Search results for "LSD"

Huobi HTX's new vision has been validated again: BANK and MET dual coin markets are strongly leading the rise.

According to Mars Finance, Huobi HTX's forward-looking layout for quality new assets has once again been confirmed by the market. Today, Lorenzo Protocol (BANK) and Meteora (MET) announced their launch on other mainstream exchanges. It is reported that these two assets have already been launched on the Huobi HTX platform. Among them, BANK was launched as the first asset on May 9, and MET was added on October 24.

Among them, BANK was launched on May 9 as the first asset, and as a popular asset in the LSD track, today's maximum increase reached 104%; MET was launched on October 24 on Huobi HTX, serving as a liquidity infrastructure project for the Solana ecosystem, with a maximum increase of 33%.

The market generally believes that the simultaneous explosion of these two assets not only reflects the growth potential of the projects themselves, but also validates Huobi HT.

MarsBitNews·2025-11-13 17:41

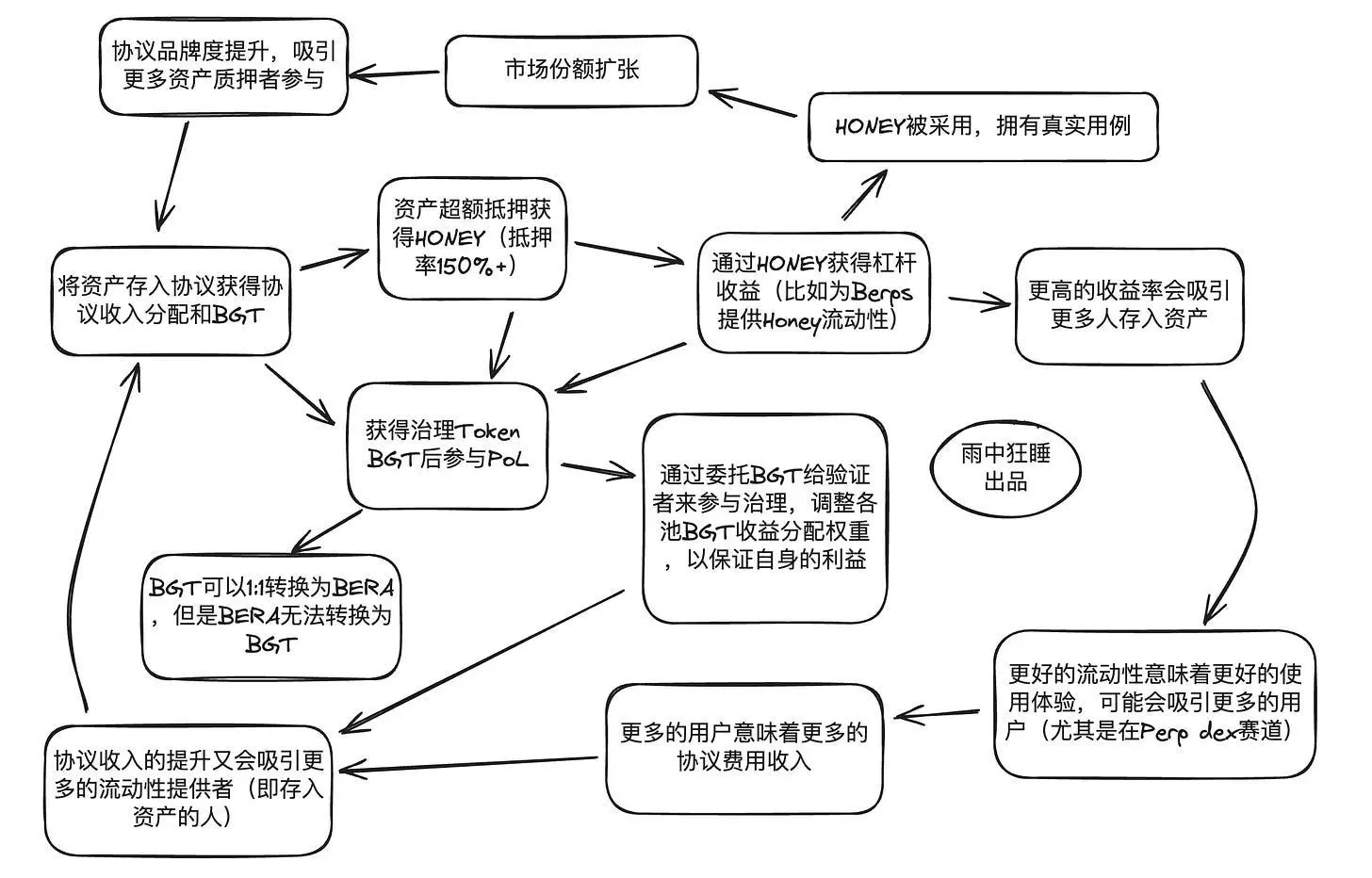

In-depth exploration of the Berachain ecosystem Liquidity infrastructure Infrared

Why follow Infrared?

On one hand, Infrared is currently implementing the points program phase, and there will be airdrops in the future.

On the other hand, on the surface, Infrared appears to be part of the LSD( Liquid Staking Derivatives) sector. However, Infrared differs from existing LSD projects such as Lido.

POL proof of Berachain

As the liquidity infrastructure of the Berachain ecosystem, the differentiation designed by Berachain is one of the fundamental reasons why Infrared stands out.

BERA-4.89%

PANews·2025-08-20 02:03

Ethereum's net sell pressure reached $418.8 million in a single day, setting a historical second-high. Can on-chain growth and coin-holding faith withstand the pullback risk? | ETH price prediction

Extreme selling signals have appeared on-chain for Ethereum (ETH), with the daily Net Taker Volume plummeting to -418.8 million USD, marking the second highest negative value in history, which means the market has net sold 116,000 ETH in a single day. Historical data shows that such selling pressure often indicates a local top. Although the price temporarily holds at the support of 3,643 USD, the technical indicators show that the bullish cup and handle pattern is facing a risk of failure—if it cannot quickly recover the resistance at 3,950 USD neckline, it may trigger a deep pullback. On-chain data reflects a Bull vs Bear Battle: the number of new addresses surged by 29.94% in a single day indicating ecological expansion, but the NVT ratio skyrocketing after circulation adjustments suggests short-term overvaluation, while the difference in profits and losses between short and long-term holders (MVRV LSD) remains at 12.36%, highlighting the Whale's faith in holding coins. The battle between bulls and bears is about to erupt.

ETH-5.32%

MarketWhisper·2025-08-07 05:15

LSD ignites demand, LYD meets returns

In the first week of 2025, the Crypto Market put on a wonderful scene. Before the final showdown in the BTCFi track, people with different perspectives and positions all have complex mindsets and feelings. This article does not aim to gossip, but to summarize the previous patterns and analyze future opportunities. LSD from

BTC-4.41%

星球日报·2025-04-14 07:36

Introducing Haedal Hae3: A liquid protocol for the Sui ecosystem, reshaping the brilliance of LSD and DAO

Author: Haedal Protocol

Compilation: Deep Tide TechFlow

1. Why do we need LSD?

LSD (Liquid Staking Derivatives) is one of the most classic and fundamental protocols in the DeFi market. Today, most blockchains rely on staking their native tokens to secure the network and incentivize participants through staking rewards. This model, together with transaction fee income and lending fee income, constitutes one of the most basic revenue mechanisms in the entire crypto space, and it is also a core component of DeFi.

However, pure token staking is not efficient in terms of capital efficiency. That's when Lido introduced an innovative solution: Liquid Staking (LST).

DeepFlowTech·2025-03-11 04:09

Indian Man Arrested for Purchasing and Distributing Drugs Using Crypto

An Indian national has been apprehended by the Anti-Narcotics Cell division in Gurugram, Haryana, for using cryptocurrency to procure the psychedelic drug LSD. According to authorities, the suspect purchased the drugs to distribute them at several high-profile parties in the region.

Indian authorit

CELL-0.18%

Cryptopolitan·2025-02-22 09:09

Yang Ge Gary: LSD detonates demand, LYD solves revenue

LSD defines narrative market explosion, LYD emphasizes Yield weakening Staking, solves problems and brings a new round of rise.

星球日报·2025-01-09 07:58

Data: The encryption market zone has a slight pullback, while the ETH and LSDFi zones pump against the trend by 2.8% and 5.57% respectively.

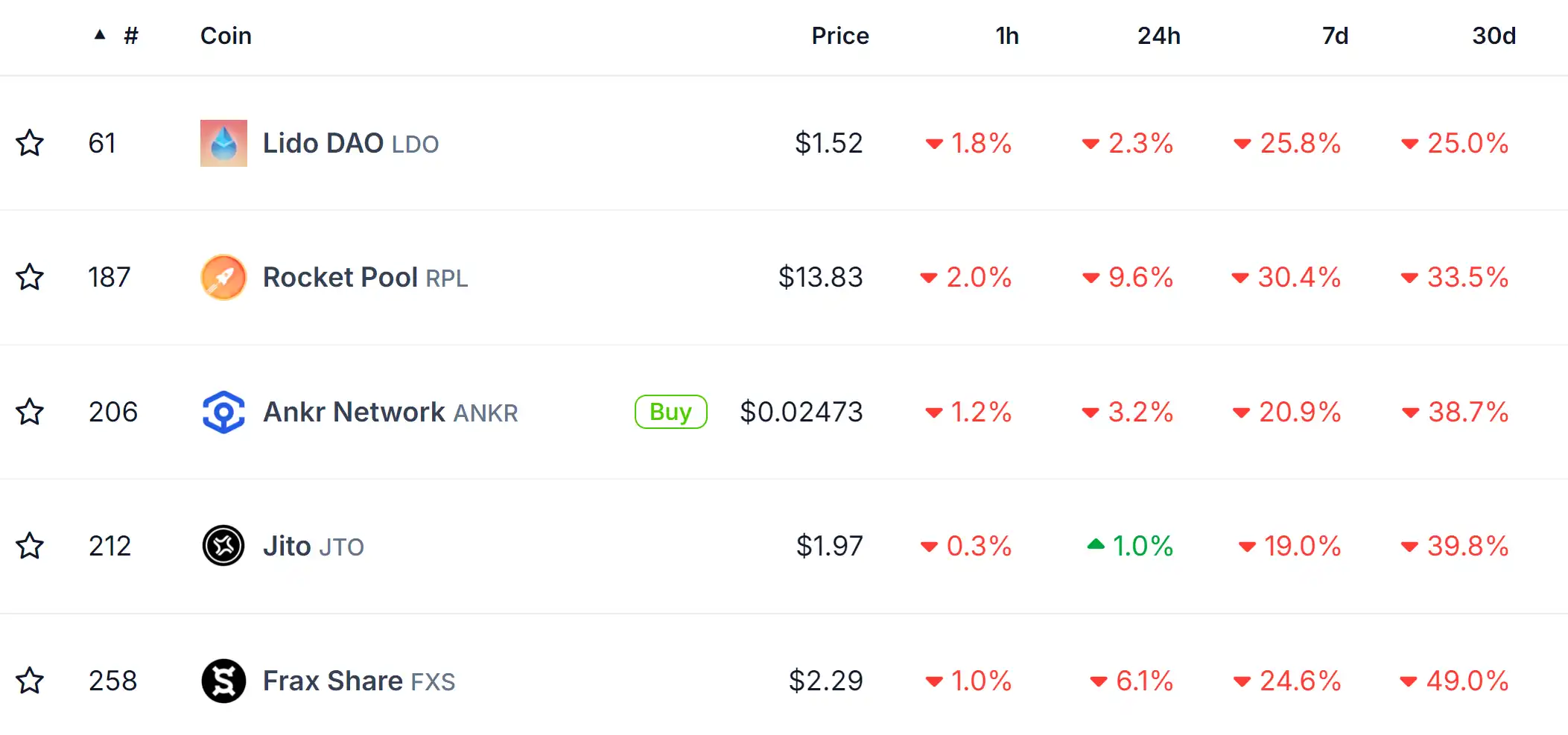

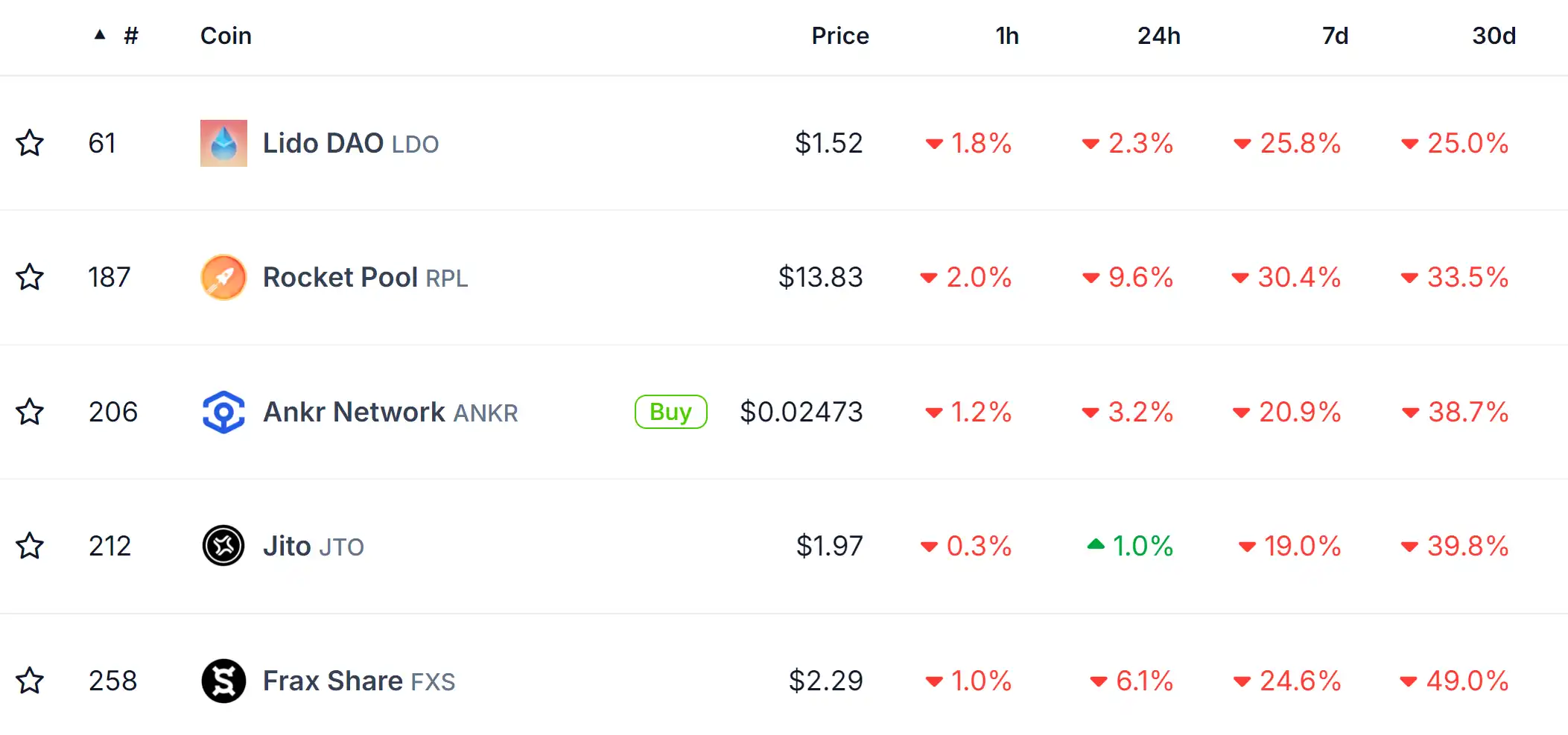

encryption market pullback, but ETH, LSD Finance zone pump against the trend. Both Lido DAO and Rocket Pool pump more than 10%. In addition, SocialFi, Layer2, Decentralized Finance and DEP zone all have gains.

CoinVoice·2024-11-26 03:34

Experts give advice: Will Mt.Gox BTC receivers continue to hold or dumping?

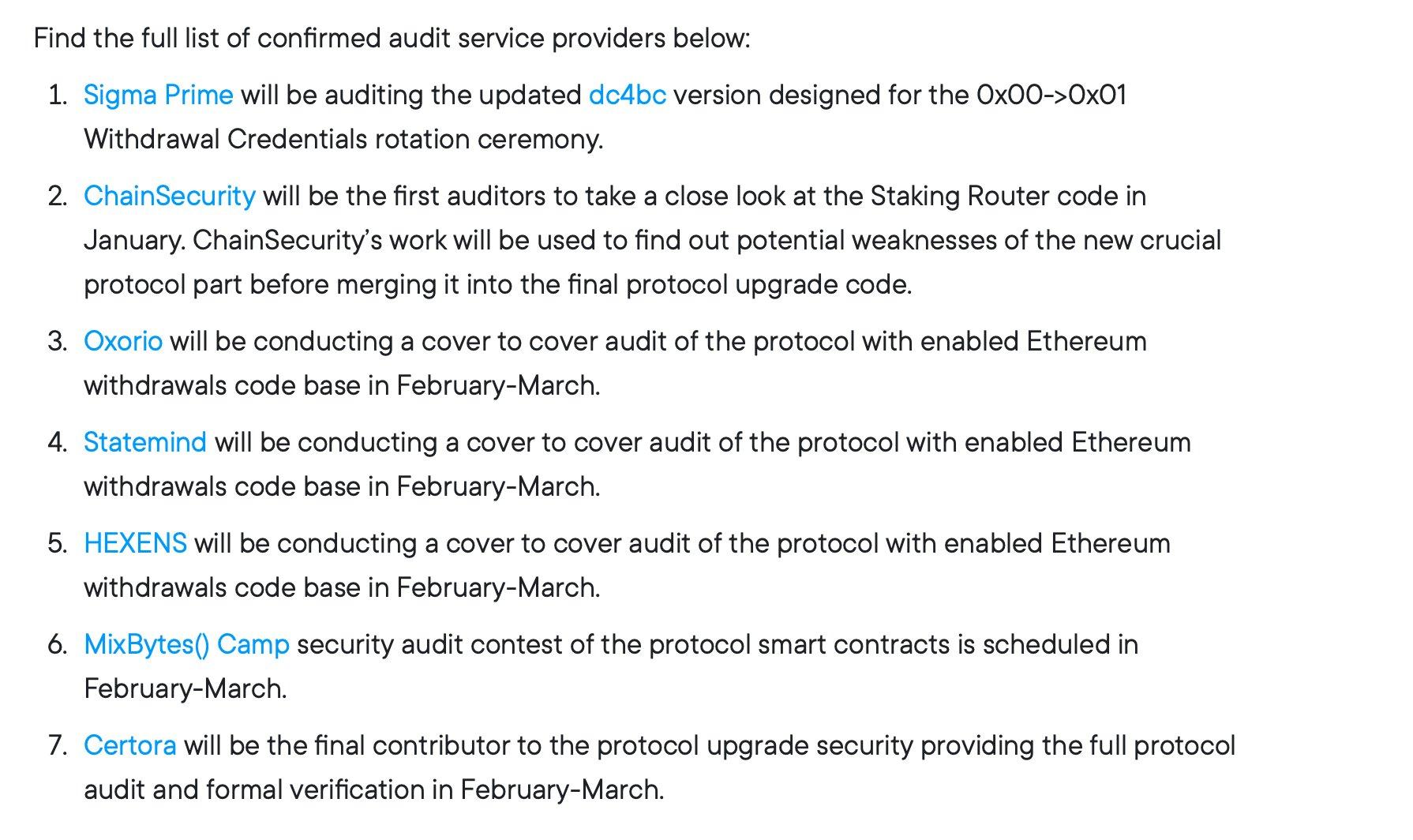

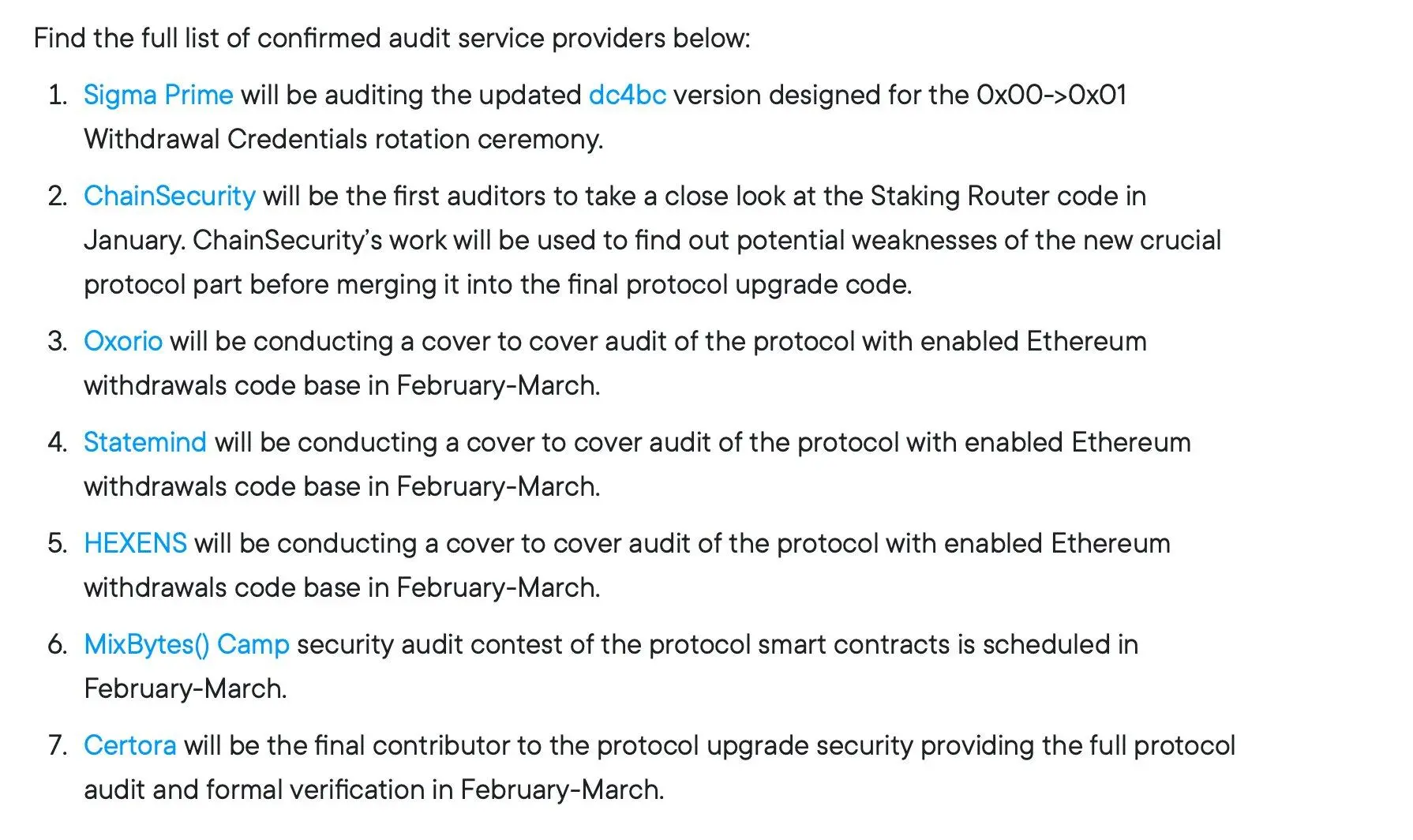

> 即将到来的升级旨在通过引入 Staking Router 架构和协议内 stETH:ETH 取款来增强质押体验。

**撰文:****@0xFinish**

**编译:ChainCatcher**

昨晚,流动性质押协议 Lido 发布 V2 升级投票公告,根据时间表:5 月 12 日 20:00 开始 Aragon 投票,5 月 14 日 20:00 主要投票阶段结束等。DeFi 研究员 Finish 在推特上发文表示 Lido V2 更新的影响将是巨大的,对于所有 LSD 用户来说,这是一个令人振奋的消息。你需要了解哪些信息?这其中有哪些即将到来的机会和变化?ChainCatcher 对其推文内容做了翻译和整理,原文如下:

这一主题将涵盖:回顾 Lido、Lido 的一些关键指标、V2 做了哪些更新、潜在影响以及如何参与。

在我们进入 Lido V2 之前,让我们快速回顾一下 Lido Finance 是什么。Lido 是以太坊上的去中心化流动性质押平台,允许用户质押他们的 $ETH 并获得 stETH 作为回报,该代币代表 1:1 质押的 ETH,可以在 Defi 中自由使用。

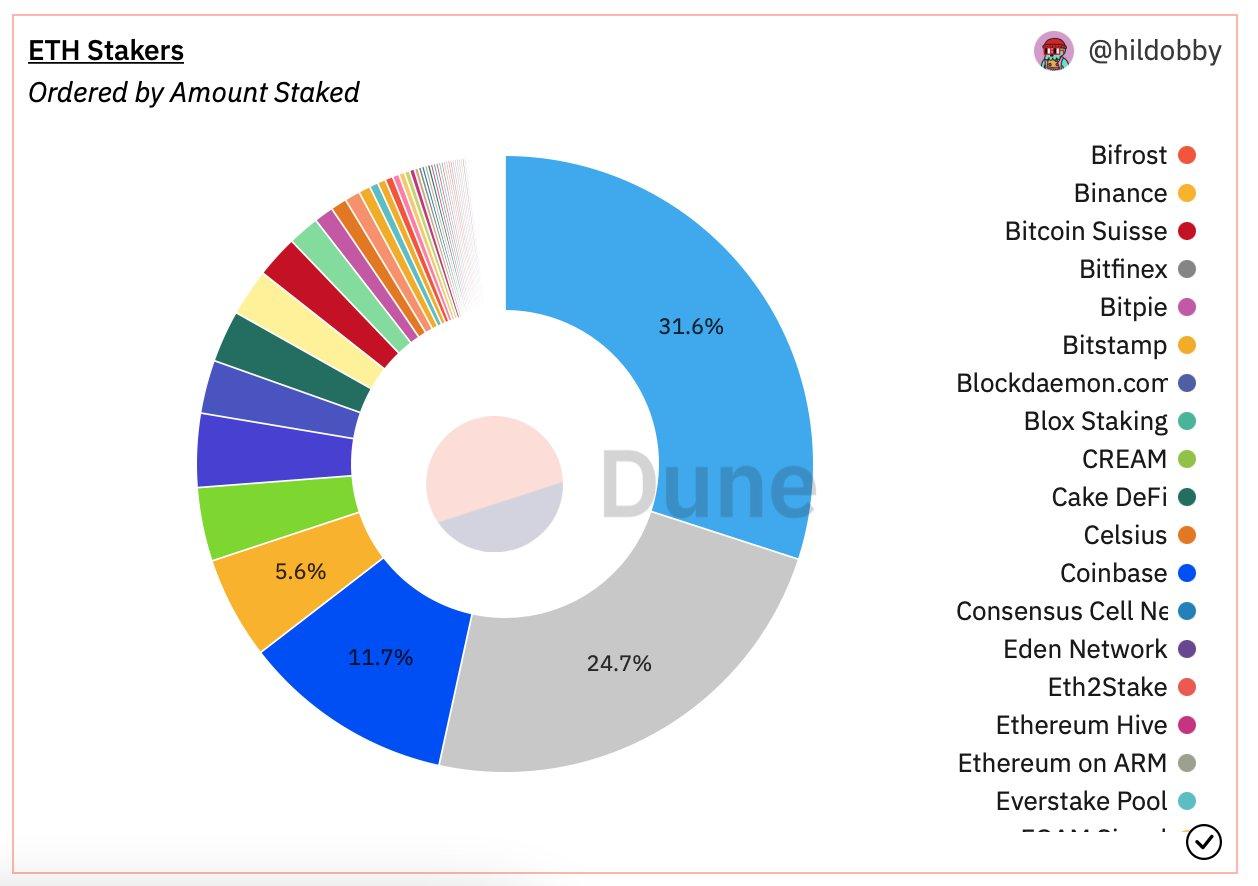

Lido 是目前最大的流动性质押平台,市场份额高达 31.6%。 这就是 V2 更新如此重要的原因,因为它对 ETH 生态系统产生了巨大影响。

Lido 也是所有平台中每月验证器增长最快的。随着 V2 更新,这些数字将增长得更快。

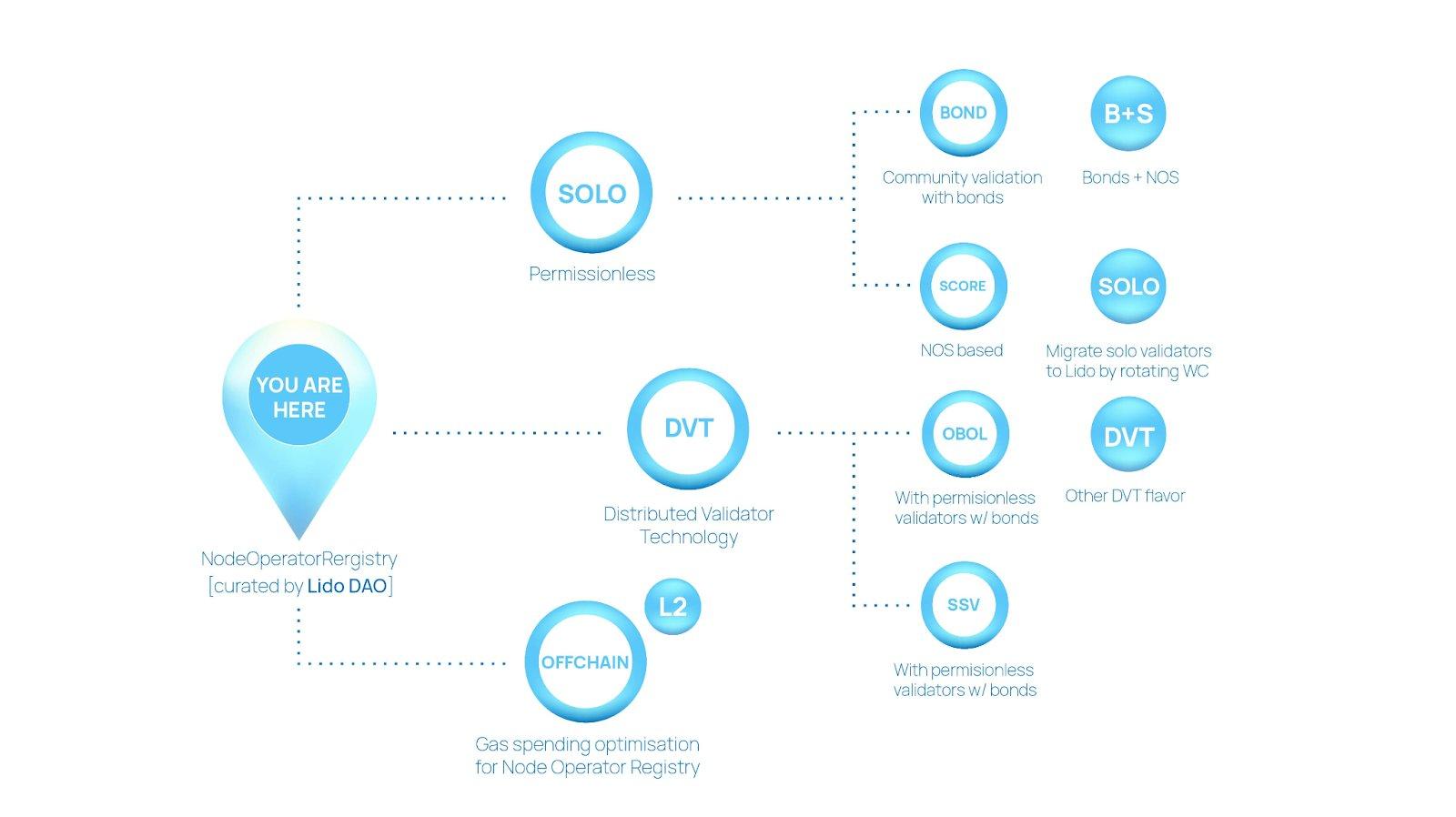

现在我们已经熟悉了 Lido,让我们深入了解 Lido V2。即将到来的升级旨在通过引入 Staking Router 架构和协议内 stETH:ETH 取款来增强质押体验。Staking Router Architecture 这种设计有助于在 Lido 协议中集成新的质押模块。这意味着用于处理抵押操作的改进和更高效的基础设施。

每个人都从中受益,质押者将把他们的资产分布在不同的实体中,这大大提高了去中心化和安全性。现在,其他类型的节点运营商 DAO、独立质押者和小团体可以参与 Lido。

即使是开发者。用户也将能够使用不同的节点运营商组合和具有各种竞争特征(例如覆盖选项和费用结构)来提议和实施模块,并申请加入 Staking Router 的模块集。

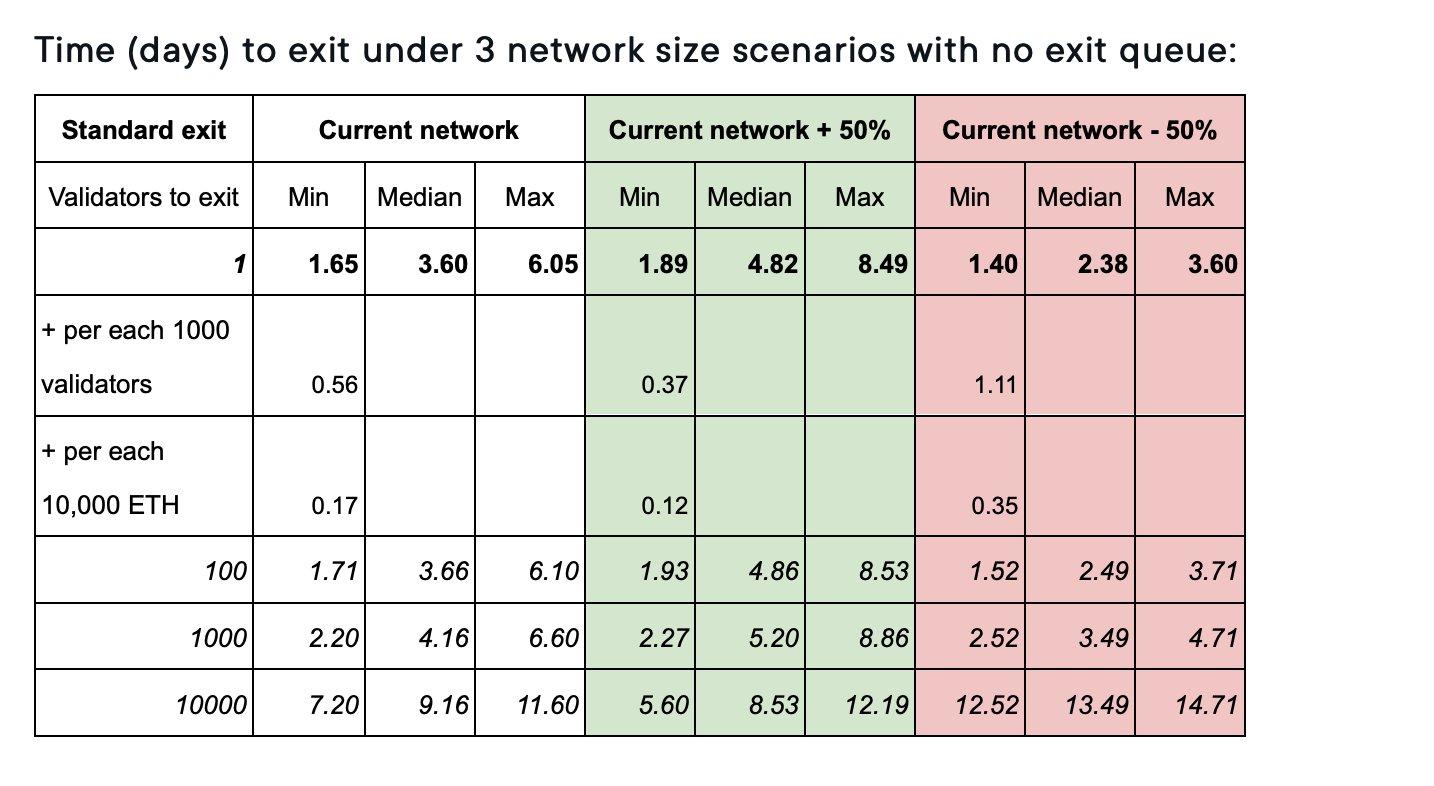

协议内 stETH:ETH 取款:这是 Lido V2 升级中为我们的利益相关者带来了改变游戏规则的功能,它简化了提款流程,使其更加人性化和高效。使用 Lido 取款会快得多,对于那些持有少于 1000 stETH 的人来说,不到 1 天即可取款。而标准的以太坊取款通常需要 2-6 天。以下是包含 3 种可能的提款时间的表格:

此外,巨量资金被锁定在协议中,安全性非常重要。Lido 有 7 次不同的审计和测试网,有 27 个不同的验证者,所以资金必须是安全的。

据 Lido 官方消息, V2 经过 9 次独立的审计,并在审计中发现了问题,所有问题都已得到确认或修复。

V2 更新将为用户带来多重好处。通过改进的安全性和新的质押路由器基础设施,LSD 将变得更加安全和去中心化。此外,通过快速提款,小钱包(<1000 $ETH)几乎可以即时提款,如果你是大钱包,你需要等待更长的时间,但与直接质押相比仍然更加灵活。

Lido V2 升级将于 5 月 12 日进行最终的链上投票。如果投票成功,升级将于 5 月 15 日上线,为 Lido 社区带来所有这些令人兴奋的新功能和改进。

BTC-4.41%

ForesightNews·2024-07-26 09:59

BTC LSD, how to help more long users share BTC staking rewards?

BTC Liquidity stake uses a cryptographic, trust-free mechanism to achieve secure stake of BTC on the Mainnet, generate returns, and benefit from other Decentralized Finance projects, while solving the inflation and launch difficulties of small and medium-sized PoS chains, providing a new way for BTC holders to earn income.

星球日报·2024-07-25 11:10

ETH ETF is coming, which ecological Tokens are worth following?

The US Securities and Exchange Commission has approved applications for 8 Ethereum spot ETFs, which are expected to be listed for trading soon; Gemini estimates that once approved, net inflows in the first 6 months could be as high as $5 billion, and the price of ETH may also pump as a result; Following continuous capital inflows, projects in the Ethereum ecosystem such as Layer 2, LSD, Decentralized Finance, stablecoin protocols based on ETH collateral, and staking are expected to benefit.

ETH-5.32%

星球日报·2024-07-10 02:26

Before the ETH spot ETF is launched, which Tokens can be traded?

The United States Securities and Exchange Commission has approved 8 ETH spot ETFs. The related companies have submitted an updated version of the S-1 registration application, and trading is expected to be launched next week or the week after. Once approved, the continuous inflow of funds may benefit the Ethereum ecosystem. Key areas to follow include Layer2, LSD, Decentralized Finance, ETH-backed stablecoin protocol, and stake, etc.

ETH-5.32%

律动·2024-07-10 02:06

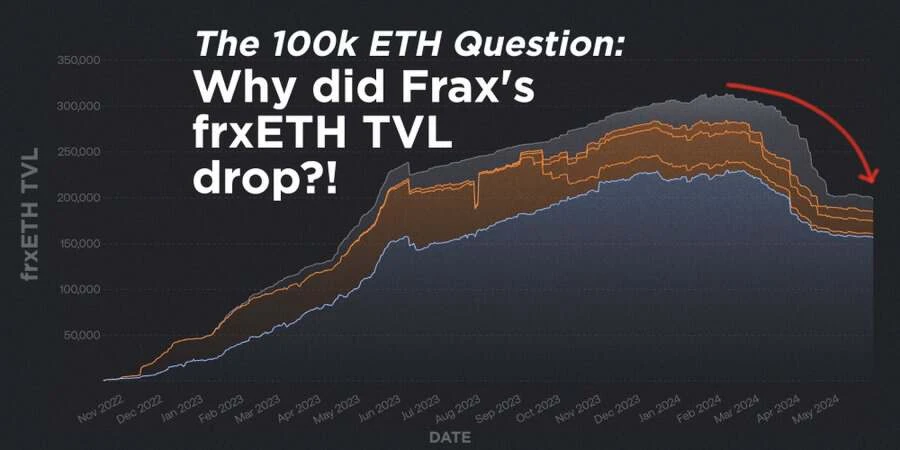

The frxETH TVL plummets, the variables hidden behind the LSD score war

Original author: StableScarab

Original text compilation: Tyler

As the highest-yielding ETH LSD, why has Frax Finance's frxETH, which was launched, suddenly reduced its TVL by 100,000 ETH in the past 3 months?

This article aims to help everyone understand the competitive ETH staking market and the underlying factors reflected by Frax Finance.

What is frxETH?

frxETH is Frax Finance

FRAX7.93%

星球日报·2024-06-13 02:23

Gryphsis Cryptocurrency Weekly Report: Bitcoin Price Breaks $52,000 for the First Time - ChainCatcher

Author: Gryphsis

Market and industry snapshots

Layer 2 Overview:

Last week, Layer 2 all showed positive growth, with zkSync Era showing the most obvious growth of 8.79%. Protocols like Ithil, Gravita Protocol, Teller, Interport Finance, and Starksport have demonstrated noteworthy TVL growth rates.

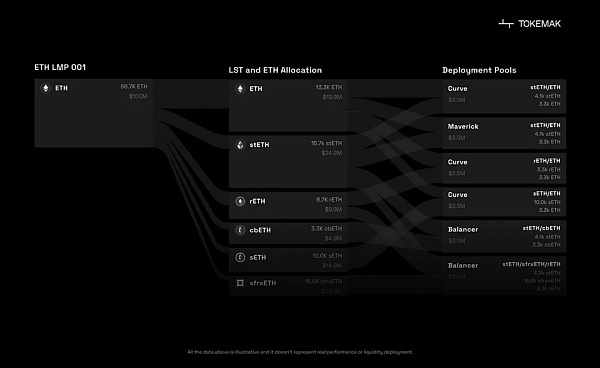

LSD Sector Overview:

In the LSD field, both Ethereum deposits and total withdrawals increased, but the withdrawal volume was more obvious at 2.51%. In terms of market share, stETH has achieved explosive growth of 3-4 times, accounting for nearly 80% of the total share. swETH and

链捕手·2024-02-28 02:13

How does Entangle, the cross-chain DeFi protocol that continues to write the LSD track and intends to enter the re-staking field, interact?

> Entangle envisions a future where DeFi dApps are not limited by a single blockchain.

Written by: Luccy

On January 10, cross-chain DeFi protocol Entangle announced the completion of US$4 million in seed and private placement rounds, with participation from Big Brain Holdings, Launch Code Capital, LBank Labs, Skynet EGLD Capital, Cogient Ventures, Owl Ventures, Faculty Group, Seier Capital and other institutions. cast. The new funding will be used to advance its protocol technology, expand its global reach, and strengthen its role in the advancement of cross-chain and interoperable data.

ForesightNews·2024-01-17 12:41

10 Predictions for 2024

> Nine Purples and Fire Luck in Twenty Years will be good for Crypto in the long run.

Written by:IOBC Capital

Looking back on the past 2023, Crypto's total market value has returned to US$1.7 trillion, with an annual growth of more than 110%. Cryptocurrency has passed the cold winter of the cycle.

During this year, the cryptocurrency industry mainly had the following impressive events:

1. Binance reached a settlement with US regulators, and Crypto corporate compliance has become a mainstream trend;

2. The Bitcoin ecosystem leads the new paradigm of Fair Launch, mainly due to the feasibility brought by Taproot upgrade.

3. Ethereum’s LSD/LSDFi defines “risk-free returns” in the cryptocurrency industry, and ETH Staking’s return positioning is similar to “Crypto

ForesightNews·2024-01-15 08:10

What other potential protocols have yet to be issued in the Cosmos ecosystem?

> Take a look at the 4 protocols in the Cosmos ecosystem that are about to launch tokens.

Written by: Sleeping in the Rain

During this period, apart from $ATOM, other chains in the Cosmos ecosystem were basically making trouble:

Neutron is recruiting some remnants of the Luna era to develop the AEZ (ATOM Economic Zone) ecosystem. The Launchpad Eclipse on it is also worthy of attention.

The main lines of Osmosis are LSD, suppressing inflation and merging with Umee (now UX).

Although Injective's ecology is weak, its main force is strong and its currency price performance is very good.

Kujira performs equally well. Kujira’s staking income is not inflation, but real income.

Thorchain goes native

ForesightNews·2024-01-15 07:23

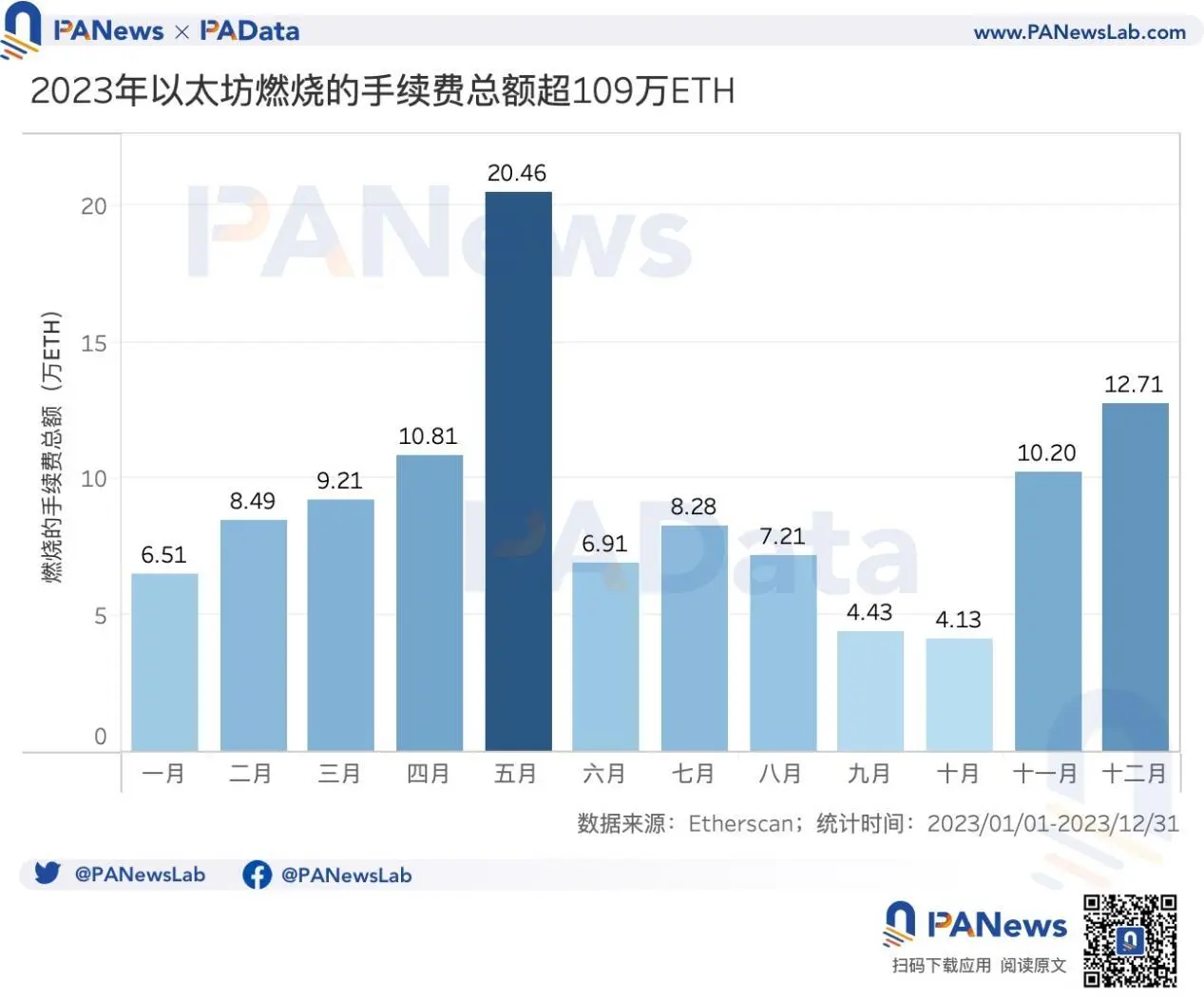

Data on Ethereum 2023: pledge amount +60%, annual supply -0.28%, average TVL of 12 L2 +333%

> This article analyzes the data of liquidity staking and L2 in 2023 to review and look forward to the development of Ethereum.

Written by: Carol, PANews

In 2023, Ethereum has two main story lines.

The first line relates to liquidity staking. In April, Ethereum completed the Shanghai upgrade, officially opened pledge withdrawals, and entered the era of "interest rate control". However, contrary to earlier market concerns, the upgrade of Ethereum not only did not cause large-scale selling pressure, but instead attracted more deposits as the currency price rose, making LSD the most popular DeFi track.

The second line is related to Layer2 (hereinafter referred to as L2). Arbitrum’s airdrop not only renewed the “myth of wealth creation” once again, but also raised expectations for other L2 airdrops. Additionally, with Base

ForesightNews·2024-01-09 07:28

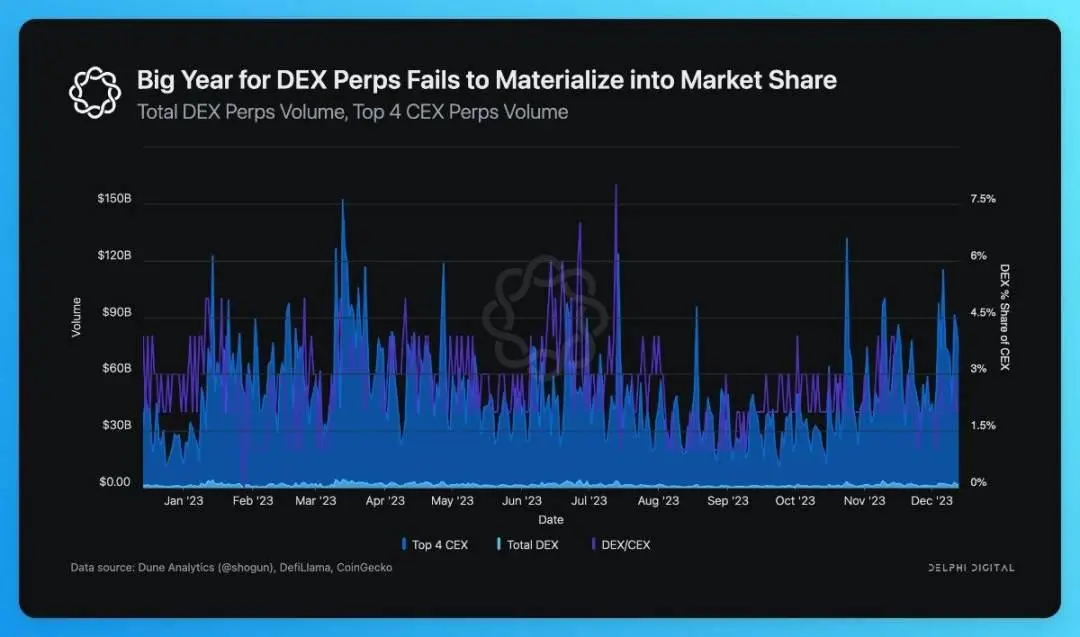

Delphi 2024 DeFi Outlook: The LSD track is saturated, and interest rate derivatives are more attractive

> Derivatives markets are emerging as a key area with untapped potential for decentralized stablecoins.

Written by Stacy Muur

Compiled by: Deep Wave TechFlow

Recently, Delphi\_Digital released its outlook for DeFi in 2024. The author Stacy Muur selected the main content and compiled it in this article for readers' reference.

Liquid pledge

Relative to the total supply of 120.2 million ETH, the ETH pledge rate is currently 23.7%. The amount of staked ETH is approaching the target of 33.5 million ETH (accounting for 27% of the total ETH supply). This staking amount is considered the optimal level to ensure network security.

LSD

ForesightNews·2023-12-27 01:57

The current bullish sentiment in the market is high, and the Cancun upgrade has begun to hype, leading the copycat charge to a wave!

With the end of November, from the perspective of the ETH exchange rate, the ETH that has been weak for nearly half a year, should start to exert force this month, ETH the morning is also to begin to exert force, it is expected that this week is likely to break through the front of the strong pressure around 2140, if the volume breaks through, then the cottage will usher in a wave of continuous outbreak, from the Cancun upgrade time we work backwards, should not be later than March next year, according to the previous wave of ETH April upgrade, January began to hype the rhythm of speculation, this month should also start to hype Cancun upgrade, after all, the market expects that the BTC ETF will also be approved between January 5 and 10 next year, once approved, good landing, may bring a wave of decline to the market, then ETH must lead the cottage charge before the good landing, and then give a certain space for the callback!

According to this expectation, the focus of this month's hype is that the two leading ARB and OP of Cancun's upgrade, followed by the LD of the LSD track...

币小白_·2023-12-02 00:15

2023 Crypto Narrative Evolution: From AI to Bitcoin What's Next

In the cryptocurrency market, it's important to understand which narrative dominates the market. Every month is a narrative performance, and each narrative has a unique protagonist. Through this article, we'll take you through the cryptocurrency market in 2023 and review a variety of compelling narratives.

2023 Focused Narrative Timeline

1.AI (22.12~)

OpenAI's ChatGPT has sparked interest in the crypto AI space.

Top performer - $AGIX $FET (~10x)

Excellent performance - OCEAN, CTXC

2.LSD (23.1~)

After the Ethereum Merge, staking demand rose, and LSD attracted attention.

Top performer - $LDO (~4x)

Excellent performance - RPL, FXS, SD

3. Chinese Narrative (23.2~...

币小白_·2023-11-30 05:27

Blast Storm: TVL's Explosion of Secrets and Controversies

dt X DeFi\_Cheetah,DODO Research

With the delivery of the second phase of Blur's airdrop rewards, the introduction of Blast, an L2 public chain also developed by the Blur team, was announced, and the announcement has exceeded $600M in just nine days, approaching the TVL of Solana's entire chain (662M).

Blast introduced

Blast's goal is to create the only L2 public chain with native yields from Ethereum and stablecoins, although the whitepaper and technical details have not yet been announced, but users are allowed to deposit funds into their mainnet contracts and start earning LSD & RWA yields, as well as start points activities.

Blast can in a short period of time...

金色财经_·2023-11-30 04:44

Why is Blast a feast for big households and the end of small households?

Why is Blast a feast for big households and the end of small households?

The whole network is milking Blast, and I'm only talking about Balst for small households. The essence of TVL mining in Blast is similar to that of LSD projects like EigenLayer. Your TVL contribution is directly proportional to your score. Then there's the ability to pull heads and the number of cards drawn by the team's luck.

In terms of the number of TVL and airdrops alone, I don't think Blast is a kind of Defi Farming. Not friendly to small households.

First of all, in terms of TVL, Blast now has 250 million TVL, and it can reach 1 billion by sight. Assuming that the total value of Blast's final airdrop is close to ARB, calculate the total value of his airdrop of 1 billion.

ARB's TVL was over 2 billion at the time, and the final airdrop value was about 1.3 billion...

币小白_·2023-11-24 05:13

Why is Blast a feast for big households and the end of small households?

Why is Blast a feast for big households and the end of small households?

The whole network is milking Blast, and I'm only talking about Balst for small households. The essence of TVL mining in Blast is similar to that of LSD projects like EigenLayer. Your TVL contribution is directly proportional to your score. Then there's the ability to pull heads and the number of cards drawn by the team's luck.

In terms of the number of TVL and airdrops alone, I don't think Blast is a kind of Defi Farming. Not friendly to small households.

First of all, in terms of TVL, Blast now has 250 million TVL, and it can reach 1 billion by sight. Assuming that the total value of Blast's final airdrop is close to ARB, calculate the total value of his airdrop of 1 billion.

ARB's TVL was over 2 billion at the time, and the final airdrop value was about 1.3 billion...

金色财经_·2023-11-24 04:58

There are three major trends in the LSD track: decentralization, DeFi enhancement, and full chain

Author: 0xmiddle Source: X (formerly Twitter) @0xmiddle

It's been half a year since Shanghai's upgrade, and the LSD War continues to heat up. Due to the huge market capitalization of 100 billion yuan, LSD has always been a highly competitive field.

There are old players like Lido and Rocket Pool, and new players like Puffer and Stader joining the table.

So what are the new trends and new ways to play in the LSD field? Where is the LSD track headed? What kind of project will gain a greater advantage over the competition? What is the endgame of the LSD circuit?

1. Decentralization: a banner of political correctness

In July of this year, LIdo launched a bombardment of Rocket Pool, pointing out that its contract has sudo permissions, and the team can make arbitrary changes to key parameters, accusing...

金色财经_·2023-11-13 09:46

Take stock of the three major trends of LSD projects: decentralization, DeFi enhancement, and full chain

Author: 0xmiddle

It's been half a year since Shanghai's upgrade, and the LSD War continues to heat up. Due to the huge market capitalization of 100 billion yuan, LSD has always been a highly competitive field. In the past, there were old players such as Lido and Rocket Pool, and then new players such as Puffer and Stader joined the table. So what are the new trends and new ways to play in the LSD field? Where is the LSD track headed? What kind of project will gain a greater advantage over the competition? What is the endgame of the LSD circuit?

Decentralization: A banner of political correctness

In July of this year, Lido launched a bombardment of Rocket Pool, pointing out that its contract has sudo permissions, and the team can make arbitrary changes to key parameters, accusing Rokect Pool of not being decentralized enough. And then in August...

COINVOICE(链声)·2023-11-13 06:10

What Aphla investment opportunities are contained in the Ethereum Cancun upgrade?

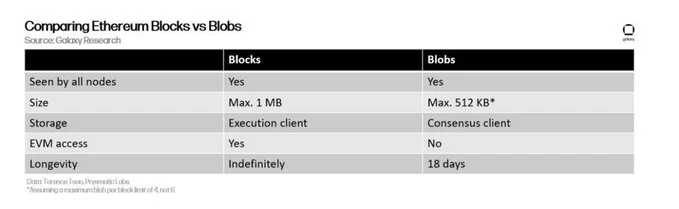

The Cancun upgrade (Dencun) is another major mainnet upgrade after the Ethereum Shanghai upgrade.

We know that the Shanghai upgrade successfully deployed to the main network in March this year gave birth to a wave of LSD and LSDfi super market. $LDO $RPL $SSV $LBR $PENDLE and other investment targets have become Aphla opportunities to outperform the market.

Therefore, the market will naturally have expectations, and the Cancun upgrade will also bring some Aphla investment opportunities.

But before discussing what Aphla investment opportunities are, let’s take a brief look at Cancun Upgrade.

1. What is Cancun Upgrade?

The upcoming Cancun upgrade is divided into two parts: Deneb focuses on the consensus layer (CL), and Cancun targets the execution layer (EL).

According to Ethereum core developer Tim Beko...

金色财经_·2023-09-25 02:39

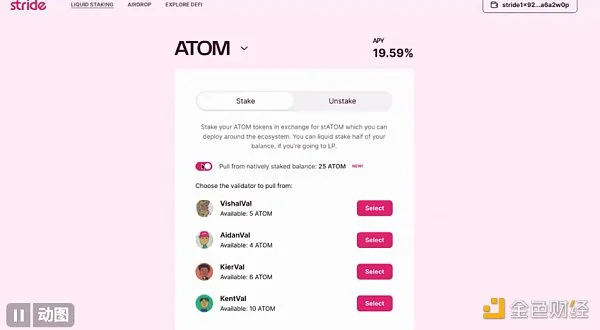

Analyzing Cosmos LSM: Redefining ATOM staking and liquidity strategies

Author: Jiang Haibo, PANews

Recently, Cosmos Hub completed the "Gais v12" upgrade and introduced the "Liquidity Staking Module" (LSM). Similar to other blockchains that use PoS mechanisms, there are already many projects that provide liquidity staking services in the Cosmos ecosystem, including Stride, pSTAKE, Quicksilver, Stafi, etc. What is LSM? Why is LSM specially introduced? What are they? What impact will the functions and limitations have on the Cosmos ecosystem? In this article, PANews will answer you one by one.

What is LSM? Why do you need LSM? How to achieve it?

LSM is an ATOM staking alternative in Cosmos Hub that allows users to convert staked ATOM into Liquid Staking Derivatives (LSD), aiming to be more secure,...

金色财经_·2023-09-21 06:12

Interest-bearing stablecoins: market landscape, potential risks and opportunities for improvement

Author: Caesar; Compiler: Shenchao TechFlow

Yielding stablecoins are considered the next revolution in the growing stablecoin ecosystem. Over the past year, many projects have emerged dedicated to developing yield-generating stablecoin products.

In this article, I will provide a comprehensive overview of the interest-bearing stablecoin landscape, highlighting the main categories in this space: LSD-backed stablecoins, Treasury-backed stablecoins, and other income-generating stablecoins. Following this, I will conduct a user analysis focused on identifying which types of users may or may not find interest-bearing stablecoins attractive.

I will conduct a SWOT analysis of interest-bearing stablecoins to shed light on potential areas of risk and opportunities for improvement in this space. Finally, I will share my thoughts on whether interest-bearing stablecoins meet market fit.

Overview of interest-bearing stablecoins

Interest-bearing stablecoins are a type of asset that can be...

金色财经_·2023-09-21 06:00

SWOT Analysis of LSD Stablecoin: Comprehensive Assessment of 5 Projects

2023 is an extraordinary year for builders exploring the potential of new DeFi primitives. One of the most notable developments during this time has been the rise of Liquidity Collateralized Derivatives (LSD) protocols, and the consequent protocol built on top of the LSD project, known as LSDfi.

These LSDfi projects can be divided into several different parts. In this article, my main focus is on LSD-backed stablecoins.

1. What is LSD? What is LSDfi?

Liquidity Collateralized Derivatives (LSD) are financial instruments that represent ownership of tokens pledged in a DeFi protocol. These tools enable users to stake their tokens while retaining the freedom to use these LSDs in a variety of applications. Some LSD protocols include Lido Finance and Rocket Po...

金色财经_·2023-09-15 07:55

Members of the Ethereum community: Will Lido pose a risk to the Ethereum ecosystem?

The Ethereum LSD protocol promises to limit the share of verifiers to less than 22%, but Lido's share exceeds 30%.

星球日报·2023-09-06 03:01

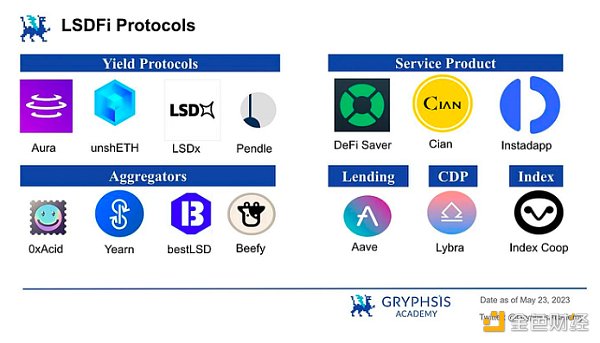

LSDFi ecosystem: current situation and future prospects

The essence of LSDFi is to combine the LSD market with DeFi products and protocols to provide users with more unique staking and lending opportunities. On the basis of LSD, LSDFi continues to innovate and explore more niche application fields.

The current pledge ratio of ETH is relatively low, far below the average level of other PoS chains. This means that the LSDFi (liquidity pledged derivatives finance) market still has huge growth potential, especially as the pledge ratio increases and more institutional funds inflow, which will promote the expansion and development of the market. The inflow of institutional funds has brought new development opportunities for LSDFi. The involvement and support of top institutions has brought more confidence to the LSDFi market. The inflow of institutional funds not only increases the depth of the market, but also drives more innovations, bringing more choices to LSDFi.

Revenue competition is one of the important characteristics of the LSDFi market. LSDFi protocol...

金色财经_·2023-09-05 08:46

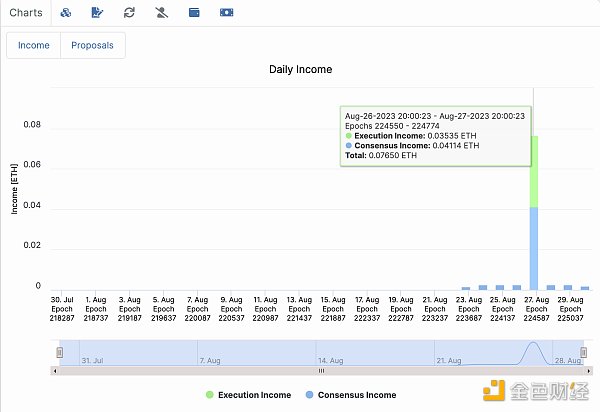

Ethereum SAAS pledge data record for one week

Author: darkforest; Source: mirror

One and a half months ago, I pledged a batch of Ethereum through the SAAS method. After a long 36-day wait, it has been online for a week. The specific data will be shown to you. You can compare it with the LSD method to let everyone have an idea of the Ethereum POS pledge. A clearer understanding.

I myself staking through two different staking service providers to diversify risks, namely P2Pvalidator and Allnodes. Judging from the operation of the nodes this week, there is basically not much difference in which operator to use.

Each staking service provider has its own staking monitoring dashboard, but personally I think the best one is the third-party beaconcha.in. Each data is more detailed and the statistical charts are more intuitive.

P2Pvalidator's board content is very concise, but the information...

金色财经_·2023-09-04 02:53

Taking Lido as an example to deeply explore the potential risks of the LSD protocol

Original Author: sacha Original Compiler: Qianwen, ChainCatcher

preamble

This article is a response to some of Danny Ryan's views (which will be presented in detail later).

The opposite of a fact is a fallacy, but the opposite of one profound truth may very well be another profound truth.

— Niels Bohr

Overall, I think Danny's position is great. But I also think there are equally significant risks to his approach that have not been properly discussed in public.

I don't think Danny's point is wrong per se, but I do think there's another side to his point that isn't communicated clearly enough. That's exactly what this article is about.

Introduction to Dual Governance

Dual governance is an important step in reducing the governance risk of the Lido Protocol. It represents the transition from shareholder capitalism to stakeholder capital...

金色财经_·2023-08-25 13:13

Taking Lido as an example, an in-depth discussion on the potential risks of the LSD protocol

This article is a response to some of Danny Ryan's comments on the LSD protocol.

星球日报·2023-08-25 12:08

In-depth analysis of LSD's governance risk, capital risk and protocol risk

Author: sacha, hackdm.io; Compiler: Lynn

A section-by-section response to an article written by Danny Ryan. Originally posted on notes.ethereum.org on May 30, 2022 and later copied to github.

Thanks to Hasu, Jon, Barnabé, Sam, Victor, Vasiliy, and Izzy for reading drafts of this article.

foreword

The opposite of a fact is a lie, but the opposite of one profound truth may very well be another profound truth.

— Niels Bohr

Overall, I think the position Danny is taking is great. But I also think his approach has equally important risks that have not been properly discussed in public.

I don't think Danny is wrong per se, but I do think...

金色财经_·2023-08-25 01:13

Proof of Validator: A key security puzzle on the road to Ethereum expansion

Today, a new concept was quietly born in the Ethereum research forum: Proof of Validator.

This protocol mechanism allows network nodes to prove that they are Ethereum validators without revealing their specific identities.

What does this have to do with us?

Under normal circumstances, the market is more likely to pay attention to the superficial narratives brought about by certain technological innovations on Ethereum, and seldom researches the technology itself in depth in advance. For example, the Shanghai upgrade, merger, transfer from PoW to PoS and expansion of Ethereum, the market only remembers the narrative of LSD, LSDFi and re-pledging.

But don't forget that performance and security are top priorities for Ethereum. The former determines the upper limit, while the latter determines the bottom line.

It can be clearly seen that on the one hand, Ethereum has been actively promoting various expansion solutions to improve performance; but on the other hand, on the road to expansion, in addition to practicing internal skills, it is also necessary to guard against external attacks. ...

金色财经_·2023-08-24 09:21

Inventory of 8 "Old Projects" of Transformation LSD

guide

After the upgrade of Ethereum Shanghai, LSDfi and ETH derivatives have undoubtedly become hot topics and narratives, and have also become a track for funds. Different from RWA, ETH pledge solves the income problem of encrypted users in a more native way, and has become an important part of Defi's future narrative.

According to incomplete statistics, the current ETH pledge scale is $22.7M ETH, about $41.4 billion, while the funds locked in the LSDfi protocol are less than $1 billion.

/

How to use ETH derivatives to create a "risk-free" income bottom layer, and use the huge ETH capital pool to create a flywheel has become a major attraction of DeFi in the future. In addition to using newly issued protocol tokens such as Lybra and UnshETH to lease ETH and LSD TVL protocol...

金色财经_·2023-08-11 03:27

DODO Research: The battle for LSD across the bull-bear project side

How to use ETH derivatives to create a "risk-free" income bottom layer, and use the huge ETH capital pool to create a flywheel has become a major attraction of DeFi in the future.

星球日报·2023-08-11 02:07

The battle for LSD across the bull-bear project

guide

After the upgrade of Ethereum Shanghai, LSDfi and ETH derivatives have undoubtedly become hot topics and narratives, and have also become a track for funds. Different from RWA, ETH pledge solves the income problem of encrypted users in a more native way, and has become an important part of Defi's future narrative.

According to incomplete statistics, the current ETH pledge scale is $22.7M ETH, about $41.4 billion, while the funds locked in the LSDfi protocol are less than $1 billion.

/

How to use ETH derivatives to create a "risk-free" income bottom layer, and use the huge ETH capital pool to create a flywheel has become a major attraction of DeFi in the future. In addition to using newly issued protocol tokens like Lybra and UnshETH to rent ETH and LSD TVL...

金色财经_·2023-08-10 13:35

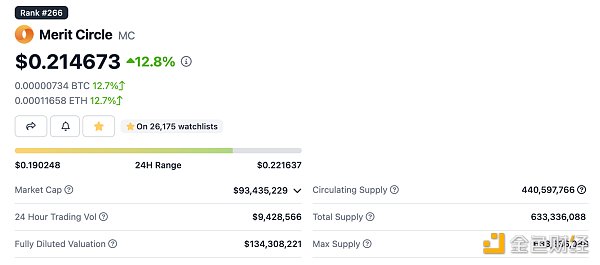

Game guild treasury comparison: $YGG, $MC, $GF whose valuation is more reasonable

By 0xscarlettw, Investment Manager @Mint Ventures

Summarize:

YGG: Almost all YGG, less than 4% of current assets;

Merit Circle has the best treasury balance, stable currency + blue chips, NFT and other game assets are almost half and half;

GuildFi treasury: Ethereum believers, 1/4 LSD stable income + 9% U + half of GF.

YGG: Almost all YGG, less than 4% of current assets

FDV 269M, mcap 49M。

Treasury situation: 203M YGG, 6.3M USDT, and the rest are ignored.

Market liquidity: Today's liquidity is particularly good, and the transaction volume is several hundred million, but it has actually shrunk to several million a few months ago.

Comment: The market's valuation of YGG should be...

金色财经_·2023-08-07 05:23

Evening must-read | LTC does not rise but falls

1. Interpretation of the three main narrative lines of the Ethereum LSD track: Why are hot money pouring in?

This article reviews the LSD track as a whole from the three dimensions of liquid staking protocol, liquid staking DeFi protocol, and decentralized solutions, and makes a summary analysis of representative agreements. It is believed that the current three major narrative directions have basically formed , and will explode with strong vitality in the next industry cycle, showing a trend of vigorous development. click to read

2. Evolution of Civilization: Getting Rid of Involution: From City Dwellers to Digital Nomads

For now, the activities of digital nomads are more about awakening the original memories of urban residents, making everyone re-emphasize public life and community culture, and re-focus on publicity, inheritance, and sustainability. This is actually a people-oriented value measure. If urban residents can embrace this value scale and embrace leisure, there is hope that they will transform into digital residents and gradually get rid of internal...

金色财经_·2023-08-03 12:20

LD Capital: Comparison of supply and demand of LDO and RPL tokens

Author: Yuuki, LD Capital

At present, the pledge rate of ETH has exceeded 20%, while still maintaining a good growth rate. We have detailed the fundamental market of the LSD track and different targets in previous reports. This article aims to analyze the token selling pressure and demand brought about by the non-secondary market transactions of the top two LSD targets of Lido and RocketPool from the perspective of funds, and provide a reference for the selection of targets for investment strategies with different investment periods. (FXS cannot be simply attributed to the LSD track due to its product diversification positioning, and there are deviations from the fundamentals of LDO and RPL, so it is not in the scope of discussion for the time being)

1. LDO Token Allocation and Sources of Selling Pressure

The total issuance of LDO is 1 billion, and the current circulation is 879 million; in the distribution of tokens, 40.2% belong to the team and verifiers, 34.6% ...

金色财经_·2023-07-23 07:18

LD Capital: Comparison of supply and demand of LDO and RPL tokens

This article aims to analyze the token selling pressure and demand brought about by the non-secondary market transactions of the top two LSD targets of Lido and RocketPool from the perspective of funds, and provide a reference for the selection of targets for investment strategies with different investment periods.

星球日报·2023-07-22 08:41

The rise of LSD: a new growth point for the DeFi ecosystem

Author: Gate Ventures Source: medium Compilation: Jinse Finance, Shan Ouba

Introduction to LSD

Following Ethereum’s recent transition to Proof-of-Stake through a “merger,” the act of staking ETH to validate the network has become a popular low-risk passive investment strategy for investors worldwide. Huge amounts of Total Value Locked (TVL) are tied up in Ethereum’s contracts and agreements, all in pursuit of “real yield.”

However, the downside of locking such a large amount of ETH is the lack of capital efficiency. To solve this problem, developers quickly rolled out a solution called Liquid Staking Derivatives (LSD). LSD is a specific type of financial instrument that enables users to earn staking rewards for their staked crypto assets without locking them up. Instead, idle liquidity is converted into a currency called stETH (“stake…

金色财经_·2023-07-17 08:24

There are new players in the liquidity staking protocol track

Liquid staking derivatives (LSD) is one of the hottest topics in 2023. Through the liquid staking protocol, you can pledge your ETH to ensure network security, and you will be given LSD as well as staking rewards. You can also LSD is used in DeFi.

We all know that in the field of staking agreements, Lido is indeed the absolute leader, but this is mainly due to his first-mover advantage. Today we will introduce other liquid staking agreements that are silently accumulating strength!

1.StaFi

StaFi Protocol is a decentralized protocol built with the Substrate architecture. You may not know much about the Substrate architecture. This is the blockchain architecture developed by Parity. The entire architecture integrates many development modules, including consensus modules, P2P modules, Staking modules, etc. , Avalanche is for...

金色财经_·2023-07-14 08:33

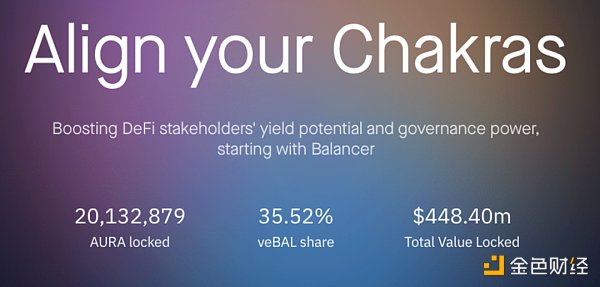

Interpretation of Balancer's innovation in DEX: 7 liquidity pools and architectural logic

Author: Jiang Haibo

Balancer has made several innovations in the development of DEX, but it is often overlooked. In June, Balancer's liquidity ranked fourth among DEXs, and its trading volume ranked fifth.

Balancer has made many innovations in the development of DEX, but it lacks a sense of presence under the competition of Uniswap and Curve. According to DeFiLlama's data, Balancer's liquidity in DEX is second only to Uniswap, Curve, and PancakeSwap, ranking fourth; the dashboard compiled by the co-founder of Dune shows that Balancer's trading volume in June this year is also second only to Uniswap, Curve, and PancakeSwap. PancakeSwap, Curve, DODO, ranked fifth.

In the development of LSD, Balancer also occupies a good market, Ba...

金色财经_·2023-07-08 09:21

Load More