Search results for "NAVI"

Forward Industries hires former ParaFi executive to lead Solana treasury strategy

Forward Industries has appointed Ryan Navi as chief investment officer to lead its Solana-focused treasury strategy. Navi, with a background in digital asset investments, will manage capital sourcing and staking operations. Despite holding significant SOL assets, the company’s shares have declined amid a broader downturn in Solana-focused firms due to falling token prices.

SOL-4.09%

Cointelegraph·2025-12-01 22:09

SUI ecosystem explosion: Astro Perp DEX volume exceeds 100 million; stablecoin USDsui launched.

In late October 2025, the decentralized perpetual futures exchange Astros, based on the SUI network, achieved a trading volume of over 100 million USD within a week of its launch, demonstrating strong growth momentum. At the same time, the SUI network officially launched the native stablecoin USDsui, developed by Bridge, a company invested in by Stripe, aimed at providing a compliant digital dollar solution for the ecosystem. These developments mark an enhancement of SUI's competitiveness in the DeFi space — directly integrating the NAVI Protocol's $1 billion lending pool and collaborating with multiple mainstream CEX wallets to provide users with a seamless trading experience.

MarketWhisper·2025-11-13 07:48

The liquidity in the Sui currency market is tight! The utilization rate of mainstream lending protocol USDC is 100%, and users cannot withdraw.

The TVL of the Sui on-chain DeFi protocol has significantly decreased over the past month, mainly due to the loss of funds after the Momentum Airdrop and the outflow of funds from major lending protocols such as NAVI, SuiLend, and Scallop. In addition, the USDC utilization rate of NAVI and SuiLend has reached 100%, preventing users from withdrawing, and the high borrowing annual interest rates highlight the tight liquidity situation.

ChainNewsAbmedia·2025-11-07 11:54

Sui ecosystem Ika short time big pump 900%, triggering million dollar liquidations

The Sui ecosystem token ika suddenly experienced a big pump at 5:03 AM Taiwan time on the 9th, soaring from 0.043 to 0.431 within half an hour, followed by a retreat. The overall increase reached 900%, but by the time of writing, it had returned to a price of 0.036. According to CoinMarketCap data, ika has a circulating market capitalization of approximately $109 million. Since ika is not listed for Futures Trading on major exchanges, it is speculated that the price fluctuation may have caused a chain liquidation phenomenon in DeFi protocols.

ika big pump event liquidated a million dollars, one address profited 200,000 through flash loans.

According to statistics

SuiLend liquidated 39.8 million ika at a market price of about 1.43 million USD (

Navi liquidated 32.1 million ika ) at a market price of approximately 115

ChainNewsAbmedia·2025-09-10 02:15

Gate Today's Popular Token Analysis: VINE, ZORA, NAVX lead the pump of crypto assets, showing extremely strong long positions momentum.

As Bitcoin (BTC) experiences a rebound, Vine (VINE), Zora (ZORA), and Navi Protocol (NAVX) lead the charge in the Crypto Assets market. Mainstream alts generally rise, with the top 100 alts outperforming Bitcoin's gains in the short-term; furthermore, the fear and greed index indicates that market sentiment remains optimistic, suggesting a potential continuation of structural rotation in the short-term.

MarketWhisper·2025-07-28 07:25

NAVI officially announced the launch of the first Multi wallet management system in the Sui ecosystem, NAVI Copilot.

NAVI Protocol has launched the first Multi wallet management system NAVI Copilot for the Sui ecosystem, allowing users to view DeFi service data in one place and intelligently manage multiple wallets and assets. It will continue to iterate in the future and introduce more management features.

DeepFlowTech·2025-07-10 11:28

NAVI has partnered with Tomo to provide quick log in features for social media.

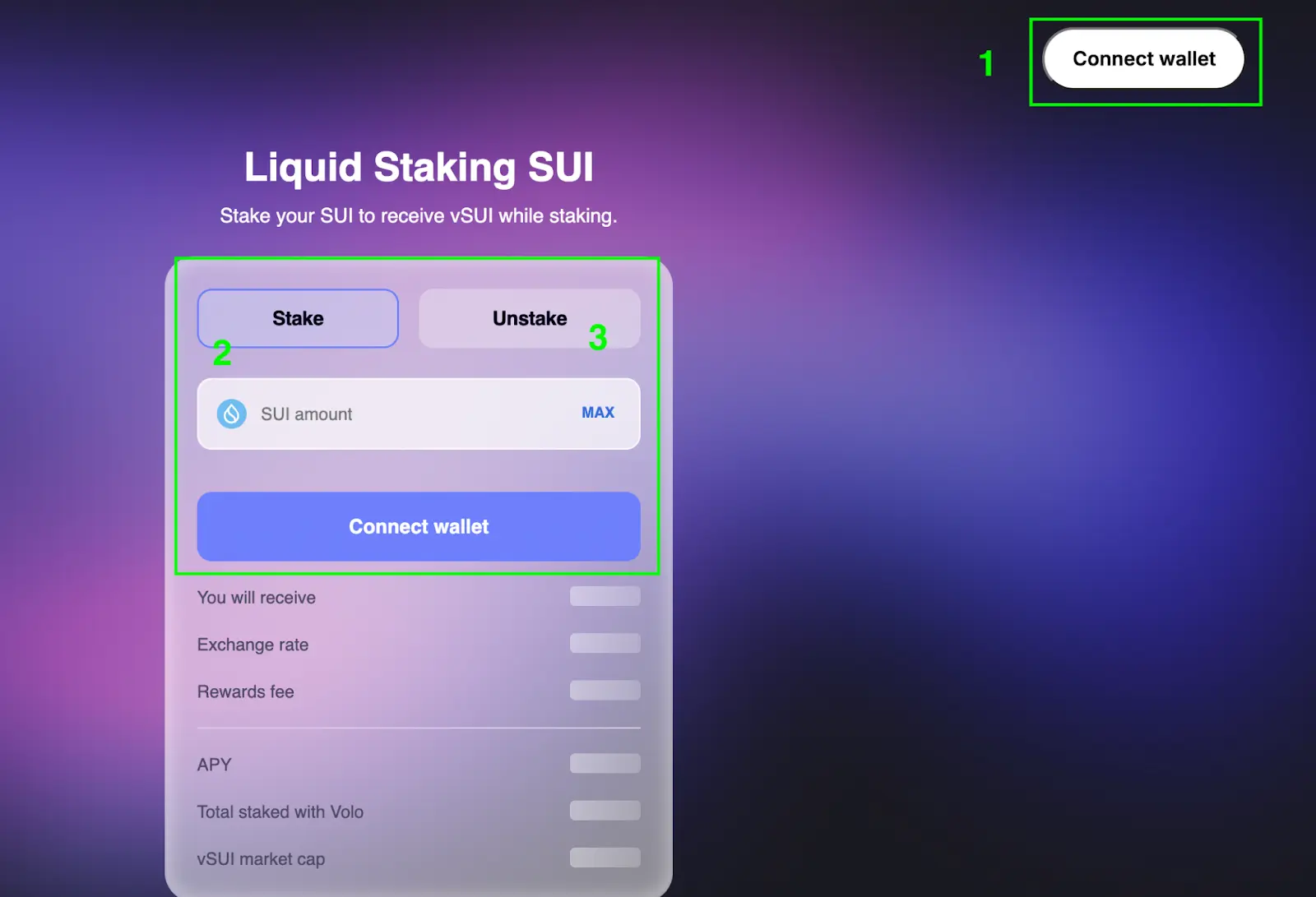

According to Shenchao TechFlow news, on July 8, NAVI, the leading liquidity protocol on Sui, has reached a partnership with Tomo Connect to provide a convenient social media log in feature for its comprehensive DeFi ecosystem. Users can log in directly using their Google, Twitter, KakaoTalk, or Telegram account to access NAVI's advanced DeFi features, including flash lending, decentralized trading via Astros, and liquid staking through Volo, among others.

NAVI is a DeFi infrastructure that supports Sui, with over 20 liquidity pools, including BTCFi, native stablecoins, and Sui assets. Tomo Connect is dedicated to providing convenient and secure user log in solutions for Web3 projects. By integrating Tomo Con

DeepFlowTech·2025-07-08 10:19

The exclusive xBTC event in collaboration with OKX has been launched by NAVI, with rewards of up to 700,000 USD.

The Sui ecosystem DeFi project NAVI Protocol has partnered with OKX to launch an exclusive xBTC event, running from June 27, 2025, to August 27, 2025, with a total rewards pool of $700,000. Users can enjoy unlimited transaction fee rebates and borrowing rewards, and NAVI is the only decentralized protocol offering xBTC.

DeepFlowTech·2025-06-27 13:34

xBTC Phase 1 is now live on Sui, NAVI has partnered with OKX to become the exclusive lending protocol for xBTC.

According to Deep Tide TechFlow news, on June 24, xBTC was launched in the Sui ecosystem, with NAVI Protocol exclusively collaborating with OKX to provide an xBTC liquidity pool and launch incentive measures. Users can deposit xBTC, USDC, or SUI to participate in the prize pool distribution. xBTC is a wrapped Bitcoin issued by OKX, ensuring a 1:1 reserve mechanism to guarantee asset security.

SUI-0.52%

DeepFlowTech·2025-06-24 11:17

Source of faith after the hack: Why does SUI still have long-term rise potential?

After the attack on Cetus on SUI, let's make a comprehensive understanding of SUI. This article is jointly published by Aquarius Capital and Klein Labs, especially thanks to the NAVI Protocol, Bucket Protocol and other ecological projects and Comma3 Ventures for their technical guidance and support in the research process. How will the Sui Foundation release the $160 million frozen from hackers? (Background added: What do the victims of the Cetus hack think?) The Sui team demanded a commitment to "full repayment" with two key conditions (TL); The DR 1.Cetus vulnerability stems from the contract implementation, not the SUI or Move language itself: This attack is fundamentally based on the boundary correction of arithmetic functions in the Cetus protocol

SUI-0.52%

動區BlockTempo·2025-06-06 14:52

NAVI Votes YES to Cetus Proposal for Full Recovery to Sui Users

NAVI has formally cast a YES vote on the Cetus protocol recovery proposal. This demonstrates its strong belief in decentralized governance and user security. Given the recent $60 million exploit and the ensuing $162 million asset freeze, NAVI’s position demonstrates how important confidence,

Coinfomania·2025-05-28 07:33

NAVI announced a partnership with OKX to exclusively launch the xBTC liquidity pool on the Sui network.

NAVI Protocol has partnered with OKX to launch the xBTC liquidity pool on the Sui network, enhancing the capital efficiency of Bitcoin holders within the Sui DeFi ecosystem. In the future, NAVI will introduce more activities to increase the liquidity and lending capabilities of xBTC. xBTC is a wrapped Bitcoin issued by OKX, adhering to a strict 1:1 reserve mechanism, allowing users to freely exchange between the exchange and the target chain, ensuring asset security through on-chain reserve proof.

SUI-0.52%

DeepFlowTech·2025-05-22 10:06

Hotcoin exchange will list TGT, CYCLE Spot and NAVX Futures Trading pairs.

Hotcoin exchange launched new trading pairs on May 21: CYCLE/USDT, NAVX/USDT contracts (supporting up to 20x leverage), TGT/USDT. These projects are respectively Cycle, Navi Protocol, and Tokyo Games Token, dedicated to Decentralized Finance, innovative DeFi solutions, and a unique gaming experience that combines gaming and Blockchain technology.

DeepFlowTech·2025-05-21 03:18

NAVI Protocol leads the Sui ecosystem BTC lending market, with a market share of over 60%.

According to DefiLlama data, the total borrowing volume of Bitcoin lending platforms has reached 2000 BTC. Among them, NAVI Protocol holds a market share of 61.79%, with 1299.4178 BTC; Suilend has a market share of 37.42%, holding 786.9962 BTC; Scallop has a market share of 0.79%, holding 16.6008 BTC.

DeepFlowTech·2025-05-06 08:39

NAVI Protocol co-founder Elliscope Fang confirmed attendance at Sui Basecamp and will give a keynote speech.

Elliscope Fang, co-founder of NAVI Protocol, will give a keynote speech at Sui Basecamp, sharing NAVI's experience in building the Sui Decentralized Finance ecosystem. As one of the annual events of the Sui ecosystem, Sui Basecamp will be held from May 1 to 2 in Dubai. NAVI Protocol is one of the event sponsors, and early sign up will receive discounts.

DeepFlowTech·2025-04-28 10:31

NAVI launched the perpetual trading platform Astro Perps

The Sui ecosystem sub-project NAVI Protocol's trading platform Astros has launched the Perptual Futures trading platform Astros Perps. Users can seamlessly transition to the Sui network through the cross-chain exchange function, offering up to 25 times leverage. The Beta testing mode will be opened on April 10, 2025, and users participating in paper trading can receive activity rewards.

MarsBitNews·2025-04-10 10:07

SUI Decentralized Finance internal strife, Scallop accuses NAVI founder of using small accounts for fear, uncertainty and doubt (FUD) against competitors, NAVI declines to comment.

A lending protocol dispute has arisen within the Sui DeFi ecosystem, with the founder of NAVI Protocol accused of using fake accounts to spread negative information about the competing product Scallop in the Sui community. The founder of Scallop directly pointed the finger at Elliscopef as the mastermind behind it, claiming that NAVI is a tumor in Sui. Both parties are accusing each other, and NAVI officials have refused to comment. The entire incident has revealed internal conflicts within Sui DeFi and has garnered significant attention.

ChainNewsAbmedia·2025-04-01 04:28

Astros launches Cross-Chain Interaction Swap feature, bringing modular interoperability

SUI ecosystem's next-generation DEX aggregator Astros launches Cross-Chain InteractionSwap feature, supporting six major blockchains, addressing the fragmentation issue of Decentralized FinanceLiquidity, and partnering with Mayan Finance to leverage Cross-Chain Interaction technology for optimal Swap rates. The launch of Astros further solidifies NAVI's position in the Decentralized Finance field, bringing more Liquidity to the SUI ecosystem, moving towards a unified Decentralized Finance experience. NAVI continues to innovate and expand, committed to the mission of improving capital efficiency and increasing Liquidity.

DeepFlowTech·2025-03-06 06:15

SUI ecosystem Decentralized Finance protocol NAVI announced a rebranding and unveiled a new brand Logo

SUI ecosystem Decentralized FinanceprotocolNAVI is rebranding, releasing a new Logo, emphasizing its mission and values, and enhancing brand consistency with Volo and NAVI.AG. The new Logo is designed with a serpentine curve, with N representing NAVI, green symbolizing vitality and security; A representing Astros, orange representing passion and value; V representing Volo, blue representing innovation and reliability; I representing infinite innovation. The rebranding signifies NAVI's leading position in the Decentralized Finance field, and new products will be launched in 2025.

DeepFlowTech·2025-02-27 05:25

Ondo Finance and NAVI Protocol Launch USDY Rewards Campaign as Sui DeFi Expands

Key Notes

Users who deposit USDY between February 26 and March 12 can compete for a share of the $35,000 reward pool.

Sui’s DeFi ecosystem now exceeds $1.3 billion in total value locked, with stable assets contributing nearly $500 million.

USDY adoption continues to grow, with integrations

Coinspeaker·2025-02-26 15:30

Navi Protocol announced an important update in February

DeepTechFlow message, on January 22nd, NAVI Protocol posted on its official x account,

X-4.24%

DeepFlowTech·2025-01-22 13:03

SUI ecosystem Decentralized Finance protocol NAVI Protocol based on NAVI.ag launches NAVI TG Bot

NAVI Protocol has launched NAVI TG Bot, which provides one-click trading and automated trading functions in the SUI ecosystem. The trading robot is currently accessible through the official link, and users can enjoy features such as no Gas fees, best prices, and lowest slippage. NAVI also plans to introduce AI-driven trading signal scanning and automatic trading functions. NAVI.ag is a DEX aggregator based on the SUI blockchain, which improves user trading efficiency and experience.

DeepFlowTech·2025-01-20 11:38

A Quick Look at 12 Award-Winning Projects of SUI Hydropower

The first group of students from the Sui Hydropower Accelerator worked hard on their projects for eight weeks and received support in various fields, covering multiple areas such as Decentralized Finance, DePIN, and RWA. Thanks to teams such as Mysten Labs, FanTV, Navi, RECRD, Scallop, Studio Mirai, and Suilend for providing practical support to entrepreneurs. At the same time, the accelerator also announced the list of award winners.

世链财经_·2025-01-11 02:41

SUI TVL Surpasses $1.7 Billion Amid Lending Platform Rivalry – What’s Next?

The decentralized finance (DeFi) ecosystem of the SUI network has reached a significant milestone, with its Total Value Locked (TVL) exceeding $1.79 billion. This achievement is largely attributed to the success of lending platforms SuiLend and NAVI Lending, which have significantly contributed to

Moon5labs·2024-12-16 10:00

SUI collaborates with Babylon and Lombard to provide local minting LBTC service for users

CoinVoice has learned that Sui has announced a partnership with Babylon and Lombard to provide users with Sui on-chain minting LBTC services. Sui's lending protocol NAVI has also announced plans to collaborate with Lombard and support LBTC on the protocol.

SUI-0.52%

CoinVoice·2024-11-25 15:54

SUI collaborates with Babylon and Lombard to provide local minting LBTC services for users

On November 25th, Sui announced its collaboration with Babylon and Lombard to provide Sui on-chain minting LBTC services to users. Sui's lending protocol NAVI also plans to collaborate with Lombard and support LBTC Mining Pool on the protocol.

crypto2023A

SUI-0.52%

REVOX·2024-11-25 15:44

First Digital’s FDUSD Stablecoin Is Officially Live on Sui

FDUSD, one of the largest stablecoins globally, has become the second native stablecoin on Sui, the Layer 1 blockchain system. This partnership provides FDUSD multi-chain compatibility to Sui, expanding its utility within the DeFi landscape. The integration of protocols such as NAVI and Cetus and leveraging Sui’s native liquidity layer, DeepBook, will fuel the development of new applications, enhancing FDUSD's performance. FDUSD is entirely backed by cash and cash equivalents, and Sui's blockchain is an ideal platform for stablecoins due to its scalability and composability.

CaptainAltcoin·2024-11-20 14:16

Sui ecology explodes, Navi or Scallop, who is the leader in lending?

> When evaluating DeFi protocols, you cannot simply look at TVL.

Written by: spinach spinach

What is the reason for Sui’s surge? Is Sui's ecosystem about to explode? Spinach will give you a brief review and understanding of some projects in the Sui ecosystem that are currently worthy of attention.

After Spinach discovered last time that Sui's TVL and cross-chain activities had increased significantly, Spinach also experienced a surge in Sui by accident (without doing any research in advance).

I have never researched or paid attention to Move ecological spinach before, so I don’t know much about it, but since I wrote a few tweets about Move smart inscriptions, I discovered Move.

ForesightNews·2024-01-24 01:54

Interpretation of NAVI Protocol: The native token will be launched soon, and Sui Ecosystem will become the leading DeFi protocol with the highest TVL

> Focusing on LST, a 100-billion-level track, the native token will be launched soon, helping the project reach new heights.

Written by: Shenchao TechFlow

When it comes to the ecological cornerstone of the public chain, DeFi is the best choice.

It can be said that the modern financial trading system is constantly evolving and innovating around "improving market transaction liquidity". Under such a premise that "those who gain liquidity win the world", DeFi is a container for revitalizing liquidity, and among them: lending connects the supply and demand of tokens through smart contracts, and LSTFi (Liquid Stake Token Finance) can both release Capital liquidity can also achieve stable and diversified returns. The two are not only the track for hundreds of billions of business volume in the minds of countless people, but also the top priority of the public chain ecological construction.

In fact, an excellent DeFi

ForesightNews·2024-01-23 14:11

SUI TVL breaks through the US$300 million mark. A quick look at the top 10 potential ecological TVL projects in one article

> Inventory of the top 10 potential projects in SUI ecological TVL.

Written by: Web3 Insights

Since December, the SUI ecosystem has exploded, and TVL has soared. On January 14, TVL exceeded the US$300 million mark, with a weekly increase of more than 80%. As of this writing, TVL has reached US$320 million.

According to DefiLama, among the top 10 TVL projects, the track with the largest proportion is Dex; the Lending track’s Scallop and NAVI Protocol occupy the top two, and TVL accounts for one-third of the SUI ecological TVL.

This article compiles the top 10 SUI ecological TVL rankings

ForesightNews·2024-01-17 11:30

Load More