Search results for "PERP"

Hyperliquid (HYPE) Leads Perp Volume — Is More Upside Ahead?

_Key Takeaways_

_Hyperliquid (HYPE) surged over 8%, reclaiming the $23.30 level amid rising market interest._

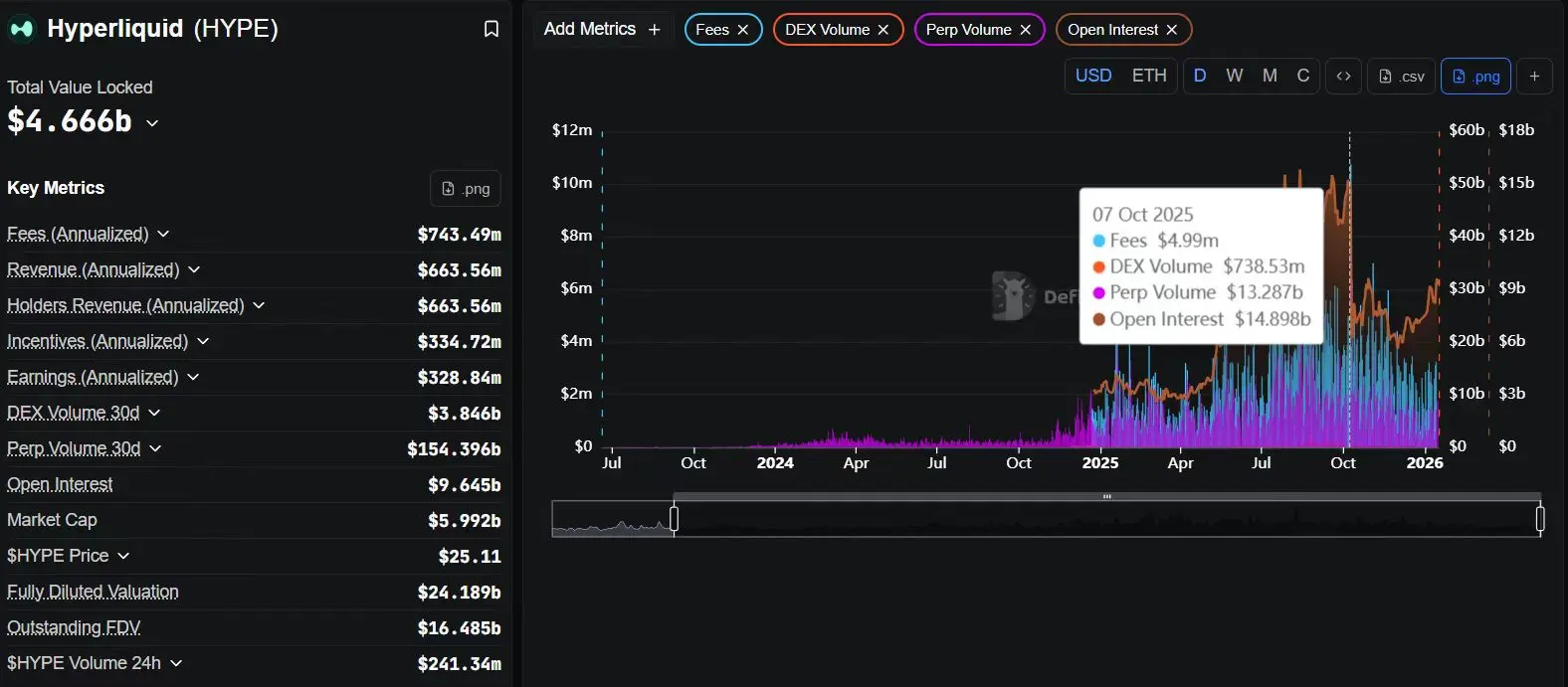

_DefiLlama data shows Hyperl

CoinsProbe·20h ago

Hyperliquid (HYPE) Leads Perp Volume — Is More Upside Ahead?

_Key Takeaways_

_Hyperliquid (HYPE) surged over 8%, reclaiming the $23.30 level amid rising market interest._

_DefiLlama data shows Hyperl

HYPE2.56%

CoinsProbe·01-31 15:11

Hyperliquid (HYPE) Leads Perp Volume — Is More Upside Ahead?

_Key Takeaways_

_Hyperliquid (HYPE) surged over 8%, reclaiming the $23.30 level amid rising market interest._

_DefiLlama data shows Hyperl

CoinsProbe·01-30 15:06

Stock Contract Track Deep Research Report: The Next Trillion-Dollar Battlefield of On-Chain Derivatives

Author: Huobi Growth Academy

Summary

Stock contracts, as innovative products connecting traditional financial markets with the crypto derivatives system, are rapidly reshaping on-chain trading patterns. We will delve into the product essence, growth logic, technical architecture, and market ecology of this emerging sector, and systematically analyze the regulatory challenges and future prospects it faces. Research shows that perpetual stock contracts are not merely a simple conceptual innovation but are built on the foundation of over $160 trillion in global stock market capitalization, combined with the structural opportunities of mature perpetual contract trading paradigms. Currently, leading Perp DEXs represented by Hyperliquid, Aster, and Lighter have taken the lead in establishing a complete stock perpetual product matrix, forming a clear advantage in trading depth, user experience, and asset coverage. However, regulatory uncertainty remains the biggest constraint in this sector, and exploration of product compliance pathways is ongoing.

PANews·01-30 06:39

Hyperliquid (HYPE) Leads Perp Volume — Is More Upside Ahead?

_Key Takeaways_

_Hyperliquid (HYPE) surged over 8%, reclaiming the $23.30 level amid rising market interest._

_DefiLlama data shows Hyperl

CoinsProbe·01-29 15:06

Secured $8 million in seed funding, Bulk Trade aims to become the "performance king" of Perp DEXs

Bulk Trade in the Perp DEX space attempts to achieve centralized trading speed and decentralized settlement capabilities through a customized Solana validator client architecture. Its innovative order matching and propagation logic significantly improve trading efficiency, and by using a centralized current-price order book, it eliminates liquidity issues common in traditional DEXs, ensuring the security and execution efficiency of trades. Currently in internal testing, looking forward to its performance on the public testnet.

SOL-0.95%

PANews·01-29 05:27

Hyperliquid (HYPE) Leads Perp Volume — Is More Upside Ahead?

_Key Takeaways_

_Hyperliquid (HYPE) surged over 8%, reclaiming the $23.30 level amid rising market interest._

_DefiLlama data shows Hyperl

CoinsProbe·01-28 15:01

Hyperliquid (HYPE) Leads Perp Volume — Is More Upside Ahead?

_Key Takeaways_

_Hyperliquid (HYPE) surged over 8%, reclaiming the $23.30 level amid rising market interest._

_DefiLlama data shows Hyperl

HYPE2.56%

CoinsProbe·01-27 14:56

Hyperliquid (HYPE) Leads Perp Volume — Is More Upside Ahead?

_Key Takeaways_

_Hyperliquid (HYPE) surged over 8%, reclaiming the $23.30 level amid rising market interest._

_DefiLlama data shows Hyperl

CoinsProbe·01-26 14:56

Hyperliquid (HYPE) Leads Perp Volume — Is More Upside Ahead?

_Key Takeaways_

_Hyperliquid (HYPE) surged over 8%, reclaiming the $23.30 level amid rising market interest._

_DefiLlama data shows Hyperl

HYPE2.56%

CoinsProbe·01-25 14:51

Hyperliquid (HYPE) Leads Perp Volume — Is More Upside Ahead?

_Key Takeaways_

_Hyperliquid (HYPE) surged over 8%, reclaiming the $23.30 level amid rising market interest._

_DefiLlama data shows Hyperl

HYPE2.56%

CoinsProbe·01-24 14:51

What is the most expensive thing in the 21st century? The traffic anxiety of exchanges

Author: Uncle Zuo

Out of money, I can only keep your attention

At 6 PM, I end the broadcast, change into OK's clothes, and head out to drink a few beers during Binance's big liquidation.

In the Meme counter's crazy Perp marketplace, earning some rebates by using mom KYC.

The big show of 2026 begins, witnessing the collapse of the exchange's skyscraper, unlike previous direct explosions such as major liquidations or triggering public opinion, now the public no longer focuses on the exchange, reflected in Binance Square and OKX Planet's inability to attract new users.

When even the inspiring stories of beautiful female dealers go unnoticed, the exchange has to come out and shout, "Look at the kids, you get to watch for free and even get paid!"

This article commemorates the first anniversary of Chuanbao's ascension, a presidential-level stunt that gives us full emotional value.

Lie back and wait for the money

If you don't explode in silence, you'll perish in silence.

In 2025, the exchange did nothing wrong, embracing Per

PANews·01-22 06:36

The Rise and Future of Perp DEX: A Structural Revolution in On-Chain Derivatives

Over the past two years, one of the most important changes in the crypto market has not been a new public chain or a popular narrative, but rather the gradual and continuous migration of derivatives trading from centralized exchanges to on-chain platforms. In this process, Perpetual DEX (Decentralized Perpetual Contract Exchange) has gradually evolved from an experimental product to one of the most valuable tracks within the DeFi ecosystem.

If spot trading is considered the starting point of DeFi, then perpetual contracts are becoming its true "cash flow core."

Why Perp DEX is Rising

In the traditional crypto trading system, perpetual contracts have long been the most important profit source for centralized exchanges. Whether it’s trading fees, funding rates, or additional earnings from liquidations, CEXs almost monopolize the entire derivatives cash flow. For DeFi, this is not a question of “whether to do it”

PANews·01-21 09:13

Delphi Digital 2026 Top 10 Predictions: AI Agents Autonomous Trading, Perp DEX Becomes the New Wall Street

Delphi Digital releases the 2026 Outlook Report, presenting ten key predictions. The report states that AI agents will achieve autonomous trading through x402 and ERC-8004 protocols, perpetual contract decentralized exchanges will disrupt traditional finance and become the new Wall Street, the market is expected to upgrade to first-class derivatives, and the ecosystem will regain stablecoin yields from USDC issuers.

MarketWhisper·01-21 02:42

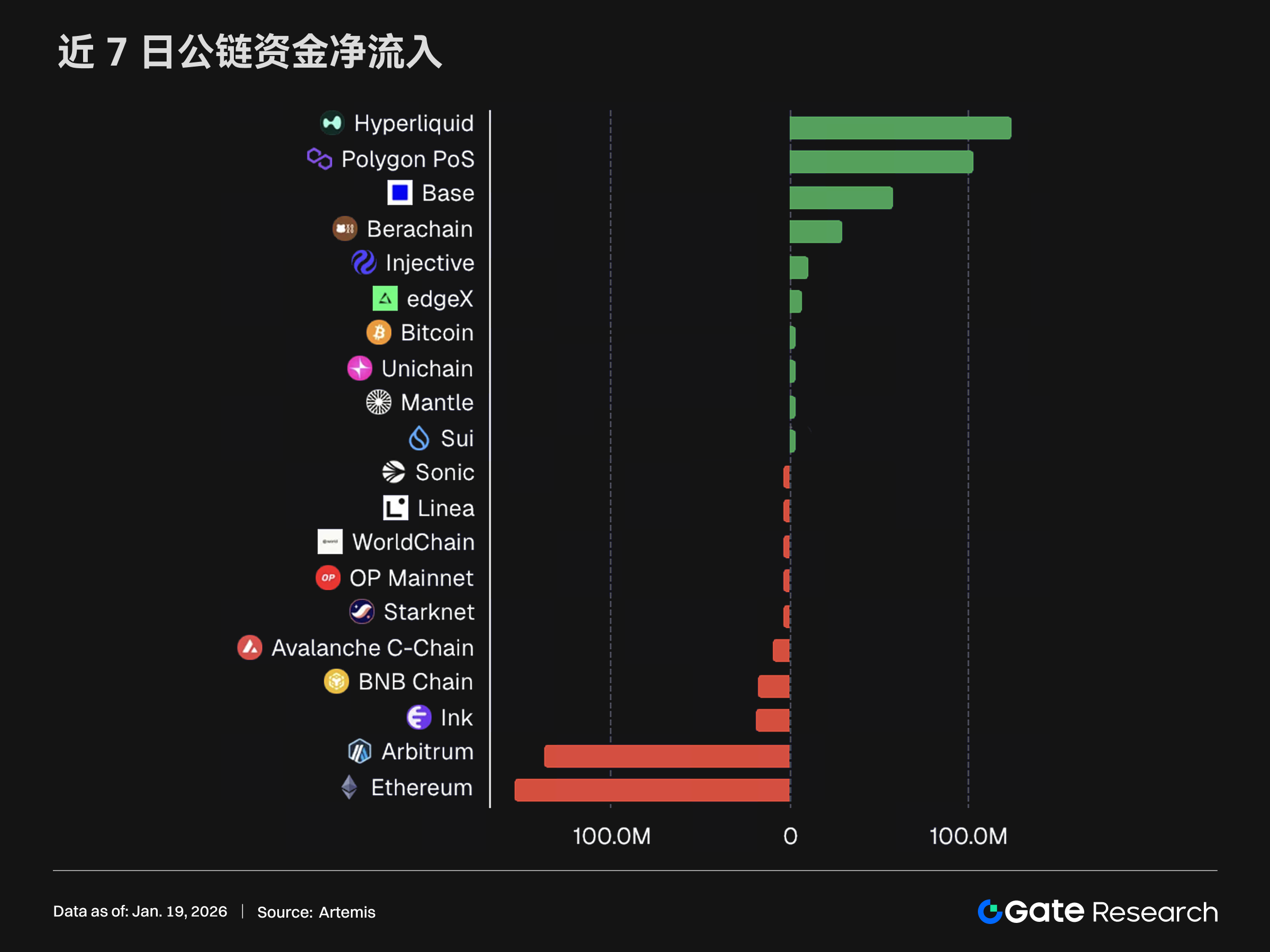

Gate Research Institute: FED Chair Candidate Draws Attention, Solana Ecosystem Meme Activity Picks Up | Gate VIP Weekly Report

Last week, the crypto market rebounded, with BTC entering a high-level consolidation, and ETH performing more steadily. Capital flow was concentrated in high-efficiency trading scenarios, with Perp DEX and prediction markets attracting significant funds. The report will provide an in-depth analysis of these trends, along with market data and technical insights.

GateResearch·01-20 09:36

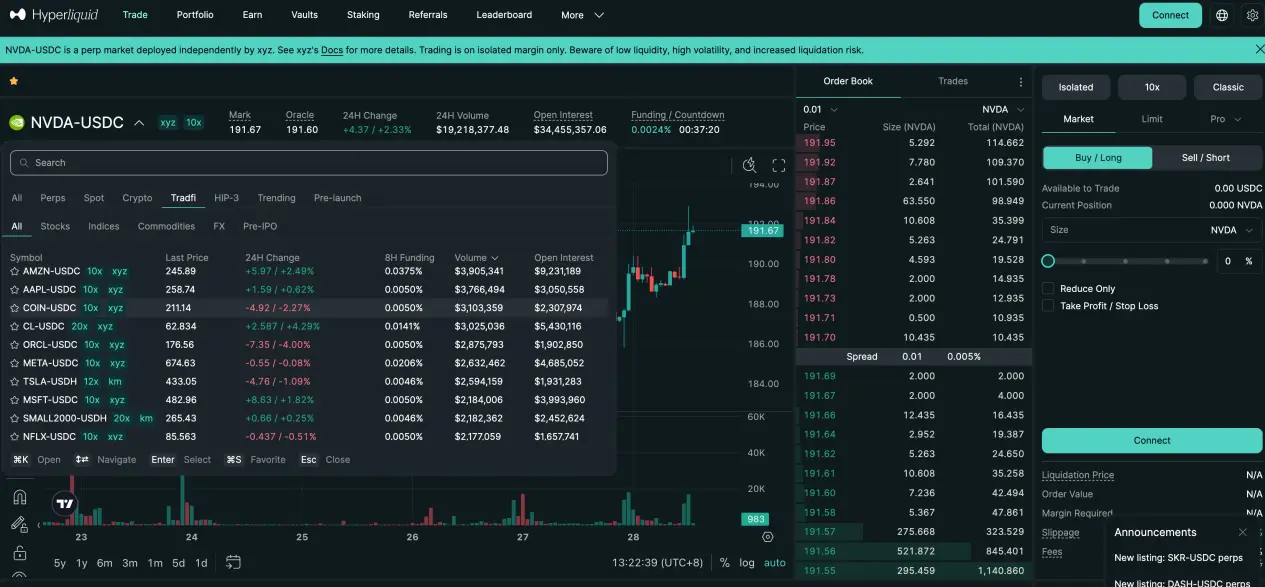

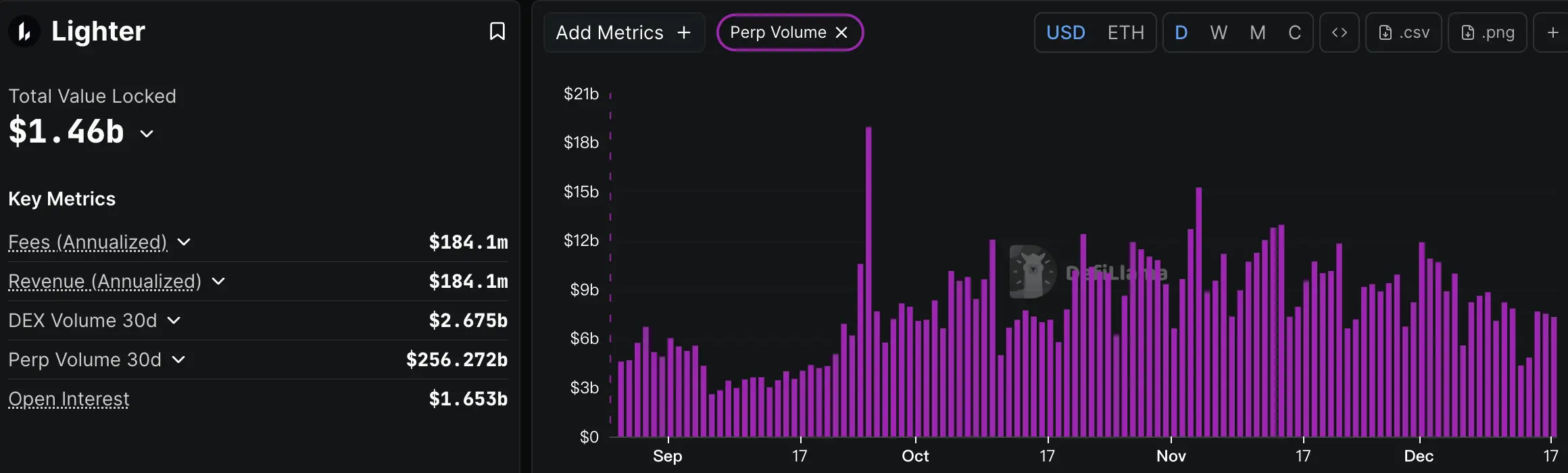

Hyperliquid Reclaims Top Spot in Perp DEX Trading

Hyperliquid has emerged as the leading perpetual decentralized exchange (Perp DEX), showcasing superior liquidity and execution, as evidenced by significant trading volumes surpassing competitors. In contrast, Lighter’s performance decline post-airdrop indicates that user confidence hinges on platform reliability rather than incentives alone.

CryptoFrontNews·01-19 11:51

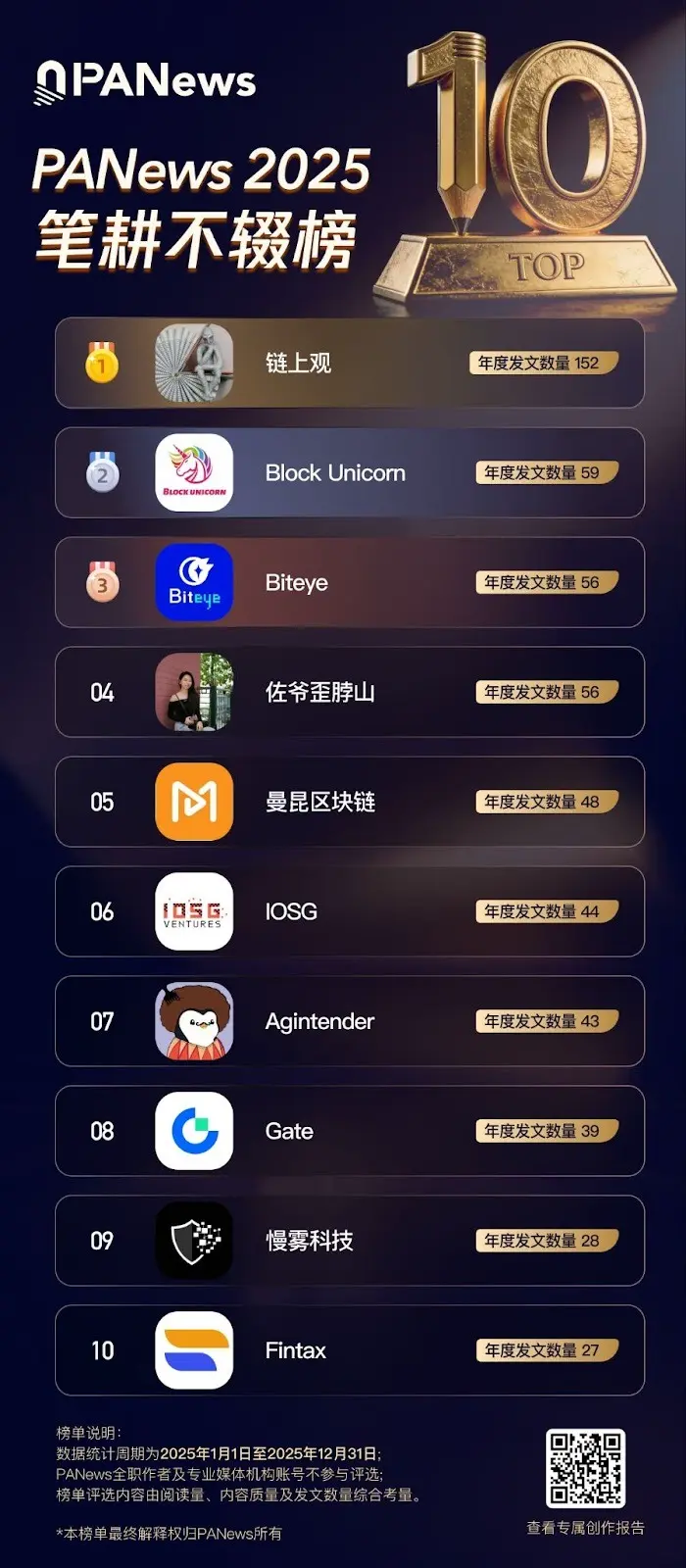

PANews 2025 Annual Influence Column Four Major Lists Officially Released

Looking back at 2025, Bitcoin reached a new all-time high of $126,000 after touching a low of $74,500. Trump's coin issuance sparked a celebrity Meme trend, and the narrative of AI and Crypto integration remained prominent throughout the year. Projects like Virtuals, Base, Pump, Monad, and Berachain garnered significant attention in 2025. Aster's airdrop unexpectedly boosted Perp

PANews·01-16 03:41

MetaMask Now Expands Into Gold, Silver, and Forex Perp Trading

MetaMask Perps now supports gold, silver, and major forex trading.

Users can trade commodities and currencies using perpetual contracts with leverage.

MetaMask has rolled out perpetual trading for gold, silver, and major forex pairs on its mobile app, giving users the ability to go long or s

CryptoNewsFlash·01-15 17:33

Perp DEXs to Dominate Finance by 2026, Says Delphi Digital

Decentralized Perpetual Futures Exchanges Grow as Trading Volumes Surge

Perpetual decentralized exchanges (DEXs) are rapidly gaining market share, offering traders lower-cost, blockchain-based alternatives to traditional centralized trading venues. These platforms enable users to trade perpetual

CryptoBreaking·01-15 11:55

Perp DEX traders pivot from airdrop hunting to CEX‑style execution quality

Perpetual DEXs now rival CEX volume as Hyperliquid, Aster and Lighter shift competition from airdrops to infrastructure, privacy tools and pro‑grade execution for institutional traders.

Summary

Perp DEX volumes have grown to tens of billions daily as leading venues deploy custom chains to cut l

Cryptonews·01-15 10:48

The Rise of Execution Quality in the Perp DEX Market

_Traders are moving from airdrops to execution quality as Perp DEX volume now rivals centralised exchanges._

_Hyperliquid and Aster are leading the industry by building custom blockchains that offer speed and professional features._

_New privacy tools like Shield Mode also protect

LiveBTCNews·01-15 10:20

From "On-Chain Applications" to "Financial Infrastructure": The Generational Development and Transition of Perp DEX

Author: Max.s

The past 2025 years have often been regarded as the "Great Screening Era" for derivatives tracks. Standing at the current power landscape of Perp DEX, we can clearly see: the vast majority of once-glorious fork projects have fallen silent, while the survivors are reshaping the financial order with a brand-new posture.

The survival of Perp DEX does not stem from it being faster or cheaper than centralized exchanges (CEX), but because it solves the most core cost in the financial system — trust. After experiencing several secondary exchange clearing black box crises (the Double Ten Crash, which painfully affected all market makers!), the market has reached a consensus: transparency is not optional but the underlying logic of infrastructure.

Early Perp DEXs were often seen as "low-end versions" of CEXs, but with full-chain abstraction (Chain

PANews·01-15 04:40

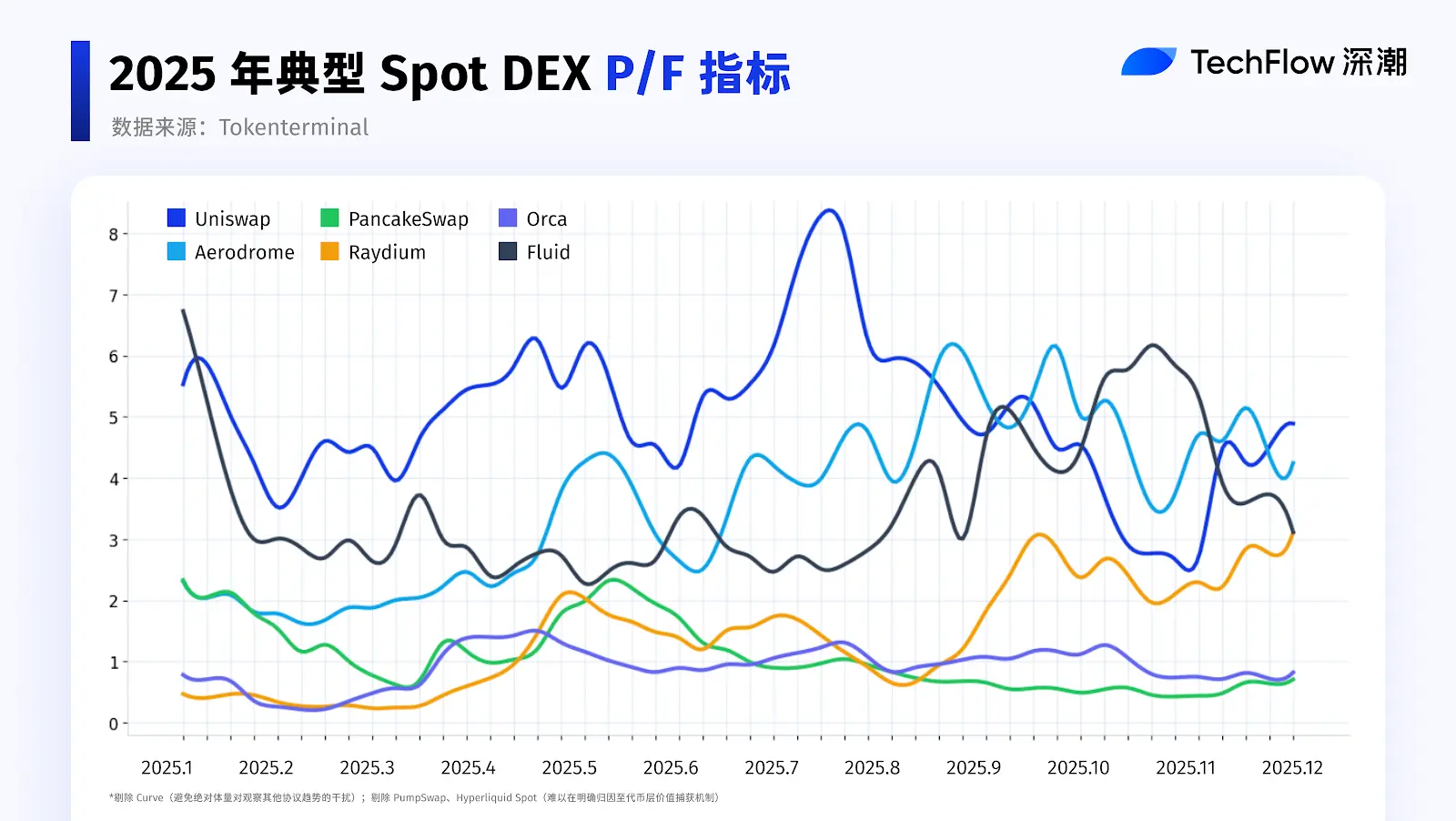

Reviewing the 2025 showdown between DEX and CEX: Perp DEX is the biggest engine

Writing by: Cecelia, Deep Tide TechFlow

DEX, is it really going to replace CEX?

From a lower market share in 2020 to a rapid increase in trading volume this year, the presence of decentralized exchanges is indeed becoming stronger.

Is the DEX comeback really not far away? But maybe not so soon?

Don't rush to applaud the victory of decentralization, and don't dismiss it with old reasons like complex processes and poor user experience.

Read this report first, and you'll know for sure.

2025: The Year DEX Liquidity Takes Off

Compared to the slow growth in the past two years, 2025 can be said to be the year when DEX liquidity truly takes off.

In terms of both scale and growth rate, the trading volume of DEX has shown a significant leap, approaching nearly 4 times the previous total trading volume.

Data source: dune.com (@c

PANews·01-15 01:31

Lighter Perp DEX Faces Sharp Decline Amid TGE Fallout

Lighter, a perpetuals DEX, has faced a significant decline in its token value post-TGE, raising concerns about its sustainability. Despite ongoing trading activity, it struggles to compete with platforms like HyperliquidX, which monetizes at a much higher rate. The focus on market share without innovation may jeopardize Lighter's future success.

CryptoFrontNews·01-14 16:51

Perp DEXs to Dominate Finance by 2026, Says Delphi Digital

Decentralized Perpetual Futures Exchanges Grow as Trading Volumes Surge

Perpetual decentralized exchanges (DEXs) are rapidly gaining market share, offering traders lower-cost, blockchain-based alternatives to traditional centralized trading venues. These platforms enable users to trade perpetual

CryptoBreaking·01-14 11:50

MetaMask Now Expands Into Gold, Silver, and Forex Perp Trading

MetaMask Perps now supports gold, silver, and major forex trading.

Users can trade commodities and currencies using perpetual contracts with leverage.

MetaMask has rolled out perpetual trading for gold, silver, and major forex pairs on its mobile app, giving users the ability to go long or s

CryptoNewsFlash·01-14 10:40

YZi Labs invests "tens of millions of dollars" in decentralized exchange Genius Trading, CZ joins as an advisor, is on-chain Binance coming?

Well-known family office YZi Labs invests tens of millions of dollars in decentralized trading platform Genius Trading, with Binance co-founder CZ serving as an advisor. Is the on-chain version of Binance about to be born?

(Previous context: How to trade US stocks with 100x leverage on Perp DEX?)

(Additional background: As the crypto market enters a bear market, let's see what major Perp DEXs are up to lately.)

Table of Contents

- One-stop on-chain trading platform

- Focus on privacy

- Fundraising background and team overview

According to The Block, Binance founder Zhao Changpeng's family office YZi Labs has invested in the decentralized trading platform Genius Trading.

動區BlockTempo·01-13 16:00

Gate Research Institute: Cryptocurrency Market Volatility and Recovery, Perp DEX Drives On-Chain Fund Reallocation | Gate VIP Weekly Report

Last week, the market showed BTC oscillating and recovering, with ETH performing better than non-mainstream assets. Public chain capital flows concentrated into trading networks, with StarkNet becoming the core technological support for Perp DEX. The full report provides in-depth analysis and market data.

GateResearch·01-13 10:16

After Lighter, "these 23 perpetual contract DEXs" might be the "potential stocks" of 2026.

Article by: June, Deep Tide TechFlow

As Lighter completes TGE by the end of 2025, the focus in the perpetual contract DEX field begins to shift, and the market gradually turns to evaluating the next batch of potential token issuance projects.

From current trends, 2026 is highly likely to usher in a new wave of strong release cycles. Several perpetual contract decentralized exchanges are still in the pre-TGE stage but have already initiated continuous staking or incentive programs, generating considerable on-chain trading volume with genuine user participation.

For participants looking to get ahead, understanding the current performance of these projects is more important than simply chasing narratives.

Based on DefiLlama’s perpetual contract trading volume data over the past 30 days, the following is a list of top-ranked Perp DEXs that have not yet issued tokens, for reference and

LIT0.85%

区块客·01-13 04:30

After Lighter, "these 23 perpetual contract DEXs" might be the "potential stocks" of 2026.

Article by: June, Deep Tide TechFlow

As Lighter completes TGE by the end of 2025, the focus in the perpetual contract DEX field begins to shift, and the market gradually turns to evaluating the next batch of potential token issuance projects.

From current trends, 2026 is highly likely to usher in a new wave of strong release cycles. Several perpetual contract decentralized exchanges are still in the pre-TGE stage but have already initiated continuous staking or incentive programs, generating considerable on-chain trading volume with genuine user participation.

For participants looking to get ahead, understanding the current performance of these projects is more important than simply chasing narratives.

Based on DefiLlama’s perpetual contract trading volume data over the past 30 days, the following is a list of top-ranked Perp DEXs that have not yet issued tokens, for reference and

LIT0.85%

区块客·01-12 04:25

After Lighter, "these 23 perpetual contract DEXs" might be the "potential stocks" of 2026.

Article by: June, Deep Tide TechFlow

As Lighter completes TGE by the end of 2025, the focus in the perpetual contract DEX field begins to shift, and the market gradually turns to evaluating the next batch of potential token issuance projects.

From current trends, 2026 is highly likely to usher in a new wave of strong release cycles. Several perpetual contract decentralized exchanges are still in the pre-TGE stage but have already initiated continuous staking or incentive programs, generating considerable on-chain trading volume with genuine user participation.

For participants looking to get ahead, understanding the current performance of these projects is more important than simply chasing narratives.

Based on DefiLlama’s perpetual contract trading volume data over the past 30 days, the following is a list of top-ranked Perp DEXs that have not yet issued tokens, for reference and

LIT0.85%

区块客·01-11 04:25

After Lighter, "these 23 perpetual contract DEXs" might be the "potential stocks" of 2026.

Article by: June, Deep Tide TechFlow

As Lighter completes TGE by the end of 2025, the focus in the perpetual contract DEX field begins to shift, and the market gradually turns to evaluating the next batch of potential token issuance projects.

From current trends, 2026 is highly likely to usher in a new wave of strong release cycles. Several perpetual contract decentralized exchanges are still in the pre-TGE stage but have already initiated continuous staking or incentive programs, generating considerable on-chain trading volume with genuine user participation.

For participants looking to get ahead, understanding the current performance of these projects is more important than simply chasing narratives.

Based on DefiLlama’s perpetual contract trading volume data over the past 30 days, the following is a list of top-ranked Perp DEXs that have not yet issued tokens, for reference and

LIT0.85%

区块客·01-10 04:25

Aster Perp Volume Hits $6.6B, Surpassing Top Crypto Competitors

Aster has surged to the top of the crypto derivatives market with $6.60 billion in perpetual futures trading volume, significantly outpacing competitors Hyperliquid and Lighter. This reflects a growing interest in perpetual trading and suggests favorable trading conditions on Aster. The competitive landscape remains strong, indicating that the market is rapidly evolving.

Coinfomania·01-06 08:09

A review of 9 Perp DEX projects expected to airdrop in 2026

Author: fiyalkin, Crypto KOL

Compiled by: Felix, PANews

Recently, crypto KOL fiyalkin summarized a list of Perp DEX projects that may conduct token issuance in 2026, including brief introductions, key data, and more. These projects are all in the early stages of development and have not yet issued tokens. Below are the details.

1. Variational

Variational is a decentralized peer-to-peer (P2P) derivatives trading protocol built on Arbitrum, focusing on on-chain trading, settlement, and clearing of broad derivatives such as perpetual contracts, options, and futures.

Based on the Variational protocol, several applications have been developed, including those for simple perpetual contract trading.

PANews·01-05 07:25

Lighter Airdrop of $675 million $LIT sparks controversy, users dissatisfied with the airdrop mechanism

According to Bubblemaps data, the decentralized perpetual contract exchange (Perp DEX) Lighter issued its native token $LIT on December 30, 2025 (TGE), distributing up to $675 million worth of tokens to early participants via airdrop.

Lighter allocated 50% of the total supply to the ecosystem, including an immediate airdrop of 25% of the tokens to early participants in the 2025 scoring season. This move directly converted 12.5 million points from the first and second seasons into LIT (distributing 20 coins per point), aiming to reward loyal users. However, it sparked strong community backlash due to perceptions of unfairness. Half of the community praised the promotion as fair and community-centric, while the other half questioned resource allocation favoring insiders and long-term impacts.

LIT0.85%

区块客·01-02 10:44

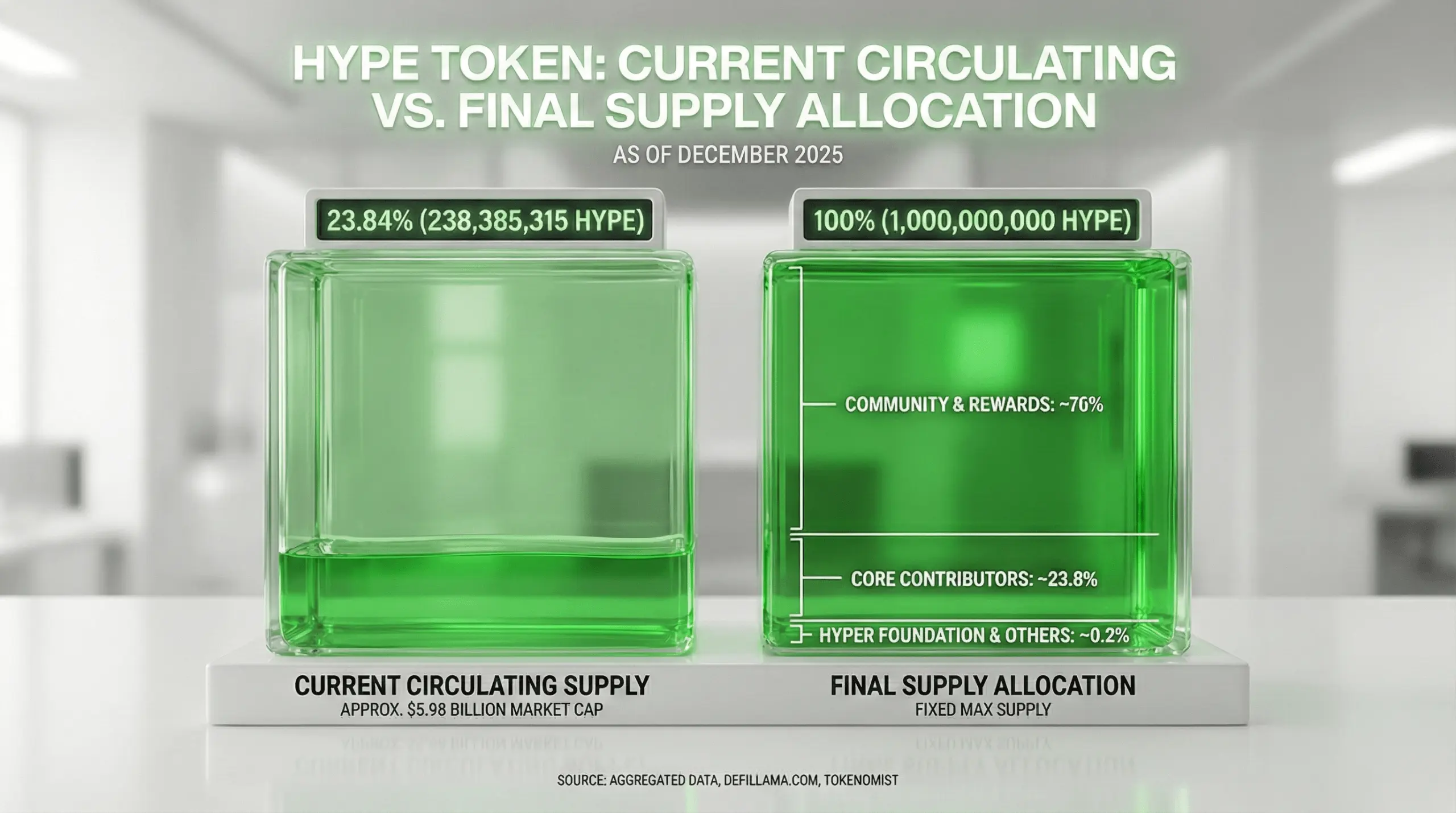

Hyperliquid redefines on-chain perp trading in 2025

Hyperliquid emerged in 2025 not thanks to marketing or token hype, but through infrastructure capability. This platform operates a fully onchain centralized limit order book on a dedicated layer 1 blockchain, enabling perpetual futures trading with speed, market depth, and a seamless trading experience.

TapChiBitcoin·01-02 02:23

Hyperliquid Explained: A Deep Dive Into the Perp DEX That Reshaped Crypto in 2025

Hyperliquid didn’t rely on hype cycles or marketing blitzes to break into the spotlight—it engineered its way into relevance, forcing the crypto industry to reassess how far onchain trading infrastructure had come.

What Hyperliquid Is

At its core, Hyperliquid is a decentralized exchange ( DEX)

Coinpedia·01-01 15:33

Lighter Airdrop of $675 million $LIT sparks controversy, users dissatisfied with the airdrop mechanism

According to Bubblemaps data, the decentralized perpetual contract exchange (Perp DEX) Lighter issued its native token $LIT on December 30, 2025 (TGE), distributing up to $675 million worth of tokens to early participants via airdrop.

Lighter allocated 50% of the total supply to the ecosystem, including an immediate airdrop of 25% of the tokens to early participants in the 2025 scoring season. This move directly converted 12.5 million points from the first and second seasons into LIT (distributing 20 coins per point), aiming to reward loyal users. However, it sparked strong community backlash due to perceptions of unfairness. Half of the community praised the promotion as fair and community-centric, while the other half questioned resource allocation favoring insiders and long-term impacts.

LIT0.85%

区块客·01-01 10:42

Perp DEX Volumes Nearly Triple in 2025 as Onchain Derivatives Scale

Perp DEX trading volume reached a record high of 12.09T by 2025, having reached 65% of total lifetime volume within a year

Activity remained more concentrated during the second half of the year, exceeding the aggregate of the first half for the fourth quarter.

Hyperliquid’s dominance came under t

TheNewsCrypto·2025-12-31 13:32

Lighter Airdrop of $675 million $LIT sparks controversy, users dissatisfied with the airdrop mechanism

According to Bubblemaps data, the decentralized perpetual contract exchange (Perp DEX) Lighter issued its native token $LIT on December 30, 2025 (TGE), distributing up to $675 million worth of tokens to early participants through an airdrop.

Lighter allocated 50% of the total supply to the ecosystem, including an immediate airdrop of 25% of the tokens to early participants in the 2025 scoring season. This move directly converted 12.5 million points from the first and second seasons into LIT (distributing 20 tokens per point), aiming to reward loyal users. However, it sparked strong community backlash due to perceptions of unfairness.

Half of the community praised the promotion as fair and community-centric, while the other half questioned whether resource distribution favored insiders and its long-term impact.

LIT0.85%

区块客·2025-12-31 10:40

Airdrop of $675 million sparks distribution controversy; Lighter faces user retention challenges after token launch

Author: Jae, PANews

The final airdrop suspense of this year came to an end last night (December 30). Perp DEX (Decentralized Perpetual Contract Exchange) Lighter announced the completion of its airdrop distribution, with a total of $675 million worth of tokens airdropped to early participants, bringing a touch of warmth to the cold market at the end of 2025.

Although the winter market is somewhat bleak, the competition for liquidity and trading experience on the Perp DEX battlefield is becoming increasingly fierce. The industry is witnessing the gradual replacement of early automated market makers (AMMs) by high-performance centralized limit order books (CLOBs). Based on zk-rollup technology, Lighter has quickly stood out, leveraging its zero-fee strategy and customized ZK circuits to attempt to redefine the standards of on-chain derivatives trading.

Since ancient times, airdrops have been difficult to balance, and Lighter undoubtedly faces competition from other airdrop projects.

PANews·2025-12-31 10:13

Perp DEX Lighter launches native token $LIT, receive an immediate airdrop for the 2025 points season

Ethereum L2 Decentralized Perpetual Contract Exchange (Perp DEX) Lighter officially announces the launch of its native token "Lighter Infrastructure Token" (LIT).

The structure of the LIT token is designed to channel all value from Lighter's core DEX and future products to LIT holders. Income (tracked on-chain in real-time) will be allocated for ecosystem growth and buybacks based on market conditions. The team states, "We are long-term builders with the goal of maximizing the value created over the long term." The token distribution plan is: 50% allocated to the ecosystem, and the remaining 50% to the team and investors (the latter with a one-year cliff and a three-year linear vesting).

The launch of this token coincides with Lighter's introduction of spot trading functionality, from

区块客·2025-12-31 09:28

Lighter Launches LIT Token with Full Revenue Flow to Holders – A U.S.-Based DeFi Model

Lighter, a decentralized perpetuals exchange (Perp DEX) on Ethereum Layer 2, has officially launched its native token LIT.

CryptopulseElite·2025-12-30 09:59

Perp DEX Lighter launches native token $LIT, receive an immediate airdrop for the 2025 points season

Ethereum L2 Decentralized Perpetual Contract Exchange (Perp DEX) Lighter officially announces the launch of its native token "Lighter Infrastructure Token" (LIT).

The structure of the LIT token is designed to channel all value from Lighter's core DEX and future products to LIT holders. Income (tracked on-chain in real-time) will be allocated for ecosystem growth and buybacks based on market conditions. The team states, "We are long-term builders with the goal of maximizing the value created over the long term." The token distribution plan is: 50% allocated to the ecosystem, and the remaining 50% to the team and investors (the latter with a one-year cliff and a three-year linear vesting).

The launch of this token coincides with Lighter's introduction of spot trading functionality, from

区块客·2025-12-30 09:24

BitMart tops BTC–ETH perp liquidity across leading centralized exchanges

BitMart has shown superior order book depth in Bitcoin and Ethereum perpetual markets compared to rival exchanges, resulting in tighter spreads and lower slippage during market fluctuations. This consistency indicates a robust market-making infrastructure.

Cryptonews·2025-12-29 09:06

Opinion: Buybacks are not suitable for Web3; the opportunity is being reserved for other Perp DEXs

Buyback and burn tokens, while M&A burns competitors.

In traditional finance, buybacks are a defensive retirement option that giants resort to "due to their inability to grow further."

The point of this article is: why might startup projects miss out on a moat in the illusion of buybacks? Why is expansion more important than buybacks in Web3?

Buybacks are not suitable for Web3 (at least not now).

By 2025, the "buyback narrative" will dominate — it is an obvious and straightforward price support method, but it has long-term structural issues.

It's understandable why this idea has quickly gained popularity in Web3 — it precisely leverages Web3's core element: speculation.

When a mechanism can continuously buy tokens and create a "sustainable buy volume," this design is highly tempting. It is very easy to explain and also very easy to sell.

PANews·2025-12-26 11:07

Gate CEO Dr. Han Exclusive Interview: MiCA and VARA Dual Authorization Rewrite the 2026 Market

Gate rebrands to Gate.com, obtaining licenses from MiCA and Dubai VARA. Founder Dr. Han revealed that in October, they will launch the CrossEx cross-exchange platform for professional investors to manage capital centrally. Gate Layer supports Gate Perp DEX and Gate Fun zero-code token platform.

MarketWhisper·2025-12-25 05:05

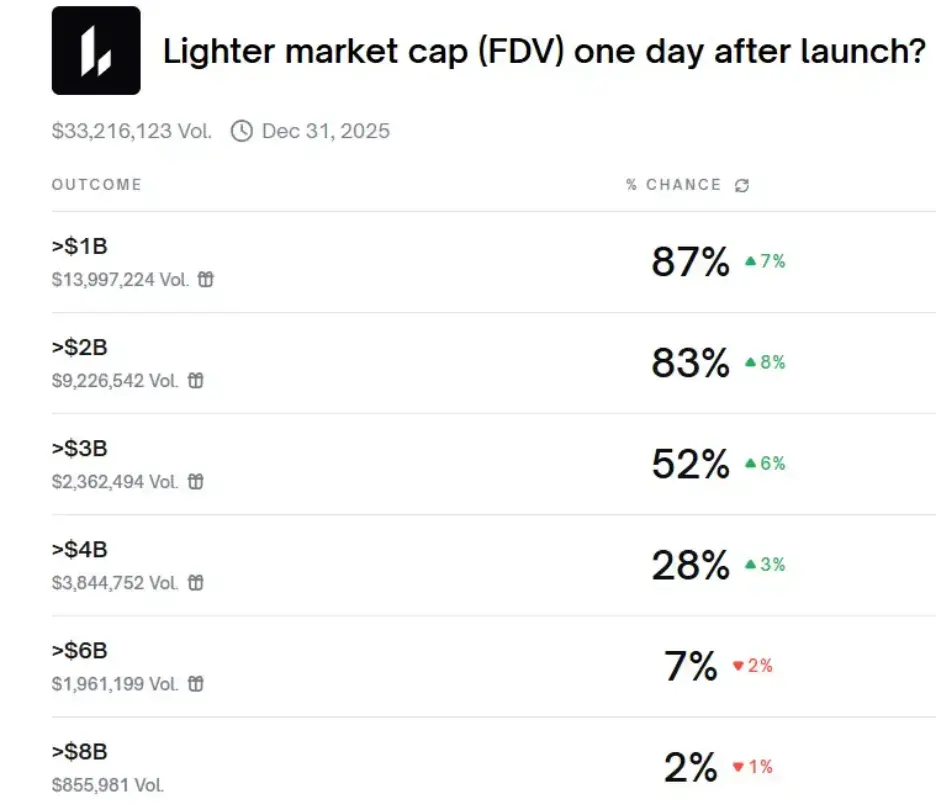

Polymarket bets surge on Lighter airdrop as Hyperliquid lists LIT

Lighter, a perpetual decentralized exchange (perp DEX) and a major rival to Hyperliquid, is fueling airdrop speculation as Polymarket traders bet on a token launch before year’s end.

Sebas, also known as Babastianj, a core contributor to the Lighter DEX, announced on the project’s Discord channel

Cointelegraph·2025-12-23 13:00

Lighter is about to launch on Coinbase. Is it too late to issue tokens now?

Taiwan time on the 20th near noon, the Lighter token contract transferred 250 million LIT, suspected to be preparing for listing. But is this move too late to catch up with the Perp DEX competition? This article is from CoinW Research Institute.

(Previous background: Aster, Lighter… fierce enemies encircle, Hyperliquid's siege war)

(Additional background: Market share dropped from 80% to 20%, what exactly happened to Hyperliquid?)

Table of Contents

1. Where does the controversy over Lighter originate: the mismatch between expected pre-commitment and information lag

2. Pre-pricing under high exposure: why is Lighter considered a "quasi-asset"

3. Ignoring TGE, has Lighter truly demonstrated product value?

動區BlockTempo·2025-12-20 09:45

Lighter is about to launch on Coinbase. Is it too late to issue tokens now?

Summary

Recently, Lighter has become the focal point of discussions in the Perp DEX sector. Lighter is actively traded, its points system operates stably, and Coinbase has included it in its listing roadmap; however, the token issuance date and specific details remain unclear, leading to market expectations being advanced while key information lags behind, sparking controversy. Unlike projects that rely solely on incentives, Lighter attracts a large number of long-term users through an efficient matching mechanism and a good trading experience, demonstrating strong product value. This has caused the market to start valuing it based on mature asset standards in advance, thereby amplifying disagreements. The entire Perp DEX sector is at a critical stage of transitioning from “incentive-driven” to “value-intrinsic” development. How to design tokens that can effectively motivate users while reasonably reflecting the platform’s true value has become a common challenge in the industry. The past projects’回

PANews·2025-12-19 23:31

Load More