Search results for "PET"

BNB Chain Foundation buys into meme coins "HakiMi" and "Laozi" with explosive growth, continues to increase positions in the BSC Meme track

Binance founder Zhao Changpeng (CZ) posted on social platform X this evening (8th), revealing that his upcoming memoir in Chinese may be titled "Binance Life."

(Background: The value interrogation of Chinese meme coins: How far is it from "Binance Life" to the DOGE legend?)

(Additional context: CZ's pet meme coin BROCCOLI714 skyrocketed tenfold before crashing again. The founder of the formula, Vida: How did I make millions of dollars from it?)

According to the latest on-chain analysis by analyst Ai Aunt (@ai_9684xtpa), the BNB Chain Foundation address purchased Meme assets worth $50,000 earlier today, with the target focusing on the currently highly popular "Hajimi" (HAJIMI) and

動區BlockTempo·01-11 05:10

Cardano Creator Dubs 'New ADA,' Midnight, A 'Manhattan Project' - U.Today

Charles Hoskinson just gave Cardano’s privacy spinoff a major label, telling X that Midnight is set to become the "Manhattan Project" of privacy-enhanced transactions (PET), chain abstraction and smart compliance.

He is not framing this as a weekend brainstorm. According to Hoskinson, he is

UToday·2025-12-26 09:23

Wall Street’s Crypto Divide: Inside JPMorgan’s Pivot

1. The Reversal

Begin with the contradiction at the heart of 2025: Jamie Dimon—who for years called Bitcoin a fraud, dismissed crypto as a pet rock, and compared ownership to “your right to smoke”,now presides over a bank quietly assembling a crypto trading apparatus.

Bloomberg’s Monday report

CryptoDaily·2025-12-24 12:35

Wall Street’s Crypto Divide: Inside JPMorgan’s Pivot

1. The Reversal

Begin with the contradiction at the heart of 2025: Jamie Dimon—who for years called Bitcoin a fraud, dismissed crypto as a pet rock, and compared ownership to “your right to smoke”,now presides over a bank quietly assembling a crypto trading apparatus.

Bloomberg’s Monday report

CryptoDaily·2025-12-23 12:33

From 'Pet Rocks' to Trading Targets: JPMorgan Explores the Wall Street Shift Behind Crypto Assets Trading

Global banking giant JPMorgan Chase & Co. is actively exploring the provision of crypto assets trading services to its institutional clients, marking a new stage in the acceptance of digital assets by traditional financial giants. According to informed sources, the plan is still in the early evaluation stage and may cover Spot and derivatives trading, with the final scheme depending on client demand, risk assessment, and regulatory feasibility. This shift is particularly noteworthy as the bank's CEO Jamie Dimon has publicly criticized Bitcoin in the past, but his attitude has become more pragmatic and open in recent years. This move comes against the backdrop of a clearer regulatory environment in the U.S. and large banks deepening their involvement in crypto assets, potentially bringing significant incremental funding and legitimacy to the market.

MarketWhisper·2025-12-23 03:27

The Hottest Blockchain Pet Game of 2025: SuperCat Encryption Cat Raising and NFT Trading Guide

[PVP](https://www.gate.com/post/topic/PVP) [NFT](https://www.gate.com/post/topic/NFT) [Blockchain Game](https://www.gate.com/post/topic/%E5%8D%80%E5%A1%8A%E9%8F%88%E9%81%8A%E6%88%B2) In the digital world, owning a unique Crypto Assets cat game pet is becoming a new trend. Players can not only experience the fun of raising blockchain pets but also collect and trade NFT cats on the SuperCat platform. Through the Crypto Assets game economy, virtual pet trading platforms are rapidly rising, becoming a new trend in Blockchain games. Learn how to leverage this wave to increase.

幣圈動態·2025-12-01 04:05

2025 Puppies Coin Investment Guide: Pet Coin Market Analysis and Trading Strategies

[DEFI](https://www.gate.com/post/topic/DEFI) [NFT](https://www.gate.com/post/topic/NFT) [Investment Strategy](https://www.gate.com/post/topic/%E6%8A%95%E8%B3%87%E7%AD%96%E7%95%A5) Pet coin investment is showing a new emerging pet coin trend in 2025, attracting the attention of investors. Puppies coin market analysis reveals that as a newcomer in pet-themed encryption currency, it has established a complete ecosystem covering virtual pet raising and social interaction functions. Through puppies coin trading strategies, investors can effectively profit in a fluctuating market, thus promoting pet coin investment to become a market focus.

幣圈動態·2025-11-28 14:03

2025 Pet-themed Crypto Assets DOGE Investment Strategy and Market Analysis

[DOGE](https://www.gate.com/post/topic/DOGE) [Community](https://www.gate.com/post/topic/%E7%A4%BE%E7%BE%A4) [Investment Strategy](https://www.gate.com/post/topic/%E6%8A%95%E8%B3%87%E7%AD%96%E7%95%A5) In 2025, the pet-themed trend in the Crypto Assets market has sparked a wave, especially as DOGE has become the focus of investors' attention. Whether you're looking to understand DOGE investment strategies or market analysis, this article will provide you with an in-depth analysis and comparison of DOGE trading platforms, allowing you to grasp the latest development trends of pet-related Blockchain projects. From the rise of pet coins to the market.

DOGE3.58%

幣圈動態·2025-11-18 07:01

BABYDOGE coin trend analysis: 2023 latest market forecast

[MEME]() [DOGE]() [crypto market]() In cryptocurrency investment strategies, understanding market fluctuations and trends is crucial. With BABYDOGE price predictions showing its amazing performance, cryptocurrency volatility analysis provides deep insights. The DOGE market trend is influenced by the community, while memes investment risks should not be taken lightly. This article delves into the prospects of Blockchain pet coins, guiding you to seize emerging opportunities on the Gate platform. Spark curiosity and stimulate thinking, these will help you make informed investment decisions.

BABYDOGE has shown remarkable price trends since the beginning of 2023, standing out in the crypto market. This meme coin based on the Binance Smart Chain has experienced over 200% growth in the second quarter, attracting widespread attention from investors. BABYDOGE price predictions indicate that this growth is not coincidental, but rather the result of multiple market factors working together.

DOGE3.58%

幣圈動態·2025-11-14 20:06

2025 BABYDOGE investment strategy: Pet-themed Crypto Assets market analysis

[DOGE]() [Crypto Assets]() [NFT]() In the crypto assets market, pet-themed cryptocurrencies are rapidly rising, attracting significant attention from investors. Have you ever wondered how pet-themed digital assets are changing the landscape of this market? From BABYDOGE investment strategies to DOGE alternatives, meme coin market trends show considerable potential. Explore the innovations of pet-related blockchain projects and unlock unexpected rise opportunities. This article will reveal how pet-themed crypto assets are becoming a leading force in the emerging market. Get ready to delve into new investment perspectives for 2025.

As a representative of pet-themed cryptocurrencies, BABYDOGE has evolved from a mere meme coin into a digital asset with substantial application value in the market. By 2025, with the maturity of Blockchain technology, BABYDOGE is gradually being recognized by mainstream institutions and investors, and its market capitalization has surpassed the 24 billion dollar mark. This transformation not only

幣圈動態·2025-11-14 05:01

Catz coin: A virtual money exclusively for cat lovers is launched on Gate.com

[COM]() [Virtual Money]() [Blockchain]() In this era swept by digitalization, a brand new cat-themed crypto asset is attracting the attention of cat lovers around the world. Catz coin, as a virtual money exclusive to cat owners, is not only a new investment choice in animal-themed token investment but also a unique pet-related blockchain project built on the cute pet economy. With the support of the Gate.com platform, the market potential of cat lovers' digital assets is limitless, allowing investors to explore this warm innovation ecosystem deeply.

Catz coin, as a pioneer of cat-themed Crypto Assets, is rapidly rising in the Virtual Money market, becoming a beloved digital asset among cat lovers. This virtual currency exclusive to cat owners is not just an investment tool, but also a connecting bridge for the community of cat enthusiasts. The launch on the Gate.com platform has given Catz coin greater exposure and interaction.

幣圈動態·2025-11-13 10:04

Man Clones Best Friend: Tom Brady’s New Pup Is a Copy of the Original

In brief

Colossal announced acquiring pet cloning Viagen earlier this week.

The company claims cloned pets live full life spans

Critics accused Colossal of "playing God" as cloning raises ethics and welfare questions

Decrypt's Art, Fashion, and Entertainment Hub.

Discover

Decrypt·2025-11-07 01:09

Elon Musk made Floki the CEO! The tweet stimulated a big pump in meme coins, but experts warn that the rebound may be hard to sustain.

Elon Musk posted a witty tweet on the social media platform X, announcing that his pet Shiba Inu Floki is "returning to work" as the virtual CEO of X Corp, along with an AI-generated video. This post immediately triggered speculative trading of the related meme coin FLOKI, surging over 33%. However, experts warn that market rebounds influenced by celebrities are difficult to sustain.

MarketWhisper·2025-10-21 02:07

Top Crypto Presales 2025: BlockchainFX 35% Bonus With OCT35, HEXY Pet Care Growth, Snorter Meme B...

Could BlockchainFX ($BFX) be the top 100x crypto presale in 2025 that turns early buyers into crypto millionaires? The project is already ranking as one of the best crypto presales to invest in October 2025, raising over $8.5 million from more than 11,900 participants

With a confirmed launch

SOL3.02%

CaptainAltcoin·2025-09-30 19:35

Sol Strategies rings the bell for "STKE"

September 9, 2024

Sol Strategies, then still operating under its original name Cypherpunk Holdings, had not yet undergone a rebranding. It was still trading on the Canadian Securities Exchange, a market typically reserved for small and micro-cap companies. Just a few months ago, the company hired former Valkyrie CEO Leah Wald as its new CEO. At that time, Cypherpunk was little known, and investor interest was extremely low.

At the same time, Upexi focuses on promoting consumer goods for direct selling brands, specializing in areas such as pet care and energy solutions on Amazon. In this crowded market, the competition for clicks is exceptionally fierce. DeFi Development Corp (DFDV), which was still operating under its old name at the time.

金色财经_·2025-09-16 09:15

Are there still opportunities in various domestic industries? Understand the current status of various industries in one article.

The article reviews the current situation in various domestic industries, pointing out that many industries have limited opportunities, especially adult experience venues, second-hand housing, and coffee shops, which are considered inaccessible. In contrast, cross-border e-commerce, the pet industry, and adult products are viewed positively. The article emphasizes the advantages of the Blockchain industry, believing it has more opportunities and dividends, but also reminds to pay attention to asset security. Overall, Blockchain is seen as a rare major trend at present.

金色财经_·2025-08-16 06:29

On-chain behemoth war: Who will control the flow of value and become the new oligopoly in the Web3 industry?

Written by: Saurabh Deshpande, Decentralised.co

In November 2023, Blackstone Group acquired a pet care app named Rover. Initially, Rover was just for finding people to walk dogs or watch cats. The pet care industry typically consists of tens of thousands of small, primarily localized and offline service providers. Rover integrated these suppliers into a searchable marketplace, adding review and payment features, making it the default platform for pet care services. By the time Blackstone privatizes it in 2024, Rover has become the hub of demand in this field. Pet owners think of Rover first, while service providers have no choice but to list on this platform.

ZipRecruiter has done something similar in the recruitment field. It aggregates information from employers and job boards.

JUP10.29%

TechubNews·2025-08-09 06:45

Thank you, Dad! TOFU Story is grateful to you, sending you 8.8 KAIA & 8.8 LINE points, wishing you 8888.

On this Father's Day, "TOFU Story" has prepared a special surprise for all the hardworking dads around the world. As a LINE original mini-game, TOFU Story not only brings adorable tofu characters but also creates an unprecedented experience of earning while playing through redeemable LINE points and rewards. This Father's Day, we sincerely invite everyone to spend warm moments with their dads, claim exclusive benefits, and nurture a tofu character that belongs to your family. (Previously: Youtuber Mukbang also participated! Finished a meal in 30 seconds, walked away with over 350 USDT in prize money!) (Background: TOFU Story: Earn LINE Points by playing the LINE mini-game while nurturing a pet tofu. Join now to share 30,000 LINE points.) (This article is a press release from TOFU Story.

KAIA11.78%

動區BlockTempo·2025-08-07 07:34

Inside Hexydog ($HEXY): A High-Potential Crypto Presale Backed by Real Use Cases

Hexydog is

becoming one of the top crypto presales to watch in 2025. This project connects

blockchain with the global pet care industry and works to create a useful system.

Its goal is to move past typical cryptocurrencies. The presale price rose from

$0.0021 to $0.0036 reflecting rising

TheTradable·2025-07-29 11:37

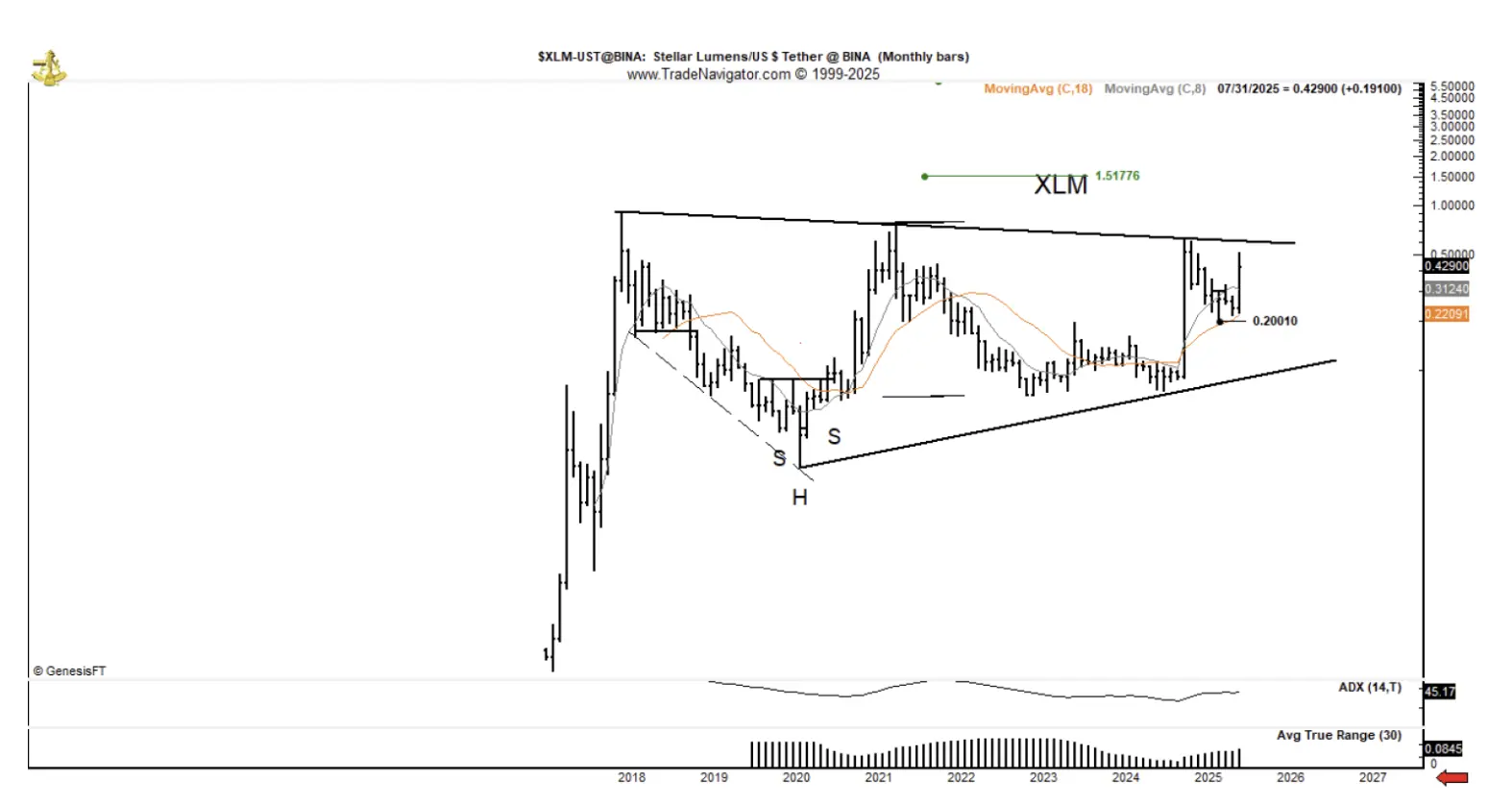

Analyst Peter Brandt rarely bullish! XLM monthly chart shows a rare "inverse head and shoulders" pattern, breakout confirmation could lead to a 3x rise? | Stellar price prediction

Peter Brandt, a legendary cryptocurrency trader known for his sharp tongue and precise chart analysis, has recently made a rare public expression of optimism for Stellar (XLM). Brandt believes that while over 95% of active tokens (around 11,000) will ultimately drop to zero and become "pet rocks," XLM is likely to be one of the few that stands out as a "rock star." His analysis is based on the clear potential multi-year "Inverse Head and Shoulders" bottom reversal pattern evident on the XLM monthly chart, with the neck line resistance below $0.50. The current XLM price ($0.429) is attempting a strong breakout, and if it can hold above the $0.42-$0.45 range on the monthly chart, the technical target could be as high as $1.50, representing a potential increase of over three times. This article provides an in-depth analysis of Brandt's chart views, his bullish logic under a harsh market backdrop, and the long-term support from XLM's fundamentals in cross-border payments and collaboration with the Stellar Development Foundation (SDF), offering key trend insights for XLM holders and Stellar ecosystem followers.

XLM1.79%

MarketWhisper·2025-07-28 06:54

The Last Resistor of Wall Street Surrenders? JPMorgan Will Fully Invest in Crypto Assets

Dimon has capitulated! JPMorgan is ALL IN on encryption, the last resistance of Wall Street has fallen!

> Financial giants turn around, the encryption world welcomes a historic moment!

>

>

"Bitcoin is a scam," "Ponzi scheme," "pet rock" – these labels once came from the mouths of leaders of the world's largest banks. Just last year, JPMorgan CEO Jamie Dimon publicly criticized cryptocurrencies using these terms, even claiming, "If I were the government, I would shut it down."

However, today, this last "stubborn faction" on Wall Street raised the white flag.

According to CNBC financial commentator Jim Cramer, Dimon may now be "fully committed to encryption"! The banking giant who once threatened to fire any employee trading Bitcoin is now turning the ship around, sailing full speed into the encryption blue ocean.

From "Arch-Enemy" to "Believer": Damon’s Astonishing Turnaround

Back to 2021, Dimon

BTC1.97%

金色财经_·2025-07-16 00:28

TOFU Story: Earn LINE Points while playing the LINE mini-game and raise pet tofu. Join now to share 30,000 LINE Points.

"TOFU Story" is a game that combines LINE Points, where players can raise pet tofu in their daily lives and earn points. The global user count has surpassed 120,000, and a new user event is launched to share 30,000 LINE points. The game is designed to be simple, allowing players to unlock achievements and purchase card packs to obtain tofu, with an upgrade mechanism set to launch in 2024. The event also includes physical community competitions, integrating virtual and real-world experiences to realize Web3 lifestyle applications.

動區BlockTempo·2025-07-14 09:59

DAIKO Reimagines Pet Care by Merging Web3 with Real-World Rewards - BlockTelegraph

An Ireland-based startup is seeking to transform the everyday dog walk into a digitally enhanced, incentivized experience through blockchain technology and smart hardware integration. DAIKO, an emerging player in the pet-tech sector, is introducing a novel ecosystem that links pet care

BlockTelegraph·2025-07-01 09:38

Bankless: The Wave of Privacy Technologies in Crypto Assets

Author: David C, Source: Bankless, Translated by: Shaw Jinse Caijing

As concerns about surveillance and data development intensify, the cryptocurrency sector has recently accelerated the integration of privacy-enhancing technologies (PET) into its core infrastructure.

Blockchain is designed to be completely transparent. While the crypto industry has long emphasized privacy methods (such as token mixers or privacy-based tokens), it has also been working to expand the scope of privacy (beyond simple DeFi and payments) without restricting privacy to specialized networks.

As blockchain is increasingly applied in artificial intelligence training and institutional financing, the adoption of alternative cryptographic technologies is also becoming more popular. Among them, four technologies are particularly hot: Multi-Party Computation ( MPC ), Fully Homomorphic Encryption ( FHE ), Trusted Execution Environment ( TEE ), and Zero-Knowledge Transmission Security Layer ( z.

FHE-6%

金色财经_·2025-06-26 06:52

Hexydog Crypto Presale Review & Price Prediction: Should You Buy $HEXY Token?

Hexydog is a new utility token that has arrived on the market as a presale. Featuring Doge-based memes while also presenting a use case focused on blockchain-based pet care, the project has raised upwards of $440K to date.

With its marketing material highlighting multiple future-centric

TOKEN39.04%

TheCryptonomist·2025-06-25 14:37

Why Dogecoin Was Tumbling on Thursday

Key Points

A decision on a proposed exchange-traded fund was delayed by a major regulator.

Other altcoin ETF hopefuls were affected too.

10 stocks we like better than Dogecoin ›

Dogecoin (CRYPTO: DOGE) was no one's idea of a pet cryptocurrency on Thursday. The bellwether meme coin had a

YahooFinance·2025-06-12 23:59

Why Goldman Sachs' judgment on Ethereum is wrong.

Written by: Brendan on Blockchain Translated by: Baihua Blockchain

A few years ago, Ethereum was still the "little brother" of Bitcoin, known for decentralized finance (DeFi), pixelated NFTs, and highly creative smart contract experiments, far from being a choice for "serious" investors. However, by 2025, Ethereum has become the focus of Wall Street.

Goldman Sachs perfectly embodied the traditional institutional mindset in 2021, when they disparaged Ethereum as "too volatile and speculative," calling it "a solution looking for a problem." Their research team believed that smart contract technology was overhyped, with limited real-world applications, and that institutional clients had "no legitimate use case" for programmable currency. They were not alone; JPMorgan referred to it as a "pet rock," and traditional asset management companies avoided it even more.

However, this view is like when the internet was called "a flash in the pan".

ETH1.51%

金色财经_·2025-06-05 14:54

Why is Goldman Sachs' judgment on Ethereum wrong?

Written by: Brendan on Blockchain

Compiled: Plain Language Blockchain

A few years ago, Ethereum was still the "little brother" of Bitcoin, known for decentralized finance (DeFi), pixelated NFTs, and highly creative smart contract experiments, far from the choice of "serious" investors. However, by 2025, Ethereum has become the focus of Wall Street.

Goldman Sachs perfectly embodied the mindset of traditional institutions in 2021, when they disparaged Ethereum as "too volatile and speculative" and called it "looking for solutions to problems." Their research team argues that smart contract technology is overhyped, with limited real-world applications, and "no legitimate use case" for programmable currencies for institutional customers. They are not alone, JPMorgan Chase calls them "pet stones", and traditional asset managers avoid them.

However, this view is like when the internet was called "

ETH1.51%

DeepFlowTech·2025-06-05 06:35

Cardano’s Hoskinson Turns Down $3 Million Offer for His ‘Priceless’ Pet Pig

Cardano’s Charles Hoskinson just turned down a surprising offer for his pet pig Nike, calling him “priceless” and refusing to sell

ADA4.27%

BitcoincomNews·2025-05-27 11:00

He Yi visited the sick dog Korico at a pet hospital in Singapore, and it has now recovered.

He Yi has recently been accompanying his recovering dog Korico at a pet hospital in Singapore, showing his love for pets. Korico has recovered after treatment, and everyone has sent their blessings. He Yi stated that taking care of pets is a responsibility and looks forward to sharing more happy times with his dog.

TechubNews·2025-05-06 09:27

Conan Community completes $1.2 million financing to promote Blockchain public welfare practices.

According to Mars Finance, the encryption public welfare project Conan community announced the completion of a $1.2 million financing, led by ChainGuard, with participation from institutions such as SciChain DAO and SZNP. The community focuses on three major areas, including promoting internet of things medical public welfare programs, supporting animal rescue and vaccination efforts, and funding decentralized research projects related to pet healthcare, having already implemented dozens of public welfare rescue activities. It has previously donated over $100,000 to Vitalik for charity.

MarsBitNews·2025-04-23 16:38

Cat's Interview: I am in Japan, receiving Crypto Assets to sell houses.

These "infrastructurers" without flashy narratives ultimately define the true value of the crypto economy. (Synopsis: American real estate company Propy allows "mortgage BTC, ETH" loans to buy houses, and the rise in currency prices can be used to repay) (Background supplement: The "golden cross" of bitcoin in the housing market is coming! Too handsome to shout that house prices will fall by 20% again: 2025 will have the eighth wave of house fights, divided into two hits) He was a practitioner in traditional banks and wealth management offices, and a pioneer in turning digital currencies into a tool for buying houses. He has been sharing on Twitter for 10+ years and has received some of the world's most mysterious on-chain customers. You can use USDT to buy a Japanese homestay with him, or you can pet your cat while discussing assets going overseas. "I bought a house for my cat!" —————— I am the gorgeous dividing line —————— This person is active on Chinese Twitter with the image of a cat

動區BlockTempo·2025-04-02 14:10

Catizen 2025 Strategic Blueprint: Introducing virtual pet 'AI Cat' and 200 games, accelerating $CATI consumption

The Catizen Foundation plans to launch an AI-integrated virtual pet 'AI Cat' and release the 2025 strategic blueprint to accelerate the consumption of $CATIToken, consolidating its leading position in the Web3 entertainment field. They have built a three-in-one ecosystem of games, social, and economy to strengthen the transition from Web2 to Web3. AI Cat enhances user emotional connections through dynamic interaction, promotes a positive cycle of Token consumption, and plans to expand Token usage scenarios by launching over 200 new games to drive the rise of the Token economy.

DeepFlowTech·2025-03-12 12:54

Catizen: AI Cat & 200 games will be launched in 2025, accelerating the consumption of $CATI

BOMBIE blockchain game officially lands on LINE's Mini Dapp platform, launching a new server grand prize event, including TSLModel Y, iPhone 16 Pro Max, 1 million $CATI, and other rewards. Catizen releases its 2025 strategic blueprint, introducing the AI Cat virtual pet integrated with artificial intelligence technology, and plans to launch 200 innovative games. By accelerating token consumption through technological iteration and content expansion, it solidifies its leading position in the Web3 entertainment track. The increasingly complete ecosystem will further promote the expansion of token use cases and drive continuous growth in token economy.

動區BlockTempo·2025-03-12 07:43

Bitwise Chief Investment Officer: The significance of BTC strategic reserves is underestimated

Original author: Matt Hougan, Chief Investment Officer at Bitwise

Original compilation: Luffy, Foresight News

Last week, the US government established a strategic reserve of Bitcoin.

Let this sentence linger in your mind for a moment.

Over the 15 years since the birth of Bitcoin, it has been mocked and questioned, referred to as a 'pet rock' or 'rat poison squared'. And today, 15 years later, the US government declares Bitcoin to be a 'strategic' asset and 'not to be sold'.

This is a historic milestone, pretending to be at this time

星球日报·2025-03-11 10:29

Bitwise: Why did the market react wrong? What is the only important issue with BTC

by Matt · Hougan, Chief Investment Officer, Bitwise; Deng Tong, Golden Finance

What is really important about strategic bitcoin reserves.

The U.S. government built a strategic Bitcoin reserve last week.

Please take a moment to reflect on these words.

Fifteen years after the birth of Bitcoin – known as the "pet rock" and "rat poison" – the U.S. government declared Bitcoin a "strategic" asset that could not be sold.

This is a historic milestone that will propel Bitcoin to new all-time highs over time. Congratulations to everyone who believed in this possibility before it became popular.

But now we have to talk about how the market perceives the news.

The market reacted and the reasons for the error

Despite the historic significance of the statement, Bitcoin has fallen sharply in recent days. As I write this memo, Bitcoin has fallen from Thursday's high above $92,000

金色财经_·2025-03-11 00:40

CZ Weighs Community Proposal for Meme Coin Inspired by His Dog

Changpeng Zhao contemplates creating a meme coin inspired by his pet dog following community suggestions, sparking speculation in the crypto market. Despite previous skepticism, CZ considers engaging with meme coins on the BNB Chain.

CryptoPotato·2025-02-13 07:49

24H hot currencies and headlines | US January CPI monthly rate 0.4%, expected 0.30%; Trump has nominated a16z crypto policy director to lead CFTC (February 13)

CZ's dog guide follow, which means considering whether to disclose specific information about pet dogs and issuanceMeme one day.

星球日报·2025-02-13 01:59

Three Homomorphic Encryption Trends for 2025 - The Daily Hodl

HodlX Guest PostSubmit Your Post

As 2025 dawns, FHE (fully homomorphic encryption) is a PET (privacy-enhancing technology) on the cusp of going mainstream.

FHE keeps data encrypted during computation so that even if it’s intercepted, it can’t be read.

Hardware acceleration, venture capital

S5.12%

GateUser-299f2bac·2025-01-14 20:40

“Bitcoin Has No Intrinsic Value,” JPMorgan CEO Insists—But There’s a Catch

JPMorgan CEO Jamie Dimon has reiterated his position that Bitcoin has "no intrinsic value," and linked it to illicit activities. However, Dimon acknowledged people are free to invest if they choose, comparing it to smoking. The bank is more open to blockchain, and has initiatives like the JPM Coin aimed at institutional transactions. Dimon has previously likened bitcoin to "pet rocks" and called for strict regulation.

ZyCrypto·2025-01-14 18:53

JPMorgan's CEO, America's Largest Bank, Talks About Bitcoin Again! Was He an BTC Enemy, Has His Opinion Changed?

JPMorgan Chase CEO Jamie Dimon, while acknowledging the inevitability of digital currencies, remains critical of Bitcoin. He believes that a form of digital currency will emerge, but he expressed skepticism towards Bitcoin, stating that it is mainly used by criminals. However, he supports individuals' right to buy and sell cryptocurrency, clarifying that it does not mean he endorses BTC. This comment follows Dimon's history of high-profile criticism towards Bitcoin, comparing it to a "pet rock" and rejecting it as a speculative asset with no inherent value.

Bitcoinsistemi·2025-01-12 22:01

Shareholders Urge Mark Zuckerberg to Buy Bitcoin for Meta

Mark Zuckerberg, who famously named his pet goat Bitcoin, was proposed to add Bitcoin to Meta (Facebook) holdings.

According to podcaster and CEO of Jubilee Royalty Tim Kotzman, a Bitcoin Treasury Shareholder Proposal has been submitted to Meta Platforms Inc., marking a significant development in

UToday·2025-01-11 11:41

Quick Look at AI Pet Game The Farm: AI Agents Bring New Gameplay to Blockchain Games?

Author: ZEN, PANews

Although the track of chain games has attracted much attention from capital and the market, its gameplay and mode are severely homogenized, lacking real innovative breakthroughs. However, with the rise of AI agent technology, the chain game industry may usher in a new opportunity for change. In this wave, The Farm seeks to create an unprecedented immersive game world and redefine the way players interact with the virtual ecosystem through deep integration with AI agents.

In addition to the conceptual innovation, The Farm, which fits the current hot spots of the industry, has also received preliminary market recognition. Its current market value has reached 75 million USD, and it even saw a nearly 50% increase on January 3rd.

The Farm: GenAI-driven AI agent game

The Farm is the first GenAI-driven AI based on Hyperliquid

DeepFlowTech·2025-01-06 07:17

Peanut the Squirrel: Could PNUT Token Price Hit a New All-Time High Soon?

Solana (SOL) based memecoin inspired by a squirrel pet dubbed Peanut the Squirrel (PNUT) has continued to make significant waves in the cryptocurrency industry. The small-cap memecoin project, with a fully diluted valuation of about $683 million and a 24-hour average trading volume of about $1.1

BitcoincomNews·2024-12-23 09:11

SoonChain Partners with PettAI to Revolutionize AI-Based Gaming on Layer 2

SoonChain has announced a new collaboration with PettAI, a virtual pet game that is setting new standards for AI-based games on Layer 2 (L2). This collaboration was officially announced through SoonChain X account this is a great milestone for both platforms.

PettAI Partnership Enhances

BlockchainReporter·2024-12-19 13:25

Cardano Founder Sparks Speculation on New Meme Coin Venture

Charles Hoskinson teases a new meme coin concept inspired by his "memeable" pet, sparking curiosity across the crypto community

The Cardano founder hints at a revolutionary project, potentially rivaling Dogecoin or Shiba Inu, using unique meme-driven marketing

Hoskinson’s cryptic post fuels

CryptoFrontNews·2024-12-15 17:13

Peanut the Squirrel (PNUT) Soars by 25% Daily: Is This the Potential Reason?

TL;DR

PNUT surged to almost $1.40 before stabilizing at $1.27, driven by Coinbase adding it to its “roadmap” and an overall resurgence in the meme coin sector.

Inspired by a controversial incident involving a pet squirrel, PNUT gained massive attention after its launch in November, with early

CryptoPotato·2024-12-12 03:28

Peanut Pet Owner Launches New Token, Threatens Lawsuit Against Community

Less than a month after the story of Peanut the squirrel and Fred the raccoon broke headlines, Mark Longo, the owner of the two pets whose tragic deaths caused a public outcry and spurred a movement, has launched his own token.

Longo spoke in a Twitter video about how he came to process the story

AICoinOfficial·2024-11-26 05:58

Load More