Search results for "NOT"

Beyond the Gold Rush: Decoding Cathie Wood’s Bubble Call and Its Signal for Crypto

In a pivotal market commentary, ARK Invest CEO Cathie Wood has declared gold, not artificial intelligence, to be the real asset bubble, following the precious metal's parabolic surge to a record \$5,594 and subsequent 9% crash.

This assertion is grounded in a staggering metric: gold's market capitalization now equates to 170% of the U.S. M2 money supply, a level last witnessed during the Great Depression in 1934. Concurrently, Bitcoin has retreated over 35% from its 2025 highs, yet its l

CryptopulseElite·27m ago

XRP Price Prediction 2026: Can It Hold $1.55 Support Amid Market Turbulence?

XRP faces a critical test as its price hovers near the \$1.60 mark, a level not seen in nearly nine months following a significant market-wide correction.

Despite a 24-hour trading volume exceeding \$4 billion indicating sustained interest, the token has succumbed to selling pressure linked to Bitcoin's downturn and broader macroeconomic concerns. However, a nuanced picture emerges from institutional activity, where select XRP-spot ETFs recorded notable inflows last week, suggesting some

CryptopulseElite·38m ago

TradingBaseAI Column | The most scarce ability in the market is not to seize opportunities, but to avoid being "eliminated" in the competition. In today's rapidly changing market environment, the true skill lies in maintaining resilience and adaptability, ensuring you are not the one who gets phased out as conditions evolve. Developing this ability is crucial for long-term success and staying ahead of the curve.

The article emphasizes that in the market, what truly matters is how to maintain ongoing participation, not just seizing opportunities. Many people are eliminated not because of a lack of ability, but because their participation methods are unstable, leading to a loss of engagement over the long term. TradingBaseAI is dedicated to enhancing participants' long-term retention ability by reducing the risk of elimination through systematic structures, thereby ensuring continuous participation in the market.

TechubNews·44m ago

Trump nominates Powell as Federal Reserve Chair. What does this mean for Bitcoin?

Trump nominates Waller to be Federal Reserve Chair, with markets expecting more aggressive rate cuts and balance sheet reduction. However, interbank liquidity has shifted from excess to tight, and forced balance sheet reduction could trigger a crisis; rate cuts need to balance relations with Trump, and with unemployment not breaking 4.5%, support is unlikely. Waller advocates for a "trend dependence" approach rather than "data dependence," and a lack of flexibility in the policy framework could amplify market volatility.

MarketWhisper·44m ago

Visa and Mastercard pour cold water on "stablecoins": Difficult to implement in financially mature countries like the United States

Visa and Mastercard stated that stablecoins have not demonstrated significant demand in mature markets and are unlikely to challenge traditional payment methods in the short term. Although stablecoins have technical advantages, risks and practical scenario limitations restrict their use in everyday payments. Financial institutions should view stablecoins as an integration option rather than a substitute.

CryptoCity·1h ago

The Saylor Stress Test: How a $900M Paper Loss Exposes the Flaws and Future of Corporate Bitcoin Strategy

Bitcoin's plunge below \$75,000 has pushed Michael Saylor's Strategy into an unprecedented position, with its massive 712,647 BTC treasury now sitting on over \$900 million in unrealized losses as the price trades below its \$76,037 average cost basis.

This breach of a critical psychological and financial threshold is not a momentary blip, but a fundamental stress test for the entire corporate Bitcoin treasury thesis. The event signals a pivotal shift from a market that rewarded aggressi

CryptopulseElite·1h ago

How Record ETF Outflows Signal Crypto’s Painful Shift From Narrative to Fundamentals

In January 2026, U.S. spot Bitcoin ETFs witnessed approximately \$1.6 billion in net outflows, marking the third-worst month in their history and driving Bitcoin’s price below \$80,000 for the first time since April 2025.

This exodus, mirrored in Ethereum ETFs but contrasted by inflows into SOL and XRP products, is not a typical market correction; it is a fundamental repricing event signaling the end of the post-ETF approval narrative cycle and the beginning of crypto’s demanding integra

CryptopulseElite·2h ago

CrossCurve Threatens Legal Action After $3M Cross-Chain Bridge Exploit

In brief

CrossCurve said Sunday an attacker exploited a flaw in its bridge contracts and identified 10 Ethereum addresses that received the funds.

Its CEO, Boris Povar, said their team would pursue legal and enforcement action if the funds are not returned within 72 hours.

Security

Decrypt·2h ago

The Compliance Trap: How India’s 2026 Budget Cemented a New Phase in Crypto Regulation

India's 2026 Union Budget has decisively maintained its stringent crypto tax regime—a 30% levy on gains and a 1% Tax Deducted at Source (TDS)—while introducing a new penalty framework for reporting lapses, including daily fines and a flat ₹50,000 charge.

This move is not a simple policy status quo; it is a strategic pivot from debating tax rates to enforcing compliance, signaling the government's priority is control and auditability over fostering a competitive domestic market. The decis

CryptopulseElite·2h ago

Will Chinese residents be taxed on crypto assets held after the implementation of CARF?

CARF's advancement will enhance the ability of tax authorities in various countries to obtain information on overseas crypto assets and promote transparency. Although China has not yet joined CARF, once crypto assets are converted into fiat currency and integrated into financial accounts, the risk increases. Tax authorities in different countries can track tax evasion behaviors through existing cooperation mechanisms.

TechubNews·2h ago

The Unrealized Loss Litmus Test: How Corporate Bitcoin Treasuries Reveal Strategy, Not Failure

At a Bitcoin price of approximately \$78,500, prominent public companies like Metaplanet and Trump Media sit on paper losses exceeding one billion and four hundred million dollars, respectively, while early adopters like Tesla remain comfortably profitable.

This divergence is not a story of good versus bad bets, but a public stress test revealing the core mechanic of the corporate Bitcoin treasury thesis: it is a long-duration financing strategy wrapped in a volatile asset. The critical

CryptopulseElite·2h ago

Will Chinese residents be taxed on crypto assets held after the implementation of CARF?

The implementation of CARF will enhance the ability of tax authorities in various countries to regulate overseas crypto assets by facilitating information exchange to identify undeclared income. Even if China has not yet joined CARF, tax risks still exist, especially when crypto assets are liquidated and potentially taxed retroactively through CRS. Additionally, tax authorities in different countries can obtain relevant tax evasion clues through bilateral cooperation.

PANews·3h ago

MicroStrategy’s Double-Down: How a “Bitcoin Brinkmanship” Strategy Redefines Corporate Crypto Capital

MicroStrategy has signaled plans to acquire more Bitcoin despite its massive holdings hovering near its average cost basis, funded by an aggressive hike in dividends on its specialized preferred stock.

This move is critical not merely as corporate news but as a high-stakes stress test for the “Bitcoin treasury” model, highlighting the intricate mechanics and inherent risks of leveraging equity capital markets for crypto accumulation. For the industry, it signifies a pivotal evolution fro

CryptopulseElite·5h ago

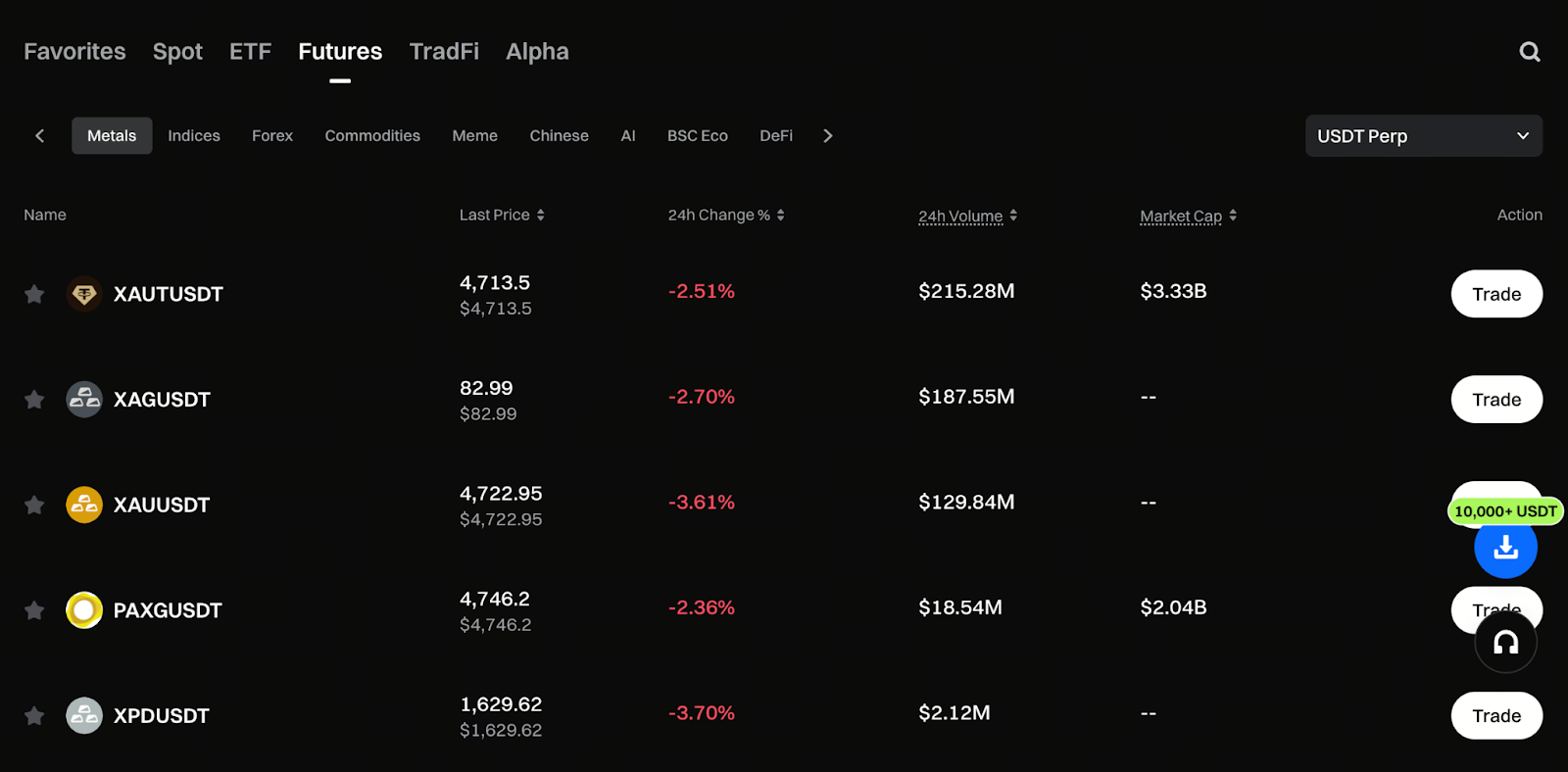

Gate Precious Metals Perpetual Contracts: Making Gold and Silver Part of Your Instant Strategy

The launch of precious metal perpetual contracts has changed the hedging role of gold and silver, allowing them not only to be used for passive defense but also for immediate trading to participate in short-term fluctuations. This move enhances traders' strategic flexibility, promotes the integration of traditional finance and the crypto market, and provides practical solutions for multi-asset allocation.

GateLearn·5h ago

The 2026 Gold, Silver, and Bitcoin Crash Is a Battle for the Soul of the “Debasement Trade”

The coordinated crash of gold, silver, and Bitcoin in late January 2026 is not a market failure but a violent unveiling of a fierce capital war between competing “hard asset” narratives.

This event, framed by Robert Kiyosaki as a buying opportunity and dissected by JPMorgan as a rotation from oversold crypto to overbought metals, signals a critical inflection point where the simplistic “digital gold” thesis fractures under the weight of institutional strategy, monetary policy fears, and

CryptopulseElite·5h ago

Why do Bitcoin and Ethereum tend to fall together but not rise together? What are the reasons behind this phenomenon? Understanding the market dynamics and investor behavior can shed light on why these two leading cryptocurrencies often move in tandem during downturns, yet sometimes diverge during upward trends. Factors such as market sentiment, macroeconomic influences, and technological developments all play a role in this complex relationship.

Title: 《Why BTC and ETH Haven’t Rallied with Other Risk Assets》

Author: @GarrettBullish

Translation: Peggy, BlockBeats

Editor’s Note: Against the backdrop of multiple asset classes rising, the stagflation of BTC and ETH is often simply attributed to their "risk asset nature." This article argues that the core issue is not macroeconomics but the crypto market’s own deleveraging phase and market structure.

As deleveraging approaches completion and trading activity drops to low levels, existing funds find it difficult to counteract short-term volatility amplified by high-leverage retail investors, passive funds, and speculative trading. With new funds and

TechubNews·5h ago

Robinhood reviews the GameStop incident: from T+2 to T+1, stock tokenization is the future

Robinhood CEO Vlad Tenev reflects on the GameStop incident five years ago, pointing out that the real reason for trading restrictions lies in outdated clearing systems, not retail investors or brokerages. He advocates reshaping the market structure through stock tokenization to achieve instant settlement and reduce systemic risk, and calls for regulatory reforms to support innovation.

DEFI1.39%

CryptoCity·6h ago

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun.

Author: Ryan Watkins

Translation: Deep潮 TechFlow

Introduction: By 2026, the crypto economy is in the most critical transition period in 8 years. This article explores how the market has "soft-landing" from the overexcitement of 2021 and gradually establishing valuation frameworks based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for an industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but an underestimated, cross-cycle entry opportunity.

The full text is as follows:

Key Points

This asset class in 2021

区块客·6h ago

The real culprit behind the crypto crash: Wash Effect

Author: jk, Odaily Planet Daily

Open any cryptocurrency data platform, and all you see is a sea of red.

As of press time, Bitcoin (BTC) is priced at $78,214, down 6.9% in 24 hours, with a 7-day decline of 12.4%. Ethereum (ETH) is even more brutal, currently at $2,415, down 10.5% in 24 hours, with an 18.2% drop over 7 days. Solana (SOL) is also not spared: $103.51, down 11.6% in 24 hours, with an 18.4% decline over 7 days. Looking at BNB and XRP, both have experienced double-digit drops.

The question is, what triggered this collective retreat?

The answer points to the same name: Kevin Warsh.

On January 30, U.S. President Donald Trump on the social platform Truth

PANews·8h ago

Market Quiet, Smart Money Buying: 5 Altcoins With 50–300% Upside Potential in the next 3 Months

Accumulation phases are being reported across several altcoins with tightening price ranges and stable volume floors.

Meme and infrastructure tokens are both appearing in high-risk, high-yield watchlists.

Breakout potential is being linked to liquidity return, not

CryptoNewsLand·10h ago

Cardano (ADA) ETFs Take a Step Forward After SEC Filing Updates

Cardano just popped back onto the ETF radar. A document circulating online shows updated SEC filings from Volatility Shares, and it’s not a small update.

The firm is actively moving ahead with three different ADA-related ETFs, telling us this isn’t a stalled idea or a placeholder filing.

The

ADA-3.91%

CaptainAltcoin·13h ago

Shiba Inu Open Interest Crashes 11% as SHIB Price Hits Near 3-Year Low - U.Today

Shiba Inu's price has dropped to lows not seen since October 2023, amid a significant crypto market sell-off. Over $2.45 billion in liquidations occurred recently, heavily impacting long positions. Open interest for Shiba Inu fell 11%, signaling reduced trader exposure. Market volatility may increase due to low liquidity and risk appetite. Amid the downturn, Shiba Inu could see potential targets for recovery, with key support levels identified.

SHIB-3.24%

UToday·14h ago

Litecoin to $400? Yes, but 'Digital Silver' Still Has to Survive $63 Guillotine First - U.Today

The bullish outlook for Litecoin is not over, as chartist Aksel Kibar identifies a critical support level at $63. A breakout could push prices toward $400, but a drop below $47 would invalidate this potential. The upcoming years may redefine Litecoin’s market presence.

UToday·15h ago

SUI Price Tests Critical Support Near $1.35 While Macro Trend Stays Upward

SUI hovers near $1.35, testing channel support with potential relief bounce toward $2.90.

Volume clusters around the current price suggest two-way trade and seller exhaustion, not panic.

RSI shows momentum reset without oversold pressure, indicating neutral short-term

SUI-3.83%

CryptoNewsLand·15h ago

US SEC and CFTC Chairmen Join Forces to Pave the Way for Cryptocurrency Regulation

The Chairmen of the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have jointly stated for the first time that they will work together to promote cryptocurrency regulation policies and clearly define jurisdictional boundaries. Even though congressional legislation has not yet been completed, the two agencies have already begun collaborating to reduce uncertainty for cryptocurrency businesses and are exploring the establishment of a transitional regulatory framework to promote stable industry development.

ETH-7.51%

区块客·18h ago

Silver Wiped Out 28% in a Day as Bank Short Covering Raises New Manipulation Fears

The Silver price saw a brutal selloff on Friday, dropping 28% in a single session and erasing massive value across the market. The move shocked traders, not just because of the size of the decline, but because of what appeared to happen at the lows.

As silver price hit its bottom, data

KAS-7.85%

CaptainAltcoin·22h ago

【Madman on Trends】Bitcoin heading towards "break," consider swing trading below 80,000

The article analyzes Bitcoin's short-term trend, predicting that trading can be done in waves below 80,000, with an expected rebound of 6-10%. If it drops to 77,000-78,000, the rebound may return to the current price. Emphasize the need to observe capital inflow to determine whether it is a true bottom. The article only represents personal opinions and does not constitute investment advice.

区块客·23h ago

It is during the darkest hours that winners and losers are distinguished: the market always returns stronger after a collapse.

This article addresses investors who feel hopeless during market crashes, urging them to stay resilient and emphasizing that the current predicament is the key to distinguishing winners from losers. Although market conditions are tough, the fundamentals remain strong, and more capital will flow in the future. The golden era will still come, encouraging investors not to give up.

動區BlockTempo·02-01 03:40

Nvidia's $100 billion investment plan in OpenAI has been halted

Nvidia's $100 billion investment plan in OpenAI faces delays amid internal concerns. Initial talks for a partnership to establish computing capacity have not advanced, and the companies are reassessing collaboration options due to competitive pressures. The delay has caused uncertainty about the timeline and the potential scope of their joint projects, with both sides considering alternative strategies to stay ahead in the rapidly evolving AI industry. Internal reviews are ongoing to address these issues and determine the best path forward for both organizations.

TapChiBitcoin·02-01 01:41

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun.

Author: Ryan Watkins

Translation: Deep潮 TechFlow

Introduction: By 2026, the crypto economy is in the most critical transition period in 8 years. This article explores how the market has "soft-landing" from the overexcitement of 2021 and gradually establishing valuation frameworks based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for an industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but an underestimated, cross-cycle entry opportunity.

The full text is as follows:

Key Points

This asset class in 2021

区块客·02-01 01:16

Next Altseason Setup? 5 Altcoins Positioned for Potential 150+ Breakouts if Momentum Returns

Several altcoins show compressed ranges and stable liquidity ahead of possible altseason momentum phases.

Breakout projections near 150% are being treated as conditional, not guaranteed scenarios.

Focus has shifted toward structurally resilient and high-liquidity networks.

CryptoNewsLand·01-31 21:31

Moltbook: How AI Agents Ended up Building Their Own Social Network

Moltbook is a fast-growing, Reddit-style social network where artificial intelligence (AI) agents—not humans—post, argue, collaborate, and quietly form culture on their own terms.

From Moltbots to Moltbook: The Rise of the Agent Internet

Billed as “the front page of the agent internet,” Moltbook

BTC-2.2%

Coinpedia·01-31 20:43

SUI Price Outlook: Is SUI at the Stage Where Big Money Enters?

The SUI price is back in focus, and this time it’s not because of a quick spike or social hype. A weekly chart shared by Crypto Patel is getting a lot of attention because it shows something more structural, not something driven by short-term excitement.

This is the kind of setup that tends to

CaptainAltcoin·01-31 19:05

The U.S. Department of Justice releases 3 million pages of Epstein investigation documents, revealing high-level interactions, island invitations, and unprosecuted details.

The U.S. Department of Justice released over 3 million pages of Epstein investigation documents, revealing complex connections among celebrities, but still facing criticism for hiding a large amount of information. The documents mention Bannon, Musk, and Prince Andrew, and expose Epstein's mansion rules. Victims' groups accuse the government of not being fully transparent and promise to pursue accountability for all perpetrators. The Department of Justice stated that additional documents are yet to be released.

ChainNewsAbmedia·01-31 18:47

SUI Price Tests Critical Support Near $1.35 While Macro Trend Stays Upward

SUI hovers near $1.35, testing channel support with potential relief bounce toward $2.90.

Volume clusters around the current price suggest two-way trade and seller exhaustion, not panic.

RSI shows momentum reset without oversold pressure, indicating neutral short-term

SUI-3.83%

CryptoNewsLand·01-31 16:31

Silver Liquidation Raised Eyebrows: Here’s What Actually Happened

Silver moved fast, then pulled back just as quickly. That sudden liquidation caught attention because the price action felt out of sync with what was happening underneath the surface. The move did not last long, yet it opened a window into how silver price discovery works when paper markets

XRP-4.81%

CaptainAltcoin·01-31 11:20

MegaETH Will Not Give MEGA Tokens as Listing Fees or Airdrops

MegaETH has been very transparent that it will not dole out MEGA tokens as listing fees or as air drops to exchanges

The decision to list MEGA will be based on an independent assessment.

In its official statements, MegaETH has been consistent about this: it has not and will not dole out MEGA toke

TheNewsCrypto·01-31 10:27

XRP Short-Term Price Outlook: Reversal Not In Sight Yet

XRP price has spent weeks grinding lower, and the chart now tells a story that feels tense rather than dramatic. Price continues to respect a downward channel, sliding under key averages and testing trader patience. The latest daily structure shows XRP sitting below $1.77, a zone that once offered s

CaptainAltcoin·01-31 10:20

Brief shutdown! The US government partially shuts down again, the House extends until Monday before reconvening to vote on the funding bill.

The U.S. government entered a partial shutdown again early Saturday morning. Although the Senate has passed the budget plan, the House has not yet voted, leading to a halt in funding for some agencies. The House is expected to reconvene on Monday. The Speaker of the House expressed support for the Senate's funding plan and hopes to resolve the budget dispute quickly. This incident highlights the fiscal policy disagreements between the two major U.S. parties.

ChainNewsAbmedia·01-31 09:45

XRP Success Must Come From Increased Usage, Not ‘Global Reset’ Narrative

The essay argues that XRP's long-term success relies on real-world utility rather than speculative narratives, with community member WrathofKahneman emphasizing increased adoption and transaction volumes as key factors, despite current low market ranking.

TheCryptoBasic·01-31 09:19

Does the rise of privacy coins mean that a bear market is imminent?

Privacy tokens often become the focus of speculation at the end of each bull market, reflecting the market's conflicting privacy demands and regulatory pressures. Historically, privacy tokens like ZEC and XMR have sparked heated discussions due to technological innovations, but in practical applications, privacy needs have not been fully met. Behind the current hype around privacy tokens, there is a complex interaction between regulation and market sentiment, leading to investors' repositioning behaviors. The future of privacy tokens still requires exploration of their true application scenarios and value.

PANews·01-31 08:05

【Madman on Trends】Bitcoin heading towards "break," consider swing trading below 80,000

Bitcoin currently appears to be approaching a breakdown. It is predicted that trading can be done in the range below 80,000, with a rebound of approximately 6-10%, and a potential drop to 77,000-78,000. After the rebound, it may decline again, and market liquidity needs to be observed. The bottom has not been seen yet. This article is for personal opinion only and does not constitute investment advice.

区块客·01-31 08:05

The bull market is not over! Tom Lee: A "bear market-level correction" may occur in 2026, which could be a good opportunity for strategic positioning

整理&編譯:深潮 TechFlow

重點總結

Tom Lee 是 Fundstrat Global Advisors 的共同創辦人兼研究負責人,同時擔任以太坊財政公司 Bitmine Immersion 的董事長,也是快速成長的 Granny Shots ETF 系列(目前管理資產規模已達 47 億美元)的 Fundstrat Capital 的首席投資長。

在本期節目中,Tom 分享了他的市場觀點。他認為,從 2022 年開始的十年牛市仍在初期,儘管今年可能會經歷一次劇烈的市場回調,讓人感覺像熊市,但股票市場預計在 2026 年迎來強勁反彈。他指出,今年投資人需要面對三大變化:新的聯準會

区块客·01-31 05:45

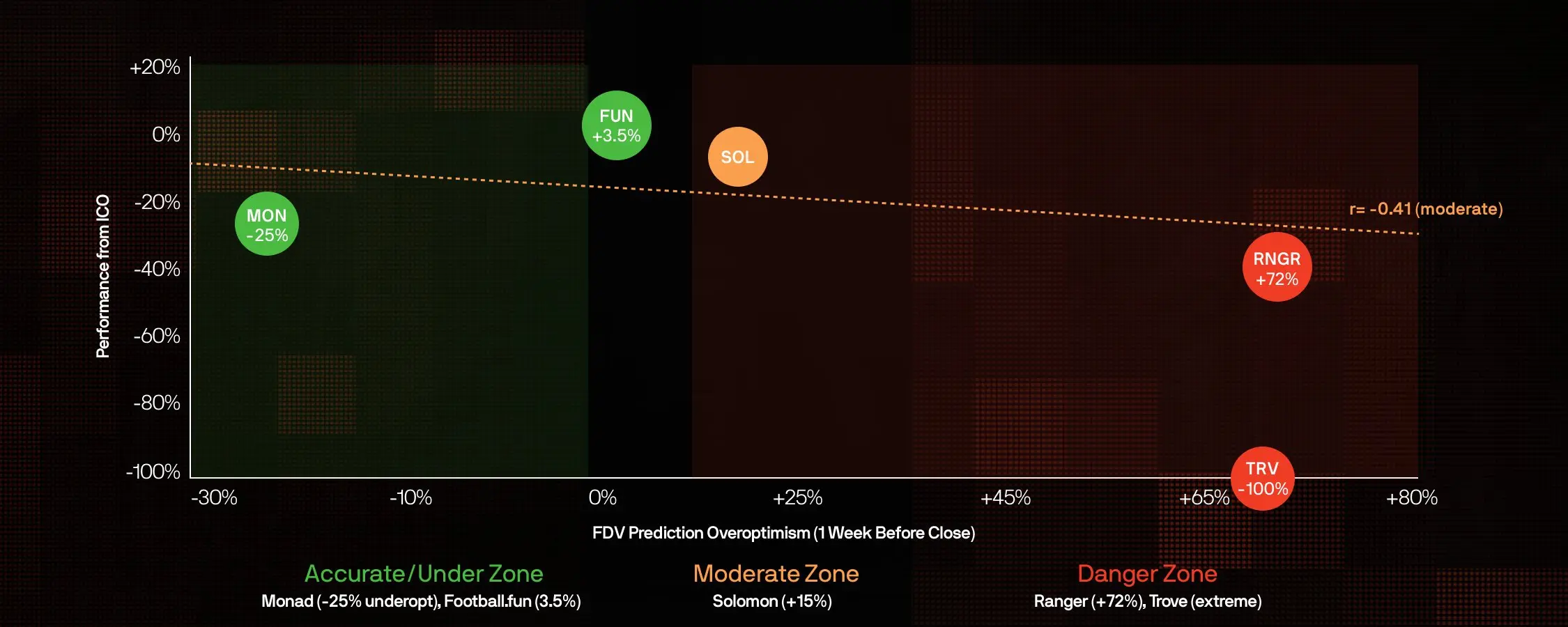

The actual win rate is only 60%, data reveals the truth about ICO predictions on Polymarket. The data uncovers that the success rate for ICO forecasts on Polymarket is only around 60%, indicating that the predictions are not as reliable as they might seem. This suggests that investors should exercise caution and not rely solely on these predictions when making financial decisions.

Polymarket's token sale prediction markets show that prediction accuracy is not reliable and actually exhibits systematic over-optimism. An in-depth analysis of 231 markets found that the prediction accuracy one week before closing was only 66.7%. High trading volume in the market is often a contrarian signal, indicating a greater risk of collapse. Investors should remain cautious of over-optimism to avoid significant losses.

PANews·01-31 03:23

What happens when Silicon Valley's new favorite, Clawdbot, enables local AI agents to "go on-chain"?

Recently, the open-source project Clawdbot (now called Moltbot) has quickly gained popularity, aiming to provide a resident AI agent that automatically performs tasks and connects to Web3. It lowers the barrier to Web3 participation through self-hosting and multi-channel access, and can help with monitoring and automation. However, users should be cautious of security risks, set permissions reasonably, and ensure privacy safety. The agent can serve as an assistant but should not become an asset manager.

PANews·01-31 02:38

Falling Wedge Breakout Confirmed: 5 Altcoins Worth Risking In With 3x–7x Upside Ahead

Falling wedge breakouts suggest declining selling pressure rather than immediate price acceleration.

The highlighted altcoins show structured recoveries with defined risk levels.

Market behavior reflects rotation and accumulation, not broad speculative momentum.

A co

CryptoNewsLand·01-30 23:31

Let Altcoins Grow: 5 Can’t-Miss Buys as 2026 Sets Up 2x–6x Long-Term Gains

Market focus is shifting toward exceptional utility-driven altcoins ahead of 2026.

Liquidity depth and network reliability are emerging as dominant valuation factors.

Long-term gains are increasingly linked to adoption metrics, not narratives.

A number of big and mid-cap al

CryptoNewsLand·01-30 21:31

Is the silver shortage narrative about to be rewritten? Peter Brandt warns: miners are疯狂 hedging, and the risk of oversupply is accumulating

Renowned trader Peter Brandt warns investors that extreme trading volume in the silver market may not indicate strong demand and could reflect the risk of rapidly increasing supply. He pointed out that silver trading volume has reached 4.3 billion ounces and believes that miners should hedge during high prices. High prices may also encourage increased recycling supply, leading to decreased demand, challenging the notion of a "silver shortage."

動區BlockTempo·01-30 15:10

US SEC and CFTC Chairmen Join Forces to Pave the Way for Cryptocurrency Regulation

The Chairmen of the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have jointly stated for the first time that they will work together to promote cryptocurrency regulation policies and clearly define jurisdictional boundaries. Even though congressional legislation has not yet been completed, the two agencies have already begun collaborating to reduce uncertainty for cryptocurrency businesses and are exploring the establishment of a transitional regulatory framework to promote stable industry development.

ETH-7.51%

区块客·01-30 13:55

Load More