Search results for "PAIN"

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun.

Author: Ryan Watkins

Translation: Deep潮 TechFlow

Introduction: By 2026, the crypto economy is in the most critical transition period in 8 years. This article explores how the market has "soft-landing" from the overexcitement of 2021 and gradually establishing valuation frameworks based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for an industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but an underestimated, cross-cycle entry opportunity.

The full text is as follows:

Key Points

This asset class in 2021

区块客·8h ago

Ethereum Bears Take Over: Is $ETH Destined for More Pain Ahead?

Key Takeaways

Ethereum ($ETH) has broken below the critical $2,637 support, signaling a shift in short-term market structure.

Price is

ETH-6.24%

CoinsProbe·15h ago

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun.

Author: Ryan Watkins

Translation: Deep潮 TechFlow

Introduction: By 2026, the crypto economy is in the most critical transition period in 8 years. This article explores how the market has "soft-landing" from the overexcitement of 2021 and gradually establishing valuation frameworks based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for an industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but an underestimated, cross-cycle entry opportunity.

The full text is as follows:

Key Points

This asset class in 2021

区块客·02-01 01:16

Ethereum Bears Take Over: Is $ETH Destined for More Pain Ahead?

Key Takeaways

Ethereum ($ETH) has broken below the critical $2,637 support, signaling a shift in short-term market structure.

Price is

ETH-6.24%

CoinsProbe·01-31 17:46

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun.

Author: Ryan Watkins

Translation: Deep潮 TechFlow

Introduction: By 2026, the crypto economy is in the most critical transition period in 8 years. This article explores how the market has "soft-landing" from the overexcitement of 2021 and gradually establishing valuation frameworks based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for an industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but an underestimated, cross-cycle entry opportunity.

The full text is as follows:

Key Points

This asset class in 2021

区块客·01-30 01:10

VanEck launches the first AVAX ETF in the US! Featuring a dual engine of "price exposure + staking yield"

Asset management firm VanEck launches the first ETF in the US tracking Avalanche's native token AVAX, called the "VanEck Avalanche ETF" (ticker VAVX), allowing investors to participate in price fluctuations and earn staking rewards. Avalanche aims to address the three major pain points of blockchain and supports smart contracts. VAVX offers management fee discounts, with full management fee waivers for initial assets under management within $500 million.

AVAX-1.87%

区块客·01-29 11:35

Building a Cross-AI Large Model "Privacy Memory Layer", ZetaChain Collaborates with Multi-Model Aggregation Application Anuma to Create a New AI Experience

Author: Zen, PANews

In today's generative AI applications, users often face fragmented conversational experiences. When switching between different models, the context of previous conversations is often not preserved, requiring users to repeatedly provide the same information from scratch. For example, details discussed on ChatGPT cannot be directly transferred when switching to Claude or other models, severely impacting efficiency.

Moreover, the dialogue data of these large models is usually stored on various platform servers, leaving users without privacy guarantees and lacking control over their own data. "These real-world issues not only cause a fragmented user experience but also raise concerns about user data sovereignty and security."

To address this pain point, the industry has begun exploring the concept of a "migratable, user-controlled memory layer," and blockchain technology may be the key to achieving this goal.

An open interoperable blockchain-based system

PANews·01-29 04:51

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun.

Author: Ryan Watkins

Translation: Deep潮 TechFlow

Introduction: By 2026, the crypto economy is in the most critical transition period in 8 years. This article explores how the market has "soft-landing" from the overexcitement of 2021 and gradually establishing valuation frameworks based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for an industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but an underestimated, cross-cycle entry opportunity.

The full text is as follows:

Key Points

This asset class in 2021

区块客·01-29 01:05

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun.

Author: Ryan Watkins

Translation: Deep潮 TechFlow

Introduction: By 2026, the crypto economy is in the most critical transition period in 8 years. This article explores how the market has "soft-landing" from the overexcitement of 2021 and gradually establishing valuation frameworks based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for an industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but an underestimated, cross-cycle entry opportunity.

The full text is as follows:

Key Points

This asset class in 2021

区块客·01-28 01:01

VanEck launches the first AVAX ETF in the US! Featuring a dual engine of "price exposure + staking yield"

Asset management firm VanEck launches the first ETF in the US tracking Avalanche's native token AVAX, called the "VanEck Avalanche ETF" (ticker VAVX), allowing investors to participate in price fluctuations and earn staking rewards. Avalanche aims to address the three major pain points of blockchain and supports smart contracts. VAVX offers management fee discounts, with full management fee waivers for initial assets under management within $500 million.

AVAX-1.87%

区块客·01-27 11:49

The Four Pillars Reshape the Future of Crypto: Survival Rules in the Post-Speculation Era

Author: Go2Mars Web3 Research

This article aims to provide an analytical framework to help understand: the current "value return" is not a helpless end to the bear market, but a necessary pain before the birth of the next generation of trusted financial infrastructure.

Over the past two years, the crypto industry has experienced Bitcoin shifting from a speculative asset and cycle indicator, to a liquidity pool during monetary easing, and now to a non-sovereign macro anchor asset and strategic reserve option; stablecoins have also evolved from a medium for crypto speculation to a healthy on-chain USD that facilitates cross-border on-chain payments and settlements, providing the world with a low-threshold channel to access USD.

In stark contrast, the altcoin market has seen the vast majority of crypto projects disprove themselves so far, with some projects' former glory unlikely to reoccur. More broadly, many projects have perished during their preparation phase due to the industry's bleak outlook.

As liquidity tides recede, investment

PANews·01-27 08:35

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun.

Author: Ryan Watkins

Translation: Deep潮 TechFlow

Introduction: By 2026, the crypto economy is in the most critical transition period in 8 years. This article explores how the market has "soft-landing" from the overexcitement of 2021 and gradually establishing valuation frameworks based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for an industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but an underestimated, cross-cycle entry opportunity.

The full text is as follows:

Key Points

This asset class in 2021

区块客·01-26 11:48

Bitcoin underperforms gold, but the golden age of the crypto economy has just begun

Author: Ryan Watkins

Translation: Deep Tide TechFlow

Introduction: By 2026, the crypto economy is in its most critical transition in eight years. This article explores how the market has achieved a "soft landing" from the overexuberance of 2021 and is gradually establishing a valuation framework based on cash flow and real use cases.

The author explains the pain of the past four years through the "Red Queen Effect" and points out that with relaxed US regulations and the explosion of enterprise applications, crypto assets are shifting from cyclical speculation to long-term trend growth.

Faced with a global trust crisis and currency devaluation, this is not only a recovery for the industry but also the rise of a parallel financial system. For investors deeply involved in Web3, this is not just a cognitive reshaping but also an underestimated, cross-cycle entry opportunity.

Full text below:

Key Points

This asset class in 202

PANews·01-25 02:40

4 Top Crypto Presales to Watch, Led by BlockchainFX ($BFX) and Its Jan 31 Trading App Launch

Ever wished trading could feel simpler, like one place for everything instead of five tabs and three logins? That’s the pain BlockchainFX ($BFX) is built to fix, and it’s why the presale is pulling attention right now.

On the credibility front, BlockchainFX has also been positioned as

APP10.54%

CaptainAltcoin·01-23 21:35

Bitcoin New Holder Pain Extends: $98,000 Needed For Relief

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

On-chain data shows Bitcoin short-term holders have extended their underwater streak, with BTC continuing to trade under their cost basis.

Bitcoin Short-Term Holders Are Still Holding Net

Bitcoinistcom·01-21 03:08

Bitcoin bulls risk further pain as Peter Brandt flags bearish channel

Veteran trader Peter Brandt warns that Bitcoin may face further price drops unless strong buying breaks through key resistance near six figures. He acknowledges the potential for error in his forecasts amid current volatility and macro concerns.

BTC-2.01%

Cryptonews·01-20 08:48

Genius Terminal Evaluation Report: CZ and YZi Labs Support, Is It a "Big Hair" from Heaven or a Marketing Trap?

Author: Cat Teacher scupt

YZi Labs (CZ related) + Hyperliquid collaboration, is it truly "secure" or just marketing? Let's analyze the evidence and risks one by one.

1) What does the project do? What problem does it solve?

One-sentence positioning: A private, non-signed on-chain trading terminal that provides professional DeFi users with unified access to cross-chain spot, perpetual, pre-issuance tokens, and yields.

Target users and pain points

Target users:

- High-frequency traders

- Narrative-driven speculators

- Whale wallet holders

- Advanced native DeFi users

- Institutional asset allocators

Core pain points:

- DeFi fragmentation: multiple clicks to trade, complex Gas management, frequent cross-chain wallet switching

- Lack of CEX-level experience: unable to achieve the speed, privacy, and aggregation capabilities of centralized exchanges, leading to trading

PANews·01-16 04:37

RWA Public Chain MANTRA Pain Resolution Team! Founder explains: $OM plummeted 90%, forcing a restructuring decision, hoping to turn things around by 2026

MANTRA Public Chain announces a comprehensive strategic restructuring. CEO John Patrick Mullin stated that the company will extend its runway through layoffs and operational streamlining, aiming to re-enter the market competition by 2026. This is the most difficult decision since the company's founding, in response to the 2025 token crash and market environment changes. The goal of the restructuring is to shift towards profitability and sustainable operations. Market reactions are mixed, and whether the company can regain competitiveness in the future remains to be seen.

動區BlockTempo·01-14 12:35

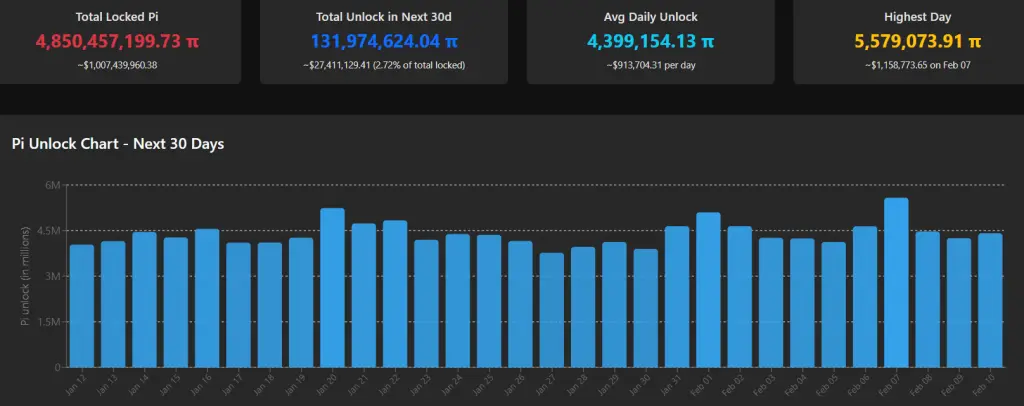

Pi Coin achieves a major development breakthrough! Integrate payments in 10 minutes, price prediction surges to $0.65

Pi Network releases developer toolkit, enabling applications to integrate PI payments within 10 minutes, supporting the four major mainstream frameworks. Addresses the pain point of lack of practical use cases for Pi coins and counters the daily unlocking pressure of 900,000 USD. Technically, a 3-month symmetrical triangle has formed, with a breakout above $0.265 targeting $0.40, and long-term growth with the ecosystem could push it to $0.65.

PI-1.75%

MarketWhisper·01-13 02:55

Is the "decentralized stablecoin" really stable? Vitalik Buterin points out "3 major pain points" to be addressed

Ethereum co-founder Vitalik Buterin issued a major statement on Sunday, pointing out that the cryptocurrency industry needs "better decentralized stablecoins" and highlighting the "3 core issues" that have yet to be solved in the field.

Vitalik Buterin posted on social platform X that existing decentralized stablecoin designs still have room for improvement, mainly stuck at the following 3 bottlenecks:

1. Dependence on the US dollar: a better tracking index than the "US dollar price" must be found;

2. Oracle security: decentralized oracles that cannot be manipulated by large amounts of capital must be designed;

3. Staking incentives: solve the problem of staking yield competition.

Breaking free from dollar dependence

Regarding the first point, Vitalik Buterin stated that while pegging to the US dollar is feasible in the short term, from a long-term perspective of "national-level resilience," even if it is warm

区块客·01-12 14:53

XRP Hits $2.17 but Digitap ($TAP) Is Technically the Best Crypto to Buy 2026

XRP recently fell to $2.10 after peaking near $2.40, leaving many investors watching their portfolios shrink. The technical charts show lower highs and lower lows, a clear bearish pattern that suggests more pain could be ahead. But when established tokens struggle, smart money looks elsewhere for th

BlockChainReporter·01-11 12:04

🏦Web3 Just Needed: The 8 Most Notable U Cards to Watch in 2026

According to on-chain data from @Dune, the global crypto card spending experienced exponential growth in the second half of 2025, with the monthly volume soaring from tens of millions at the beginning of the year to surpassing the $100 million mark. This data directly reflects the real users' preferences in daily consumption.

💼 Core pain point: What problem does the U card solve?

The most frustrating issue with withdrawals now is price erosion.

Currently, the USD to RMB exchange rate is 7, but if you sell USDT for cash on a CEX, the rate is only 6.87. Before even spending, you lose 2% due to erosion. Plus, OTC transactions often carry the risk of frozen cards, which is why the U card is gradually becoming a necessity for Web 3 users.

Bypassing middlemen, making offline payments, and deducting directly at real-time exchange rates for daily expenses not only avoids discount erosion but also eliminates the risk of negotiations with acceptors.

💳 2026

Biteye·01-11 06:42

Farewell to keyword search: Gmail introduces Gemini AI and cross-application integration

Google officially announces Gmail entering the "Gemini Era," marking the full integration of generative AI technology into personal productivity tools. This update deeply integrates the Gemini 3 model, transforming the traditional email inbox into a personal intelligent assistant with semantic understanding capabilities, no longer limited to sending and receiving messages. This is not only a feature upgrade but also demonstrates Google's intention to further solidify its market share in AI applications through its highly engaged Gmail user base. By automating information processing and enabling cross-application collaboration, Google aims to address the pain points of information overload faced by modern workers.

Today we’re bringing @Gmail into the Gemini era, making it a

ChainNewsAbmedia·01-09 01:53

Will the stock market crash in 2026? The options market suggests investors might have miscalculated the odds.

Investors estimate a 31% chance of a stock market crash by 2026, but the options market is only pricing in 8%. Historically, such events occur every 10 to 12.5 years, and the last one was less than 6 years ago. The pain index is rising, and stock valuations are at historical highs, so the probability of a crash may be underestimated.

MarketWhisper·01-08 07:15

00981A Annual profit of 61% but criticized? Giant Jay criticizes ETF for peeling two layers of skin! Experts have a different opinion

00981A Due to the controversy over the "doll stacking" caused by purchasing ETFs such as 0050 and 0052. Trader Giant Jie criticizes this move as peeling two layers of skin, questioning whether managers are providing passive performance at an active fee rate. DeFi commentator Yu Zhe'an and researcher Freddy countered, stating that allocating to ETFs can reduce slippage costs and bypass the regulatory limit of a 10% single stock holding. In a market with a very high weighting in TSMC, this is a pragmatic strategy to track Beta and optimize liquidity.

Man Report co-founder and former J.P. Morgan Asset Management Executive Director Vincent also said that the holding limit is actually a pain point for many funds. In his previous work experience, his team often tried to find ways to keep the fund's performance aligned with TSMC's trend. Knowing that they should buy more TSMC but having to sell in pain due to the holding limit.

Renowned trader Giant Jie: 00981

ChainNewsAbmedia·01-07 04:19

IPO Genie Vs Bitcoin Hyper Vs Nexchain: Which Token Could Deliver 100x–1000x In 2026?

If you’ve been in crypto for more than one cycle, you already know the pain. Every new presale claims to be _“the next big thing’’, ev_ery influencer promises _“easy 100x’’ a_nd yet, most tokens barely survive their first few months.

For everyday investors, this creates real frustration. You w

CaptainAltcoin·01-05 21:05

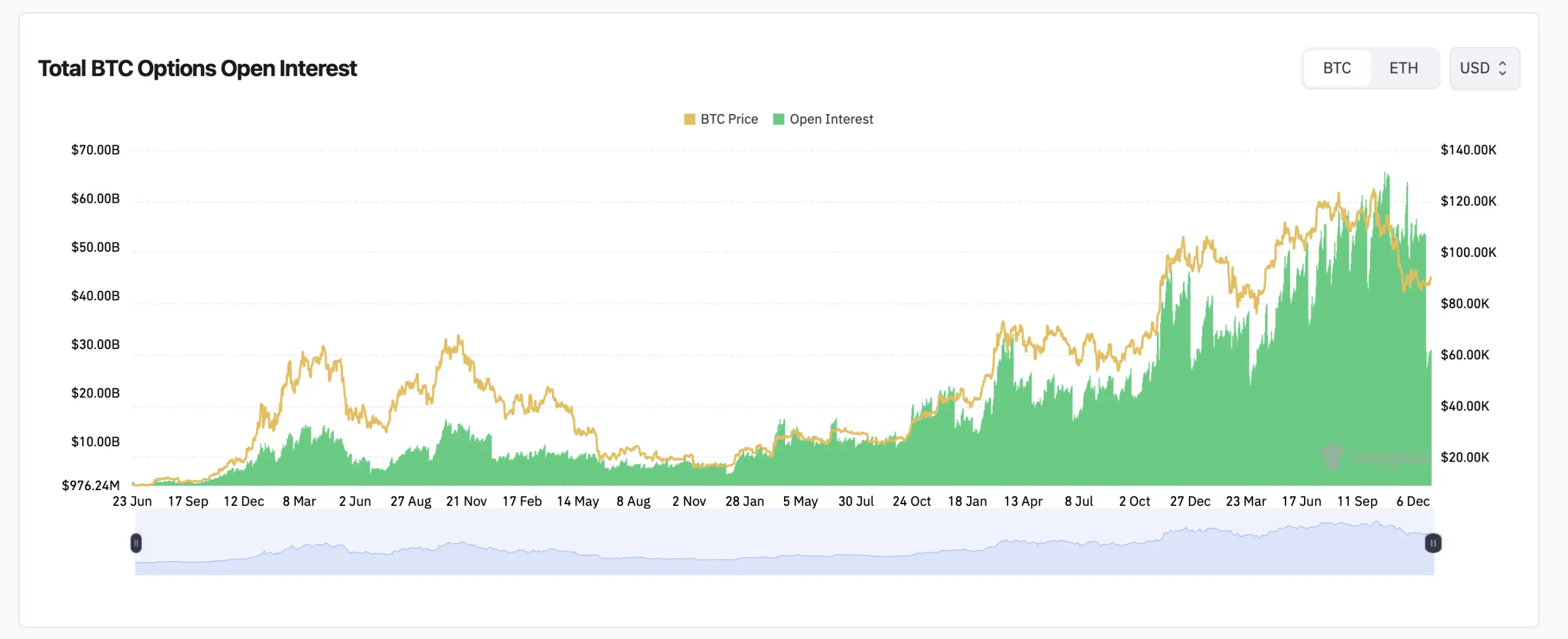

Bitcoin Derivatives Market Leans Bullish, but Max Pain Looms Below Spot

Bitcoin’s spot value hovered at $91,219 on Jan. 4, 2025, and the derivatives market appears anything but relaxed. Futures and options positioning across major venues shows traders leaning in, not backing away, with open interest holding near cycle highs and options contracts stacking up around

Coinpedia·01-04 18:33

Stablecoin First Stock Circle: The Infrastructure Beast of Global Financial Internet

Written by: Lawyer Liu Honglin

01 Key Summary: The Infrastructure Moment of Digital Dollar

2025 is not only the year for Circle Internet Group, Inc. (hereinafter referred to as "Circle" or "the Company") to complete its capitalization on the New York Stock Exchange (NYSE), but also a critical turning point in its business narrative from a single "stablecoin issuer" to a "Financial Infrastructure Economic Operating System" (Economic OS) on a global scale. As the global regulatory framework—especially the full implementation of the EU MiCA regulation and the signing of the US "GENIUS Act"—takes shape, the digital asset industry is undergoing intense pain and rebirth, transitioning from wild growth to compliance and institutionalization.

Against this grand historical backdrop, Circle, with its years of坚持全额储

USDC-0.01%

TechubNews·01-04 06:19

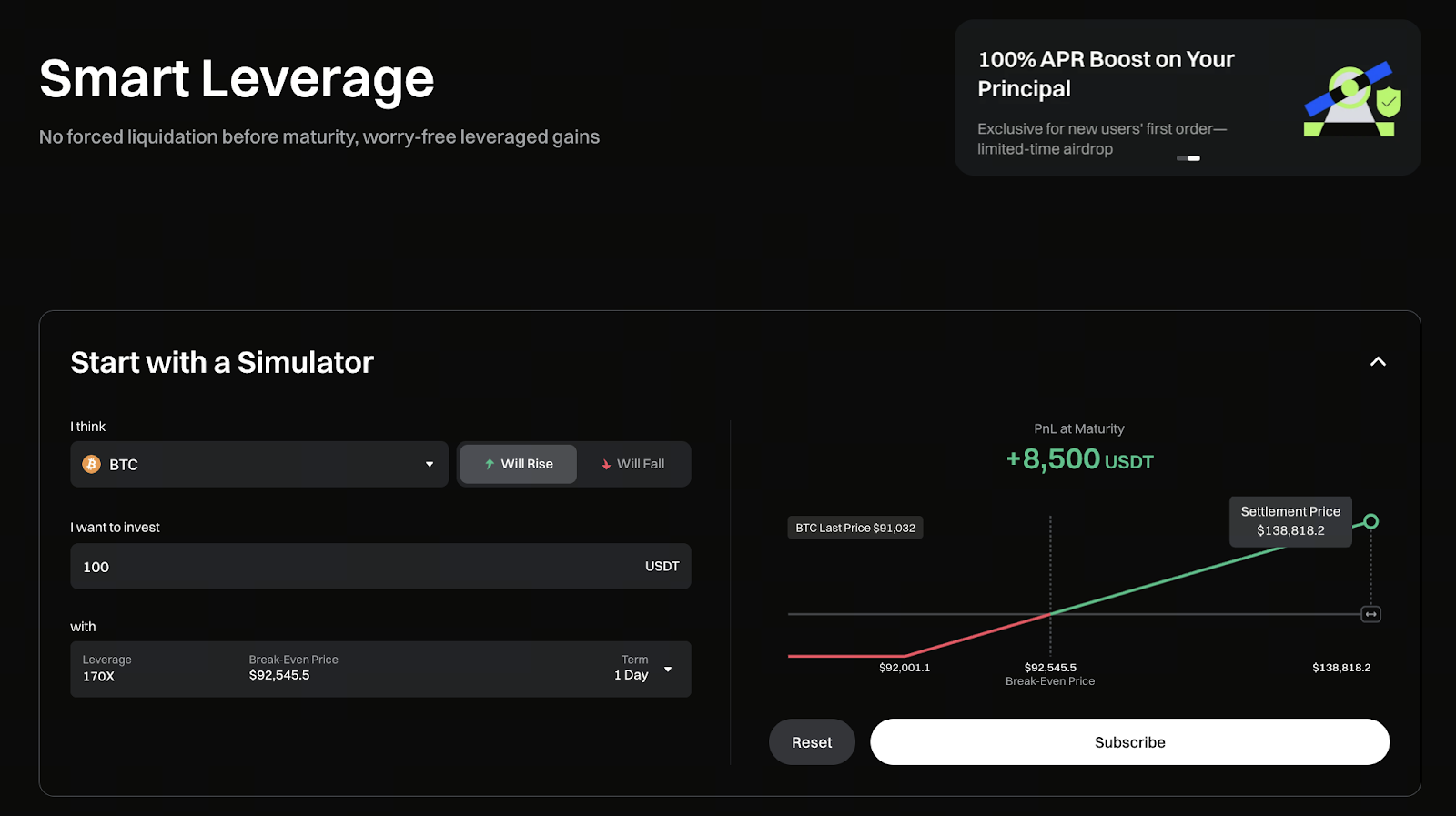

Is Gate Leverage Worry-Free worth participating in? Liquidation prevention mechanism, new user subsidies, and common questions explained

Gate Leverage Worry-Free solves what problems

Figure: [https://www.gate.com/smart-leverage](https://www.gate.com/smart-leverage)

In the crypto market, many traders do not lose money because of incorrect direction judgment, but are "liquidated" early due to short-term sharp fluctuations. The forced liquidation mechanism in traditional leverage or perpetual contracts is the core source of this issue.

The launch of Gate Leverage Worry-Free directly addresses this pain point. This product uses a structured approach, allowing users to avoid worrying about forced liquidation during the holding period, thereby focusing more on market trend judgment.

Is Leverage Worry-Free really "not going to liquidate"

It should be clarified that Gate Leverage Worry-Free does not trigger forced liquidation during the holding period, but this does not mean there is no risk.

Product

GT-4.14%

GateLearn·01-04 02:05

SkyBridge’s Scaramucci bets on Solana, Avalanche and TON as 2026 altcoin winners

Scaramucci names Solana, Avalanche and TON as top altcoins, citing 2025 whale selling, 2026 rate cuts and U.S. crypto regulation as key drivers.

Summary

Scaramucci blames 2025 altcoin pain on whale selling into ETF demand and an October deleveraging-driven liquidity crunch that dragged

Cryptonews·01-01 15:06

[Editorial] The "Linux Moment" of Cryptocurrency: The End of Ideology and the Victory of Pragmatism

The huge foundation supporting the internet world is "Linux." Most servers worldwide run on Linux, and the core of the Android smartphones we use every day is also Linux. However, ordinary users may not even realize they are using Linux. They don't need to know. As long as the network speed is fast and applications run smoothly, that's enough.

The turning point currently facing the cryptocurrency market is precisely this "Linux path." In the past few years, the cryptocurrency industry misjudged the public's willingness to follow their values. They believed that concepts like decentralization, self-sovereign identity, and radical transparency would change the world.

But this assumption is wrong. As previously diagnosed in this publication through editorials, the pain and initial state of the cryptocurrency market integrating into the mainstream financial system are not driven by grand ideals. The public has chosen pure "pragmatism."

Recently, institutions and mainstream applications have introduced crypto into the market.

TechubNews·2025-12-29 15:23

Pantera, Sequoia, and Samsung team up to bet, is FIN aiming to take over traditional banks' jobs?

Writing by: KarenZ, Foresight News

In the current global financial system, large-scale cross-border transfers are still plagued by "slow arrival, high fees, and complicated procedures." A startup called FIN is directly addressing this pain point with stablecoins, attempting to rewrite the industry landscape.

As a project founded by two former Citadel employees, FIN is not just making small moves on the fringes but is building a large-scale payment track using stablecoin technology, dedicated to providing instant and efficient cross-border transfer experiences for enterprises and high-net-worth individuals.

In early December 2025, FIN announced the completion of a $17 million funding round, led by Pantera Capital, with Sequoia and Samsung

TechubNews·2025-12-28 01:17

Pantera, Sequoia, and Samsung team up to bet, is FIN aiming to take over the traditional banking industry?

When quantitative elites start payments, what makes FIN, built by Citadel veterans, able to attract top-tier venture capital? Upgrading from TipLink to a payment platform focused on large-scale cross-border transfers, FIN is challenging the traditional banking global payment system with stablecoin technology.

(Background: Stablecoins won't drain banks! Cornell study: Deposit stickiness is extremely strong, forcing banks to upgrade)

(Additional context: United Stables launched $U stablecoin deployed on BNB and Ethereum, emphasizing "unified liquidity" and AI payment economy)

Contents

Core positioning of FIN

Core team: Quantitative DNA + Pain point-driven

Funding history

From TipLink to FIN: How does the project operate?

Summary

In the current global financial system, large-scale cross-border transfers are still plagued by

動區BlockTempo·2025-12-26 12:55

Secondary Market Daily Report 20251226

Market Trends

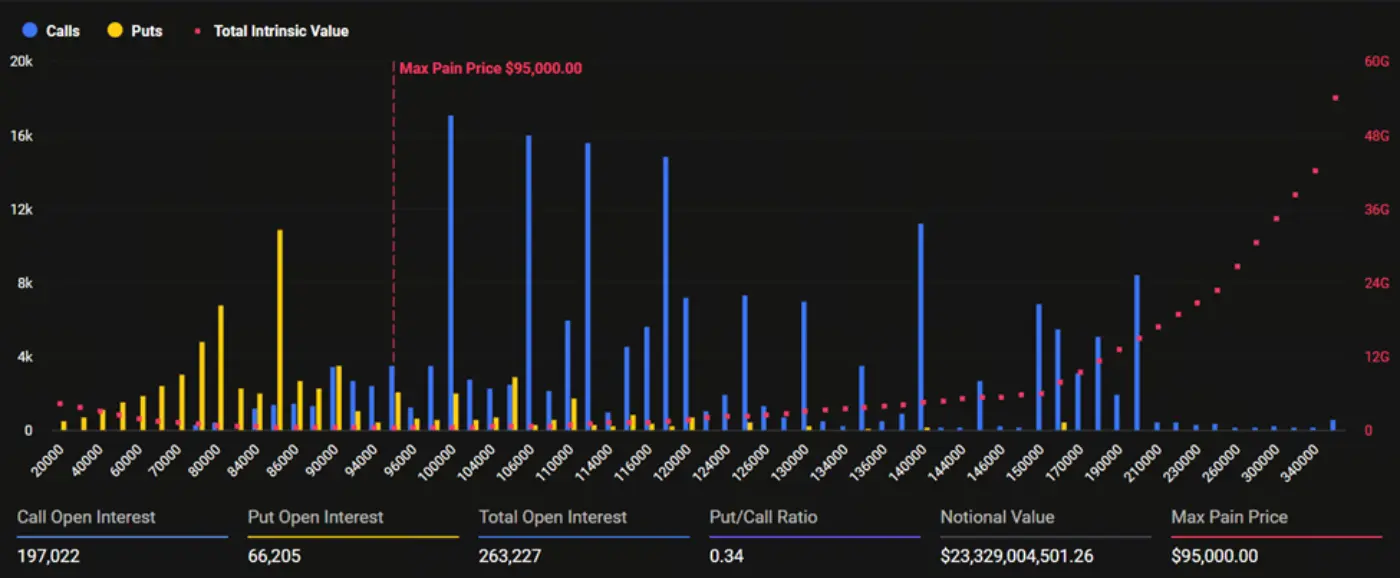

The cryptocurrency market overall shows a downward trend today, with BTC falling below $87,000 and SOL losing the key level of $120. The low liquidity during Christmas week has amplified market concerns over regulatory risks and economic uncertainties. The current market is on the eve of the "largest options expiration day in history," with massive expiring positions causing volatility to reach extreme levels. Short-term operations should remain highly cautious.

Mainstream Coins

BTC

Is facing a dramatic impact from $23 billion in options expiring (the largest in history). Currently, the biggest pain point for shorts is around $96,000, but the put pressure at $85,000 should not be underestimated. In the short term, prices may experience frequent "needle-like" movements before expiration. Looking long-term, Japan's Metaplanet Board has approved a plan to increase holdings of 210,000 BTC by the end of 2027, providing a solid

Biteye·2025-12-26 09:33

The Largest Crypto Options Expiration in History: How Will the $27 Billion Bitcoin and Ethereum Options Expiration Define the Start of 2026?

On December 26th, Beijing time, the world's largest cryptocurrency derivatives exchange Deribit is about to experience an unprecedented "Ultimate Settlement." Bitcoin and Ethereum options contracts worth up to $27 billion are set to expire, with Bitcoin options accounting for $23.6 billion and Ethereum options for $3.8 billion, representing over 50% of the exchange's total open interest. This expiration coincides with the overlap of quarterly and monthly contracts, with the "maximum pain" prices located around $95,000 and $3,000 respectively. Although implied market volatility has retreated from high levels, this historic scale of expiration is not merely a risk release; it is more likely to reshape the flow of funds after expiration, laying a new structural direction for the cryptocurrency market in early 2026.

MarketWhisper·2025-12-26 05:56

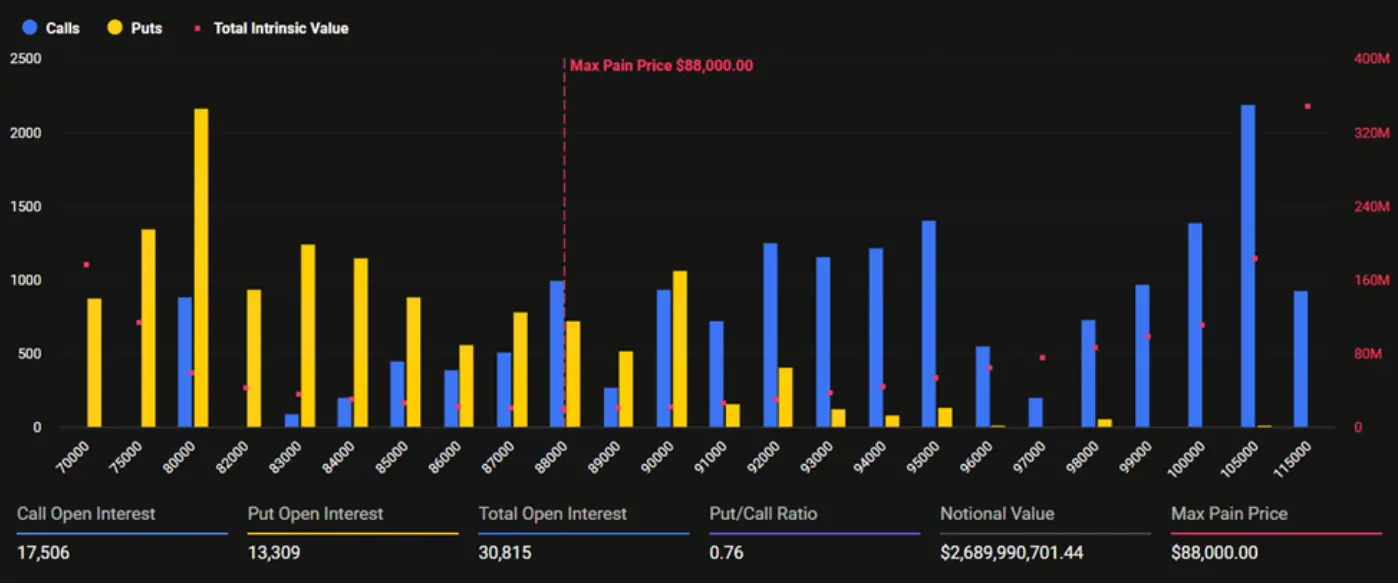

Ethereum 6 billion options expire! $3,100 pain point determines long and short life and death

On December 26, approximately $6 billion worth of Ethereum options contracts will expire, with Deribit holding about $3.8 billion. This is the biggest derivatives event of the week. The number of call options is 2.2 times that of put options, but the $3,100 "pain point" price has become a key level for bulls and bears. If Ethereum fails to effectively break through this level, a large number of call options will become worthless. The current price remains above $2,900, but the market structure is fragile.

MarketWhisper·2025-12-26 05:23

Holding XRP Got Painful: Treasury Data Shows Heavy Losses

XRP holders have had another rough stretch, and the latest on-chain view makes that pain easy to see. XRP is down around 3% this week and still trades below $1.90. Price action has stayed heavy, and every bounce has struggled to stick.

A CryptoQuant chart tracking Evernorth’s unrealized PnL adds

XRP-3.62%

CaptainAltcoin·2025-12-24 16:35

$27 billion in cryptocurrency options will expire on Christmas Day! Traders are betting on a "Christmas Rebound," can BTC rise to $96,000?

As the year-end approaches, the crypto derivatives market is undergoing an unprecedented "structural reset." On December 26 (Boxing Day), the world's largest crypto assets options exchange Deribit will have Bitcoin and Ether options contracts with a total value of up to $27 billion expiring, with Bitcoin options accounting for $23.6 billion and Ether options for $3.8 billion. This expiration involves more than 50% of Deribit's total open contract volume, and the market shows a clear bullish bias, with the put-to-call ratio dropping to as low as 0.38.

At the same time, data from institutions like Matrixport shows that the sentiment among options traders has shifted from extreme bearishness to "slightly bullish" for the first time since the sharp drop in October, with the key indicator 25-Delta skew starting to rebound. This series of signs, combined with the characteristics of thin liquidity at year-end, sets the stage for the long-awaited "Santa Claus rally" in the market, while the $96,000 "maximum pain point" price for Bitcoin will become the focus of today's long and short battle.

MarketWhisper·2025-12-23 03:07

Gate Vault Multi-chain Safe: A controllable and recoverable asset security foundation for Web3 users.

When Web3 is to go mainstream, security must come first.

The speed of development of on-chain applications has already surpassed most users' understanding of security risks. Loss of private keys, phishing attacks, and platform failures are not isolated incidents, but rather recurring real-world tests during the popularization of Web3. Once assets go wrong, it is difficult to recover, and users will naturally keep their distance from the decentralized world.

The emergence of Gate Vault addresses this core pain point by not merely enhancing wallet functions, but by fundamentally redesigning a security architecture that is more aligned with real usage scenarios, starting from the essential questions of who can control assets and how to reduce single point risks.

No longer relying on a single private key security model

Traditional wallets concentrate all permissions in a single private key, which is convenient but extremely vulnerable. Gate Vault employs MPC (Multi-Party Computation) technology to split the complete private key.

GateLearn·2025-12-22 01:38

Crypto market cap falls to 8-month low, analysts see more pain ahead

The total crypto market capitalization has fallen to an eight-month low, erasing much of this year’s gains, as analysts remain bearish in the short term.

Total market capitalization fell to $2.93 trillion in late trading on Thursday, its lowest level since April, according to CoinGecko.

The total

Cointelegraph·2025-12-19 11:54

$3.16 billion in crypto options to be settled before Christmas. How will Bitcoin and Ethereum prices move?

The cryptocurrency derivatives market is facing a critical year-end test. On December 19th at 08:00 UTC, approximately $3.16 billion worth of Bitcoin and Ethereum options will expire simultaneously on the Deribit exchange. This is the last major derivatives settlement before Christmas. Among them, Bitcoin options dominate with a notional value of up to $2.69 billion, with the current price close to the "maximum pain point" of $88,000; Ethereum options are valued at $473 million, with their "maximum pain point" at $3,100, which is significantly different from the current price. In the context of holiday liquidity being thin, this "annual report card" is testing the market's short-term balance and could serve as a trigger for pre-holiday volatility. Traders are holding their breath, waiting for the next clear market catalyst.

MarketWhisper·2025-12-19 05:50

United Stables launches the new generation stablecoin U: nearly $60 million attracted within 24 hours, targeting the fragmented liquidity dilemma

The stablecoin market welcomes a heavyweight new player built by United Stables. On December 18, the next-generation stablecoin $U , aimed at creating a unified liquidity layer, officially launched on the BNB Chain and Ethereum mainnet. Its innovative "Stablecoin Inclusive Reserve" model consolidates mainstream stablecoins such as USDT, USDC, USD1, and others as reserve assets, attempting to end the market pain point of liquidity fragmentation. The launch performance has been remarkable: in less than 24 hours, its circulating supply rapidly rose to 58.9 million tokens, and it quickly gained full integration with leading DeFi protocols like PancakeSwap, Lista DAO, and major exchanges. This is not just the birth of a new asset but may also signal a strategic shift for stablecoins from "fiefdoms" to a "unified foundational layer."

MarketWhisper·2025-12-19 05:44

Web3 AI Security Track Newcomer AgentLISA Raises $12 Million, LISA Token Launches Airdrop

The Web3 AI security track receives a major announcement. The world's first AI agent security operating system AgentLISA recently announced the completion of a $12 million funding round and plans to launch its token LISA on platforms such as Binance Alpha on December 18. The project aims to leverage its proprietary TrustLLM large model to revolutionize the industry pain points of high costs and long cycles in smart contract auditing, reducing audit times from several weeks to just a few minutes. This token generation event (TGE) and launch mark a high level of recognition from capital and the market for the "AI + blockchain security" integrated track, which is expected to build a new security foundation for decentralized applications.

MarketWhisper·2025-12-19 05:25

Synthetix returns to the Ethereum mainnet every three years: All DEXs will come back

Gas fees plummet dramatically, coupled with the mainnet's liquidity and security advantages. After three years away, Synthetix returns to Ethereum, injecting a key variable into the 2025 DeFi landscape.

(Background recap: The insider story of RWA protocol Ondo Finance's explosion in popularity: BlackRock and Morgan Stanley entering the real-world asset space)

(Additional background: The US SEC terminates the investigation into Ondo Finance with "no charges"! $ONDO surges and breaks through $0.5)

Table of Contents

Gas fees plummet dramatically, costs are no longer a pain point

Deep liquidity, institutional funds locking in on the mainnet

Chain reaction: Layer 2 positioning reshuffle

Conclusion: The next step for the mainnet financial hub

Derivative protocol Synthetix announced on December 17

動區BlockTempo·2025-12-19 02:00

Bitcoin in Focus as Stock and Options Contracts Expire on Friday

In brief

The "triple witching" of stock derivatives can impact crypto indirectly by shifting equity market risk appetite, which then flows into high-beta assets like Bitcoin.

A larger, direct crypto event is the December 26 expiry of over $13.3B in Bitcoin options, where the "max pain" price is

Decrypt·2025-12-17 10:54

CZ Urges Crypto Holders to Stay Steady Amid Market Dip – "Smart Money Buys Low and Endures"

CZ encouraged cryptocurrency investors during the ongoing market downturn, reminding them to focus on long-term discipline rather than short-term pain.

CryptopulseElite·2025-12-17 07:07

Why has the UAE, which was built on oil, become a new hotspot for the cryptocurrency industry?

The recent crypto market has experienced extreme fluctuations, with Bitcoin retracing over 30% from its all-time high on one side, and the UAE bustling with various crypto conferences on the other, attracting top institutions and industry veterans.

It's hard to imagine that this oil-rich region has now become a new hotspot for the crypto industry. Why exactly are major institutions gathering here and even establishing headquarters?

Looking back to 2024, the UAE incorporated the crypto industry into its "2031 National Investment Strategy" and launched the "Tokenization Regulatory Sandbox Guide" in 2025, forming a layered regulatory model with federal and local cooperation.

Currently, the Dubai Virtual Assets Regulatory Authority (VARA) has issued licenses to 36 companies, while the Abu Dhabi Global Market explicitly classifies crypto assets as regulated financial products, effectively resolving the industry's "regulatory uncertainty" pain point and contrasting sharply with regulatory deadlocks in some other regions.

It is precisely due to regulatory

金色财经_·2025-12-17 06:36

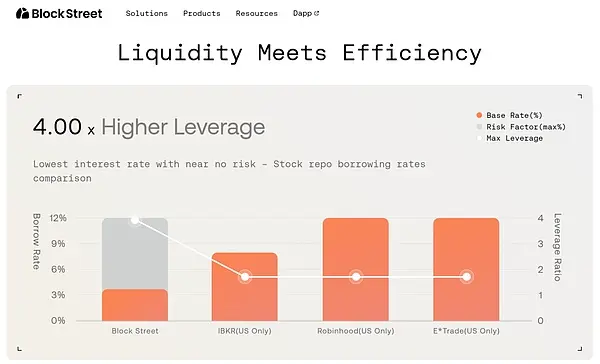

Talking with Blockstreet Hedy about US stocks: RWA tokenization is not the end point

By 2025, people will have fully recognized the transformative potential of blockchain and stablecoins, as well as their potential power in the monetary field. It can be said that we already have a tokenized blueprint that enables assets to achieve permissionless access worldwide and supports peer-to-peer transfers.

Since stablecoins—the tokenized form of fiat currency—can operate efficiently in the real world, what about the tokenization of stocks?

In the stock market, the current pain points are particularly prominent: the existing stock securities market is fragmented by region, cumbersome, and slow. Almost every region has its own Central Securities Depository (CSD)—the US has DTCC, Europe has Euroclear and Clearstream, and Asia has numerous others. Transferring stocks through brokers from one CSD to another can take several days or even weeks. Similarly, there are many frictions in the settlement of securities and the corresponding funds.

RWA-3.65%

金色财经_·2025-12-16 08:50

Gold near previous high, Bitcoin undergoes deep correction: Grayscale predicts a new high in the first half of 2026

Recently, traditional safe-haven assets like gold and digital assets like Bitcoin have exhibited a rare and extreme divergence. Gold prices have climbed to $4,305 per ounce, just one step away from the all-time high, with an annual increase of up to 64%; meanwhile, Bitcoin hovers around $86,000, roughly 30% below its October peak. Renowned asset management firm Grayscale, in its latest "Digital Asset Outlook 2026," interprets the current market as the pain point of the "institutionalization era," and predicts that Bitcoin will hit a new all-time high in the first half of 2026. This judgment is based on structural changes such as global debt expansion, clearer regulatory frameworks, and continuous institutional capital inflows.

BTC-2.01%

MarketWhisper·2025-12-16 05:52

Load More