin price of approximately \$78,500, prominent public companies like Metaplanet and Trump Media sit on paper losses exceeding one billion and four hundred million dollars, respectively, while early adopters like Tesla remain comfortably profitable.

This divergence is not a story of good versus bad bets, but a public stress test revealing the core mechanic of the corporate Bitcoin treasury thesis: it is a long-duration financing strategy wrapped in a volatile asset. The critical

CryptopulseElite·02-02 05:26

Bullish "hope" shattered? Bitcoin drops below $78,000, analysts warn: weekend sell-off is just the beginning

Bitcoin has recently experienced a sharp decline, falling below $78,000, hitting a new low since last year, mainly due to long-term profit-taking and insufficient market liquidity. Analysts predict that the market is currently in a bearish pattern, with weakening demand and technical indicators suggesting a potential deeper correction. Traders are betting that Bitcoin will drop to $75,000, and optimistic sentiment has diminished.

区块客·02-02 04:44

XRP Price Crash! 70 Million Liquidation Wave Approaches, $1.60 Becomes the Defense Line

XRP encounters a new wave of selling pressure, with the current trading price approaching $1.70, down approximately 2.5% in the past 24 hours. Futures market liquidations exceed $70 million, mostly from bullish long positions. Technical analysis shows that the downward trend line remains in control of the price movement, with $1.64 and $1.60 becoming the next key support levels. Market sentiment is weak, and Bitcoin's lack of upward momentum further suppresses XRP's rebound potential.

XRP2.15%

MarketWhisper·02-02 01:54

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun.

Author: Ryan Watkins

Translation: Deep潮 TechFlow

Introduction: By 2026, the crypto economy is in the most critical transition period in 8 years. This article explores how the market has "soft-landing" from the overexcitement of 2021 and gradually establishing valuation frameworks based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for an industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but an underestimated, cross-cycle entry opportunity.

The full text is as follows:

Key Points

This asset class in 2021

区块客·02-02 01:20

Litecoin Charts Show Market Indecision With Resistance Near $71.30 Level

Litecoin trades near critical support with indecisive momentum across BTC and USDT pairs.

A move above $71.30 may open the path toward $80.00 in the short term.

Long-term projections show rising price bands with wide scenario ranges through 2032.

Litecoin price outlook reflects

CryptoFrontNews·02-01 21:46

Sleeping Stashes Blink: Early Bitcoin Wallets Shift Nearly 5,000 BTC in January

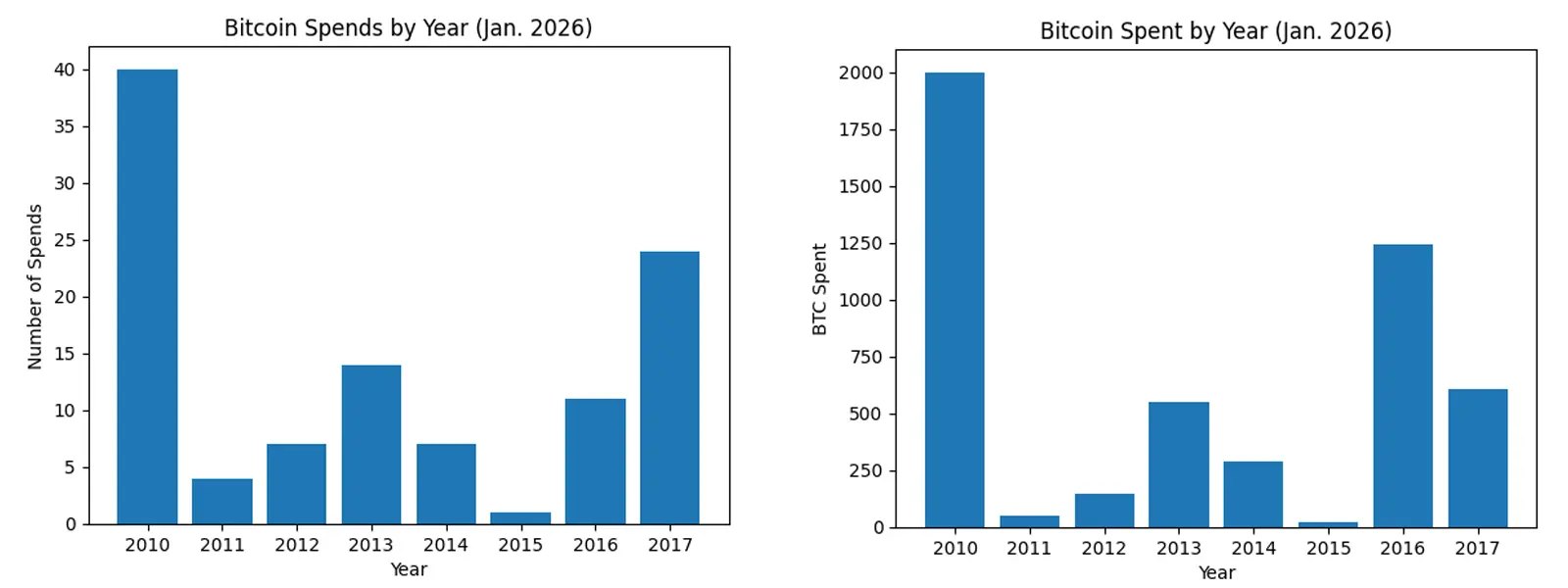

By the numbers, January 2026 saw long-sleeping wallets from the 2010–2017 era finally stretch their legs, moving about 4,905.98 BTC—worth roughly $383 million at today’s exchange rates—after years of radio silence. Digging deeper, the data shows that 40.77% of those spends came from truly ancient

BTC2.79%

Coinpedia·02-01 20:35

Ethereum Foundation Cuts Back Funding Amid Market Pressure and Long-Term Vision Shift

The Ethereum Foundation is entering a period of austerity and will cut back funding for most projects to sustain long-term operations.

Vitalik intends to become more involved in projects building on the network and to perform tasks that would have previously been designated to the Foundation’

CryptoNewsFlash·02-01 18:50

Shiba Inu Open Interest Crashes 11% as SHIB Price Hits Near 3-Year Low - U.Today

Shiba Inu's price has dropped to lows not seen since October 2023, amid a significant crypto market sell-off. Over $2.45 billion in liquidations occurred recently, heavily impacting long positions. Open interest for Shiba Inu fell 11%, signaling reduced trader exposure. Market volatility may increase due to low liquidity and risk appetite. Amid the downturn, Shiba Inu could see potential targets for recovery, with key support levels identified.

SHIB3.45%

UToday·02-01 17:11

Ripple Announces XRP Community Day 2026 With Focus on ETFs, Partnerships and Utility

XRP Community Day 2026 will take place on February 11-12 and will include live sessions devoted to ETFs, partnerships, wrapped XRP, and real-world applications.

Ripple executives, including Brad Garlinghouse and Monica Long, will speak on XRP’s expanding role in capital markets and

CryptoNewsFlash·02-01 08:45

Black Friday Massacre! Bitcoin drops below $82,000, analysts warn 'may dip to $70,000'

As the global financial markets weaken simultaneously, the cryptocurrency market once again becomes a major casualty. After experiencing a sharp decline in the overnight session, Bitcoin saw selling pressure emerge again this morning (30th), further breaking below $82,000. Analysts warn that as key support levels are consecutively lost, Bitcoin has "almost no clear support below," and may fall to $70,000 in the short term.

As of 10:25 AM Taipei time, Bitcoin is trading at $81,401, down 8% for the day; Ethereum has dropped 9.5% to $2,707; BNB, Ripple (XRP), and Solana (SOL) have fallen between 7% and 8.6%.

According to CoinGlass data, in the past 24 hours, the total liquidation amount across the network reached $1.779 billion, with over $1.67 billion coming from long positions. Bitcoin's liquidation amount reached 8.

区块客·02-01 08:19

Dogecoin’s Downtrend Continues Amid Weak ETF Demand and Persistent Selling

Key Insights

Dogecoin faces continued selling pressure as ETF demand and spot inflows remain stagnant.

Institutional interest in DOGE remains low, further weighed down by persistent outflows.

A break below the long-term trendline could signal a major downturn, with $0.08 to $0.09 as

CryptoFrontNews·02-01 07:21

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun.

Author: Ryan Watkins

Translation: Deep潮 TechFlow

Introduction: By 2026, the crypto economy is in the most critical transition period in 8 years. This article explores how the market has "soft-landing" from the overexcitement of 2021 and gradually establishing valuation frameworks based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for an industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but an underestimated, cross-cycle entry opportunity.

The full text is as follows:

Key Points

This asset class in 2021

区块客·02-01 01:16

Crypto Market Massacre! Bitcoin drops below $80,000, long liquidation exceeds $1 billion

On the early morning of February 1st, Bitcoin broke below the critical $80,000 mark, reaching a low of $79,000 amid intense volatility in the cryptocurrency market. This sharp decline triggered over $270 million in liquidations within just an hour. The breach of key support levels has sounded alarm bells among traders and analysts, who consider $80,000 an important psychological threshold. During this large-scale liquidation event in the crypto market, as of 1 a.m. on February 1st, according to Coinglass data, over $1 billion in long positions were wiped out in the past four hours.

This wave of impact mainly targeted leveraged traders betting on price increases, leading to forced liquidations and further exacerbating the market decline.

This latest wipeout is a continuation of a series of brutal liquidation events between 2025 and 2026, with global macroeconomic pressures repeatedly triggering chain reactions of sell-offs. The United States

区块客·02-01 00:12

JPMorgan: Bitcoin futures are oversold, and gold is expected to reach $8,500.

JPMorgan analyzes that Bitcoin futures are oversold, while gold and silver futures are overbought, reflecting that retail and institutional investors prefer precious metals. The forecast is that gold prices will reach $8,000 to $8,500 per ounce as private equity and central banks continue to increase their holdings. Although precious metals face a correction risk in the short term, they are bullish in the long term, while market confidence in Bitcoin has weakened.

区块客·02-01 00:04

Load More